Turning Complex Derivative Data into Clear Market Insights

What the Derivatives Data Reveals About NSE F&O Trends on 8 May 2025

Table of Contents

In NSE F&O Trends analysis for 8 May 2025, the derivatives landscape paints a cautious yet revealing picture of underlying market sentiment. Despite broader market weakness, particularly visible in the NIFTY and MIDCPNIFTY futures slipping into discount zones, option data shows an interesting tug-of-war between aggressive call writers and selective put additions. While volumes remained mixed, declining open interest across most indices suggests short unwinding and reduced conviction from bulls, even as some segments like FINNIFTY and BANKNIFTY saw localized buildup. This data-rich session offers key takeaways for traders tracking market direction via the lens of futures and options behavior.

NSE F&O Trends

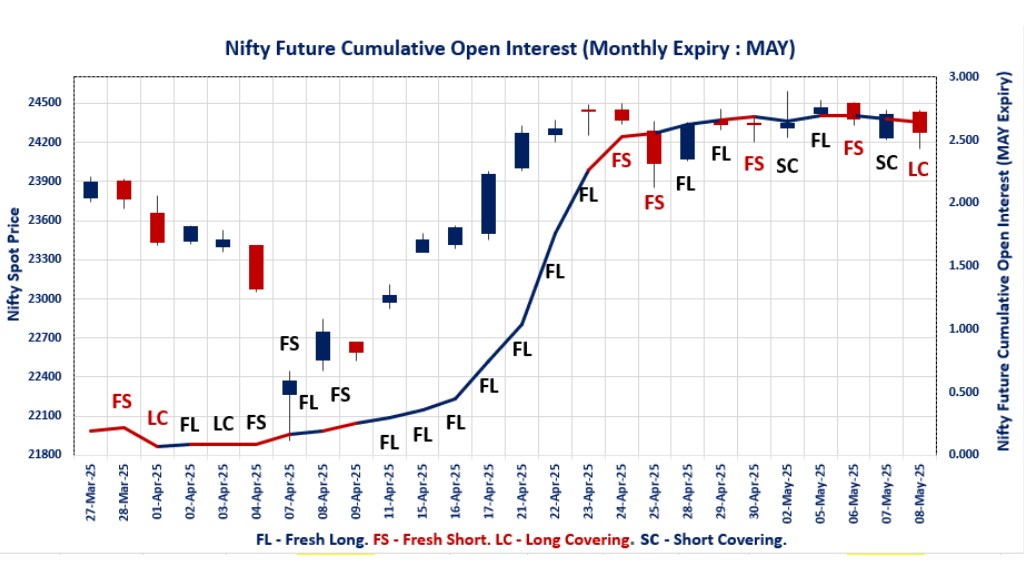

NIFTY MAY Future

NIFTY Spot closed at: 24,273.80 (-0.58%)

NIFTY MAY Future closed at: 24,271.90 (-0.77%)

Discount: -1.9 (Decreased by -48.9 points)

Open Interest Change: -2.9%

Volume Change: 13.7%

NIFTY Weekly Expiry (15/05/2025) Option Analysis

Put-Call Ratio (OI): 0.877 (Increased from 0.799)

Put-Call Ratio (Volume): 1.147

Max Pain Level: 24350

Maximum CALL OI: 26000

Maximum PUT OI: 22000

Highest CALL Addition: 26000

Highest PUT Addition: 22000

NIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.236 (Decreased from 1.343)

Put-Call Ratio (Volume): 1.373

Max Pain Level: 24200

Maximum CALL OI: 25000

Maximum PUT OI: 24000

Highest CALL Addition: 24800

Highest PUT Addition: 23000

BANKNIFTY MAY Future

BANKNIFTY Spot closed at: 54,365.65 (-0.45%)

BANKNIFTY MAY Future closed at: 54,288.60 (-0.70%)

Discount: -77.05 (Decreased by -137.15 points)

Open Interest Change: 0.5%

Volume Change: -10.1%

BANKNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.800 (Decreased from 0.831)

Put-Call Ratio (Volume): 0.973

Max Pain Level: 54500

Maximum CALL OI: 63000

Maximum PUT OI: 54000

Highest CALL Addition: 54000

Highest PUT Addition: 54000

FINNIFTY MAY Future

FINNIFTY Spot closed at: 25,980.65 (-0.71%)

FINNIFTY MAY Future closed at: 25,964.90 (-0.89%)

Discount: -15.75 (Decreased by -48.4 points)

Open Interest Change: -0.5%

Volume Change: 1.4%

FINNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.693 (Decreased from 0.761)

Put-Call Ratio (Volume): 1.126

Max Pain Level: 26200

Maximum CALL OI: 29500

Maximum PUT OI: 26000

Highest CALL Addition: 26200

Highest PUT Addition: 26200

MIDCPNIFTY MAY Future

MIDCPNIFTY Spot closed at: 11,983.40 (-1.92%)

MIDCPNIFTY MAY Future closed at: 11,980.35 (-2.20%)

Discount: -3.05 (Decreased by -35.2 points)

Open Interest Change: -3.5%

Volume Change: -8.3%

MIDCPNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.049 (Decreased from 1.085)

Put-Call Ratio (Volume): 1.107

Max Pain Level: 12100

Maximum CALL OI: 13000

Maximum PUT OI: 12000

Highest CALL Addition: 12300

Highest PUT Addition: 11000

FII & DII Cash Market Activity

FIIs Net Buy: ₹ 2,007.96 Cr

DIIs Net Sell: ₹ 596.25 Cr

FII Derivatives Activity

| FII Trading Stats | 8.05.25 | 7.05.25 | 6.05.25 |

| FII Cash (Provisional Data) | 2,007.96 | 2,585.86 | 3,794.52 |

| Index Future Open Interest Long Ratio | 52.17% | 50.14% | 49.23% |

| Index Future Volume Long Ratio | 55.11% | 53.70% | 53.88% |

| Call Option Open Interest Long Ratio | 64.38% | 50.98% | 51.28% |

| Call Option Volume Long Ratio | 50.82% | 49.95% | 50.42% |

| Put Option Open Interest Long Ratio | 61.19% | 49.56% | 50.18% |

| Put Option Volume Long Ratio | 50.88% | 49.89% | 50.81% |

| Stock Future Open Interest Long Ratio | 65.24% | 65.50% | 65.14% |

| Stock Future Volume Long Ratio | 48.84% | 53.36% | 49.65% |

| Index Futures | Fresh Long | Short Covering | Fresh Long |

| Index Options | Short Covering | Fresh Short | Fresh Long |

| Nifty Futures | Fresh Long | Long Covering | Fresh Long |

| Nifty Options | Short Covering | Fresh Short | Fresh Long |

| BankNifty Futures | Fresh Short | Fresh Long | Long Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Long |

| FinNifty Futures | Fresh Long | Fresh Short | Short Covering |

| FinNifty Options | Fresh Long | Fresh Long | Short Covering |

| MidcpNifty Futures | Long Covering | Fresh Long | Fresh Long |

| MidcpNifty Options | Fresh Short | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Long Covering |

| NiftyNxt50 Options | Long Covering | Fresh Long | Long Covering |

| Stock Futures | Long Covering | Fresh Long | Short Covering |

| Stock Options | Fresh Long | Fresh Long | Fresh Short |

NSE F&O Trends | Options Insights

NIFTY Weekly Expiry (15.05.2025)

The NIFTY index closed at 24273.8. The NIFTY weekly expiry for May 15, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.877 against previous 0.799. The 26000CE option holds the maximum open interest, followed by the 26200CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 22000PE and 26200CE options. On the other hand, open interest reductions were prominent in the 24500PE, 23550PE, and 23700PE options. Trading volume was highest in the 24400PE option, followed by the 24400CE and 24000PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 15-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,273.80 | 0.877 | 0.799 | 1.147 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,63,04,550 | 4,07,33,250 | 3,55,71,300 |

| PUT: | 6,68,85,075 | 3,25,40,025 | 3,43,45,050 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 76,78,425 | 39,76,200 | 2,55,818 |

| 26,200 | 55,85,775 | 31,80,750 | 1,92,963 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 76,78,425 | 39,76,200 | 2,55,818 |

| 26,200 | 55,85,775 | 31,80,750 | 1,92,963 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,650 | 5,39,775 | -6,075 | 42,306 |

| 25,750 | 5,45,925 | -5,250 | 43,088 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 34,10,175 | 16,02,600 | 3,69,519 |

| 25,000 | 46,14,375 | 26,17,650 | 3,10,406 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 44,51,775 | 32,86,050 | 2,84,418 |

| 20,650 | 41,74,125 | 28,92,900 | 1,44,613 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 44,51,775 | 32,86,050 | 2,84,418 |

| 20,650 | 41,74,125 | 28,92,900 | 1,44,613 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 14,37,750 | -5,38,200 | 1,78,465 |

| 23,550 | 3,49,875 | -2,87,325 | 31,354 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 26,44,725 | 2,94,825 | 4,07,252 |

| 24,000 | 39,26,475 | 17,03,250 | 3,37,922 |

NIFTY Monthly Expiry (29.05.2025)

The NIFTY index closed at 24273.8. The NIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.236 against previous 1.343. The 24000PE option holds the maximum open interest, followed by the 25000CE and 23000PE options. Market participants have shown increased interest with significant open interest additions in the 24800CE option, with open interest additions also seen in the 25000CE and 24900CE options. On the other hand, open interest reductions were prominent in the 22000PE, 26000CE, and 23500PE options. Trading volume was highest in the 24000PE option, followed by the 25000CE and 23000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,273.80 | 1.236 | 1.343 | 1.373 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,22,84,175 | 3,80,56,125 | 42,28,050 |

| PUT: | 5,22,44,850 | 5,10,91,275 | 11,53,575 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 49,45,125 | 8,42,175 | 75,369 |

| 24,500 | 46,19,025 | 3,04,650 | 69,667 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 21,16,875 | 13,72,950 | 50,038 |

| 25,000 | 49,45,125 | 8,42,175 | 75,369 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 22,02,075 | -2,29,725 | 37,212 |

| 26,100 | 10,03,350 | -1,11,675 | 9,483 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 49,45,125 | 8,42,175 | 75,369 |

| 24,500 | 46,19,025 | 3,04,650 | 69,667 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 69,52,350 | 68,175 | 84,465 |

| 23,000 | 46,20,450 | 3,92,775 | 71,953 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 46,20,450 | 3,92,775 | 71,953 |

| 23,100 | 5,48,325 | 3,63,825 | 12,285 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 29,95,275 | -2,56,125 | 49,524 |

| 23,500 | 33,97,875 | -2,27,025 | 53,994 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 69,52,350 | 68,175 | 84,465 |

| 23,000 | 46,20,450 | 3,92,775 | 71,953 |

BANKNIFTY Monthly Expiry (29.05.2025)

The BANKNIFTY index closed at 54365.65. The BANKNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.800 against previous 0.831. The 63000CE option holds the maximum open interest, followed by the 54000PE and 53000PE options. Market participants have shown increased interest with significant open interest additions in the 54000PE option, with open interest additions also seen in the 54000CE and 47000PE options. On the other hand, open interest reductions were prominent in the 53500PE, 53500CE, and 52000PE options. Trading volume was highest in the 55000CE option, followed by the 54000PE and 54500PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,365.65 | 0.800 | 0.831 | 0.973 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,27,37,270 | 2,22,14,379 | 5,22,891 |

| PUT: | 1,81,89,000 | 1,84,63,140 | -2,74,140 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 30,15,840 | 36,750 | 1,42,331 |

| 60,000 | 12,30,390 | -32,190 | 73,691 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 8,69,310 | 1,82,220 | 31,673 |

| 56,000 | 9,65,790 | 92,040 | 1,43,290 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,500 | 5,76,720 | -1,26,300 | 8,200 |

| 58,500 | 4,22,430 | -97,530 | 57,448 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 9,89,220 | -43,470 | 1,71,513 |

| 56,000 | 9,65,790 | 92,040 | 1,43,290 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 18,19,410 | 3,58,110 | 1,71,366 |

| 53,000 | 13,24,770 | -11,760 | 1,08,361 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 18,19,410 | 3,58,110 | 1,71,366 |

| 47,000 | 5,60,970 | 1,50,960 | 42,934 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,500 | 5,73,480 | -4,84,290 | 88,321 |

| 52,000 | 8,60,520 | -1,11,720 | 91,606 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 18,19,410 | 3,58,110 | 1,71,366 |

| 54,500 | 5,70,090 | -53,580 | 1,47,744 |

FINNIFTY Monthly Expiry (29.05.2025)

The FINNIFTY index closed at 25980.65. The FINNIFTY monthly expiry for MAY 29, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.693 against previous 0.761. The 29500CE option holds the maximum open interest, followed by the 27000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26200CE option, with open interest additions also seen in the 27500CE and 26000CE options. On the other hand, open interest reductions were prominent in the 23000PE, 25500PE, and 29000CE options. Trading volume was highest in the 26000PE option, followed by the 26200CE and 26200PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,980.65 | 0.693 | 0.761 | 1.126 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 11,45,040 | 10,25,700 | 1,19,340 |

| PUT: | 7,93,520 | 7,80,975 | 12,545 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 1,67,245 | 5,395 | 1,237 |

| 27,000 | 1,52,555 | 9,880 | 2,706 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 64,220 | 23,790 | 3,603 |

| 27,500 | 76,570 | 21,060 | 1,778 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 29,000 | 36,725 | -4,095 | 569 |

| 26,050 | 9,490 | -2,470 | 306 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 64,220 | 23,790 | 3,603 |

| 27,000 | 1,52,555 | 9,880 | 2,706 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,26,945 | -455 | 3,990 |

| 25,000 | 64,220 | 3,900 | 2,656 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 50,505 | 9,945 | 3,553 |

| 22,000 | 14,820 | 8,840 | 356 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 33,930 | -15,925 | 1,876 |

| 25,500 | 56,420 | -4,290 | 1,500 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,26,945 | -455 | 3,990 |

| 26,200 | 50,505 | 9,945 | 3,553 |

MIDCPNIFTY Monthly Expiry (29.05.2025)

The MIDCPNIFTY index closed at 11983.4. The MIDCPNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.049 against previous 1.085. The 12000PE option holds the maximum open interest, followed by the 11000PE and 11500PE options. Market participants have shown increased interest with significant open interest additions in the 11000PE option, with open interest additions also seen in the 10000PE and 10500PE options. On the other hand, open interest reductions were prominent in the 67000CE, 65500CE, and 65500PE options. Trading volume was highest in the 12000PE option, followed by the 12200PE and 12200CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 11,983.40 | 1.049 | 1.085 | 1.107 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 45,53,520 | 44,05,440 | 1,48,080 |

| PUT: | 47,78,400 | 47,79,240 | -840 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 3,93,480 | 12,600 | 9,761 |

| 13,500 | 3,43,080 | -30,840 | 3,773 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,300 | 2,54,520 | 49,920 | 14,100 |

| 12,400 | 1,22,400 | 35,040 | 6,391 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,800 | 1,93,560 | -54,360 | 1,583 |

| 13,500 | 3,43,080 | -30,840 | 3,773 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 3,14,640 | 33,480 | 16,597 |

| 12,300 | 2,54,520 | 49,920 | 14,100 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 5,63,520 | -1,30,440 | 24,703 |

| 11,000 | 5,13,120 | 1,53,600 | 8,823 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 5,13,120 | 1,53,600 | 8,823 |

| 10,000 | 2,81,520 | 1,15,680 | 4,549 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 5,63,520 | -1,30,440 | 24,703 |

| 11,500 | 4,29,960 | -1,05,840 | 11,529 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 5,63,520 | -1,30,440 | 24,703 |

| 12,200 | 2,15,520 | -75,720 | 16,898 |

Conclusion: What’s the Verdict from Today’s F&O Data?

The 8 May 2025 derivatives action reveals a market in recalibration mode. With NIFTY futures now at a discount and open interest falling, short unwinding seems to be the theme, signaling hesitation at higher levels. A similar tone in MIDCPNIFTY reinforces broader market caution. Meanwhile, FINNIFTY’s balanced OI with matched highest additions at 26200 could hint at a battleground level for upcoming sessions. On the options front, rising PCR (volume) vs declining PCR (OI) suggests intraday bullishness but positional uncertainty.

Last-Hour Selling Pushes Indices into Discount: Is a Deeper Pullback on the Cards

Yesterday’s last-hour selling pressure dragged all major indices—NIFTY, BANKNIFTY, and FINNIFTY futures—into discount territory, signaling some clear short-term nervousness. Interestingly, despite the Max Pain levels sticking around the 24,350–24,200 zone for both weekly and monthly NIFTY expiries, the options data is hinting at the potential for a deeper pullback, possibly towards the 23,000–22,000 range. The heavy CALL open interest at 24,800–25,000 levels is acting like a near-term ceiling, making it tough for the index to climb higher. And while the weekly Put-Call Ratio (PCR) ticked up from 0.799 to 0.877, the drop in monthly PCR from 1.343 to 1.236 leans more toward a bearish undertone.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.