Turning Complex Derivative Data into Clear Market Insights

Unlock F&O trends with data-driven analysis

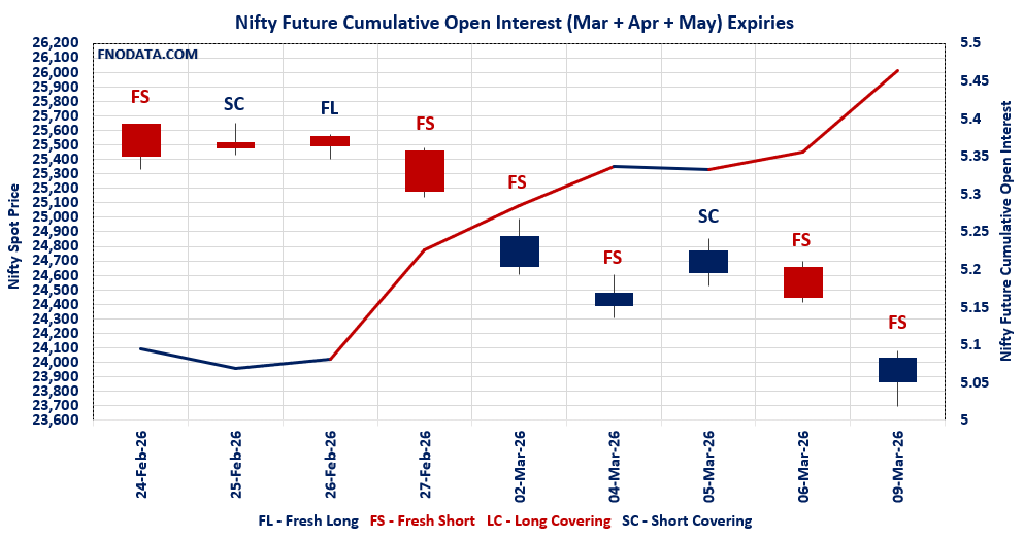

- NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 9/03/2026Monday’s derivatives data clearly reflects strong bearish participation across indices, and the Open Interest Volume Analysis confirms that traders aggressively built fresh short positions in index futures. NIFTY, BANKNIFTY, and MIDCPNIFTY all witnessed a sharp rise in open interest along with a spike in trading volume, which typically signals institutional short build-up rather than simple profit booking. The NIFTY fell… Read more: NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 9/03/2026

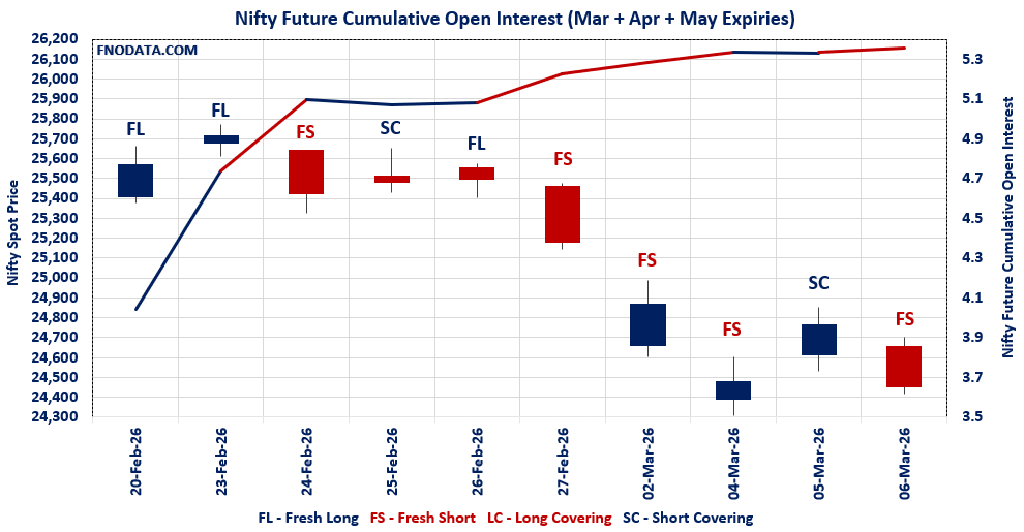

- NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 6/03/2026The Indian equity derivatives market witnessed aggressive selling pressure, and the Open Interest Volume Analysis across index futures clearly indicates that traders are building fresh short positions across major indices. With NIFTY falling 1.27%, BANKNIFTY dropping over 2.15%, and SENSEX declining 1.37%, the derivatives data confirms that the downside move was not merely profit booking but rather a structured build-up… Read more: NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 6/03/2026

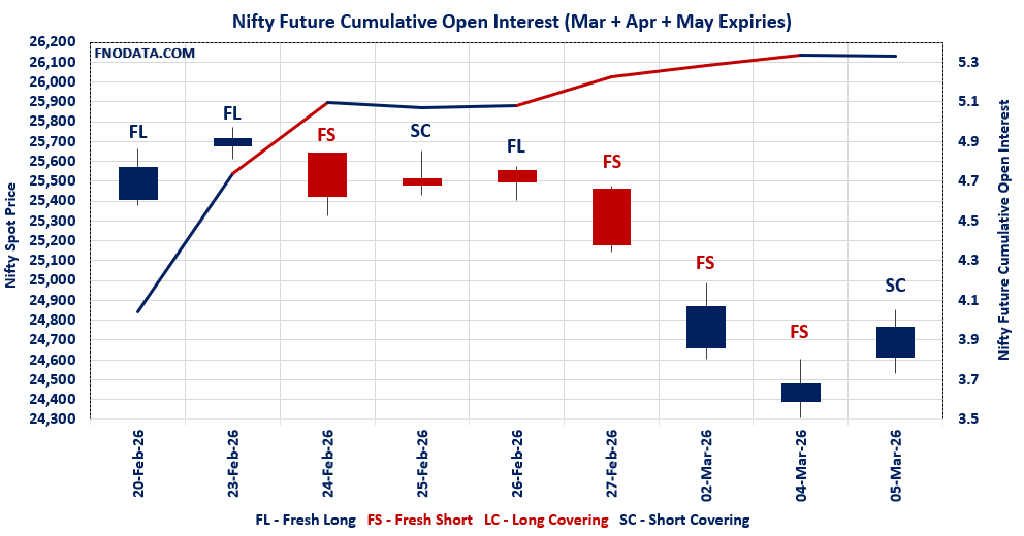

- NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 5/03/2026Thursday’s market action delivered a broad-based rebound across indices, but the Open Interest Volume Analysis reveals that the rally was driven more by short covering than aggressive fresh buying, particularly in NIFTY and MIDCPNIFTY futures. While prices moved higher sharply, declining futures open interest and sharply lower trading volumes indicate traders were primarily unwinding bearish bets rather than building strong… Read more: NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 5/03/2026

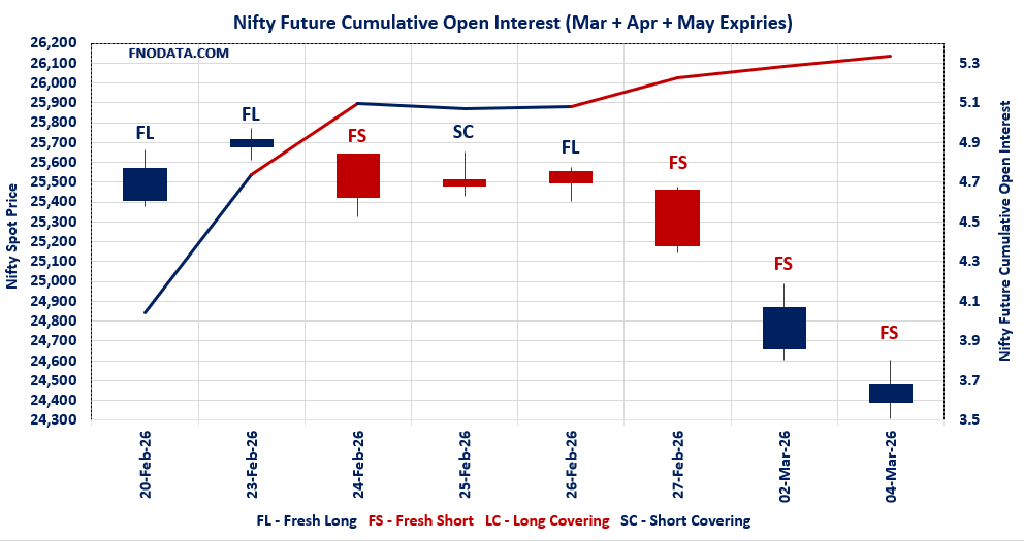

- NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 4/03/2026oday’s Open Interest Volume Analysis across index derivatives clearly reflects aggressive short build-up across large-cap indices, indicating that traders are positioning for continued downside pressure in the near term. Both NIFTY and BANKNIFTY futures witnessed a sharp rise in open interest along with falling prices, which is a classic signal of fresh short creation by institutional participants. In NIFTY futures,… Read more: NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 4/03/2026

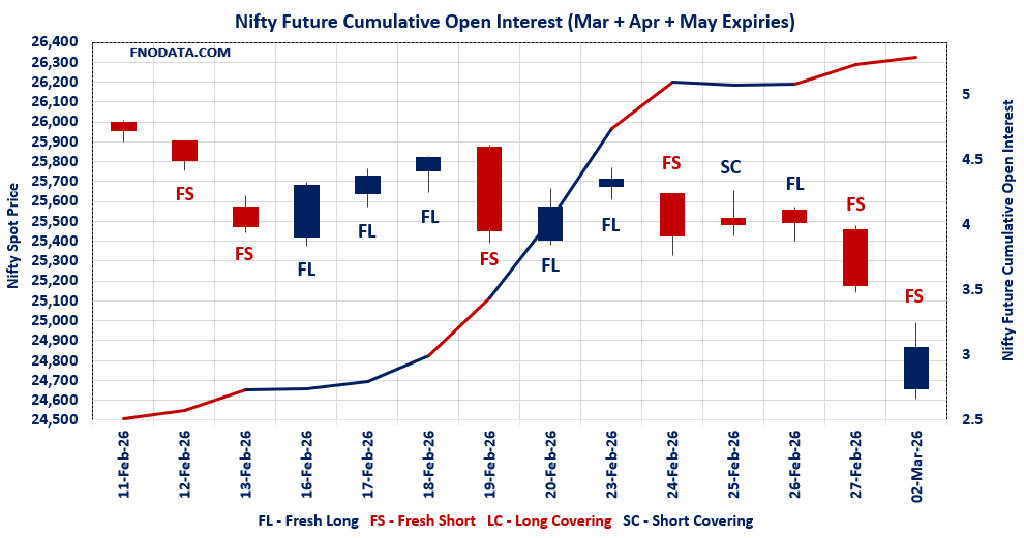

- NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 2/03/2026Yesterday’s Open Interest Volume Analysis clearly signals aggressive fresh short buildup across NIFTY, BANKNIFTY, MIDCPNIFTY, and SENSEX futures, confirming institutional selling rather than mere profit booking. NIFTY Spot closed at 24,865 (-1.24%), but what matters more is the 5.87% jump in combined OI with 42% volume surge — this is classical short creation, not long unwinding. March and April futures… Read more: NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 2/03/2026

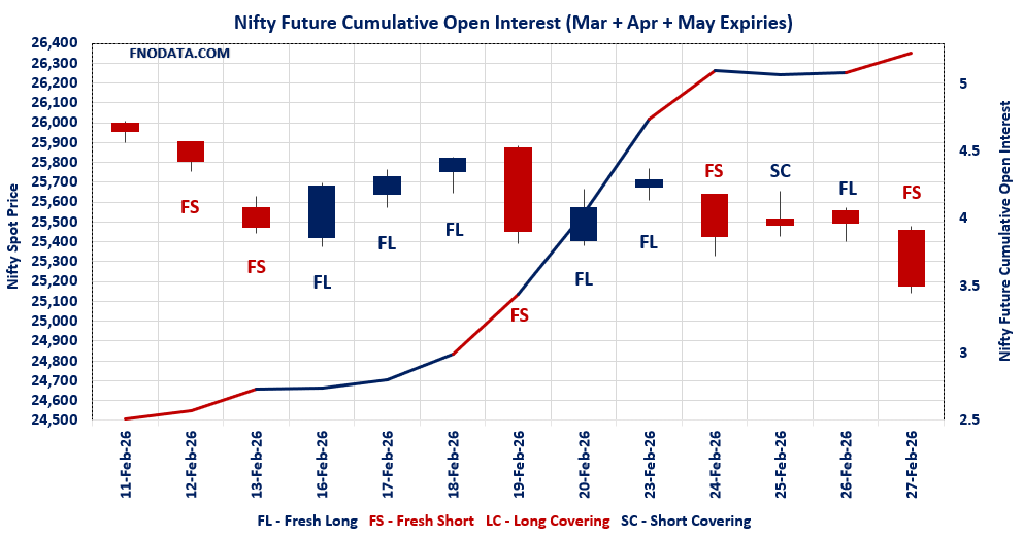

- NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 27/02/2026Today’s Open Interest Volume Analysis across NIFTY, BANKNIFTY, MIDCPNIFTY and SENSEX clearly signals aggressive short build-up in frontline indices, with sharp spikes in futures OI and volumes — especially in April series contracts. The market decline is not merely price-led; it is derivative-backed selling, confirmed by rising open interest alongside falling prices across major indices. The data suggests institutional positioning… Read more: NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 27/02/2026