Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 12/12/2025

Table of Contents

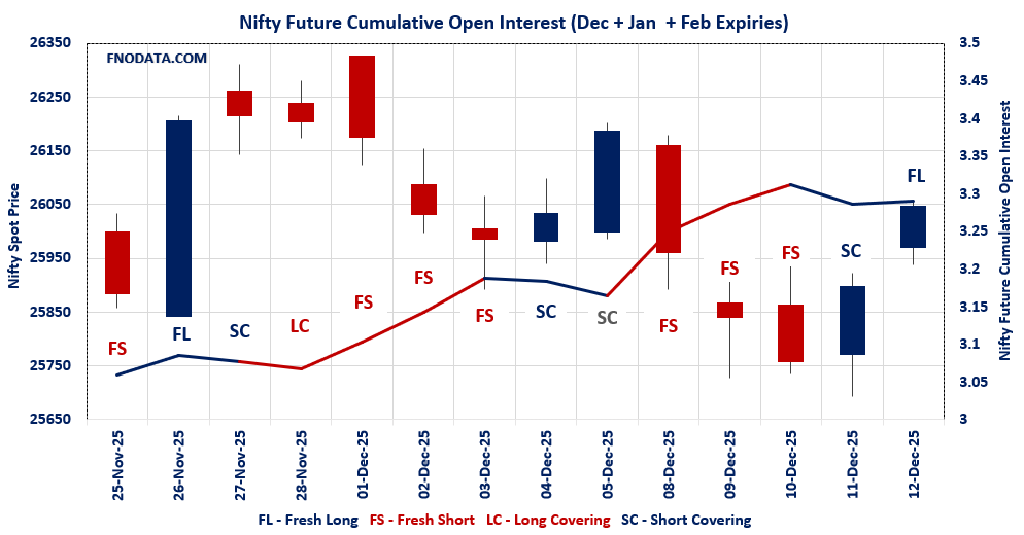

Markets extended yesterday’s relief rally with NIFTY popping 0.57% today, and this Open Interest Volume Analysis on combined futures reveals a subtle shift toward bulls testing the waters—short covering dominates most books but fresh longs in key spots hint at potential rotation.

Opening (Bullet Points)

NIFTY combined futures whisper fresh longs amid low conviction: Tiny +0.32% OI bump on -13% volume drop with spot up 0.57% suggests selective long addition, not crowd rush—December flat, January building modestly.

Premiums compressing across board: Both contracts saw premium erosion despite price gains, classic sign of bulls paying up less as shorts unwind cautiously.

PCR flipping bearish fast: Weekly at 1.169, monthly 1.056—put dominance returning with max pain locked at 26,000, traders defending downside now.

BANKNIFTY pure short covering play: -2.62% combined OI plunge on fading volume shows banks exhaling after selloff, no fresh bets yet.

FINNIFTY neutral at zero OI change: Flat combined open interest with volume crash signals equilibrium—shorts covered, no longs rushing in.

MIDCPNIFTY steals the show: Aggressive +7.05% combined OI explosion on 159% volume surge screams fresh longs, midcaps leading risk-on charge.

SENSEX massive unwind: -13.38% OI drop aligns with broad short covering, premiums tanking signals relief not conviction.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26046.95 (0.573%)

Combined = December + January + February

Combined Fut Open Interest Change: 0.32%

Combined Fut Volume Change: -13.35%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 10% Previous 10%

NIFTY DECEMBER Future closed at: 26145.4 (0.523%)

December Fut Premium 98.45 (Decreased by -12.5 points)

December Fut Open Interest Change: 0.10%

December Fut Volume Change: -13.86%

December Fut Open Interest Analysis: Fresh Long

NIFTY JANUARY Future closed at: 26300.4 (0.498%)

January Fut Premium 253.45 (Decreased by -18 points)

January Fut Open Interest Change: 1.72%

January Fut Volume Change: -4.87%

January Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (16/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.169 (Increased from 0.844)

Put-Call Ratio (Volume): 0.968

Max Pain Level: 26000

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26050

Highest PUT Addition: 26000

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.056 (Increased from 1.027)

Put-Call Ratio (Volume): 1.071

Max Pain Level: 26000

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26500

Highest PUT Addition: 25800

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59389.95 (0.304%)

Combined = December + January + February

Combined Fut Open Interest Change: -2.62%

Combined Fut Volume Change: -22.36%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 12% Previous 12%

BANKNIFTY DECEMBER Future closed at: 59657.8 (0.272%)

December Fut Premium 267.85 (Decreased by -18.5 points)

December Fut Open Interest Change: -1.7%

December Fut Volume Change: -24.6%

December Fut Open Interest Analysis: Short Covering

BANKNIFTY JANUARY Future closed at: 59961.4 (0.234%)

January Fut Premium 571.45 (Decreased by -40.3 points)

January Fut Open Interest Change: -11.52%

January Fut Volume Change: 15.48%

January Fut Open Interest Analysis: Short Covering

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.898 (Increased from 0.872)

Put-Call Ratio (Volume): 0.889

Max Pain Level: 59500

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 59500

Highest CALL Addition: 60000

Highest PUT Addition: 58500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13908.25 (1.313%)

Combined = December + January + February

Combined Fut Open Interest Change: 7.05%

Combined Fut Volume Change: 158.89%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 4% Previous 4%

MIDCPNIFTY DECEMBER Future closed at: 13974.8 (1.524%)

December Fut Premium 66.55 (Increased by 29.55 points)

December Fut Open Interest Change: 7.57%

December Fut Volume Change: 176.20%

December Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY JANUARY Future closed at: 14048.05 (1.430%)

January Fut Premium 139.8 (Increased by 17.85 points)

January Fut Open Interest Change: -5.71%

January Fut Volume Change: 3.17%

January Fut Open Interest Analysis: Short Covering

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.995 (Increased from 0.877)

Put-Call Ratio (Volume): 0.858

Max Pain Level: 13900

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13500

Highest CALL Addition: 14500

Highest PUT Addition: 13800

SENSEX Monthly Expiry (24/12/2025) Future

SENSEX Spot closed at: 85,267.66 (0.530%)

SENSEX Monthly Future closed at: 85,516.35 (0.458%)

Premium: 248.69 (Decreased by -59.23 points)

Open Interest Change: -13.38%

Volume Change: -51.91%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (18/12/2025) Option Analysis

Put-Call Ratio (OI): 1.015 (Decreased from 1.158)

Put-Call Ratio (Volume): 0.941

Max Pain Level: 85100

Maximum CALL OI: 88000

Maximum PUT OI: 82000

Highest CALL Addition: 88000

Highest PUT Addition: 85000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,114.22 Cr.

DIIs Net BUY: ₹ 3,868.94 Cr.

FII Derivatives Activity

| FII Trading Stats | 12.12.25 | 11.12.25 | 10.12.25 |

| FII Cash (Provisional Data) | -1,114.22 | -2,020.94 | -1,651.06 |

| Index Future Open Interest Long Ratio | 10.09% | 11.45% | 10.67% |

| Index Future Volume Long Ratio | 42.40% | 52.23% | 39.71% |

| Call Option Open Interest Long Ratio | 50.73% | 48.46% | 48.45% |

| Call Option Volume Long Ratio | 50.37% | 50.00% | 50.08% |

| Put Option Open Interest Long Ratio | 60.27% | 62.40% | 65.95% |

| Put Option Volume Long Ratio | 49.89% | 49.61% | 50.00% |

| Stock Future Open Interest Long Ratio | 61.91% | 61.91% | 61.55% |

| Stock Future Volume Long Ratio | 50.81% | 54.28% | 48.44% |

| Index Futures | Long Covering | Fresh Long | Fresh Short |

| Index Options | Fresh Long | Fresh Short | Fresh Long |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Short | Fresh Long |

| BankNifty Futures | Long Covering | Fresh Long | Fresh Short |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Long |

| FinNifty Futures | Fresh Short | Long Covering | Short Covering |

| FinNifty Options | Long Covering | Short Covering | Fresh Long |

| MidcpNifty Futures | Long Covering | Fresh Long | Long Covering |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Fresh Long | Fresh Short | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Fresh Long |

| Stock Futures | Fresh Long | Fresh Long | Long Covering |

| Stock Options | Fresh Long | Fresh Long | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (18/12/2025)

The SENSEX index closed at 85267.66. The SENSEX weekly expiry for DECEMBER 18, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.015 against previous 1.158. The 88000CE option holds the maximum open interest, followed by the 82000PE and 85000PE options. Market participants have shown increased interest with significant open interest additions in the 85000PE option, with open interest additions also seen in the 88000CE and 85200PE options. On the other hand, open interest reductions were prominent in the 84900CE, 84500CE, and 84800CE options. Trading volume was highest in the 85200PE option, followed by the 85000PE and 85200CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 18-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85267.66 | 1.015 | 1.158 | 0.941 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 82,45,960 | 37,91,360 | 44,54,600 |

| PUT: | 83,65,740 | 43,91,420 | 39,74,320 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 5,99,180 | 3,25,620 | 41,55,580 |

| 87000 | 4,84,700 | 1,12,900 | 78,02,480 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 5,99,180 | 3,25,620 | 41,55,580 |

| 85200 | 3,40,660 | 2,91,800 | 2,04,44,480 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84900 | 79,220 | -63,960 | 26,60,340 |

| 84500 | 96,960 | -60,580 | 7,76,220 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85200 | 3,40,660 | 2,91,800 | 2,04,44,480 |

| 85500 | 3,30,040 | 1,72,560 | 1,86,35,540 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,55,140 | 2,54,540 | 33,64,800 |

| 85000 | 5,21,940 | 3,35,360 | 2,26,81,020 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 5,21,940 | 3,35,360 | 2,26,81,020 |

| 85200 | 3,41,160 | 3,22,140 | 2,31,62,900 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82400 | 31,700 | -21,380 | 5,85,120 |

| 79500 | 24,980 | -12,460 | 4,49,820 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85200 | 3,41,160 | 3,22,140 | 2,31,62,900 |

| 85000 | 5,21,940 | 3,35,360 | 2,26,81,020 |

NIFTY Weekly Expiry (16/12/2025)

The NIFTY index closed at 26046.95. The NIFTY weekly expiry for DECEMBER 16, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.169 against previous 0.844. The 26000PE option holds the maximum open interest, followed by the 25800PE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 26000PE option, with open interest additions also seen in the 25950PE and 25900PE options. On the other hand, open interest reductions were prominent in the 25900CE, 25950CE, and 26000CE options. Trading volume was highest in the 26000PE option, followed by the 26000CE and 26100CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 16-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,046.95 | 1.169 | 0.844 | 0.968 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,29,57,850 | 15,98,37,675 | -68,79,825 |

| PUT: | 17,88,60,000 | 13,49,63,625 | 4,38,96,375 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,18,25,025 | 14,55,375 | 13,08,596 |

| 27,000 | 97,27,275 | -93,225 | 6,73,488 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,050 | 52,43,325 | 18,61,500 | 59,41,473 |

| 26,500 | 1,18,25,025 | 14,55,375 | 13,08,596 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 32,25,300 | -40,95,975 | 20,69,109 |

| 25,950 | 15,23,250 | -20,42,250 | 25,33,338 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 87,67,800 | -18,99,975 | 84,94,037 |

| 26,100 | 83,67,300 | -18,70,200 | 60,59,380 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,31,35,725 | 87,63,825 | 90,23,068 |

| 25,800 | 1,24,74,225 | 29,56,875 | 29,61,547 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,31,35,725 | 87,63,825 | 90,23,068 |

| 25,950 | 68,72,025 | 53,00,100 | 44,31,833 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 39,96,225 | -8,87,550 | 4,73,376 |

| 24,300 | 9,28,200 | -4,79,325 | 76,697 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,31,35,725 | 87,63,825 | 90,23,068 |

| 25,900 | 1,14,90,600 | 45,18,750 | 45,73,534 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 26046.95. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.056 against previous 1.027. The 26000PE option holds the maximum open interest, followed by the 27000CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 25800PE option, with open interest additions also seen in the 26500CE and 26000PE options. On the other hand, open interest reductions were prominent in the 26000CE, 25600PE, and 24800PE options. Trading volume was highest in the 26000PE option, followed by the 26000CE and 26500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,046.95 | 1.056 | 1.027 | 1.071 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,87,27,650 | 5,84,87,000 | 2,40,650 |

| PUT: | 6,19,90,125 | 6,00,89,775 | 19,00,350 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 71,54,950 | -37,475 | 64,524 |

| 26,000 | 67,08,075 | -8,89,150 | 1,29,053 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 57,24,900 | 9,81,900 | 1,00,202 |

| 27,500 | 24,53,475 | 2,37,900 | 15,318 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 67,08,075 | -8,89,150 | 1,29,053 |

| 26,200 | 34,71,900 | -2,11,200 | 60,370 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 67,08,075 | -8,89,150 | 1,29,053 |

| 26,500 | 57,24,900 | 9,81,900 | 1,00,202 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 72,64,775 | 4,89,325 | 1,51,076 |

| 25,000 | 52,39,125 | 81,975 | 43,820 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 33,69,300 | 12,38,550 | 81,015 |

| 26,000 | 72,64,775 | 4,89,325 | 1,51,076 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 14,43,825 | -3,08,850 | 42,742 |

| 24,800 | 9,49,200 | -2,11,425 | 10,126 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 72,64,775 | 4,89,325 | 1,51,076 |

| 25,500 | 44,62,350 | -95,250 | 97,339 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59389.95. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.898 against previous 0.872. The 59500PE option holds the maximum open interest, followed by the 60000CE and 59500CE options. Market participants have shown increased interest with significant open interest additions in the 58500PE option, with open interest additions also seen in the 60000CE and 59400PE options. On the other hand, open interest reductions were prominent in the 59100CE, 62000CE, and 60000PE options. Trading volume was highest in the 59500CE option, followed by the 59500PE and 60000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,389.95 | 0.898 | 0.872 | 0.889 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,53,48,820 | 1,53,27,960 | 20,860 |

| PUT: | 1,37,79,700 | 1,33,66,420 | 4,13,280 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 14,98,700 | 84,000 | 1,29,844 |

| 59,500 | 13,35,740 | -49,945 | 1,74,569 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 14,98,700 | 84,000 | 1,29,844 |

| 58,500 | 7,14,210 | 68,075 | 8,082 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,100 | 71,995 | -56,455 | 13,614 |

| 62,000 | 6,06,410 | -56,245 | 29,882 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 13,35,740 | -49,945 | 1,74,569 |

| 60,000 | 14,98,700 | 84,000 | 1,29,844 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 16,85,670 | 64,820 | 1,47,950 |

| 59,000 | 13,19,710 | 65,555 | 1,10,276 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 10,60,920 | 1,06,505 | 48,103 |

| 59,400 | 2,38,385 | 73,010 | 1,09,125 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 5,85,970 | -55,195 | 42,250 |

| 55,500 | 2,69,505 | -34,405 | 9,558 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 16,85,670 | 64,820 | 1,47,950 |

| 59,000 | 13,19,710 | 65,555 | 1,10,276 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13908.25. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.995 against previous 0.877. The 14500CE option holds the maximum open interest, followed by the 15000CE and 13500PE options. Market participants have shown increased interest with significant open interest additions in the 13800PE option, with open interest additions also seen in the 13900PE and 13500PE options. On the other hand, open interest reductions were prominent in the 69500CE, 68000CE, and 68100PE options. Trading volume was highest in the 14000CE option, followed by the 13800CE and 13800PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,908.25 | 0.995 | 0.877 | 0.858 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 91,58,240 | 96,22,620 | -4,64,380 |

| PUT: | 91,11,900 | 84,36,540 | 6,75,360 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 10,05,760 | 1,25,440 | 10,460 |

| 15,000 | 9,05,660 | -30,520 | 3,547 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 10,05,760 | 1,25,440 | 10,460 |

| 14,250 | 2,22,180 | 1,00,240 | 1,788 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 8,32,300 | -3,12,900 | 24,539 |

| 14,100 | 6,31,400 | -1,12,980 | 11,971 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 8,32,300 | -3,12,900 | 24,539 |

| 13,800 | 4,01,940 | -49,560 | 21,168 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 8,93,480 | 1,99,500 | 14,730 |

| 13,000 | 8,07,100 | -40,040 | 8,601 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 5,82,960 | 2,53,120 | 20,904 |

| 13,900 | 3,98,020 | 2,16,160 | 10,472 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 87,360 | -1,54,980 | 3,595 |

| 14,000 | 5,48,940 | -1,17,600 | 8,100 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 5,82,960 | 2,53,120 | 20,904 |

| 13,500 | 8,93,480 | 1,99,500 | 14,730 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Open Interest Volume Analysis takeaway: Bounce intact but fragile: Short covering fuels upside across most combined books, MIDCPNIFTY longs add breadth—yet thin volumes and rising PCR warn of traps.

Actionable trades—buy the dip, sell the rip: Load MIDCPNIFTY longs targeting 14,000 with 13,800 stops; NIFTY range 25,900-26,200 for iron condors—expiry favors theta decay.

Sector alpha: Chase midcap strength, trim BANKNIFTY/FINNIFTY longs; skip outright NIFTY bets till volume confirms.

Monday watchlist: Fresh OI buildup on volume = trend change; PCR spike above 1.2 = short back to 25,700—position small, volatility loves surprises.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.