Turning Complex Derivative Data into Clear Market Insights

Explosive Moves in NSE & BSE F&O Trends – Insights You Can’t Miss (15 May 2025)

Table of Contents

On 15th May 2025, the NSE & BSE F&O Trends showcased an explosive rally, but the underlying data reveals some cautious undercurrents. Despite a strong surge in spot prices, premiums shrank sharply and option chains suggest strategic hedging ahead of upcoming expiries. This NIFTY and BANKNIFTY futures analysis deciphers whether today’s bullishness signals a sustainable breakout or a trap in disguise. As we examine futures OI changes, option writing zones, and PCR shifts, the sentiment appears mixed—with clear signs of repositioning and guarded optimism.

NSE & BSE F&O Trends

NIFTY MAY Future

NIFTY MAY Future

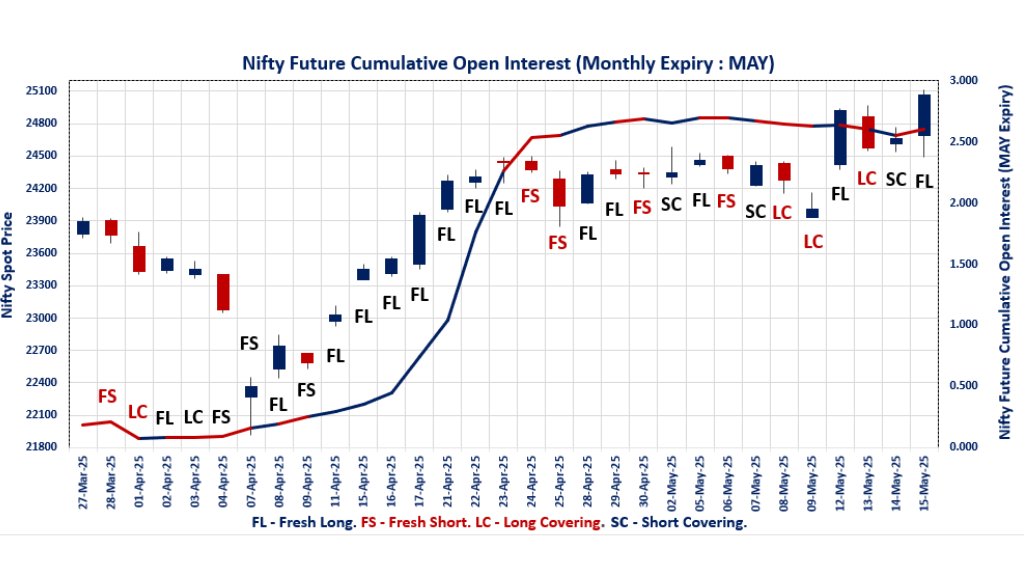

NIFTY Spot closed at: 25,062.10 (1.60%)

NIFTY MAY Future closed at: 25,078.70 (1.47%)

Premium: 16.6 (Decreased by -32.4 points)

Open Interest Change: 4.8%

Volume Change: 112.1%

NIFTY Weekly Expiry (22/05/2025) Option Analysis

Put-Call Ratio (OI): 0.996 (Increased from 0.745)

Put-Call Ratio (Volume): 0.867

Max Pain Level: 24900

Maximum CALL OI: 25100

Maximum PUT OI: 25050

Highest CALL Addition: 25100

Highest PUT Addition: 25050

NIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.251 (Increased from 1.171)

Put-Call Ratio (Volume): 0.965

Max Pain Level: 24500

Maximum CALL OI: 25000

Maximum PUT OI: 24000

Highest CALL Addition: 26500

Highest PUT Addition: 24500

BANKNIFTY MAY Future

BANKNIFTY Spot closed at: 55,355.60 (1.01%)

BANKNIFTY MAY Future closed at: 55,399.60 (0.89%)

Premium: 44 (Decreased by -64.7 points)

Open Interest Change: 2.9%

Volume Change: 36.9%

BANKNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.937 (Increased from 0.819)

Put-Call Ratio (Volume): 0.921

Max Pain Level: 55000

Maximum CALL OI: 63000

Maximum PUT OI: 55000

Highest CALL Addition: 55400

Highest PUT Addition: 50000

FINNIFTY MAY Future

FINNIFTY Spot closed at: 26,482.80 (1.29%)

FINNIFTY MAY Future closed at: 26,512.50 (1.16%)

Premium: 29.7 (Decreased by -32.15 points)

Open Interest Change: -1.1%

Volume Change: 37.5%

FINNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.842 (Increased from 0.698)

Put-Call Ratio (Volume): 0.824

Max Pain Level: 26300

Maximum CALL OI: 29500

Maximum PUT OI: 26000

Highest CALL Addition: 29000

Highest PUT Addition: 25500

MIDCPNIFTY MAY Future

MIDCPNIFTY Spot closed at: 12,741.35 (0.67%)

MIDCPNIFTY MAY Future closed at: 12,782.30 (0.70%)

Premium: 40.95 (Increased by 3.35 points)

Open Interest Change: -1.0%

Volume Change: 2.3%

MIDCPNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.063 (Decreased from 1.076)

Put-Call Ratio (Volume): 0.871

Max Pain Level: 12400

Maximum CALL OI: 13000

Maximum PUT OI: 12000

Highest CALL Addition: 14000

Highest PUT Addition: 12600

SENSEX Weekly Expiry (20.05.25) Future

SENSEX Spot closed at: 82,530.74 (1.48%)

SENSEX Weekly Future closed at: 82,440.05 (1.31%)

Discount: -90.69 (Decreased by -136.03 points)

Open Interest Change: -28.9%

Volume Change: 28.5%

SENSEX Weekly Expiry (20/05/2025) Option Analysis

Put-Call Ratio (OI): 1.101 (Increased from 0.452)

Put-Call Ratio (Volume): 0.863

Max Pain Level: 81300

Maximum CALL OI: 85000

Maximum PUT OI: 77000

Highest CALL Addition: 86000

Highest PUT Addition: 80000

fII & DII Cash Market Activity

FIIs Net Buy: ₹ 5,392.94 Cr

DIIs Net Sell: ₹ 1,668.47 Cr

FII Derivatives Activity

| FII Trading Stats | 15.05.25 | 14.05.25 | 13.05.25 |

| FII Cash (Provisional Data) | 5,392.94 | 931.8 | -476.86 |

| Index Future Open Interest Long Ratio | 45.60% | 38.27% | 37.54% |

| Index Future Volume Long Ratio | 63.18% | 52.16% | 28.48% |

| Call Option Open Interest Long Ratio | 58.95% | 54.62% | 54.10% |

| Call Option Volume Long Ratio | 50.20% | 50.07% | 49.49% |

| Put Option Open Interest Long Ratio | 58.09% | 54.23% | 54.87% |

| Put Option Volume Long Ratio | 49.90% | 49.88% | 49.92% |

| Stock Future Open Interest Long Ratio | 66.07% | 65.28% | 65.29% |

| Stock Future Volume Long Ratio | 56.20% | 50.00% | 42.71% |

| Index Futures | Fresh Long | Fresh Long | Long Covering |

| Index Options | Short Covering | Long Covering | Fresh Short |

| Nifty Futures | Fresh Long | Fresh Short | Long Covering |

| Nifty Options | Short Covering | Short Covering | Fresh Short |

| BankNifty Futures | Fresh Long | Fresh Long | Long Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Long |

| FinNifty Futures | Fresh Long | Fresh Short | Fresh Short |

| FinNifty Options | Long Covering | Fresh Short | Fresh Short |

| MidcpNifty Futures | Long Covering | Short Covering | Short Covering |

| MidcpNifty Options | Fresh Short | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Short Covering | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Fresh Long |

| Stock Futures | Fresh Long | Fresh Long | Long Covering |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

NSE & bSE F&O Trends | Options Insights

NIFTY Weekly Expiry (22.05.2025)

The NIFTY index closed at 25062.1. The NIFTY weekly expiry for May 22, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.996 against previous 0.745. The 25050PE option holds the maximum open interest, followed by the 25100CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25050PE option, with open interest additions also seen in the 25000PE and 25100CE options. On the other hand, open interest reductions were prominent in the 25000CE, 25500CE, and 24000PE options. Trading volume was highest in the 25100CE option, followed by the 25000CE and 25200CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 15-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,062.10 | 0.996 | 0.745 | 0.867 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 17,58,34,725 | 19,25,93,025 | -1,67,58,300 |

| PUT: | 17,50,85,325 | 14,35,67,550 | 3,15,17,775 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 1,61,00,025 | 98,94,075 | 2,05,30,214 |

| 25,200 | 98,30,625 | 11,07,450 | 1,23,07,757 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 1,61,00,025 | 98,94,075 | 2,05,30,214 |

| 25,050 | 81,44,700 | 51,14,400 | 1,15,25,386 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 62,65,200 | -84,15,825 | 1,34,61,816 |

| 25,500 | 83,50,500 | -61,19,700 | 35,97,211 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 1,61,00,025 | 98,94,075 | 2,05,30,214 |

| 25,000 | 62,65,200 | -84,15,825 | 1,34,61,816 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,050 | 1,99,51,275 | 1,98,55,275 | 1,15,16,532 |

| 25,000 | 1,22,52,000 | 1,13,94,375 | 84,46,247 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,050 | 1,99,51,275 | 1,98,55,275 | 1,15,16,532 |

| 25,000 | 1,22,52,000 | 1,13,94,375 | 84,46,247 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 78,69,000 | -44,10,075 | 33,14,146 |

| 23,500 | 39,90,900 | -40,71,675 | 7,26,934 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,050 | 1,99,51,275 | 1,98,55,275 | 1,15,16,532 |

| 24,500 | 85,30,350 | 5,08,725 | 1,12,76,226 |

SENSEX Weekly Expiry (20.05.2025)

The SENSEX index closed at 82530.74. The SENSEX weekly expiry for May 20, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.101 against previous 0.452. The 85000CE option holds the maximum open interest, followed by the 84000CE and 86000CE options. Market participants have shown increased interest with significant open interest additions in the 80000PE option, with open interest additions also seen in the 77000PE and 78000PE options. On the other hand, open interest reductions were prominent in the 89000CE, 88500CE, and 81500CE options. Trading volume was highest in the 81000PE option, followed by the 85000CE and 84000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 20-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82530.74 | 1.101 | 0.452 | 0.863 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,01,84,820 | 77,08,340 | 24,76,480 |

| PUT: | 1,12,17,400 | 34,82,309 | 77,35,091 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 8,28,600 | 2,83,200 | 95,59,560 |

| 84000 | 6,96,300 | 2,95,080 | 84,86,700 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 6,92,080 | 3,34,640 | 56,54,220 |

| 84000 | 6,96,300 | 2,95,080 | 84,86,700 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 89000 | 1,36,940 | -1,39,960 | 18,96,240 |

| 88500 | 83,620 | -93,640 | 8,85,620 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 8,28,600 | 2,83,200 | 95,59,560 |

| 84000 | 6,96,300 | 2,95,080 | 84,86,700 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 77000 | 5,97,840 | 4,09,760 | 52,24,100 |

| 78000 | 5,78,200 | 3,93,360 | 46,92,480 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 5,46,700 | 4,12,260 | 62,88,800 |

| 77000 | 5,97,840 | 4,09,760 | 52,24,100 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 67000 | 3,000 | -1,800 | 31,020 |

| 66800 | 3,060 | -300 | 3,680 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 4,70,420 | 3,18,200 | 1,12,44,700 |

| 81500 | 3,33,580 | 2,02,240 | 66,41,780 |

NIFTY Monthly Expiry (29.05.2025)

The NIFTY index closed at 25062.1. The NIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.251 against previous 1.171. The 24000PE option holds the maximum open interest, followed by the 25000CE and 24500PE options. Market participants have shown increased interest with significant open interest additions in the 24500PE option, with open interest additions also seen in the 25000PE and 25100PE options. On the other hand, open interest reductions were prominent in the 25000CE, 24800CE, and 24500CE options. Trading volume was highest in the 25000CE option, followed by the 24500PE and 25500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,062.10 | 1.251 | 1.171 | 0.965 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,73,75,700 | 4,73,47,500 | 28,200 |

| PUT: | 5,92,52,775 | 5,54,24,625 | 38,28,150 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 48,64,950 | -5,33,025 | 2,44,954 |

| 26,000 | 35,68,050 | 1,48,050 | 1,10,538 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 9,66,675 | 6,41,850 | 34,953 |

| 25,100 | 9,90,000 | 4,86,300 | 59,665 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 48,64,950 | -5,33,025 | 2,44,954 |

| 24,800 | 14,36,550 | -5,15,025 | 97,210 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 48,64,950 | -5,33,025 | 2,44,954 |

| 25,500 | 35,36,625 | -54,075 | 1,77,071 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 67,13,700 | 1,82,100 | 1,66,787 |

| 24,500 | 44,71,650 | 11,96,925 | 1,89,505 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 44,71,650 | 11,96,925 | 1,89,505 |

| 25,000 | 34,14,075 | 9,24,300 | 1,24,772 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 25,62,225 | -2,20,125 | 26,255 |

| 23,000 | 39,44,550 | -1,63,950 | 55,331 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 44,71,650 | 11,96,925 | 1,89,505 |

| 24,000 | 67,13,700 | 1,82,100 | 1,66,787 |

BANKNIFTY Monthly Expiry (29.05.2025)

The BANKNIFTY index closed at 55355.6. The BANKNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.937 against previous 0.819. The 63000CE option holds the maximum open interest, followed by the 55000PE and 50000PE options. Market participants have shown increased interest with significant open interest additions in the 50000PE option, with open interest additions also seen in the 54000PE and 55000PE options. On the other hand, open interest reductions were prominent in the 60000CE, 40500PE, and 55000CE options. Trading volume was highest in the 55000CE option, followed by the 55000PE and 56000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,355.60 | 0.937 | 0.819 | 0.921 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,31,70,290 | 2,49,22,569 | -17,52,279 |

| PUT: | 2,17,00,950 | 2,04,24,030 | 12,76,920 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 23,43,690 | -82,830 | 43,020 |

| 60,000 | 14,70,300 | -2,81,760 | 90,658 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,400 | 3,38,310 | 75,360 | 76,291 |

| 59,200 | 1,07,670 | 63,060 | 8,005 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 14,70,300 | -2,81,760 | 90,658 |

| 55,000 | 9,31,260 | -1,98,540 | 2,62,781 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 9,31,260 | -1,98,540 | 2,62,781 |

| 56,000 | 11,74,620 | -32,460 | 1,82,335 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 19,02,390 | 1,45,860 | 2,10,836 |

| 50,000 | 15,82,140 | 1,83,060 | 81,289 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 15,82,140 | 1,83,060 | 81,289 |

| 54,000 | 12,44,670 | 1,65,240 | 1,46,644 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 40,500 | 12,59,940 | -2,47,440 | 60,892 |

| 47,000 | 4,70,310 | -1,09,440 | 19,660 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 19,02,390 | 1,45,860 | 2,10,836 |

| 54,500 | 5,95,410 | 78,690 | 1,71,936 |

FINNIFTY Monthly Expiry (29.05.2025)

The FINNIFTY index closed at 26482.8. The FINNIFTY monthly expiry for MAY 29, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.842 against previous 0.698. The 29500CE option holds the maximum open interest, followed by the 27000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 25500PE option, with open interest additions also seen in the 26500PE and 29000CE options. On the other hand, open interest reductions were prominent in the 27000CE, 26300CE, and 26200CE options. Trading volume was highest in the 27000CE option, followed by the 26000PE and 26500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,482.80 | 0.842 | 0.698 | 0.824 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 12,62,430 | 13,60,970 | -98,540 |

| PUT: | 10,62,815 | 9,49,780 | 1,13,035 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 29,500 | 1,72,055 | -2,795 | 1,394 |

| 27,000 | 1,63,410 | -29,055 | 7,099 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 29,000 | 87,945 | 13,910 | 762 |

| 26,000 | 39,000 | 5,070 | 2,034 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,63,410 | -29,055 | 7,099 |

| 26,300 | 41,730 | -17,940 | 2,352 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,63,410 | -29,055 | 7,099 |

| 26,500 | 88,140 | -11,245 | 4,675 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,20,185 | 4,030 | 6,731 |

| 25,500 | 1,08,745 | 43,030 | 2,958 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,08,745 | 43,030 | 2,958 |

| 26,500 | 62,920 | 29,250 | 1,925 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 42,510 | -2,600 | 607 |

| 22,000 | 19,110 | -2,145 | 243 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,20,185 | 4,030 | 6,731 |

| 26,100 | 33,930 | 390 | 3,003 |

MIDCPNIFTY Monthly Expiry (29.05.2025)

The MIDCPNIFTY index closed at 12741.35. The MIDCPNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.063 against previous 1.076. The 12000PE option holds the maximum open interest, followed by the 13000CE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 12600PE option, with open interest additions also seen in the 14000CE and 12700PE options. On the other hand, open interest reductions were prominent in the 67000CE, 65600CE, and 65500CE options. Trading volume was highest in the 12700CE option, followed by the 13000CE and 12700PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,741.35 | 1.063 | 1.076 | 0.871 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 62,24,640 | 60,03,840 | 2,20,800 |

| PUT: | 66,16,080 | 64,60,200 | 1,55,880 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,85,120 | -60,360 | 21,020 |

| 13,500 | 5,56,800 | 18,240 | 7,815 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 1,92,600 | 1,00,560 | 2,429 |

| 12,750 | 94,080 | 70,560 | 3,647 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 2,86,080 | -67,320 | 3,610 |

| 13,000 | 5,85,120 | -60,360 | 21,020 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 2,26,560 | 26,280 | 21,021 |

| 13,000 | 5,85,120 | -60,360 | 21,020 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,07,520 | -46,800 | 10,428 |

| 11,000 | 5,46,360 | -14,760 | 4,849 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 3,78,720 | 1,04,760 | 10,229 |

| 12,700 | 2,18,040 | 1,00,320 | 16,764 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,07,520 | -46,800 | 10,428 |

| 12,625 | 32,520 | -33,240 | 2,671 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 2,18,040 | 1,00,320 | 16,764 |

| 12,000 | 7,07,520 | -46,800 | 10,428 |

Conclusion: Cautious Optimism Dominates Despite the F&O Surge

Despite today’s strong gains in NIFTY and BANKNIFTY futures, the F&O landscape reflects cautious optimism rather than euphoria. Falling premiums across major indices along with a surge in Open Interest suggest subdued confidence in immediate follow-through. Option chains are showing tighter ranges and rising PCRs — indicative of a hedged bullish view. Max-Pain level for Nifty monthly expiry stayed at 24,500 suggesting a possible pullback. Though the SENSEX spot closed at 82,530.74; the Max-Pain level for weekly expiry stayed at 81,300 with highest PUT Open Interest was at 77,000 also suggests cautious undertone. Contraction in FINNIFTY future premium along with reduction in Open Interest also points to profit-booking. Traders should remain nimble, focus on range-based strategies, and keep an eye on max pain zones and OI shifts to time entries better during this high-volatility phase.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]