Turning Complex Derivative Data into Clear Market Insights

NSE & BSE F&O Insights: Muted Momentum with a Side of Volatility | May 2, 2025

Table of Contents

On May 2, 2025, the NIFTY market delivered mixed signals with the spot closing slightly higher at 24,346.70 while the May Futures slipped marginally, narrowing the premium to just 54 points. Today’s NSE & BSE F&O Insights are particularly crucial as traders reposition ahead of the weekly expiry. The dramatic drop in the Put-Call Ratio (OI) to 0.695 indicates a bearish tone creeping into the options chain, with notable additions on the 24,000 PUT and 25,000 CALL strikes. Max Pain holding firm at 24,350 reinforces the critical support zone. Let’s dive deep into the derivatives data and decode what it really means for the broader trend.

Derivative Trends | NSE & BSE

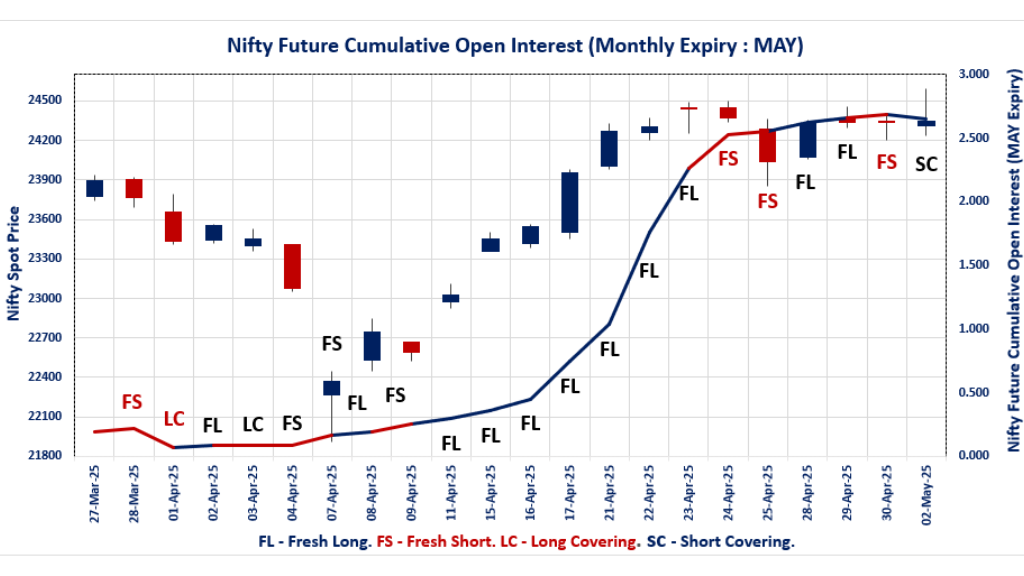

NIFTY MAY Future

NIFTY Spot closed at: 24,346.70 (0.05%)

NIFTY MAY Future closed at: 24,400.70 (-0.07%)

Premium: 54 (Decreased by -30.2 points)

Open Interest Change: -3.1%

Volume Change: 130.2%

NIFTY Weekly Expiry (8/05/2025) Option Analysis

Put-Call Ratio (OI): 0.695 (Decreased from 0.984)

Put-Call Ratio (Volume): 0.878

Max Pain Level: 24350

Maximum CALL OI: 26000

Maximum PUT OI: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24000

NIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.367 (Decreased from 1.398)

Put-Call Ratio (Volume): 1.087

Max Pain Level: 24000

Maximum CALL OI: 25000

Maximum PUT OI: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24000

BANKNIFTY MAY Future

BANKNIFTY Spot closed at: 55,115.35 (0.05%)

BANKNIFTY MAY Future closed at: 55,209.80 (-0.06%)

Premium: 94.45 (Decreased by -60.2 points)

Open Interest Change: -1.9%

Volume Change: 53.4%

BANKNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.903 (Decreased from 0.903)

Put-Call Ratio (Volume): 0.932

Max Pain Level: 54700

Maximum CALL OI: 63000

Maximum PUT OI: 53000

Highest CALL Addition: 60000

Highest PUT Addition: 53500

FINNIFTY MAY Future

FINNIFTY Spot closed at: 26,151.75 (0.15%)

FINNIFTY MAY Future closed at: 26,193.10 (-0.01%)

Premium: 41.35 (Decreased by -42.1 points)

Open Interest Change: -0.6%

Volume Change: 58.8%

FINNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.734 (Decreased from 0.952)

Put-Call Ratio (Volume): 0.510

Max Pain Level: 26200

Maximum CALL OI: 27000

Maximum PUT OI: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 24000

MIDCPNIFTY MAY Future

MIDCPNIFTY Spot closed at: 11,977.00 (-0.81%)

MIDCPNIFTY MAY Future closed at: 11,996.90 (-0.64%)

Premium: 19.9 (Increased by 20.5 points)

Open Interest Change: -0.8%

Volume Change: 37.0%

MIDCPNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.984 (Decreased from 0.994)

Put-Call Ratio (Volume): 0.956

Max Pain Level: 12100

Maximum CALL OI: 13000

Maximum PUT OI: 12000

Highest CALL Addition: 13500

Highest PUT Addition: 12000

SENSEX Weekly Expiry (6.05.25) Future

SENSEX Spot closed at: 80,501.99 (0.32%)

SENSEX Weekly Future closed at: 80,403.50 (0.19%)

Discount: -98.49 (Decreased by -107.45 points)

Open Interest Change: -14.0%

Volume Change: 114.0%

SENSEX Weekly Expiry (6/05/2025) Option Analysis

Put-Call Ratio (OI): 0.708 (Decreased from 0.809)

Put-Call Ratio (Volume): 0.867

Max Pain Level: 80500

Maximum CALL OI: 83000

Maximum PUT OI: 75000

Highest CALL Addition: 82000

Highest PUT Addition: 65600

FII & DII Cash Market Activity

FIIs Net Buy: ₹ 2,769.81 Cr

DIIs Net Buy: ₹ 3,290.49 Cr

FII Derivatives Activity

| FII Trading Stats | 2.04.25 | 30.04.25 | 29.04.25 |

| FII Cash (Provisional Data) | 2,769.81 | 50.57 | 2,385.61 |

| Index Future Open Interest Long Ratio | 47.37% | 46.88% | 44.30% |

| Index Future Volume Long Ratio | 51.33% | 60.39% | 56.54% |

| Call Option Open Interest Long Ratio | 53.21% | 62.90% | 49.36% |

| Call Option Volume Long Ratio | 49.09% | 50.32% | 49.53% |

| Put Option Open Interest Long Ratio | 51.65% | 55.17% | 48.43% |

| Put Option Volume Long Ratio | 49.65% | 50.19% | 49.94% |

| Stock Future Open Interest Long Ratio | 64.85% | 64.92% | 64.67% |

| Stock Future Volume Long Ratio | 49.93% | 53.01% | 49.68% |

| Index Futures | Fresh Long | Fresh Long | Fresh Long |

| Index Options | Fresh Short | Short Covering | Fresh Short |

| Nifty Futures | Fresh Long | Fresh Long | Fresh Long |

| Nifty Options | Fresh Short | Short Covering | Fresh Short |

| BankNifty Futures | Long Covering | Short Covering | Fresh Short |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Short | Fresh Short | Long Covering |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Futures | Short Covering | Short Covering | Fresh Short |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Long Covering | Long Covering | Fresh Long |

| NiftyNxt50 Options | Fresh Long | Long Covering | Fresh Long |

| Stock Futures | Fresh Long | Fresh Long | Fresh Short |

| Stock Options | Fresh Short | Fresh Long | Fresh Short |

NSE & BSE Options Analysis | Options Insights

NIFTY Weekly Expiry (8.05.2025)

The NIFTY index closed at 24346.7. The NIFTY weekly expiry for MAY 8, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.695 against previous 0.984. The 26000CE option holds the maximum open interest, followed by the 25000CE and 26100CE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 24500CE and 26000CE options. On the other hand, open interest reductions were prominent in the 22600PE, 22100PE, and 22800PE options. Trading volume was highest in the 24500CE option, followed by the 24300PE and 24600CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 08-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,346.70 | 0.695 | 0.984 | 0.878 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 13,69,75,800 | 7,03,28,475 | 6,66,47,325 |

| PUT: | 9,51,54,600 | 6,91,93,500 | 2,59,61,100 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,03,61,850 | 46,23,300 | 7,84,897 |

| 25,000 | 1,00,36,950 | 52,78,875 | 24,89,999 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,00,36,950 | 52,78,875 | 24,89,999 |

| 24,500 | 73,64,775 | 47,11,800 | 30,66,719 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 21,46,425 | -97,425 | 1,12,726 |

| 24,100 | 3,52,425 | -81,525 | 78,442 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 73,64,775 | 47,11,800 | 30,66,719 |

| 24,600 | 55,35,600 | 31,34,925 | 25,13,975 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 68,01,750 | 22,59,375 | 21,39,531 |

| 22,000 | 59,68,275 | 9,44,400 | 4,61,239 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 68,01,750 | 22,59,375 | 21,39,531 |

| 24,300 | 47,81,175 | 18,03,150 | 26,68,462 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,600 | 5,74,125 | -7,14,900 | 2,01,287 |

| 22,100 | 6,18,900 | -4,82,325 | 1,45,608 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 47,81,175 | 18,03,150 | 26,68,462 |

| 24,400 | 37,16,850 | 13,25,475 | 24,22,829 |

SENSEX Weekly Expiry (6.05.2025)

The SENSEX index closed at 80501.99. The SENSEX weekly expiry for May 6, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.708 against previous 0.809. The 83000CE option holds the maximum open interest, followed by the 84000CE and 82500CE options. Market participants have shown increased interest with significant open interest additions in the 82000CE option, with open interest additions also seen in the 83000CE and 85000CE options. On the other hand, open interest reductions were prominent in the 72000PE, 69000PE, and 79000CE options. Trading volume was highest in the 82000CE option, followed by the 81000CE and 80000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 06-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80501.99 | 0.708 | 0.809 | 0.867 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,58,90,560 | 75,88,429 | 83,02,131 |

| PUT: | 1,12,56,780 | 61,38,240 | 51,18,540 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 11,63,080 | 4,48,420 | 2,62,88,560 |

| 84000 | 9,59,460 | 3,79,600 | 98,48,760 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 9,11,100 | 5,42,140 | 3,62,69,700 |

| 83000 | 11,63,080 | 4,48,420 | 2,62,88,560 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 20,700 | -8,640 | 70,780 |

| 79500 | 32,120 | -5,400 | 1,87,840 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 9,11,100 | 5,42,140 | 3,62,69,700 |

| 81000 | 4,91,760 | 2,84,440 | 3,09,11,620 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 75000 | 9,31,760 | 3,00,000 | 75,26,280 |

| 78000 | 5,15,540 | 1,14,900 | 1,48,39,860 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 65600 | 4,59,520 | 3,02,480 | 20,42,880 |

| 73500 | 3,36,740 | 3,00,820 | 30,89,660 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 72000 | 1,61,460 | -1,20,680 | 25,51,560 |

| 69000 | 29,600 | -10,380 | 3,94,920 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 4,40,880 | 1,26,240 | 2,78,97,060 |

| 80500 | 2,86,720 | 1,40,480 | 2,46,63,640 |

NIFTY Monthly Expiry (29.05.2025)

The NIFTY index closed at 24346.7. The NIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.367 against previous 1.398. The 24000PE option holds the maximum open interest, followed by the 23000PE and 25000CE options. Market participants have shown increased interest with significant open interest additions in the 24000PE option, with open interest additions also seen in the 25000CE and 24600CE options. On the other hand, open interest reductions were prominent in the 23500PE, 25500CE, and 24000CE options. Trading volume was highest in the 25000CE option, followed by the 24000PE and 24500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,346.70 | 1.367 | 1.398 | 1.087 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,43,94,325 | 3,34,58,700 | 9,35,625 |

| PUT: | 4,70,21,400 | 4,67,75,250 | 2,46,150 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 40,43,625 | 5,46,975 | 1,11,387 |

| 24,500 | 39,71,775 | -16,500 | 90,456 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 40,43,625 | 5,46,975 | 1,11,387 |

| 24,600 | 6,04,875 | 2,30,550 | 28,215 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 23,31,075 | -1,88,475 | 73,305 |

| 24,000 | 30,51,000 | -1,65,525 | 21,113 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 40,43,625 | 5,46,975 | 1,11,387 |

| 24,500 | 39,71,775 | -16,500 | 90,456 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 59,14,200 | 5,58,300 | 1,01,736 |

| 23,000 | 43,06,875 | -7,275 | 58,155 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 59,14,200 | 5,58,300 | 1,01,736 |

| 24,100 | 8,52,075 | 90,300 | 20,103 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 33,56,025 | -1,91,325 | 62,964 |

| 24,200 | 11,10,450 | -1,43,775 | 30,246 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 59,14,200 | 5,58,300 | 1,01,736 |

| 24,500 | 24,47,550 | -63,825 | 82,813 |

BANKNIFTY Monthly Expiry (29.05.2025)

The BANKNIFTY index closed at 55115.35. The BANKNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.903 against previous 0.903. The 63000CE option holds the maximum open interest, followed by the 53000PE and 60000CE options. Market participants have shown increased interest with significant open interest additions in the 60000CE option, with open interest additions also seen in the 53500PE and 59500CE options. On the other hand, open interest reductions were prominent in the 57000CE, 62000CE, and 52500PE options. Trading volume was highest in the 55000PE option, followed by the 55500CE and 55500PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,115.35 | 0.903 | 0.903 | 0.932 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,94,23,200 | 1,89,46,119 | 4,77,081 |

| PUT: | 1,75,38,510 | 1,71,17,370 | 4,21,140 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 22,10,940 | -8,910 | 64,395 |

| 60,000 | 14,58,390 | 1,31,100 | 1,03,253 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 14,58,390 | 1,31,100 | 1,03,253 |

| 59,500 | 3,52,740 | 73,590 | 40,371 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 7,98,990 | -63,570 | 1,24,072 |

| 62,000 | 4,11,840 | -51,360 | 33,464 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 10,65,000 | 11,010 | 1,56,528 |

| 56,000 | 8,43,420 | 36,480 | 1,24,343 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 16,62,480 | 31,170 | 1,05,391 |

| 54,000 | 11,57,970 | 44,550 | 1,09,770 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 53,500 | 9,29,190 | 84,930 | 50,587 |

| 55,100 | 1,41,660 | 47,100 | 66,044 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 52,500 | 3,57,630 | -48,540 | 44,332 |

| 44,000 | 56,160 | -18,390 | 5,244 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 9,43,050 | 25,080 | 1,77,610 |

| 55,500 | 8,70,180 | 6,870 | 1,29,472 |

FINNIFTY Monthly Expiry (29.05.2025)

The FINNIFTY index closed at 26151.75. The FINNIFTY monthly expiry for MAY 29, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.734 against previous 0.952. The 27000CE option holds the maximum open interest, followed by the 29500CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 29500CE and 26300CE options. On the other hand, open interest reductions were prominent in the 25000PE, 26000CE, and 23000PE options. Trading volume was highest in the 27000CE option, followed by the 26500CE and 26300CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,151.75 | 0.734 | 0.952 | 0.510 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 9,54,005 | 6,91,730 | 2,62,275 |

| PUT: | 7,00,505 | 6,58,580 | 41,925 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,92,790 | 1,35,330 | 15,175 |

| 29,500 | 1,42,090 | 19,630 | 2,440 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,92,790 | 1,35,330 | 15,175 |

| 29,500 | 1,42,090 | 19,630 | 2,440 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 58,565 | -7,280 | 801 |

| 26,200 | 36,985 | -1,755 | 2,063 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,92,790 | 1,35,330 | 15,175 |

| 26,500 | 53,105 | 5,720 | 2,966 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,17,520 | 910 | 2,537 |

| 25,500 | 61,425 | 7,865 | 842 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 28,795 | 8,450 | 778 |

| 25,500 | 61,425 | 7,865 | 842 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 59,800 | -11,700 | 1,636 |

| 23,000 | 41,795 | -2,405 | 1,123 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,17,520 | 910 | 2,537 |

| 26,200 | 34,645 | 3,835 | 1,916 |

MIDCPNIFTY Monthly Expiry (29.05.2025)

The MIDCPNIFTY index closed at 11977. The MIDCPNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.984 against previous 0.994. The 12000PE option holds the maximum open interest, followed by the 13000CE and 11500PE options. Market participants have shown increased interest with significant open interest additions in the 12000PE option, with open interest additions also seen in the 13500CE and 13000CE options. On the other hand, open interest reductions were prominent in the 66000CE, 66000CE, and 64000CE options. Trading volume was highest in the 12000PE option, followed by the 12200CE and 12500CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 11,977.00 | 0.984 | 0.994 | 0.956 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 33,60,360 | 31,09,440 | 2,50,920 |

| PUT: | 33,06,120 | 30,90,480 | 2,15,640 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,31,520 | 63,480 | 8,998 |

| 13,500 | 3,01,920 | 67,080 | 2,963 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 3,01,920 | 67,080 | 2,963 |

| 13,000 | 4,31,520 | 63,480 | 8,998 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 2,57,640 | -16,440 | 7,611 |

| 12,300 | 1,44,840 | -13,440 | 5,090 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 1,93,680 | -8,400 | 11,015 |

| 12,500 | 2,35,200 | 20,040 | 10,343 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 5,44,680 | 71,520 | 20,801 |

| 11,500 | 3,61,680 | 16,680 | 8,467 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 5,44,680 | 71,520 | 20,801 |

| 11,000 | 3,40,680 | 38,400 | 6,689 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 1,47,960 | -55,440 | 7,358 |

| 12,300 | 1,05,360 | -26,040 | 1,535 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 5,44,680 | 71,520 | 20,801 |

| 11,500 | 3,61,680 | 16,680 | 8,467 |

Conclusion: Muted Momentum | Bulls are Losing Grip

Today’s NIFTY options insights paint a mixed-to-bearish picture ahead of the weekly expiry. Across indices, declining Put-Call Ratios, shrinking premiums, and unwinding open interest signal uncertainty and profit booking. While volumes are rising, indicating activity, the data leans more toward defensive positioning rather than bullish confidence. Rising volume in a range-bound market indicates distribution; traders should stay nimble, track Max Pain and Open Interest clusters closely, and consider risk-defined strategies amid rising caution. 24,000 in NIFTY should be considered absolute floor for this weekly expiry; any break of which should start panic selling.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]