Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 12/02/2026

Table of Contents

If we strip away the noise and look purely at Open Interest Volume Analysis, the derivative landscape on 12/02/2026 clearly tilted risk-off, with shorts asserting dominance across NIFTY, MIDCPNIFTY, and SENSEX, while BANKNIFTY attempted stabilization via long covering.

The standout theme was price decline accompanied by rising Open Interest and higher volumes, a classic signal of fresh short buildup, not panic unwinding. This is crucial — the market is not exiting positions, it is adding directional bets.

Rising futures premium despite falling spot prices (especially in NIFTY and SENSEX) suggests rollover-driven shorts, where traders are confident enough to carry bearish exposure forward rather than exit.

Options data reinforced this caution: Put-Call Ratios compressed sharply, CALL writing intensified near overhead strikes, and Max Pain gravitated close to current prices, hinting at range compression with a negative bias rather than a sharp bounce.

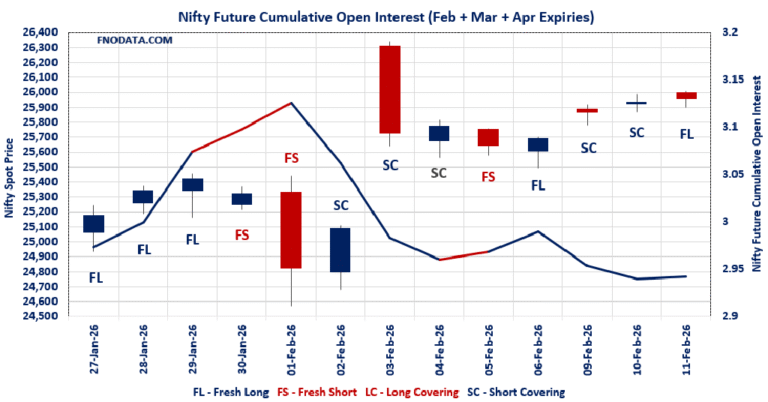

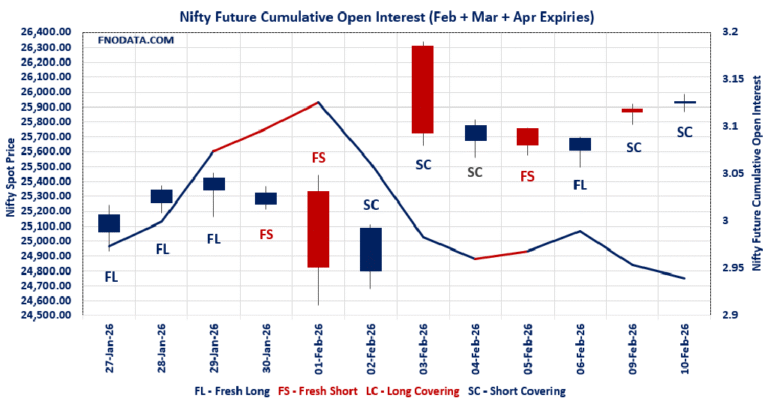

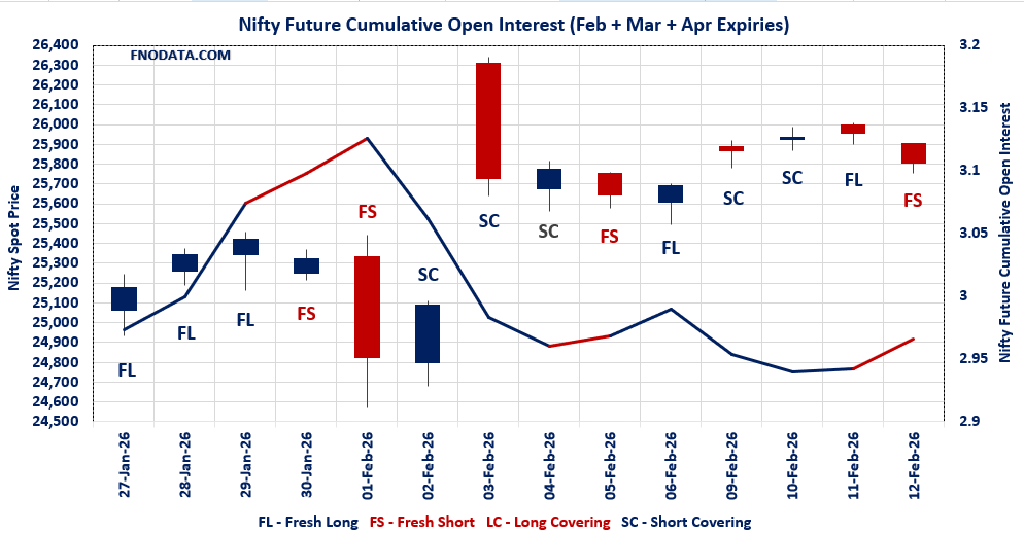

NIFTY — Shorts in Control, Bounce Likely to Be Sold

Fresh Short formation confirmed:

Spot down (-0.56%) with OI +2.34% and Volume +14.7% → textbook bearish structure.

February & March Futures both showed:

Rising premiums + rising OI = confidence in short carry-forward.

Weekly Options:

PCR (OI) collapsed to 0.61 → aggressive CALL dominance.

CALL additions clustered at 25900–26000, creating a strong supply zone.

Monthly Options:

PCR still above 1 but declining → bulls losing grip, not exiting fully.

Actionable Insight:

Upside towards 25900–26000 likely to face selling pressure.

Any intraday bounce without OI reduction should be treated as a sell-on-rise opportunity.

BANKNIFTY — Long Covering, Not Fresh Bullishness

Spot was almost flat, but Combined OI fell sharply (-8.28%) with rising volume, confirming long unwinding, not new buying.

February Futures:

OI down 10% with volume spike → strong long exit.

March Futures:

OI up with flat price → early fresh shorts emerging at higher levels.

Options data:

PCR above 1 but slipping → neutral-to-negative bias.

CALL & PUT additions both at 60800, pointing to range tightening.

Actionable Insight:

Expect range-bound trade with volatility compression.

Directional clarity only if OI expands with price beyond 60800 or below 60000.

MIDCPNIFTY — Clear Risk-Off Signal

Spot down (-0.42%), while OI +4.6% and Volume +33% → strong fresh short aggression.

Both Feb & March Futures:

Rising OI + rising premium = positional bearish bets, not hedges.

Options:

PCR (OI) still above 1 but falling → PUT writers getting cautious.

CALL addition at 13900 caps upside decisively.

Actionable Insight:

Midcaps remain vulnerable.

Any pullback rally without OI contraction is structurally weak.

SENSEX — Institutions Adding Shorts

Spot fell (-0.66%) with OI +2.18% and Volume +49.6% → high-conviction fresh shorts.

Rising futures premium despite fall = rollover-driven bearish positioning.

Weekly Options:

PCR (OI) slid to 0.72 → CALL writers firmly in control.

Heavy activity around 84000 suggests a magnet + resistance zone.

Actionable Insight:

Below 83800 Max Pain, downside momentum can accelerate.

Short-term trend remains sell on rallies.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25807.2 (-0.565%)

Combined = February + March + April

Combined Fut Open Interest Change: 2.34%

Combined Fut Volume Change: 14.71%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 11% Previous 10%

NIFTY FEBRUARY Future closed at: 25858.2 (-0.523%)

February Fut Premium 51 (Increased by 10.65 points)

February Fut Open Interest Change: 1.94%

February Fut Volume Change: 13.29%

February Fut Open Interest Analysis: Fresh Short

NIFTY March Future closed at: 26025.3 (-0.481%)

March Fut Premium 218.1 (Increased by 20.95 points)

March Fut Open Interest Change: 6.30%

March Fut Volume Change: 36.29%

March Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (17/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 0.611 (Decreased from 0.891)

Put-Call Ratio (Volume): 1.094

Max Pain Level: 25850

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 24500

Highest CALL Addition: 25900

Highest PUT Addition: 25550

NIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.113 (Decreased from 1.184)

Put-Call Ratio (Volume): 1.065

Max Pain Level: 25800

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25500

Highest CALL Addition: 26000

Highest PUT Addition: 25500

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 60739.75 (-0.009%)

Combined = February + March + April

Combined Fut Open Interest Change: -8.28%

Combined Fut Volume Change: 21.49%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 13% Previous 11%

BANKNIFTY FEBRUARY Future closed at: 60796.6 (-0.020%)

February Fut Premium 56.85 (Decreased by -6.8 points)

February Fut Open Interest Change: -10.0%

February Fut Volume Change: 24.7%

February Fut Open Interest Analysis: Long Covering

BANKNIFTY MARCH Future closed at: 61143.2 (-0.014%)

March Fut Premium 403.45 (Decreased by -3.2 points)

March Fut Open Interest Change: 5.24%

March Fut Volume Change: -9.19%

March Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.094 (Decreased from 1.127)

Put-Call Ratio (Volume): 1.067

Max Pain Level: 60300

Maximum CALL Open Interest: 60000

Maximum PUT Open Interest: 60000

Highest CALL Addition: 60800

Highest PUT Addition: 60800

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13893.5 (-0.425%)

Combined = February + March + April

Combined Fut Open Interest Change: 4.61%

Combined Fut Volume Change: 33.05%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 5% Previous 5%

MIDCPNIFTY FEBRUARY Future closed at: 13896.2 (-0.387%)

February Fut Premium 2.7 (Increased by 5.3 points)

February Fut Open Interest Change: 4.55%

February Fut Volume Change: 35.50%

February Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY MARCH Future closed at: 13960.3 (-0.414%)

March Fut Premium 66.8 (Increased by 1.25 points)

March Fut Open Interest Change: 5.47%

March Fut Volume Change: 3.70%

March Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (24/02/2026) Option Analysis

Put-Call Ratio (Open Interest): 1.118 (Decreased from 1.182)

Put-Call Ratio (Volume): 0.788

Max Pain Level: 13750

Maximum CALL Open Interest: 14500

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13900

Highest PUT Addition: 13200

SENSEX Monthly Expiry (26/02/2026) Future

SENSEX Spot closed at: 83,674.92 (-0.663%)

SENSEX Monthly Future closed at: 83,900.05 (-0.625%)

Premium: 225.13 (Increased by 30.82 points)

Open Interest Change: 2.18%

Volume Change: 49.65%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (19/02/2026) Option Analysis

Put-Call Ratio (OI): 0.723 (Decreased from 0.843)

Put-Call Ratio (Volume): 0.977

Max Pain Level: 83800

Maximum CALL OI: 84000

Maximum PUT OI: 84000

Highest CALL Addition: 84000

Highest PUT Addition: 84500

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 108.42 Cr.

DIIs Net BUY: ₹ 276.85 Cr.

FII Derivatives Activity

| FII Trading Stats | 12.02.26 | 11.02.26 | 10.02.26 |

| FII Cash (Provisional Data) | 108.42 | 943.81 | 69.45 |

| Index Future Open Interest Long Ratio | 22.01% | 22.14% | 21.69% |

| Index Future Volume Long Ratio | 48.47% | 52.50% | 67.82% |

| Call Option Open Interest Long Ratio | 49.36% | 50.53% | 51.10% |

| Call Option Volume Long Ratio | 49.71% | 49.90% | 49.93% |

| Put Option Open Interest Long Ratio | 58.97% | 58.72% | 61.47% |

| Put Option Volume Long Ratio | 50.18% | 49.63% | 49.72% |

| Stock Future Open Interest Long Ratio | 59.88% | 60.08% | 60.17% |

| Stock Future Volume Long Ratio | 48.99% | 49.34% | 48.43% |

| Index Futures | Long Covering | Fresh Long | Fresh Long |

| Index Options | Fresh Short | Fresh Short | Long Covering |

| Nifty Futures | Fresh Short | Fresh Long | Fresh Long |

| Nifty Options | Fresh Long | Fresh Short | Long Covering |

| BankNifty Futures | Short Covering | Fresh Long | Short Covering |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Long | Short Covering | Fresh Long |

| FinNifty Options | Fresh Short | Short Covering | Fresh Short |

| MidcpNifty Futures | Fresh Short | Long Covering | Short Covering |

| MidcpNifty Options | Long Covering | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Fresh Short | Fresh Long | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Fresh Short | Fresh Short | Fresh Short |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (19/02/2026)

The SENSEX index closed at 83674.92. The SENSEX weekly expiry for FEBRUARY 19, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.723 against previous 0.843. The 84000CE option holds the maximum open interest, followed by the 84500CE and 86000CE options. Market participants have shown increased interest with significant open interest additions in the 84000CE option, with open interest additions also seen in the 84500CE and 83800CE options. On the other hand, open interest reductions were prominent in the 84200PE, 84400PE, and 84300PE options. Trading volume was highest in the 84000CE option, followed by the 84000PE and 84500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 19-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 83674.92 | 0.723 | 0.843 | 0.977 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 51,74,700 | 16,16,240 | 35,58,460 |

| PUT: | 37,40,400 | 13,62,040 | 23,78,360 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 5,21,100 | 3,87,980 | 23,88,040 |

| 84500 | 4,75,640 | 3,68,920 | 15,34,140 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 5,21,100 | 3,87,980 | 23,88,040 |

| 84500 | 4,75,640 | 3,68,920 | 15,34,140 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 91900 | 120 | -60 | 80 |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 5,21,100 | 3,87,980 | 23,88,040 |

| 84500 | 4,75,640 | 3,68,920 | 15,34,140 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 3,02,080 | 1,47,220 | 19,52,860 |

| 84500 | 2,69,720 | 2,13,380 | 6,79,760 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 2,69,720 | 2,13,380 | 6,79,760 |

| 83800 | 1,75,460 | 1,61,780 | 13,59,860 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84200 | 26,280 | -12,240 | 2,23,320 |

| 84400 | 16,420 | -3,980 | 66,660 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 3,02,080 | 1,47,220 | 19,52,860 |

| 83800 | 1,75,460 | 1,61,780 | 13,59,860 |

NIFTY Weekly Expiry (17/02/2026)

The NIFTY index closed at 25807.2. The NIFTY weekly expiry for FEBRUARY 17, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 0.611 against previous 0.891. The 26000CE option holds the maximum open interest, followed by the 27000CE and 25900CE options. Market participants have shown increased interest with significant open interest additions in the 25900CE option, with open interest additions also seen in the 25800CE and 25850CE options. On the other hand, open interest reductions were prominent in the 26000PE, 25950PE, and 25900PE options. Trading volume was highest in the 25800PE option, followed by the 25850PE and 25900PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 17-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,807.20 | 0.611 | 0.891 | 1.094 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 17,58,12,130 | 11,32,98,315 | 6,25,13,815 |

| PUT: | 10,73,68,495 | 10,09,74,315 | 63,94,180 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,65,09,155 | 50,73,965 | 20,41,378 |

| 27,000 | 1,39,87,155 | 45,04,500 | 7,20,547 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 1,11,26,505 | 71,14,510 | 30,25,566 |

| 25,800 | 73,50,200 | 55,81,485 | 21,49,666 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,79,530 | -33,150 | 1,939 |

| 25,000 | 2,01,695 | -24,895 | 2,847 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 1,11,26,505 | 71,14,510 | 30,25,566 |

| 25,850 | 60,84,845 | 52,57,525 | 22,21,240 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 84,95,435 | 14,39,425 | 3,76,113 |

| 25,800 | 61,41,330 | 16,99,490 | 37,41,272 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,550 | 30,12,100 | 18,09,080 | 6,00,087 |

| 25,800 | 61,41,330 | 16,99,490 | 37,41,272 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 26,79,950 | -32,92,185 | 12,45,773 |

| 25,950 | 14,13,295 | -25,01,915 | 9,02,644 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 61,41,330 | 16,99,490 | 37,41,272 |

| 25,850 | 27,96,820 | 5,29,425 | 30,84,194 |

NIFTY Monthly Expiry (24/02/2026)

The NIFTY index closed at 25807.2. The NIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.113 against previous 1.184. The 26000CE option holds the maximum open interest, followed by the 25500PE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 25900CE and 25800CE options. On the other hand, open interest reductions were prominent in the 26500CE, 26000PE, and 25700PE options. Trading volume was highest in the 26000CE option, followed by the 25800PE and 25900PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,807.20 | 1.113 | 1.184 | 1.065 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,07,04,160 | 4,79,22,420 | 27,81,740 |

| PUT: | 5,64,20,390 | 5,67,34,665 | -3,14,275 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 62,07,370 | 8,26,280 | 1,94,322 |

| 26,500 | 47,88,680 | -7,93,715 | 78,641 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 62,07,370 | 8,26,280 | 1,94,322 |

| 25,900 | 22,22,155 | 8,07,170 | 1,12,643 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 47,88,680 | -7,93,715 | 78,641 |

| 26,800 | 6,32,125 | -95,745 | 21,608 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 62,07,370 | 8,26,280 | 1,94,322 |

| 25,900 | 22,22,155 | 8,07,170 | 1,12,643 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 54,52,460 | 3,23,635 | 1,09,582 |

| 25,000 | 49,64,245 | 76,115 | 73,053 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 54,52,460 | 3,23,635 | 1,09,582 |

| 25,900 | 19,29,655 | 2,16,515 | 1,36,684 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 35,32,490 | -6,41,160 | 1,21,853 |

| 25,700 | 25,08,285 | -1,64,970 | 86,304 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 22,56,930 | -51,740 | 1,48,182 |

| 25,900 | 19,29,655 | 2,16,515 | 1,36,684 |

BANKNIFTY Monthly Expiry (24/02/2026)

The BANKNIFTY index closed at 60739.75. The BANKNIFTY monthly expiry for FEBRUARY 24, 2026 has revealed key trends in open interest. The current Put/Call Ratio is at 1.094 against previous 1.127. The 60000PE option holds the maximum open interest, followed by the 60000CE and 58000PE options. Market participants have shown increased interest with significant open interest additions in the 60800CE option, with open interest additions also seen in the 62000CE and 60800PE options. On the other hand, open interest reductions were prominent in the 58000PE, 65000CE, and 58500PE options. Trading volume was highest in the 60800PE option, followed by the 60800CE and 60700PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 60,739.75 | 1.094 | 1.127 | 1.067 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,39,61,640 | 1,34,89,230 | 4,72,410 |

| PUT: | 1,52,78,490 | 1,52,08,560 | 69,930 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 14,85,360 | -21,090 | 21,657 |

| 61,000 | 8,29,800 | 1,020 | 1,13,602 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,800 | 5,43,630 | 1,91,010 | 1,52,108 |

| 62,000 | 6,89,910 | 1,20,300 | 47,925 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 65,000 | 4,95,960 | -44,250 | 11,767 |

| 59,000 | 2,31,690 | -32,220 | 2,683 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,800 | 5,43,630 | 1,91,010 | 1,52,108 |

| 60,700 | 5,41,200 | 9,240 | 1,19,444 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 22,53,480 | 46,200 | 97,115 |

| 58,000 | 8,88,420 | -70,470 | 24,019 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,800 | 3,60,150 | 1,15,770 | 1,53,932 |

| 60,900 | 2,17,380 | 54,240 | 62,528 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 8,88,420 | -70,470 | 24,019 |

| 58,500 | 5,73,900 | -40,860 | 18,525 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 60,800 | 3,60,150 | 1,15,770 | 1,53,932 |

| 60,700 | 5,69,640 | 3,300 | 1,45,874 |

MIDCPNIFTY Monthly Expiry (24/02/2026)

The MIDCPNIFTY index closed at 13893.5. The MIDCPNIFTY monthly expiry for FEBRUARY 24, 2026, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.118 against previous 1.182. The 13000PE option holds the maximum open interest, followed by the 14500CE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 13900CE option, with open interest additions also seen in the 14100CE and 14200CE options. On the other hand, open interest reductions were prominent in the 68000CE, 66000PE, and 69800CE options. Trading volume was highest in the 14100CE option, followed by the 14000CE and 13900CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 24-02-2026 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,893.50 | 1.118 | 1.182 | 0.788 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 71,33,520 | 68,60,760 | 2,72,760 |

| PUT: | 79,76,520 | 81,11,760 | -1,35,240 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 10,87,560 | -48,840 | 7,393 |

| 14,000 | 8,67,720 | 72,000 | 18,740 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 3,82,680 | 1,60,080 | 18,598 |

| 14,100 | 3,99,240 | 1,34,040 | 28,581 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,300 | 2,86,800 | -61,320 | 7,422 |

| 14,500 | 10,87,560 | -48,840 | 7,393 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 14,100 | 3,99,240 | 1,34,040 | 28,581 |

| 14,000 | 8,67,720 | 72,000 | 18,740 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,04,000 | -18,600 | 4,823 |

| 13,500 | 4,94,160 | 18,480 | 9,686 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 3,52,320 | 44,520 | 3,394 |

| 13,600 | 3,54,720 | 39,480 | 5,081 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 3,97,080 | -39,480 | 6,203 |

| 13,950 | 41,520 | -34,080 | 1,988 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,900 | 2,99,400 | 25,440 | 18,382 |

| 13,800 | 4,39,320 | -3,360 | 12,498 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Across indices, Open Interest Volume Analysis confirms one message:

This is not profit booking — it is deliberate short positioning.

The absence of large-scale short covering, combined with falling PCRs and rising volumes, tells us the market is preparing for further downside or prolonged consolidation, not a V-shaped recovery.

BANKNIFTY is the only index showing relative resilience, but even there, long covering ≠ bullish reversal.

Trading Strategy Going Forward:

Favor sell-on-rise setups over bottom fishing.

Track OI reduction, not price alone, for any credible reversal signal.

Until PCR stabilizes and futures OI starts unwinding, defensive positioning remains the higher-probability trade.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.