Turning Complex Derivative Data into Clear Market Insights

Derivatives Insights: NIFTY Options Data Signals Bearish Shift Due to Macro Uncertainty | April 30, 2025

Table of Contents

In today’s trading session on April 30, 2025, the spotlight was firmly on NIFTY Options Data, which displayed intriguing signs of Bearish repositioning . Despite a flat close in NIFTY and broader indices, options positioning revealed sharp activity around 24300–24500 levels, signaling a potential inflection zone. Rising PCRs in select indices and declining premiums in NIFTY Futures paint a mixed, but insightful, picture for derivative traders planning their next move.

Derivative Trends | NSE

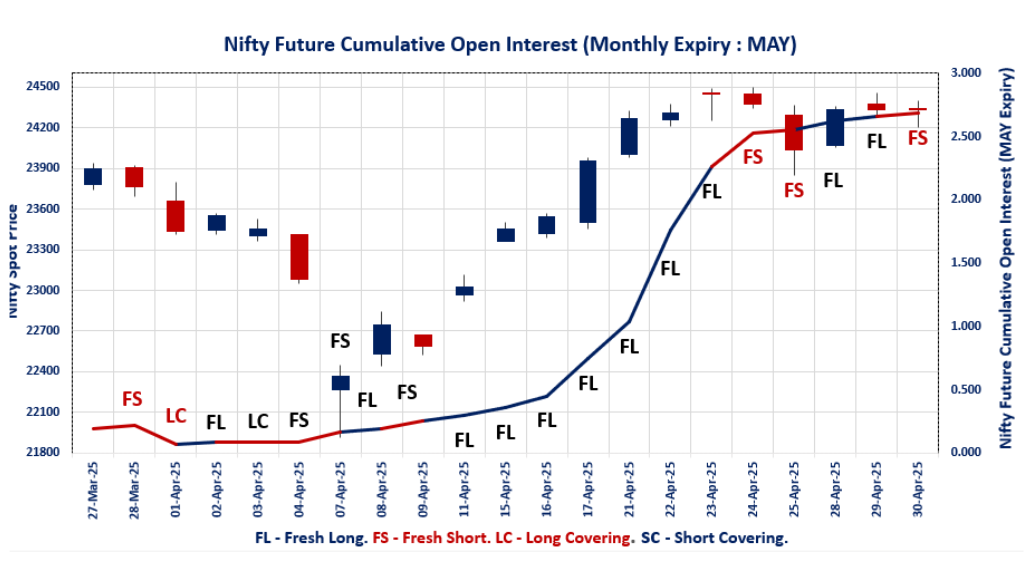

NIFTY MAY Future

NIFTY Spot closed at: 24,334.20 (-0.01%)

NIFTY MAY Future closed at: 24,418.40 (-0.03%)

Premium: 84.2 (Decreased by -5.15 points)

Open Interest Change: 2.1%

Volume Change: -12.2%

NIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.398 (Decreased from 1.407)

Put-Call Ratio (Volume): 1.285

Max Pain Level: 24000

Maximum CALL OI: 24500

Maximum PUT OI: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24000

BANKNIFTY MAY Future

BANKNIFTY Spot closed at: 55,087.15 (-0.55%)

BANKNIFTY MAY Future closed at: 55,241.80 (-0.48%)

Premium: 154.65 (Increased by 36.3 points)

Open Interest Change: -2.9%

Volume Change: -22.0%

BANKNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.903 (Decreased from 0.910)

Put-Call Ratio (Volume): 1.068

Max Pain Level: 54600

Maximum CALL OI: 63000

Maximum PUT OI: 53000

Highest CALL Addition: 63000

Highest PUT Addition: 47500

FINNIFTY MAY Future

FINNIFTY Spot closed at: 26,113.55 (-0.31%)

FINNIFTY MAY Future closed at: 26,197.00 (-0.20%)

Premium: 83.45 (Increased by 27.5 points)

Open Interest Change: 4.8%

Volume Change: -35.6%

FINNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.952 (Increased from 0.934)

Put-Call Ratio (Volume): 0.964

Max Pain Level: 26200

Maximum CALL OI: 29500

Maximum PUT OI: 26000

Highest CALL Addition: 29500

Highest PUT Addition: 26600

MIDCPNIFTY MAY Future

MIDCPNIFTY Spot closed at: 12,075.30 (-0.98%)

MIDCPNIFTY MAY Future closed at: 12,074.70 (-1.03%)

Discount: -0.6 (Decreased by -5.8 points)

Open Interest Change: -2.4%

Volume Change: 34.4%

MIDCPNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.994 (Increased from 0.834)

Put-Call Ratio (Volume): 0.964

Max Pain Level: 12150

Maximum CALL OI: 13000

Maximum PUT OI: 12000

Highest CALL Addition: 12100

Highest PUT Addition: 12000

FII & DII Cash Market Activity

FIIs Net Buy: ₹ 50.57 Cr

DIIs Net Buy: ₹ 1,792.15 Cr

FII Derivatives Activity

| FII Trading Stats | 30.04.25 | 29.04.25 | 28.04.25 |

| FII Cash (Provisional Data) | 50.57 | 2,385.61 | 2,474.10 |

| Index Future Open Interest Long Ratio | 46.88% | 44.30% | 42.33% |

| Index Future Volume Long Ratio | 60.39% | 56.54% | 64.44% |

| Call Option Open Interest Long Ratio | 62.90% | 49.36% | 52.16% |

| Call Option Volume Long Ratio | 50.32% | 49.53% | 50.07% |

| Put Option Open Interest Long Ratio | 55.17% | 48.43% | 48.73% |

| Put Option Volume Long Ratio | 50.19% | 49.94% | 49.70% |

| Stock Future Open Interest Long Ratio | 64.92% | 64.67% | 64.81% |

| Stock Future Volume Long Ratio | 53.01% | 49.68% | 56.14% |

| Index Futures | Fresh Long | Fresh Long | Fresh Long |

| Index Options | Short Covering | Fresh Short | Fresh Short |

| Nifty Futures | Fresh Long | Fresh Long | Fresh Long |

| Nifty Options | Short Covering | Fresh Short | Fresh Short |

| BankNifty Futures | Short Covering | Fresh Short | Short Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Short | Long Covering | Long Covering |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Long |

| MidcpNifty Futures | Short Covering | Fresh Short | Fresh Long |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Long Covering | Fresh Long | Short Covering |

| NiftyNxt50 Options | Long Covering | Fresh Long | Fresh Long |

| Stock Futures | Fresh Long | Fresh Short | Fresh Long |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

NSE Options Analysis | Options Insights

NIFTY Monthly Expiry (29.05.2025)

The NIFTY index closed at 24334.2. The NIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.398 against previous 1.407. The 24000PE option holds the maximum open interest, followed by the 23000PE and 24500CE options. Market participants have shown increased interest with significant open interest additions in the 24000PE option, with open interest additions also seen in the 25000CE and 25500CE options. On the other hand, open interest reductions were prominent in the 25400CE, 24250PE, and 24100CE options. Trading volume was highest in the 25000CE option, followed by the 24000PE and 23500PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,334.20 | 1.398 | 1.407 | 1.285 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,34,58,700 | 3,13,36,725 | 21,21,975 |

| PUT: | 4,67,75,250 | 4,40,82,375 | 26,92,875 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 39,88,275 | 10,125 | 39,575 |

| 25,000 | 34,96,650 | 4,80,975 | 47,927 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 34,96,650 | 4,80,975 | 47,927 |

| 25,500 | 25,19,550 | 3,66,750 | 26,407 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 5,86,200 | -30,450 | 6,189 |

| 24,100 | 6,81,750 | -23,325 | 1,714 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 34,96,650 | 4,80,975 | 47,927 |

| 24,500 | 39,88,275 | 10,125 | 39,575 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 53,55,900 | 4,89,825 | 46,187 |

| 23,000 | 43,14,150 | 2,54,400 | 39,277 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 53,55,900 | 4,89,825 | 46,187 |

| 23,500 | 35,47,350 | 3,23,400 | 42,981 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,250 | 1,04,100 | -27,600 | 1,875 |

| 22,800 | 4,37,100 | -19,500 | 4,411 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 53,55,900 | 4,89,825 | 46,187 |

| 23,500 | 35,47,350 | 3,23,400 | 42,981 |

BANKNIFTY Monthly Expiry (29.05.2025)

The BANKNIFTY index closed at 55087.15. The BANKNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.903 against previous 0.910. The 63000CE option holds the maximum open interest, followed by the 53000PE and 60000CE options. Market participants have shown increased interest with significant open interest additions in the 63000CE option, with open interest additions also seen in the 60000CE and 47500PE options. On the other hand, open interest reductions were prominent in the 55700CE, 54000PE, and 55600CE options. Trading volume was highest in the 55000PE option, followed by the 55200PE and 57000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,087.15 | 0.903 | 0.910 | 1.068 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,89,49,110 | 1,78,32,429 | 11,16,681 |

| PUT: | 1,71,17,370 | 1,62,22,230 | 8,95,140 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 22,19,850 | 4,04,760 | 73,555 |

| 60,000 | 13,27,290 | 2,08,530 | 71,792 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 22,19,850 | 4,04,760 | 73,555 |

| 60,000 | 13,27,290 | 2,08,530 | 71,792 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,700 | 1,48,200 | -58,890 | 22,101 |

| 55,600 | 1,64,460 | -53,730 | 33,327 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 8,62,560 | 53,430 | 1,05,663 |

| 55,500 | 10,53,990 | -35,880 | 92,982 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 16,31,310 | 39,660 | 89,357 |

| 54,000 | 11,13,420 | -56,460 | 83,434 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 47,500 | 2,37,420 | 1,29,060 | 15,414 |

| 51,000 | 8,02,710 | 78,060 | 45,348 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 11,13,420 | -56,460 | 83,434 |

| 55,600 | 72,810 | -36,360 | 16,556 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 9,17,970 | 18,360 | 1,45,582 |

| 55,200 | 1,66,380 | 14,100 | 1,09,672 |

FINNIFTY Monthly Expiry (29.05.2025)

The FINNIFTY index closed at 26113.55. The FINNIFTY monthly expiry for MAY 29, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.952 against previous 0.934. The 29500CE option holds the maximum open interest, followed by the 26000PE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 29500CE option, with open interest additions also seen in the 26600PE and 25000PE options. On the other hand, open interest reductions were prominent in the 27000CE, 26400CE, and 26250CE options. Trading volume was highest in the 26000PE option, followed by the 29500CE and 26200CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,113.55 | 0.952 | 0.934 | 0.964 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,91,730 | 5,79,215 | 1,12,515 |

| PUT: | 6,58,580 | 5,41,060 | 1,17,520 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 1,22,460 | 54,990 | 2,799 |

| 26,000 | 65,845 | 8,580 | 606 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 1,22,460 | 54,990 | 2,799 |

| 26,100 | 20,475 | 10,920 | 1,765 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 57,460 | -6,500 | 1,606 |

| 26,400 | 31,460 | -2,925 | 615 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 1,22,460 | 54,990 | 2,799 |

| 26,200 | 38,740 | 10,010 | 2,415 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,16,610 | 9,165 | 2,914 |

| 25,000 | 71,500 | 16,705 | 1,942 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 25,870 | 20,150 | 621 |

| 25,000 | 71,500 | 16,705 | 1,942 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,050 | 12,740 | -975 | 336 |

| 26,450 | 3,770 | -780 | 68 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,16,610 | 9,165 | 2,914 |

| 26,100 | 26,260 | 12,350 | 2,358 |

MIDCPNIFTY Monthly Expiry (29.05.2025)

The MIDCPNIFTY index closed at 12075.3. The MIDCPNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.994 against previous 0.834. The 12000PE option holds the maximum open interest, followed by the 13000CE and 11500PE options. Market participants have shown increased interest with significant open interest additions in the 12000PE option, with open interest additions also seen in the 12100CE and 11500PE options. On the other hand, open interest reductions were prominent in the 66000CE, 56800PE, and 56800CE options. Trading volume was highest in the 12200CE option, followed by the 12200PE and 12000PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,075.30 | 0.994 | 0.834 | 0.964 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 31,09,440 | 28,67,760 | 2,41,680 |

| PUT: | 30,90,480 | 23,92,200 | 6,98,280 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 3,68,040 | 12,120 | 5,566 |

| 12,800 | 2,74,080 | -27,720 | 7,235 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,100 | 1,90,680 | 1,20,000 | 7,073 |

| 13,500 | 2,34,840 | 64,080 | 1,807 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,300 | 1,58,280 | -43,920 | 5,408 |

| 13,200 | 1,41,600 | -29,640 | 3,193 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 2,02,080 | 19,680 | 11,634 |

| 12,800 | 2,74,080 | -27,720 | 7,235 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 4,73,160 | 1,80,240 | 10,881 |

| 11,500 | 3,45,000 | 78,960 | 6,547 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 4,73,160 | 1,80,240 | 10,881 |

| 11,500 | 3,45,000 | 78,960 | 6,547 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,225 | 19,680 | -3,840 | 1,183 |

| 12,300 | 1,31,400 | -3,120 | 1,597 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 2,03,400 | 41,640 | 11,302 |

| 12,000 | 4,73,160 | 1,80,240 | 10,881 |

Final Thoughts – Is the Market Setting Up for a Breakout or Breakdown?

The NSE Derivative Data for April 30, 2025, indicates a market in waiting. While spot prices are showing consolidation, derivatives data is signaling a buildup of bearish directional bets. Both Max-Pain level and high PUT Open Interest addition at 24,000 suggesting strong support for NIFTY. Maximum Open Interest at 24,500 CALL suggesting resistance. Suggested range in NIFTY within 24,500 – 24,000 levels. High CALL Open Interest addition in BANKNIFTY suggesting potential headwind with supports at 53,000 – 47,500 zones. PCR drop across the board suggesting either start of a consolidation phase or a bear pull-back.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]