Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 25/07/2025

Table of Contents

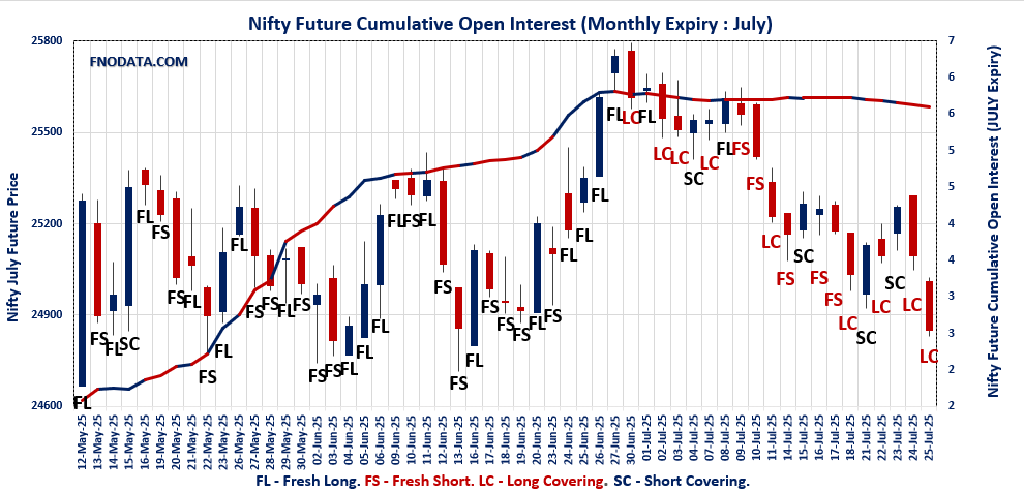

The Open Interest Volume Analysis for 25th July 2025 signals a decisive turn for Indian indices as expiry approaches, with bears clearly in the driver’s seat. Nifty July futures retreated sharply by nearly 1% to 24,850.40, accompanied by a 1.6% drop in open interest—a sign that traders are not just booking profits but pulling back their participation altogether. The premium collapsed by nearly 20 points, reflecting the lack of appetite for holding risky long positions into the weekend.

Option data amplifies the caution: the monthly Put-Call Ratio (OI) for Nifty tanked to a notably bearish 0.575, as call writers swarmed the 25,000 strike and put support marched down to 24,700—making 25,000 the next battleground for expiry fate. Across the desk, BankNifty, FINNIFTY, and MIDCPNIFTY all echoed this tone, each notching solid declines in both price and open interest, further underlining that risk-off sentiment is ruling the derivative landscape.

Derivative Insights

Nifty:

Fresh shorts are getting unwound and risk appetite is drying up.

Strongest call OI and additions are at 25,000, forming an immediate ceiling.

PCR (OI) below 0.6 is deeply bearish; any selloff below 24,800 could snowball, targeting 24,700 and below.

BankNifty:

Spot and futures both slid nearly 1% and OI fell nearly 3%.

PCR (OI) at 0.67 and highest call OI at 57,000 paint a clear picture of sellers dominating the upper hand; look for expiry pinning near 56,800 to 57,000.

Financials & Midcaps:

FINNIFTY and MIDCPNIFTY both endured pronounced weakness, with FINNIFTY OI down over 6% and MIDCPNIFTY premiums sharply lower.

PCR (OI) for FINNIFTY tumbled below 0.73, signaling a withdrawal of bullish bets.

MIDCPNIFTY’s OI actually rose as price fell, a textbook sign of fresh short buildup.

SENSEX:

Despite a hefty price and OI jump, heavy call writing at 83,500/84,000 and dropping PCR (OI) signal any upside will be capped by expiry hedges.

Actionable Takeaways

Nifty traders: Focus on protective or bearish strategies. Vertical put spreads or shorting at resistance (around 25,000) may be optimal if spot closes below 24,800.

BankNifty: Watch for expiry gravitation to the 56,800–57,000 band—but rallies toward 57,000 or higher should be met with caution and tight stops.

FINNIFTY & MIDCPNIFTY: Only aggressive bottom-fishing should be attempted near max pain or if strong reversal signs appear; otherwise, trend-following shorts may offer better risk-reward.

SENSEX: Expiry watch on 81,700–82,000 for settlement; aggressive upside is likely to encounter stiff opposition from option sellers.

NSE & BSE F&O Market Signals

NIFTY JULY Future

NIFTY Spot closed at: 24,837.00 (-0.90%)

NIFTY JULY Future closed at: 24,850.40 (-0.98%)

Premium: 13.4 (Decreased by -19.9 points)

Open Interest Change: -1.6%

Volume Change: 10.3%

NIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.575 (Decreased from 0.757)

Put-Call Ratio (Volume): 1.077

Max Pain Level: 25000

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25000

Highest PUT Addition: 24700

BANKNIFTY JULY Future

BANKNIFTY Spot closed at: 56,528.90 (-0.94%)

BANKNIFTY JULY Future closed at: 56,585.80 (-0.93%)

Premium: 56.9 (Increased by 5.35 points)

Open Interest Change: -2.8%

Volume Change: 46.1%

BANKNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.674 (Decreased from 0.839)

Put-Call Ratio (Volume): 1.070

Max Pain Level: 56800

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 56000

Highest CALL Addition: 57000

Highest PUT Addition: 56200

FINNIFTY JULY Future

FINNIFTY Spot closed at: 26,808.00 (-0.88%)

FINNIFTY JULY Future closed at: 26,824.60 (-0.94%)

Premium: 16.6 (Decreased by -15.7 points)

Open Interest Change: -6.2%

Volume Change: 82.4%

FINNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.727 (Decreased from 0.836)

Put-Call Ratio (Volume): 1.127

Max Pain Level: 26900

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 26800

MIDCPNIFTY JULY Future

MIDCPNIFTY Spot closed at: 12,925.90 (-1.39%)

MIDCPNIFTY JULY Future closed at: 12,948.95 (-1.45%)

Premium: 23.05 (Decreased by -9.2 points)

Open Interest Change: 1.2%

Volume Change: 0.5%

MIDCPNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.556 (Decreased from 0.692)

Put-Call Ratio (Volume): 0.771

Max Pain Level: 13075

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12500

Highest CALL Addition: 13000

Highest PUT Addition: 12800

SENSEX Weekly Expiry (29/07/2025) Future

SENSEX Spot closed at: 81,463.09 (-0.88%)

SENSEX Weekly Future closed at: 81,530.70 (-0.91%)

Premium: 67.61 (Decreased by -28.02 points)

Open Interest Change: 8.0%

Volume Change: 28.5%

SENSEX Weekly Expiry (29/07/2025) Option Analysis

Put-Call Ratio (OI): 0.546 (Decreased from 0.674)

Put-Call Ratio (Volume): 1.187

Max Pain Level: 81700

Maximum CALL OI: 84000

Maximum PUT OI: 81500

Highest CALL Addition: 83500

Highest PUT Addition: 81500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,979.96 Cr

DIIs Net BUY: ₹ 2,138.59 Cr

FII Derivatives Activity

| FII Trading Stats | 25.07.25 | 24.07.25 | 23.07.25 |

| FII Cash (Provisional Data) | -1,979.96 | -2,133.69 | -4,209.11 |

| Index Future Open Interest Long Ratio | 14.29% | 14.83% | 15.33% |

| Index Future Volume Long Ratio | 39.04% | 50.02% | 59.09% |

| Call Option Open Interest Long Ratio | 48.42% | 52.07% | 50.98% |

| Call Option Volume Long Ratio | 49.34% | 49.80% | 50.34% |

| Put Option Open Interest Long Ratio | 63.25% | 63.39% | 57.17% |

| Put Option Volume Long Ratio | 50.43% | 50.11% | 49.55% |

| Stock Future Open Interest Long Ratio | 61.55% | 61.92% | 61.98% |

| Stock Future Volume Long Ratio | 47.62% | 48.54% | 51.69% |

| Index Futures | Fresh Short | Short Covering | Fresh Long |

| Index Options | Fresh Short | Long Covering | Fresh Short |

| Nifty Futures | Fresh Short | Short Covering | Fresh Long |

| Nifty Options | Fresh Short | Long Covering | Fresh Short |

| BankNifty Futures | Fresh Short | Long Covering | Short Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Long | Long Covering | Fresh Long |

| FinNifty Options | Short Covering | Fresh Short | Fresh Short |

| MidcpNifty Futures | Fresh Short | Long Covering | Fresh Short |

| MidcpNifty Options | Fresh Long | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Fresh Short | Short Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Short | Fresh Short | Fresh Long |

| Stock Futures | Long Covering | Long Covering | Fresh Long |

| Stock Options | Short Covering | Fresh Long | Fresh Long |

NSE & BSE Option market Trends : Options Insights

SENSEX weekly Expiry (29/07/2025)

The SENSEX index closed at 81463.09. The SENSEX weekly expiry for JULY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.546 against previous 0.674. The 84000CE option holds the maximum open interest, followed by the 85000CE and 83500CE options. Market participants have shown increased interest with significant open interest additions in the 83500CE option, with open interest additions also seen in the 82000CE and 81500CE options. On the other hand, open interest reductions were prominent in the 82100PE, 82000PE, and 82200PE options. Trading volume was highest in the 81500PE option, followed by the 81000PE and 82000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 29-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81463.09 | 0.546 | 0.674 | 1.187 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,19,57,120 | 1,27,29,829 | 92,27,291 |

| PUT: | 1,19,92,980 | 85,83,680 | 34,09,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 12,91,720 | 4,97,000 | 1,29,49,600 |

| 85000 | 12,74,740 | 4,83,460 | 90,45,320 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 12,50,680 | 7,64,020 | 1,25,04,740 |

| 82000 | 10,12,580 | 7,25,660 | 3,47,28,500 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 86500 | 1,24,120 | -1,38,380 | 20,93,960 |

| 84100 | 1,35,040 | -77,860 | 19,14,760 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 10,12,580 | 7,25,660 | 3,47,28,500 |

| 81800 | 4,45,200 | 4,26,880 | 2,37,54,160 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 9,76,480 | 6,13,440 | 5,24,66,400 |

| 80000 | 8,17,060 | 1,39,080 | 1,86,16,680 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 9,76,480 | 6,13,440 | 5,24,66,400 |

| 81000 | 6,69,320 | 2,91,500 | 4,08,07,540 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82100 | 55,900 | -2,49,700 | 38,76,100 |

| 82000 | 2,80,780 | -2,16,560 | 1,56,61,160 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 9,76,480 | 6,13,440 | 5,24,66,400 |

| 81000 | 6,69,320 | 2,91,500 | 4,08,07,540 |

NIFTY Monthly Expiry (31/07/2025)

The NIFTY index closed at 24837. The NIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.575 against previous 0.757. The 25000CE option holds the maximum open interest, followed by the 26000CE and 25200CE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 24900CE and 25200CE options. On the other hand, open interest reductions were prominent in the 25000PE, 25100PE, and 25200PE options. Trading volume was highest in the 24800PE option, followed by the 24900PE and 25000CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,837.00 | 0.575 | 0.757 | 1.077 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 19,08,40,500 | 11,76,01,125 | 7,32,39,375 |

| PUT: | 10,97,40,900 | 8,90,72,700 | 2,06,68,200 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,45,44,975 | 95,48,025 | 27,74,857 |

| 26,000 | 1,31,56,200 | 12,25,725 | 8,34,557 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,45,44,975 | 95,48,025 | 27,74,857 |

| 24,900 | 64,61,925 | 58,53,225 | 22,82,490 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,200 | 3,18,000 | -79,275 | 30,426 |

| 23,000 | 5,33,550 | -43,875 | 993 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,45,44,975 | 95,48,025 | 27,74,857 |

| 24,900 | 64,61,925 | 58,53,225 | 22,82,490 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 82,64,175 | -82,950 | 6,47,194 |

| 24,500 | 63,38,850 | 10,81,050 | 14,18,420 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 54,56,625 | 29,51,850 | 18,55,506 |

| 24,600 | 42,71,475 | 18,26,550 | 12,85,691 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 62,70,825 | -14,00,925 | 17,83,720 |

| 25,100 | 30,68,700 | -8,88,675 | 4,25,659 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 51,54,450 | 3,57,375 | 32,86,764 |

| 24,900 | 38,10,375 | 7,04,175 | 32,73,552 |

BANKNIFTY Monthly Expiry (31/07/2025)

The BANKNIFTY index closed at 56528.9. The BANKNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.674 against previous 0.839. The 57000CE option holds the maximum open interest, followed by the 60000CE and 58000CE options. Market participants have shown increased interest with significant open interest additions in the 57000CE option, with open interest additions also seen in the 56500CE and 56800CE options. On the other hand, open interest reductions were prominent in the 57000PE, 58300CE, and 46000PE options. Trading volume was highest in the 57000CE option, followed by the 56500PE and 57000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 56,528.90 | 0.674 | 0.839 | 1.070 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,39,69,015 | 2,03,93,809 | 35,75,206 |

| PUT: | 1,61,53,305 | 1,71,16,575 | -9,63,270 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 20,47,010 | 4,84,575 | 4,82,408 |

| 60,000 | 15,52,950 | -90,300 | 87,978 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 20,47,010 | 4,84,575 | 4,82,408 |

| 56,500 | 6,76,410 | 3,66,030 | 2,31,543 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,300 | 1,84,590 | -3,14,160 | 82,518 |

| 60,500 | 3,49,510 | -2,19,695 | 33,677 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 20,47,010 | 4,84,575 | 4,82,408 |

| 56,500 | 6,76,410 | 3,66,030 | 2,31,543 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 12,34,590 | -1,12,770 | 3,06,720 |

| 55,000 | 10,72,120 | -88,830 | 1,59,781 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,200 | 3,37,260 | 1,30,305 | 1,16,437 |

| 55,400 | 1,96,595 | 98,350 | 53,688 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 10,16,540 | -3,32,920 | 3,94,872 |

| 46,000 | 6,38,645 | -2,34,080 | 31,788 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,500 | 8,04,405 | -25,690 | 4,28,676 |

| 57,000 | 10,16,540 | -3,32,920 | 3,94,872 |

FINNIFTY Monthly Expiry (31/07/2025)

The FINNIFTY index closed at 26808. The FINNIFTY monthly expiry for JULY 31, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.727 against previous 0.836. The 27000CE option holds the maximum open interest, followed by the 28000CE and 27500CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 26900CE and 27500CE options. On the other hand, open interest reductions were prominent in the 27000PE, 28000CE, and 27200CE options. Trading volume was highest in the 26800PE option, followed by the 27000CE and 26700PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,808.00 | 0.727 | 0.836 | 1.127 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 24,97,560 | 18,91,695 | 6,05,865 |

| PUT: | 18,15,320 | 15,81,970 | 2,33,350 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 3,01,925 | 2,22,690 | 42,704 |

| 28,000 | 2,68,775 | -41,470 | 10,579 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 3,01,925 | 2,22,690 | 42,704 |

| 26,900 | 1,06,340 | 83,265 | 14,314 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 2,68,775 | -41,470 | 10,579 |

| 27,200 | 1,01,530 | -31,135 | 11,983 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 3,01,925 | 2,22,690 | 42,704 |

| 27,100 | 90,220 | 11,830 | 17,461 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,67,635 | -13,910 | 10,848 |

| 26,800 | 1,09,785 | 51,220 | 52,022 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 1,09,785 | 51,220 | 52,022 |

| 26,700 | 1,02,505 | 47,580 | 18,021 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,04,195 | -56,290 | 14,020 |

| 27,100 | 43,095 | -17,030 | 4,062 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 1,09,785 | 51,220 | 52,022 |

| 26,700 | 1,02,505 | 47,580 | 18,021 |

MIDCPNIFTY Monthly Expiry (31/07/2025)

The MIDCPNIFTY index closed at 12925.9. The MIDCPNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.556 against previous 0.692. The 13500CE option holds the maximum open interest, followed by the 13300CE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 13000CE option, with open interest additions also seen in the 13100CE and 12800PE options. On the other hand, open interest reductions were prominent in the 69000CE, 68500PE, and 68500PE options. Trading volume was highest in the 13100CE option, followed by the 13000PE and 13200CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,925.90 | 0.556 | 0.692 | 0.771 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,01,49,500 | 1,57,58,680 | 43,90,820 |

| PUT: | 1,11,98,320 | 1,09,11,880 | 2,86,440 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 18,48,560 | 62,300 | 37,139 |

| 13,300 | 17,49,440 | 4,87,340 | 51,271 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 14,09,940 | 10,44,680 | 55,789 |

| 13,100 | 10,57,560 | 6,36,440 | 81,961 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,500 | 6,57,580 | -1,49,240 | 5,852 |

| 14,000 | 17,06,880 | -88,200 | 27,501 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 10,57,560 | 6,36,440 | 81,961 |

| 13,200 | 15,45,460 | 3,25,920 | 57,455 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 10,46,360 | 45,360 | 24,050 |

| 13,000 | 9,48,080 | -4,56,260 | 80,242 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 9,05,520 | 5,46,420 | 35,654 |

| 12,750 | 2,41,920 | 1,92,080 | 6,386 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 9,48,080 | -4,56,260 | 80,242 |

| 13,200 | 4,58,220 | -3,67,360 | 10,867 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 9,48,080 | -4,56,260 | 80,242 |

| 12,900 | 6,19,500 | 41,860 | 55,375 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis makes it clear that sellers are dictating the pace and expiry gravity is shifting lower across the board. Nifty’s 25,000 is now a psychological and technical pivot: lose it, and the floodgates could open to 24,700 or even 24,500. For the prudent trader, range-bound or bearish spreads and cautious intraday plays are the setups of choice until reversal signals emerge. BankNifty, FINNIFTY, and MIDCPNIFTY face similar expiry-linked hurdles, with heavy call OI capping upside while puts retreat to lower strikes. Unless buyers step in with strong demand, this Open Interest Volume Analysis will continue to favor shorts and hedges, offering clarity amidst expiry volatility. Stay nimble, keep stops tight, and let data—not emotion—drive trading decisions in the days ahead.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]