Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 5/12/2025

Table of Contents

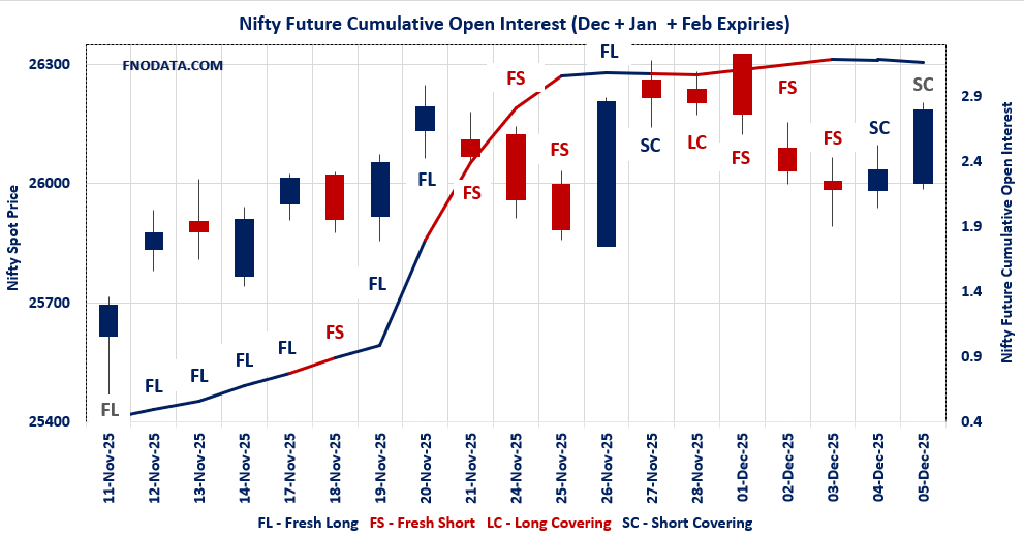

NIFTY futures combined OI fell -1.91% on short covering, but volume jumped 29.88%—this combo with spot up 0.587% means sellers covered aggressively on conviction, easing downside and fueling the bounce toward 26200.

BANKNIFTY mirrored with -7.74% OI drop and massive 70.66% volume spike on short covering; reasoning: bears panicked out as banks rallied 0.824%, hinting bulls could reload if premiums stabilize.

FINNIFTY’s mild -1.4% OI trim paired with 52.1% volume surge shows short covering too, supporting the 0.979% gain—low OI change tempers it, but volume confirms real money chasing upside.

MIDCPNIFTY combined OI down -2.62% with 29.93% volume pop on short covering aligns with 0.889% spot rise; fresh air for midcaps, though watch if volume sustains for follow-through.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26186.45 (0.587%)

Combined = December + January + February

Combined Fut Open Interest Change: -1.91%

Combined Fut Volume Change: 29.88%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 9% Previous 8%

NIFTY DECEMBER Future closed at: 26333.2 (0.560%)

December Fut Premium 146.75 (Decreased by -6 points)

December Fut Open Interest Change: -2.46%

December Fut Volume Change: 29.60%

December Fut Open Interest Analysis: Short Covering

NIFTY JANUARY Future closed at: 26493.1 (0.541%)

January Fut Premium 306.65 (Decreased by -10.1 points)

January Fut Open Interest Change: 2.64%

January Fut Volume Change: 26.66%

January Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (9/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.239 (Increased from 0.807)

Put-Call Ratio (Volume): 0.928

Max Pain Level: 26000

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26400

Highest PUT Addition: 26000

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.138 (Increased from 1.111)

Put-Call Ratio (Volume): 1.102

Max Pain Level: 26000

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26800

Highest PUT Addition: 25800

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59777.2 (0.824%)

Combined = December + January + February

Combined Fut Open Interest Change: -7.74%

Combined Fut Volume Change: 70.66%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 12% Previous 11%

BANKNIFTY DECEMBER Future closed at: 60055.6 (0.691%)

December Fut Premium 278.4 (Decreased by -76.1 points)

December Fut Open Interest Change: -8.8%

December Fut Volume Change: 70.9%

December Fut Open Interest Analysis: Short Covering

BANKNIFTY JANUARY Future closed at: 60394.2 (0.640%)

January Fut Premium 617 (Decreased by -104.7 points)

January Fut Open Interest Change: 0.91%

January Fut Volume Change: 60.97%

January Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.044 (Increased from 0.904)

Put-Call Ratio (Volume): 0.853

Max Pain Level: 59500

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 59500

Highest CALL Addition: 62500

Highest PUT Addition: 59000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27881.9 (0.979%)

Combined = December + January + February

Combined Fut Open Interest Change: -1.4%

Combined Fut Volume Change: 52.1%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 2% Previous 2%

FINNIFTY DECEMBER Future closed at: 28015.6 (0.828%)

December Fut Premium 133.7 (Decreased by -40.25 points)

December Fut Open Interest Change: -1.41%

December Fut Volume Change: 50.88%

December Fut Open Interest Analysis: Short Covering

FINNIFTY JANUARY Future closed at: 28193 (1.241%)

January Fut Premium 311.1 (Increased by 75.25 points)

January Fut Open Interest Change: 0.00%

January Fut Volume Change: 100.00%

January Fut Open Interest Analysis: Short Covering

FINNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.783 (Increased from 0.783)

Put-Call Ratio (Volume): 0.697

Max Pain Level: 27800

Maximum CALL Open Interest: 28200

Maximum PUT Open Interest: 27500

Highest CALL Addition: 28200

Highest PUT Addition: 27800

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13998.5 (0.889%)

Combined = December + January + February

Combined Fut Open Interest Change: -2.62%

Combined Fut Volume Change: 29.93%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 3% Previous 3%

MIDCPNIFTY DECEMBER Future closed at: 14053.85 (0.944%)

December Fut Premium 55.35 (Increased by 8.15 points)

December Fut Open Interest Change: -2.76%

December Fut Volume Change: 27.51%

December Fut Open Interest Analysis: Short Covering

MIDCPNIFTY JANUARY Future closed at: 14129.25 (0.869%)

January Fut Premium 130.75 (Decreased by -1.6 points)

January Fut Open Interest Change: -1.29%

January Fut Volume Change: 100.99%

January Fut Open Interest Analysis: Short Covering

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.850 (Decreased from 0.856)

Put-Call Ratio (Volume): 0.726

Max Pain Level: 14000

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 14000

Highest CALL Addition: 14500

Highest PUT Addition: 13700

SENSEX Monthly Expiry (24/12/2025) Future

SENSEX Spot closed at: 85,712.37 (0.524%)

SENSEX Monthly Future closed at: 86,132.05 (0.450%)

Premium: 419.68 (Decreased by -61.4 points)

Open Interest Change: -9.85%

Volume Change: -28.65%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (11/12/2025) Option Analysis

Put-Call Ratio (OI): 1.214 (Increased from 0.825)

Put-Call Ratio (Volume): 0.861

Max Pain Level: 85600

Maximum CALL OI: 89000

Maximum PUT OI: 83000

Highest CALL Addition: 89000

Highest PUT Addition: 83000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 438.90 Cr.

DIIs Net BUY: ₹ 4,189.17 Cr.

FII Derivatives Activity

| FII Trading Stats | 5.12.25 | 4.12.25 | 3.12.25 |

| FII Cash (Provisional Data) | -438.9 | -1,944.19 | -3,206.92 |

| Index Future Open Interest Long Ratio | 13.75% | 12.50% | 14.06% |

| Index Future Volume Long Ratio | 52.71% | 29.24% | 34.00% |

| Call Option Open Interest Long Ratio | 50.68% | 48.18% | 49.44% |

| Call Option Volume Long Ratio | 50.34% | 49.71% | 50.17% |

| Put Option Open Interest Long Ratio | 60.29% | 63.89% | 64.93% |

| Put Option Volume Long Ratio | 49.82% | 50.00% | 50.30% |

| Stock Future Open Interest Long Ratio | 61.74% | 61.70% | 61.53% |

| Stock Future Volume Long Ratio | 51.79% | 53.70% | 46.46% |

| Index Futures | Fresh Long | Fresh Short | Fresh Short |

| Index Options | Fresh Long | Fresh Short | Fresh Long |

| Nifty Futures | Fresh Long | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Short | Fresh Long |

| BankNifty Futures | Fresh Short | Long Covering | Long Covering |

| BankNifty Options | Fresh Long | Fresh Long | Fresh Long |

| FinNifty Futures | Fresh Long | Short Covering | Fresh Short |

| FinNifty Options | Short Covering | Short Covering | Long Covering |

| MidcpNifty Futures | Fresh Long | Fresh Short | Short Covering |

| MidcpNifty Options | Fresh Short | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Long Covering | Fresh Long | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Fresh Long | Fresh Long | Long Covering |

| Stock Options | Fresh Short | Fresh Short | Fresh Long |

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (11/12/2025)

The SENSEX index closed at 85712.37. The SENSEX weekly expiry for DECEMBER 11, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.214 against previous 0.825. The 83000PE option holds the maximum open interest, followed by the 84000PE and 85000PE options. Market participants have shown increased interest with significant open interest additions in the 83000PE option, with open interest additions also seen in the 84000PE and 82500PE options. On the other hand, open interest reductions were prominent in the 85200CE, 85100CE, and 85000CE options. Trading volume was highest in the 86000CE option, followed by the 85500PE and 85500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 11-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85712.37 | 1.214 | 0.825 | 0.861 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 85,07,020 | 39,95,140 | 45,11,880 |

| PUT: | 1,03,29,840 | 32,96,080 | 70,33,760 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 89000 | 5,38,620 | 3,15,680 | 48,53,980 |

| 86000 | 5,35,540 | 2,34,020 | 1,90,47,560 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 89000 | 5,38,620 | 3,15,680 | 48,53,980 |

| 88600 | 2,79,200 | 2,77,500 | 10,52,680 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85200 | 85,960 | -58,700 | 53,21,320 |

| 85100 | 35,060 | -56,060 | 26,66,580 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 5,35,540 | 2,34,020 | 1,90,47,560 |

| 85500 | 3,11,560 | 1,10,680 | 1,79,47,180 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 7,31,320 | 5,43,300 | 51,43,080 |

| 84000 | 6,84,560 | 4,89,140 | 81,97,460 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 7,31,320 | 5,43,300 | 51,43,080 |

| 84000 | 6,84,560 | 4,89,140 | 81,97,460 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 28,240 | -8,260 | 66,800 |

| 87400 | 180 | -140 | 240 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 4,93,080 | 3,68,420 | 1,86,77,720 |

| 85000 | 6,48,920 | 3,38,680 | 1,61,19,280 |

NIFTY Weekly Expiry (9/12/2025)

The NIFTY index closed at 26186.45. The NIFTY weekly expiry for DECEMBER 9, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.239 against previous 0.807. The 26000PE option holds the maximum open interest, followed by the 26500CE and 27000CE options. Market participants have shown increased interest with significant open interest additions in the 26000PE option, with open interest additions also seen in the 26100PE and 26050PE options. On the other hand, open interest reductions were prominent in the 26000CE, 26100CE, and 26050CE options. Trading volume was highest in the 26200CE option, followed by the 26000PE and 26100CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 09-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,186.45 | 1.239 | 0.807 | 0.928 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 14,79,31,200 | 15,68,03,325 | -88,72,125 |

| PUT: | 18,32,97,300 | 12,65,54,925 | 5,67,42,375 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,12,72,725 | -3,73,800 | 27,85,076 |

| 27,000 | 1,11,69,825 | -10,91,850 | 10,15,790 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 1,04,89,800 | 34,66,650 | 35,22,374 |

| 26,450 | 49,57,575 | 18,45,000 | 19,59,823 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 37,37,550 | -52,59,975 | 29,48,330 |

| 26,100 | 46,66,575 | -50,01,450 | 57,41,833 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 99,06,825 | 9,97,575 | 71,21,360 |

| 26,100 | 46,66,575 | -50,01,450 | 57,41,833 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,68,18,750 | 68,68,950 | 62,12,187 |

| 25,900 | 1,07,34,825 | 30,11,925 | 30,84,974 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,68,18,750 | 68,68,950 | 62,12,187 |

| 26,100 | 1,04,85,600 | 61,01,925 | 55,91,852 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 55,24,275 | -10,94,100 | 9,22,190 |

| 24,400 | 3,49,650 | -3,40,350 | 78,647 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,68,18,750 | 68,68,950 | 62,12,187 |

| 26,100 | 1,04,85,600 | 61,01,925 | 55,91,852 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 26186.45. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.138 against previous 1.111. The 26000PE option holds the maximum open interest, followed by the 27000CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 26800CE option, with open interest additions also seen in the 25800PE and 25400PE options. On the other hand, open interest reductions were prominent in the 26000CE, 26200CE, and 26600CE options. Trading volume was highest in the 26000PE option, followed by the 26000CE and 26500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,186.45 | 1.138 | 1.111 | 1.102 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,37,10,950 | 5,54,97,975 | -17,87,025 |

| PUT: | 6,11,20,225 | 6,16,84,525 | -5,64,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 67,71,675 | -2,07,150 | 73,991 |

| 26,000 | 62,04,875 | -7,05,475 | 82,244 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 24,79,425 | 4,70,250 | 41,190 |

| 27,100 | 8,80,200 | 1,97,250 | 24,605 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 62,04,875 | -7,05,475 | 82,244 |

| 26,200 | 25,30,500 | -4,34,625 | 66,759 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 62,04,875 | -7,05,475 | 82,244 |

| 26,500 | 41,86,800 | -3,63,675 | 81,540 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 75,42,775 | -1,06,425 | 1,37,209 |

| 25,000 | 50,00,675 | -86,175 | 37,874 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 20,95,875 | 3,19,500 | 47,061 |

| 25,400 | 13,57,275 | 2,97,150 | 28,838 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 12,37,650 | -3,43,575 | 29,543 |

| 25,500 | 41,73,825 | -2,51,325 | 80,750 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 75,42,775 | -1,06,425 | 1,37,209 |

| 25,500 | 41,73,825 | -2,51,325 | 80,750 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59777.2. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.044 against previous 0.904. The 59500PE option holds the maximum open interest, followed by the 59000PE and 60000CE options. Market participants have shown increased interest with significant open interest additions in the 59000PE option, with open interest additions also seen in the 60000PE and 58000PE options. On the other hand, open interest reductions were prominent in the 59500CE, 60000CE, and 64000CE options. Trading volume was highest in the 60000CE option, followed by the 59500PE and 59500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,777.20 | 1.044 | 0.904 | 0.853 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,34,98,160 | 1,41,28,580 | -6,30,420 |

| PUT: | 1,40,89,815 | 1,27,69,745 | 13,20,070 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 12,73,160 | -1,87,040 | 1,83,359 |

| 59,500 | 10,18,605 | -2,21,830 | 1,40,957 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 62,500 | 3,13,215 | 65,835 | 28,566 |

| 63,000 | 7,94,325 | 54,740 | 33,974 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 10,18,605 | -2,21,830 | 1,40,957 |

| 60,000 | 12,73,160 | -1,87,040 | 1,83,359 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 12,73,160 | -1,87,040 | 1,83,359 |

| 59,500 | 10,18,605 | -2,21,830 | 1,40,957 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 16,64,915 | 1,21,660 | 1,67,507 |

| 59,000 | 13,45,260 | 1,79,165 | 1,15,368 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 13,45,260 | 1,79,165 | 1,15,368 |

| 60,000 | 7,75,880 | 1,73,810 | 76,929 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,200 | 2,27,745 | -34,685 | 51,185 |

| 60,300 | 45,185 | -31,710 | 5,544 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 16,64,915 | 1,21,660 | 1,67,507 |

| 59,000 | 13,45,260 | 1,79,165 | 1,15,368 |

FINNIFTY Monthly Expiry (30/12/2025)

The FINNIFTY index closed at 27881.9. The FINNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.783 against previous 0.783. The 28200CE option holds the maximum open interest, followed by the 27500PE and 28000CE options. Market participants have shown increased interest with significant open interest additions in the 28200CE option, with open interest additions also seen in the 27800PE and 29050CE options. On the other hand, open interest reductions were prominent in the 27900CE, 26700PE, and 27500PE options. Trading volume was highest in the 28000CE option, followed by the 27800CE and 27800PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,881.90 | 0.783 | 0.783 | 0.697 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,55,685 | 4,89,775 | 65,910 |

| PUT: | 4,35,175 | 3,83,370 | 51,805 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,200 | 1,02,830 | 34,190 | 2,633 |

| 28,000 | 61,035 | -5,200 | 3,948 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,200 | 1,02,830 | 34,190 | 2,633 |

| 29,050 | 27,170 | 19,890 | 586 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 12,025 | -16,380 | 1,678 |

| 28,900 | 8,970 | -8,710 | 695 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 61,035 | -5,200 | 3,948 |

| 27,800 | 21,710 | -4,680 | 3,045 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 64,935 | -12,675 | 1,820 |

| 28,000 | 46,345 | 12,675 | 1,492 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 38,025 | 23,335 | 2,786 |

| 26,200 | 18,720 | 16,510 | 450 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 10,205 | -14,300 | 493 |

| 27,500 | 64,935 | -12,675 | 1,820 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 38,025 | 23,335 | 2,786 |

| 27,700 | 26,065 | 9,425 | 2,168 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13998.5. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.850 against previous 0.856. The 14000PE option holds the maximum open interest, followed by the 14500CE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 14500CE option, with open interest additions also seen in the 14300CE and 13700PE options. On the other hand, open interest reductions were prominent in the 70000CE, 69500CE, and 69000CE options. Trading volume was highest in the 14300CE option, followed by the 14000CE and 14000PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,998.50 | 0.850 | 0.856 | 0.726 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 73,31,800 | 71,57,360 | 1,74,440 |

| PUT: | 62,29,860 | 61,27,800 | 1,02,060 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 9,01,180 | 1,33,280 | 13,758 |

| 14,000 | 8,96,560 | -62,860 | 19,268 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 9,01,180 | 1,33,280 | 13,758 |

| 14,300 | 4,58,080 | 98,280 | 20,501 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 15,000 | 7,34,720 | -80,640 | 4,603 |

| 14,000 | 8,96,560 | -62,860 | 19,268 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,300 | 4,58,080 | 98,280 | 20,501 |

| 14,000 | 8,96,560 | -62,860 | 19,268 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,57,880 | 85,400 | 14,241 |

| 13,500 | 5,81,980 | -2,23,440 | 10,246 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 3,39,080 | 85,960 | 6,223 |

| 14,000 | 9,57,880 | 85,400 | 14,241 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 5,81,980 | -2,23,440 | 10,246 |

| 14,200 | 66,500 | -1,10,180 | 1,305 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 9,57,880 | 85,400 | 14,241 |

| 13,900 | 2,73,000 | 51,520 | 13,038 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

NIFTY: Ride the short-covering momentum—buy dips to 26000 max pain with calls, trail stops below recent lows; PCR jump to 1.239 warns of put defense, so scale out near 26500 OI wall.

BANKNIFTY: Explosive volume on covering favors longs—grab 59500 calls if holds, but hedge with 60000 puts given premium crush signaling volatility ahead.

FINNIFTY/MIDCPNIFTY: Both covering setups suit intraday longs targeting max pain (27800/14000); enter on pullbacks with 1:2 risk-reward, exit if OI builds shorts again.

Cross-check: PCR rises in NIFTY/BANKNIFTY signal put buying caution—avoid overleveraging, use volume fade as exit cue for any reversal.

Bottom line, this Open Interest Volume Analysis flags widespread short covering as your green light for upside bias into weekly expiry, but stay sharp on PCR spikes and max pain magnets—perfect setup for hedged longs if volume holds.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.