Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 9/12/2025

Table of Contents

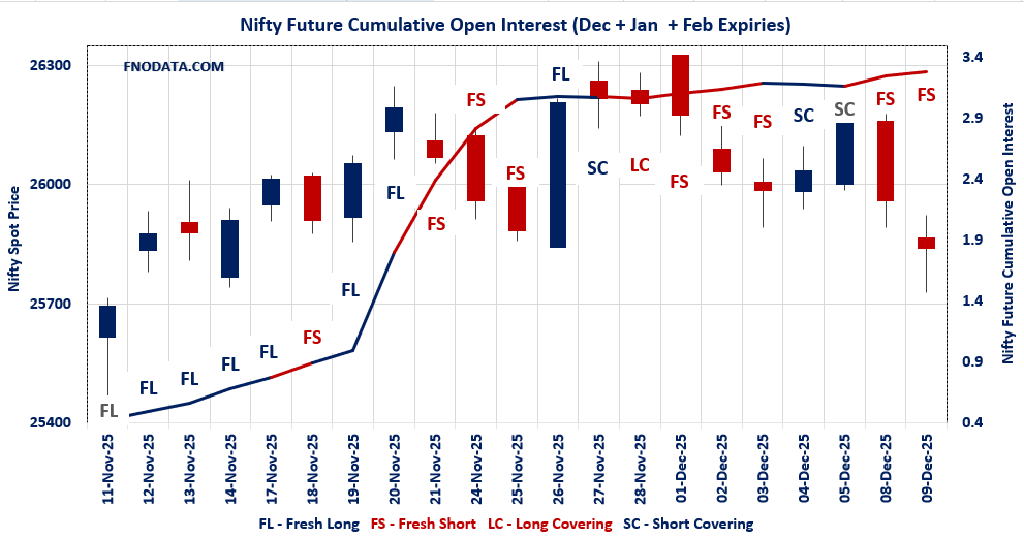

NIFTY’s Open Interest Volume Analysis screams fresh short buildup: Combined futures OI jumped 3.63% with modest volume uptick (3.60%), but spot dipped 0.47%—classic “price down, OI up” signaling bears piling in aggressively across December and January contracts.

Premiums oddly holding despite the slide: December and January futures saw premium expansion even as prices fell, hinting at some underlying long-side stickiness, but the dominant fresh short narrative overshadows it for now.

Weekly options turn bullish on PCR: OI-based PCR dropped to 0.668 with max pain at 25,900, showing call dominance and potential defense higher up—watch if this counters the futures bearishness.

BANKNIFTY mixed bag with long covering: Combined OI down -0.73% on heavy volume drop, pure profit-taking from longs in December, though January adds fresh shorts—sector rotating out of steam.

FINNIFTY joins the short party: +2.7% combined OI amid volume plunge, fresh shorts everywhere except flat January action, pointing to financials losing upside mojo fast.

MIDCPNIFTY light long unwind: Slight -0.43% OI drop with flat volume suggests casual covering, not panic—midcaps holding relatively better in this risk-off vibe.

SENSEX echoes the caution: +4.22% OI surge on rising volume screams fresh shorts, aligning with broad market bear tilt.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25839.65 (-0.466%)

Combined = December + January + February

Combined Fut Open Interest Change: 3.63%

Combined Fut Volume Change: 3.60%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 9% Previous 9%

NIFTY DECEMBER Future closed at: 25960.2 (-0.401%)

December Fut Premium 120.55 (Increased by 16.4 points)

December Fut Open Interest Change: 3.11%

December Fut Volume Change: 3.11%

December Fut Open Interest Analysis: Fresh Short

NIFTY JANUARY Future closed at: 26131.2 (-0.402%)

January Fut Premium 291.55 (Increased by 15.3 points)

January Fut Open Interest Change: 7.35%

January Fut Volume Change: 4.08%

January Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (16/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.668 (Decreased from 0.683)

Put-Call Ratio (Volume): 0.779

Max Pain Level: 25900

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 27000

Highest PUT Addition: 25400

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.024 (Decreased from 1.092)

Put-Call Ratio (Volume): 0.875

Max Pain Level: 26000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26000

Highest PUT Addition: 25300

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59222.35 (-0.027%)

Combined = December + January + February

Combined Fut Open Interest Change: -0.73%

Combined Fut Volume Change: -26.83%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 11% Previous 11%

BANKNIFTY DECEMBER Future closed at: 59528.4 (-0.041%)

December Fut Premium 306.05 (Decreased by -8.4 points)

December Fut Open Interest Change: -1.4%

December Fut Volume Change: -27.3%

December Fut Open Interest Analysis: Long Covering

BANKNIFTY JANUARY Future closed at: 59863 (-0.014%)

January Fut Premium 640.65 (Increased by 7.6 points)

January Fut Open Interest Change: 5.04%

January Fut Volume Change: -23.19%

January Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.893 (Increased from 0.875)

Put-Call Ratio (Volume): 0.877

Max Pain Level: 59500

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 59500

Highest CALL Addition: 59000

Highest PUT Addition: 58900

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27549.75 (-0.496%)

Combined = December + January + February

Combined Fut Open Interest Change: 2.7%

Combined Fut Volume Change: -45.3%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 3% Previous 2%

FINNIFTY DECEMBER Future closed at: 27703.1 (-0.447%)

December Fut Premium 153.35 (Increased by 12.9 points)

December Fut Open Interest Change: 1.98%

December Fut Volume Change: -45.00%

December Fut Open Interest Analysis: Fresh Short

FINNIFTY JANUARY Future closed at: 27943.8 (-0.234%)

January Fut Premium 394.05 (Increased by 71.9 points)

January Fut Open Interest Change: 36.36%

January Fut Volume Change: -53.85%

January Fut Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.775 (Decreased from 0.805)

Put-Call Ratio (Volume): 1.096

Max Pain Level: 27800

Maximum CALL Open Interest: 28200

Maximum PUT Open Interest: 27800

Highest CALL Addition: 28000

Highest PUT Addition: 28000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13741.35 (-0.170%)

Combined = December + January + February

Combined Fut Open Interest Change: -0.43%

Combined Fut Volume Change: 0.96%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 3% Previous 3%

MIDCPNIFTY DECEMBER Future closed at: 13787.35 (-0.053%)

December Fut Premium 46 (Increased by 16.05 points)

December Fut Open Interest Change: -0.71%

December Fut Volume Change: -0.45%

December Fut Open Interest Analysis: Long Covering

MIDCPNIFTY JANUARY Future closed at: 13869.3 (-0.008%)

January Fut Premium 127.95 (Increased by 22.3 points)

January Fut Open Interest Change: 8.10%

January Fut Volume Change: 22.07%

January Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.792 (Decreased from 0.817)

Put-Call Ratio (Volume): 0.817

Max Pain Level: 13975

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 14000

Highest CALL Addition: 14300

Highest PUT Addition: 13600

SENSEX Monthly Expiry (24/12/2025) Future

SENSEX Spot closed at: 84,666.28 (-0.513%)

SENSEX Monthly Future closed at: 85,064.50 (-0.514%)

Premium: 398.22 (Decreased by -3.44 points)

Open Interest Change: 4.22%

Volume Change: 29.70%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (11/12/2025) Option Analysis

Put-Call Ratio (OI): 0.626 (Increased from 0.579)

Put-Call Ratio (Volume): 0.914

Max Pain Level: 84900

Maximum CALL OI: 86000

Maximum PUT OI: 83000

Highest CALL Addition: 86000

Highest PUT Addition: 83000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 3,760.08 Cr.

DIIs Net BUY: ₹ 6,224.89 Cr.

FII Derivatives Activity

| FII Trading Stats | 9.12.25 | 8.12.25 | 5.12.25 |

| FII Cash (Provisional Data) | -3,760.08 | -655.59 | -438.9 |

| Index Future Open Interest Long Ratio | 10.79% | 12.07% | 13.75% |

| Index Future Volume Long Ratio | 44.51% | 27.76% | 52.71% |

| Call Option Open Interest Long Ratio | 47.59% | 46.06% | 50.68% |

| Call Option Volume Long Ratio | 50.28% | 49.40% | 50.34% |

| Put Option Open Interest Long Ratio | 67.41% | 64.44% | 60.29% |

| Put Option Volume Long Ratio | 50.22% | 50.36% | 49.82% |

| Stock Future Open Interest Long Ratio | 61.70% | 61.52% | 61.74% |

| Stock Future Volume Long Ratio | 51.83% | 48.41% | 51.79% |

| Index Futures | Long Covering | Fresh Short | Fresh Long |

| Index Options | Short Covering | Fresh Short | Fresh Long |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Long |

| Nifty Options | Short Covering | Fresh Short | Fresh Long |

| BankNifty Futures | Long Covering | Fresh Short | Fresh Short |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Long |

| FinNifty Futures | Long Covering | Fresh Short | Fresh Long |

| FinNifty Options | Long Covering | Fresh Long | Short Covering |

| MidcpNifty Futures | Fresh Long | Fresh Short | Fresh Long |

| MidcpNifty Options | Fresh Long | Short Covering | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Fresh Short | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Fresh Long |

| Stock Futures | Fresh Long | Long Covering | Fresh Long |

| Stock Options | Fresh Short | Fresh Long | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (11/12/2025)

The SENSEX index closed at 84666.28. The SENSEX weekly expiry for DECEMBER 11, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.626 against previous 0.579. The 86000CE option holds the maximum open interest, followed by the 85500CE and 87000CE options. Market participants have shown increased interest with significant open interest additions in the 86000CE option, with open interest additions also seen in the 85000CE and 87000CE options. On the other hand, open interest reductions were prominent in the 85500PE, 85200PE, and 88600CE options. Trading volume was highest in the 84500PE option, followed by the 85000CE and 84700PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 11-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 84666.28 | 0.626 | 0.579 | 0.914 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,78,43,080 | 1,82,26,080 | 96,17,000 |

| PUT: | 1,74,20,280 | 1,05,58,300 | 68,61,980 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 21,74,420 | 8,75,020 | 2,33,23,740 |

| 85500 | 17,79,360 | 4,55,720 | 2,33,27,640 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 21,74,420 | 8,75,020 | 2,33,23,740 |

| 85000 | 13,01,320 | 7,57,600 | 3,09,47,120 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 88600 | 84,160 | -1,16,500 | 7,94,620 |

| 90500 | 42,800 | -73,240 | 10,71,680 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 13,01,320 | 7,57,600 | 3,09,47,120 |

| 85500 | 17,79,360 | 4,55,720 | 2,33,27,640 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 13,86,340 | 6,32,740 | 1,02,10,280 |

| 84000 | 12,86,020 | 6,30,340 | 2,30,40,740 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 13,86,340 | 6,32,740 | 1,02,10,280 |

| 84000 | 12,86,020 | 6,30,340 | 2,30,40,740 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 2,72,920 | -1,64,780 | 17,20,580 |

| 85200 | 1,33,660 | -1,18,400 | 26,14,960 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 7,76,300 | 1,23,720 | 3,29,00,760 |

| 84700 | 5,05,860 | 2,33,260 | 2,59,22,680 |

NIFTY Weekly Expiry (16/12/2025)

The NIFTY index closed at 25839.65. The NIFTY weekly expiry for DECEMBER 16, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.668 against previous 0.683. The 27000CE option holds the maximum open interest, followed by the 26000CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 26000CE and 25400PE options. On the other hand, open interest reductions were prominent in the 26200PE, 26850CE, and 26050PE options. Trading volume was highest in the 26000CE option, followed by the 25800PE and 25900CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 16-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,839.65 | 0.668 | 0.683 | 0.779 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,07,14,350 | 5,36,48,250 | 4,70,66,100 |

| PUT: | 6,72,39,975 | 3,66,35,025 | 3,06,04,950 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 84,94,800 | 38,70,000 | 2,87,904 |

| 26,000 | 78,25,125 | 37,15,350 | 7,04,124 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 84,94,800 | 38,70,000 | 2,87,904 |

| 26,000 | 78,25,125 | 37,15,350 | 7,04,124 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,850 | 4,78,725 | -1,10,475 | 42,276 |

| 26,750 | 4,71,975 | -58,650 | 46,459 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 78,25,125 | 37,15,350 | 7,04,124 |

| 25,900 | 40,85,700 | 32,68,200 | 5,85,523 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 54,06,675 | 20,01,750 | 2,06,856 |

| 25,500 | 50,76,225 | 20,20,350 | 3,39,858 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 47,24,250 | 34,98,825 | 2,29,805 |

| 24,500 | 40,97,700 | 29,35,275 | 1,71,818 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 11,61,525 | -3,06,600 | 39,756 |

| 26,050 | 3,07,050 | -1,04,400 | 25,582 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 44,85,900 | 24,61,800 | 6,65,354 |

| 25,900 | 27,45,675 | 11,62,875 | 5,05,946 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 25839.65. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.024 against previous 1.092. The 26000CE option holds the maximum open interest, followed by the 27000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 26400CE and 25900CE options. On the other hand, open interest reductions were prominent in the 25700PE, 26600CE, and 26100PE options. Trading volume was highest in the 26000CE option, followed by the 26000PE and 26500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,839.65 | 1.024 | 1.092 | 0.875 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,96,69,600 | 5,70,28,175 | 26,41,425 |

| PUT: | 6,10,76,700 | 6,22,81,650 | -12,04,950 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 82,07,625 | 12,14,525 | 1,65,844 |

| 27,000 | 73,82,500 | 3,78,150 | 69,268 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 82,07,625 | 12,14,525 | 1,65,844 |

| 26,400 | 22,56,675 | 6,70,125 | 49,224 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 11,64,900 | -4,14,075 | 44,777 |

| 26,800 | 14,75,775 | -2,79,750 | 41,248 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 82,07,625 | 12,14,525 | 1,65,844 |

| 26,500 | 56,67,225 | -2,00,700 | 1,03,330 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 72,50,000 | -1,29,600 | 1,13,150 |

| 25,000 | 50,94,850 | 65,150 | 59,806 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 13,75,875 | 2,94,300 | 34,840 |

| 25,900 | 14,07,975 | 2,73,825 | 57,147 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 19,92,900 | -4,97,250 | 67,072 |

| 26,100 | 18,15,675 | -2,92,425 | 24,377 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 72,50,000 | -1,29,600 | 1,13,150 |

| 25,800 | 18,73,650 | -2,27,325 | 88,818 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59222.35. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.893 against previous 0.875. The 59500PE option holds the maximum open interest, followed by the 60000CE and 59000PE options. Market participants have shown increased interest with significant open interest additions in the 58900PE option, with open interest additions also seen in the 59000PE and 57000PE options. On the other hand, open interest reductions were prominent in the 59500CE, 59800CE, and 61500CE options. Trading volume was highest in the 59000PE option, followed by the 59500CE and 60000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,222.35 | 0.893 | 0.875 | 0.877 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,52,54,740 | 1,51,57,405 | 97,335 |

| PUT: | 1,36,18,870 | 1,32,65,400 | 3,53,470 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 15,07,275 | 20,195 | 1,09,180 |

| 59,500 | 12,77,570 | -1,51,305 | 1,32,486 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 7,63,735 | 58,800 | 95,825 |

| 59,300 | 2,17,630 | 55,300 | 56,020 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 12,77,570 | -1,51,305 | 1,32,486 |

| 59,800 | 4,16,640 | -54,565 | 36,702 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 12,77,570 | -1,51,305 | 1,32,486 |

| 60,000 | 15,07,275 | 20,195 | 1,09,180 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 16,47,905 | 30,800 | 83,102 |

| 59,000 | 12,82,925 | 66,010 | 1,69,973 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,900 | 2,02,020 | 79,485 | 60,555 |

| 59,000 | 12,82,925 | 66,010 | 1,69,973 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,800 | 1,88,300 | -45,535 | 9,701 |

| 57,400 | 49,385 | -26,040 | 5,308 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 12,82,925 | 66,010 | 1,69,973 |

| 59,500 | 16,47,905 | 30,800 | 83,102 |

FINNIFTY Monthly Expiry (30/12/2025)

The FINNIFTY index closed at 27549.75. The FINNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.775 against previous 0.805. The 28200CE option holds the maximum open interest, followed by the 27800PE and 28000CE options. Market participants have shown increased interest with significant open interest additions in the 28000CE option, with open interest additions also seen in the 27850CE and 28000PE options. On the other hand, open interest reductions were prominent in the 27500PE, 27800PE, and 28500CE options. Trading volume was highest in the 27500PE option, followed by the 27600CE and 28000CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,549.75 | 0.775 | 0.805 | 1.096 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,87,730 | 5,61,925 | 25,805 |

| PUT: | 4,55,325 | 4,52,270 | 3,055 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,200 | 1,08,030 | 1,300 | 376 |

| 28,000 | 64,155 | 11,570 | 1,140 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 64,155 | 11,570 | 1,140 |

| 27,850 | 14,495 | 7,735 | 310 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,500 | 24,570 | -4,420 | 405 |

| 28,800 | 10,530 | -3,380 | 153 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 12,870 | 3,965 | 1,150 |

| 28,000 | 64,155 | 11,570 | 1,140 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 88,205 | -4,550 | 459 |

| 27,500 | 52,780 | -8,320 | 2,177 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 33,410 | 5,915 | 215 |

| 25,700 | 4,030 | 3,315 | 82 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 52,780 | -8,320 | 2,177 |

| 27,800 | 88,205 | -4,550 | 459 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 52,780 | -8,320 | 2,177 |

| 27,600 | 14,365 | -130 | 1,111 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13741.35. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.792 against previous 0.817. The 14000CE option holds the maximum open interest, followed by the 14500CE and 15000CE options. Market participants have shown increased interest with significant open interest additions in the 13600PE option, with open interest additions also seen in the 14300CE and 14550CE options. On the other hand, open interest reductions were prominent in the 67700PE, 68400CE, and 69000CE options. Trading volume was highest in the 14000CE option, followed by the 13700PE and 13500PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,741.35 | 0.792 | 0.817 | 0.817 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 88,01,240 | 81,70,120 | 6,31,120 |

| PUT: | 69,73,540 | 66,72,400 | 3,01,140 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 11,43,380 | -40,740 | 38,885 |

| 14,500 | 9,65,020 | 98,420 | 11,839 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,300 | 6,14,460 | 1,12,840 | 12,561 |

| 14,550 | 1,12,700 | 1,12,700 | 1,132 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,100 | 6,85,580 | -62,720 | 9,316 |

| 14,800 | 4,00,960 | -57,820 | 2,673 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 11,43,380 | -40,740 | 38,885 |

| 13,800 | 3,29,140 | 41,020 | 16,949 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 7,14,420 | -2,08,880 | 5,670 |

| 13,000 | 6,40,920 | -7,140 | 12,298 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 5,04,980 | 1,95,020 | 16,393 |

| 13,700 | 3,87,100 | 1,06,960 | 22,189 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 7,14,420 | -2,08,880 | 5,670 |

| 13,800 | 3,13,600 | -43,120 | 12,310 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 3,87,100 | 1,06,960 | 22,189 |

| 13,500 | 5,79,180 | 39,060 | 19,017 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Big picture from Open Interest Volume Analysis: Bears in control, but options offer hope: Heavy short buildup across indices on falling prices warns of downside pressure, yet improving PCRs suggest bulls might defend key levels.

Actionable play—stay short-biased but tactical: Fade rallies to 26,000 on NIFTY with stops above; ideal for put buying or short strangles if volume confirms OI shorts—target max pain zones like 25,900-26,000.

Sector edge: Skip BANKNIFTY/FINNIFTY longs amid covering/shorts; nibble MIDCPNIFTY dips for relative safety.

Watch tomorrow’s trigger: Reversal if combined OI starts unwinding on volume spike—else, brace for 25,700 test; trail stops tight in this choppy expiry week.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.