Turning Complex Derivative Data into Clear Market Insights

Market Meltdown Alert | NSE & BSE F&O Analysis Post Global Sell-Off | 7-04-2025

Table of Contents

NSE & BSE F&O Analysis | Bloodbath on Dalal Street as Global Markets Spiral

In today’s NIFTY F&O Analysis, Indian equities faced a brutal sell-off, triggered by a domino effect from collapsing global Market Meltdown. With the U.S. tariff shock sparking fears of stagflation and supply chain disruptions, the fallout was immediate across all major Indian indices. The NIFTY plummeted over 3%, BANKNIFTY tanked close to 3.2%, and FINNIFTY and MIDCPNIFTY were hammered, reflecting widespread panic. Rising premiums in futures and a dramatic drop in Put-Call Ratios point to massive short build-up, while relentless FII-DII selling in the cash market shows no sign of abating. The mood is grim, and the charts are echoing the bear’s roar.

NSE & BSE F&O Analysis | Short Built-up with Volume Spike

SENSEX Weekly Expiry (8.04.25) Future

SENSEX Spot closed at: 73,137.90 (-2.95%)

SENSEX Weekly Future closed at: 73,228.40 (-2.78%)

Premium: 90.5 (Increased by 129.79 points)

Open Interest Change: 101.1%

Volume Change: 362.3%

SENSEX Weekly Expiry (8/04/2025) Option Analysis

Put-Call Ratio (OI): 0.715 (Increased from 0.673)

Put-Call Ratio (Volume): 0.749

Max Pain Level: 74000

Maximum CALL OI: 76000

Maximum PUT OI: 68000

Highest CALL Addition: 75000

Highest PUT Addition: 68000

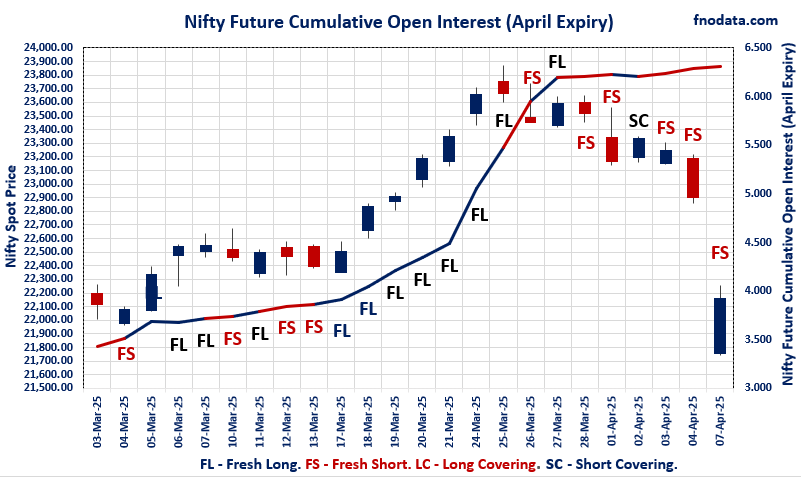

NIFTY April Future

NIFTY Spot closed at: 22,161.60 (-3.24%)

NIFTY April Future closed at: 22,263.80 (-3.02%)

Premium: 102.2 (Increased by 48.5 points)

Open Interest Change: 1.6%

Volume Change: 142.6%

NIFTY Weekly Expiry (9/04/2025) Option Analysis

Put-Call Ratio (OI): 0.577 (Decreased from 0.606)

Put-Call Ratio (Volume): 0.585

Max Pain Level: 22550

Maximum CALL OI: 25400

Maximum PUT OI: 20650

Highest CALL Addition: 22700

Highest PUT Addition: 20700

NIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 1.051 (Increased from 0.974)

Put-Call Ratio (Volume): 0.620

Max Pain Level: 23050

Maximum CALL OI: 23500

Maximum PUT OI: 21000

Highest CALL Addition: 22000

Highest PUT Addition: 20500

BANKNIFTY April Future

BANKNIFTY Spot closed at: 49,860.10 (-3.19%)

BANKNIFTY April Future closed at: 50,095.70 (-2.90%)

Premium: 235.6 (Increased by 144.75 points)

Open Interest Change: -1.9%

Volume Change: 112.7%

BANKNIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 0.804 (Decreased from 1.031)

Put-Call Ratio (Volume): 1.093

Max Pain Level: 51000

Maximum CALL OI: 59000

Maximum PUT OI: 50000

Highest CALL Addition: 59000

Highest PUT Addition: 40500

FINNIFTY April Future

FINNIFTY Spot closed at: 23,908.45 (-3.49%)

FINNIFTY April Future closed at: 24,039.10 (-3.15%)

Premium: 130.65 (Increased by 84.45 points)

Open Interest Change: -11.3%

Volume Change: 234.4%

FINNIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 0.777 (Decreased from 0.809)

Put-Call Ratio (Volume): 1.061

Max Pain Level: 24700

Maximum CALL OI: 26500

Maximum PUT OI: 24000

Highest CALL Addition: 24000

Highest PUT Addition: 20000

MIDCPNIFTY April Future

MIDCPNIFTY Spot closed at: 10,769.50 (-3.69%)

MIDCPNIFTY April Future closed at: 10,787.60 (-3.62%)

Premium: 18.1 (Increased by 6.8 points)

Open Interest Change: 8.8%

Volume Change: 42.5%

MIDCPNIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 0.835 (Increased from 0.737)

Put-Call Ratio (Volume): 0.894

Max Pain Level: 11300

Maximum CALL OI: 12000

Maximum PUT OI: 10000

Highest CALL Addition: 11000

Highest PUT Addition: 9300

FII & DII Cash Market Activity

FIIs Net Sell: ₹ 9,040.01 Cr

DIIs Net Buy: ₹ 12,122.45 Cr

FII Derivatives Activity

| FII Trading Stats | 7.04.25 | 4.04.25 | 3.04.25 |

| FII Cash (Provisional Data) | -9,040.01 | -3,483.98 | -2,806.00 |

| Index Future Open Interest Long Ratio | 25.14% | 29.01% | 30.13% |

| Index Future Volume Long Ratio | 42.31% | 39.50% | 36.63% |

| Call Option Open Interest Long Ratio | 60.55% | 59.57% | 63.24% |

| Call Option Volume Long Ratio | 50.29% | 50.41% | 49.90% |

| Put Option Open Interest Long Ratio | 63.98% | 64.20% | 62.13% |

| Put Option Volume Long Ratio | 50.44% | 50.87% | 49.75% |

| Stock Future Open Interest Long Ratio | 63.82% | 63.47% | 64.32% |

| Stock Future Volume Long Ratio | 52.25% | 45.66% | 46.92% |

| Index Futures | Fresh Short | Fresh Short | Fresh Short |

| Index Options | Fresh Long | Fresh Long | Long Covering |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Long | Long Covering |

| BankNifty Futures | Long Covering | Fresh Short | Fresh Long |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Long |

| FinNifty Futures | Long Covering | Fresh Long | Fresh Long |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Futures | Fresh Long | Fresh Short | Fresh Short |

| MidcpNifty Options | Fresh Long | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Fresh Long |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Short Covering | Long Covering | Long Covering |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

NSE & BSE F&O Analysis | Options Insights

SENSEX Weekly Expiry (8.04.2025)

The SENSEX index closed at 73137.9. The SENSEX weekly expiry for April 1, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.715 against previous 0.673. The 68000PE option holds the maximum open interest, followed by the 76000CE and 77000CE options. Market participants have shown increased interest with significant open interest additions in the 68000PE option, with open interest additions also seen in the 75000CE and 76000CE options. On the other hand, open interest reductions were prominent in the 74000PE, 79000CE, and 73000PE options. Trading volume was highest in the 68000PE option, followed by the 75000CE and 74000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 08-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 73137.9 | 0.715 | 0.673 | 0.749 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,38,39,620 | 1,94,23,400 | 44,16,220 |

| PUT: | 1,70,37,680 | 1,30,67,289 | 39,70,391 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 76000 | 17,62,940 | 8,41,260 | 2,59,96,000 |

| 77000 | 16,10,340 | 3,14,440 | 1,65,59,080 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 9,32,320 | 8,42,320 | 4,26,81,220 |

| 76000 | 17,62,940 | 8,41,260 | 2,59,96,000 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 6,15,960 | -4,15,940 | 59,55,200 |

| 79500 | 3,42,880 | -2,97,660 | 39,55,260 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 9,32,320 | 8,42,320 | 4,26,81,220 |

| 74000 | 5,00,020 | 4,95,800 | 3,56,35,500 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 68000 | 34,79,480 | 27,46,680 | 4,40,63,460 |

| 70000 | 9,29,500 | 4,28,560 | 3,48,49,660 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 68000 | 34,79,480 | 27,46,680 | 4,40,63,460 |

| 69000 | 7,52,080 | 6,75,160 | 2,25,80,740 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 74000 | 1,63,660 | -4,73,340 | 24,58,260 |

| 73000 | 5,85,280 | -4,09,880 | 1,31,75,820 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 68000 | 34,79,480 | 27,46,680 | 4,40,63,460 |

| 70000 | 9,29,500 | 4,28,560 | 3,48,49,660 |

NIFTY Weekly Expiry (9.04.2025)

The NIFTY index closed at 22161.6. The NIFTY weekly expiry for April 9, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.577 against previous 0.606. The 25400CE option holds the maximum open interest, followed by the 24000CE and 23000CE options. Market participants have shown increased interest with significant open interest additions in the 22700CE option, with open interest additions also seen in the 22000CE and 22500CE options. On the other hand, open interest reductions were prominent in the 22500PE, 23200CE, and 24500CE options. Trading volume was highest in the 22000PE option, followed by the 23000CE and 22500CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 09-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 22,161.60 | 0.577 | 0.606 | 0.585 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 18,50,84,775 | 18,86,62,050 | -35,77,275 |

| PUT: | 10,67,63,850 | 11,42,37,075 | -74,73,225 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 1,18,98,000 | -25,52,625 | 9,12,325 |

| 24,000 | 1,15,81,500 | 13,67,175 | 10,79,485 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,700 | 57,17,175 | 53,57,700 | 12,89,863 |

| 22,000 | 50,03,325 | 49,44,600 | 16,92,804 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,200 | 64,53,450 | -40,77,300 | 10,02,918 |

| 24,500 | 43,31,700 | -33,07,125 | 5,51,755 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 1,04,77,725 | 6,29,475 | 22,20,862 |

| 22,500 | 43,60,500 | 40,05,000 | 21,59,304 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 20,650 | 1,03,84,725 | 29,66,250 | 16,09,434 |

| 21,000 | 78,05,775 | 25,23,150 | 17,03,870 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 20,700 | 54,19,650 | 29,70,525 | 9,70,857 |

| 20,650 | 1,03,84,725 | 29,66,250 | 16,09,434 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 21,88,725 | -55,19,175 | 3,16,457 |

| 22,700 | 17,96,325 | -26,01,225 | 1,12,030 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 77,22,150 | -5,99,850 | 24,64,752 |

| 21,000 | 78,05,775 | 25,23,150 | 17,03,870 |

BANKNIFTY Monthly Expiry (24.04.2025)

The BANKNIFTY index closed at 49860.1. The BANKNIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.804 against previous 1.031. The 59000CE option holds the maximum open interest, followed by the 52000CE and 53000CE options. Market participants have shown increased interest with significant open interest additions in the 59000CE option, with open interest additions also seen in the 40500PE and 55000CE options. On the other hand, open interest reductions were prominent in the 51000PE, 50000PE, and 51500PE options. Trading volume was highest in the 50000PE option, followed by the 49000PE and 48000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 49,860.10 | 0.804 | 1.031 | 1.093 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,04,25,680 | 1,78,38,189 | 25,87,491 |

| PUT: | 1,64,13,060 | 1,83,86,610 | -19,73,550 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 15,26,040 | 4,82,370 | 1,71,778 |

| 52,000 | 13,02,060 | 99,150 | 2,24,134 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 15,26,040 | 4,82,370 | 1,71,778 |

| 55,000 | 12,83,850 | 3,48,360 | 1,44,783 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 12,88,470 | -1,89,630 | 1,99,263 |

| 52,500 | 5,92,950 | -1,86,150 | 1,38,929 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 13,02,060 | 99,150 | 2,24,134 |

| 50,000 | 7,18,050 | 3,47,730 | 2,14,913 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 10,84,830 | -4,41,600 | 2,99,738 |

| 48,000 | 8,95,350 | -2,34,630 | 2,41,975 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 40,500 | 5,61,150 | 3,68,880 | 1,95,607 |

| 43,000 | 3,46,650 | 2,42,970 | 86,815 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 6,50,550 | -4,68,480 | 81,215 |

| 50,000 | 10,84,830 | -4,41,600 | 2,99,738 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 10,84,830 | -4,41,600 | 2,99,738 |

| 49,000 | 8,36,550 | -3,27,210 | 2,72,107 |

FINNIFTY Monthly Expiry (24.04.2025)

The FINNIFTY index closed at 23908.45. The FINNIFTY monthly expiry for April 24, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.777 against previous 0.809. The 26500CE option holds the maximum open interest, followed by the 24000PE and 28000CE options. Market participants have shown increased interest with significant open interest additions in the 24000CE option, with open interest additions also seen in the 20000PE and 24500CE options. On the other hand, open interest reductions were prominent in the 25500CE, 24500PE, and 24750PE options. Trading volume was highest in the 24000PE option, followed by the 25000CE and 20000PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 23,908.45 | 0.777 | 0.809 | 1.061 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 13,07,345 | 11,71,495 | 1,35,850 |

| PUT: | 10,16,210 | 9,48,090 | 68,120 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,33,575 | 27,560 | 4,799 |

| 28,000 | 1,20,575 | 5,005 | 3,821 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 61,945 | 54,730 | 6,909 |

| 24,500 | 54,665 | 35,100 | 4,621 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,09,460 | -26,130 | 8,338 |

| 25,600 | 16,510 | -15,860 | 492 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,09,395 | -13,650 | 12,435 |

| 25,500 | 1,09,460 | -26,130 | 8,338 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,29,870 | -12,740 | 14,110 |

| 20,000 | 60,190 | 45,175 | 9,279 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 20,000 | 60,190 | 45,175 | 9,279 |

| 21,000 | 32,825 | 27,885 | 2,599 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 49,335 | -24,505 | 3,057 |

| 24,750 | 10,595 | -18,330 | 668 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,29,870 | -12,740 | 14,110 |

| 20,000 | 60,190 | 45,175 | 9,279 |

MIDCPNIFTY Monthly Expiry (24.04.2025)

The MIDCPNIFTY index closed at 10769.5. The MIDCPNIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.835 against previous 0.737. The 12000CE option holds the maximum open interest, followed by the 12500CE and 11600CE options. Market participants have shown increased interest with significant open interest additions in the 9300PE option, with open interest additions also seen in the 11000CE and 10500CE options. On the other hand, open interest reductions were prominent in the 62000PE, 49500PE, and 69500PE options. Trading volume was highest in the 10500PE option, followed by the 11500CE and 11000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 10,769.50 | 0.835 | 0.737 | 0.894 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 67,01,040 | 64,61,760 | 2,39,280 |

| PUT: | 55,96,560 | 47,63,760 | 8,32,800 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 6,46,800 | -84,360 | 12,924 |

| 12,500 | 6,19,200 | -13,800 | 7,110 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 2,96,400 | 2,49,480 | 13,094 |

| 10,500 | 1,61,880 | 1,61,280 | 5,854 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 66,480 | -1,02,720 | 2,080 |

| 11,600 | 5,13,600 | -87,720 | 5,363 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,500 | 4,86,000 | -57,120 | 14,319 |

| 11,000 | 2,96,400 | 2,49,480 | 13,094 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 10,000 | 4,87,440 | 33,240 | 11,752 |

| 10,500 | 4,73,160 | 1,26,600 | 20,081 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 9,300 | 4,03,080 | 3,75,840 | 8,406 |

| 9,500 | 1,59,720 | 1,34,280 | 6,454 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 3,93,840 | -85,080 | 8,578 |

| 11,500 | 2,63,760 | -84,120 | 1,868 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 10,500 | 4,73,160 | 1,26,600 | 20,081 |

| 10,600 | 2,16,600 | 1,26,960 | 12,131 |

Conclusion: Panic Grips Markets as Global Storm Intensifies

Today’s data reveals a textbook risk-off scenario. Sharp drops in Put-Call Ratios, rising futures premiums, and massive volume spikes suggest heavy short positions across the board. FIIs and DIIs continue to offload positions aggressively, with no signs of reversal yet. The sudden surge in Max Pain levels and PUT additions at lower strikes like 20,500 and 20,700 on NIFTY signals traders positioning for deeper cuts. With global markets under pressure from tariff-led stagflation fears, caution is the need of the hour. Traders are advised to remain nimble, avoid bottom-fishing, and track volatility metrics closely.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]