Turning Complex Derivative Data into Clear Market Insights

Nifty Futures Analysis: Sharp OI Drop Signals Market Uncertainty ahead of trump announcement

Table of Contents

Nifty Futures Overview

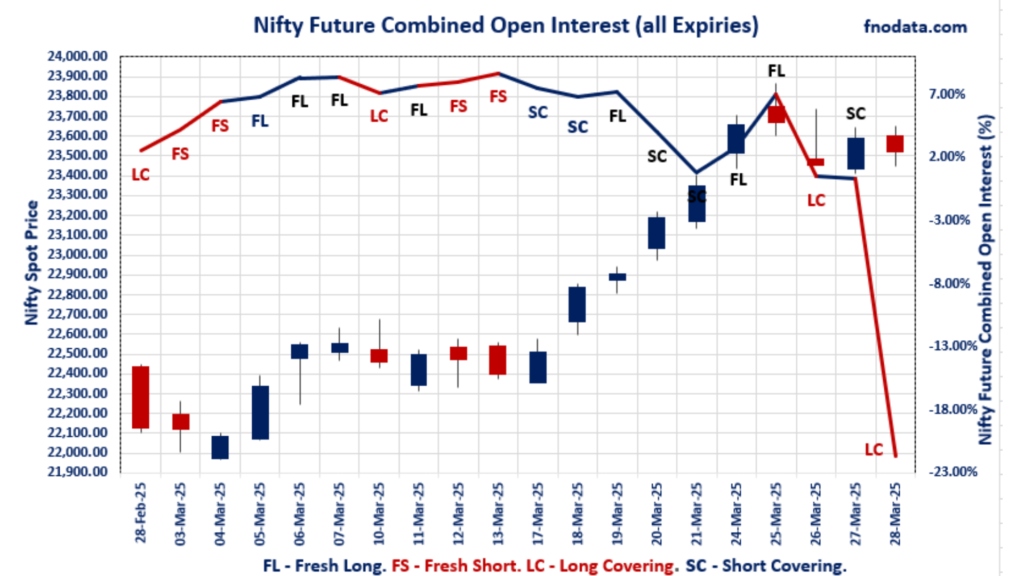

The Nifty Futures Analysis indicates a bearish tilt as Nifty spot closed at 23,519.35, down by 0.31%. Meanwhile, Nifty April futures ended at 23,637.65, registering a 0.59% loss while maintaining a 118.3-point premium over the spot price. Notably, the Nifty futures premium contracted by 67.4 points, reflecting a shift in market sentiment.

A significant highlight is the 21.61% fall in combined Nifty Futures open interest (April, May & June Expiry), accompanied by a 31.12% drop in total futures volume. This suggests a large-scale unwinding of positions, signaling uncertainty or profit booking ahead of key market events.

Put-Call Ratio (PCR) Insights

Nifty April PCR declined to 1.249 (from 1.282).

Nifty May PCR increased to 1.455 (from 1.381).

Nifty June PCR debuted at 1.529.

Total PCR (all expiries) dropped to 0.920 (from 1.006), indicating higher Call writing and a more cautious market sentiment.

A falling Total PCR suggests that traders are taking defensive positions, potentially anticipating market volatility in the near term.

FII & DII Cash Market Activity

FIIs were net sellers of ₹ 4,352.82 Cr, indicating profit booking or reduced risk appetite.

DIIs were net buyers of ₹ 7,646.49 Cr, suggesting domestic institutional investors stepped in to absorb selling pressure and support the market.

The contrasting actions between FIIs and DIIs highlight mixed sentiment, with FIIs showing caution while DIIs remain confident in the long-term prospects.

FII Derivatives Activity

Foreign Institutional Investors (FIIs) reduced their long exposure across index futures and options:

FII Index Future Open Interest Long Ratio fell to 35.02% (from 39.86%), reflecting reduced confidence in long positions.

FII Index Future Volume Long Ratio dropped sharply to 33.72% (from 52.41%), suggesting lower participation in bullish trades.

FII Call Option Open Interest Long Ratio declined to 53.89% (from 62.13%), indicating reduced optimism in upside moves.

FII Put Option Open Interest Long Ratio decreased to 56.47% (from 63.55%), signaling less aggressive hedging.

| FII Trading Stats | 28.03.25 | 27.03.25 | 26.03.25 |

| FII Cash (Provisional Data) | -4,352.82 | 11,111.25 | 2,240.55 |

| Index Future Open Interest Long Ratio | 35.02% | 39.86% | 33.58% |

| Index Future Volume Long Ratio | 33.72% | 52.41% | 51.88% |

| Call Option Open Interest Long Ratio | 53.89% | 62.13% | 55.43% |

| Call Option Volume Long Ratio | 49.33% | 49.94% | 50.34% |

| Put Option Open Interest Long Ratio | 56.47% | 63.55% | 56.61% |

| Put Option Volume Long Ratio | 49.65% | 49.87% | 50.34% |

| Stock Future Open Interest Long Ratio | 63.89% | 64.34% | 65.22% |

| Stock Future Volume Long Ratio | 46.79% | 50.66% | 50.17% |

| Index Futures | Fresh Short | Short Covering | Short Covering |

| Index Options | Fresh Short | Long Covering | Fresh Long |

| Nifty Futures | Fresh Short | Short Covering | Short Covering |

| Nifty Options | Fresh Short | Long Covering | Short Covering |

| BankNifty Futures | Fresh Short | Short Covering | Fresh Short |

| BankNifty Options | Fresh Short | Short Covering | Fresh Long |

| FinNifty Futures | Fresh Long | Fresh Long | Fresh Long |

| FinNifty Options | Fresh Long | Long Covering | Fresh Long |

| MidcpNifty Futures | Fresh Short | Long Covering | Long Covering |

| MidcpNifty Options | Fresh Short | Long Covering | Long Covering |

| NiftyNxt50 Futures | Long Covering | Short Covering | Fresh Long |

| NiftyNxt50 Options | Fresh Short | Short Covering | Short Covering |

| Stock Futures | Long Covering | Short Covering | Short Covering |

| Stock Options | Fresh Short | Long Covering | Long Covering |

Nifty/Sensex Options Analysis : Major Indices | Options Insights

SENSEX Weekly Expiry (01.04.2025)

The SENSEX index closed at 77414.92. The SENSEX weekly expiry for April 1, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.923 against previous 0.886. The 83000CE option holds the maximum open interest, followed by the 75000PE and 80000CE options. Market participants have shown increased interest with significant open interest additions in the 83000CE option, with open interest additions also seen in the 80500CE and 68000PE options. On the other hand, open interest reductions were prominent in the 82500CE, 78000PE, and 79900CE options. Trading volume was highest in the 78000CE option, followed by the 77000PE and 77500PE options, indicating active trading in these strikes.

| SENSEX | Monthly | Expiry: | 01-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 77414.92 | 0.923 | 0.886 | 1.047 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,85,44,000 | 1,10,88,920 | 74,55,080 |

| PUT: | 1,71,23,620 | 98,26,329 | 72,97,291 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 19,74,400 | 12,11,460 | 79,79,480 |

| 80000 | 12,70,720 | 3,93,880 | 1,12,11,960 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 19,74,400 | 12,11,460 | 79,79,480 |

| 80500 | 9,62,900 | 6,28,600 | 60,40,980 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 3,67,060 | -2,10,280 | 21,35,140 |

| 79900 | 96,520 | -88,320 | 28,09,140 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 8,22,120 | 1,74,800 | 4,84,45,920 |

| 77500 | 6,08,360 | 3,73,540 | 3,58,13,700 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 13,83,100 | 5,95,740 | 1,18,68,460 |

| 74000 | 9,78,920 | 5,66,340 | 81,45,000 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 68000 | 7,72,760 | 6,11,300 | 41,20,680 |

| 75000 | 13,83,100 | 5,95,740 | 1,18,68,460 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 2,21,840 | -1,99,780 | 65,42,560 |

| 72000 | 1,75,500 | -85,000 | 21,31,760 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 77000 | 8,01,840 | 1,63,060 | 4,82,75,680 |

| 77500 | 5,09,820 | 1,07,580 | 4,63,56,940 |

NIFTY Weekly Expiry (3.04.2025)

The NIFTY index closed at 23519.35. The NIFTY weekly expiry for April 3, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.779 against previous 0.845. The 25400CE option holds the maximum open interest, followed by the 24500CE and 25000CE options. Market participants have shown increased interest with significant open interest additions in the 25400CE option, with open interest additions also seen in the 24000CE and 22500PE options. On the other hand, open interest reductions were prominent in the 23600PE, 23800PE, and 23700PE options. Trading volume was highest in the 23500PE option, followed by the 23600CE and 23600PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 03-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 23,519.35 | 0.779 | 0.845 | 0.977 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,49,30,575 | 10,19,08,350 | 5,30,22,225 |

| PUT: | 12,07,24,800 | 8,60,87,250 | 3,46,37,550 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 1,75,87,125 | 53,96,250 | 7,41,031 |

| 24,500 | 92,73,300 | 20,08,275 | 7,62,044 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 1,75,87,125 | 53,96,250 | 7,41,031 |

| 24,000 | 81,89,700 | 37,50,225 | 18,22,522 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,200 | 5,09,100 | -1,07,850 | 32,724 |

| 22,800 | 8,35,500 | -95,100 | 4,891 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,600 | 62,77,125 | 30,76,725 | 31,78,453 |

| 23,700 | 50,82,150 | 19,98,300 | 20,77,504 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 76,58,625 | 30,84,300 | 4,52,546 |

| 23,500 | 62,05,275 | 21,56,400 | 37,31,049 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 76,58,625 | 30,84,300 | 4,52,546 |

| 20,350 | 59,76,150 | 29,62,950 | 5,90,192 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,600 | 27,89,850 | -7,51,500 | 28,08,885 |

| 23,800 | 11,26,050 | -4,80,000 | 2,35,607 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 62,05,275 | 21,56,400 | 37,31,049 |

| 23,600 | 27,89,850 | -7,51,500 | 28,08,885 |

NIFTY Monthly Expiry (24.04.2025)

The NIFTY index closed at 23519.35. The NIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.249 against previous 1.282. The 23500PE option holds the maximum open interest, followed by the 23500CE and 23000PE options. Market participants have shown increased interest with significant open interest additions in the 23700CE option, with open interest additions also seen in the 23700PE and 23600CE options. On the other hand, open interest reductions were prominent in the 23800PE, 21300PE, and 25100CE options. Trading volume was highest in the 23500PE option, followed by the 24000CE and 23000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 23,519.35 | 1.249 | 1.282 | 1.026 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,56,22,600 | 3,30,05,550 | 26,17,050 |

| PUT: | 4,45,09,875 | 4,23,15,000 | 21,94,875 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 35,88,300 | -16,500 | 62,483 |

| 24,000 | 33,20,850 | 3,29,325 | 77,198 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,700 | 15,95,550 | 5,60,250 | 40,962 |

| 23,600 | 18,89,700 | 4,91,850 | 49,087 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 1,53,000 | -69,675 | 10,088 |

| 25,400 | 98,475 | -66,900 | 8,086 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 33,20,850 | 3,29,325 | 77,198 |

| 23,500 | 35,88,300 | -16,500 | 62,483 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 51,15,375 | 2,00,925 | 1,08,047 |

| 23,000 | 35,20,575 | 1,37,175 | 64,667 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,700 | 15,06,900 | 5,04,525 | 40,269 |

| 23,600 | 11,77,050 | 3,80,700 | 55,913 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,800 | 15,33,225 | -1,22,325 | 23,654 |

| 21,300 | 1,80,750 | -1,13,850 | 9,122 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 51,15,375 | 2,00,925 | 1,08,047 |

| 23,000 | 35,20,575 | 1,37,175 | 64,667 |

BANKNIFTY Monthly Expiry (24.04.2025)

The BANKNIFTY index closed at 51564.85. The BANKNIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.992 against previous 1.070. The 53000CE option holds the maximum open interest, followed by the 53000PE and 50000PE options. Market participants have shown increased interest with significant open interest additions in the 59000CE option, with open interest additions also seen in the 48000PE and 53000CE options. On the other hand, open interest reductions were prominent in the 46000PE, 52400PE, and 51000CE options. Trading volume was highest in the 51500PE option, followed by the 52000CE and 51600PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 51,564.85 | 0.992 | 1.070 | 0.946 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,35,97,740 | 1,05,82,749 | 30,14,991 |

| PUT: | 1,34,85,960 | 1,13,26,800 | 21,59,160 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 12,87,210 | 1,77,390 | 1,82,591 |

| 52,000 | 9,55,200 | 1,43,850 | 2,37,759 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 6,12,000 | 4,27,920 | 96,211 |

| 53,000 | 12,87,210 | 1,77,390 | 1,82,591 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 6,20,340 | -21,690 | 26,743 |

| 50,000 | 4,17,210 | -12,480 | 8,156 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 9,55,200 | 1,43,850 | 2,37,759 |

| 53,000 | 12,87,210 | 1,77,390 | 1,82,591 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 12,54,300 | 57,390 | 15,934 |

| 50,000 | 9,76,590 | 51,660 | 1,08,026 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 48,000 | 8,19,030 | 2,14,260 | 67,270 |

| 51,500 | 8,22,240 | 1,76,370 | 2,93,988 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 46,000 | 3,56,760 | -36,840 | 40,051 |

| 52,400 | 34,920 | -29,400 | 8,573 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 51,500 | 8,22,240 | 1,76,370 | 2,93,988 |

| 51,600 | 1,99,140 | 45,960 | 1,87,416 |

Market Outlook

The sharp contraction in Nifty futures open interest and volume points to profit booking or a cautious stance by market participants. Additionally, the decline in FII long positions across derivatives suggests that institutional investors are either reducing exposure or waiting for a clearer market direction.

F&O analysis indicates that a significant portion of last month’s open interest was allowed to expire without rollover, reflecting a lack of conviction among traders. Furthermore, the hesitation to initiate fresh positions ahead of the U.S. President Donald Trump’s tariff announcements on April 3rd suggests a risk-averse approach, as global trade policies could introduce volatility into the markets.

Despite the drop in April PCR, the steady rise in May and June PCRs implies that traders are still positioning themselves for potential upward moves in the coming months. Nifty Options activity suggesting participants are expecting Nifty to stay within 23,500 – 24,000 levels till Trump announcement on April 3, 2025.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

[…] Check Previous Day’s Nifty Indices F&O Analysis […]