Turning Complex Derivative Data into Clear Market Insights

Market Breakdown | Nifty & Bank Nifty Face Heavy Selling Amid FII Exit | 1.04.2025

Table of Contents

NSE Indices F&O Analysis: Premium Expansion Amid Bearish Pressure

NIFTY F&O Analysis

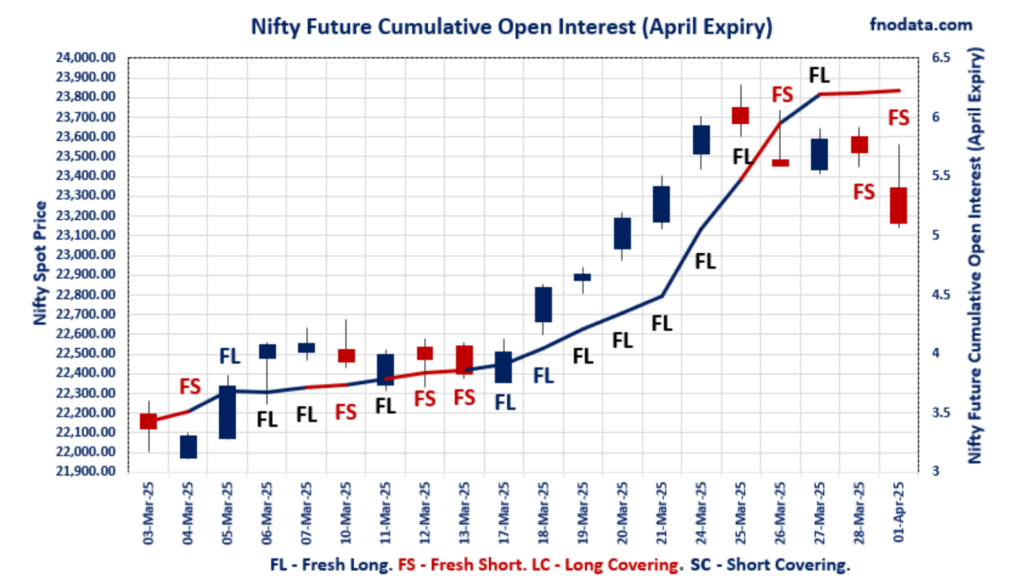

NIFTY Spot closed at 23165.7; down by 1.34%%. NIFTY April Future closed at 23321.4; registering a 1.34% loss while maintaining a 155.7-point premium over the spot price. NIFTY April Future premium expanded by 37.4 points, reflecting a shift in market sentiment.

NIFTY April Put-Call ratio (PCR) decreased from 1.249 to 1.202. Max pain level for NIFTY April expiry stayed at 23500 which is the same level as previous session. NIFTY April Expiry CALL option writers are active at 23500, while PUT option writers are also concentrated at 23500. Maximum CALL addition is at 23500 while maximum PUT Open Interest addition was at 23300.

BANKNIFTY F&O Analysis

BANKNIFTY Spot closed at 50827.5; down by 1.26%%. BANKNIFTY April Future closed at 51187.1; registering a 1.26% loss while maintaining a 359.6-point premium over the spot price. BANKNIFTY April future premium expanded by 83.6 points.

BANKNIFTY April Put-Call ratio (PCR) decreased from 0.995 to 0.902. Max pain level for BANKNIFTY April expiry moved to 51400 from previous 51500. April Expiry CALL option writers are active at 53000, while PUT option writers are also concentrated at 53000. Maximum CALL addition is at 55500 while maximum PUT Open Interest addition was at 47000.

FINNIFTY F&O Analysis

FINNIFTY Spot closed at 24529.4; down by 2.01%. FINNIFTY April Future closed at 24686.2; registering a 2.01% loss while maintaining a 156.8-point premium over the spot price. FINNIFTY futures premium expanded by 40.3 points.

FINNIFTY April Put-Call ratio (PCR) decreased from 0.844 to 0.535. Max pain level for FINNIFTY April expiry moved to 24900 from previous 25000. FINNIFTY April Expiry CALL option writers are active at 25500, while PUT option writers are also concentrated at 25500. Maximum CALL addition is at 25500 while maximum PUT Open Interest addition was at 24700.

MIDCPNIFTY F&O Analysis

MIDCPNIFTY Spot closed at 11383.9; down by 1.34%. MIDCPNIFTY April Future closed at 11399.6; registering a 1.34% loss while maintaining a 15.7-point premium over the spot price. MIDCPNIFTY futures premium expanded by 6.9 points.

MIDCPNIFTY April Put-Call ratio (PCR) increased from 0.708 to 0.800. Max pain level for MIDCPNIFTY April expiry moved to 11500 from previous 11550. MIDCPNIFTY April Expiry CALL option writers are active at 12000, while PUT option writers are also concentrated at 11000. Maximum CALL addition is at 11500 while maximum PUT Open Interest addition was at 11400.

FII & DII Cash Market Activity

Foreign Institutional Investors (FIIs) net sold ₹5,901.63 Cr in the cash market.

Domestic Institutional Investors (DIIs) provided support, buying ₹4,322.58 Cr worth of equities.

FII Derivative Positioning: Signs of Caution

FII Index Future Long Ratio fell from 35.02% to 30.62%, signaling reduced bullish bets.

FII Call Option Long Ratio declined from 53.89% to 52.6%, showing lower confidence in upside movement.

FII Put Option Long Ratio increased from 56.47% to 57.47%, indicating heightened hedging activity.

| FII Trading Stats | 1.04.25 | 28.03.25 | 27.03.25 |

| FII Cash (Provisional Data) | -5,901.63 | -4,352.82 | 11,111.25 |

| Index Future Open Interest Long Ratio | 30.62% | 35.02% | 39.86% |

| Index Future Volume Long Ratio | 33.99% | 33.72% | 52.41% |

| Call Option Open Interest Long Ratio | 52.60% | 53.89% | 62.13% |

| Call Option Volume Long Ratio | 49.98% | 49.33% | 49.94% |

| Put Option Open Interest Long Ratio | 57.47% | 56.47% | 63.55% |

| Put Option Volume Long Ratio | 50.34% | 49.65% | 49.87% |

| Stock Future Open Interest Long Ratio | 64.07% | 63.89% | 64.34% |

| Stock Future Volume Long Ratio | 51.54% | 46.79% | 50.66% |

| Index Futures | Fresh Short | Fresh Short | Short Covering |

| Index Options | Fresh Long | Fresh Short | Long Covering |

| Nifty Futures | Fresh Short | Fresh Short | Short Covering |

| Nifty Options | Fresh Long | Fresh Short | Long Covering |

| BankNifty Futures | Long Covering | Fresh Short | Short Covering |

| BankNifty Options | Fresh Long | Fresh Short | Short Covering |

| FinNifty Futures | Short Covering | Fresh Long | Fresh Long |

| FinNifty Options | Fresh Short | Fresh Long | Long Covering |

| MidcpNifty Futures | Fresh Short | Fresh Short | Long Covering |

| MidcpNifty Options | Fresh Long | Fresh Short | Long Covering |

| NiftyNxt50 Futures | Short Covering | Long Covering | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Short Covering |

| Stock Futures | Short Covering | Long Covering | Short Covering |

| Stock Options | Fresh Short | Fresh Short | Long Covering |

Nifty/Sensex Options Analysis : Major Indices | Options Insights

NIFTY Weekly Expiry (3.04.2025)

The NIFTY index closed at 23165.7. The NIFTY weekly expiry for April 3, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.629 against previous 0.779. The 25400CE option holds the maximum open interest, followed by the 23500CE and 24000CE options. Market participants have shown increased interest with significant open interest additions in the 23500CE option, with open interest additions also seen in the 23400CE and 23300CE options. On the other hand, open interest reductions were prominent in the 23400PE, 23500PE, and 23550PE options. Trading volume was highest in the 23500CE option, followed by the 23200PE and 23000PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 03-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 23,165.70 | 0.629 | 0.779 | 0.919 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 21,71,82,900 | 15,49,30,575 | 6,22,52,325 |

| PUT: | 13,66,12,800 | 12,07,24,800 | 1,58,88,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 1,65,15,750 | -10,71,375 | 9,15,986 |

| 23,500 | 1,33,36,575 | 90,06,750 | 30,10,005 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 1,33,36,575 | 90,06,750 | 30,10,005 |

| 23,400 | 79,36,950 | 66,21,300 | 20,24,697 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 1,65,15,750 | -10,71,375 | 9,15,986 |

| 24,400 | 35,75,100 | -7,30,125 | 4,13,625 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 1,33,36,575 | 90,06,750 | 30,10,005 |

| 23,600 | 1,04,26,125 | 41,49,000 | 21,14,118 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 75,78,300 | -80,325 | 7,90,202 |

| 23,000 | 74,18,400 | 21,09,600 | 22,90,297 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,800 | 66,84,150 | 23,95,200 | 10,59,405 |

| 23,200 | 49,36,650 | 21,50,775 | 29,02,149 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,400 | 19,00,950 | -14,14,350 | 16,47,740 |

| 23,500 | 48,12,300 | -13,92,975 | 15,98,284 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,200 | 49,36,650 | 21,50,775 | 29,02,149 |

| 23,000 | 74,18,400 | 21,09,600 | 22,90,297 |

NIFTY Monthly Expiry (24.04.2025)

The NIFTY index closed at 23165.7. The NIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.202 against previous 1.249. The 23500PE option holds the maximum open interest, followed by the 23500CE and 23000PE options. Market participants have shown increased interest with significant open interest additions in the 23300PE option, with open interest additions also seen in the 23500CE and 23300CE options. On the other hand, open interest reductions were prominent in the 23500PE, 23800PE, and 23600PE options. Trading volume was highest in the 23000PE option, followed by the 24000CE and 23500PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 23,165.70 | 1.202 | 1.249 | 0.973 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,81,91,350 | 3,56,22,600 | 25,68,750 |

| PUT: | 4,58,97,375 | 4,45,09,875 | 13,87,500 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 42,08,700 | 6,20,400 | 92,500 |

| 24,000 | 33,53,325 | 32,475 | 96,009 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 42,08,700 | 6,20,400 | 92,500 |

| 23,300 | 11,27,100 | 5,69,625 | 34,472 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 20,500 | 9,31,950 | -1,39,725 | 3,354 |

| 24,700 | 4,49,625 | -1,29,975 | 28,216 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 33,53,325 | 32,475 | 96,009 |

| 23,500 | 42,08,700 | 6,20,400 | 92,500 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 47,47,350 | -3,68,025 | 93,011 |

| 23,000 | 35,20,350 | -225 | 98,450 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,300 | 15,03,225 | 6,22,725 | 45,341 |

| 22,500 | 32,10,750 | 3,54,675 | 54,373 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 47,47,350 | -3,68,025 | 93,011 |

| 23,800 | 13,75,500 | -1,57,725 | 12,505 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 35,20,350 | -225 | 98,450 |

| 23,500 | 47,47,350 | -3,68,025 | 93,011 |

BANKNIFTY Monthly Expiry (24.04.2025)

The BANKNIFTY index closed at 50827.5. The BANKNIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.902 against previous 0.995. The 53000CE option holds the maximum open interest, followed by the 53000PE and 52000CE options. Market participants have shown increased interest with significant open interest additions in the 55500CE option, with open interest additions also seen in the 54000CE and 51000CE options. On the other hand, open interest reductions were prominent in the 51500PE, 51000PE, and 51700PE options. Trading volume was highest in the 51000PE option, followed by the 51500PE and 51500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 50,827.50 | 0.902 | 0.995 | 1.008 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,55,80,170 | 1,35,60,369 | 20,19,801 |

| PUT: | 1,40,55,930 | 1,34,85,960 | 5,69,970 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 13,12,170 | 24,960 | 1,42,355 |

| 52,000 | 9,58,200 | 3,000 | 1,57,657 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 4,36,560 | 1,80,270 | 50,603 |

| 54,000 | 8,72,100 | 1,67,190 | 93,154 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 3,71,040 | -46,170 | 10,237 |

| 49,000 | 4,90,230 | -26,340 | 7,683 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 51,500 | 7,48,740 | 75,780 | 1,60,517 |

| 52,000 | 9,58,200 | 3,000 | 1,57,657 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 12,40,170 | -14,130 | 4,854 |

| 50,000 | 9,20,430 | -56,160 | 1,30,227 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 47,000 | 6,85,170 | 1,24,800 | 41,760 |

| 44,000 | 2,36,070 | 1,20,900 | 16,772 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 51,500 | 5,80,860 | -2,41,380 | 1,62,328 |

| 51,000 | 7,82,370 | -1,35,270 | 2,30,883 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 7,82,370 | -1,35,270 | 2,30,883 |

| 51,500 | 5,80,860 | -2,41,380 | 1,62,328 |

FINNIFTY Monthly Expiry (24.04.2025)

The FINNIFTY index closed at 24529.4. The FINNIFTY monthly expiry for April 24, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.535 against previous 0.844. The 25500CE option holds the maximum open interest, followed by the 26000CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 25500CE option, with open interest additions also seen in the 25600CE and 25700CE options. On the other hand, open interest reductions were prominent in the 25000PE, 24000PE, and 25100PE options. Trading volume was highest in the 25000CE option, followed by the 25000PE and 24500PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,529.40 | 0.535 | 0.844 | 0.785 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 9,16,630 | 5,52,370 | 3,64,260 |

| PUT: | 4,90,035 | 4,66,310 | 23,725 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,31,105 | 1,04,325 | 3,931 |

| 26,000 | 96,395 | -1,235 | 3,319 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,31,105 | 1,04,325 | 3,931 |

| 25,600 | 46,150 | 37,895 | 1,231 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 8,060 | -6,175 | 244 |

| 25,300 | 11,245 | -2,145 | 444 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 68,380 | 7,735 | 6,502 |

| 25,500 | 1,31,105 | 1,04,325 | 3,931 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 55,380 | -19,565 | 3,224 |

| 25,000 | 44,135 | -47,970 | 4,591 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 23,595 | 15,470 | 1,698 |

| 23,800 | 13,845 | 13,585 | 867 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 44,135 | -47,970 | 4,591 |

| 24,000 | 55,380 | -19,565 | 3,224 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 44,135 | -47,970 | 4,591 |

| 24,500 | 40,625 | 11,765 | 4,160 |

Market Outlook: Uncertainty Looms Amid Weak Global Cues & Trump Liberation Day Event

The market is at a critical juncture as FIIs continue heavy selling, reducing their long positions in index futures while increasing their put option holdings, signaling a cautious to bearish outlook. This suggests that institutional investors are hedging against potential downside risks, possibly due to global uncertainties, economic policy shifts, or upcoming data releases.

Key Factors to Watch:

Resistance at 23,500 for Nifty & 53,000 for Bank Nifty:

Options data suggests strong call writing at these levels, making them key resistance zones.

If these levels are breached on the upside, it could indicate short covering, but until then, caution is advised.

Trump Liberation Day & Global Market Sentiment:

April 3rd, marked as “Trump Liberation Day,” could trigger global market volatility, as the former U.S. president is expected to make major economic and policy announcements, particularly regarding tariffs and geopolitical trade policies.

If new tariffs are imposed, sectors like IT, Pharma, and Auto in India could take a hit as they rely on global markets for growth.

The Federal Reserve’s monetary stance will also play a key role in shaping FII flows.

Sectoral Impact & Economic Growth Concerns:

IT, Auto, and Pharma stocks remain vulnerable due to global uncertainties, AI disruption, and potential tariff changes.

Defensive sectors like FMCG may struggle due to reduced white-collar demand.

Trading Strategy Going Forward:

Short-term traders: Should remain cautious and watch for support levels around 23,000 in Nifty and 50,000 in Bank Nifty.

Long-term investors: Should focus on sectors that are resilient to global downturns, such as manufacturing and energy.

Derivatives traders: Should track FII positioning, PCR trends, and Open Interest shifts for directional cues.

Overall, while Nifty and Bank Nifty may see short-term relief rallies, the broader market structure remains weak. With macro uncertainty, institutional selling pressure, and potential global shocks from Trump’s economic policies, a trend reversal would require strong domestic inflows and positive global cues.

For the bullish bias to continue, Nifty must sustain above the 100-DMA at 23,477, and Bank Nifty must hold above the 200-DMA at 51,015.

For now, the market remains in a sell-on-rise mode, and traders should approach with strict risk management and cautious optimism.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]