Turning Complex Derivative Data into Clear Market Insights

Nifty/Sensex F&O Analysis | Premium Contraction | Range 24,500 – 23,500

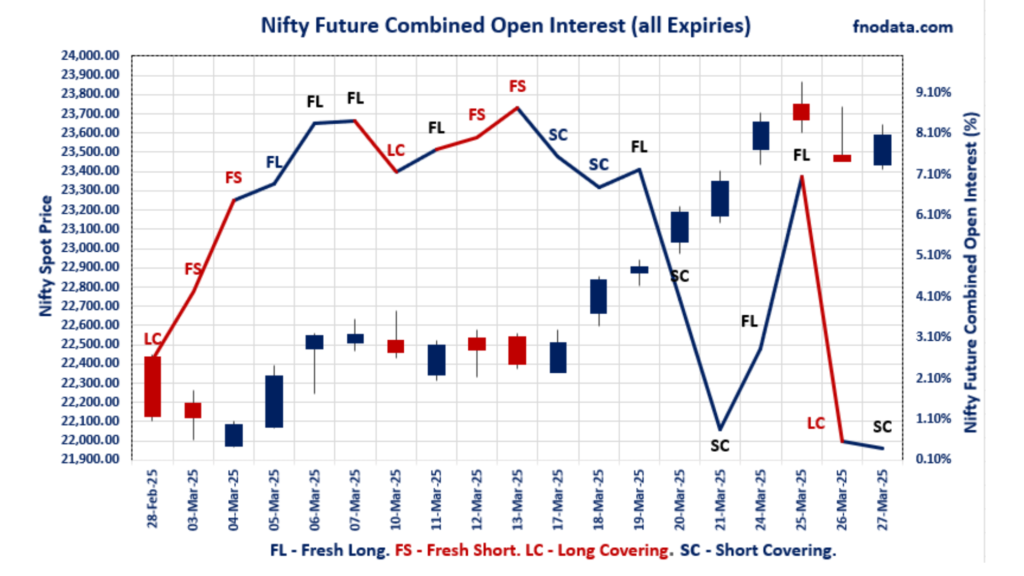

Nifty spot closed at 23,591.95, marking a 0.45% gain, while Nifty April futures ended at 23,777.65, registering a 0.41% increase and maintaining a 185.7-point premium over the spot price. However, the futures premium contracted by 8.9 points, reflecting a cautious approach by traders. Alongside this, the combined Nifty Futures open interest declined by 0.16%, while volume surged by 23.06%, indicating heightened trading activity. Nifty/Sensex F&O Analysis points toward cautious range-bound sessions before April 3 2025 Trump announcements on Tariffs.

Table of Contents

Put-Call Ratio (PCR) Insights

Nifty April PCR dropped to 1.282 (from 1.363).

Nifty May PCR declined to 1.381 (from 1.414).

Total PCR (excluding March contracts) fell to 1.006 (from 1.103).

A declining Put-Call Ratio (PCR) suggests that Call writers are becoming more active, signaling potential profit booking or a cautious outlook in the market.

FII Derivatives Activity

Foreign Institutional Investors (FIIs) displayed stronger bullish positioning in index futures and options:

FII Derivatives Activity

Foreign Institutional Investors (FIIs) displayed stronger bullish positioning in index futures and options:

FII Index Future Open Interest Long Ratio jumped to 39.86% (from 33.58%), showing increased confidence in long positions.

FII Index Future Volume Long Ratio slightly increased to 52.41% (from 51.88%), indicating a more balanced trade approach.

FII Call Option Open Interest Long Ratio improved to 62.13% (from 55.43%), highlighting increased participation in long call positions.

FII Put Option Open Interest Long Ratio surged to 63.55% (from 56.61%), suggesting hedging or protective strategies.

| FII Trading Stats | 27.03.25 | 26.03.25 | 25.03.25 |

| FII Cash (Provisional Data) | 11,111.25 | 2,240.55 | 5,371.57 |

| Index Future Open Interest Long Ratio | 39.86% | 33.58% | 32.94% |

| Index Future Volume Long Ratio | 52.41% | 51.88% | 52.32% |

| Call Option Open Interest Long Ratio | 62.13% | 55.43% | 53.83% |

| Call Option Volume Long Ratio | 49.94% | 50.34% | 50.19% |

| Put Option Open Interest Long Ratio | 63.55% | 56.61% | 54.49% |

| Put Option Volume Long Ratio | 49.87% | 50.34% | 50.56% |

| Stock Future Open Interest Long Ratio | 64.34% | 65.22% | 65.16% |

| Stock Future Volume Long Ratio | 50.66% | 50.17% | 50.30% |

| Index Futures | Short Covering | Short Covering | Short Covering |

| Index Options | Long Covering | Fresh Long | Fresh Long |

| Nifty Futures | Short Covering | Short Covering | Fresh Long |

| Nifty Options | Long Covering | Short Covering | Fresh Long |

| BankNifty Futures | Short Covering | Fresh Short | Long Covering |

| BankNifty Options | Short Covering | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Long | Fresh Long | Fresh Long |

| FinNifty Options | Long Covering | Fresh Long | Fresh Short |

| MidcpNifty Futures | Long Covering | Long Covering | Long Covering |

| MidcpNifty Options | Long Covering | Long Covering | Short Covering |

| NiftyNxt50 Futures | Short Covering | Fresh Long | Short Covering |

| NiftyNxt50 Options | Short Covering | Short Covering | Fresh Long |

| Stock Futures | Short Covering | Short Covering | Fresh Long |

| Stock Options | Long Covering | Long Covering | Fresh Short |

Nifty/Sensex F&O Analysis : Major Indices | Options Insights

SENSEX Weekly Expiry (01.04.2025)

The SENSEX index closed at 77606.43. The SENSEX weekly expiry for April 1, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.910 against previous 0.728. The 80000CE option holds the maximum open interest, followed by the 75000PE and 76500PE options. Market participants have shown increased interest with significant open interest additions in the 75000PE option, with open interest additions also seen in the 80000CE and 76500PE options. On the other hand, open interest reductions were prominent in the 68000PE, 70700PE, and 68500PE options. Trading volume was highest in the 78000CE option, followed by the 77500PE and 77600PE options, indicating active trading in these strikes.

| SENSEX | Monthly | Expiry: | 01-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 77606.43 | 0.910 | 0.728 | 0.925 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,10,88,920 | 68,94,409 | 41,94,511 |

| PUT: | 1,00,86,820 | 50,18,940 | 50,67,880 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 8,76,840 | 5,49,760 | 48,02,460 |

| 83000 | 7,62,940 | 2,48,280 | 36,48,440 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 8,76,840 | 5,49,760 | 48,02,460 |

| 78000 | 6,47,320 | 2,93,980 | 67,52,000 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81700 | 11,980 | -19,260 | 2,37,040 |

| 81600 | 21,620 | -16,460 | 4,15,740 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 6,47,320 | 2,93,980 | 67,52,000 |

| 77700 | 1,93,380 | 1,12,760 | 56,21,480 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 7,87,360 | 5,96,820 | 33,84,600 |

| 76500 | 7,77,980 | 4,30,800 | 32,07,920 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 7,87,360 | 5,96,820 | 33,84,600 |

| 76500 | 7,77,980 | 4,30,800 | 32,07,920 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 68000 | 1,61,460 | -86,080 | 11,13,220 |

| 70700 | 7,940 | -22,400 | 79,640 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 77500 | 4,02,240 | 2,54,800 | 63,73,600 |

| 77600 | 2,43,420 | 1,80,000 | 63,58,880 |

NIFTY Weekly Expiry (3.04.2025)

The NIFTY index closed at 23591.95. The NIFTY weekly expiry for April 3, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.845 against previous 0.908. The 25400CE option holds the maximum open interest, followed by the 24500CE and 25000CE options. Market participants have shown increased interest with significant open interest additions in the 25400CE option, with open interest additions also seen in the 24500CE and 25000CE options. On the other hand, open interest reductions were prominent in the 21850PE, 22250PE, and 22500CE options. Trading volume was highest in the 23500PE option, followed by the 23600CE and 24000CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 03-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 23,591.95 | 0.845 | 0.908 | 0.826 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,19,08,350 | 6,29,98,125 | 3,89,10,225 |

| PUT: | 8,60,87,250 | 5,72,15,250 | 2,88,72,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 1,21,90,875 | 70,43,025 | 2,93,656 |

| 24,500 | 72,65,025 | 41,32,500 | 2,74,305 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 1,21,90,875 | 70,43,025 | 2,93,656 |

| 24,500 | 72,65,025 | 41,32,500 | 2,74,305 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 18,72,975 | -75,450 | 5,569 |

| 23,200 | 6,16,950 | -74,325 | 13,536 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,600 | 32,00,400 | 13,90,575 | 3,22,021 |

| 24,000 | 44,39,475 | 14,42,475 | 3,19,189 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 45,74,325 | 9,35,250 | 1,41,592 |

| 22,000 | 42,71,325 | 20,73,675 | 1,64,104 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 21,000 | 39,54,150 | 24,45,075 | 1,23,030 |

| 23,600 | 35,41,350 | 21,62,475 | 3,12,550 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 21,850 | 44,250 | -97,200 | 8,552 |

| 22,250 | 31,21,950 | -95,400 | 24,326 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 40,48,875 | 9,66,975 | 3,52,391 |

| 23,600 | 35,41,350 | 21,62,475 | 3,12,550 |

NIFTY Monthly Expiry (24.04.2025)

The NIFTY index closed at 23591.95. The NIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.282 against previous 1.363. The 23500PE option holds the maximum open interest, followed by the 23500CE and 23000PE options. Market participants have shown increased interest with significant open interest additions in the 23500PE option, with open interest additions also seen in the 23500CE and 23600CE options. On the other hand, open interest reductions were prominent in the 20500PE, 25400CE, and 22600PE options. Trading volume was highest in the 23500PE option, followed by the 23500CE and 24000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 23,591.95 | 1.282 | 1.363 | 1.054 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,30,05,550 | 2,63,96,550 | 66,09,000 |

| PUT: | 4,23,15,000 | 3,59,83,725 | 63,31,275 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 36,04,800 | 16,36,800 | 64,785 |

| 24,000 | 29,91,525 | 3,09,975 | 42,261 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 36,04,800 | 16,36,800 | 64,785 |

| 23,600 | 13,97,850 | 9,15,375 | 35,027 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 1,65,375 | -48,225 | 5,026 |

| 25,300 | 1,21,950 | -17,850 | 4,484 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 36,04,800 | 16,36,800 | 64,785 |

| 24,000 | 29,91,525 | 3,09,975 | 42,261 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 49,14,450 | 16,70,550 | 80,594 |

| 23,000 | 33,83,400 | 1,49,475 | 40,735 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 49,14,450 | 16,70,550 | 80,594 |

| 23,400 | 14,26,875 | 7,53,525 | 29,149 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 20,500 | 18,87,825 | -54,225 | 12,814 |

| 22,600 | 4,49,775 | -32,400 | 8,948 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 49,14,450 | 16,70,550 | 80,594 |

| 23,000 | 33,83,400 | 1,49,475 | 40,735 |

BANKNIFTY Monthly Expiry (24.04.2025)

The BANKNIFTY index closed at 51575.85. The BANKNIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.070 against previous 1.059. The 53000PE option holds the maximum open interest, followed by the 53000CE and 50000PE options. Market participants have shown increased interest with significant open interest additions in the 51500PE option, with open interest additions also seen in the 50000PE and 52000CE options. On the other hand, open interest reductions were prominent in the 53400CE, 51100CE, and 43500PE options. Trading volume was highest in the 52000CE option, followed by the 51500PE and 51000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 51,575.85 | 1.070 | 1.059 | 1.009 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,05,82,770 | 84,75,600 | 21,07,170 |

| PUT: | 1,13,26,800 | 89,71,749 | 23,55,051 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 11,09,820 | 1,55,070 | 40,488 |

| 52,000 | 8,11,350 | 1,78,170 | 67,595 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 8,11,350 | 1,78,170 | 67,595 |

| 53,000 | 11,09,820 | 1,55,070 | 40,488 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,400 | 47,220 | -13,200 | 2,465 |

| 51,100 | 9,840 | -4,200 | 2,181 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 8,11,350 | 1,78,170 | 67,595 |

| 51,500 | 5,58,630 | 1,19,970 | 47,317 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 11,96,910 | 62,610 | 8,981 |

| 50,000 | 9,24,930 | 2,57,580 | 39,591 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 51,500 | 6,45,870 | 2,73,990 | 55,583 |

| 50,000 | 9,24,930 | 2,57,580 | 39,591 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 43,500 | 15,330 | -3,060 | 507 |

| 44,100 | 870 | -2,850 | 156 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 51,500 | 6,45,870 | 2,73,990 | 55,583 |

| 51,000 | 8,32,290 | 1,65,150 | 50,940 |

Market Outlook

The significant rise in FII long positions in index futures and options along with robust Buy figure in cash markets indicate renewed optimism. However, the contraction in Nifty futures premium and declining PCR ratios hint at possible profit booking and a cautious sentiment among market participants. The upcoming sessions will be crucial to determine if Nifty sustains its upward momentum or faces resistance near higher levels.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

[…] Check Previous Day’s Nifty Indices F&O Analysis […]