Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 1/02/2026

Table of Contents

Open Interest Volume Analysis clearly signals aggressive risk-off positioning as NIFTY, BANKNIFTY, MIDCPNIFTY, and SENSEX all witnessed simultaneous price decline + sharp OI expansion, a classic footprint of fresh short build-up by institutions.

The most important takeaway from today’s data is volume confirmation — futures volume jumped above 100% across most indices, which means today’s move is not panic selling by retailers, but decisive positioning by smart money.

NIFTY futures premium collapsed sharply, showing that bulls are unwilling to pay for carry, while weekly PCR dropped below 0.5, confirming short-term bearish sentiment dominance.

BANKNIFTY is the biggest red flag: OI + volume + rollover all rising together, which usually appears at the start of a directional downtrend, not at the end of one.

Options data strengthens this view — CALL writing is shifting higher, PUT writing is moving lower, indicating that market participants are rebuilding resistance zones and removing downside protection.

From an opening perspective, expect volatile and weak bias trade, where any gap-up is likely to be sold into unless futures OI starts unwinding.

In short: Today’s Open Interest Volume Analysis confirms that control has shifted to bears, and traders must focus more on risk management than bottom-fishing in the opening hour.

NSE & BSE F&O Market Signals

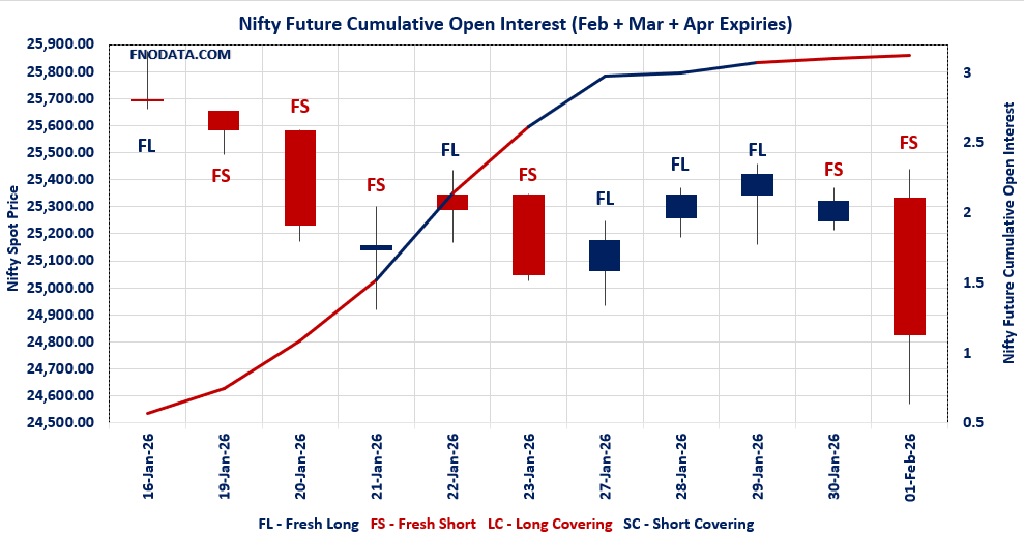

NIFTY Future analysis

NIFTY Spot closed at: 24825.45 (-1.956%)

Combined = February + March + April

Combined Fut Open Interest Change: 2.81%

Combined Fut Volume Change: 109.42%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 7% Previous 7%

NIFTY FEBRUARY Future closed at: 24853.5 (-2.215%)

February Fut Premium 28.05 (Decreased by -67.7 points)

February Fut Open Interest Change: 2.89%

February Fut Volume Change: 107.73%

February Fut Open Interest Analysis: Fresh Short

NIFTY March Future closed at: 25029.6 (-2.162%)

March Fut Premium 204.15 (Decreased by -58 points)

March Fut Open Interest Change: -1.32%

March Fut Volume Change: 130.30%

March Fut Open Interest Analysis: Long Covering

NIFTY Weekly Expiry (3/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.428 (Decreased from 0.762)

Put-Call Ratio (Volume): 0.954

Max Pain Level: 25000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 23500

Highest CALL Addition: 26000

Highest PUT Addition: 23500

NIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.048 (Decreased from 1.117)

Put-Call Ratio (Volume): 0.926

Max Pain Level: 25500

Maximum CALL Open Interest: 25500

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25000

Highest PUT Addition: 24500

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 58417.2 (-2.002%)

Combined = February + March + April

Combined Fut Open Interest Change: 8.46%

Combined Fut Volume Change: 137.09%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 9% Previous 8%

BANKNIFTY FEBRUARY Future closed at: 58701.4 (-2.015%)

February Fut Premium 284.2 (Decreased by -13.95 points)

February Fut Open Interest Change: 7.6%

February Fut Volume Change: 132.0%

February Fut Open Interest Analysis: Fresh Short

BANKNIFTY MARCH Future closed at: 59075.2 (-2.024%)

March Fut Premium 658 (Decreased by -27.35 points)

March Fut Open Interest Change: 12.66%

March Fut Volume Change: 202.40%

March Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.855 (Decreased from 1.053)

Put-Call Ratio (Volume): 0.895

Max Pain Level: 59600

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 60000

Highest CALL Addition: 59000

Highest PUT Addition: 56000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13020.25 (-2.834%)

Combined = February + March + April

Combined Fut Open Interest Change: 6.91%

Combined Fut Volume Change: 64.63%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 3% Previous 3%

MIDCPNIFTY FEBRUARY Future closed at: 13025.5 (-2.802%)

February Fut Premium5.25 (Increased by 4.35 points)

February Fut Open Interest Change: 7.00%

February Fut Volume Change: 62.29%

February Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY MARCH Future closed at: 13064.9 (-3.001%)

March Fut Premium44.65 (Decreased by -24.45 points)

March Fut Open Interest Change: 1.07%

March Fut Volume Change: 114.81%

March Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.270 (Decreased from 1.339)

Put-Call Ratio (Volume): 0.793

Max Pain Level: 13300

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13000

Highest CALL Addition: 15000

Highest PUT Addition: 11600

SENSEX Monthly Expiry (26/02/2026) Future

SENSEX Spot closed at: 80,722.94 (-1.880%)

SENSEX Monthly Future closed at: 81,245.05 (-2.001%)

Premium: 522.11 (Decreased by -112.36 points)

Open Interest Change: 14.02%

Volume Change: 83.42%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (5/02/2026) Option Analysis

Put-Call Ratio (OI): 0.467 (Decreased from 0.840)

Put-Call Ratio (Volume): 0.963

Max Pain Level: 81600

Maximum CALL OI: 85000

Maximum PUT OI: 78000

Highest CALL Addition: 85000

Highest PUT Addition: 75000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 588.34 Cr.

DIIs Net SELL: ₹ 682.73 Cr.

FII Derivatives Activity

| FII Trading Stats | 1.02.26 | 30.01.26 | 29.01.26 |

| FII Cash (Provisional Data) | -588.34 | 2,251.37 | -393.97 |

| Index Future Open Interest Long Ratio | 11.71% | 12.10% | 12.29% |

| Index Future Volume Long Ratio | 41.38% | 41.58% | 38.52% |

| Call Option Open Interest Long Ratio | 42.96% | 45.42% | 43.49% |

| Call Option Volume Long Ratio | 49.53% | 50.16% | 50.00% |

| Put Option Open Interest Long Ratio | 65.74% | 65.35% | 64.87% |

| Put Option Volume Long Ratio | 50.25% | 50.39% | 49.76% |

| Stock Future Open Interest Long Ratio | 60.42% | 60.69% | 61.30% |

| Stock Future Volume Long Ratio | 45.87% | 45.67% | 45.15% |

| Index Futures | Fresh Short | Fresh Short | Fresh Short |

| Index Options | Fresh Short | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Short | Fresh Long | Fresh Short |

| BankNifty Futures | Long Covering | Fresh Long | Short Covering |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Long | Short Covering | Long Covering |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Long |

| MidcpNifty Futures | Fresh Long | Short Covering | Short Covering |

| MidcpNifty Options | Short Covering | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Long Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Short | Fresh Long |

| Stock Futures | Long Covering | Long Covering | Long Covering |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (5/02/2026)

The SENSEX index closed at 80722.94. The SENSEX weekly expiry for FEBRUARY 5, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.467 against previous 0.840. The 85000CE option holds the maximum open interest, followed by the 86000CE and 83000CE options. Market participants have shown increased interest with significant open interest additions in the 85000CE option, with open interest additions also seen in the 83000CE and 84000CE options. On the other hand, open interest reductions were prominent in the 82000PE, 82100PE, and 82200PE options. Trading volume was highest in the 81000PE option, followed by the 82500CE and 80000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 05-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80722.94 | 0.467 | 0.840 | 0.963 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,70,16,400 | 78,11,160 | 92,05,240 |

| PUT: | 79,44,880 | 65,61,920 | 13,82,960 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 11,06,800 | 5,63,520 | 1,66,56,700 |

| 86000 | 8,74,180 | 3,34,540 | 96,65,220 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 11,06,800 | 5,63,520 | 1,66,56,700 |

| 83000 | 7,98,220 | 5,09,180 | 1,75,70,580 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 92900 | 2,980 | -9,100 | 66,900 |

| 82200 | 2,57,500 | -8,380 | 72,46,320 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 7,58,060 | 3,31,240 | 1,80,39,300 |

| 83000 | 7,98,220 | 5,09,180 | 1,75,70,580 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 5,82,640 | 47,780 | 92,00,760 |

| 77000 | 4,60,840 | 98,340 | 84,42,560 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 3,60,660 | 1,94,900 | 58,01,420 |

| 80000 | 3,56,100 | 1,20,080 | 1,78,95,040 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 2,16,180 | -1,80,280 | 1,24,28,260 |

| 82100 | 73,420 | -1,37,940 | 51,99,280 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 2,19,000 | 52,280 | 2,03,22,460 |

| 80000 | 3,56,100 | 1,20,080 | 1,78,95,040 |

NIFTY Weekly Expiry (3/02/2026)

The NIFTY index closed at 24825.45. The NIFTY weekly expiry for FEBRUARY 3, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.428 against previous 0.762. The 26000CE option holds the maximum open interest, followed by the 26500CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 25500CE and 26500CE options. On the other hand, open interest reductions were prominent in the 25300PE, 24900PE, and 25200PE options. Trading volume was highest in the 25000PE option, followed by the 25500CE and 24500PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 03-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,825.45 | 0.428 | 0.762 | 0.954 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 28,30,81,630 | 14,47,58,380 | 13,83,23,250 |

| PUT: | 12,11,57,335 | 11,02,85,565 | 1,08,71,770 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 2,13,87,600 | 98,69,405 | 56,81,274 |

| 26,500 | 1,91,54,590 | 87,62,065 | 24,73,223 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 2,13,87,600 | 98,69,405 | 56,81,274 |

| 25,500 | 1,61,66,670 | 94,96,695 | 62,97,402 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,550 | 8,56,895 | -3,61,075 | 4,26,276 |

| 27,300 | 7,69,405 | -1,06,665 | 2,02,149 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,61,66,670 | 94,96,695 | 62,97,402 |

| 26,000 | 2,13,87,600 | 98,69,405 | 56,81,274 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 1,25,83,675 | 57,60,625 | 16,38,948 |

| 23,300 | 1,17,48,360 | 34,61,705 | 15,26,410 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 1,25,83,675 | 57,60,625 | 16,38,948 |

| 23,300 | 1,17,48,360 | 34,61,705 | 15,26,410 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 22,51,925 | -27,00,620 | 33,36,819 |

| 24,900 | 20,00,245 | -24,92,945 | 41,37,812 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 49,07,955 | -19,56,695 | 71,21,679 |

| 24,500 | 65,91,715 | 9,95,020 | 57,08,915 |

NIFTY Monthly Expiry (24/02/2026)

The NIFTY index closed at 24825.45. The NIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.048 against previous 1.117. The 25500CE option holds the maximum open interest, followed by the 25000PE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 25500CE and 24500PE options. On the other hand, open interest reductions were prominent in the 26600CE, 25000PE, and 25400PE options. Trading volume was highest in the 25000PE option, followed by the 26000CE and 24000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,825.45 | 1.048 | 1.117 | 0.926 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,37,43,440 | 3,91,25,385 | 46,18,055 |

| PUT: | 4,58,55,550 | 4,36,98,915 | 21,56,635 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 54,14,370 | 10,92,195 | 1,84,250 |

| 26,000 | 48,61,480 | 52,650 | 2,45,660 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 35,02,460 | 12,04,710 | 1,46,666 |

| 25,500 | 54,14,370 | 10,92,195 | 1,84,250 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 8,36,485 | -4,76,060 | 55,567 |

| 27,000 | 30,85,355 | -1,24,930 | 77,252 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 48,61,480 | 52,650 | 2,45,660 |

| 25,500 | 54,14,370 | 10,92,195 | 1,84,250 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 50,01,230 | -4,36,800 | 2,72,544 |

| 24,500 | 34,06,195 | 8,21,080 | 1,95,954 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 34,06,195 | 8,21,080 | 1,95,954 |

| 23,500 | 26,74,750 | 6,67,030 | 83,789 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 50,01,230 | -4,36,800 | 2,72,544 |

| 25,400 | 19,98,880 | -2,37,575 | 61,025 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 50,01,230 | -4,36,800 | 2,72,544 |

| 24,000 | 30,71,640 | 3,93,965 | 2,21,059 |

BANKNIFTY Monthly Expiry (24/02/2026)

The BANKNIFTY index closed at 58417.2. The BANKNIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.855 against previous 1.053. The 60000CE option holds the maximum open interest, followed by the 60000PE and 58000PE options. Market participants have shown increased interest with significant open interest additions in the 59000CE option, with open interest additions also seen in the 61000CE and 56000PE options. On the other hand, open interest reductions were prominent in the 59500PE, 60000PE, and 59600PE options. Trading volume was highest in the 60000CE option, followed by the 59000PE and 58000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 58,417.20 | 0.855 | 1.053 | 0.895 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,08,13,320 | 85,34,340 | 22,78,980 |

| PUT: | 92,42,970 | 89,89,410 | 2,53,560 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 18,02,880 | 1,49,310 | 1,96,165 |

| 62,000 | 6,36,780 | 92,190 | 97,509 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 4,70,970 | 1,84,590 | 76,736 |

| 61,000 | 6,09,450 | 1,73,760 | 1,05,106 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,100 | 1,10,340 | -41,610 | 38,746 |

| 62,500 | 2,23,950 | -23,580 | 44,149 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 18,02,880 | 1,49,310 | 1,96,165 |

| 61,000 | 6,09,450 | 1,73,760 | 1,05,106 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 14,70,120 | -1,05,720 | 65,869 |

| 58,000 | 6,59,850 | -29,550 | 1,14,676 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 3,90,840 | 1,56,540 | 68,819 |

| 55,500 | 1,52,460 | 73,710 | 24,446 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 3,40,500 | -1,49,910 | 93,460 |

| 60,000 | 14,70,120 | -1,05,720 | 65,869 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 5,90,010 | -1,620 | 1,51,781 |

| 58,000 | 6,59,850 | -29,550 | 1,14,676 |

MIDCPNIFTY Monthly Expiry (24/02/2026)

The MIDCPNIFTY index closed at 13020.25. The MIDCPNIFTY monthly expiry for FEBRUARY 24, 2026, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.270 against previous 1.339. The 13000PE option holds the maximum open interest, followed by the 12500PE and 12000PE options. Market participants have shown increased interest with significant open interest additions in the 15000CE option, with open interest additions also seen in the 14000CE and 13400CE options. On the other hand, open interest reductions were prominent in the 65900PE, 65900PE, and 65900CE options. Trading volume was highest in the 14000CE option, followed by the 13000PE and 13500CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,020.25 | 1.270 | 1.339 | 0.793 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 55,35,840 | 51,27,360 | 4,08,480 |

| PUT: | 70,30,200 | 68,66,280 | 1,63,920 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 7,37,400 | -83,880 | 11,307 |

| 14,000 | 6,32,760 | 1,04,280 | 27,477 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 15,000 | 3,52,440 | 1,33,200 | 4,177 |

| 14,000 | 6,32,760 | 1,04,280 | 27,477 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,300 | 1,85,400 | -1,62,600 | 5,901 |

| 14,500 | 7,37,400 | -83,880 | 11,307 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 6,32,760 | 1,04,280 | 27,477 |

| 13,500 | 4,82,880 | 29,880 | 20,083 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 13,26,960 | -9,000 | 20,830 |

| 12,500 | 8,88,960 | 21,120 | 15,030 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,600 | 2,45,640 | 73,440 | 5,457 |

| 13,100 | 2,36,880 | 50,880 | 9,233 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 1,90,320 | -1,22,520 | 11,383 |

| 12,900 | 1,32,360 | -72,720 | 7,404 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 13,26,960 | -9,000 | 20,830 |

| 12,000 | 7,37,640 | 49,200 | 15,750 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Open Interest Volume Analysis leaves no ambiguity — this is a fresh short market, not a correction, because price fall is backed by rising OI + explosive volume, especially in BANKNIFTY and SENSEX.

Weekly options show fear rising fast (PCR below 0.5 in NIFTY & SENSEX), while monthly options still show slow repositioning, meaning the market is preparing for more downside before stability.

Max Pain levels are far above current prices, which increases the probability of mean reversion rallies, but those rallies should be treated as sell-on-rise opportunities until OI unwinds.

MIDCPNIFTY’s aggressive short build-up suggests broader market weakness is not over, so stock-specific longs should be avoided unless they show relative strength + delivery support.

The key trigger to watch is OI reduction with price stability — only then can we say shorts are covering and the market is preparing for a base.

Actionable Trading Plan from Derivative Data:

✅ Intraday traders: Trade with trend, sell resistance, avoid long carry trades.

⚠️ Positional traders: Wait for OI unwinding before building longs.

🛑 Options traders: Prefer call spreads / bear spreads over naked selling.

👀 Investors: Stay patient — derivatives are still pricing in downside risk.

Final word: Until Open Interest Volume Analysis shows short covering instead of short building, the market remains in a sell-on-rise regime and discipline will outperform prediction.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]