Turning Complex Derivative Data into Clear Market Insights

Nifty Futures Witness Short Covering; What It Means for Traders as Put-Call Ratio (PCR) Rises

Nifty Gains 0.5% as Futures Premium Rises, Signalling Short-Covering Pressure

The Indian stock market witnessed a positive session, with Nifty spot closing at 22,508.75, up 0.5%. Meanwhile, Nifty March futures ended at 22,584.3, registering a 0.62% gain and maintaining a 75.55-point premium over the spot price.

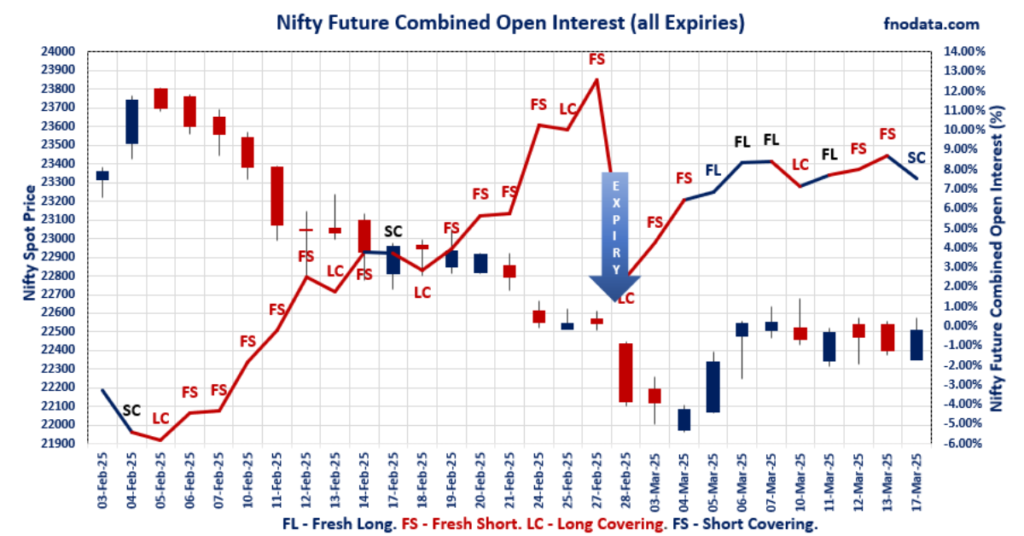

The increase in futures premium by 28.5 points along with a 1.2% fall in the combined Nifty Futures open interest (March, April & May), suggests short-covering pressure. Additionally, a 5.8% rise in combined Nifty future volume indicates a increase in overall trading activity, pointing towards cautious approach from bears ahead of crucial FED interest rate decision due on Wednesday night.

For traders and investors, the premium expansion and overall positive close point towards potential near-term stability, but staying cautious amid evolving market trends is key.

Nifty Put-Call Ratio (PCR) Insights:

Nifty March PCR: 0.987 (up from 0.953)

Nifty April PCR: 1.228 (up from 1.217)

Nifty May PCR: 1.239 (up from 1.235)

The increase in PCR for all three Expiries suggests higher put writing and call unwinding, indicating that traders are building support at lower levels. This is typically a bullish sign as sellers of put options expect the market to stay strong above their strike prices.

Nifty Total PCR (all Expiries): 1.047 (up from 0.866)

The sharp jump from 0.866 to 1.047 could signal that the market is shifting from a bearish to a neutral-to-bullish stance.

FII & DII Cash Activity: Diverging Market Positions

In the cash market, FIIs net sold ₹ 4,488.45 Cr, whereas DIIs provided strong support with net buying of ₹ 6,000.60 Cr, helping cushion the market.

FII Index Future Positioning: Short Covering Ahead of FED Meeting:

FII activity in both Nifty & Bank Nifty futures showed signs of short-covering.

FII Index Future Open Interest Long Ratio improved to 20.17% (from 18.82%).

FII Index Future Volume Long Ratio surged to 71.26% (from 49.19%).

FII Trading statistics in Cash & Derivative Markets

| FII Trading Stats | 17.03.25 | 13.03.25 | 12.03.25 |

| FII Cash (Provisional Data) | -4488.45 | -792.9 | -1,627.6 |

| Index Future Open Interest Long Ratio | 20.17% | 18.82% | 17.90% |

| Index Future Volume Long Ratio | 71.26% | 49.19% | 43.39% |

| Call Option Open Interest Long Ratio | 58.41% | 56.57% | 57.10% |

| Call Option Volume Long Ratio | 50.79% | 48.99% | 49.80% |

| Put Option Open Interest Long Ratio | 60.35% | 62.37% | 60.98% |

| Put Option Volume Long Ratio | 50.11% | 49.33% | 49.89% |

| Stock Future Open Interest Long Ratio | 63.87% | 63.39% | 63.73% |

| Stock Future Volume Long Ratio | 55.68% | 46.58% | 50.79% |

| Index Futures | Short Covering | Fresh Short | Fresh Short |

| Index Options | Fresh Long | Long Covering | Fresh Short |

| Nifty Futures | Short Covering | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Long Covering | Fresh Short |

| BankNifty Futures | Short Covering | Fresh Long | Short Covering |

| BankNifty Options | Long Covering | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Long | Long Covering | Fresh Long |

| FinNifty Options | Short Covering | Fresh Short | Long Covering |

| MidcpNifty Futures | Short Covering | Fresh Short | Fresh Long |

| MidcpNifty Options | Short Covering | Fresh Short | Long Covering |

| NiftyNxt50 Futures | Short Covering | Long Covering | Short Covering |

| NiftyNxt50 Options | Fresh Short | Long Covering | Fresh Short |

| Stock Futures | Fresh Long | Long Covering | Short Covering |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

Major Indices | Options Insights

SENSEX Weekly Expiry (18.03.2025)

The SENSEX index closed at 74169.95. The SENSEX weekly expiry for March 18, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.949against previous 0.762. The72000 PE option holds the maximum open interest, followed by the75500 CE and 75000 CE options. Market participants have shown increased interest with significant open interest additions in the72500 PE option, with open interest additions also seen in the 75500 CE and 73000 PE options. On the other hand, open interest reductions were prominent in the72700 PE, 74000 CE, and 78000 CE options. Trading volume was highest in the 74000 PE option, followed by the74500 CE and 75000 CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 18-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 74169.95 | 0.949 | 0.762 | 1.036 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,68,70,920 | 1,24,49,860 | 44,21,060 |

| PUT: | 1,60,03,200 | 94,85,920 | 65,17,280 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 75500 | 12,52,660 | 5,66,080 | 1,85,03,200 |

| 75000 | 12,44,040 | 4,84,780 | 5,66,05,280 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 75500 | 12,52,660 | 5,66,080 | 1,85,03,200 |

| 75000 | 12,44,040 | 4,84,780 | 5,66,05,280 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 74000 | 4,22,960 | -1,25,760 | 2,78,75,360 |

| 78000 | 3,82,460 | -93,620 | 25,62,760 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 74500 | 7,43,580 | 2,93,400 | 5,86,13,840 |

| 75000 | 12,44,040 | 4,84,780 | 5,66,05,280 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 72000 | 13,44,160 | 63,720 | 1,13,03,200 |

| 72500 | 10,95,780 | 7,46,440 | 1,62,30,080 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 72500 | 10,95,780 | 7,46,440 | 1,62,30,080 |

| 73000 | 9,55,620 | 5,40,140 | 4,02,48,540 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 72700 | 2,83,580 | -2,30,120 | 1,24,75,200 |

| 70000 | 3,85,220 | -85,000 | 33,54,900 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 74000 | 7,61,180 | 4,38,100 | 6,09,15,080 |

| 73500 | 7,11,840 | 5,03,120 | 5,19,61,220 |

NIFTY Weekly Expiry (20.03.2025):

The NIFTY index closed at 22508.75. The NIFTY weekly expiry for March 20, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.031 against previous 0.993. The 23500 CE option holds the maximum open interest, followed by the 23000 CE and 22000 PE options. Market participants have shown increased interest with significant open interest additions in the 22500 PE option, with open interest additions also seen in the 22300 PE and 22850 CE options. On the other hand, open interest reductions were prominent in the 22400 CE, 22000 PE, and 20500 PE options. Trading volume was highest in the 22500 PE option, followed by the 22500 CE and 22600 CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 20-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 22,508.75 | 1.031 | 0.993 | 1.009 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 12,22,59,300 | 7,53,59,250 | 4,69,00,050 |

| PUT: | 12,60,47,475 | 7,48,21,575 | 5,12,25,900 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 98,74,875 | 24,41,550 | 5,07,716 |

| 23,000 | 88,53,150 | 36,69,375 | 14,66,360 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,850 | 55,49,925 | 45,98,100 | 11,12,676 |

| 22,800 | 79,74,300 | 43,16,325 | 19,76,235 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,400 | 19,00,500 | -14,96,475 | 8,97,618 |

| 24,200 | 2,34,900 | -76,125 | 21,929 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 69,22,950 | 18,82,125 | 34,49,987 |

| 22,600 | 48,46,950 | 13,41,600 | 26,56,894 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 85,57,650 | -7,42,650 | 15,72,506 |

| 22,500 | 83,98,725 | 53,21,700 | 38,26,211 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 83,98,725 | 53,21,700 | 38,26,211 |

| 22,300 | 73,45,200 | 49,25,850 | 19,12,490 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 85,57,650 | -7,42,650 | 15,72,506 |

| 20,500 | 20,22,975 | -7,20,975 | 1,59,057 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 83,98,725 | 53,21,700 | 38,26,211 |

| 22,400 | 56,36,100 | 23,64,075 | 23,60,776 |

NIFTY Monthly Expiry (27.03.2025)

The NIFTY index closed at22508.75. The NIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.987 against previous 0.953. The 22000 PE option holds the maximum open interest, followed by the 31000 CE and 22500 PE options. Market participants have shown increased interest with significant open interest additions in the 21500 PE option, with open interest additions also seen in the 20350 PE and 23200 CE options. On the other hand, open interest reductions were prominent in the 22500 CE, 22400 CE, and 24500 CE options. Trading volume was highest in the 22500 PE option, followed by the 22500 CE and 22000 PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 22,508.75 | 0.987 | 0.953 | 1.098 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,03,34,075 | 6,78,80,350 | 24,53,725 |

| PUT: | 6,93,94,800 | 6,47,05,850 | 46,88,950 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 31,000 | 69,53,000 | 1,47,350 | 12,825 |

| 23,000 | 65,81,400 | 2,90,525 | 1,53,296 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,200 | 15,11,775 | 4,08,300 | 53,916 |

| 23,100 | 12,03,000 | 3,56,100 | 49,220 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 56,27,475 | -2,97,600 | 1,61,896 |

| 22,400 | 12,58,275 | -1,66,650 | 47,028 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 56,27,475 | -2,97,600 | 1,61,896 |

| 23,000 | 65,81,400 | 2,90,525 | 1,53,296 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 82,82,600 | 3,05,700 | 1,54,761 |

| 22,500 | 67,89,450 | 4,01,775 | 2,00,273 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 21,500 | 38,79,525 | 5,08,125 | 88,179 |

| 20,350 | 6,24,000 | 5,02,875 | 12,060 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 19,000 | 6,28,325 | -81,150 | 4,928 |

| 21,800 | 13,37,400 | -74,100 | 52,061 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 22,500 | 67,89,450 | 4,01,775 | 2,00,273 |

| 22,000 | 82,82,600 | 3,05,700 | 1,54,761 |

BANKNIFTY Monthly Expiry (27.03.2025)

The BANKNIFTY index closed at48354.15. The BANKNIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.031 against previous 0.935. The 49000 CE option holds the maximum open interest, followed by the 40500 PE and 48000 PE options. Market participants have shown increased interest with significant open interest additions in the 48500 PE option, with open interest additions also seen in the 48400 PE and 50400 CE options. On the other hand, open interest reductions were prominent in the 48000 CE, 52000 CE, and 48100 CE options. Trading volume was highest in the 48500 CE option, followed by the 48500 PE and 48400 PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 48,354.15 | 1.031 | 0.935 | 0.997 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,48,32,305 | 2,58,84,990 | -10,52,685 |

| PUT: | 2,55,89,790 | 2,42,08,674 | 13,81,116 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 49,000 | 18,96,540 | -35,760 | 1,92,172 |

| 50,000 | 15,74,070 | 35,670 | 1,53,685 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 50,400 | 2,82,150 | 1,62,810 | 31,812 |

| 48,500 | 13,08,030 | 64,920 | 2,96,562 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 48,000 | 7,59,750 | -2,27,580 | 1,12,131 |

| 52,000 | 11,12,250 | -1,61,520 | 68,739 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 48,500 | 13,08,030 | 64,920 | 2,96,562 |

| 48,400 | 3,79,350 | 62,190 | 2,17,587 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 40,500 | 16,64,070 | -91,080 | 59,447 |

| 48,000 | 16,03,905 | 69,150 | 2,18,366 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 48,500 | 9,86,760 | 3,16,380 | 2,45,870 |

| 48,400 | 4,82,010 | 2,03,790 | 2,43,562 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 40,500 | 16,64,070 | -91,080 | 59,447 |

| 44,800 | 90,900 | -71,220 | 10,439 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 48,500 | 9,86,760 | 3,16,380 | 2,45,870 |

| 48,400 | 4,82,010 | 2,03,790 | 2,43,562 |

FINNIFTY Monthly Expiry (27.03.2025)

The FINNIFTY index closed at23529.25. The FINNIFTY monthly expiry for March 27, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 1.342 against previous 1.161. The 19500 PE option holds the maximum open interest, followed by the 22000 PE and 24500 CE options. Market participants have shown increased interest with significant open interest additions in the 22000 PE option, with open interest additions also seen in the 23500 PE and 22500 PE options. On the other hand, open interest reductions were prominent in the 23800 CE, 23500 CE, and 22200 PE options. Trading volume was highest in the 23500 PE option, followed by the 23500 CE and 22000 PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 23,529.25 | 1.342 | 1.161 | 1.260 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 19,84,515 | 18,58,415 | 1,26,100 |

| PUT: | 26,62,920 | 21,58,520 | 5,04,400 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,99,420 | 7,345 | 6,097 |

| 24,000 | 1,65,555 | 47,905 | 7,825 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,65,555 | 47,905 | 7,825 |

| 24,400 | 73,645 | 30,680 | 2,951 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,800 | 1,35,915 | -28,015 | 3,995 |

| 23,500 | 1,07,640 | -27,300 | 10,719 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 1,07,640 | -27,300 | 10,719 |

| 24,000 | 1,65,555 | 47,905 | 7,825 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 19,500 | 3,05,110 | 24,050 | 1,633 |

| 22,000 | 2,88,210 | 1,07,185 | 8,545 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 22,000 | 2,88,210 | 1,07,185 | 8,545 |

| 23,500 | 94,445 | 60,905 | 13,201 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 22,200 | 83,395 | -18,200 | 2,165 |

| 21,500 | 1,41,310 | -12,675 | 1,590 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 94,445 | 60,905 | 13,201 |

| 22,000 | 2,88,210 | 1,07,185 | 8,545 |

MIDCPNIFTY Monthly Expiry (27.03.2025)

The MIDCPNIFTY index closed at 10893.15. The MIDCPNIFTY monthly expiry for March 27, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.925 against previous 1.000. The 10000 PE option holds the maximum open interest, followed by the 11500 CE and 11000 CE options. Market participants have shown increased interest with significant open interest additions in the 11200 CE option, with open interest additions also seen in the 11600 CE and 11300 CE options. On the other hand, open interest reductions were prominent in the 60000 CE, 57000 PE, and 58000 CE options. Trading volume was highest in the 11200 CE option, followed by the 10900 CE and 10800 PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 27-03-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 10,893.15 | 0.925 | 1.000 | 0.786 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,02,53,520 | 92,77,560 | 9,75,960 |

| PUT: | 94,87,800 | 92,79,840 | 2,07,960 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 11,500 | 9,60,840 | 98,520 | 15,374 |

| 11,000 | 9,36,960 | 70,800 | 22,707 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 11,200 | 7,50,000 | 1,72,440 | 33,850 |

| 11,600 | 4,10,400 | 1,63,440 | 9,324 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 1,96,560 | -70,080 | 1,321 |

| 12,200 | 2,24,040 | -69,000 | 2,547 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 11,200 | 7,50,000 | 1,72,440 | 33,850 |

| 10,900 | 7,04,640 | 60,120 | 27,341 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 10,000 | 10,34,760 | 59,280 | 15,937 |

| 10,500 | 8,73,600 | 10,080 | 16,921 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 10,700 | 6,46,680 | 85,320 | 9,272 |

| 9,900 | 3,49,680 | 78,840 | 7,550 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 10,200 | 2,73,000 | -1,57,680 | 8,011 |

| 9,700 | 1,67,040 | -76,200 | 1,658 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 10,800 | 5,34,000 | 39,720 | 23,921 |

| 10,900 | 6,48,840 | 12,480 | 22,349 |

Short Covering in Nifty Futures Signals Potential Rebound

Signs of short covering in Nifty futures suggest a possible rebound, easing downside risks and hinting at a shift in market sentiment.

DII buying continues to provide stability, counteracting FII selling in the cash market and supporting the broader market trend.

The rise in PCR along with fall in Open Interest indicates short-covering pressure.

Meanwhile, FII index futures are witnessing short covering with higher volumes, signalling a potential shift from bearish to neutral or bullish positioning.

According to options data, Nifty faces strong resistance between 23,000 and 23,200, where heavy call writing has been observed. This range could act as a barrier for further upside unless significant buying emerges. Immediate support remains at 22,500. Traders should closely monitor market sentiment and institutional activity for confirmation of a pullback rally.