Turning Complex Derivative Data into Clear Market Insights

Is Confidence Back? Derivatives Market Trend Analysis – April 28, 2025

Explore the explosive derivatives market trend analysis for April 28, 2025, with a detailed breakdown of NIFTY, BANKNIFTY, FINNIFTY, MIDCPNIFTY, and SENSEX futures and options data. Discover key trading insights, max pain levels, and future market expectations.

Table of Contents

The trading session on April 28, 2025, witnessed an explosive rebound across all major indices, with strong price action mirrored by significant changes in the Derivatives Market Trend Analysis. NIFTY, BANKNIFTY, FINNIFTY, MIDCPNIFTY, and SENSEX all surged sharply, backed by a positive shift in Put-Call Ratios (PCR) and widening premiums in futures contracts. While the surge looks promising, the mixed Open Interest (OI) movements and drop in volumes suggest that not all is smooth sailing ahead, as traders are showing caution at higher levels, especially ahead of crucial SENSEX & NIFTY weekly expiries.

Derivative Trends | NSE & BSE

NIFTY MAY Future

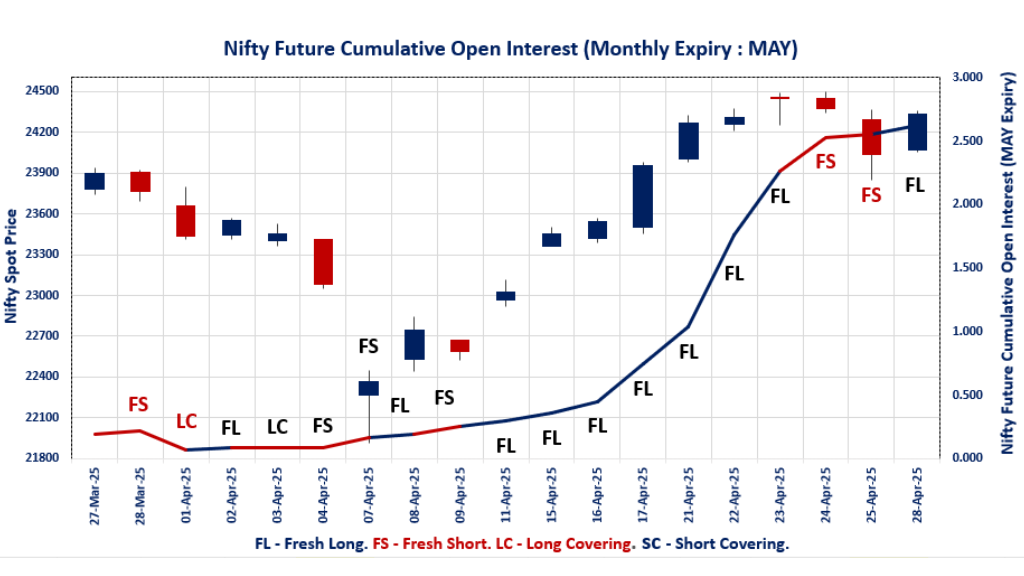

NIFTY Spot closed at: 24,328.50 (1.20%)

NIFTY MAY Future closed at: 24,452.80 (1.30%)

Premium: 124.3 (Increased by 24.55 points)

Open Interest Change: 7.6%

Volume Change: -38.0%

NIFTY Weekly Expiry (30/04/2025) Option Analysis

Put-Call Ratio (OI): 1.186 (Increased from 0.696)

Put-Call Ratio (Volume): 0.879

Max Pain Level: 24250

Maximum CALL OI: 25000

Maximum PUT OI: 24000

Highest CALL Addition: 24500

Highest PUT Addition: 24000

NIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.431 (Decreased from 1.433)

Put-Call Ratio (Volume): 1.222

Max Pain Level: 24000

Maximum CALL OI: 24500

Maximum PUT OI: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24500

BANKNIFTY MAY Future

BANKNIFTY Spot closed at: 55,432.80 (1.41%)

BANKNIFTY MAY Future closed at: 55,671.20 (1.73%)

Premium: 238.4 (Increased by 178.45 points)

Open Interest Change: 1.9%

Volume Change: -36.1%

BANKNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.991 (Decreased from 0.996)

Put-Call Ratio (Volume): 0.761

Max Pain Level: 54500

Maximum CALL OI: 63000

Maximum PUT OI: 53000

Highest CALL Addition: 63000

Highest PUT Addition: 55000

FINNIFTY MAY Future

FINNIFTY Spot closed at: 26,291.65 (0.98%)

FINNIFTY MAY Future closed at: 26,413.70 (1.30%)

Premium: 122.05 (Increased by 83.25 points)

Open Interest Change: 1.2%

Volume Change: -54.6%

FINNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.119 (Increased from 0.893)

Put-Call Ratio (Volume): 0.910

Max Pain Level: 26250

Maximum CALL OI: 29500

Maximum PUT OI: 26000

Highest CALL Addition: 26300

Highest PUT Addition: 26300

MIDCPNIFTY MAY Future

MIDCPNIFTY Spot closed at: 12,200.40 (1.91%)

MIDCPNIFTY MAY Future closed at: 12,244.65 (2.34%)

Premium: 44.25 (Increased by 51.4 points)

Open Interest Change: -0.2%

Volume Change: -60.2%

MIDCPNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.873 (Decreased from 0.965)

Put-Call Ratio (Volume): 0.710

Max Pain Level: 12100

Maximum CALL OI: 13000

Maximum PUT OI: 12000

Highest CALL Addition: 12200

Highest PUT Addition: 12200

SENSEX Weekly Expiry (29.04.25) Future

SENSEX Spot closed at: 80,218.37 (1.27%)

SENSEX Weekly Future closed at: 80,202.10 (1.37%)

Discount: -16.27 (Increased by 80.16 points)

Open Interest Change: 24.5%

Volume Change: -24.2%

SENSEX Weekly Expiry (29/04/2025) Option Analysis

Put-Call Ratio (OI): 1.071 (Increased from 0.601)

Put-Call Ratio (Volume): 0.838

Max Pain Level: 80000

Maximum CALL OI: 82000

Maximum PUT OI: 79000

Highest CALL Addition: 82000

Highest PUT Addition: 79000

FII & DII Cash Market Activity

FIIs Net Buy: ₹ 2,474.10 Cr

DIIs Net Buy: ₹ 2,817.64 Cr

FII Derivatives Activity

| FII Trading Stats | 28.04.25 | 25.04.25 | 24.04.25 |

| FII Cash (Provisional Data) | 2,474.10 | 2,952.33 | 8,250.53 |

| Index Future Open Interest Long Ratio | 42.33% | 37.63% | 40.86% |

| Index Future Volume Long Ratio | 64.44% | 44.34% | 53.13% |

| Call Option Open Interest Long Ratio | 52.16% | 51.89% | 66.97% |

| Call Option Volume Long Ratio | 50.07% | 48.72% | 49.88% |

| Put Option Open Interest Long Ratio | 48.73% | 50.31% | 63.08% |

| Put Option Volume Long Ratio | 49.70% | 48.87% | 50.03% |

| Stock Future Open Interest Long Ratio | 64.81% | 64.13% | 64.17% |

| Stock Future Volume Long Ratio | 56.14% | 50.87% | 51.52% |

| Index Futures | Fresh Long | Fresh Short | Short Covering |

| Index Options | Fresh Short | Fresh Short | Long Covering |

| Nifty Futures | Fresh Long | Fresh Short | Short Covering |

| Nifty Options | Fresh Short | Fresh Short | Long Covering |

| BankNifty Futures | Short Covering | Fresh Short | Short Covering |

| BankNifty Options | Fresh Short | Fresh Short | Short Covering |

| FinNifty Futures | Long Covering | Long Covering | Long Covering |

| FinNifty Options | Fresh Long | Fresh Long | Long Covering |

| MidcpNifty Futures | Fresh Long | Fresh Short | Long Covering |

| MidcpNifty Options | Fresh Short | Fresh Short | Long Covering |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Fresh Long |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Long Covering |

| Stock Futures | Fresh Long | Short Covering | Short Covering |

| Stock Options | Fresh Short | Fresh Short | Long Covering |

NSE & BSE Options Analysis | Options Insights

NIFTY Weekly Expiry (30.04.2025)

The NIFTY index closed at 24328.5. The NIFTY weekly expiry for April 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.186 against previous 0.696. The 24000PE option holds the maximum open interest, followed by the 25000CE and 24500CE options. Market participants have shown increased interest with significant open interest additions in the 24000PE option, with open interest additions also seen in the 24200PE and 24300PE options. On the other hand, open interest reductions were prominent in the 24200CE, 24000CE, and 24100CE options. Trading volume was highest in the 24300CE option, followed by the 24500CE and 24400CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 30-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,328.50 | 1.186 | 0.696 | 0.879 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 13,79,57,400 | 14,48,13,750 | -68,56,350 |

| PUT: | 16,35,63,900 | 10,07,37,225 | 6,28,26,675 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,17,10,575 | 12,57,825 | 10,40,585 |

| 24,500 | 1,03,47,750 | 15,47,700 | 31,32,021 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,03,47,750 | 15,47,700 | 31,32,021 |

| 26,100 | 98,34,450 | 13,39,650 | 6,60,677 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 33,28,275 | -16,50,900 | 24,46,259 |

| 24,000 | 22,65,375 | -13,58,550 | 4,70,007 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 61,48,650 | -7,11,825 | 38,03,548 |

| 24,500 | 1,03,47,750 | 15,47,700 | 31,32,021 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,22,80,950 | 65,55,225 | 22,42,584 |

| 23,000 | 76,88,700 | 13,31,250 | 5,74,155 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,22,80,950 | 65,55,225 | 22,42,584 |

| 24,200 | 76,39,875 | 54,08,175 | 27,26,637 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,650 | 7,80,825 | -1,09,575 | 2,53,101 |

| 23,400 | 20,17,275 | -95,550 | 3,80,531 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 66,05,475 | 47,15,850 | 27,47,584 |

| 24,200 | 76,39,875 | 54,08,175 | 27,26,637 |

SENSEX Weekly Expiry (29.04.2025)

The SENSEX index closed at 80,218.37. The SENSEX weekly expiry for April 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.071 against previous 0.601. The 82000CE option holds the maximum open interest, followed by the 81000CE and 83000CE options. Market participants have shown increased interest with significant open interest additions in the 79000PE option, with open interest additions also seen in the 80000PE and 79500PE options. On the other hand, open interest reductions were prominent in the 85000CE, 87600CE, and 83000CE options. Trading volume was highest in the 81000CE option, followed by the 80500CE and 80000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 29-04-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80,218.37 | 1.071 | 0.601 | 0.838 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,93,85,320 | 1,72,04,000 | 21,81,320 |

| PUT: | 2,07,68,060 | 1,03,44,869 | 1,04,23,191 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 15,60,100 | 5,99,420 | 1,76,46,720 |

| 81000 | 11,67,700 | 2,67,640 | 5,34,37,020 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 15,60,100 | 5,99,420 | 1,76,46,720 |

| 81200 | 5,40,060 | 3,51,640 | 1,61,52,940 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 4,79,900 | -2,04,400 | 25,65,300 |

| 87600 | 3,65,820 | -1,77,300 | 23,31,120 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 11,67,700 | 2,67,640 | 5,34,37,020 |

| 80500 | 6,70,140 | 1,62,380 | 5,00,07,780 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 10,18,040 | 6,74,940 | 3,14,14,200 |

| 74000 | 9,70,200 | 4,19,900 | 50,22,940 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 10,18,040 | 6,74,940 | 3,14,14,200 |

| 80000 | 8,03,120 | 6,17,000 | 3,84,36,040 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 72000 | 2,04,480 | -76,120 | 23,29,180 |

| 70000 | 1,42,660 | -47,760 | 11,39,800 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 8,03,120 | 6,17,000 | 3,84,36,040 |

| 79500 | 8,15,820 | 6,05,080 | 3,65,51,640 |

NIFTY Monthly Expiry (29.05.2025)

The NIFTY index closed at 24328.5. The NIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.431 against previous 1.433. The 24000PE option holds the maximum open interest, followed by the 23000PE and 24500CE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 25500CE and 24500PE options. On the other hand, open interest reductions were prominent in the 25900CE, 23700CE, and 25800CE options. Trading volume was highest in the 25000CE option, followed by the 24000PE and 23000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,328.50 | 1.431 | 1.433 | 1.222 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,95,63,200 | 2,71,16,175 | 24,47,025 |

| PUT: | 4,23,05,250 | 3,88,67,250 | 34,38,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 36,45,075 | 2,49,600 | 47,077 |

| 24,000 | 32,56,275 | 4,950 | 29,521 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 26,91,450 | 5,75,400 | 66,955 |

| 25,500 | 19,69,425 | 4,64,025 | 46,004 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 4,06,500 | -1,10,175 | 8,017 |

| 23,700 | 2,80,425 | -53,550 | 1,398 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 26,91,450 | 5,75,400 | 66,955 |

| 24,500 | 36,45,075 | 2,49,600 | 47,077 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 46,61,700 | 4,39,875 | 65,350 |

| 23,000 | 37,35,600 | 3,49,725 | 55,677 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 18,54,900 | 4,62,675 | 30,514 |

| 24,000 | 46,61,700 | 4,39,875 | 65,350 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,900 | 1,65,825 | -37,425 | 4,844 |

| 21,200 | 75,000 | -36,600 | 2,432 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 46,61,700 | 4,39,875 | 65,350 |

| 23,000 | 37,35,600 | 3,49,725 | 55,677 |

BANKNIFTY Monthly Expiry (29.05.2025)

The BANKNIFTY index closed at 55432.8. The BANKNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.991 against previous 0.996. The 53000PE option holds the maximum open interest, followed by the 63000CE and 60000CE options. Market participants have shown increased interest with significant open interest additions in the 63000CE option, with open interest additions also seen in the 55000PE and 55500PE options. On the other hand, open interest reductions were prominent in the 54500CE, 52000PE, and 53000CE options. Trading volume was highest in the 55000PE option, followed by the 55500CE and 56000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,432.80 | 0.991 | 0.996 | 0.761 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,62,10,230 | 1,45,74,129 | 16,36,101 |

| PUT: | 1,60,63,950 | 1,45,20,690 | 15,43,260 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 14,47,200 | 2,87,400 | 95,565 |

| 60,000 | 11,48,370 | 1,67,190 | 1,17,264 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 14,47,200 | 2,87,400 | 95,565 |

| 60,000 | 11,48,370 | 1,67,190 | 1,17,264 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 2,17,620 | -59,100 | 22,721 |

| 53,000 | 9,52,590 | -40,950 | 3,678 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 10,15,830 | 1,05,360 | 1,43,673 |

| 56,000 | 6,68,370 | -31,620 | 1,42,960 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 15,30,780 | -3,900 | 83,400 |

| 54,000 | 10,86,240 | 1,82,700 | 1,03,851 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 9,42,630 | 2,26,200 | 1,46,025 |

| 55,500 | 8,78,520 | 2,00,340 | 95,738 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 9,59,850 | -52,170 | 85,556 |

| 51,000 | 7,18,590 | -37,320 | 59,006 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 9,42,630 | 2,26,200 | 1,46,025 |

| 54,000 | 10,86,240 | 1,82,700 | 1,03,851 |

FINNIFTY Monthly Expiry (29.05.2025)

The FINNIFTY index closed at 26291.65. The FINNIFTY monthly expiry for MAY 29, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 1.119 against previous 0.893. The 26000PE option holds the maximum open interest, followed by the 25000PE and 29500CE options. Market participants have shown increased interest with significant open interest additions in the 26300PE option, with open interest additions also seen in the 25500PE and 26000PE options. On the other hand, open interest reductions were prominent in the 26000CE, 27000CE, and 26500CE options. Trading volume was highest in the 25000PE option, followed by the 26000PE and 26500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,291.65 | 1.119 | 0.893 | 0.910 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,06,480 | 4,53,505 | 52,975 |

| PUT: | 5,66,995 | 4,05,015 | 1,61,980 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 81,315 | 3,575 | 1,841 |

| 26,000 | 55,640 | -9,360 | 1,452 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 22,945 | 13,325 | 2,808 |

| 26,700 | 11,635 | 8,060 | 1,020 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 55,640 | -9,360 | 1,452 |

| 27,000 | 46,800 | -8,060 | 1,675 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 47,710 | -2,860 | 2,849 |

| 26,300 | 22,945 | 13,325 | 2,808 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,03,675 | 13,845 | 2,870 |

| 25,000 | 87,815 | 8,255 | 3,269 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 32,045 | 26,130 | 2,417 |

| 25,500 | 42,120 | 20,735 | 1,142 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 6,370 | -2,275 | 335 |

| 25,200 | 6,370 | -2,275 | 335 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 87,815 | 8,255 | 3,269 |

| 26,000 | 1,03,675 | 13,845 | 2,870 |

Conclusion: Key Lessons from Today’s Derivatives Market Trend Analysis

The Derivatives Market Trend Analysis for April 28, 2025, reveals an interesting bullish price movement fueled largely by short covering and selective long additions. While indices have recovered sharply, mixed OI and sharply falling volumes point towards a fragile rally. Traders need to be cautious as heavy CALL open interests at higher levels could lead to profit booking or resistance soon. Until fresh long build-up with volume confirmation occurs, expect volatility to remain high as expiry pressures start to dominate. NIFTY weekly expiry support zones at 24,250 – 24,000 with fresh PUT built-up in NIFTY monthly contracts suggesting underlying bullishness. Break below 24,000 should shift the momentum.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]