Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 11/12/2025

Table of Contents

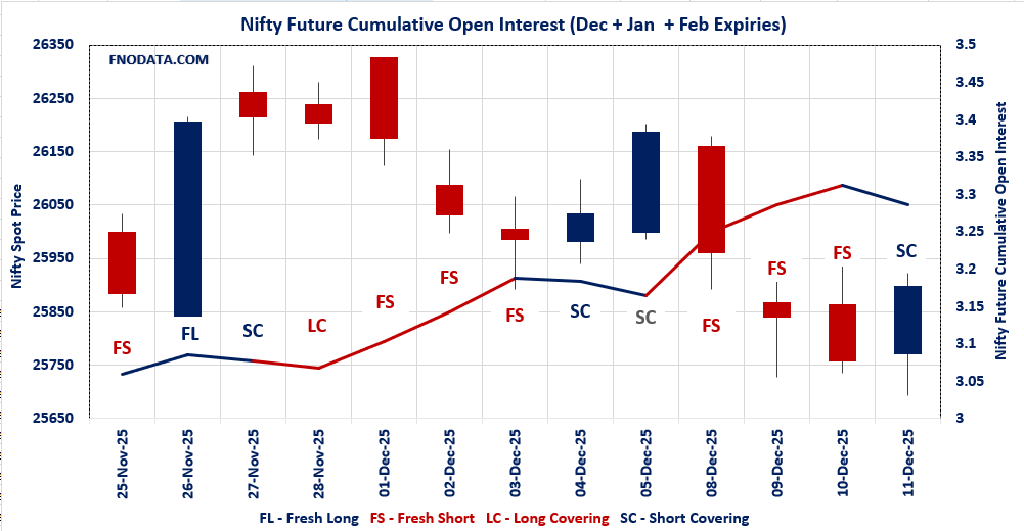

Markets finally caught a breather today with NIFTY bouncing 0.55% amid widespread short covering, and this Open Interest Volume Analysis across combined futures paints a classic relief rally picture—let’s break down what it really means for tomorrow.

Opening (Bullet Points)

NIFTY’s combined futures saw OI drop -2.53% on modest volume up 10.74%, pure short covering as price recovered sharply—bears blinking first after two days of aggressive buildup.

December led the unwind at -3.39% OI while January added fresh longs (+4.67%), showing near-term relief but longer-dated bulls dipping toes back in.

Options PCR jumped to 0.844 weekly/1.027 monthly with max pain steady at 25,900-26,000—put buying picking up, potentially capping this bounce.

BANKNIFTY combined OI plunged -4.97% on solid volume gain, aggressive short covering across the board though January longs hint at rotation.

FINNIFTY and MIDCPNIFTY both covering shorts (-2.9%/-1.67% combined OI), midcaps stealing the show with +1.43% spot pop—breadth improving.

SENSEX futures OI shed -6.48% on volume surge, aligning with index-wide unwind but premiums compressing signals caution.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25898.55 (0.546%)

Combined = December + January + February

Combined Fut Open Interest Change: -2.53%

Combined Fut Volume Change: 10.74%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 10% Previous 9%

NIFTY DECEMBER Future closed at: 26009.5 (0.563%)

December Fut Premium 110.95 (Increased by 5.05 points)

December Fut Open Interest Change: -3.39%

December Fut Volume Change: 11.76%

December Fut Open Interest Analysis: Short Covering

NIFTY JANUARY Future closed at: 26170 (0.529%)

January Fut Premium 271.45 (Decreased by -2.95 points)

January Fut Open Interest Change: 4.67%

January Fut Volume Change: -3.35%

January Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (16/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.844 (Increased from 0.544)

Put-Call Ratio (Volume): 0.910

Max Pain Level: 25900

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26350

Highest PUT Addition: 25700

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.027 (Increased from 0.997)

Put-Call Ratio (Volume): 0.917

Max Pain Level: 26000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26400

Highest PUT Addition: 25600

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59209.85 (0.423%)

Combined = December + January + February

Combined Fut Open Interest Change: -4.97%

Combined Fut Volume Change: 19.85%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 12% Previous 11%

BANKNIFTY DECEMBER Future closed at: 59496.2 (0.422%)

December Fut Premium 286.35 (Increased by 0.35 points)

December Fut Open Interest Change: -6.4%

December Fut Volume Change: 20.3%

December Fut Open Interest Analysis: Short Covering

BANKNIFTY JANUARY Future closed at: 59821.6 (0.419%)

January Fut Premium 611.75 (Increased by 0.15 points)

January Fut Open Interest Change: 6.08%

January Fut Volume Change: 13.41%

January Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.872 (Increased from 0.812)

Put-Call Ratio (Volume): 0.882

Max Pain Level: 59400

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 59500

Highest CALL Addition: 64000

Highest PUT Addition: 59500

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27561.9 (0.575%)

Combined = December + January + February

Combined Fut Open Interest Change: -2.9%

Combined Fut Volume Change: -22.3%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 4% Previous 3%

FINNIFTY DECEMBER Future closed at: 27695.5 (0.511%)

December Fut Premium 133.6 (Decreased by -16.7 points)

December Fut Open Interest Change: -3.51%

December Fut Volume Change: -23.72%

December Fut Open Interest Analysis: Short Covering

FINNIFTY JANUARY Future closed at: 27850 (0.478%)

January Fut Premium 288.1 (Decreased by -25.1 points)

January Fut Open Interest Change: 16.67%

January Fut Volume Change: 57.14%

January Fut Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.692 (Decreased from 0.729)

Put-Call Ratio (Volume): 0.974

Max Pain Level: 27800

Maximum CALL Open Interest: 28200

Maximum PUT Open Interest: 27500

Highest CALL Addition: 29000

Highest PUT Addition: 25500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13728.05 (1.431%)

Combined = December + January + February

Combined Fut Open Interest Change: -1.67%

Combined Fut Volume Change: -3.40%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 4% Previous 4%

MIDCPNIFTY DECEMBER Future closed at: 13765.05 (1.410%)

December Fut Premium 37 (Decreased by -2.35 points)

December Fut Open Interest Change: -2.16%

December Fut Volume Change: -4.47%

December Fut Open Interest Analysis: Short Covering

MIDCPNIFTY JANUARY Future closed at: 13850 (1.425%)

January Fut Premium 121.95 (Increased by 0.9 points)

January Fut Open Interest Change: 11.61%

January Fut Volume Change: 5.25%

January Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.877 (Increased from 0.728)

Put-Call Ratio (Volume): 0.798

Max Pain Level: 13875

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 15000

Highest PUT Addition: 12700

SENSEX Monthly Expiry (24/12/2025) Future

SENSEX Spot closed at: 84,818.13 (0.506%)

SENSEX Monthly Future closed at: 85,126.05 (0.462%)

Premium: 307.92 (Decreased by -35.16 points)

Open Interest Change: -6.48%

Volume Change: 54.20%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (18/12/2025) Option Analysis

Put-Call Ratio (OI): 1.158 (Increased from 0.646)

Put-Call Ratio (Volume): 1.126

Max Pain Level: 84800

Maximum CALL OI: 87000

Maximum PUT OI: 83000

Highest CALL Addition: 88000

Highest PUT Addition: 81500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 2,020.94 Cr.

DIIs Net BUY: ₹ 3,796.07 Cr.

FII Derivatives Activity

| FII Trading Stats | 11.12.25 | 10.12.25 | 9.12.25 |

| FII Cash (Provisional Data) | -2,020.94 | -1,651.06 | -3,760.08 |

| Index Future Open Interest Long Ratio | 11.45% | 10.67% | 10.79% |

| Index Future Volume Long Ratio | 52.23% | 39.71% | 44.51% |

| Call Option Open Interest Long Ratio | 48.46% | 48.45% | 47.59% |

| Call Option Volume Long Ratio | 50.00% | 50.08% | 50.28% |

| Put Option Open Interest Long Ratio | 62.40% | 65.95% | 67.41% |

| Put Option Volume Long Ratio | 49.61% | 50.00% | 50.22% |

| Stock Future Open Interest Long Ratio | 61.91% | 61.55% | 61.70% |

| Stock Future Volume Long Ratio | 54.28% | 48.44% | 51.83% |

| Index Futures | Fresh Long | Fresh Short | Long Covering |

| Index Options | Fresh Short | Fresh Long | Short Covering |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Short | Fresh Long | Short Covering |

| BankNifty Futures | Fresh Long | Fresh Short | Long Covering |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Long Covering | Short Covering | Long Covering |

| FinNifty Options | Short Covering | Fresh Long | Long Covering |

| MidcpNifty Futures | Fresh Long | Long Covering | Fresh Long |

| MidcpNifty Options | Fresh Long | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Fresh Short | Short Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Fresh Long |

| Stock Futures | Fresh Long | Long Covering | Fresh Long |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (18/12/2025)

The SENSEX index closed at 84818.13. The SENSEX weekly expiry for DECEMBER 18, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.158 against previous 0.646. The 87000CE option holds the maximum open interest, followed by the 83000PE and 82000PE options. Market participants have shown increased interest with significant open interest additions in the 81500PE option, with open interest additions also seen in the 83000PE and 82000PE options. On the other hand, open interest reductions were prominent in the 85800PE, 86700PE, and 83900CE options. Trading volume was highest in the 83000PE option, followed by the 85000CE and 84500PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 18-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 84818.13 | 1.158 | 0.646 | 1.126 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 37,91,360 | 18,29,520 | 19,61,840 |

| PUT: | 43,91,420 | 11,82,640 | 32,08,780 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 3,71,800 | 1,64,400 | 13,99,320 |

| 88000 | 2,73,560 | 1,90,660 | 9,99,760 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 2,73,560 | 1,90,660 | 9,99,760 |

| 87000 | 3,71,800 | 1,64,400 | 13,99,320 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83900 | 3,920 | -1,920 | 12,400 |

| 88800 | 4,620 | -1,300 | 9,900 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 2,67,780 | 59,820 | 25,83,020 |

| 84500 | 1,57,540 | 71,280 | 17,93,880 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 3,25,800 | 2,21,860 | 28,77,880 |

| 82000 | 3,00,600 | 2,16,240 | 14,50,860 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 2,52,640 | 2,22,060 | 6,98,220 |

| 83000 | 3,25,800 | 2,21,860 | 28,77,880 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85800 | 5,340 | -5,760 | 29,700 |

| 86700 | 2,720 | -2,060 | 3,780 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 3,25,800 | 2,21,860 | 28,77,880 |

| 84500 | 2,98,360 | 1,83,420 | 24,87,580 |

NIFTY Weekly Expiry (16/12/2025)

The NIFTY index closed at 25898.55. The NIFTY weekly expiry for DECEMBER 16, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.844 against previous 0.544. The 25000PE option holds the maximum open interest, followed by the 26000CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 25700PE option, with open interest additions also seen in the 25000PE and 25800PE options. On the other hand, open interest reductions were prominent in the 25800CE, 26000CE, and 25850CE options. Trading volume was highest in the 25800PE option, followed by the 25900CE and 25800CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 16-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,898.55 | 0.844 | 0.544 | 0.910 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,98,37,675 | 16,77,33,450 | -78,95,775 |

| PUT: | 13,49,63,625 | 9,13,08,450 | 4,36,55,175 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,06,67,775 | -24,92,325 | 33,03,901 |

| 26,500 | 1,03,69,650 | 15,55,050 | 9,58,722 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,350 | 48,87,450 | 16,29,600 | 5,60,775 |

| 26,500 | 1,03,69,650 | 15,55,050 | 9,58,722 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 31,41,825 | -27,33,150 | 33,35,602 |

| 26,000 | 1,06,67,775 | -24,92,325 | 33,03,901 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 73,21,275 | -17,67,375 | 36,80,729 |

| 25,800 | 31,41,825 | -27,33,150 | 33,35,602 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,11,55,575 | 45,95,925 | 8,07,326 |

| 25,800 | 95,17,350 | 45,25,425 | 40,16,868 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 95,15,850 | 57,20,625 | 31,73,004 |

| 25,000 | 1,11,55,575 | 45,95,925 | 8,07,326 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 19,83,375 | -8,16,150 | 2,49,612 |

| 26,300 | 4,94,775 | -5,00,550 | 33,648 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 95,17,350 | 45,25,425 | 40,16,868 |

| 25,700 | 95,15,850 | 57,20,625 | 31,73,004 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 25898.55. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.027 against previous 0.997. The 26000CE option holds the maximum open interest, followed by the 27000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 25600PE option, with open interest additions also seen in the 26400CE and 25700PE options. On the other hand, open interest reductions were prominent in the 26000CE, 26000PE, and 26200PE options. Trading volume was highest in the 26000CE option, followed by the 26000PE and 25500PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,898.55 | 1.027 | 0.997 | 0.917 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,84,87,000 | 6,07,70,600 | -22,83,600 |

| PUT: | 6,00,89,775 | 6,06,12,150 | -5,22,375 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 75,97,225 | -9,57,675 | 1,53,324 |

| 27,000 | 71,92,425 | -1,08,325 | 56,782 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 29,88,300 | 1,73,400 | 69,730 |

| 26,200 | 36,83,100 | 1,44,675 | 63,971 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 75,97,225 | -9,57,675 | 1,53,324 |

| 25,900 | 13,78,875 | -2,19,000 | 57,852 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 75,97,225 | -9,57,675 | 1,53,324 |

| 26,500 | 47,43,000 | -1,09,350 | 82,972 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 67,75,450 | -4,30,550 | 96,408 |

| 25,000 | 51,57,150 | 46,775 | 55,734 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 17,52,675 | 1,96,200 | 45,682 |

| 25,700 | 20,53,425 | 1,61,850 | 70,445 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 67,75,450 | -4,30,550 | 96,408 |

| 26,200 | 24,16,050 | -2,49,825 | 19,645 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 67,75,450 | -4,30,550 | 96,408 |

| 25,500 | 45,57,600 | 1,07,250 | 94,439 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59209.85. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.872 against previous 0.812. The 59500PE option holds the maximum open interest, followed by the 60000CE and 59500CE options. Market participants have shown increased interest with significant open interest additions in the 64000CE option, with open interest additions also seen in the 59500PE and 59200PE options. On the other hand, open interest reductions were prominent in the 60000CE, 59000CE, and 59500CE options. Trading volume was highest in the 59000PE option, followed by the 59500CE and 59000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,209.85 | 0.872 | 0.812 | 0.882 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,53,27,960 | 1,62,44,295 | -9,16,335 |

| PUT: | 1,33,66,420 | 1,31,97,160 | 1,69,260 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 14,14,700 | -2,06,815 | 1,11,300 |

| 59,500 | 13,85,685 | -88,970 | 1,62,129 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 64,000 | 5,55,555 | 97,475 | 20,232 |

| 62,500 | 3,24,100 | 28,805 | 16,714 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 14,14,700 | -2,06,815 | 1,11,300 |

| 59,000 | 7,54,880 | -1,02,970 | 1,15,638 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 13,85,685 | -88,970 | 1,62,129 |

| 59,000 | 7,54,880 | -1,02,970 | 1,15,638 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 16,20,850 | 74,200 | 93,740 |

| 59,000 | 12,54,155 | 1,050 | 1,67,081 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 16,20,850 | 74,200 | 93,740 |

| 59,200 | 2,42,655 | 54,670 | 94,629 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 6,33,535 | -49,875 | 39,540 |

| 59,400 | 1,65,375 | -34,895 | 47,215 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 12,54,155 | 1,050 | 1,67,081 |

| 59,200 | 2,42,655 | 54,670 | 94,629 |

FINNIFTY Monthly Expiry (30/12/2025)

The FINNIFTY index closed at 27561.9. The FINNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.692 against previous 0.729. The 28200CE option holds the maximum open interest, followed by the 28000CE and 27500PE options. Market participants have shown increased interest with significant open interest additions in the 29000CE option, with open interest additions also seen in the 28500CE and 28500CE options. On the other hand, open interest reductions were prominent in the 29050CE, 27800PE, and 26200PE options. Trading volume was highest in the 26100PE option, followed by the 27900CE and 27500PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,561.90 | 0.692 | 0.729 | 0.974 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,51,495 | 6,57,800 | -6,305 |

| PUT: | 4,50,775 | 4,79,310 | -28,535 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,200 | 1,07,770 | -4,160 | 437 |

| 28,000 | 71,825 | 520 | 1,064 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 29,000 | 31,785 | 7,150 | 483 |

| 28,500 | 30,095 | 3,770 | 167 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 29,050 | 17,095 | -11,180 | 511 |

| 27,600 | 14,040 | -6,045 | 998 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 23,985 | 3,770 | 1,939 |

| 27,500 | 55,185 | -4,355 | 1,239 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 68,770 | 1,170 | 1,885 |

| 27,800 | 68,250 | -8,710 | 200 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 3,640 | 2,470 | 60 |

| 26,700 | 10,400 | 2,145 | 169 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,800 | 68,250 | -8,710 | 200 |

| 26,200 | 5,980 | -6,825 | 245 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 11,895 | -6,565 | 2,153 |

| 27,500 | 68,770 | 1,170 | 1,885 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13728.05. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.877 against previous 0.728. The 14000CE option holds the maximum open interest, followed by the 15000CE and 14500CE options. Market participants have shown increased interest with significant open interest additions in the 12700PE option, with open interest additions also seen in the 13600PE and 13700PE options. On the other hand, open interest reductions were prominent in the 67500CE, 67000CE, and 70500CE options. Trading volume was highest in the 13800CE option, followed by the 14000CE and 13700CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,728.05 | 0.877 | 0.728 | 0.798 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 96,22,620 | 1,09,11,880 | -12,89,260 |

| PUT: | 84,36,540 | 79,44,580 | 4,91,960 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 11,45,200 | -2,72,860 | 21,943 |

| 15,000 | 9,36,180 | 21,000 | 3,210 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 15,000 | 9,36,180 | 21,000 | 3,210 |

| 14,150 | 93,240 | 14,840 | 787 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 11,45,200 | -2,72,860 | 21,943 |

| 13,700 | 2,59,700 | -1,35,800 | 16,351 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 4,51,500 | -93,100 | 24,314 |

| 14,000 | 11,45,200 | -2,72,860 | 21,943 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 8,47,140 | -90,300 | 12,854 |

| 13,500 | 6,93,980 | 18,760 | 12,583 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 2,42,340 | 1,67,300 | 3,692 |

| 13,600 | 6,41,480 | 1,43,500 | 14,439 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 4,66,480 | -1,72,200 | 8,032 |

| 13,000 | 8,47,140 | -90,300 | 12,854 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 6,41,480 | 1,43,500 | 14,439 |

| 13,000 | 8,47,140 | -90,300 | 12,854 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Open Interest Volume Analysis says relief rally, not trend reversal—short covering drove the bounce but fresh longs limited to far-month, watch for retest.

Actionable: Buy dips to 25,900 max pain with stops below 25,800; sell calls above 26,200 if PCR keeps rising—expiry week favors range plays.

Sector tilt: MIDCPNIFTY strongest for longs, fade BANKNIFTY/FINNIFTY if volume fades—trail profits tight.

Tomorrow’s key: OI rebound on upside volume confirms bulls; renewed shorts tank it back to 25,700—stay nimble, no hero trades here.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]