Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 5/02/2026

Table of Contents

The derivatives market for 5/02/2026 sends a clear but nuanced signal when viewed through the lens of Open Interest Volume Analysis—the dominant theme across indices is price weakness backed by selective fresh shorts and unwinding longs, rather than panic-driven liquidation.

NIFTY Futures show price decline with rising open interest and falling volumes, a classic fresh short build-up, confirming that sellers are entering with conviction but without aggressive participation, indicating controlled bearish bias, not breakdown.

The sharp drop in Weekly PCR (OI) from 0.959 to 0.649 highlights rapid call writers’ dominance, especially at 27000, while put writers retreat, reinforcing a near-term resistance-heavy structure around higher strikes.

Monthly options tell a different story—PCR (OI) remains above 1, suggesting positional put writing at lower levels, hinting that smart money expects support near 25500–25700, even as short-term pressure persists.

BANKNIFTY stands out: falling prices combined with declining open interest and collapsing volumes signal long covering, not fresh shorts—this is critical, as it implies downside exhaustion rather than trend reversal.

MIDCPNIFTY reflects internal divergence—February contracts show aggressive long unwinding, while March futures quietly build fresh shorts, signaling sector rotation risk rather than broad market collapse.

SENSEX derivatives add weight to caution: rising open interest with price decline and expanding volumes confirms fresh institutional short positioning, while the steep PCR (OI) drop in weekly options highlights short-term bearish sentiment dominance.

In summary, Open Interest Volume Analysis reveals a market that is bearish by structure, not by fear, where ranges are respected, volatility is selective, and traders must trade levels—not emotions.

NSE & BSE F&O Market Signals

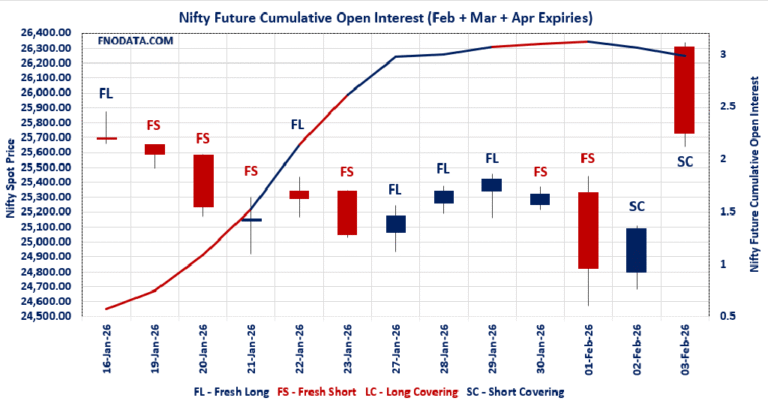

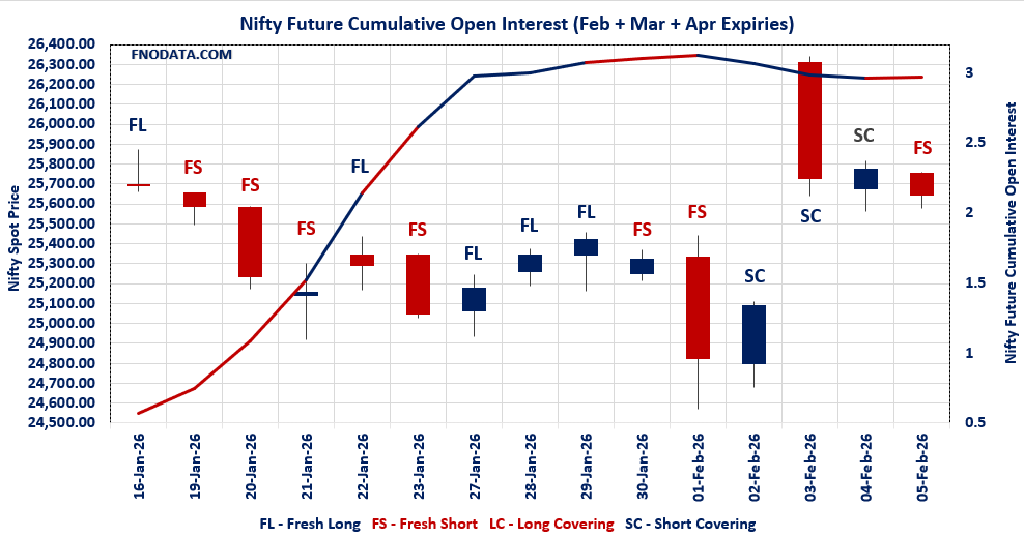

NIFTY Future analysis

NIFTY Spot closed at: 25642.8 (-0.517%)

Combined = February + March + April

Combined Fut Open Interest Change: 0.85%

Combined Fut Volume Change: -11.95%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 9% Previous 9%

NIFTY FEBRUARY Future closed at: 25725 (-0.479%)

February Fut Premium 82.2 (Increased by 9.4 points)

February Fut Open Interest Change: 0.70%

February Fut Volume Change: -11.79%

February Fut Open Interest Analysis: Fresh Short

NIFTY March Future closed at: 25891.5 (-0.467%)

March Fut Premium 248.7 (Increased by 11.6 points)

March Fut Open Interest Change: 2.28%

March Fut Volume Change: -18.07%

March Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (3/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.649 (Decreased from 0.959)

Put-Call Ratio (Volume): 1.022

Max Pain Level: 25650

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 27000

Highest PUT Addition: 24850

NIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.123 (Decreased from 1.173)

Put-Call Ratio (Volume): 0.971

Max Pain Level: 25700

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25500

Highest CALL Addition: 25700

Highest PUT Addition: 24700

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 60063.65 (-0.290%)

Combined = February + March + April

Combined Fut Open Interest Change: -4.30%

Combined Fut Volume Change: -44.90%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 10% Previous 10%

BANKNIFTY FEBRUARY Future closed at: 60254.8 (-0.270%)

February Fut Premium 191.15 (Increased by 11.3 points)

February Fut Open Interest Change: -4.4%

February Fut Volume Change: -44.7%

February Fut Open Interest Analysis: Long Covering

BANKNIFTY MARCH Future closed at: 60606.2 (-0.266%)

March Fut Premium 542.55 (Increased by 12.9 points)

March Fut Open Interest Change: -2.46%

March Fut Volume Change: -49.55%

March Fut Open Interest Analysis: Long Covering

BANKNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.996 (Decreased from 1.062)

Put-Call Ratio (Volume): 1.046

Max Pain Level: 60000

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 60000

Highest CALL Addition: 64000

Highest PUT Addition: 60900

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13700.5 (-0.156%)

Combined = February + March + April

Combined Fut Open Interest Change: -8.14%

Combined Fut Volume Change: 33.57%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 4% Previous 4%

MIDCPNIFTY FEBRUARY Future closed at: 13732.9 (-0.289%)

February Fut Premium 32.4 (Decreased by -18.4 points)

February Fut Open Interest Change: -8.52%

February Fut Volume Change: 35.96%

February Fut Open Interest Analysis: Long Covering

MIDCPNIFTY MARCH Future closed at: 13802.9 (-0.237%)

March Fut Premium 102.4 (Decreased by -11.5 points)

March Fut Open Interest Change: 1.33%

March Fut Volume Change: -5.75%

March Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.097 (Increased from 1.077)

Put-Call Ratio (Volume): 0.882

Max Pain Level: 13500

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13000

Highest CALL Addition: 14100

Highest PUT Addition: 12500

SENSEX Monthly Expiry (26/02/2026) Future

SENSEX Spot closed at: 83,313.93 (-0.601%)

SENSEX Monthly Future closed at: 83,760.55 (-0.529%)

Premium: 446.62 (Increased by 58.21 points)

Open Interest Change: 6.60%

Volume Change: 21.92%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (12/02/2026) Option Analysis

Put-Call Ratio (OI): 0.732 (Decreased from 1.062)

Put-Call Ratio (Volume): 1.059

Max Pain Level: 83400

Maximum CALL OI: 83500

Maximum PUT OI: 83500

Highest CALL Addition: 83500

Highest PUT Addition: 83500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 2,150.51 Cr.

DIIs Net BUY: ₹ 1,129.82 Cr.

FII Derivatives Activity

| FII Trading Stats | 5.02.26 | 4.02.26 | 3.02.26 |

| FII Cash (Provisional Data) | -2,150.51 | 29.79 | 5,236.28 |

| Index Future Open Interest Long Ratio | 18.50% | 18.67% | 16.85% |

| Index Future Volume Long Ratio | 54.00% | 61.56% | 65.67% |

| Call Option Open Interest Long Ratio | 47.34% | 47.04% | 45.41% |

| Call Option Volume Long Ratio | 49.96% | 50.25% | 49.95% |

| Put Option Open Interest Long Ratio | 60.46% | 58.88% | 62.79% |

| Put Option Volume Long Ratio | 50.56% | 49.46% | 49.82% |

| Stock Future Open Interest Long Ratio | 60.49% | 60.79% | 60.90% |

| Stock Future Volume Long Ratio | 46.99% | 50.05% | 52.41% |

| Index Futures | Short Covering | Short Covering | Short Covering |

| Index Options | Fresh Long | Fresh Short | Long Covering |

| Nifty Futures | Short Covering | Short Covering | Short Covering |

| Nifty Options | Fresh Long | Fresh Short | Long Covering |

| BankNifty Futures | Long Covering | Fresh Long | Fresh Long |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Long Covering | Short Covering | Short Covering |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Futures | Short Covering | Short Covering | Short Covering |

| MidcpNifty Options | Short Covering | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Short Covering | Fresh Long |

| NiftyNxt50 Options | Fresh Short | Fresh Short | Fresh Long |

| Stock Futures | Long Covering | Fresh Long | Fresh Long |

| Stock Options | Fresh Short | Fresh Long | Fresh Short |

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (12/02/2026)

The SENSEX index closed at 83313.93. The SENSEX weekly expiry for FEBRUARY 12, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.732 against previous 1.062. The 83500CE option holds the maximum open interest, followed by the 88000CE and 83500PE options. Market participants have shown increased interest with significant open interest additions in the 83500CE option, with open interest additions also seen in the 88000CE and 83500PE options. On the other hand, open interest reductions were prominent in the 83800PE, 83700PE, and 84200PE options. Trading volume was highest in the 83500PE option, followed by the 83500CE and 83000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 12-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 83313.93 | 0.732 | 1.062 | 1.059 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 54,73,960 | 15,22,000 | 39,51,960 |

| PUT: | 40,08,740 | 16,15,800 | 23,92,940 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 5,77,520 | 5,13,020 | 21,66,400 |

| 88000 | 5,73,300 | 4,32,540 | 11,81,100 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 5,77,520 | 5,13,020 | 21,66,400 |

| 88000 | 5,73,300 | 4,32,540 | 11,81,100 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81100 | 2,740 | -280 | 840 |

| 81400 | 2,460 | -80 | 80 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 5,77,520 | 5,13,020 | 21,66,400 |

| 84000 | 4,08,120 | 2,39,440 | 16,71,640 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 4,65,540 | 3,46,300 | 22,66,620 |

| 83000 | 2,59,420 | 1,48,840 | 19,10,420 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 4,65,540 | 3,46,300 | 22,66,620 |

| 83400 | 1,68,240 | 1,62,280 | 9,27,360 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83800 | 16,120 | -4,720 | 1,71,740 |

| 83700 | 22,300 | -4,500 | 2,67,420 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 4,65,540 | 3,46,300 | 22,66,620 |

| 83000 | 2,59,420 | 1,48,840 | 19,10,420 |

NIFTY Weekly Expiry (10/02/2026)

The NIFTY index closed at 25642.8. The NIFTY weekly expiry for FEBRUARY 10, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.649 against previous 0.959. The 27000CE option holds the maximum open interest, followed by the 26000CE and 25800CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 25700CE and 26000CE options. On the other hand, open interest reductions were prominent in the 25800PE, 25700PE, and 25750PE options. Trading volume was highest in the 25600PE option, followed by the 25700CE and 25700PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 10-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,642.80 | 0.649 | 0.959 | 1.022 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 19,19,18,285 | 12,26,66,505 | 6,92,51,780 |

| PUT: | 12,46,43,740 | 11,76,54,095 | 69,89,645 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,77,25,890 | 69,66,570 | 7,28,728 |

| 26,000 | 1,45,66,435 | 48,19,165 | 14,31,937 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,77,25,890 | 69,66,570 | 7,28,728 |

| 25,700 | 89,14,035 | 56,98,680 | 28,65,414 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 8,74,250 | -4,06,250 | 12,638 |

| 25,000 | 9,35,610 | -57,395 | 16,996 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 89,14,035 | 56,98,680 | 28,65,414 |

| 25,800 | 1,13,91,770 | 37,06,755 | 20,41,533 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 95,73,980 | 16,95,395 | 6,72,596 |

| 24,000 | 84,13,275 | 10,89,075 | 3,77,697 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,850 | 39,15,925 | 28,02,995 | 2,11,363 |

| 25,000 | 95,73,980 | 16,95,395 | 6,72,596 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 41,58,050 | -22,05,255 | 11,00,644 |

| 25,700 | 44,92,475 | -13,90,025 | 28,14,148 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 46,57,380 | 7,65,895 | 30,12,649 |

| 25,700 | 44,92,475 | -13,90,025 | 28,14,148 |

NIFTY Monthly Expiry (24/02/2026)

The NIFTY index closed at 25642.8. The NIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.123 against previous 1.173. The 26000CE option holds the maximum open interest, followed by the 25500PE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25700CE option, with open interest additions also seen in the 26000CE and 26400CE options. On the other hand, open interest reductions were prominent in the 26500CE, 26000PE, and 25800PE options. Trading volume was highest in the 26000CE option, followed by the 25500PE and 25700PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,642.80 | 1.123 | 1.173 | 0.971 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,40,09,875 | 4,26,37,270 | 13,72,605 |

| PUT: | 4,94,09,165 | 5,00,22,440 | -6,13,275 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 65,31,395 | 4,41,740 | 1,24,633 |

| 26,500 | 35,42,695 | -5,25,915 | 58,427 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 13,82,810 | 4,69,170 | 69,537 |

| 26,000 | 65,31,395 | 4,41,740 | 1,24,633 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 35,42,695 | -5,25,915 | 58,427 |

| 28,000 | 7,84,420 | -57,330 | 9,135 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 65,31,395 | 4,41,740 | 1,24,633 |

| 25,800 | 20,92,545 | 84,695 | 71,054 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 51,71,335 | -78,260 | 1,07,119 |

| 25,000 | 46,99,565 | -90,610 | 67,244 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 20,24,230 | 3,31,305 | 19,695 |

| 25,200 | 19,26,730 | 1,11,475 | 21,208 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 29,79,665 | -2,70,985 | 36,637 |

| 25,800 | 16,97,865 | -2,08,975 | 53,063 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 51,71,335 | -78,260 | 1,07,119 |

| 25,700 | 16,10,310 | -46,995 | 77,416 |

BANKNIFTY Monthly Expiry (24/02/2026)

The BANKNIFTY index closed at 60063.65. The BANKNIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.996 against previous 1.062. The 60000PE option holds the maximum open interest, followed by the 60000CE and 58000PE options. Market participants have shown increased interest with significant open interest additions in the 64000CE option, with open interest additions also seen in the 61700CE and 60000CE options. On the other hand, open interest reductions were prominent in the 60000PE, 60500PE, and 55000PE options. Trading volume was highest in the 60000PE option, followed by the 60000CE and 60200PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 60,063.65 | 0.996 | 1.062 | 1.046 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,13,61,810 | 1,10,06,550 | 3,55,260 |

| PUT: | 1,13,19,420 | 1,16,94,000 | -3,74,580 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 16,08,960 | 52,980 | 1,07,239 |

| 61,000 | 6,11,970 | -8,730 | 44,260 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 64,000 | 4,55,910 | 57,540 | 19,838 |

| 61,700 | 1,23,990 | 54,690 | 7,522 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 65,000 | 4,56,810 | -23,880 | 16,664 |

| 58,000 | 1,95,840 | -18,480 | 1,331 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 16,08,960 | 52,980 | 1,07,239 |

| 60,500 | 5,82,870 | 34,770 | 65,950 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 19,10,910 | -72,270 | 1,44,489 |

| 58,000 | 8,04,660 | -2,880 | 30,826 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,900 | 45,270 | 19,500 | 2,209 |

| 53,500 | 74,070 | 16,050 | 2,386 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 19,10,910 | -72,270 | 1,44,489 |

| 60,500 | 3,21,330 | -60,540 | 33,863 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 19,10,910 | -72,270 | 1,44,489 |

| 60,200 | 2,31,030 | -30,120 | 71,912 |

MIDCPNIFTY Monthly Expiry (24/02/2026)

The MIDCPNIFTY index closed at 13700.5. The MIDCPNIFTY monthly expiry for FEBRUARY 24, 2026, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.097 against previous 1.077. The 13000PE option holds the maximum open interest, followed by the 14500CE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 12500PE option, with open interest additions also seen in the 12750PE and 12900PE options. On the other hand, open interest reductions were prominent in the 68800PE, 66000PE, and 68000PE options. Trading volume was highest in the 14000CE option, followed by the 13700CE and 13700PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,700.50 | 1.097 | 1.077 | 0.882 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 62,55,120 | 63,98,520 | -1,43,400 |

| PUT: | 68,63,040 | 68,93,040 | -30,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 9,53,040 | -87,240 | 6,113 |

| 14,000 | 7,55,160 | -1,05,000 | 19,864 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,100 | 2,00,280 | 34,560 | 4,444 |

| 14,300 | 2,49,000 | 21,960 | 5,173 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 7,55,160 | -1,05,000 | 19,864 |

| 14,500 | 9,53,040 | -87,240 | 6,113 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 7,55,160 | -1,05,000 | 19,864 |

| 13,700 | 3,87,000 | 4,440 | 16,795 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 10,30,440 | 1,440 | 8,090 |

| 12,000 | 6,27,840 | -5,040 | 1,576 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 5,45,400 | 77,040 | 3,313 |

| 12,750 | 67,920 | 60,480 | 760 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 2,93,880 | -51,960 | 3,825 |

| 13,700 | 3,49,320 | -32,640 | 14,774 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,700 | 3,49,320 | -32,640 | 14,774 |

| 13,600 | 2,59,080 | -29,040 | 14,399 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

NIFTY

Fresh shorts in both February and March futures, along with falling PCR (OI), suggest sell-on-rise strategy remains valid below 25850–25900.

However, monthly put positioning near 25500–25700 warns bears to book partial profits near max pain zones instead of chasing lows.

BANKNIFTY

Long covering with heavy volume contraction indicates selling pressure is reducing, not intensifying.

Traders should avoid aggressive shorts near 60000, as risk–reward now favors range trades unless fresh OI builds on breakdown.

MIDCPNIFTY

February long unwinding is largely done; March fresh shorts suggest further downside is possible but likely slower.

Ideal approach: wait for OI expansion with price confirmation before directional bets.

SENSEX

Rising open interest + higher volumes + falling prices = institutional short bias confirmed.

Weekly options data suggests intraday volatility with downside skew, but 83500 remains a critical magnet level.

Across indices, falling volumes with OI changes indicate participation is selective, meaning false breakouts and whipsaws are likely.

The real edge right now lies in Open Interest Volume Analysis, not candle patterns—track where OI expands with price, not where price moves alone.

Trader’s Playbook:

Index traders: short rallies, cover near max pain

Option sellers: prefer call spreads over naked calls

Positional traders: wait for volume confirmation before committing capital

Bottom line: the market is bearish in intent, controlled in execution, and only traders who respect open interest structure will stay ahead of the curve.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.