Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 11/07/2025

Table of Contents

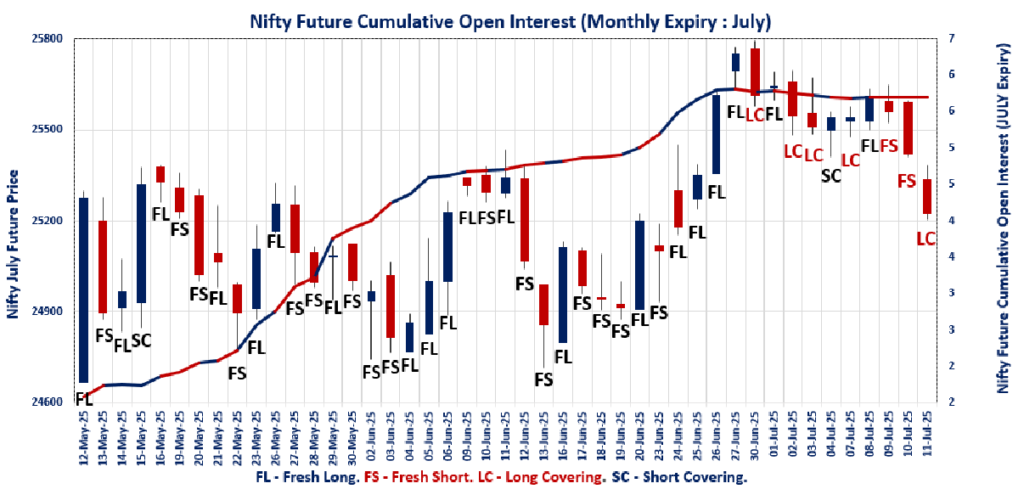

The Open Interest Volume Analysis for 11th July 2025 reveals a market under pressure, with Nifty July futures closing down 0.78% at 25,223.40 and open interest barely changing. The premium widened by nearly 7 points, a sign that traders are hedging downside risk as spot prices slip below 25,200. On the options front, the weekly Put-Call Ratio (OI) dropped sharply to 0.544, its lowest in weeks, as call writers aggressively built positions at 25,300 and 25,500, while put writers focused on 25,000 and 25,200. Max pain for the weekly expiry is locked at 25,250, making this the key pivot for the coming sessions. The monthly option chain shows a slightly more supportive picture, with a PCR (OI) above 1.09 and max pain at 25,300, but the highest call and put additions are both clustered just above spot, signaling indecision and a likely tug-of-war near current levels.

BankNifty futures mirrored the cautious tone, falling 0.44% with a 1% OI rise and a sharply lower premium, while the monthly PCR (OI) slipped to 0.828—suggesting traders are still booking profits and rolling over shorts. FINNIFTY and MIDCPNIFTY both lost ground, with their PCRs dropping further and max pain levels shifting lower, pointing to continued risk-off sentiment in financials and midcaps. SENSEX futures saw a notable OI and volume spike, but with a PCR (OI) still below 0.6, the broader market remains defensive.

NSE & BSE F&O Market Signals

NIFTY JULY Future

NIFTY Spot closed at: 25,149.85 (-0.81%)

NIFTY JULY Future closed at: 25,223.40 (-0.78%)

Premium: 73.55 (Increased by 6.9 points)

Open Interest Change: -0.1%

Volume Change: 11.7%

NIFTY Weekly Expiry (17/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.544 (Decreased from 0.698)

Put-Call Ratio (Volume): 0.990

Max Pain Level: 25250

Maximum CALL Open Interest: 25500

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25300

Highest PUT Addition: 25000

NIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.096 (Decreased from 1.168)

Put-Call Ratio (Volume): 0.805

Max Pain Level: 25300

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25700

Highest PUT Addition: 25200

BANKNIFTY JULY Future

BANKNIFTY Spot closed at: 56,754.70 (-0.35%)

BANKNIFTY JULY Future closed at: 56,917.60 (-0.44%)

Premium: 162.9 (Decreased by -52.7 points)

Open Interest Change: 1.0%

Volume Change: 3.9%

BANKNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.828 (Decreased from 0.865)

Put-Call Ratio (Volume): 0.862

Max Pain Level: 56800

Maximum CALL Open Interest: 56000

Maximum PUT Open Interest: 56000

Highest CALL Addition: 60000

Highest PUT Addition: 52000

FINNIFTY JULY Future

FINNIFTY Spot closed at: 26,853.10 (-0.49%)

FINNIFTY JULY Future closed at: 26,946.70 (-0.54%)

Premium: 93.6 (Decreased by -13.85 points)

Open Interest Change: -0.9%

Volume Change: 45.8%

FINNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.841 (Decreased from 0.915)

Put-Call Ratio (Volume): 1.132

Max Pain Level: 27000

Maximum CALL Open Interest: 28500

Maximum PUT Open Interest: 24500

Highest CALL Addition: 27000

Highest PUT Addition: 26300

MIDCPNIFTY JULY Future

MIDCPNIFTY Spot closed at: 13,026.85 (-1.39%)

MIDCPNIFTY JULY Future closed at: 13,036.70 (-1.63%)

Premium: 9.85 (Decreased by -31.7 points)

Open Interest Change: -1.4%

Volume Change: 60.5%

MIDCPNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.681 (Decreased from 0.755)

Put-Call Ratio (Volume): 0.687

Max Pain Level: 13225

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13100

Highest PUT Addition: 13100

SENSEX Weekly Expiry (15/07/2025) Future

SENSEX Spot closed at: 82,500.47 (-0.83%)

SENSEX Weekly Future closed at: 82,621.70 (-0.79%)

Premium: 121.23 (Increased by 34.21 points)

Open Interest Change: 34.3%

Volume Change: 105.4%

SENSEX Weekly Expiry (15/07/2025) Option Analysis

Put-Call Ratio (OI): 0.505 (Increased from 0.489)

Put-Call Ratio (Volume): 1.110

Max Pain Level: 82700

Maximum CALL OI: 85000

Maximum PUT OI: 80000

Highest CALL Addition: 85000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 5,104.22 Cr

DIIs Net BUY: ₹ 3,558.63 Cr

FII Derivatives Activity

| FII Trading Stats | 11.07.25 | 10.07.25 | 9.07.25 |

| FII Cash (Provisional Data) | -5,104.22 | 221.06 | 77 |

| Index Future Open Interest Long Ratio | 20.22% | 24.66% | 27.70% |

| Index Future Volume Long Ratio | 29.02% | 36.39% | 38.81% |

| Call Option Open Interest Long Ratio | 50.63% | 54.69% | 51.06% |

| Call Option Volume Long Ratio | 49.43% | 49.93% | 49.83% |

| Put Option Open Interest Long Ratio | 62.13% | 63.07% | 59.07% |

| Put Option Volume Long Ratio | 50.27% | 50.20% | 50.01% |

| Stock Future Open Interest Long Ratio | 62.92% | 63.28% | 63.73% |

| Stock Future Volume Long Ratio | 47.10% | 44.35% | 48.81% |

| Index Futures | Fresh Short | Long Covering | Fresh Short |

| Index Options | Fresh Short | Short Covering | Fresh Short |

| Nifty Futures | Fresh Short | Long Covering | Fresh Short |

| Nifty Options | Fresh Short | Short Covering | Fresh Short |

| BankNifty Futures | Fresh Short | Long Covering | Fresh Long |

| BankNifty Options | Fresh Long | Fresh Short | Long Covering |

| FinNifty Futures | Short Covering | Short Covering | Long Covering |

| FinNifty Options | Fresh Long | Fresh Short | Fresh Long |

| MidcpNifty Futures | Long Covering | Long Covering | Fresh Long |

| MidcpNifty Options | Long Covering | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Long Covering | Short Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Short |

| Stock Futures | Long Covering | Long Covering | Fresh Short |

| Stock Options | Short Covering | Short Covering | Short Covering |

NSE & BSE Option market Trends : Options Insights

NIFTY weekly Expiry (17/07/2025)

The NIFTY index closed at 25149.85. The NIFTY weekly expiry for JULY 17, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.544 against previous 0.698. The 25500CE option holds the maximum open interest, followed by the 26000CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 25300CE option, with open interest additions also seen in the 25200CE and 26000CE options. On the other hand, open interest reductions were prominent in the 25400PE, 25500PE, and 25350PE options. Trading volume was highest in the 25200PE option, followed by the 25300CE and 25000PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 17-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,149.85 | 0.544 | 0.698 | 0.990 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,10,42,875 | 7,78,85,025 | 7,31,57,850 |

| PUT: | 8,22,26,700 | 5,43,87,900 | 2,78,38,800 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,07,73,375 | 41,80,950 | 15,86,795 |

| 26,000 | 1,02,27,900 | 50,50,875 | 7,46,327 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 98,92,425 | 88,59,750 | 23,81,646 |

| 25,200 | 58,34,325 | 52,84,500 | 19,59,785 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,800 | 7,800 | -600 | 38 |

| 23,500 | 10,425 | -225 | 41 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 98,92,425 | 88,59,750 | 23,81,646 |

| 25,200 | 58,34,325 | 52,84,500 | 19,59,785 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 75,43,575 | 28,12,125 | 4,37,827 |

| 25,000 | 73,64,175 | 36,81,450 | 21,49,965 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 73,64,175 | 36,81,450 | 21,49,965 |

| 24,000 | 75,43,575 | 28,12,125 | 4,37,827 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 24,64,875 | -10,37,250 | 5,48,007 |

| 25,500 | 31,50,000 | -6,46,500 | 2,08,163 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 40,72,275 | 14,24,850 | 28,98,984 |

| 25,000 | 73,64,175 | 36,81,450 | 21,49,965 |

SENSEX weekly Expiry (15/07/2025)

The SENSEX index closed at 82500.47. The SENSEX weekly expiry for JULY 15, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.505 against previous 0.489. The 85000CE option holds the maximum open interest, followed by the 86000CE and 84000CE options. Market participants have shown increased interest with significant open interest additions in the 85000CE option, with open interest additions also seen in the 83000CE and 84000CE options. On the other hand, open interest reductions were prominent in the 85500CE, 83000PE, and 87000CE options. Trading volume was highest in the 82500PE option, followed by the 82000PE and 83000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 15-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82500.47 | 0.505 | 0.489 | 1.110 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,34,41,780 | 1,51,38,900 | 83,02,880 |

| PUT: | 1,18,29,820 | 73,99,409 | 44,30,411 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 21,03,740 | 11,82,040 | 1,23,38,680 |

| 86000 | 16,00,980 | -61,340 | 82,98,760 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 21,03,740 | 11,82,040 | 1,23,38,680 |

| 83000 | 11,19,260 | 9,50,100 | 3,33,30,280 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 8,64,080 | -2,50,860 | 78,13,860 |

| 87000 | 5,04,360 | -1,89,500 | 31,46,180 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 11,19,260 | 9,50,100 | 3,33,30,280 |

| 83500 | 14,62,320 | 1,19,800 | 2,31,47,060 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 9,52,460 | 3,98,200 | 73,95,420 |

| 81000 | 8,39,040 | 1,27,000 | 1,48,73,500 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 9,52,460 | 3,98,200 | 73,95,420 |

| 82500 | 6,45,520 | 3,63,000 | 4,35,61,520 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 4,16,900 | -2,03,240 | 2,07,94,880 |

| 83300 | 1,05,520 | -1,82,820 | 24,94,600 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 6,45,520 | 3,63,000 | 4,35,61,520 |

| 82000 | 6,08,980 | 2,16,080 | 3,53,21,880 |

NIFTY Monthly Expiry (31/07/2025)

The NIFTY index closed at 25149.85. The NIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.096 against previous 1.168. The 25000PE option holds the maximum open interest, followed by the 26000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 25700CE option, with open interest additions also seen in the 25200CE and 25600CE options. On the other hand, open interest reductions were prominent in the 26000CE, 25500PE, and 25400PE options. Trading volume was highest in the 26000CE option, followed by the 25000PE and 25500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,149.85 | 1.096 | 1.168 | 0.805 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,18,64,625 | 3,98,51,250 | 20,13,375 |

| PUT: | 4,58,69,700 | 4,65,26,700 | -6,57,000 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 46,73,850 | -10,06,275 | 1,16,893 |

| 25,500 | 43,31,925 | 3,87,300 | 90,693 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 20,54,925 | 7,07,625 | 45,253 |

| 25,200 | 9,56,700 | 5,19,525 | 33,261 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 46,73,850 | -10,06,275 | 1,16,893 |

| 26,300 | 6,75,300 | -2,53,950 | 20,401 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 46,73,850 | -10,06,275 | 1,16,893 |

| 25,500 | 43,31,925 | 3,87,300 | 90,693 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 73,81,500 | 1,10,775 | 94,129 |

| 24,500 | 31,84,500 | -97,575 | 47,291 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 14,24,025 | 3,08,100 | 49,524 |

| 24,600 | 7,89,600 | 2,42,550 | 21,196 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 30,80,325 | -4,43,850 | 45,614 |

| 25,400 | 13,49,775 | -4,14,600 | 34,191 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 73,81,500 | 1,10,775 | 94,129 |

| 25,200 | 14,24,025 | 3,08,100 | 49,524 |

BANKNIFTY Monthly Expiry (31/07/2025)

The BANKNIFTY index closed at 56754.7. The BANKNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.828 against previous 0.865. The 56000PE option holds the maximum open interest, followed by the 56000CE and 57000CE options. Market participants have shown increased interest with significant open interest additions in the 60000CE option, with open interest additions also seen in the 65000CE and 56800CE options. On the other hand, open interest reductions were prominent in the 57000PE, 55000PE, and 46000PE options. Trading volume was highest in the 57000CE option, followed by the 57000PE and 56800PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 56,754.70 | 0.828 | 0.865 | 0.862 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,65,72,395 | 1,59,90,345 | 5,82,050 |

| PUT: | 1,37,28,820 | 1,38,28,194 | -99,374 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 13,85,370 | -5,215 | 9,734 |

| 57,000 | 12,55,415 | 59,430 | 1,50,031 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,000 | 11,16,990 | 1,22,990 | 60,601 |

| 65,000 | 2,98,095 | 1,02,585 | 11,777 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 3,44,575 | -34,545 | 10,886 |

| 57,500 | 10,38,450 | -27,685 | 70,230 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 12,55,415 | 59,430 | 1,50,031 |

| 58,000 | 9,22,600 | 27,370 | 70,813 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 21,46,025 | -34,230 | 74,094 |

| 57,000 | 11,24,340 | -1,08,710 | 1,39,744 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 52,000 | 5,15,655 | 84,175 | 12,370 |

| 56,900 | 2,02,125 | 57,540 | 59,926 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 11,24,340 | -1,08,710 | 1,39,744 |

| 55,000 | 8,41,190 | -46,200 | 51,547 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 11,24,340 | -1,08,710 | 1,39,744 |

| 56,800 | 1,97,785 | 23,415 | 82,962 |

FINNIFTY Monthly Expiry (31/07/2025)

The FINNIFTY index closed at 26853.1. The FINNIFTY monthly expiry for JULY 31, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.841 against previous 0.915. The 28500CE option holds the maximum open interest, followed by the 27500CE and 28000CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 28500CE and 26300PE options. On the other hand, open interest reductions were prominent in the 26500PE, 25000PE, and 27050PE options. Trading volume was highest in the 27000PE option, followed by the 27000CE and 28000CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,853.10 | 0.841 | 0.915 | 1.132 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 9,19,425 | 8,52,475 | 66,950 |

| PUT: | 7,72,980 | 7,79,675 | -6,695 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,500 | 1,14,660 | 26,065 | 1,676 |

| 27,500 | 1,09,785 | 1,885 | 2,013 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 85,930 | 26,845 | 3,624 |

| 28,500 | 1,14,660 | 26,065 | 1,676 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,200 | 31,980 | -8,450 | 1,799 |

| 28,000 | 95,550 | -6,955 | 2,474 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 85,930 | 26,845 | 3,624 |

| 28,000 | 95,550 | -6,955 | 2,474 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 67,925 | 10,855 | 367 |

| 25,000 | 56,615 | -12,220 | 994 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 25,415 | 16,250 | 457 |

| 24,000 | 31,720 | 15,015 | 473 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 46,280 | -17,485 | 2,357 |

| 25,000 | 56,615 | -12,220 | 994 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 51,545 | -1,430 | 6,130 |

| 26,500 | 46,280 | -17,485 | 2,357 |

MIDCPNIFTY Monthly Expiry (31/07/2025)

The MIDCPNIFTY index closed at 13026.85. The MIDCPNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.681 against previous 0.755. The 14000CE option holds the maximum open interest, followed by the 13500CE and 14500CE options. Market participants have shown increased interest with significant open interest additions in the 13100CE option, with open interest additions also seen in the 13000CE and 13200CE options. On the other hand, open interest reductions were prominent in the 69000PE, 57000CE, and 57000PE options. Trading volume was highest in the 13000PE option, followed by the 13500CE and 13200CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,026.85 | 0.681 | 0.755 | 0.687 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 83,63,320 | 71,15,080 | 12,48,240 |

| PUT: | 56,99,120 | 53,71,240 | 3,27,880 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 11,19,580 | 83,300 | 10,473 |

| 13,500 | 10,07,720 | 16,660 | 14,975 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 2,43,600 | 2,30,020 | 13,335 |

| 13,000 | 3,47,480 | 1,82,980 | 7,920 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 2,95,540 | -43,680 | 12,518 |

| 13,875 | 16,240 | -21,980 | 435 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 10,07,720 | 16,660 | 14,975 |

| 13,200 | 2,87,980 | 1,40,140 | 14,917 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,59,540 | -56,840 | 19,395 |

| 12,500 | 5,22,200 | 37,940 | 8,905 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 1,59,460 | 78,400 | 10,414 |

| 12,600 | 1,69,680 | 58,660 | 2,631 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,59,540 | -56,840 | 19,395 |

| 13,400 | 2,54,800 | -56,700 | 1,542 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 6,59,540 | -56,840 | 19,395 |

| 13,200 | 1,59,600 | -41,720 | 10,940 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis highlights a market that’s consolidating with a clear bearish tilt. For Nifty, the 25,200–25,250 zone is the battleground—expect volatility if this support cracks, with the next downside at 25,000 and resistance at 25,500–25,700 due to heavy call writing. For actionable trades, neutral-to-bearish strategies like short straddles or iron condors around 25,250 may be favored, or look for quick directional plays on a break of 25,200 or 25,500. BankNifty’s 56,800–57,000 range is equally pivotal, with strong resistance at higher strikes and support at 56,000. Sectoral divergences matter: FINNIFTY’s OI drop and MIDCPNIFTY’s steady base at 13,200 could offer tactical opportunities for nimble traders. As expiry approaches, this Open Interest Volume Analysis will be your best compass for navigating volatility and positioning for the next decisive move.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]