Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 4/12/2025

Table of Contents

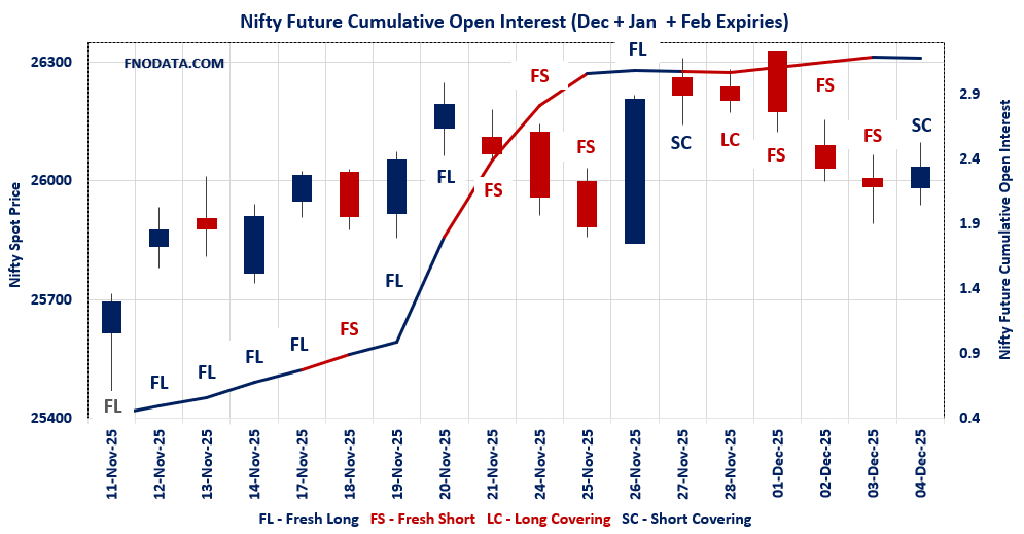

NIFTY’s combined futures saw -0.36% OI drop and -17.77% volume plunge with short covering; this unwinding alongside a spot rebound suggests bears are booking profits, potentially opening doors for a quick bounce if volume picks up.

BANKNIFTY combined OI jumped 5.22% on fresh shorts even as volume tanked -27.91%, reasoning that new sellers are stepping in aggressively post its brief green day, eyeing resistance around 59500 max pain.

FINNIFTY combined OI spiked 10.5% with fresh shorts and -15.5% volume, indicating strong bearish conviction building despite flat spot—watch for breakdowns below 27800 as premium erodes.

MIDCPNIFTY bucked the trend with 2.36% OI gain on fresh longs amid massive -58.73% volume fade, signaling selective bulls betting on midcap recovery; low volume tempers conviction though.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26033.75 (0.184%)

Combined = December + January + February

Combined Fut Open Interest Change: -0.36%

Combined Fut Volume Change: -17.77%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 8% Previous 8%

NIFTY DECEMBER Future closed at: 26186.5 (0.192%)

December Fut Premium 152.75 (Increased by 2.55 points)

December Fut Open Interest Change: -0.60%

December Fut Volume Change: -17.20%

December Fut Open Interest Analysis: Short Covering

NIFTY JANUARY Future closed at: 26350.5 (0.182%)

January Fut Premium 316.75 (Increased by 0.15 points)

January Fut Open Interest Change: 1.00%

January Fut Volume Change: -23.71%

January Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (9/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.807 (Increased from 0.691)

Put-Call Ratio (Volume): 0.921

Max Pain Level: 26000

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26500

Highest PUT Addition: 26000

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.111 (Increased from 1.106)

Put-Call Ratio (Volume): 0.887

Max Pain Level: 26000

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26700

Highest PUT Addition: 25700

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59288.7 (-0.100%)

Combined = December + January + February

Combined Fut Open Interest Change: 5.22%

Combined Fut Volume Change: -27.91%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 11% Previous 11%

BANKNIFTY DECEMBER Future closed at: 59643.2 (-0.157%)

December Fut Premium 354.5 (Decreased by -34.25 points)

December Fut Open Interest Change: 5.1%

December Fut Volume Change: -28.1%

December Fut Open Interest Analysis: Fresh Short

BANKNIFTY JANUARY Future closed at: 60010.4 (-0.132%)

January Fut Premium 721.7 (Decreased by -20.05 points)

January Fut Open Interest Change: 4.91%

January Fut Volume Change: -25.35%

January Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.904 (Decreased from 0.967)

Put-Call Ratio (Volume): 0.908

Max Pain Level: 59500

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 59500

Highest CALL Addition: 59500

Highest PUT Addition: 59500

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27611.45 (-0.066%)

Combined = December + January + February

Combined Fut Open Interest Change: 10.5%

Combined Fut Volume Change: -15.5%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 2% Previous 1%

FINNIFTY DECEMBER Future closed at: 27785.4 (-0.101%)

December Fut Premium 173.95 (Decreased by -10.05 points)

December Fut Open Interest Change: 10.22%

December Fut Volume Change: -14.24%

December Fut Open Interest Analysis: Fresh Short

FINNIFTY JANUARY Future closed at: 27847.3 (-0.367%)

January Fut Premium 235.85 (Decreased by -84.35 points)

January Fut Open Interest Change: 28.57%

January Fut Volume Change: -46.15%

January Fut Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.783 (Decreased from 0.848)

Put-Call Ratio (Volume): 1.077

Max Pain Level: 27800

Maximum CALL Open Interest: 28200

Maximum PUT Open Interest: 27500

Highest CALL Addition: 27500

Highest PUT Addition: 28000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13875.2 (0.225%)

Combined = December + January + February

Combined Fut Open Interest Change: 2.36%

Combined Fut Volume Change: -58.73%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 3% Previous 3%

MIDCPNIFTY DECEMBER Future closed at: 13922.4 (0.161%)

December Fut Premium 47.2 (Decreased by -8.85 points)

December Fut Open Interest Change: 2.32%

December Fut Volume Change: -58.58%

December Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY JANUARY Future closed at: 14007.55 (0.188%)

January Fut Premium 132.35 (Decreased by -4.85 points)

January Fut Open Interest Change: 1.88%

January Fut Volume Change: -65.65%

January Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.856 (Decreased from 0.860)

Put-Call Ratio (Volume): 0.724

Max Pain Level: 14000

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 14000

Highest CALL Addition: 14400

Highest PUT Addition: 13400

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,944.19 Cr.

DIIs Net BUY: ₹ 3,661.05 Cr.

FII Derivatives Activity

| FII Trading Stats | 4.12.25 | 3.12.25 | 2.12.25 |

| FII Cash (Provisional Data) | -1,944.19 | -3,206.92 | -3,642.30 |

| Index Future Open Interest Long Ratio | 12.50% | 14.06% | 15.91% |

| Index Future Volume Long Ratio | 29.24% | 34.00% | 29.72% |

| Call Option Open Interest Long Ratio | 48.18% | 49.44% | 48.26% |

| Call Option Volume Long Ratio | 49.71% | 50.17% | 49.99% |

| Put Option Open Interest Long Ratio | 63.89% | 64.93% | 65.89% |

| Put Option Volume Long Ratio | 50.00% | 50.30% | 50.18% |

| Stock Future Open Interest Long Ratio | 61.70% | 61.53% | 61.86% |

| Stock Future Volume Long Ratio | 53.70% | 46.46% | 55.40% |

| Index Futures | Fresh Short | Fresh Short | Fresh Short |

| Index Options | Fresh Short | Fresh Long | Short Covering |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Short | Fresh Long | Short Covering |

| BankNifty Futures | Long Covering | Long Covering | Long Covering |

| BankNifty Options | Fresh Long | Fresh Long | Fresh Long |

| FinNifty Futures | Short Covering | Fresh Short | Long Covering |

| FinNifty Options | Short Covering | Long Covering | Fresh Long |

| MidcpNifty Futures | Fresh Short | Short Covering | Fresh Long |

| MidcpNifty Options | Fresh Short | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Fresh Long | Long Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Fresh Long | Long Covering | Short Covering |

| Stock Options | Fresh Short | Fresh Long | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE Option market Trends : Options Insights

NIFTY Weekly Expiry (9/12/2025)

The NIFTY index closed at 26033.75. The NIFTY weekly expiry for DECEMBER 9, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.807 against previous 0.691. The 27000CE option holds the maximum open interest, followed by the 26500CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26000PE option, with open interest additions also seen in the 26050PE and 26500CE options. On the other hand, open interest reductions were prominent in the 25950CE, 25900CE, and 26900CE options. Trading volume was highest in the 26000PE option, followed by the 26000CE and 26100CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 09-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,033.75 | 0.807 | 0.691 | 0.921 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,68,03,325 | 14,78,40,375 | 89,62,950 |

| PUT: | 12,65,54,925 | 10,21,22,175 | 2,44,32,750 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,22,61,675 | 9,40,125 | 6,49,007 |

| 26,500 | 1,16,46,525 | 22,57,200 | 10,90,269 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,16,46,525 | 22,57,200 | 10,90,269 |

| 26,100 | 96,68,025 | 18,41,400 | 31,41,867 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,950 | 16,47,225 | -8,51,700 | 10,12,379 |

| 25,900 | 17,97,300 | -5,66,250 | 8,97,801 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 89,97,525 | -4,36,275 | 37,05,073 |

| 26,100 | 96,68,025 | 18,41,400 | 31,41,867 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 99,49,800 | 30,22,200 | 41,08,769 |

| 25,500 | 91,49,925 | 2,39,925 | 7,11,104 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 99,49,800 | 30,22,200 | 41,08,769 |

| 26,050 | 34,04,250 | 22,68,375 | 18,04,775 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 7,30,950 | -3,80,475 | 39,176 |

| 23,800 | 14,89,950 | -2,83,275 | 70,128 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 99,49,800 | 30,22,200 | 41,08,769 |

| 25,900 | 77,22,900 | 16,72,725 | 21,87,059 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 26033.75. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.111 against previous 1.106. The 26000PE option holds the maximum open interest, followed by the 27000CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 26700CE option, with open interest additions also seen in the 25700PE and 25800PE options. On the other hand, open interest reductions were prominent in the 26500CE, 26000CE, and 27500CE options. Trading volume was highest in the 26000PE option, followed by the 26000CE and 26500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,033.75 | 1.111 | 1.106 | 0.887 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,54,97,975 | 5,53,72,625 | 1,25,350 |

| PUT: | 6,16,84,525 | 6,12,65,700 | 4,18,825 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 69,78,825 | 36,350 | 54,394 |

| 26,000 | 69,10,350 | -2,20,300 | 79,742 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 21,79,875 | 5,44,200 | 30,429 |

| 26,200 | 29,65,125 | 1,84,425 | 42,815 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 45,50,475 | -3,21,225 | 71,468 |

| 26,000 | 69,10,350 | -2,20,300 | 79,742 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 69,10,350 | -2,20,300 | 79,742 |

| 26,500 | 45,50,475 | -3,21,225 | 71,468 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 76,49,200 | -17,900 | 86,096 |

| 25,000 | 50,86,850 | -11,750 | 26,659 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 23,85,675 | 2,88,600 | 24,273 |

| 25,800 | 17,76,375 | 2,26,800 | 28,993 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 28,92,450 | -1,52,625 | 32,446 |

| 24,800 | 11,17,725 | -1,12,725 | 6,839 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 76,49,200 | -17,900 | 86,096 |

| 25,500 | 44,25,150 | -73,875 | 51,586 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59288.7. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.904 against previous 0.967. The 59500PE option holds the maximum open interest, followed by the 60000CE and 59500CE options. Market participants have shown increased interest with significant open interest additions in the 59500PE option, with open interest additions also seen in the 59500CE and 60000CE options. On the other hand, open interest reductions were prominent in the 58500PE, 59000PE, and 58500CE options. Trading volume was highest in the 59500PE option, followed by the 59500CE and 60000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,288.70 | 0.904 | 0.967 | 0.908 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,41,28,580 | 1,35,34,595 | 5,93,985 |

| PUT: | 1,27,69,745 | 1,30,83,695 | -3,13,950 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 14,60,200 | 1,61,735 | 89,966 |

| 59,500 | 12,40,435 | 2,33,415 | 1,11,066 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 12,40,435 | 2,33,415 | 1,11,066 |

| 60,000 | 14,60,200 | 1,61,735 | 89,966 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 8,38,495 | -87,920 | 9,715 |

| 62,500 | 2,47,380 | -13,790 | 11,978 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 12,40,435 | 2,33,415 | 1,11,066 |

| 60,000 | 14,60,200 | 1,61,735 | 89,966 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 15,43,255 | 2,69,325 | 1,11,215 |

| 59,000 | 11,66,095 | -93,135 | 87,993 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 15,43,255 | 2,69,325 | 1,11,215 |

| 59,200 | 2,62,430 | 81,690 | 67,348 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 9,88,295 | -3,59,800 | 46,237 |

| 59,000 | 11,66,095 | -93,135 | 87,993 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 15,43,255 | 2,69,325 | 1,11,215 |

| 59,000 | 11,66,095 | -93,135 | 87,993 |

FINNIFTY Monthly Expiry (30/12/2025)

The FINNIFTY index closed at 27611.45. The FINNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.783 against previous 0.848. The 27500PE option holds the maximum open interest, followed by the 28200CE and 28000CE options. Market participants have shown increased interest with significant open interest additions in the 27500CE option, with open interest additions also seen in the 28000PE and 28000PE options. On the other hand, open interest reductions were prominent in the 27500PE, 28100CE, and 28100PE options. Trading volume was highest in the 27500PE option, followed by the 28000CE and 27600PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,611.45 | 0.783 | 0.848 | 1.077 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,89,775 | 4,96,145 | -6,370 |

| PUT: | 3,83,370 | 4,20,875 | -37,505 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,200 | 68,640 | -1,625 | 414 |

| 28,000 | 66,235 | 2,795 | 1,521 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 35,620 | 3,055 | 817 |

| 28,000 | 66,235 | 2,795 | 1,521 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,100 | 22,035 | -6,305 | 544 |

| 27,600 | 14,105 | -4,810 | 968 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 66,235 | 2,795 | 1,521 |

| 27,700 | 15,470 | 130 | 1,164 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 77,610 | -22,555 | 4,078 |

| 28,000 | 33,670 | 2,795 | 123 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 33,670 | 2,795 | 123 |

| 27,900 | 13,130 | 2,730 | 62 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 77,610 | -22,555 | 4,078 |

| 28,100 | 9,490 | -5,525 | 112 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 77,610 | -22,555 | 4,078 |

| 27,600 | 15,730 | -2,860 | 1,464 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13875.2. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.856 against previous 0.860. The 14000CE option holds the maximum open interest, followed by the 14000PE and 15000CE options. Market participants have shown increased interest with significant open interest additions in the 13400PE option, with open interest additions also seen in the 13600PE and 14400CE options. On the other hand, open interest reductions were prominent in the 67700PE, 68500CE, and 67000CE options. Trading volume was highest in the 14000CE option, followed by the 14500CE and 13900PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,875.20 | 0.856 | 0.860 | 0.724 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 71,57,360 | 63,35,280 | 8,22,080 |

| PUT: | 61,27,800 | 54,50,480 | 6,77,320 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,59,420 | 38,920 | 11,812 |

| 15,000 | 8,15,360 | 88,480 | 4,312 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,400 | 3,77,020 | 1,32,720 | 5,715 |

| 14,100 | 7,49,420 | 1,18,440 | 5,370 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,300 | 3,59,800 | -23,380 | 4,911 |

| 14,050 | 1,07,940 | -22,260 | 994 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,59,420 | 38,920 | 11,812 |

| 14,500 | 7,67,900 | -5,460 | 10,016 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 8,72,480 | 71,540 | 8,910 |

| 13,500 | 8,05,420 | -8,680 | 4,574 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 2,07,620 | 1,71,780 | 3,229 |

| 13,600 | 2,81,960 | 1,33,000 | 3,438 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,93,040 | -38,360 | 2,833 |

| 14,100 | 3,46,220 | -19,600 | 584 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 2,21,480 | 35,980 | 9,462 |

| 14,000 | 8,72,480 | 71,540 | 8,910 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

For NIFTY, short covering eases downside risk—go long on dips to 26000 max pain with tight stops, but trail if OI rebounds higher signaling fresh shorts.

BANKNIFTY fresh shorts scream caution; avoid fresh longs, consider put spreads or waits for long covering confirmation before banking bulls return.

Fade FINNIFTY longs here given heavy short buildup—short the index or buy puts targeting 27500 support, especially with PCR dipping bearish.

MIDCPNIFTY fresh longs offer a contrarian play; scale in calls above 14000 if volume revives, but size small due to volume weakness.

Wrapping up, this Open Interest Volume Analysis highlights NIFTY relief versus broader short pressure elsewhere—stay nimble, hedge across indices, and let PCR shifts plus max pain guide your expiry plays for smarter risk-reward tomorrow. What’s your take on this rotation? Drop a comment!

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.