Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 3/12/2025

Table of Contents

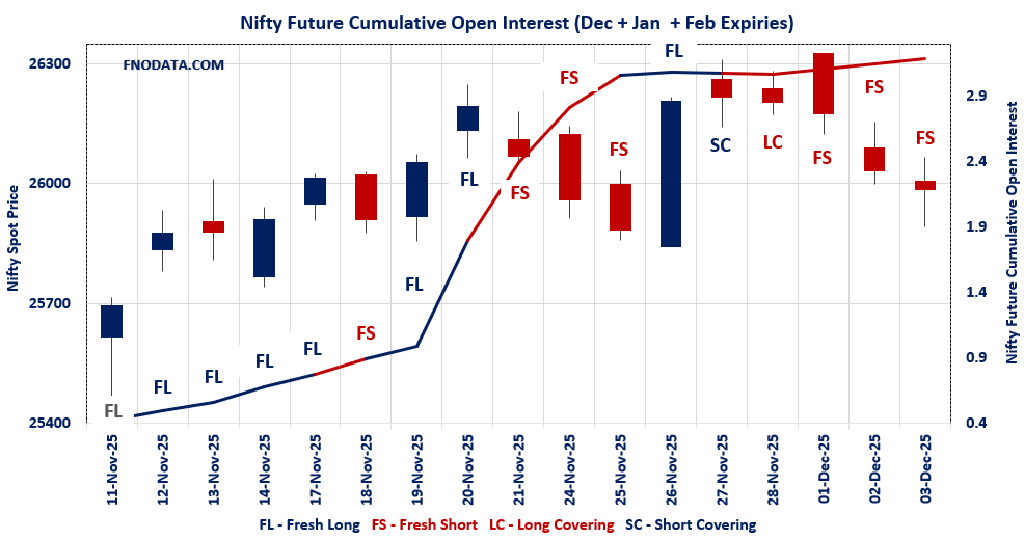

On 3rd December 2025, combined open interest (OI) and volume in NIFTY futures for December to February showed a robust increase of 4.55% in OI and 8.73% in volume, signaling fresh short positions entering the market. This indicates that traders expect a cautious to bearish near-term outlook despite minor price declines in the spot and futures markets.

In contrast, BANKNIFTY futures show fresh long positions with a 3.64% rise in OI accompanied by a strong 43.94% surge in volume, reflecting renewed buying interest and bullish sentiment in banking securities ahead of expiries.

FINNIFTY futures reveal short covering with combined OI falling by 4.8%, but with some fresh longs appearing in January contracts. This mixed action suggests choppy sentiment where bears are reducing positions while new bulls are emerging for selective expiry months.

MIDCPNIFTY futures exhibit continued long unwinding with an 8.47% drop in combined OI, although January contracts show fresh short building, indicating some defensive positioning around midcaps amid volatility.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25986 (-0.177%)

Combined = December + January + February

Combined Fut Open Interest Change: 4.55%

Combined Fut Volume Change: 8.73%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 8% Previous 8%

NIFTY DECEMBER Future closed at: 26136.2 (-0.293%)

December Fut Premium 150.2 (Decreased by -30.6 points)

December Fut Open Interest Change: 4.26%

December Fut Volume Change: 8.48%

December Fut Open Interest Analysis: Fresh Short

NIFTY JANUARY Future closed at: 26302.6 (-0.326%)

January Fut Premium 316.6 (Decreased by -39.9 points)

January Fut Open Interest Change: 6.22%

January Fut Volume Change: 24.19%

January Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (9/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.691 (Decreased from 0.725)

Put-Call Ratio (Volume): 0.961

Max Pain Level: 26000

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25500

Highest CALL Addition: 26000

Highest PUT Addition: 25900

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.106 (Decreased from 1.159)

Put-Call Ratio (Volume): 0.762

Max Pain Level: 26000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26500

Highest PUT Addition: 25000

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59348.25 (0.126%)

Combined = December + January + February

Combined Fut Open Interest Change: 3.64%

Combined Fut Volume Change: 43.94%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 11% Previous 10%

BANKNIFTY DECEMBER Future closed at: 59737 (0.120%)

December Fut Premium 388.75 (Decreased by -2.85 points)

December Fut Open Interest Change: 3.5%

December Fut Volume Change: 44.5%

December Fut Open Interest Analysis: Fresh Long

BANKNIFTY JANUARY Future closed at: 60090 (0.071%)

January Fut Premium 741.75 (Decreased by -32.05 points)

January Fut Open Interest Change: 4.69%

January Fut Volume Change: 39.33%

January Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.967 (Decreased from 0.991)

Put-Call Ratio (Volume): 0.989

Max Pain Level: 59400

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 58500

Highest CALL Addition: 59500

Highest PUT Addition: 59500

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27629.6 (0.233%)

Combined = December + January + February

Combined Fut Open Interest Change: -4.8%

Combined Fut Volume Change: 15.5%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 1% Previous 1%

FINNIFTY DECEMBER Future closed at: 27813.6 (0.182%)

December Fut Premium 184 (Decreased by -13.95 points)

December Fut Open Interest Change: -5.26%

December Fut Volume Change: 13.40%

December Fut Open Interest Analysis: Short Covering

FINNIFTY JANUARY Future closed at: 27949.8 (0.505%)

January Fut Premium 320.2 (Increased by 75.95 points)

January Fut Open Interest Change: 40.00%

January Fut Volume Change: 116.67%

January Fut Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.848 (Increased from 0.760)

Put-Call Ratio (Volume): 1.098

Max Pain Level: 27800

Maximum CALL Open Interest: 28200

Maximum PUT Open Interest: 27500

Highest CALL Addition: 27500

Highest PUT Addition: 27500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13844 (-1.047%)

Combined = December + January + February

Combined Fut Open Interest Change: -8.47%

Combined Fut Volume Change: 0.02%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 3% Previous 2%

MIDCPNIFTY DECEMBER Future closed at: 13900.05 (-0.946%)

December Fut Premium 56.05 (Increased by 13.8 points)

December Fut Open Interest Change: -9.52%

December Fut Volume Change: -1.43%

December Fut Open Interest Analysis: Long Covering

MIDCPNIFTY JANUARY Future closed at: 13981.2 (-0.870%)

January Fut Premium 137.2 (Increased by 23.85 points)

January Fut Open Interest Change: 46.96%

January Fut Volume Change: 66.10%

January Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.860 (Decreased from 0.908)

Put-Call Ratio (Volume): 0.737

Max Pain Level: 14000

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13500

Highest CALL Addition: 14500

Highest PUT Addition: 13500

SENSEX Monthly Expiry (24/12/2025) Future

SENSEX Spot closed at: 85,106.81 (-0.037%)

SENSEX Monthly Future closed at: 85,602.95 (-0.237%)

Premium: 496.14 (Decreased by -171.84 points)

Open Interest Change: 9.26%

Volume Change: 7.42%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (4/12/2025) Option Analysis

Put-Call Ratio (OI): 0.789 (Increased from 0.637)

Put-Call Ratio (Volume): 0.968

Max Pain Level: 85100

Maximum CALL OI: 86000

Maximum PUT OI: 85000

Highest CALL Addition: 85000

Highest PUT Addition: 84900

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 3,206.92 Cr.

DIIs Net BUY: ₹ 4,730.41 Cr.

FII Derivatives Activity

| FII Trading Stats | 3.12.25 | 2.12.25 | 1.12.25 |

| FII Cash (Provisional Data) | -3,206.92 | -3,642.30 | -1,171.31 |

| Index Future Open Interest Long Ratio | 14.06% | 15.91% | 18.84% |

| Index Future Volume Long Ratio | 34.00% | 29.72% | 50.90% |

| Call Option Open Interest Long Ratio | 49.44% | 48.26% | 49.43% |

| Call Option Volume Long Ratio | 50.17% | 49.99% | 49.95% |

| Put Option Open Interest Long Ratio | 64.93% | 65.89% | 61.44% |

| Put Option Volume Long Ratio | 50.30% | 50.18% | 50.08% |

| Stock Future Open Interest Long Ratio | 61.53% | 61.86% | 61.38% |

| Stock Future Volume Long Ratio | 46.46% | 55.40% | 49.11% |

| Index Futures | Fresh Short | Fresh Short | Short Covering |

| Index Options | Fresh Long | Short Covering | Fresh Long |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Short Covering | Fresh Long |

| BankNifty Futures | Long Covering | Long Covering | Short Covering |

| BankNifty Options | Fresh Long | Fresh Long | Fresh Long |

| FinNifty Futures | Fresh Short | Long Covering | Long Covering |

| FinNifty Options | Long Covering | Fresh Long | Fresh Long |

| MidcpNifty Futures | Short Covering | Fresh Long | Long Covering |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Long Covering | Fresh Short | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Long Covering | Short Covering | Fresh Short |

| Stock Options | Fresh Long | Fresh Long | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (4/12/2025)

The SENSEX index closed at 85106.81. The SENSEX weekly expiry for DECEMBER 4, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.789 against previous 0.637. The 86000CE option holds the maximum open interest, followed by the 87000CE and 85500CE options. Market participants have shown increased interest with significant open interest additions in the 85000CE option, with open interest additions also seen in the 84900PE and 84800PE options. On the other hand, open interest reductions were prominent in the 88000CE, 85500PE, and 87500CE options. Trading volume was highest in the 85000CE option, followed by the 84500PE and 84800PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 04-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85106.81 | 0.789 | 0.637 | 0.968 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,95,14,660 | 2,82,14,360 | 1,13,00,300 |

| PUT: | 3,11,86,180 | 1,79,62,020 | 1,32,24,160 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 29,44,920 | 7,28,100 | 4,61,84,080 |

| 87000 | 25,34,420 | 9,18,800 | 2,31,71,020 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 15,78,720 | 12,08,200 | 13,53,67,380 |

| 85500 | 22,37,840 | 10,00,400 | 9,80,15,420 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 13,88,820 | -4,57,060 | 1,84,37,640 |

| 87500 | 11,55,280 | -1,87,280 | 1,49,86,820 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 15,78,720 | 12,08,200 | 13,53,67,380 |

| 85200 | 14,01,920 | 8,43,520 | 10,43,96,300 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 20,46,880 | 10,22,680 | 11,62,29,740 |

| 84500 | 20,26,600 | 6,99,360 | 12,91,25,180 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84900 | 14,62,900 | 12,00,640 | 11,35,00,040 |

| 84800 | 16,05,940 | 10,73,440 | 12,33,53,920 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 3,85,120 | -2,30,580 | 71,90,620 |

| 85200 | 5,46,760 | -1,46,220 | 3,16,82,880 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 20,26,600 | 6,99,360 | 12,91,25,180 |

| 84800 | 16,05,940 | 10,73,440 | 12,33,53,920 |

NIFTY Weekly Expiry (9/12/2025)

The NIFTY index closed at 25986. The NIFTY weekly expiry for DECEMBER 9, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.691 against previous 0.725. The 27000CE option holds the maximum open interest, followed by the 26000CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 27000CE and 26500CE options. On the other hand, open interest reductions were prominent in the 27900CE, 26200PE, and 26150PE options. Trading volume was highest in the 25900PE option, followed by the 26000CE and 26000PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 09-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,986.00 | 0.691 | 0.725 | 0.961 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 14,78,40,375 | 9,68,21,850 | 5,10,18,525 |

| PUT: | 10,21,22,175 | 7,01,90,175 | 3,19,32,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,13,21,550 | 46,85,100 | 7,74,037 |

| 26,000 | 94,33,800 | 52,09,200 | 31,00,558 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 94,33,800 | 52,09,200 | 31,00,558 |

| 27,000 | 1,13,21,550 | 46,85,100 | 7,74,037 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 8,48,475 | -16,52,625 | 1,93,763 |

| 26,950 | 7,82,100 | -25,425 | 2,44,091 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 94,33,800 | 52,09,200 | 31,00,558 |

| 26,100 | 78,26,625 | 31,10,625 | 20,86,406 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 89,10,000 | 25,37,625 | 8,14,660 |

| 25,000 | 74,15,250 | 19,62,825 | 4,41,274 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 60,50,175 | 32,92,575 | 35,81,779 |

| 25,500 | 89,10,000 | 25,37,625 | 8,14,660 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 22,57,575 | -8,89,500 | 2,83,792 |

| 26,150 | 5,49,300 | -3,53,700 | 1,76,833 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 60,50,175 | 32,92,575 | 35,81,779 |

| 26,000 | 69,27,600 | 14,55,075 | 30,60,636 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 25986. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.106 against previous 1.159. The 26000PE option holds the maximum open interest, followed by the 26000CE and 27000CE options. Market participants have shown increased interest with significant open interest additions in the 26500CE option, with open interest additions also seen in the 26000CE and 26100CE options. On the other hand, open interest reductions were prominent in the 27000CE, 27400CE, and 26500PE options. Trading volume was highest in the 27000CE option, followed by the 26000PE and 26500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,986.00 | 1.106 | 1.159 | 0.762 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,53,72,625 | 5,29,88,450 | 23,84,175 |

| PUT: | 6,12,65,700 | 6,14,26,050 | -1,60,350 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 71,30,650 | 9,22,500 | 82,021 |

| 27,000 | 69,42,475 | -4,36,275 | 1,06,607 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 48,71,700 | 9,68,100 | 88,480 |

| 26,000 | 71,30,650 | 9,22,500 | 82,021 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 69,42,475 | -4,36,275 | 1,06,607 |

| 27,400 | 4,73,100 | -2,96,475 | 14,438 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 69,42,475 | -4,36,275 | 1,06,607 |

| 26,500 | 48,71,700 | 9,68,100 | 88,480 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 76,67,100 | 1,00,050 | 90,040 |

| 25,000 | 50,98,600 | 4,46,500 | 40,304 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 50,98,600 | 4,46,500 | 40,304 |

| 23,500 | 9,78,825 | 2,96,850 | 9,330 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 22,20,900 | -2,82,900 | 20,350 |

| 25,700 | 20,97,075 | -1,84,650 | 20,785 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 76,67,100 | 1,00,050 | 90,040 |

| 25,500 | 44,99,025 | -65,400 | 49,643 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59348.25. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.967 against previous 0.991. The 58500PE option holds the maximum open interest, followed by the 60000CE and 59500PE options. Market participants have shown increased interest with significant open interest additions in the 59500PE option, with open interest additions also seen in the 59500CE and 59000PE options. On the other hand, open interest reductions were prominent in the 58500PE, 58500CE, and 60000PE options. Trading volume was highest in the 59000PE option, followed by the 60000CE and 59500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,348.25 | 0.967 | 0.991 | 0.989 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,35,34,595 | 1,33,62,535 | 1,72,060 |

| PUT: | 1,30,83,695 | 1,32,43,820 | -1,60,125 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 12,98,465 | -49,805 | 1,13,080 |

| 59,500 | 10,07,020 | 4,40,160 | 1,11,234 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 10,07,020 | 4,40,160 | 1,11,234 |

| 59,000 | 6,80,155 | 59,010 | 83,530 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 9,26,415 | -3,64,525 | 20,888 |

| 62,000 | 6,75,150 | -93,310 | 40,040 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 12,98,465 | -49,805 | 1,13,080 |

| 59,500 | 10,07,020 | 4,40,160 | 1,11,234 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 13,48,095 | -7,55,580 | 81,788 |

| 59,500 | 12,73,930 | 5,78,095 | 1,05,682 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 12,73,930 | 5,78,095 | 1,05,682 |

| 59,000 | 12,59,230 | 75,670 | 1,65,057 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 13,48,095 | -7,55,580 | 81,788 |

| 60,000 | 5,89,645 | -99,680 | 29,349 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 12,59,230 | 75,670 | 1,65,057 |

| 59,500 | 12,73,930 | 5,78,095 | 1,05,682 |

FINNIFTY Monthly Expiry (30/12/2025)

The FINNIFTY index closed at 27629.6. The FINNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.848 against previous 0.760. The 27500PE option holds the maximum open interest, followed by the 28200CE and 28000CE options. Market participants have shown increased interest with significant open interest additions in the 27500PE option, with open interest additions also seen in the 27500CE and 27600CE options. On the other hand, open interest reductions were prominent in the 28200CE, 28800CE, and 27800CE options. Trading volume was highest in the 27500PE option, followed by the 27400PE and 27500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,629.60 | 0.848 | 0.760 | 1.098 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,96,145 | 4,86,525 | 9,620 |

| PUT: | 4,20,875 | 3,69,525 | 51,350 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,200 | 70,265 | -11,700 | 626 |

| 28,000 | 63,440 | 2,860 | 1,477 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 32,565 | 15,275 | 1,603 |

| 27,600 | 18,915 | 5,720 | 744 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,200 | 70,265 | -11,700 | 626 |

| 28,800 | 11,830 | -8,905 | 265 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 32,565 | 15,275 | 1,603 |

| 28,000 | 63,440 | 2,860 | 1,477 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,00,165 | 39,585 | 3,350 |

| 28,000 | 30,875 | -7,085 | 140 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,00,165 | 39,585 | 3,350 |

| 27,600 | 18,590 | 4,485 | 1,031 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 30,875 | -7,085 | 140 |

| 26,100 | 8,060 | -1,690 | 81 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,00,165 | 39,585 | 3,350 |

| 27,400 | 13,975 | 4,355 | 1,828 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13844. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.860 against previous 0.908. The 14000CE option holds the maximum open interest, followed by the 13500PE and 14000PE options. Market participants have shown increased interest with significant open interest additions in the 14500CE option, with open interest additions also seen in the 14000CE and 13500PE options. On the other hand, open interest reductions were prominent in the 69000PE, 69900PE, and 69200CE options. Trading volume was highest in the 14000CE option, followed by the 14500CE and 14300CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,844.00 | 0.860 | 0.908 | 0.737 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 63,35,280 | 53,64,100 | 9,71,180 |

| PUT: | 54,50,480 | 48,68,920 | 5,81,560 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,20,500 | 2,03,420 | 14,206 |

| 14,500 | 7,73,360 | 2,14,060 | 14,169 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 7,73,360 | 2,14,060 | 14,169 |

| 14,000 | 9,20,500 | 2,03,420 | 14,206 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,300 | 3,83,180 | -45,500 | 12,976 |

| 13,500 | 83,720 | -37,940 | 986 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,20,500 | 2,03,420 | 14,206 |

| 14,500 | 7,73,360 | 2,14,060 | 14,169 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 8,14,100 | 1,89,000 | 8,374 |

| 14,000 | 8,00,940 | 29,400 | 10,794 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 8,14,100 | 1,89,000 | 8,374 |

| 13,100 | 2,41,640 | 97,020 | 2,494 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 1,85,500 | -74,340 | 10,456 |

| 14,300 | 64,400 | -36,120 | 685 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 8,00,940 | 29,400 | 10,794 |

| 13,900 | 1,85,500 | -74,340 | 10,456 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Option market put-call ratios in NIFTY and BANKNIFTY suggest slightly bearish to neutral bias with max pain levels near current prices, signaling markets expect some consolidation or mild downside pressure.

The increase in combined OI and volume in NIFTY futures together with fresh shorts suggests traders should be cautious on long exposures, consider protective hedges or short strategies while monitoring the strong long flows in BANKNIFTY for clues on sector rotation.

Watching option max pain levels and put-call ratios for upcoming weekly and monthly expiries can help gauge potential support and resistance areas, aiding tactical trade decisions.

Overall, the “Open Interest Volume Analysis” points to a nuanced market where fresh shorts in NIFTY contrast with fresh longs in BANKNIFTY, urging traders to adapt strategies dynamically and manage risk prudently in this evolving environment.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.