Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 24/12/2025

Table of Contents

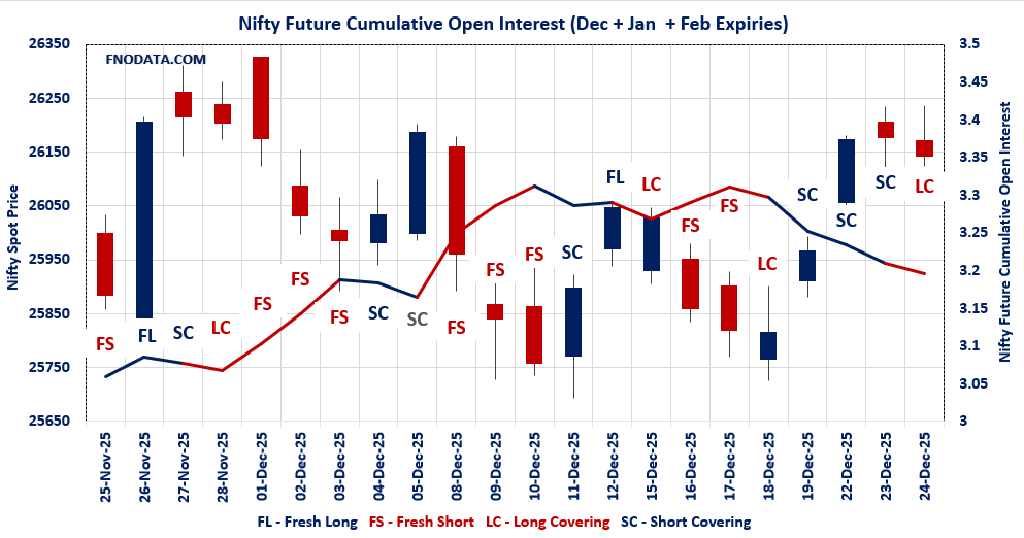

Markets pulled back slightly today with NIFTY off 0.13% amid explosive volume, and this Open Interest Volume Analysis across combined futures reveals massive long covering dominating the action—profit-taking hits hard while January shorts signal caution ahead of year-end close.

NIFTY combined futures bleed longs aggressively: -1.49% OI drop on +20% volume surge screams profit booking after the rally, December hammered -7.78% while January loads fresh shorts (+31.49%)—bears positioning big.

Premiums mixed in thin flows: December steady, January compressing—theta decay accelerates as holiday positioning ramps.

PCR swings bullish tilt: Monthly eases to 0.913 with max pain 26,150—call dominance returns, hinting defense higher up.

BANKNIFTY covering fireworks: -4.62% combined OI plunge on +113% volume explosion shows banks unloading gains fast, January shorts piling in.

MIDCPNIFTY massive unwind: -5.67% combined OI with +256% volume roar marks panic profit-taking, discounts widening signals weakness.

SENSEX bear reload: +12.75% combined OI bucks trend with fresh shorts, countering broad covering narrative.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 26142.1 (-0.134%)

Combined = December + January + February

Combined Fut Open Interest Change: -1.49%

Combined Fut Volume Change: 20.44%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 24% Previous 19%

NIFTY DECEMBER Future closed at: 26173.1 (-0.129%)

December Fut Premium 31 (Increased by 1.25 points)

December Fut Open Interest Change: -7.78%

December Fut Volume Change: 7.39%

December Fut Open Interest Analysis: Long Covering

NIFTY JANUARY Future closed at: 26351.9 (-0.155%)

January Fut Premium 209.8 (Decreased by -5.85 points)

January Fut Open Interest Change: 31.49%

January Fut Volume Change: 62.60%

January Fut Open Interest Analysis: Fresh Short

NIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.913 (Decreased from 1.084)

Put-Call Ratio (Volume): 0.992

Max Pain Level: 26150

Maximum CALL Open Interest: 26200

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26200

Highest PUT Addition: 26000

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 59183.6 (-0.196%)

Combined = December + January + February

Combined Fut Open Interest Change: -4.62%

Combined Fut Volume Change: 112.90%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 23% Previous 19%

BANKNIFTY DECEMBER Future closed at: 59253 (-0.260%)

December Fut Premium 69.4 (Decreased by -38.65 points)

December Fut Open Interest Change: -9.8%

December Fut Volume Change: 101.6%

December Fut Open Interest Analysis: Long Covering

BANKNIFTY JANUARY Future closed at: 59662.6 (-0.218%)

January Fut Premium 479 (Decreased by -14.65 points)

January Fut Open Interest Change: 19.61%

January Fut Volume Change: 177.19%

January Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.693 (Decreased from 0.779)

Put-Call Ratio (Volume): 0.919

Max Pain Level: 59200

Maximum CALL Open Interest: 59500

Maximum PUT Open Interest: 59000

Highest CALL Addition: 59500

Highest PUT Addition: 59100

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13813.1 (-0.955%)

Combined = December + January + February

Combined Fut Open Interest Change: -5.67%

Combined Fut Volume Change: 255.59%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 16% Previous 8%

MIDCPNIFTY DECEMBER Future closed at: 13803.7 (-1.146%)

December Fut Discount -9.4 (Decreased by -26.8 points)

December Fut Open Interest Change: -13.68%

December Fut Volume Change: 242.90%

December Fut Open Interest Analysis: Long Covering

MIDCPNIFTY JANUARY Future closed at: 13879.85 (-1.116%)

January Fut Discount 66.75 (Decreased by -23.45 points)

January Fut Open Interest Change: 86.79%

January Fut Volume Change: 308.55%

January Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (30/12/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.870 (Decreased from 1.118)

Put-Call Ratio (Volume): 0.946

Max Pain Level: 13900

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13900

Highest PUT Addition: 13900

SENSEX Monthly Expiry (29/01/2025) Future

SENSEX Spot closed at: 85,408.70 (-0.136%)

SENSEX Monthly Future closed at: 86,036.15 (-0.142%)

Premium: 627.45 (Decreased by -6.06 points)

Open Interest Change: 12.75%

Volume Change: 0.62%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (1/01/2025) Option Analysis

Put-Call Ratio (OI): 0.826 (Decreased from 0.989)

Put-Call Ratio (Volume): 1.012

Max Pain Level: 85500

Maximum CALL OI: 85500

Maximum PUT OI: 85500

Highest CALL Addition: 88000

Highest PUT Addition: 85500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,721.26 Cr.

DIIs Net BUY: ₹ 2,381.34 Cr.

FII Derivatives Activity

| FII Trading Stats | 24.12.25 | 23.12.25 | 22.12.25 |

| FII Cash (Provisional Data) | -1,721.26 | -1,794.80 | -457.34 |

| Index Future Open Interest Long Ratio | 12.44% | 12.77% | 11.39% |

| Index Future Volume Long Ratio | 51.75% | 69.49% | 73.73% |

| Call Option Open Interest Long Ratio | 49.88% | 51.28% | 52.71% |

| Call Option Volume Long Ratio | 49.79% | 49.79% | 50.42% |

| Put Option Open Interest Long Ratio | 60.38% | 60.83% | 57.02% |

| Put Option Volume Long Ratio | 50.46% | 50.07% | 49.82% |

| Stock Future Open Interest Long Ratio | 62.12% | 62.04% | 61.83% |

| Stock Future Volume Long Ratio | 49.93% | 50.88% | 50.69% |

| Index Futures | Short Covering | Short Covering | Short Covering |

| Index Options | Fresh Short | Long Covering | Fresh Long |

| Nifty Futures | Short Covering | Short Covering | Short Covering |

| Nifty Options | Fresh Short | Long Covering | Fresh Long |

| BankNifty Futures | Short Covering | Long Covering | Short Covering |

| BankNifty Options | Long Covering | Fresh Short | Fresh Short |

| FinNifty Futures | Short Covering | Fresh Long | Fresh Short |

| FinNifty Options | Fresh Short | Fresh Long | Fresh Short |

| MidcpNifty Futures | Short Covering | Short Covering | Fresh Short |

| MidcpNifty Options | Fresh Short | Short Covering | Fresh Short |

| NiftyNxt50 Futures | Long Covering | Fresh Long | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Short Covering | Fresh Long | Fresh Long |

| Stock Options | Short Covering | Short Covering | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (1/01/2025)

The SENSEX index closed at 85408.7. The SENSEX weekly expiry for JANUARY 1, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.826 against previous 0.989. The 85500CE option holds the maximum open interest, followed by the 85500PE and 88000CE options. Market participants have shown increased interest with significant open interest additions in the 88000CE option, with open interest additions also seen in the 85500CE and 85500PE options. On the other hand, open interest reductions were prominent in the 89100CE, 79400PE, and 79400PE options. Trading volume was highest in the 85500PE option, followed by the 85500CE and 85000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 01-01-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 85408.7 | 0.826 | 0.989 | 1.012 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 37,11,640 | 12,51,380 | 24,60,260 |

| PUT: | 30,65,700 | 12,37,220 | 18,28,480 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 3,96,360 | 2,46,760 | 17,96,620 |

| 88000 | 3,61,380 | 2,87,640 | 11,06,400 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 3,61,380 | 2,87,640 | 11,06,400 |

| 85500 | 3,96,360 | 2,46,760 | 17,96,620 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 89100 | 40 | -20 | 80 |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 3,96,360 | 2,46,760 | 17,96,620 |

| 86000 | 2,19,220 | 1,20,900 | 13,37,380 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 3,81,660 | 2,15,200 | 25,75,840 |

| 85000 | 2,92,160 | 1,60,320 | 13,46,640 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 3,81,660 | 2,15,200 | 25,75,840 |

| 85000 | 2,92,160 | 1,60,320 | 13,46,640 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| 87900 | 220 | 20 | 40 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 3,81,660 | 2,15,200 | 25,75,840 |

| 85000 | 2,92,160 | 1,60,320 | 13,46,640 |

NIFTY Monthly Expiry (30/12/2025)

The NIFTY index closed at 26142.1. The NIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.913 against previous 1.084. The 26000PE option holds the maximum open interest, followed by the 26200CE and 27000CE options. Market participants have shown increased interest with significant open interest additions in the 26200CE option, with open interest additions also seen in the 26400CE and 26250CE options. On the other hand, open interest reductions were prominent in the 24500PE, 25400PE, and 24800PE options. Trading volume was highest in the 26200PE option, followed by the 26200CE and 26150PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,142.10 | 0.913 | 1.084 | 0.992 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,88,69,225 | 10,51,59,625 | 5,37,09,600 |

| PUT: | 14,50,77,800 | 11,39,91,650 | 3,10,86,150 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 1,34,13,450 | 58,54,725 | 34,17,097 |

| 27,000 | 1,21,63,375 | 10,64,500 | 6,01,208 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 1,34,13,450 | 58,54,725 | 34,17,097 |

| 26,400 | 1,03,37,475 | 52,13,250 | 11,98,609 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 10,70,550 | -1,31,700 | 28,487 |

| 25,900 | 11,97,300 | -1,18,125 | 56,192 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 1,34,13,450 | 58,54,725 | 34,17,097 |

| 26,250 | 63,31,500 | 41,83,875 | 18,28,127 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,52,55,200 | 33,52,825 | 13,80,925 |

| 25,000 | 1,04,21,150 | 23,43,325 | 4,04,307 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,52,55,200 | 33,52,825 | 13,80,925 |

| 25,500 | 79,52,175 | 23,77,350 | 4,12,710 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 34,88,175 | -4,15,500 | 1,28,051 |

| 25,400 | 26,45,325 | -2,47,575 | 4,04,054 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 74,95,050 | 9,07,950 | 35,77,127 |

| 26,150 | 39,77,175 | 16,30,350 | 19,77,571 |

BANKNIFTY Monthly Expiry (30/12/2025)

The BANKNIFTY index closed at 59183.6. The BANKNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.693 against previous 0.779. The 59500CE option holds the maximum open interest, followed by the 60000CE and 59000PE options. Market participants have shown increased interest with significant open interest additions in the 59500CE option, with open interest additions also seen in the 61000CE and 59300CE options. On the other hand, open interest reductions were prominent in the 58000PE, 57500PE, and 59500PE options. Trading volume was highest in the 59500CE option, followed by the 59500PE and 59000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 59,183.60 | 0.693 | 0.779 | 0.919 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,07,22,160 | 2,02,49,905 | 4,72,255 |

| PUT: | 1,43,64,070 | 1,57,69,750 | -14,05,680 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 24,10,660 | 3,95,045 | 3,19,457 |

| 60,000 | 19,91,045 | 1,15,990 | 1,81,715 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 24,10,660 | 3,95,045 | 3,19,457 |

| 61,000 | 11,75,055 | 2,84,795 | 1,17,744 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,800 | 1,45,740 | -1,60,580 | 31,575 |

| 60,100 | 2,57,460 | -1,46,475 | 80,171 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 24,10,660 | 3,95,045 | 3,19,457 |

| 59,400 | 6,84,985 | 1,21,625 | 2,09,673 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 13,79,910 | -16,205 | 2,37,936 |

| 59,500 | 11,14,610 | -1,74,930 | 2,38,529 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,100 | 3,14,580 | 45,010 | 1,07,702 |

| 57,900 | 1,52,250 | 37,520 | 22,509 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 8,72,655 | -1,93,935 | 1,17,912 |

| 57,500 | 4,10,795 | -1,77,590 | 56,608 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 11,14,610 | -1,74,930 | 2,38,529 |

| 59,000 | 13,79,910 | -16,205 | 2,37,936 |

MIDCPNIFTY Monthly Expiry (30/12/2025)

The MIDCPNIFTY index closed at 13813.1. The MIDCPNIFTY monthly expiry for DECEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.870 against previous 1.118. The 14000CE option holds the maximum open interest, followed by the 13900CE and 13000PE options. Market participants have shown increased interest with significant open interest additions in the 13900CE option, with open interest additions also seen in the 14000CE and 14050CE options. On the other hand, open interest reductions were prominent in the 69500CE, 68000CE, and 69000PE options. Trading volume was highest in the 14000CE option, followed by the 13900PE and 13800PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-12-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,813.10 | 0.870 | 1.118 | 0.946 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,34,06,820 | 98,12,740 | 35,94,080 |

| PUT: | 1,16,64,380 | 1,09,68,720 | 6,95,660 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 17,05,340 | 6,03,120 | 71,148 |

| 13,900 | 12,81,000 | 8,99,360 | 46,952 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 12,81,000 | 8,99,360 | 46,952 |

| 14,000 | 17,05,340 | 6,03,120 | 71,148 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 10,75,760 | -1,20,540 | 15,296 |

| 14,800 | 3,49,580 | -55,580 | 2,758 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 17,05,340 | 6,03,120 | 71,148 |

| 13,900 | 12,81,000 | 8,99,360 | 46,952 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,87,480 | -86,800 | 10,443 |

| 14,000 | 8,23,900 | 1,44,060 | 32,086 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 8,23,060 | 2,49,480 | 55,253 |

| 13,800 | 7,90,020 | 2,08,740 | 52,001 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,550 | 87,500 | -1,13,680 | 7,666 |

| 13,650 | 1,33,560 | -97,020 | 11,864 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 8,23,060 | 2,49,480 | 55,253 |

| 13,800 | 7,90,020 | 2,08,740 | 52,001 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Open Interest Volume Analysis verdict: Rally pause, not reversal: Long covering swamps combined books everywhere except SENSEX shorts—26,000 support tested but volume suggests exhaustion.

Actionable Christmas eve plays: Sell 26,100-26,300 rallies with 26,400 stops; favor put credit spreads or short futures—theta gang paradise into holidays.

Sector caution: Trim BANKNIFTY/MIDCPNIFTY longs aggressively; light NIFTY bias higher if PCR holds—avoid hero trades.

Tomorrow’s Santa check: Volume fade + OI stabilize = range hold; fresh shorts dominate = 25,800 breach—position tiny, year-end flows get wild.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]