Turning Complex Derivative Data into Clear Market Insights

Positive Turnaround | NIFTY Futures and Options Analysis Signals Short Covering Pressure | 11/04/2025

Table of Contents

Tariff War & Global Volatility Trigger Derivatives Short Covering

Despite persistent concerns from the ongoing U.S.–China tariff war and sustained global volatility, Indian equity markets staged a strong recovery, surprising many after recent weakness. Today’s NIFTY Futures and Options Analysis reflects a bullish undertone, with rising spot prices, improved put-call ratios, and strong put writing, especially near Max Pain levels. While foreign investors remained net sellers, aggressive domestic institutional buying offset the pressure and drove broader market strength.

NSE & BSE F&O Analysis

NIFTY April Future

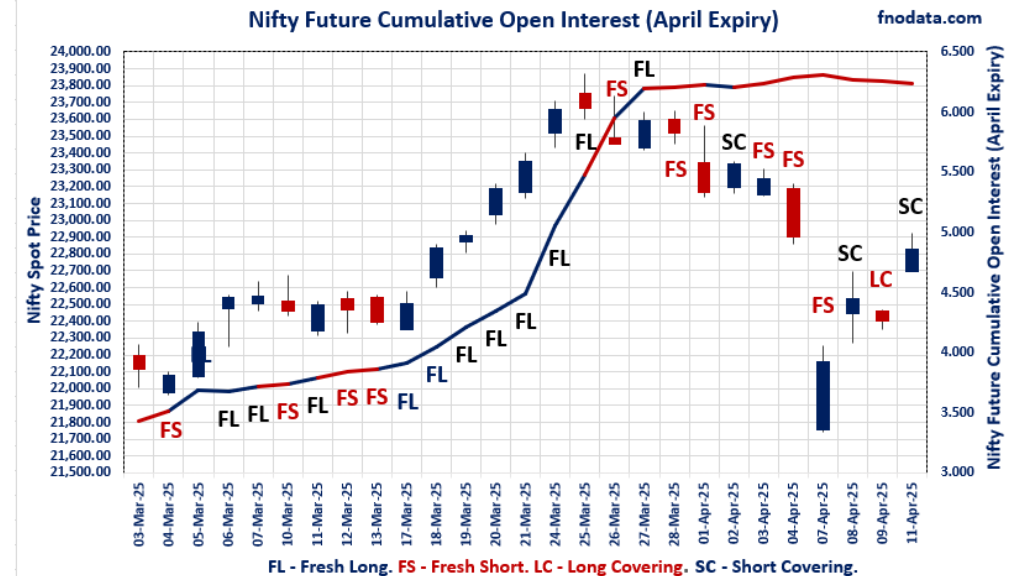

NIFTY Spot closed at: 22,828.55 (1.92%)

NIFTY April Future closed at: 22,917.65 (1.95%)

Premium: 89.1 (Increased by 8.6 points)

Open Interest Change: -1.9%

Volume Change: 33.2%

NIFTY Weekly Expiry (17/04/2025) Option Analysis

Put-Call Ratio (OI): 0.805 (Increased from 0.743)

Put-Call Ratio (Volume): 0.849

Max Pain Level: 22750

Maximum CALL OI: 25400

Maximum PUT OI: 20400

Highest CALL Addition: 24500

Highest PUT Addition: 20400

NIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 1.115 (Increased from 1.068)

Put-Call Ratio (Volume): 0.886

Max Pain Level: 23000

Maximum CALL OI: 23500

Maximum PUT OI: 21000

Highest CALL Addition: 22900

Highest PUT Addition: 22800

BANKNIFTY April Future

BANKNIFTY Spot closed at: 51,002.35 (1.52%)

BANKNIFTY April Future closed at: 51,162.05 (1.37%)

Premium: 159.7 (Decreased by -68.75 points)

Open Interest Change: 2.5%

Volume Change: -13.8%

BANKNIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 0.862 (Increased from 0.738)

Put-Call Ratio (Volume): 0.888

Max Pain Level: 51000

Maximum CALL OI: 59000

Maximum PUT OI: 50000

Highest CALL Addition: 51200

Highest PUT Addition: 51000

FINNIFTY April Future

FINNIFTY Spot closed at: 24,555.55 (1.75%)

FINNIFTY April Future closed at: 24,636.30 (1.65%)

Premium: 80.75 (Decreased by -22.8 points)

Open Interest Change: -3.8%

Volume Change: 27.3%

FINNIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 0.789 (Increased from 0.781)

Put-Call Ratio (Volume): 0.756

Max Pain Level: 24600

Maximum CALL OI: 25500

Maximum PUT OI: 24000

Highest CALL Addition: 26800

Highest PUT Addition: 24500

MIDCPNIFTY April Future

MIDCPNIFTY Spot closed at: 11,226.30 (1.86%)

MIDCPNIFTY April Future closed at: 11,243.45 (1.93%)

Premium: 17.15 (Increased by 8.1 points)

Open Interest Change: -1.0%

Volume Change: -9.5%

MIDCPNIFTY Monthly Expiry (24/04/2025) Option Analysis

Put-Call Ratio (OI): 0.892 (Increased from 0.851)

Put-Call Ratio (Volume): 0.903

Max Pain Level: 11225

Maximum CALL OI: 12000

Maximum PUT OI: 10500

Highest CALL Addition: 12000

Highest PUT Addition: 11200

SENSEX Weekly Future (15/04/2025)

SENSEX Spot closed at: 75,157.26 (1.77%)

SENSEX Weekly Future closed at: 75,210.35 (1.69%)

Premium: 53.09 (Decreased by -63.56 points)

Open Interest Change: -1.8%

Volume Change: 50.2%

SENSEX Weekly Expiry (15/04/2025) Option Analysis

Put-Call Ratio (OI): 0.886 (Increased from 0.871)

Put-Call Ratio (Volume): 1.001

Max Pain Level: 73900

Maximum CALL OI: 80000

Maximum PUT OI: 70000

Highest CALL Addition: 80000

Highest PUT Addition: 70000

FII & DII Cash Market Activity:

FIIs Net Sell: ₹2,519.03 Cr

DIIs Net Buy: ₹3,759.27 Cr

FII Derivatives Activity

| FII Trading Stats | 11.04.25 | 9.04.25 | 8.04.25 |

| FII Cash (Provisional Data) | -2,519.03 | -4,358.02 | -4,994.24 |

| Index Future Open Interest Long Ratio | 25.36% | 21.59% | 24.27% |

| Index Future Volume Long Ratio | 63.14% | 44.70% | 48.77% |

| Call Option Open Interest Long Ratio | 64.64% | 64.14% | 64.70% |

| Call Option Volume Long Ratio | 50.94% | 49.11% | 50.83% |

| Put Option Open Interest Long Ratio | 67.96% | 67.36% | 67.53% |

| Put Option Volume Long Ratio | 50.75% | 49.10% | 51.18% |

| Stock Future Open Interest Long Ratio | 64.11% | 63.55% | 63.77% |

| Stock Future Volume Long Ratio | 56.06% | 48.37% | 49.48% |

| Index Futures | Fresh Long | Long Covering | Long Covering |

| Index Options | Fresh Long | Long Covering | Fresh Long |

| Nifty Futures | Fresh Long | Long Covering | Long Covering |

| Nifty Options | Fresh Long | Long Covering | Fresh Long |

| BankNifty Futures | Fresh Long | Short Covering | Short Covering |

| BankNifty Options | Fresh Long | Fresh Long | Fresh Long |

| FinNifty Futures | Fresh Short | Fresh Long | Fresh Long |

| FinNifty Options | Short Covering | Fresh Long | Long Covering |

| MidcpNifty Futures | Fresh Long | Fresh Long | Fresh Long |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Fresh Long | Long Covering | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Fresh Long | Long Covering | Fresh Short |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

NSE & SENSEX F&O Analysis | Options Insights

NIFTY Weekly Expiry (17.04.2025)

The NIFTY index closed at 22828.55. The NIFTY weekly expiry for April 17, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.805 against previous 0.743. The 20400PE option holds the maximum open interest, followed by the 25400CE and 24500CE options. Market participants have shown increased interest with significant open interest additions in the 20400PE option, with open interest additions also seen in the 24500CE and 25000CE options. On the other hand, open interest reductions were prominent in the 22500CE, 20500PE, and 22400CE options. Trading volume was highest in the 22800PE option, followed by the 23000CE and 22800CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 17-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 22,828.55 | 0.805 | 0.743 | 0.849 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 11,77,01,400 | 8,59,78,425 | 3,17,22,975 |

| PUT: | 9,47,84,175 | 6,38,58,600 | 3,09,25,575 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 1,48,26,675 | 27,26,400 | 8,50,362 |

| 24,500 | 99,83,700 | 44,79,150 | 6,11,292 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 99,83,700 | 44,79,150 | 6,11,292 |

| 25,000 | 76,82,550 | 36,84,675 | 6,08,486 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 19,98,000 | -10,52,700 | 1,34,710 |

| 22,400 | 15,33,225 | -8,12,400 | 59,829 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 39,61,275 | 1,16,100 | 17,86,703 |

| 22,800 | 24,12,900 | 11,58,225 | 14,32,047 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 20,400 | 1,65,16,725 | 84,20,175 | 8,45,152 |

| 20,700 | 64,83,600 | 59,325 | 2,74,813 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 20,400 | 1,65,16,725 | 84,20,175 | 8,45,152 |

| 22,800 | 25,54,200 | 22,73,700 | 18,69,895 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 20,500 | 50,58,375 | -9,43,050 | 4,26,530 |

| 22,400 | 24,73,425 | -4,32,900 | 6,47,043 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 22,800 | 25,54,200 | 22,73,700 | 18,69,895 |

| 22,500 | 39,68,625 | 11,10,750 | 10,91,502 |

SENSEX Weekly Expiry (15.04.2025)

The SENSEX index closed at 75157.26. The SENSEX weekly expiry for April 15, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.886 against previous 0.871. The 80000CE option holds the maximum open interest, followed by the 79000CE and 70000PE options. Market participants have shown increased interest with significant open interest additions in the 70000PE option, with open interest additions also seen in the 80000CE and 79000CE options. On the other hand, open interest reductions were prominent in the 65600PE, 66000PE, and 74000CE options. Trading volume was highest in the 75000PE option, followed by the 77000CE and 76000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 15-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 75157.26 | 0.886 | 0.871 | 1.001 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,41,53,620 | 92,07,080 | 49,46,540 |

| PUT: | 1,25,38,360 | 80,15,609 | 45,22,751 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 11,67,440 | 5,13,400 | 66,35,920 |

| 79000 | 11,07,760 | 3,82,420 | 99,09,100 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 11,67,440 | 5,13,400 | 66,35,920 |

| 79000 | 11,07,760 | 3,82,420 | 99,09,100 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 74000 | 1,51,800 | -1,74,020 | 8,03,800 |

| 73900 | 65,780 | -1,07,540 | 2,82,740 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 77000 | 6,63,140 | 1,61,460 | 2,46,72,080 |

| 76000 | 5,20,540 | 90,560 | 2,45,96,320 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 70000 | 10,24,380 | 5,27,900 | 1,01,57,060 |

| 69000 | 7,02,260 | -30,840 | 64,49,120 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 70000 | 10,24,380 | 5,27,900 | 1,01,57,060 |

| 73000 | 5,39,400 | 3,50,040 | 1,77,98,200 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 65600 | 3,36,580 | -3,95,420 | 43,38,820 |

| 66000 | 2,62,920 | -2,73,140 | 34,23,160 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 3,73,520 | 3,40,440 | 2,64,34,040 |

| 74000 | 3,36,240 | 56,060 | 1,97,11,700 |

NIFTY Monthly Expiry (24.04.2025)

The NIFTY index closed at 22828.55. The NIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.115 against previous 1.068. The 23500CE option holds the maximum open interest, followed by the 21000PE and 24000CE options. Market participants have shown increased interest with significant open interest additions in the 22800PE option, with open interest additions also seen in the 22900PE and 23000PE options. On the other hand, open interest reductions were prominent in the 23000CE, 22500CE, and 24500CE options. Trading volume was highest in the 23000CE option, followed by the 23500CE and 24000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 22,828.55 | 1.115 | 1.068 | 0.886 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,94,07,600 | 5,02,72,350 | -8,64,750 |

| PUT: | 5,50,71,600 | 5,36,68,875 | 14,02,725 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 49,26,225 | 3,17,025 | 1,57,997 |

| 24,000 | 40,04,175 | 1,99,425 | 1,37,637 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,900 | 9,04,650 | 3,18,450 | 57,712 |

| 23,500 | 49,26,225 | 3,17,025 | 1,57,997 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 30,65,700 | -11,42,250 | 1,83,416 |

| 22,500 | 23,46,900 | -6,04,500 | 45,282 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 30,65,700 | -11,42,250 | 1,83,416 |

| 23,500 | 49,26,225 | 3,17,025 | 1,57,997 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 21,000 | 47,63,100 | 99,600 | 93,537 |

| 23,500 | 38,90,475 | 62,475 | 29,420 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,800 | 10,92,900 | 4,86,750 | 92,931 |

| 22,900 | 7,89,750 | 4,53,975 | 59,269 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 37,45,425 | -2,38,650 | 1,26,680 |

| 20,500 | 33,22,050 | -1,78,050 | 59,262 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 37,45,425 | -2,38,650 | 1,26,680 |

| 22,500 | 38,63,400 | -1,30,875 | 1,22,755 |

BANKNIFTY Monthly Expiry (24.04.2025)

The BANKNIFTY index closed at 51002.35. The BANKNIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.862 against previous 0.738. The 59000CE option holds the maximum open interest, followed by the 53000CE and 54000CE options. Market participants have shown increased interest with significant open interest additions in the 51000PE option, with open interest additions also seen in the 45000PE and 40500PE options. On the other hand, open interest reductions were prominent in the 52000CE, 50500CE, and 54500CE options. Trading volume was highest in the 51000CE option, followed by the 51000PE and 52000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 51,002.35 | 0.862 | 0.738 | 0.888 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,13,48,510 | 2,40,62,340 | -27,13,830 |

| PUT: | 1,84,03,470 | 1,77,49,179 | 6,54,291 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 20,72,280 | -1,83,930 | 1,09,100 |

| 53,000 | 14,26,290 | -1,79,310 | 1,55,696 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 51,200 | 2,25,960 | 88,560 | 1,07,243 |

| 51,100 | 2,20,350 | 78,030 | 1,02,039 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 11,91,210 | -3,63,810 | 2,05,194 |

| 50,500 | 4,81,170 | -2,17,320 | 54,584 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 8,91,540 | -1,63,890 | 2,97,468 |

| 52,000 | 11,91,210 | -3,63,810 | 2,05,194 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 11,35,530 | -2,580 | 1,66,013 |

| 49,000 | 8,89,200 | 76,290 | 1,30,060 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 8,56,950 | 2,12,790 | 2,70,837 |

| 45,000 | 7,17,180 | 1,70,610 | 89,907 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 47,000 | 6,55,740 | -1,46,190 | 98,783 |

| 49,500 | 4,32,330 | -62,730 | 65,033 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 8,56,950 | 2,12,790 | 2,70,837 |

| 50,000 | 11,35,530 | -2,580 | 1,66,013 |

FINNIFTY Monthly Expiry (24.04.2025)

The FINNIFTY index closed at 24555.55. The FINNIFTY monthly expiry for April 24, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.789 against previous 0.781. The 25500CE option holds the maximum open interest, followed by the 28000CE and 24000PE options. Market participants have shown increased interest with significant open interest additions in the 24500PE option, with open interest additions also seen in the 26800CE and 25200CE options. On the other hand, open interest reductions were prominent in the 24200CE, 25500CE, and 25000CE options. Trading volume was highest in the 25000CE option, followed by the 25500CE and 26000CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,555.55 | 0.789 | 0.781 | 0.756 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 17,14,115 | 16,55,355 | 58,760 |

| PUT: | 13,52,455 | 12,92,980 | 59,475 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 2,16,970 | -26,325 | 5,642 |

| 28,000 | 1,62,695 | 20,865 | 2,106 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 31,005 | 25,285 | 916 |

| 25,200 | 47,970 | 25,155 | 1,223 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 28,015 | -31,135 | 1,379 |

| 25,500 | 2,16,970 | -26,325 | 5,642 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,21,485 | -10,140 | 6,500 |

| 25,500 | 2,16,970 | -26,325 | 5,642 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,37,475 | -4,550 | 3,882 |

| 22,500 | 1,19,730 | 2,925 | 1,270 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 79,495 | 35,230 | 5,406 |

| 22,000 | 80,470 | 15,405 | 2,841 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,800 | 33,735 | -9,880 | 814 |

| 23,000 | 49,270 | -9,750 | 2,705 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 79,495 | 35,230 | 5,406 |

| 24,000 | 1,37,475 | -4,550 | 3,882 |

MIDCPNIFTY Monthly Expiry (24.04.2025)

The MIDCPNIFTY index closed at 11226.3. The MIDCPNIFTY monthly expiry for April 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.892 against previous 0.851. The 12000CE option holds the maximum open interest, followed by the 10500PE and 12500CE options. Market participants have shown increased interest with significant open interest additions in the 11200PE option, with open interest additions also seen in the 12000CE and 11200CE options. On the other hand, open interest reductions were prominent in the 51500PE, 61700CE, and 61700CE options. Trading volume was highest in the 11200PE option, followed by the 11500CE and 11000PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 24-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 11,226.30 | 0.892 | 0.851 | 0.903 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 72,32,760 | 74,46,720 | -2,13,960 |

| PUT: | 64,50,600 | 63,38,160 | 1,12,440 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,85,400 | 83,520 | 15,557 |

| 12,500 | 5,45,280 | -90,120 | 5,852 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,85,400 | 83,520 | 15,557 |

| 11,200 | 2,73,240 | 73,680 | 17,527 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 2,94,720 | -1,52,640 | 4,757 |

| 11,100 | 1,73,040 | -1,13,400 | 4,939 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,500 | 4,78,560 | 2,760 | 18,576 |

| 11,200 | 2,73,240 | 73,680 | 17,527 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 10,500 | 6,07,440 | -28,320 | 13,710 |

| 11,000 | 5,32,920 | -1,44,240 | 17,563 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,200 | 4,03,080 | 2,35,800 | 18,852 |

| 10,700 | 1,91,160 | 45,600 | 5,038 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 5,32,920 | -1,44,240 | 17,563 |

| 9,500 | 1,78,920 | -55,320 | 3,344 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,200 | 4,03,080 | 2,35,800 | 18,852 |

| 11,000 | 5,32,920 | -1,44,240 | 17,563 |

Conclusion: Neutral Outlook Amid Global Trade Tensions and Domestic Market Signals

Despite recent volatility, the Indian equity markets exhibit a cautiously optimistic stance. The NIFTY April Futures closed at 22,917.65, marking a 1.95% increase, with a premium of 89.1 points. Open Interest decreased by 1.9%, while volume surged by 33.2%, indicating short-covering market sentiment.

In the options segment, significant put writing at the 22,800 strike in NIFTY monthly contracts suggests traders are establishing a support level around this mark. The maximum Put Open Interest at 21,000 further indicates that market participants do not anticipate the index falling below this level in the near term. Conversely, substantial Call Open Interest at 22,900 and 23,500 points to potential resistance levels, highlighting areas where upward momentum may face challenges.

Foreign Institutional Investors (FIIs) have initiated fresh long positions in index futures, reflecting renewed confidence in the market’s upward trajectory. This development, coupled with the observed options activity, underscores a neutral to slightly bullish outlook among institutional players.

In summary, while global trade uncertainties continue to pose risks, domestic market indicators and strategic international negotiations contribute to a neutral market outlook. Investors are advised to remain vigilant, monitor key support and resistance levels, and stay informed about ongoing trade developments that may impact market dynamics.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]