Turning Complex Derivative Data into Clear Market Insights

NSE Indices F&O Analysis | Sharp Recovery After Global Meltdown | 8-04-2025

Table of Contents

NSE Indices F&O Analysis | Resilient Bounce Back After Brutal Sell-Off

In today’s NIFTY F&O Analysis, Indian markets staged a resilient comeback following Monday’s brutal sell-off. Despite continued selling by both FIIs and DIIs, key indices like NIFTY, BANKNIFTY, and MIDCPNIFTY posted strong gains. However, a sharp decline in Open Interest across most futures suggests short covering rather than fresh long buildup. Rising Put-Call Ratios and improved Max Pain levels reflect a temporary sentiment lift, but broader caution still persists amid global uncertainty.

NSE F&O Analysis | Short covering before RBI Interest Rate Decision tomorrow

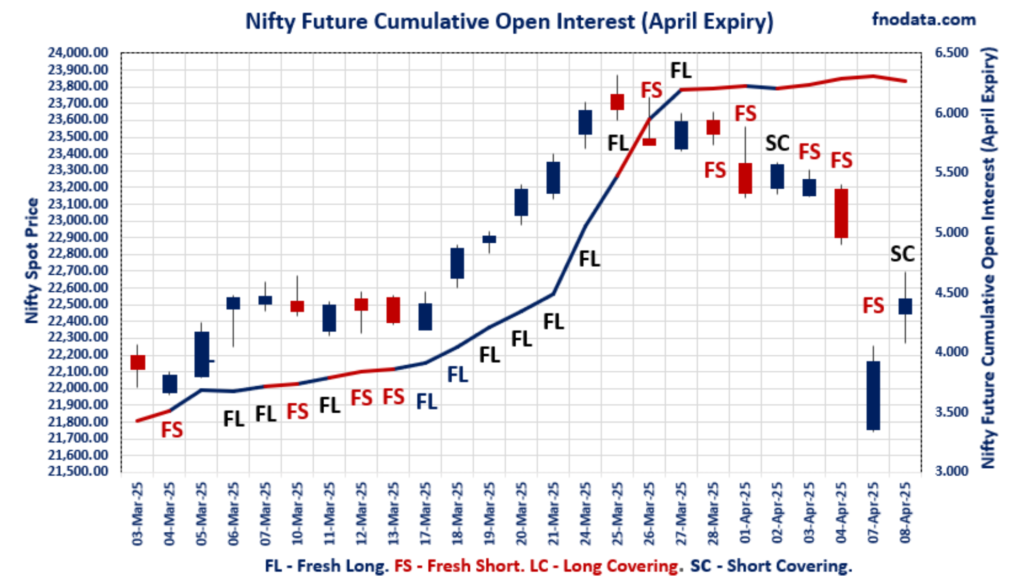

NIFTY April Future

NIFTY Spot closed at: 22,535.85 (1.69%)

NIFTY April Future closed at: 22,630.35 (1.65%)

Premium: 94.5 (Decreased by -7.7 points)

Open Interest Change: -3.2%

Volume Change: -40.5%

NIFTY Weekly Expiry (9/04/2025) Option Analysis

Put-Call Ratio (OI): 0.748 (Increased from 0.577)

Put-Call Ratio (Volume): 0.731

Max Pain Level: 22600

Maximum CALL OI: 23500

Maximum PUT OI: 21000

Highest CALL Addition: 23400

Highest PUT Addition: 20400

NIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 1.060 (Increased from 1.051)

Put-Call Ratio (Volume): 0.828

Max Pain Level: 23000

Maximum CALL OI: 23500

Maximum PUT OI: 21000

Highest CALL Addition: 23000

Highest PUT Addition: 22500

BANKNIFTY April Future

BANKNIFTY Spot closed at: 50,511.00 (1.31%)

BANKNIFTY April Future closed at: 50,768.20 (1.34%)

Premium: 257.2 (Increased by 21.6 points)

Open Interest Change: -4.6%

Volume Change: -49.4%

BANKNIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 0.779 (Decreased from 0.806)

Put-Call Ratio (Volume): 0.893

Max Pain Level: 50900

Maximum CALL OI: 59000

Maximum PUT OI: 50000

Highest CALL Addition: 59000

Highest PUT Addition: 50500

FINNIFTY April Future

FINNIFTY Spot closed at: 24,301.50 (1.64%)

FINNIFTY April Future closed at: 24,440.05 (1.67%)

Premium: 138.55 (Increased by 7.9 points)

Open Interest Change: -2.5%

Volume Change: -74.0%

FINNIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 0.789 (Increased from 0.777)

Put-Call Ratio (Volume): 0.748

Max Pain Level: 24700

Maximum CALL OI: 28000

Maximum PUT OI: 24000

Highest CALL Addition: 28000

Highest PUT Addition: 24200

MIDCPNIFTY April Future

MIDCPNIFTY Spot closed at: 11,042.00 (2.53%)

MIDCPNIFTY April Future closed at: 11,062.45 (2.55%)

Premium: 20.45 (Increased by 2.35 points)

Open Interest Change: 1.8%

Volume Change: -43.1%

MIDCPNIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 0.848 (Increased from 0.835)

Put-Call Ratio (Volume): 1.061

Max Pain Level: 11250

Maximum CALL OI: 12500

Maximum PUT OI: 10500

Highest CALL Addition: 11100

Highest PUT Addition: 11000

FII & DII Cash Market Activity:

FIIs Net Sell: ₹4,994.24 Cr

DIIs Net Sell: ₹3,097.24 Cr

FII Derivatives Activity

| FII Trading Stats | 8.04.25 | 7.04.25 | 4.04.25 |

| FII Cash (Provisional Data) | -4,994.24 | -9,040.01 | -3,483.98 |

| Index Future Open Interest Long Ratio | 24.27% | 25.14% | 29.01% |

| Index Future Volume Long Ratio | 48.77% | 42.31% | 39.50% |

| Call Option Open Interest Long Ratio | 64.70% | 60.55% | 59.57% |

| Call Option Volume Long Ratio | 50.83% | 50.29% | 50.41% |

| Put Option Open Interest Long Ratio | 67.53% | 63.98% | 64.20% |

| Put Option Volume Long Ratio | 51.18% | 50.44% | 50.87% |

| Stock Future Open Interest Long Ratio | 63.77% | 63.82% | 63.47% |

| Stock Future Volume Long Ratio | 49.48% | 52.25% | 45.66% |

| Index Futures | Long Covering | Fresh Short | Fresh Short |

| Index Options | Fresh Long | Fresh Long | Fresh Long |

| Nifty Futures | Long Covering | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Long | Fresh Long |

| BankNifty Futures | Short Covering | Long Covering | Fresh Short |

| BankNifty Options | Fresh Long | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Long | Long Covering | Fresh Long |

| FinNifty Options | Long Covering | Fresh Short | Fresh Short |

| MidcpNifty Futures | Fresh Long | Fresh Long | Fresh Short |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Long Covering | Short Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Fresh Short | Short Covering | Long Covering |

| Stock Options | Fresh Short | Fresh Long | Fresh Short |

NSE F&O Analysis | Options Insights

NIFTY Weekly Expiry (9.04.2025)

The NIFTY index closed at 22535.85. The NIFTY weekly expiry for April 9, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.748 against previous 0.577. The 23500CE option holds the maximum open interest, followed by the 24000CE and 25400CE options. Market participants have shown increased interest with significant open interest additions in the 20400PE option, with open interest additions also seen in the 20500PE and 22500PE options. On the other hand, open interest reductions were prominent in the 22000CE, 20650PE, and 22700CE options. Trading volume was highest in the 23000CE option, followed by the 22500CE and 22500PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 09-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 22,535.85 | 0.748 | 0.577 | 0.731 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 18,55,99,500 | 18,50,84,775 | 5,14,725 |

| PUT: | 13,87,83,075 | 10,67,63,850 | 3,20,19,225 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 1,22,70,825 | 18,12,600 | 13,49,681 |

| 24,000 | 1,19,80,800 | 3,99,300 | 11,48,921 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,400 | 66,01,650 | 24,26,850 | 9,50,271 |

| 23,300 | 88,85,100 | 20,27,100 | 12,29,702 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 18,92,775 | -31,10,550 | 1,47,853 |

| 22,700 | 35,41,350 | -21,75,825 | 25,43,212 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 99,32,025 | -5,45,700 | 35,61,443 |

| 22,500 | 43,86,600 | 26,100 | 28,57,668 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 21,000 | 95,07,600 | 17,01,825 | 15,04,438 |

| 20,400 | 89,69,325 | 89,69,325 | 11,65,086 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 20,400 | 89,69,325 | 89,69,325 | 11,65,086 |

| 20,500 | 59,04,600 | 59,04,600 | 7,33,793 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 20,650 | 74,26,200 | -29,58,525 | 6,40,806 |

| 22,000 | 57,78,675 | -19,43,475 | 18,90,573 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 66,02,025 | 44,13,300 | 27,85,744 |

| 22,400 | 32,02,875 | 21,92,550 | 21,01,928 |

NIFTY Monthly Expiry (24.04.2025)

The NIFTY index closed at 22535.85. The NIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.060 against previous 1.051. The 21000PE option holds the maximum open interest, followed by the 23500CE and 22000PE options. Market participants have shown increased interest with significant open interest additions in the 23000CE option, with open interest additions also seen in the 22500PE and 22600PE options. On the other hand, open interest reductions were prominent in the 22000CE, 21500PE, and 22000PE options. Trading volume was highest in the 22500PE option, followed by the 22500CE and 23000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 22,535.85 | 1.060 | 1.051 | 0.828 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,71,30,675 | 4,64,02,350 | 7,28,325 |

| PUT: | 4,99,66,800 | 4,87,61,925 | 12,04,875 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 41,05,575 | -2,05,575 | 99,805 |

| 24,000 | 38,41,650 | -90,750 | 91,988 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 35,88,750 | 9,85,800 | 1,21,888 |

| 22,700 | 10,21,125 | 5,16,150 | 54,119 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 26,08,050 | -5,01,975 | 35,356 |

| 23,500 | 41,05,575 | -2,05,575 | 99,805 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 26,80,875 | 2,90,475 | 1,39,035 |

| 23,000 | 35,88,750 | 9,85,800 | 1,21,888 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 21,000 | 41,19,825 | -2,46,675 | 71,441 |

| 22,000 | 38,97,975 | -2,65,350 | 1,15,347 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 36,04,350 | 9,32,025 | 1,47,189 |

| 22,600 | 9,08,850 | 5,30,400 | 55,137 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 21,500 | 19,92,075 | -4,66,275 | 74,342 |

| 22,000 | 38,97,975 | -2,65,350 | 1,15,347 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 36,04,350 | 9,32,025 | 1,47,189 |

| 22,000 | 38,97,975 | -2,65,350 | 1,15,347 |

BANKNIFTY Monthly Expiry (24.04.2025)

The BANKNIFTY index closed at 50511. The BANKNIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.779 against previous 0.806. The 59000CE option holds the maximum open interest, followed by the 53000CE and 52000CE options. Market participants have shown increased interest with significant open interest additions in the 59000CE option, with open interest additions also seen in the 50500PE and 53500CE options. On the other hand, open interest reductions were prominent in the 50000CE, 53000PE, and 47000PE options. Trading volume was highest in the 50500PE option, followed by the 52000CE and 51000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 50,511.00 | 0.779 | 0.806 | 0.893 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,15,77,890 | 2,03,57,139 | 12,20,751 |

| PUT: | 1,68,03,030 | 1,64,13,060 | 3,89,970 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 19,73,940 | 4,47,900 | 1,11,822 |

| 53,000 | 14,11,020 | 1,22,550 | 1,67,730 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 19,73,940 | 4,47,900 | 1,11,822 |

| 53,500 | 8,33,520 | 1,58,910 | 80,849 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 5,87,010 | -1,31,040 | 76,952 |

| 58,000 | 4,99,590 | -83,250 | 58,359 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 13,52,370 | 50,310 | 2,08,522 |

| 51,000 | 9,25,620 | 13,500 | 2,04,936 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 10,03,950 | -80,880 | 1,83,845 |

| 48,000 | 8,22,120 | -73,230 | 1,12,085 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 50,500 | 6,87,600 | 2,97,720 | 2,16,221 |

| 42,000 | 5,12,100 | 1,56,960 | 54,694 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 4,21,440 | -1,22,280 | 12,584 |

| 47,000 | 6,62,520 | -1,13,100 | 1,02,452 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 50,500 | 6,87,600 | 2,97,720 | 2,16,221 |

| 50,000 | 10,03,950 | -80,880 | 1,83,845 |

FINNIFTY Monthly Expiry (24.04.2025)

The FINNIFTY index closed at 24301.5. The FINNIFTY monthly expiry for April 24, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.789 against previous 0.777. The 24000PE option holds the maximum open interest, followed by the 28000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 24200PE option, with open interest additions also seen in the 28000CE and 27500CE options. On the other hand, open interest reductions were prominent in the 26500CE, 24000CE, and 20000PE options. Trading volume was highest in the 25000CE option, followed by the 24000PE and 24500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,301.50 | 0.789 | 0.777 | 0.748 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 13,60,060 | 13,07,345 | 52,715 |

| PUT: | 10,73,280 | 10,16,210 | 57,070 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 1,36,695 | 16,120 | 1,562 |

| 25,500 | 1,22,460 | 13,000 | 3,617 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 1,36,695 | 16,120 | 1,562 |

| 27,500 | 56,420 | 14,690 | 1,035 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,14,010 | -19,565 | 1,627 |

| 24,000 | 48,750 | -13,195 | 1,397 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,09,850 | 455 | 6,819 |

| 24,500 | 47,775 | -6,890 | 4,295 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,40,790 | 10,920 | 5,333 |

| 24,200 | 60,515 | 26,325 | 3,247 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 60,515 | 26,325 | 3,247 |

| 22,000 | 52,585 | 12,090 | 1,850 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 20,000 | 47,710 | -12,480 | 2,225 |

| 23,200 | 19,565 | -8,320 | 354 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,40,790 | 10,920 | 5,333 |

| 24,200 | 60,515 | 26,325 | 3,247 |

MIDCPNIFTY Monthly Expiry (24.04.2025)

The MIDCPNIFTY index closed at 11042. The MIDCPNIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.848 against previous 0.835. The 12500CE option holds the maximum open interest, followed by the 12000CE and 10500PE options. Market participants have shown increased interest with significant open interest additions in the 11000PE option, with open interest additions also seen in the 11100CE and 10900PE options. On the other hand, open interest reductions were prominent in the 51500PE, 51500PE, and 51500PE options. Trading volume was highest in the 11000PE option, followed by the 10500PE and 11000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 11,042.00 | 0.848 | 0.835 | 1.061 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 68,83,920 | 67,01,040 | 1,82,880 |

| PUT: | 58,39,920 | 55,96,560 | 2,43,360 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 6,76,800 | 57,600 | 3,631 |

| 12,000 | 6,75,840 | 29,040 | 9,742 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,100 | 1,89,840 | 1,08,960 | 9,459 |

| 12,500 | 6,76,800 | 57,600 | 3,631 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,200 | 1,72,920 | -35,400 | 7,210 |

| 12,300 | 1,48,440 | -32,760 | 1,732 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 2,82,000 | -14,400 | 18,956 |

| 11,500 | 4,56,840 | -29,160 | 11,375 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 10,500 | 5,30,040 | 56,880 | 18,962 |

| 10,000 | 5,15,520 | 28,080 | 8,419 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 5,12,040 | 1,18,200 | 21,370 |

| 10,900 | 1,39,440 | 67,080 | 8,282 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 10,200 | 1,32,600 | -57,960 | 3,059 |

| 10,600 | 1,75,440 | -41,160 | 5,105 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 5,12,040 | 1,18,200 | 21,370 |

| 10,500 | 5,30,040 | 56,880 | 18,962 |

Conclusion: Relief Rally or RBI-Driven Optimism?

While today’s bounce back may appear strong, the continued drop in futures OI and volume suggests the rally is still dominated by short covering. However, the shift in weekly Max Pain to 22,600 indicates a stabilizing sentiment around that level. With the RBI policy decision due tomorrow, market participants are anticipating a potential 25 bps rate cut—which could act as a short-term catalyst. Until then, traders should brace for volatility and remain cautious with aggressive trades.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]