Turning Complex Derivative Data into Clear Market Insights

Early Warning Signs Spotted in Today’s Index Futures and Options Trend – April 25, 2025

Table of Contents

The trading session on April 25, 2025, brought some important twists in the Index Futures and Options Trend, as most frontline indices closed notably lower while their derivatives structure hinted at a bigger story brewing underneath. A sharp drop in spot prices across NIFTY, BANKNIFTY, FINNIFTY, MIDCPNIFTY, and SENSEX, paired with a visible cooling-off in premiums and Put-Call Ratios, indicates that bears are tightening their grip while bulls are cautiously retreating. The derivatives data shows a mix of long unwinding and fresh defensive positioning, signaling that the market may remain highly sensitive to upcoming events and expiry adjustments.

Index Derivatives Trend | NSE & BSE

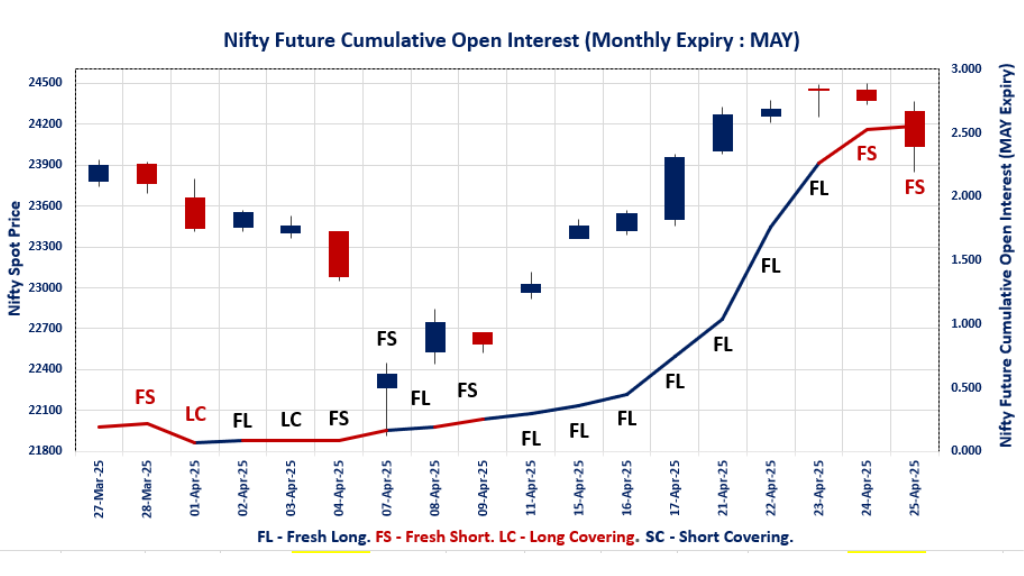

NIFTY MAY Future

NIFTY Spot closed at: 24,039.35 (-0.86%)

NIFTY MAY Future closed at: 24,139.10 (-0.96%)

Premium: 99.75 (Decreased by -26.55 points)

Open Interest Change: 2.0%

Volume Change: 120.5%

NIFTY Weekly Expiry (30/04/2025) Option Analysis

Put-Call Ratio (OI): 0.696 (Decreased from 0.814)

Put-Call Ratio (Volume): 0.943

Max Pain Level: 24100

Maximum CALL OI: 25000

Maximum PUT OI: 23500

Highest CALL Addition: 24500

Highest PUT Addition: 23500

NIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.433 (Decreased from 1.500)

Put-Call Ratio (Volume): 1.166

Max Pain Level: 24000

Maximum CALL OI: 24500

Maximum PUT OI: 24000

Highest CALL Addition: 26000

Highest PUT Addition: 24000

BANKNIFTY MAY Future

BANKNIFTY Spot closed at: 54,664.05 (-0.97%)

BANKNIFTY MAY Future closed at: 54,724.00 (-1.09%)

Premium: 59.95 (Decreased by -65.05 points)

Open Interest Change: -7.1%

Volume Change: 86.9%

BANKNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.996 (Decreased from 1.100)

Put-Call Ratio (Volume): 1.236

Max Pain Level: 54000

Maximum CALL OI: 63000

Maximum PUT OI: 53000

Highest CALL Addition: 63000

Highest PUT Addition: 53500

FINNIFTY MAY Future

FINNIFTY Spot closed at: 26,036.10 (-1.02%)

FINNIFTY MAY Future closed at: 26,074.90 (-1.11%)

Premium: 38.8 (Decreased by -24.45 points)

Open Interest Change: -0.8%

Volume Change: 5.5%

FINNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.893 (Decreased from 0.985)

Put-Call Ratio (Volume): 0.945

Max Pain Level: 26050

Maximum CALL OI: 29500

Maximum PUT OI: 26000

Highest CALL Addition: 29500

Highest PUT Addition: 26000

MIDCPNIFTY MAY Future

MIDCPNIFTY Spot closed at: 11,971.40 (-2.22%)

MIDCPNIFTY MAY Future closed at: 11,964.25 (-2.48%)

Discount: -7.15 (Decreased by -32.2 points)

Open Interest Change: 6.0%

Volume Change: 76.9%

MIDCPNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.965 (Increased from 0.937)

Put-Call Ratio (Volume): 1.012

Max Pain Level: 12000

Maximum CALL OI: 13000

Maximum PUT OI: 11000

Highest CALL Addition: 12000

Highest PUT Addition: 12000

SENSEX Weekly Expiry (29.04.25) Future

SENSEX Spot closed at: 79,212.53 (-0.74%)

SENSEX Weekly Future closed at: 79,116.10 (-0.89%)

Discount: -96.43 (Decreased by -124.25 points)

Open Interest Change: 26.1%

Volume Change: 285.7%

SENSEX Weekly Expiry (29/04/2025) Option Analysis

Put-Call Ratio (OI): 0.602 (Decreased from 0.676)

Put-Call Ratio (Volume): 0.939

Max Pain Level: 79200

Maximum CALL OI: 83000

Maximum PUT OI: 75000

Highest CALL Addition: 81000

Highest PUT Addition: 69000

FII & DII Cash Market Activity

FIIs Net Buy: ₹ 2,952.33 Cr

DIIs Net Buy: ₹ 3,539.85 Cr

FII Derivatives Activity

| FII Trading Stats | 25.04.25 | 24.04.25 | 23.04.25 |

| FII Cash (Provisional Data) | 2,952.33 | 8,250.53 | 3,332.93 |

| Index Future Open Interest Long Ratio | 37.63% | 40.86% | 33.04% |

| Index Future Volume Long Ratio | 44.34% | 53.13% | 53.10% |

| Call Option Open Interest Long Ratio | 51.89% | 66.97% | 53.67% |

| Call Option Volume Long Ratio | 48.72% | 49.88% | 49.95% |

| Put Option Open Interest Long Ratio | 50.31% | 63.08% | 52.32% |

| Put Option Volume Long Ratio | 48.87% | 50.03% | 49.77% |

| Stock Future Open Interest Long Ratio | 64.13% | 64.17% | 64.92% |

| Stock Future Volume Long Ratio | 50.87% | 51.52% | 51.04% |

| Index Futures | Fresh Short | Short Covering | Short Covering |

| Index Options | Fresh Short | Long Covering | Fresh Short |

| Nifty Futures | Fresh Short | Short Covering | Short Covering |

| Nifty Options | Fresh Short | Long Covering | Fresh Long |

| BankNifty Futures | Fresh Short | Short Covering | Short Covering |

| BankNifty Options | Fresh Short | Short Covering | Fresh Short |

| FinNifty Futures | Long Covering | Long Covering | Fresh Long |

| FinNifty Options | Fresh Long | Long Covering | Fresh Short |

| MidcpNifty Futures | Fresh Short | Long Covering | Short Covering |

| MidcpNifty Options | Fresh Short | Long Covering | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Fresh Long | Fresh Long |

| NiftyNxt50 Options | Fresh Short | Long Covering | Short Covering |

| Stock Futures | Short Covering | Short Covering | Fresh Long |

| Stock Options | Fresh Short | Long Covering | Fresh Short |

NSE & BSE Options Analysis | Options Insights

NIFTY Weekly Expiry (30.04.2025)

The NIFTY index closed at 24039.35. The NIFTY weekly expiry for April 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.696 against previous 0.814. The 25000CE option holds the maximum open interest, followed by the 24500CE and 26100CE options. Market participants have shown increased interest with significant open interest additions in the 24500CE option, with open interest additions also seen in the 25000CE and 26100CE options. On the other hand, open interest reductions were prominent in the 24200PE, 24300PE, and 24500PE options. Trading volume was highest in the 24000PE option, followed by the 24300CE and 24500CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 30-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,039.35 | 0.696 | 0.814 | 0.943 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 14,48,13,750 | 7,51,96,800 | 6,96,16,950 |

| PUT: | 10,07,37,225 | 6,12,28,275 | 3,95,08,950 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,04,52,750 | 46,01,175 | 12,02,507 |

| 24,500 | 88,00,050 | 49,88,625 | 23,32,685 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 88,00,050 | 49,88,625 | 23,32,685 |

| 25,000 | 1,04,52,750 | 46,01,175 | 12,02,507 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,300 | 1,43,175 | -34,950 | 5,199 |

| 25,700 | 23,07,075 | -12,450 | 3,17,640 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 68,60,475 | 36,77,925 | 26,01,407 |

| 24,500 | 88,00,050 | 49,88,625 | 23,32,685 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 67,08,525 | 29,65,950 | 16,47,893 |

| 23,000 | 63,57,450 | 23,04,450 | 9,65,862 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 67,08,525 | 29,65,950 | 16,47,893 |

| 23,000 | 63,57,450 | 23,04,450 | 9,65,862 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 22,31,700 | -8,99,625 | 12,63,234 |

| 24,300 | 18,89,625 | -7,06,125 | 10,68,643 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 57,25,725 | 14,08,050 | 32,99,988 |

| 23,900 | 36,52,200 | 19,94,400 | 21,14,181 |

SENSEX Weekly Expiry (29.04.2025)

The SENSEX index closed at 79212.53. The SENSEX weekly expiry for April 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.602 against previous 0.676. The 83000CE option holds the maximum open interest, followed by the 82000CE and 81000CE options. Market participants have shown increased interest with significant open interest additions in the 81000CE option, with open interest additions also seen in the 83000CE and 81500CE options. On the other hand, open interest reductions were prominent in the 80000PE, 79800PE, and 79900PE options. Trading volume was highest in the 80000CE option, followed by the 81000CE and 79000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 29-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 79212.53 | 0.602 | 0.676 | 0.939 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,72,04,000 | 92,46,589 | 79,57,411 |

| PUT: | 1,03,63,480 | 62,52,980 | 41,10,500 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 12,03,560 | 4,32,860 | 90,66,320 |

| 82000 | 9,60,680 | 2,94,400 | 1,55,37,640 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 9,00,060 | 5,57,820 | 2,46,03,540 |

| 83000 | 12,03,560 | 4,32,860 | 90,66,320 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83800 | 36,700 | -23,140 | 7,60,440 |

| 83400 | 39,480 | -22,620 | 11,90,340 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 7,05,060 | 3,06,380 | 3,13,04,320 |

| 81000 | 9,00,060 | 5,57,820 | 2,46,03,540 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 6,30,800 | 1,68,760 | 85,95,460 |

| 74000 | 5,50,300 | 2,12,140 | 52,35,700 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 69000 | 3,49,160 | 2,55,720 | 23,73,040 |

| 78000 | 4,61,320 | 2,40,440 | 2,04,54,240 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 1,86,120 | -1,38,420 | 72,49,240 |

| 79800 | 57,220 | -86,600 | 48,55,920 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 3,43,100 | 1,37,740 | 2,45,58,960 |

| 78000 | 4,61,320 | 2,40,440 | 2,04,54,240 |

NIFTY Monthly Expiry (29.05.2025)

The NIFTY index closed at 24039.35. The NIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.433 against previous 1.500. The 24000PE option holds the maximum open interest, followed by the 24500CE and 23000PE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 24000CE and 24000PE options. On the other hand, open interest reductions were prominent in the 25900CE, 25000CE, and 24500PE options. Trading volume was highest in the 24000PE option, followed by the 25000CE and 24500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,039.35 | 1.433 | 1.500 | 1.166 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,71,16,175 | 2,36,29,500 | 34,86,675 |

| PUT: | 3,88,67,250 | 3,54,33,675 | 34,33,575 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 33,95,475 | 1,54,875 | 74,359 |

| 24,000 | 32,51,325 | 4,93,650 | 62,607 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 10,07,550 | 6,02,175 | 34,141 |

| 24,000 | 32,51,325 | 4,93,650 | 62,607 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 5,16,675 | -1,38,450 | 14,342 |

| 25,000 | 21,16,050 | -83,100 | 83,749 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 21,16,050 | -83,100 | 83,749 |

| 24,500 | 33,95,475 | 1,54,875 | 74,359 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 42,21,825 | 4,55,175 | 1,06,397 |

| 23,000 | 33,85,875 | 2,01,300 | 70,447 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 42,21,825 | 4,55,175 | 1,06,397 |

| 22,500 | 26,19,075 | 4,10,850 | 48,836 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 13,92,225 | -80,175 | 39,423 |

| 20,400 | 1,86,900 | -71,550 | 6,604 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 42,21,825 | 4,55,175 | 1,06,397 |

| 23,000 | 33,85,875 | 2,01,300 | 70,447 |

BANKNIFTY Monthly Expiry (29.05.2025)

The BANKNIFTY index closed at 54664.05. The BANKNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.996 against previous 1.100. The 53000PE option holds the maximum open interest, followed by the 63000CE and 52000PE options. Market participants have shown increased interest with significant open interest additions in the 63000CE option, with open interest additions also seen in the 53500PE and 53500CE options. On the other hand, open interest reductions were prominent in the 53000CE, 53000PE, and 55500PE options. Trading volume was highest in the 55000PE option, followed by the 54000PE and 54500PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,664.05 | 0.996 | 1.100 | 1.236 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,45,74,240 | 1,07,28,360 | 38,45,880 |

| PUT: | 1,45,20,690 | 1,18,03,299 | 27,17,391 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 11,59,800 | 7,38,360 | 1,19,762 |

| 53,000 | 9,93,540 | -3,00,750 | 25,721 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 11,59,800 | 7,38,360 | 1,19,762 |

| 53,500 | 5,99,430 | 4,41,120 | 22,700 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 9,93,540 | -3,00,750 | 25,721 |

| 54,000 | 3,45,330 | -25,620 | 25,816 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 7,82,250 | 1,43,430 | 1,60,313 |

| 60,000 | 9,81,180 | 3,60,420 | 1,27,625 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 15,34,680 | -1,97,460 | 1,80,527 |

| 52,000 | 10,12,020 | 2,79,900 | 1,25,247 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 53,500 | 8,24,310 | 4,83,000 | 95,782 |

| 52,000 | 10,12,020 | 2,79,900 | 1,25,247 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 15,34,680 | -1,97,460 | 1,80,527 |

| 55,500 | 6,78,180 | -75,930 | 48,828 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 7,16,430 | -38,820 | 2,04,197 |

| 54,000 | 9,03,540 | -2,760 | 1,96,759 |

Conclusion: Today’s Index Futures and Options Trend | Early Warning Signs

Today’s Index Futures and Options Trend paints a cautious to bearish picture across sectors. Significant premium erosion, coupled with falling Put-Call Ratios and volume-OI divergence, suggests that traders are preparing for more downside or highly volatile sideways action. Fresh Short built-up witnessed in NIFTY, SENSEX & MIDCPNIFTY Futures whereas Long Unwinding witnessed in BANKNIFTY & FINNIFTY Futures underlines risk aversion in broader markets. NIFTY Max Pain levels at 24,000 – 24,100 zones in Monthly & Weekly contracts suggesting potential resistances. PUT open interest addition at 23,500 suggesting support for the Weekly expiry. For the next few sessions, max pain levels around NIFTY 24,000 – 24,100 and BANKNIFTY 54,000 will act as critical pivot points. FII fresh shorts in both NIFTY & BANKNIFTY suggesting Smart Money Positioning before the Storm. Traders should remain alert for sudden swings.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]