Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 28/07/2025

Table of Contents

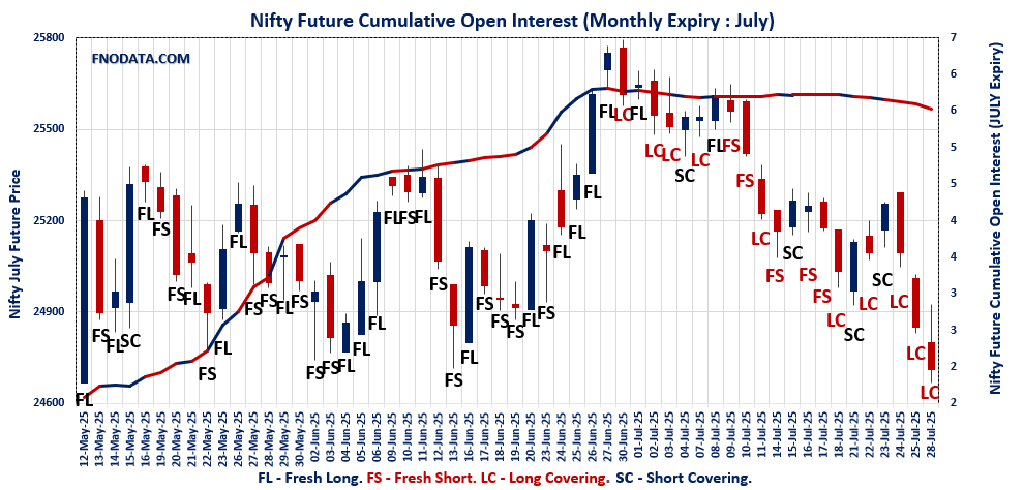

The Open Interest Volume Analysis for 28th July 2025 shows that pressure is mounting across Indian indices as the July expiry nears, with bears keeping a tight grip. Nifty July futures closed down 0.56% at 24,710.20, but the real story is the huge 7.8% plunge in open interest—a clear sign of heavy long liquidation and traders quickly moving to the sidelines rather than taking fresh risks. Notably, the futures premium jumped by nearly 16 points despite the drop, reflecting increased hedging and nervous short covering as spot prices struggle around the key 24,700 level.

On the options side, the monthly Put-Call Ratio (OI) for Nifty crashed to a deeply bearish 0.51—one of the lowest readings this series—while max pain has slumped further to 24,850, indicating where the bulk of settlement pain will lie for option sellers. Call writers continue to build at the 24,800 strike, and fresh put writers have retreated toward 24,600–24,400, suggesting market participants see more downside before stabilization.

BankNifty and FINNIFTY echoed these risk-off vibes, both seeing heavy drops in price (around 0.7–0.8%), sharply higher premiums, and steep open interest decline. The BankNifty PCR (OI) sank to 0.59, while FINNIFTY’s hit 0.69, as call writing dominated and support shifted to lower strikes. MIDCPNIFTY remains under similar pressure with a near-15% collapse in OI and further PCR dip, signaling further portfolio derisking in the midcap space. SENSEX, too, saw both price and OI roll back but retained a wide premium, as index participants positioned defensively for expiry. Across the board, the Open Interest Volume Analysis points to a market still in liquidation mode, with option flows telegraphing little hope for an immediate turnaround.

NSE & BSE F&O Market Signals

NIFTY JULY Future

NIFTY Spot closed at: 24,680.90 (-0.63%)

NIFTY JULY Future closed at: 24,710.20 (-0.56%)

Premium: 29.3 (Increased by 15.9 points)

Open Interest Change: -7.8%

Volume Change: 2.2%

NIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.511 (Decreased from 0.575)

Put-Call Ratio (Volume): 0.967

Max Pain Level: 24850

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 24800

Highest PUT Addition: 24600

BANKNIFTY JULY Future

BANKNIFTY Spot closed at: 56,084.90 (-0.79%)

BANKNIFTY JULY Future closed at: 56,179.00 (-0.72%)

Premium: 94.1 (Increased by 37.2 points)

Open Interest Change: -9.5%

Volume Change: -21.4%

BANKNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.596 (Decreased from 0.672)

Put-Call Ratio (Volume): 0.935

Max Pain Level: 56500

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 56000

Highest CALL Addition: 58500

Highest PUT Addition: 54500

FINNIFTY JULY Future

FINNIFTY Spot closed at: 26,615.20 (-0.72%)

FINNIFTY JULY Future closed at: 26,659.90 (-0.61%)

Premium: 44.7 (Increased by 28.1 points)

Open Interest Change: -7.8%

Volume Change: -36.1%

FINNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.694 (Decreased from 0.727)

Put-Call Ratio (Volume): 1.000

Max Pain Level: 26800

Maximum CALL Open Interest: 27500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27500

Highest PUT Addition: 26500

MIDCPNIFTY JULY Future

MIDCPNIFTY Spot closed at: 12,898.95 (-0.21%)

MIDCPNIFTY JULY Future closed at: 12,921.40 (-0.21%)

Premium: 22.45 (Decreased by -0.6 points)

Open Interest Change: -14.8%

Volume Change: 85.5%

MIDCPNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.571 (Increased from 0.556)

Put-Call Ratio (Volume): 0.840

Max Pain Level: 13000

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12500

Highest CALL Addition: 12900

Highest PUT Addition: 12900

SENSEX Weekly Expiry (29/07/2025) Future

SENSEX Spot closed at: 80,891.02 (-0.70%)

SENSEX Weekly Future closed at: 80,973.90 (-0.68%)

Premium: 82.88 (Increased by 15.27 points)

Open Interest Change: -7.2%

Volume Change: 13.8%

SENSEX Weekly Expiry (29/07/2025) Option Analysis

Put-Call Ratio (OI): 0.503 (Decreased from 0.546)

Put-Call Ratio (Volume): 1.129

Max Pain Level: 81100

Maximum CALL OI: 82500

Maximum PUT OI: 80000

Highest CALL Addition: 81000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 6,082.47 Cr

DIIs Net BUY: ₹ 6,764.55 Cr

FII Derivatives Activity

| FII Trading Stats | 28.07.25 | 25.07.25 | 24.07.25 |

| FII Cash (Provisional Data) | -6,082.47 | -1,979.96 | -2,133.69 |

| Index Future Open Interest Long Ratio | 14.61% | 14.29% | 14.83% |

| Index Future Volume Long Ratio | 45.10% | 39.04% | 50.02% |

| Call Option Open Interest Long Ratio | 45.98% | 48.42% | 52.07% |

| Call Option Volume Long Ratio | 49.55% | 49.34% | 49.80% |

| Put Option Open Interest Long Ratio | 62.95% | 63.25% | 63.39% |

| Put Option Volume Long Ratio | 50.07% | 50.43% | 50.11% |

| Stock Future Open Interest Long Ratio | 61.84% | 61.55% | 61.92% |

| Stock Future Volume Long Ratio | 50.40% | 47.62% | 48.54% |

| Index Futures | Fresh Short | Fresh Short | Short Covering |

| Index Options | Fresh Short | Fresh Short | Long Covering |

| Nifty Futures | Fresh Short | Fresh Short | Short Covering |

| Nifty Options | Fresh Short | Fresh Short | Long Covering |

| BankNifty Futures | Fresh Short | Fresh Short | Long Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Short | Fresh Long | Long Covering |

| FinNifty Options | Fresh Long | Short Covering | Fresh Short |

| MidcpNifty Futures | Fresh Short | Fresh Short | Long Covering |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Fresh Short |

| Stock Futures | Short Covering | Long Covering | Long Covering |

| Stock Options | Short Covering | Short Covering | Fresh Long |

NSE & BSE Option market Trends : Options Insights

SENSEX weekly Expiry (29/07/2025)

The SENSEX index closed at 80891.02. The SENSEX weekly expiry for JULY 29, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.503 against previous 0.546. The 82500CE option holds the maximum open interest, followed by the 83000CE and 82000CE options. Market participants have shown increased interest with significant open interest additions in the 81000CE option, with open interest additions also seen in the 82500CE and 83000CE options. On the other hand, open interest reductions were prominent in the 81500PE, 81600PE, and 85000CE options. Trading volume was highest in the 81000PE option, followed by the 80500PE and 81500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 29-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80891.02 | 0.503 | 0.546 | 1.129 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,21,37,760 | 2,19,54,069 | 1,01,83,691 |

| PUT: | 1,61,51,620 | 1,19,92,980 | 41,58,640 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 20,98,880 | 9,73,220 | 3,57,93,920 |

| 83000 | 20,76,040 | 8,56,660 | 3,15,01,820 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 10,88,020 | 10,11,800 | 3,79,85,840 |

| 82500 | 20,98,880 | 9,73,220 | 3,57,93,920 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 10,42,780 | -2,31,960 | 89,74,220 |

| 83400 | 2,83,280 | -1,91,700 | 50,78,420 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 12,86,140 | 5,64,400 | 7,41,65,500 |

| 82000 | 18,20,480 | 8,07,900 | 5,93,18,420 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 13,63,380 | 5,46,320 | 4,75,46,800 |

| 79000 | 11,10,800 | 4,11,160 | 1,30,15,960 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 13,63,380 | 5,46,320 | 4,75,46,800 |

| 80800 | 6,65,360 | 4,82,760 | 5,99,25,180 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 3,13,980 | -6,62,500 | 3,92,83,660 |

| 81600 | 64,920 | -2,33,400 | 1,25,57,280 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 9,22,580 | 2,53,260 | 10,39,48,980 |

| 80500 | 9,12,680 | 2,41,900 | 7,61,43,540 |

NIFTY Monthly Expiry (31/07/2025)

The NIFTY index closed at 24680.9. The NIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.511 against previous 0.575. The 25000CE option holds the maximum open interest, followed by the 26000CE and 25200CE options. Market participants have shown increased interest with significant open interest additions in the 24800CE option, with open interest additions also seen in the 24700CE and 24900CE options. On the other hand, open interest reductions were prominent in the 25000PE, 25750CE, and 24850PE options. Trading volume was highest in the 24800PE option, followed by the 24700PE and 24800CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,680.90 | 0.511 | 0.575 | 0.967 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 22,47,99,150 | 19,08,40,500 | 3,39,58,650 |

| PUT: | 11,47,75,800 | 10,97,40,900 | 50,34,900 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,58,25,150 | 12,80,175 | 28,80,148 |

| 26,000 | 1,44,06,900 | 12,50,700 | 8,80,642 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 1,11,53,175 | 79,25,100 | 34,35,784 |

| 24,700 | 47,33,025 | 39,30,600 | 16,94,293 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,750 | 15,30,375 | -11,83,575 | 3,40,455 |

| 26,500 | 67,66,500 | -10,46,550 | 3,24,712 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 1,11,53,175 | 79,25,100 | 34,35,784 |

| 25,000 | 1,58,25,150 | 12,80,175 | 28,80,148 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 83,90,025 | 1,25,850 | 7,82,676 |

| 24,500 | 74,11,425 | 10,72,575 | 21,95,615 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 59,80,275 | 17,08,800 | 25,55,829 |

| 23,700 | 35,08,800 | 15,20,700 | 3,93,694 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 48,10,650 | -14,60,175 | 5,30,726 |

| 24,850 | 14,15,100 | -11,11,650 | 16,10,615 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 44,42,100 | -7,12,350 | 39,63,243 |

| 24,700 | 50,67,825 | -3,88,800 | 38,74,918 |

BANKNIFTY Monthly Expiry (31/07/2025)

The BANKNIFTY index closed at 56084.9. The BANKNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.596 against previous 0.672. The 57000CE option holds the maximum open interest, followed by the 60000CE and 58000CE options. Market participants have shown increased interest with significant open interest additions in the 58500CE option, with open interest additions also seen in the 56500CE and 57000CE options. On the other hand, open interest reductions were prominent in the 59000CE, 57000PE, and 53000PE options. Trading volume was highest in the 56000PE option, followed by the 56500CE and 56500PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 56,084.90 | 0.596 | 0.672 | 0.935 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,66,01,155 | 2,39,69,015 | 26,32,140 |

| PUT: | 1,58,44,255 | 1,61,13,694 | -2,69,439 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 24,03,380 | 3,56,370 | 3,56,330 |

| 60,000 | 16,47,450 | 94,500 | 89,470 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,500 | 14,75,355 | 6,32,730 | 1,37,714 |

| 56,500 | 11,00,085 | 4,23,675 | 4,39,099 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 12,66,615 | -2,19,240 | 1,05,693 |

| 61,000 | 5,15,690 | -88,865 | 27,851 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,500 | 11,00,085 | 4,23,675 | 4,39,099 |

| 57,000 | 24,03,380 | 3,56,370 | 3,56,330 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 12,01,410 | -33,180 | 5,29,832 |

| 55,000 | 10,19,550 | -52,570 | 1,99,261 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 5,04,140 | 1,59,005 | 80,649 |

| 56,100 | 2,66,490 | 1,17,145 | 2,23,456 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 8,37,060 | -1,79,480 | 72,345 |

| 53,000 | 8,47,875 | -1,61,035 | 47,319 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 12,01,410 | -33,180 | 5,29,832 |

| 56,500 | 6,49,565 | -1,54,840 | 3,80,348 |

FINNIFTY Monthly Expiry (31/07/2025)

The FINNIFTY index closed at 26615.2. The FINNIFTY monthly expiry for JULY 31, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.694 against previous 0.727. The 27500CE option holds the maximum open interest, followed by the 27000CE and 28000CE options. Market participants have shown increased interest with significant open interest additions in the 27500CE option, with open interest additions also seen in the 27700CE and 27100CE options. On the other hand, open interest reductions were prominent in the 28000CE, 27000CE, and 26800PE options. Trading volume was highest in the 26800PE option, followed by the 27000CE and 26800CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,615.20 | 0.694 | 0.727 | 1.000 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 30,31,730 | 24,97,560 | 5,34,170 |

| PUT: | 21,03,140 | 18,15,320 | 2,87,820 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 2,94,190 | 99,060 | 12,482 |

| 27,000 | 2,48,235 | -53,690 | 25,302 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 2,94,190 | 99,060 | 12,482 |

| 27,700 | 1,47,290 | 73,385 | 7,200 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,000 | 2,13,785 | -54,990 | 10,294 |

| 27,000 | 2,48,235 | -53,690 | 25,302 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 2,48,235 | -53,690 | 25,302 |

| 26,800 | 1,51,255 | 67,535 | 21,985 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,72,510 | 4,875 | 12,511 |

| 26,500 | 1,38,125 | 52,260 | 19,816 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,38,125 | 52,260 | 19,816 |

| 25,900 | 1,00,230 | 45,435 | 4,128 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 70,655 | -39,130 | 27,697 |

| 26,750 | 22,880 | -35,750 | 9,624 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 70,655 | -39,130 | 27,697 |

| 26,700 | 1,27,400 | 24,895 | 20,127 |

MIDCPNIFTY Monthly Expiry (31/07/2025)

The MIDCPNIFTY index closed at 12898.95. The MIDCPNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.571 against previous 0.556. The 13500CE option holds the maximum open interest, followed by the 13000CE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 12900CE option, with open interest additions also seen in the 13000CE and 13500CE options. On the other hand, open interest reductions were prominent in the 54500CE, 54500CE, and 54500CE options. Trading volume was highest in the 13000CE option, followed by the 13000PE and 13100CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,898.95 | 0.571 | 0.556 | 0.840 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,03,43,960 | 2,01,49,500 | 1,94,460 |

| PUT: | 1,16,10,340 | 1,11,98,320 | 4,12,020 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 21,07,700 | 2,59,140 | 57,294 |

| 13,000 | 17,15,980 | 3,06,040 | 1,51,008 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 5,22,760 | 3,48,040 | 71,818 |

| 13,000 | 17,15,980 | 3,06,040 | 1,51,008 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 10,74,220 | -4,71,240 | 93,553 |

| 14,200 | 2,63,200 | -2,38,700 | 9,786 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 17,15,980 | 3,06,040 | 1,51,008 |

| 13,100 | 11,11,880 | 54,320 | 1,24,647 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 10,95,220 | 48,860 | 44,468 |

| 12,800 | 9,67,680 | 62,160 | 1,12,097 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 8,11,720 | 1,92,220 | 1,23,833 |

| 12,300 | 4,30,220 | 1,60,440 | 12,819 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 4,47,160 | -2,13,780 | 10,965 |

| 13,000 | 7,38,780 | -2,09,300 | 1,25,679 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,38,780 | -2,09,300 | 1,25,679 |

| 12,900 | 8,11,720 | 1,92,220 | 1,23,833 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis leaves little doubt—markets are deep in a risk-off zone and expiry gravity is pulling settlement targets sharply lower. With Nifty’s max pain sliding to 24,850 and the PCR (OI) under 0.52, aggressive call writing and frightened put unwinding dominate the landscape. Expect expiry action to cluster in the 24,700–24,850 range; any breach below 24,700 can open the floodgates toward 24,600 or even 24,400 if forced selling escalates. Only a surprise close above 25,000–25,050 can trigger short covering and offer a tactical bounce.

For traders, the actionable play is to continue using range-bound or bearish options strategies—shorting weak rallies, running bear put spreads, or using iron condors centered on max pain strikes. Tight stops should be the norm, as expiry volatility can bring whipsaws. BankNifty and FINNIFTY paint a similar picture: minimal confidence in a bounce, with max pain and OI crowding just overhead, keeping advances capped. In MIDCPNIFTY, risk-averse traders may wait for signs of bottoming before taking fresh bets. As we head into the last days of July expiry, this Open Interest Volume Analysis will be your best guide for managing risk and spotting the first signs of a potential post-expiry reversal—stick to the data and let the tape settle before reaching for trend reversals.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]