Turning Complex Derivative Data into Clear Market Insights

Unlock F&O trends with data-driven analysis

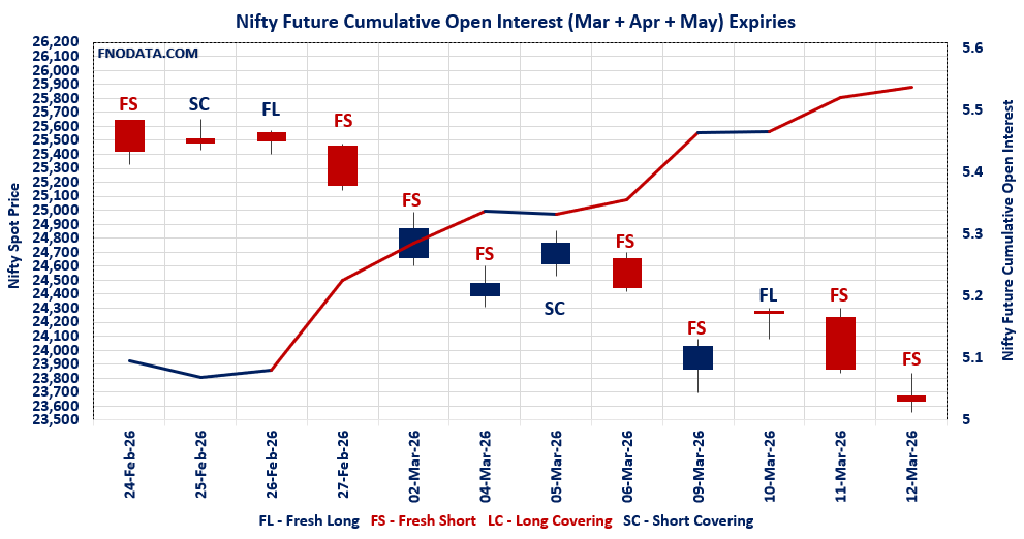

- NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 12/03/2026The Indian derivatives market on 12/03/2026 reflected a clear risk-off tone, and a detailed Open Interest Volume Analysis across NIFTY, BANKNIFTY, MIDCPNIFTY, and SENSEX suggests that traders are gradually positioning for downside risk in the near term. In NIFTY futures, the combination of price decline with rising open interest clearly indicates fresh short build-up, which signals that market participants are… Read more: NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 12/03/2026

- NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 11/03/2026Wednesday’s Open Interest Volume Analysis paints a clearly defensive picture across the broader market, as sharp declines in NIFTY, BANKNIFTY, MIDCPNIFTY and SENSEX were accompanied by aggressive Open Interest build-up on the short side. Through a detailed Open Interest Volume Analysis, the data confirms that the fall was not merely profit booking but fresh bearish participation from traders. NIFTY Futures… Read more: NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 11/03/2026

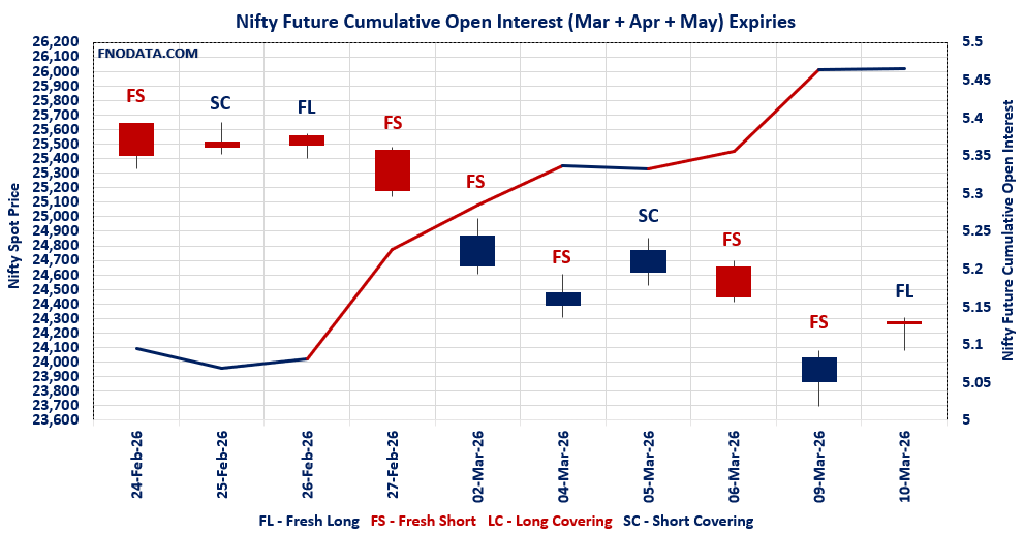

- NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 10/03/2026Tuesday’s derivatives data suggests that the market bounce was largely driven by short covering rather than aggressive conviction buying, and the Open Interest Volume Analysis clearly highlights this underlying caution. While NIFTY, BANKNIFTY and MIDCPNIFTY all closed higher, the sharp decline in futures volume across indices (around 35–42%) indicates that the move lacked strong participation from institutional traders. In the… Read more: NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 10/03/2026

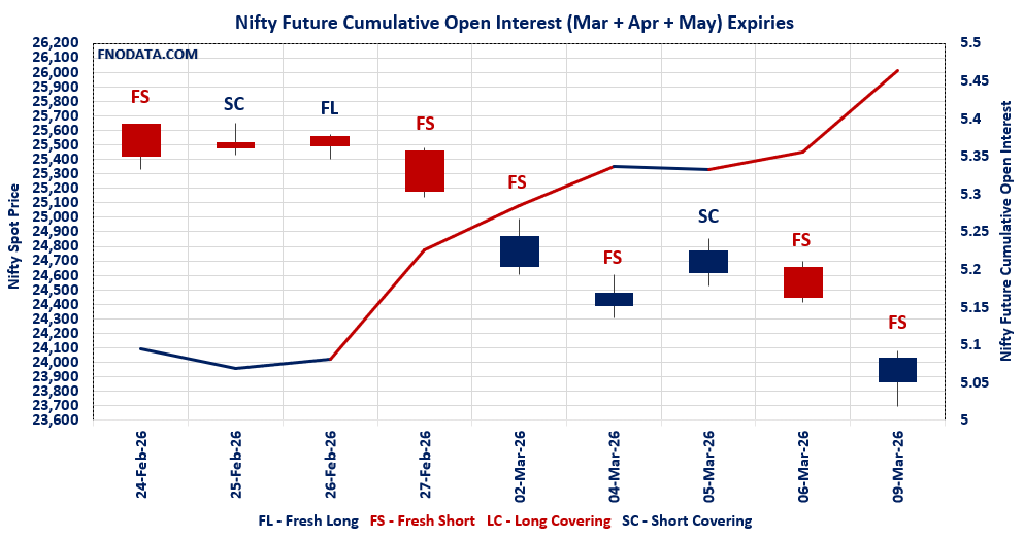

- NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 9/03/2026Monday’s derivatives data clearly reflects strong bearish participation across indices, and the Open Interest Volume Analysis confirms that traders aggressively built fresh short positions in index futures. NIFTY, BANKNIFTY, and MIDCPNIFTY all witnessed a sharp rise in open interest along with a spike in trading volume, which typically signals institutional short build-up rather than simple profit booking. The NIFTY fell… Read more: NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 9/03/2026

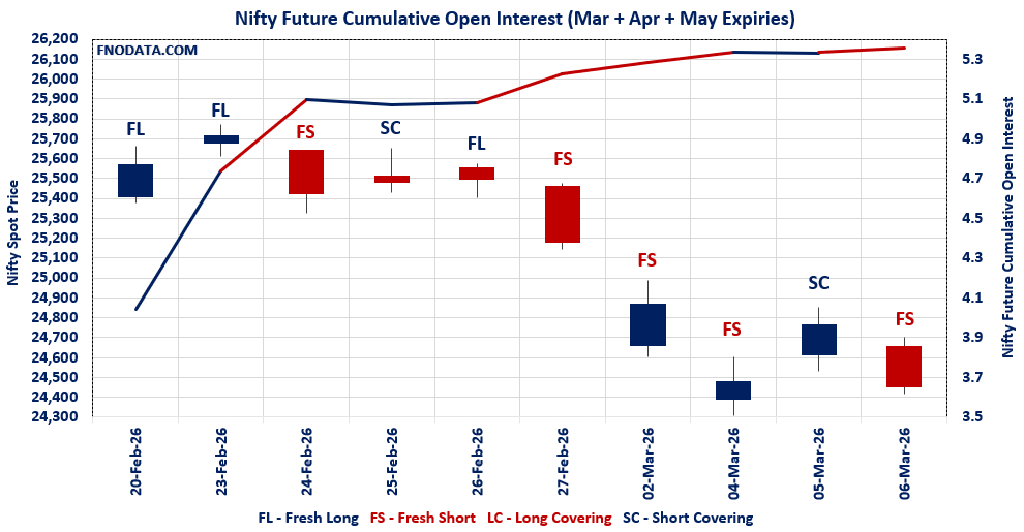

- NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 6/03/2026The Indian equity derivatives market witnessed aggressive selling pressure, and the Open Interest Volume Analysis across index futures clearly indicates that traders are building fresh short positions across major indices. With NIFTY falling 1.27%, BANKNIFTY dropping over 2.15%, and SENSEX declining 1.37%, the derivatives data confirms that the downside move was not merely profit booking but rather a structured build-up… Read more: NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 6/03/2026

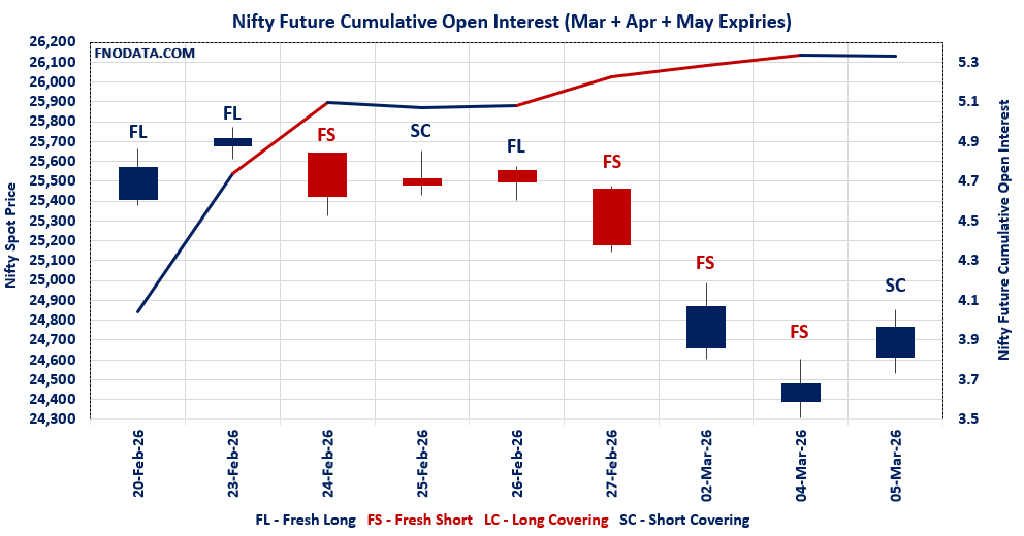

- NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 5/03/2026Thursday’s market action delivered a broad-based rebound across indices, but the Open Interest Volume Analysis reveals that the rally was driven more by short covering than aggressive fresh buying, particularly in NIFTY and MIDCPNIFTY futures. While prices moved higher sharply, declining futures open interest and sharply lower trading volumes indicate traders were primarily unwinding bearish bets rather than building strong… Read more: NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 5/03/2026