Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 21/07/2025

Table of Contents

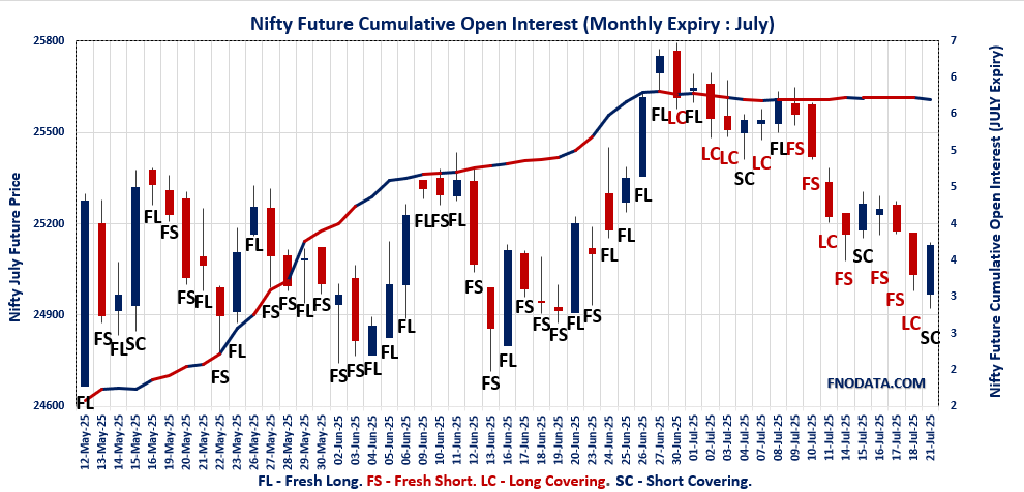

The Open Interest Volume Analysis for 21st July 2025 brings evidence of a cautious optimism rebounding in the market, as Nifty July futures bounced 0.38% to 25,127.60 and options sentiment stabilized after last week’s selling. The premium sharply contracted by 27 points, open interest continued to unwind (-3.3%), and volumes remained soft—suggesting lingering caution and short-covering rather than fresh risk-on buying.

However, noteworthy is the rise in both weekly and monthly Put-Call Ratios, reflecting renewed put writing at key strikes and slightly improved risk appetite among market participants. Max pain has shifted up to 25,100 for weekly and 25,200 for monthly expiry, with the highest call and put additions crowding around 25,100–25,600, signaling a likely expiry gravitation toward these levels.

Across the broader indices, BANKNIFTY staged a smart recovery (up 1%), FINNIFTY outperformed with a 1.5% jump, and MIDCPNIFTY posted steady gains—with all showing a welcoming drop in premiums and a retreat in open interest, indicative of short-covering and an end to the panic-driven selloff earlier in the series.

NSE & BSE F&O Market Signals

NIFTY JULY Future

NIFTY Spot closed at: 25,090.70 (0.49%)

NIFTY JULY Future closed at: 25,127.60 (0.38%)

Premium: 36.9 (Decreased by -27 points)

Open Interest Change: -3.3%

Volume Change: -18.5%

NIFTY Weekly Expiry (24/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.857 (Increased from 0.588)

Put-Call Ratio (Volume): 0.849

Max Pain Level: 25100

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25600

Highest PUT Addition: 25100

NIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.951 (Increased from 0.920)

Put-Call Ratio (Volume): 0.885

Max Pain Level: 25200

Maximum CALL Open Interest: 25500

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26000

Highest PUT Addition: 24000

BANKNIFTY JULY Future

BANKNIFTY Spot closed at: 56,952.75 (1.19%)

BANKNIFTY JULY Future closed at: 56,981.80 (1.00%)

Premium: 29.05 (Decreased by -103.55 points)

Open Interest Change: -8.5%

Volume Change: 13.7%

BANKNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.832 (Increased from 0.715)

Put-Call Ratio (Volume): 0.781

Max Pain Level: 56700

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 56000

Highest CALL Addition: 56900

Highest PUT Addition: 56800

FINNIFTY JULY Future

FINNIFTY Spot closed at: 26,986.95 (1.62%)

FINNIFTY JULY Future closed at: 27,012.10 (1.52%)

Premium: 25.15 (Decreased by -26.7 points)

Open Interest Change: -3.6%

Volume Change: 8.9%

FINNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.859 (Increased from 0.719)

Put-Call Ratio (Volume): 0.880

Max Pain Level: 26900

Maximum CALL Open Interest: 28000

Maximum PUT Open Interest: 26700

Highest CALL Addition: 27100

Highest PUT Addition: 26700

MIDCPNIFTY JULY Future

MIDCPNIFTY Spot closed at: 13,301.00 (0.99%)

MIDCPNIFTY JULY Future closed at: 13,336.35 (1.01%)

Premium: 35.35 (Increased by 3.85 points)

Open Interest Change: 0.2%

Volume Change: -9.8%

MIDCPNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.874 (Increased from 0.750)

Put-Call Ratio (Volume): 0.901

Max Pain Level: 13300

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13600

Highest PUT Addition: 13200

SENSEX Weekly Expiry (22/07/2025) Future

SENSEX Spot closed at: 82,200.34 (0.54%)

SENSEX Weekly Future closed at: 82,202.85 (0.38%)

Premium: 2.51 (Decreased by -128.96 points)

Open Interest Change: -18.7%

Volume Change: 26.7%

SENSEX Weekly Expiry (22/07/2025) Option Analysis

Put-Call Ratio (OI): 0.889 (Increased from 0.639)

Put-Call Ratio (Volume): 0.925

Max Pain Level: 82100

Maximum CALL OI: 84000

Maximum PUT OI: 81000

Highest CALL Addition: 83200

Highest PUT Addition: 81000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,681.23 Cr

DIIs Net BUY: ₹ 3,578.43 Cr

FII Derivatives Activity

| FII Trading Stats | 21.07.25 | 18.07.25 | 17.07.25 |

| FII Cash (Provisional Data) | -1,681.23 | 374.74 | -3,694.31 |

| Index Future Open Interest Long Ratio | 15.14% | 15.02% | 16.72% |

| Index Future Volume Long Ratio | 55.10% | 35.56% | 33.12% |

| Call Option Open Interest Long Ratio | 49.90% | 50.01% | 53.46% |

| Call Option Volume Long Ratio | 49.98% | 49.39% | 50.10% |

| Put Option Open Interest Long Ratio | 59.51% | 63.82% | 64.99% |

| Put Option Volume Long Ratio | 49.37% | 50.28% | 50.31% |

| Stock Future Open Interest Long Ratio | 62.07% | 62.04% | 62.28% |

| Stock Future Volume Long Ratio | 49.14% | 48.10% | 48.74% |

| Index Futures | Short Covering | Fresh Short | Fresh Short |

| Index Options | Fresh Short | Fresh Short | Short Covering |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Short |

| Nifty Options | Fresh Short | Fresh Short | Short Covering |

| BankNifty Futures | Short Covering | Fresh Short | Fresh Short |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Short |

| FinNifty Futures | Short Covering | Long Covering | Fresh Short |

| FinNifty Options | Long Covering | Fresh Long | Fresh Long |

| MidcpNifty Futures | Long Covering | Fresh Short | Fresh Long |

| MidcpNifty Options | Long Covering | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Fresh Short | Short Covering | Short Covering |

| NiftyNxt50 Options | Short Covering | Fresh Short | Fresh Long |

| Stock Futures | Long Covering | Long Covering | Long Covering |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

NSE & BSE Option market Trends : Options Insights

NIFTY weekly Expiry (24/07/2025)

The NIFTY index closed at 25090.7. The NIFTY weekly expiry for JULY 24, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.857 against previous 0.588. The 26000CE option holds the maximum open interest, followed by the 24000PE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25100PE option, with open interest additions also seen in the 25000PE and 24000PE options. On the other hand, open interest reductions were prominent in the 25900CE, 25200CE, and 26500CE options. Trading volume was highest in the 25100CE option, followed by the 25000PE and 25000CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 24-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,090.70 | 0.857 | 0.588 | 0.849 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 13,28,08,950 | 13,21,48,875 | 6,60,075 |

| PUT: | 11,38,44,375 | 7,76,96,700 | 3,61,47,675 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 96,81,075 | 8,22,000 | 7,79,986 |

| 25,500 | 79,19,250 | 11,29,575 | 14,57,627 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 46,71,225 | 11,42,700 | 8,25,217 |

| 25,500 | 79,19,250 | 11,29,575 | 14,57,627 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 34,11,225 | -21,21,525 | 4,92,176 |

| 25,200 | 71,67,150 | -13,88,175 | 25,65,603 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 75,21,000 | 1,69,350 | 38,36,875 |

| 25,000 | 42,00,150 | -11,35,200 | 33,10,281 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 82,13,250 | 32,27,475 | 6,17,014 |

| 25,000 | 79,67,325 | 33,06,375 | 37,76,361 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 70,18,650 | 50,06,700 | 17,65,171 |

| 25,000 | 79,67,325 | 33,06,375 | 37,76,361 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,800 | 21,31,800 | -6,46,350 | 2,50,373 |

| 23,700 | 17,55,975 | -2,97,600 | 1,37,903 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 79,67,325 | 33,06,375 | 37,76,361 |

| 24,900 | 74,40,675 | 25,80,675 | 27,12,521 |

SENSEX weekly Expiry (22/07/2025)

The SENSEX index closed at 82200.34. The SENSEX weekly expiry for JULY 22, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.889 against previous 0.639. The 84000CE option holds the maximum open interest, followed by the 83000CE and 83500CE options. Market participants have shown increased interest with significant open interest additions in the 81000PE option, with open interest additions also seen in the 82000PE and 83200CE options. On the other hand, open interest reductions were prominent in the 82000CE, 86000CE, and 79500PE options. Trading volume was highest in the 82000PE option, followed by the 82000CE and 82500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 22-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82200.34 | 0.889 | 0.639 | 0.925 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,22,32,880 | 1,84,85,380 | 37,47,500 |

| PUT: | 1,97,54,280 | 1,18,09,689 | 79,44,591 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 18,19,440 | 3,48,580 | 2,02,36,940 |

| 83000 | 15,66,800 | 4,92,160 | 5,51,17,660 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83200 | 9,44,800 | 6,90,020 | 1,77,32,160 |

| 83500 | 15,58,020 | 6,85,180 | 2,64,58,780 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 7,03,040 | -2,50,840 | 7,78,82,880 |

| 86000 | 2,85,080 | -2,13,520 | 28,04,720 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 7,03,040 | -2,50,840 | 7,78,82,880 |

| 82500 | 14,32,500 | 3,98,840 | 7,74,11,880 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 14,48,140 | 9,01,220 | 4,82,48,020 |

| 82000 | 14,12,920 | 8,72,600 | 8,29,00,840 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 14,48,140 | 9,01,220 | 4,82,48,020 |

| 82000 | 14,12,920 | 8,72,600 | 8,29,00,840 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 79500 | 6,46,920 | -1,67,140 | 83,86,060 |

| 78500 | 2,35,100 | -1,22,960 | 32,19,520 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 14,12,920 | 8,72,600 | 8,29,00,840 |

| 81500 | 11,79,360 | 6,78,800 | 6,60,73,680 |

NIFTY Monthly Expiry (31/07/2025)

The NIFTY index closed at 25090.7. The NIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.951 against previous 0.920. The 25500CE option holds the maximum open interest, followed by the 26000CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 24000PE option, with open interest additions also seen in the 23500PE and 26000CE options. On the other hand, open interest reductions were prominent in the 25600PE, 25000PE, and 25300PE options. Trading volume was highest in the 25000PE option, followed by the 25000CE and 25500CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,090.70 | 0.951 | 0.920 | 0.885 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,40,48,675 | 5,17,08,825 | 23,39,850 |

| PUT: | 5,14,10,025 | 4,75,92,975 | 38,17,050 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 59,25,675 | 40,275 | 1,27,564 |

| 26,000 | 56,29,500 | 3,60,975 | 88,195 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 56,29,500 | 3,60,975 | 88,195 |

| 25,300 | 24,28,350 | 3,59,325 | 1,05,562 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 5,48,925 | -90,675 | 14,929 |

| 24,500 | 6,50,250 | -58,200 | 8,740 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 38,20,575 | 39,600 | 1,56,373 |

| 25,500 | 59,25,675 | 40,275 | 1,27,564 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 52,52,400 | -1,46,025 | 1,59,083 |

| 24,500 | 36,13,275 | 2,72,100 | 96,412 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 33,92,625 | 5,20,425 | 76,129 |

| 23,500 | 22,33,350 | 3,63,750 | 22,244 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 8,70,900 | -1,68,600 | 5,261 |

| 25,000 | 52,52,400 | -1,46,025 | 1,59,083 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 52,52,400 | -1,46,025 | 1,59,083 |

| 24,900 | 16,16,475 | 3,41,025 | 97,643 |

BANKNIFTY Monthly Expiry (31/07/2025)

The BANKNIFTY index closed at 56952.75. The BANKNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.832 against previous 0.715. The 56000PE option holds the maximum open interest, followed by the 57000CE and 60000CE options. Market participants have shown increased interest with significant open interest additions in the 56800PE option, with open interest additions also seen in the 54000PE and 56700PE options. On the other hand, open interest reductions were prominent in the 59500CE, 56000CE, and 56500CE options. Trading volume was highest in the 57000CE option, followed by the 56500CE and 56000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 56,952.75 | 0.832 | 0.715 | 0.781 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,89,29,540 | 2,14,84,470 | -25,54,930 |

| PUT: | 1,57,40,375 | 1,53,59,899 | 3,80,476 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 16,78,390 | -2,92,320 | 3,13,035 |

| 60,000 | 12,71,585 | -71,225 | 97,611 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,900 | 3,89,585 | 1,31,145 | 1,26,325 |

| 59,000 | 11,42,120 | 1,04,545 | 1,26,418 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 3,99,455 | -4,40,370 | 84,185 |

| 56,000 | 10,04,360 | -4,15,520 | 52,314 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 16,78,390 | -2,92,320 | 3,13,035 |

| 56,500 | 4,56,995 | -3,83,495 | 2,07,716 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 19,17,860 | -3,44,610 | 2,00,249 |

| 57,000 | 10,24,240 | 40,355 | 1,65,655 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,800 | 3,15,350 | 1,65,270 | 1,33,008 |

| 54,000 | 7,54,005 | 1,59,565 | 73,182 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 19,17,860 | -3,44,610 | 2,00,249 |

| 52,000 | 4,04,145 | -1,51,445 | 23,581 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 19,17,860 | -3,44,610 | 2,00,249 |

| 56,500 | 8,44,795 | -6,755 | 1,99,983 |

FINNIFTY Monthly Expiry (31/07/2025)

The FINNIFTY index closed at 26986.95. The FINNIFTY monthly expiry for JULY 31, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.859 against previous 0.719. The 28000CE option holds the maximum open interest, followed by the 27000CE and 28500CE options. Market participants have shown increased interest with significant open interest additions in the 26700PE option, with open interest additions also seen in the 27100CE and 26800CE options. On the other hand, open interest reductions were prominent in the 26300PE, 28050CE, and 27000CE options. Trading volume was highest in the 27000CE option, followed by the 26900CE and 27500CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,986.95 | 0.859 | 0.719 | 0.880 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 14,90,450 | 14,91,750 | -1,300 |

| PUT: | 12,80,240 | 10,71,850 | 2,08,390 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 1,79,530 | -7,020 | 5,432 |

| 27,000 | 1,29,220 | -25,870 | 10,068 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,100 | 73,125 | 43,485 | 4,039 |

| 26,800 | 82,030 | 32,825 | 6,808 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,050 | 23,140 | -40,235 | 1,357 |

| 27,000 | 1,29,220 | -25,870 | 10,068 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,29,220 | -25,870 | 10,068 |

| 26,900 | 50,310 | -3,640 | 7,975 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 1,10,500 | 65,520 | 7,328 |

| 27,000 | 94,900 | 18,070 | 4,000 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 1,10,500 | 65,520 | 7,328 |

| 25,800 | 40,885 | 32,695 | 1,560 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 21,060 | -48,425 | 2,346 |

| 25,500 | 77,025 | -18,200 | 2,428 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 1,10,500 | 65,520 | 7,328 |

| 26,900 | 62,920 | 22,555 | 7,239 |

MIDCPNIFTY Monthly Expiry (31/07/2025)

The MIDCPNIFTY index closed at 13301. The MIDCPNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.874 against previous 0.750. The 14000CE option holds the maximum open interest, followed by the 13000PE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 13200PE option, with open interest additions also seen in the 13100PE and 13600CE options. On the other hand, open interest reductions were prominent in the 68500CE, 69000CE, and 68800CE options. Trading volume was highest in the 13300CE option, followed by the 13500CE and 13200PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,301.00 | 0.874 | 0.750 | 0.901 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,01,01,560 | 1,04,15,160 | -3,13,600 |

| PUT: | 88,30,080 | 78,10,880 | 10,19,200 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 14,60,620 | 2,800 | 7,933 |

| 13,500 | 11,67,320 | 35,700 | 24,253 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 6,37,980 | 1,46,020 | 9,036 |

| 13,550 | 2,29,460 | 1,39,860 | 2,656 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 5,46,420 | -2,67,960 | 29,571 |

| 14,800 | 1,37,900 | -1,88,580 | 2,346 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 5,46,420 | -2,67,960 | 29,571 |

| 13,500 | 11,67,320 | 35,700 | 24,253 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 13,17,960 | -58,100 | 15,462 |

| 13,300 | 6,11,660 | 1,34,960 | 18,317 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 5,54,260 | 2,91,200 | 18,653 |

| 13,100 | 4,98,680 | 1,87,320 | 10,556 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 3,40,900 | -1,00,520 | 7,253 |

| 13,000 | 13,17,960 | -58,100 | 15,462 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 5,54,260 | 2,91,200 | 18,653 |

| 13,300 | 6,11,660 | 1,34,960 | 18,317 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis suggests the market is trying to establish a floor after several days of selling, but buyers are still tiptoeing in. For Nifty, the 25,000–25,100 zone is critical support—a hold here could spark a further move to 25,250 and possibly 25,600 where heavy call open interest is clustered.

On the flip side, a close below 25,000 will likely see a revisit to the 24,900–24,800 support bands. Options data points to a battle between short-covering and lingering skepticism, so traders may look for quick straddle opportunities at 25,100 or prepare for sudden directional moves if Nifty decisively breaks the 25,000 or 25,250 levels. BankNifty’s sharp drop in OI and premium alongside a healthy price rally signals that bears are booking profits and smart money is buying dips—watch for sustained moves above 57,000 as a sign of new momentum.

For FINNIFTY and MIDCPNIFTY, the recovery is restrained but notable: financials and midcaps could provide the next sectoral leadership if overall sentiment improves. For now, let this Open Interest Volume Analysis be your tactical map—favoring range-bound or quick-react plays as markets attempt to find direction in a still jittery landscape.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]