Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 23/12/2025

Table of Contents

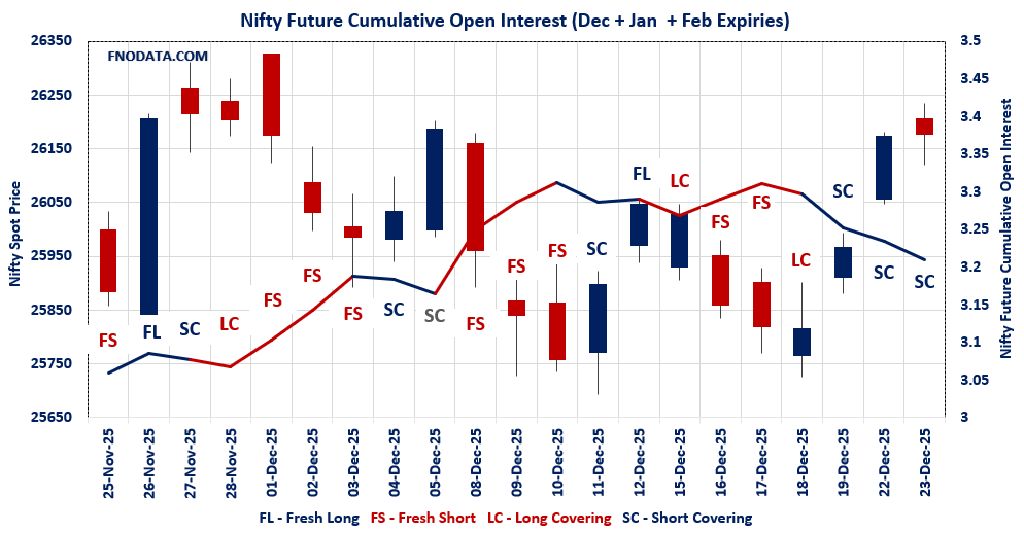

Markets traded flat today with NIFTY barely moving 0.02% amid holiday-thin volumes, and this Open Interest Volume Analysis across combined futures captures the classic profit-taking pause—short covering keeps the lid on while mixed signals hint at range consolidation into year-end.

NIFTY combined futures dominated by short covering: -2.33% OI drop on -12% volume reflects bears unwinding after recent squeeze, December aggressive at -5.7% while January loads fresh longs (+19.4%)—bulls positioning ahead.

Premiums mixed but steady: December ticking up slightly, January holding firm—time decay balanced by covering flows in low-volume environment.

PCR eases from extremes: Monthly dips to 1.084 with max pain at 26,100—put pressure lightening as traders digest the rally.

BANKNIFTY light long unwind: -1.57% combined OI shows casual profit booking, January shorts emerging cautiously.

MIDCPNIFTY covering on volume pop: -2.35% combined OI with +50% volume surge marks midcaps exhaling, no panic selling.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26177.15 (0.018%)

Combined = December + January + February

Combined Fut Open Interest Change: -2.33%

Combined Fut Volume Change: -11.74%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 19% Previous 16%

NIFTY DECEMBER Future closed at: 26206.9 (0.034%)

December Fut Premium 29.75 (Increased by 4.25 points)

December Fut Open Interest Change: -5.70%

December Fut Volume Change: -14.03%

December Fut Open Interest Analysis: Short Covering

NIFTY JANUARY Future closed at: 26392.8 (0.058%)

January Fut Premium 215.65 (Increased by 10.65 points)

January Fut Open Interest Change: 19.40%

January Fut Volume Change: -3.93%

January Fut Open Interest Analysis: Fresh Long

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.084 (Decreased from 1.131)

Put-Call Ratio (Volume): 0.996

Max Pain Level: 26100

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26200

Highest PUT Addition: 26200

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59299.55 (-0.008%)

Combined = December + January + February

Combined Fut Open Interest Change: -1.57%

Combined Fut Volume Change: -16.73%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 19% Previous 17%

BANKNIFTY DECEMBER Future closed at: 59407.6 (-0.046%)

December Fut Premium 108.05 (Decreased by -22.95 points)

December Fut Open Interest Change: -3.4%

December Fut Volume Change: -14.5%

December Fut Open Interest Analysis: Long Covering

BANKNIFTY JANUARY Future closed at: 59793.2 (-0.012%)

January Fut Premium 493.65 (Decreased by -2.95 points)

January Fut Open Interest Change: 7.59%

January Fut Volume Change: -26.86%

January Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.779 (Decreased from 0.797)

Put-Call Ratio (Volume): 0.974

Max Pain Level: 59300

Maximum CALL Open Interest: 59500

Maximum PUT Open Interest: 59000

Highest CALL Addition: 60700

Highest PUT Addition: 59300

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13946.35 (-0.181%)

Combined = December + January + February

Combined Fut Open Interest Change: -2.35%

Combined Fut Volume Change: 50.34%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 8% Previous 7%

MIDCPNIFTY DECEMBER Future closed at: 13963.75 (-0.202%)

December Fut Premium 17.4 (Decreased by -2.95 points)

December Fut Open Interest Change: -3.75%

December Fut Volume Change: 65.40%

December Fut Open Interest Analysis: Long Covering

MIDCPNIFTY JANUARY Future closed at: 14036.55 (-0.329%)

January Fut Premium 90.2 (Decreased by -21.05 points)

January Fut Open Interest Change: 17.27%

January Fut Volume Change: 16.91%

January Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.118 (Decreased from 1.211)

Put-Call Ratio (Volume): 0.999

Max Pain Level: 13900

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13000

Highest CALL Addition: 14400

Highest PUT Addition: 13700

SENSEX Monthly Expiry (24/12/2025) Future

SENSEX Spot closed at: 85,524.84 (-0.050%)

SENSEX Monthly Future closed at: 85,541.95 (0.016%)

Premium: 17.11 (Increased by 56.44 points)

Open Interest Change: -20.12%

Volume Change: 25.54%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (24/12/2025) Option Analysis

Put-Call Ratio (OI): 1.212 (Decreased from 1.472)

Put-Call Ratio (Volume): 0.990

Max Pain Level: 85500

Maximum CALL OI: 86000

Maximum PUT OI: 85000

Highest CALL Addition: 86000

Highest PUT Addition: 85200

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,794.80 Cr.

DIIs Net BUY: ₹ 3,812.37 Cr.

FII Derivatives Activity

| FII Trading Stats | 23.12.25 | 22.12.25 | 19.12.25 |

| FII Cash (Provisional Data) | -1,794.80 | -457.34 | 1,830.89 |

| Index Future Open Interest Long Ratio | 12.77% | 11.39% | 8.82% |

| Index Future Volume Long Ratio | 69.49% | 73.73% | 64.89% |

| Call Option Open Interest Long Ratio | 51.28% | 52.71% | 50.74% |

| Call Option Volume Long Ratio | 49.79% | 50.42% | 50.50% |

| Put Option Open Interest Long Ratio | 60.83% | 57.02% | 59.24% |

| Put Option Volume Long Ratio | 50.07% | 49.82% | 49.63% |

| Stock Future Open Interest Long Ratio | 62.04% | 61.83% | 61.74% |

| Stock Future Volume Long Ratio | 50.88% | 50.69% | 54.25% |

| Index Futures | Short Covering | Short Covering | Short Covering |

| Index Options | Long Covering | Fresh Long | Fresh Long |

| Nifty Futures | Short Covering | Short Covering | Short Covering |

| Nifty Options | Long Covering | Fresh Long | Fresh Long |

| BankNifty Futures | Long Covering | Short Covering | Long Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Long | Fresh Short | Fresh Short |

| FinNifty Options | Fresh Long | Fresh Short | Short Covering |

| MidcpNifty Futures | Short Covering | Fresh Short | Fresh Long |

| MidcpNifty Options | Short Covering | Fresh Short | Short Covering |

| NiftyNxt50 Futures | Fresh Long | Long Covering | Fresh Long |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Fresh Long | Fresh Long | Fresh Long |

| Stock Options | Short Covering | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (24/12/2025)

The SENSEX index closed at 85524.84. The SENSEX weekly expiry for DECEMBER 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.212 against previous 1.472. The 85000PE option holds the maximum open interest, followed by the 84000PE and 86000CE options. Market participants have shown increased interest with significant open interest additions in the 85200PE option, with open interest additions also seen in the 86000CE and 84000PE options. On the other hand, open interest reductions were prominent in the 80000PE, 87800CE, and 78000PE options. Trading volume was highest in the 85500PE option, followed by the 85500CE and 85600CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 24-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85524.84 | 1.212 | 1.472 | 0.990 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,07,64,620 | 1,02,21,600 | 1,05,43,020 |

| PUT: | 2,51,62,540 | 1,50,49,160 | 1,01,13,380 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 17,55,340 | 10,71,480 | 2,93,70,600 |

| 87000 | 14,67,840 | 6,93,480 | 1,05,86,480 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 17,55,340 | 10,71,480 | 2,93,70,600 |

| 85700 | 11,26,620 | 8,20,640 | 2,74,22,000 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 87800 | 57,080 | -1,49,340 | 11,00,380 |

| 85000 | 2,66,180 | -68,580 | 36,63,240 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 12,18,940 | 4,41,580 | 4,67,87,520 |

| 85600 | 11,04,100 | 7,21,220 | 4,07,04,780 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 19,13,960 | 8,19,520 | 2,85,30,400 |

| 84000 | 18,63,200 | 10,16,220 | 94,90,080 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85200 | 14,36,180 | 10,74,500 | 1,88,03,320 |

| 84000 | 18,63,200 | 10,16,220 | 94,90,080 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 2,54,400 | -1,59,160 | 25,14,580 |

| 78000 | 92,680 | -1,44,240 | 7,41,500 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 13,58,880 | 4,79,260 | 4,84,38,520 |

| 85600 | 6,54,640 | 4,07,480 | 3,12,92,820 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 26177.15. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.084 against previous 1.131. The 26000PE option holds the maximum open interest, followed by the 27000CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 26200CE option, with open interest additions also seen in the 26200PE and 25700PE options. On the other hand, open interest reductions were prominent in the 26000CE, 25900CE, and 25000CE options. Trading volume was highest in the 26200CE option, followed by the 26200PE and 26000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,177.15 | 1.084 | 1.131 | 0.996 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,51,59,625 | 7,63,25,425 | 2,88,34,200 |

| PUT: | 11,39,91,650 | 8,63,06,650 | 2,76,85,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,10,98,875 | 20,59,950 | 2,24,038 |

| 26,200 | 75,58,725 | 28,86,600 | 6,99,071 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 75,58,725 | 28,86,600 | 6,99,071 |

| 26,600 | 41,84,100 | 24,12,300 | 2,57,684 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,34,200 | -4,36,650 | 1,58,826 |

| 25,900 | 13,15,425 | -2,62,125 | 23,792 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 75,58,725 | 28,86,600 | 6,99,071 |

| 26,500 | 72,27,900 | 21,34,050 | 4,14,035 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,19,02,375 | 17,38,250 | 4,20,378 |

| 25,000 | 80,77,825 | 8,04,300 | 2,09,562 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 65,87,100 | 28,24,200 | 6,11,314 |

| 25,700 | 49,34,550 | 24,94,650 | 1,79,025 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 21,000 | 12,80,175 | -73,725 | 5,963 |

| 26,500 | 17,26,875 | -71,775 | 32,491 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 65,87,100 | 28,24,200 | 6,11,314 |

| 26,000 | 1,19,02,375 | 17,38,250 | 4,20,378 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59299.55. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.779 against previous 0.797. The 59500CE option holds the maximum open interest, followed by the 60000CE and 59000PE options. Market participants have shown increased interest with significant open interest additions in the 60700CE option, with open interest additions also seen in the 60800CE and 59300CE options. On the other hand, open interest reductions were prominent in the 57500PE, 63000CE, and 57000PE options. Trading volume was highest in the 59300PE option, followed by the 59300CE and 59500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,299.55 | 0.779 | 0.797 | 0.974 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,02,49,905 | 1,91,28,680 | 11,21,225 |

| PUT: | 1,57,69,750 | 1,52,54,970 | 5,14,780 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 20,15,615 | 1,15,395 | 1,52,950 |

| 60,000 | 18,75,055 | 1,12,595 | 1,09,012 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,700 | 2,53,260 | 1,33,980 | 19,668 |

| 60,800 | 3,06,320 | 1,28,450 | 33,088 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 7,25,935 | -89,845 | 37,132 |

| 59,000 | 8,15,710 | -46,865 | 53,135 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,300 | 6,45,890 | 1,28,380 | 1,74,762 |

| 59,500 | 20,15,615 | 1,15,395 | 1,52,950 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 13,96,115 | -11,410 | 1,14,981 |

| 59,500 | 12,89,540 | -7,525 | 1,17,739 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,300 | 4,90,280 | 1,04,755 | 1,78,786 |

| 59,400 | 3,52,695 | 84,175 | 1,21,814 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,500 | 5,88,385 | -1,19,280 | 39,213 |

| 57,000 | 6,93,140 | -60,445 | 36,380 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,300 | 4,90,280 | 1,04,755 | 1,78,786 |

| 59,400 | 3,52,695 | 84,175 | 1,21,814 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13946.35. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.118 against previous 1.211. The 13000PE option holds the maximum open interest, followed by the 14500CE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 14400CE option, with open interest additions also seen in the 13700PE and 13550PE options. On the other hand, open interest reductions were prominent in the 66000PE, 68000PE, and 65000PE options. Trading volume was highest in the 14000CE option, followed by the 13900PE and 14000PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,946.35 | 1.118 | 1.211 | 0.999 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 98,12,740 | 91,95,620 | 6,17,120 |

| PUT: | 1,09,68,720 | 1,11,36,720 | -1,68,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 11,96,300 | -29,960 | 10,497 |

| 14,000 | 11,02,220 | 25,200 | 32,607 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,400 | 6,04,100 | 1,70,800 | 9,251 |

| 14,050 | 2,33,520 | 1,00,940 | 17,848 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,300 | 5,59,440 | -44,520 | 11,354 |

| 14,500 | 11,96,300 | -29,960 | 10,497 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 11,02,220 | 25,200 | 32,607 |

| 14,100 | 6,28,600 | -16,800 | 20,093 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 12,74,280 | 23,240 | 10,037 |

| 13,500 | 8,31,880 | 36,400 | 11,511 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 7,43,260 | 1,26,140 | 10,707 |

| 13,550 | 2,01,180 | 1,16,060 | 2,940 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 6,79,840 | -94,640 | 21,162 |

| 12,000 | 1,02,620 | -83,160 | 778 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 5,73,580 | 16,100 | 25,997 |

| 14,000 | 6,79,840 | -94,640 | 21,162 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Open Interest Volume Analysis says range hold likely: Short covering fuels stability across combined books while January longs provide upside bias—26,000-26,200 box intact for holidays.

Actionable year-end plays: Sell 26,100-26,300 credit spreads or theta-positive butterflies; buy dips to 26,000 with 25,900 stops—avoid big bets in thin flows.

Sector tilt: Light NIFTY/BANKNIFTY longs, skip MIDCPNIFTY directionals; watch rollover extremes for positioning clues.

Wednesday edge: Volume pickup + fresh longs = 26,300 breakout; renewed shorts test support—stay nimble, year-end positioning drives wild swings.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]