Turning Complex Derivative Data into Clear Market Insights

Big Moves, Bigger Signals: Let’s Decode the NSE F&O Trends Today – 20 May 2025

Table of Contents

The Indian markets took a hit on 20th May 2025, with all major indices ending deep in the red, but the real story lies beneath the surface — in the NSE F&O trends today. Massive FII selling in cash markets, steep fall in open interest, dramatic volume spikes, and surging futures premiums are painting a clear picture: uncertainty is gripping the market just ahead of expiry. NIFTY, BANKNIFTY, FINNIFTY, and MIDCPNIFTY all saw bearish price action, but the derivatives data suggests smart money is already repositioning for the next leg. Let’s break down the signals index by index.

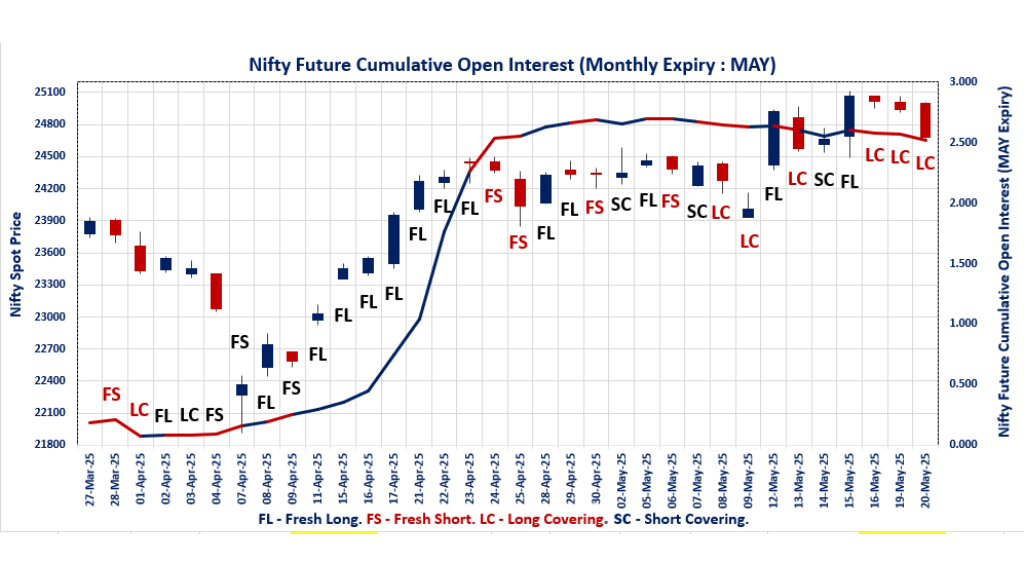

- NIFTY Spot dropped by 1.05%, yet the MAY Future lost only 0.81%, widening the premium to 90.7, up by 59.75 points.

- Open Interest plunged 5.1%, while volume shot up by 82.3% — a classic signature of Long covering and yet fresh hedged longs.

- Weekly PCR (OI) collapsed to 0.491, showing intense CALL writing pressure. Monthly PCR (OI) also declined to 1.036, indicating a waning bullish grip.

NSE F&O Trends

NIFTY MAY Future

NIFTY Spot closed at: 24,683.90 (-1.05%)

NIFTY MAY Future closed at: 24,774.60 (-0.81%)

Premium: 90.7 (Increased by 59.75 points)

Open Interest Change: -5.1%

Volume Change: 82.3%

NIFTY Weekly Expiry (22/05/2025) Option Analysis

Put-Call Ratio (OI): 0.491 (Decreased from 0.603)

Put-Call Ratio (Volume): 1.002

Max Pain Level: 24800

Maximum CALL OI: 25000

Maximum PUT OI: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 23700

NIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 1.036 (Decreased from 1.170)

Put-Call Ratio (Volume): 0.886

Max Pain Level: 24600

Maximum CALL OI: 25000

Maximum PUT OI: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24400

BANKNIFTY MAY Future

BANKNIFTY Spot closed at: 54,877.35 (-0.98%)

BANKNIFTY MAY Future closed at: 55,103.80 (-0.74%)

Premium: 226.45 (Increased by 132.35 points)

Open Interest Change: -1.4%

Volume Change: 5.1%

BANKNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.742 (Decreased from 0.853)

Put-Call Ratio (Volume): 1.012

Max Pain Level: 55000

Maximum CALL OI: 63000

Maximum PUT OI: 55000

Highest CALL Addition: 59000

Highest PUT Addition: 49500

FINNIFTY MAY Future

FINNIFTY Spot closed at: 26,193.85 (-1.18%)

FINNIFTY MAY Future closed at: 26,312.90 (-0.94%)

Premium: 119.05 (Increased by 63.35 points)

Open Interest Change: -1.5%

Volume Change: 34.2%

FINNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.627 (Decreased from 0.739)

Put-Call Ratio (Volume): 0.804

Max Pain Level: 26300

Maximum CALL OI: 27000

Maximum PUT OI: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 26300

MIDCPNIFTY MAY Future

MIDCPNIFTY Spot closed at: 12,583.25 (-1.40%)

MIDCPNIFTY MAY Future closed at: 12,611.50 (-1.34%)

Premium: 28.25 (Increased by 7.2 points)

Open Interest Change: 0.3%

Volume Change: 102.8%

MIDCPNIFTY Monthly Expiry (29/05/2025) Option Analysis

Put-Call Ratio (OI): 0.887 (Decreased from 1.086)

Put-Call Ratio (Volume): 0.770

Max Pain Level: 12500

Maximum CALL OI: 13000

Maximum PUT OI: 12000

Highest CALL Addition: 13000

Highest PUT Addition: 12750

fII & DII Cash Market Activity

FIIs Net Sell: ₹ 10,016.10 Cr

DIIs Net Buy: ₹ 6,738.39 Cr

FII Derivatives Activity

| FII Trading Stats | 20.05.25 | 19.05.25 | 16.05.25 |

| FII Cash (Provisional Data) | -10,016.10 | -525.95 | 8,831.05 |

| Index Future Open Interest Long Ratio | 37.04% | 42.32% | 42.37% |

| Index Future Volume Long Ratio | 33.68% | 49.55% | 37.65% |

| Call Option Open Interest Long Ratio | 55.50% | 55.53% | 56.75% |

| Call Option Volume Long Ratio | 50.11% | 49.91% | 49.78% |

| Put Option Open Interest Long Ratio | 56.86% | 56.55% | 56.17% |

| Put Option Volume Long Ratio | 50.16% | 50.14% | 49.56% |

| Stock Future Open Interest Long Ratio | 64.91% | 65.37% | 65.84% |

| Stock Future Volume Long Ratio | 45.79% | 45.53% | 47.56% |

| Index Futures | Long Covering | Fresh Short | Long Covering |

| Index Options | Fresh Long | Fresh Long | Fresh Short |

| Nifty Futures | Long Covering | Long Covering | Fresh Short |

| Nifty Options | Fresh Long | Fresh Short | Fresh Short |

| BankNifty Futures | Long Covering | Fresh Long | Long Covering |

| BankNifty Options | Fresh Long | Fresh Long | Short Covering |

| FinNifty Futures | Fresh Long | Short Covering | Fresh Short |

| FinNifty Options | Short Covering | Fresh Short | Fresh Short |

| MidcpNifty Futures | Short Covering | Short Covering | Short Covering |

| MidcpNifty Options | Long Covering | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Fresh Long | Fresh Long |

| NiftyNxt50 Options | Long Covering | Fresh Short | Fresh Long |

| Stock Futures | Long Covering | Long Covering | Fresh Short |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

NSE F&O Trends | Options Insights

NIFTY Weekly Expiry (22/05/2025)

The NIFTY index closed at 24683.9. The NIFTY weekly expiry for May 22, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.491 against previous 0.603. The 25000CE option holds the maximum open interest, followed by the 26000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 24800CE and 24900CE options. On the other hand, open interest reductions were prominent in the 25000PE, 26200CE, and 24900PE options. Trading volume was highest in the 25000CE option, followed by the 24900PE and 24800PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 22-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,683.90 | 0.491 | 0.603 | 1.002 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 22,04,48,625 | 17,16,01,350 | 4,88,47,275 |

| PUT: | 10,81,52,100 | 10,34,08,875 | 47,43,225 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,69,82,700 | 58,91,550 | 30,51,573 |

| 26,000 | 1,68,63,300 | 19,75,650 | 10,58,114 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,69,82,700 | 58,91,550 | 30,51,573 |

| 24,800 | 65,29,875 | 46,97,175 | 13,76,742 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 66,85,125 | -18,53,250 | 4,61,968 |

| 26,650 | 49,71,975 | -9,83,925 | 1,07,287 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,69,82,700 | 58,91,550 | 30,51,573 |

| 24,900 | 70,16,700 | 45,56,175 | 22,17,283 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 74,88,675 | 9,96,300 | 7,96,835 |

| 24,500 | 65,98,275 | 11,27,700 | 18,29,583 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,700 | 41,26,200 | 13,57,650 | 3,65,133 |

| 24,300 | 31,77,150 | 12,62,175 | 7,35,951 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 42,79,800 | -21,50,250 | 17,23,813 |

| 24,900 | 21,29,475 | -10,17,675 | 26,17,915 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 21,29,475 | -10,17,675 | 26,17,915 |

| 24,800 | 33,98,850 | -3,25,050 | 26,06,128 |

NIFTY Monthly Expiry (29/05/2025)

The NIFTY index closed at 24683.9. The NIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.036 against previous 1.170. The 25000CE option holds the maximum open interest, followed by the 24000PE and 24500PE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 26500CE and 26600CE options. On the other hand, open interest reductions were prominent in the 24500CE, 25000PE, and 24500PE options. Trading volume was highest in the 25000CE option, followed by the 25000PE and 24500PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,683.90 | 1.036 | 1.170 | 0.886 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,29,02,800 | 5,29,18,575 | 99,84,225 |

| PUT: | 6,51,92,625 | 6,18,90,975 | 33,01,650 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 71,07,150 | 15,13,725 | 2,72,567 |

| 26,000 | 51,49,125 | 7,80,900 | 1,18,170 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 71,07,150 | 15,13,725 | 2,72,567 |

| 26,500 | 23,76,525 | 10,88,025 | 63,955 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 27,20,925 | -4,69,500 | 42,954 |

| 25,600 | 9,78,600 | -1,33,350 | 62,361 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 71,07,150 | 15,13,725 | 2,72,567 |

| 25,500 | 40,39,350 | -78,675 | 1,45,063 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 57,97,275 | -70,950 | 1,11,194 |

| 24,500 | 52,47,000 | -3,03,525 | 1,49,836 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 21,56,175 | 8,91,975 | 61,711 |

| 23,000 | 43,62,525 | 7,33,950 | 75,308 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 38,55,975 | -4,18,200 | 1,74,700 |

| 24,500 | 52,47,000 | -3,03,525 | 1,49,836 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 38,55,975 | -4,18,200 | 1,74,700 |

| 24,500 | 52,47,000 | -3,03,525 | 1,49,836 |

BANKNIFTY Monthly Expiry (29/05/2025)

The BANKNIFTY index closed at 54877.35. The BANKNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.742 against previous 0.853. The 63000CE option holds the maximum open interest, followed by the 60000CE and 55000PE options. Market participants have shown increased interest with significant open interest additions in the 59000CE option, with open interest additions also seen in the 55500CE and 55000CE options. On the other hand, open interest reductions were prominent in the 55000PE, 55500PE, and 55400PE options. Trading volume was highest in the 55000PE option, followed by the 55500CE and 56000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,877.35 | 0.742 | 0.853 | 1.012 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,75,90,940 | 2,49,65,409 | 26,25,531 |

| PUT: | 2,04,75,600 | 2,13,07,920 | -8,32,320 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 22,58,460 | -20,280 | 75,407 |

| 60,000 | 18,27,000 | 1,79,370 | 88,365 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 13,27,260 | 2,88,540 | 91,270 |

| 55,500 | 15,29,490 | 2,49,840 | 2,05,483 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 5,09,580 | -50,880 | 43,530 |

| 61,500 | 3,60,990 | -32,670 | 25,274 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 15,29,490 | 2,49,840 | 2,05,483 |

| 56,000 | 14,69,580 | 2,16,900 | 1,81,246 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 18,12,480 | -2,13,360 | 3,11,591 |

| 54,000 | 11,64,240 | -10,320 | 1,17,038 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 49,500 | 5,70,060 | 1,19,310 | 28,930 |

| 48,000 | 4,68,570 | 79,860 | 24,823 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 18,12,480 | -2,13,360 | 3,11,591 |

| 55,500 | 7,44,000 | -1,19,040 | 1,42,933 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 18,12,480 | -2,13,360 | 3,11,591 |

| 55,200 | 2,07,450 | -28,710 | 1,74,697 |

FINNIFTY Monthly Expiry (29/05/2025)

The FINNIFTY index closed at 26193.85. The FINNIFTY monthly expiry for MAY 29, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.627 against previous 0.739. The 27000CE option holds the maximum open interest, followed by the 29500CE and 27500CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 26300PE and 26350CE options. On the other hand, open interest reductions were prominent in the 26000PE, 26500PE, and 26500CE options. Trading volume was highest in the 26300PE option, followed by the 26500CE and 27000CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,193.85 | 0.627 | 0.739 | 0.804 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 16,95,265 | 15,38,940 | 1,56,325 |

| PUT: | 10,63,400 | 11,37,760 | -74,360 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,98,185 | 42,770 | 4,745 |

| 29,500 | 1,65,685 | -22,425 | 1,453 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,98,185 | 42,770 | 4,745 |

| 26,350 | 32,760 | 25,740 | 1,990 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,01,010 | -23,985 | 5,764 |

| 29,500 | 1,65,685 | -22,425 | 1,453 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,01,010 | -23,985 | 5,764 |

| 27,000 | 1,98,185 | 42,770 | 4,745 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 80,340 | -50,895 | 4,627 |

| 26,300 | 77,675 | 27,040 | 6,582 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 77,675 | 27,040 | 6,582 |

| 25,700 | 31,785 | 6,695 | 851 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 80,340 | -50,895 | 4,627 |

| 26,500 | 53,885 | -28,210 | 3,443 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 77,675 | 27,040 | 6,582 |

| 26,000 | 80,340 | -50,895 | 4,627 |

MIDCPNIFTY Monthly Expiry (29/05/2025)

The MIDCPNIFTY index closed at 12583.25. The MIDCPNIFTY monthly expiry for MAY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.887 against previous 1.086. The 13000CE option holds the maximum open interest, followed by the 13500CE and 12000PE options. Market participants have shown increased interest with significant open interest additions in the 13000CE option, with open interest additions also seen in the 12700CE and 12800CE options. On the other hand, open interest reductions were prominent in the 65500PE, 63000PE, and 64000PE options. Trading volume was highest in the 13000CE option, followed by the 12800CE and 12700PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 29-05-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,583.25 | 0.887 | 1.086 | 0.770 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 75,94,320 | 68,50,680 | 7,43,640 |

| PUT: | 67,39,680 | 74,38,080 | -6,98,400 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 8,80,800 | 2,49,120 | 43,107 |

| 13,500 | 7,37,160 | 99,480 | 12,008 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 8,80,800 | 2,49,120 | 43,107 |

| 12,700 | 2,70,360 | 1,37,040 | 13,011 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 1,64,520 | -88,440 | 9,150 |

| 13,700 | 1,59,840 | -29,160 | 2,660 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 8,80,800 | 2,49,120 | 43,107 |

| 12,800 | 4,31,160 | 1,02,360 | 22,230 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 6,62,520 | -25,440 | 10,518 |

| 11,000 | 4,95,240 | -91,080 | 3,613 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,750 | 90,240 | 21,240 | 10,027 |

| 10,000 | 1,32,360 | 4,320 | 571 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,000 | 4,95,240 | -91,080 | 3,613 |

| 12,700 | 1,59,360 | -55,440 | 17,851 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 1,59,360 | -55,440 | 17,851 |

| 12,800 | 1,47,360 | -36,720 | 14,079 |

Conclusion: What the Index F&O Trends Today Tell Us About Market Sentiment

The Index F&O trends today for 20 May 2025 reflect rising caution and defensive positioning. Across NIFTY, BANKNIFTY, FINNIFTY, and MIDCPNIFTY, we’re seeing:

- Widening futures premiums

- Sharp drops in open interest

- Heavy CALL writing at out-of-the-money strikes

- Max Pain levels staying near spot prices

Key Takeaway:

NIFTY: Max Pain at 24,800 and highest CALL writing at 25,000 suggest the market may consolidate or correct further before expiry. Strong PUT buildup at 23,700 and 24,400 may act as short-term supports.

BANKNIFTY: Max Pain at 55,000 holds steady, but with CALLs aggressively added at 59,000, upside looks heavily capped for the rest of the week.

FINNIFTY : FINNIFTY appears range-bound between 26,000 – 27,000. Smart traders may already be building positions around Max Pain at 26,300.

MIDCPNIFTY: With the highest CALL additions at 13,000, MIDCPNIFTY is likely to stay capped, but smart PUT writing hints at a bottoming attempt near 12,500–12,750.

These signals point toward a choppy, range-bound expiry with a downside bias. The market is likely waiting for fresh triggers — global or domestic — before taking a directional call. For now, expect volatility, time decay traps, and smart-money plays around Max Pain zones.

Check Previous Day’s Nifty Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content on this blog is for informational purposes only and should not be considered as investment advice.

[…] Check Previous Day’s Nifty Indices F&O Analysis […]