Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 29/07/2025

Table of Contents

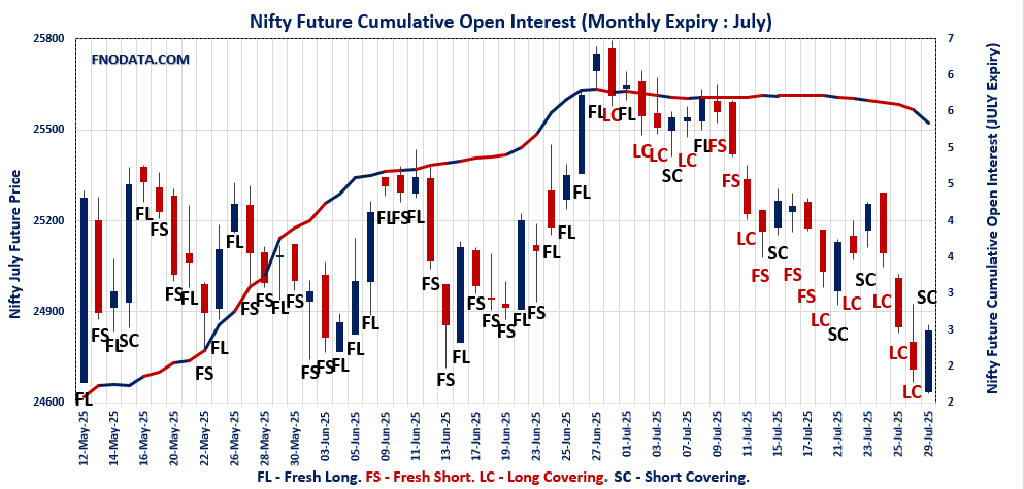

The Open Interest Volume Analysis for 29th July 2025 presents a mixed but cautiously optimistic market tone as the July monthly expiry looms large. Nifty July futures nudged up 0.52% to 24,838.80 despite a steep 18.5% drop in open interest, signaling that while some longs are exiting, fresh buying interest has re-emerged to support prices near the 24,850 max pain level. The Put-Call Ratio (OI) notably rebound to 0.71 from very depressed levels, reflecting increased put writing and call unwinding around the 24,800–25,000 strikes that are likely to govern expiry price action.

BankNifty showed a similar trend with modest futures gains (0.27%) but an equally sharp decline in open interest (-17.6%), coupled with a stable max pain of 56,400 and a slightly declining PCR (OI). Meanwhile, FINNIFTY and MIDCPNIFTY also posted gains with falling open interest, suggesting short covering along with profit taking on the sidelines. Overall, the derivatives market indicates that despite volatility and heavy position adjustments, the indices remain anchored near prominent max pain zones with expiry dynamics shaping near-term price movements.

NSE & BSE F&O Market Signals

NIFTY JULY Future

NIFTY Spot closed at: 24,821.10 (0.57%)

NIFTY JULY Future closed at: 24,838.80 (0.52%)

Premium: 17.7 (Decreased by -11.6 points)

Open Interest Change: -18.5%

Volume Change: 18.6%

NIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.710 (Increased from 0.511)

Put-Call Ratio (Volume): 0.844

Max Pain Level: 24850

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25800

Highest PUT Addition: 24800

BANKNIFTY JULY Future

BANKNIFTY Spot closed at: 56,222.00 (0.24%)

BANKNIFTY JULY Future closed at: 56,331.80 (0.27%)

Premium: 109.8 (Increased by 15.7 points)

Open Interest Change: -17.6%

Volume Change: 2.5%

BANKNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.590 (Decreased from 0.596)

Put-Call Ratio (Volume): 0.748

Max Pain Level: 56400

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 56000

Highest CALL Addition: 57500

Highest PUT Addition: 56300

FINNIFTY JULY Future

FINNIFTY Spot closed at: 26,700.70 (0.32%)

FINNIFTY JULY Future closed at: 26,749.40 (0.34%)

Premium: 48.7 (Increased by 4 points)

Open Interest Change: -14.8%

Volume Change: 29.4%

FINNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.617 (Decreased from 0.694)

Put-Call Ratio (Volume): 0.710

Max Pain Level: 26700

Maximum CALL Open Interest: 27500

Maximum PUT Open Interest: 25800

Highest CALL Addition: 27600

Highest PUT Addition: 25800

MIDCPNIFTY JULY Future

MIDCPNIFTY Spot closed at: 13,033.70 (1.04%)

MIDCPNIFTY JULY Future closed at: 13,057.30 (1.05%)

Premium: 23.6 (Increased by 1.15 points)

Open Interest Change: -33.6%

Volume Change: -6.0%

MIDCPNIFTY Monthly Expiry (31/07/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.764 (Increased from 0.571)

Put-Call Ratio (Volume): 0.802

Max Pain Level: 13050

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13500

Highest PUT Addition: 13000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 4,636.60 Cr

DIIs Net BUY: ₹ 6,146.82 Cr

FII Derivatives Activity

| FII Trading Stats | 29.07.25 | 28.07.25 | 25.07.25 |

| FII Cash (Provisional Data) | -4,636.60 | -6,082.47 | -1,979.96 |

| Index Future Open Interest Long Ratio | 13.33% | 14.61% | 14.29% |

| Index Future Volume Long Ratio | 47.26% | 45.10% | 39.04% |

| Call Option Open Interest Long Ratio | 48.62% | 45.98% | 48.42% |

| Call Option Volume Long Ratio | 50.53% | 49.55% | 49.34% |

| Put Option Open Interest Long Ratio | 60.38% | 62.95% | 63.25% |

| Put Option Volume Long Ratio | 49.58% | 50.07% | 50.43% |

| Stock Future Open Interest Long Ratio | 62.28% | 61.84% | 61.55% |

| Stock Future Volume Long Ratio | 50.69% | 50.40% | 47.62% |

| Index Futures | Fresh Short | Fresh Short | Fresh Short |

| Index Options | Fresh Long | Fresh Short | Fresh Short |

| Nifty Futures | Long Covering | Fresh Short | Fresh Short |

| Nifty Options | Fresh Long | Fresh Short | Fresh Short |

| BankNifty Futures | Fresh Long | Fresh Short | Fresh Short |

| BankNifty Options | Long Covering | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Short | Fresh Short | Fresh Long |

| FinNifty Options | Fresh Short | Fresh Long | Short Covering |

| MidcpNifty Futures | Fresh Long | Fresh Short | Fresh Short |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Fresh Short | Short Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Short |

| Stock Futures | Fresh Long | Short Covering | Long Covering |

| Stock Options | Short Covering | Short Covering | Short Covering |

NSE Option market Trends : Options Insights

NIFTY Monthly Expiry (31/07/2025)

The NIFTY index closed at 24821.1. The NIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.710 against previous 0.511. The 25000CE option holds the maximum open interest, followed by the 26000CE and 24000PE options. Market participants have shown increased interest with significant open interest additions in the 24800PE option, with open interest additions also seen in the 24000PE and 24700PE options. On the other hand, open interest reductions were prominent in the 24800CE, 25900CE, and 25600CE options. Trading volume was highest in the 24700PE option, followed by the 24700CE and 24800CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,821.10 | 0.710 | 0.511 | 0.844 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 19,59,73,950 | 22,47,99,150 | -2,88,25,200 |

| PUT: | 13,91,15,550 | 11,47,75,800 | 2,43,39,750 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,40,96,925 | -17,28,225 | 19,31,501 |

| 26,000 | 1,26,50,250 | -17,56,650 | 5,91,975 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 74,89,950 | 20,07,450 | 4,95,110 |

| 25,150 | 44,65,050 | 2,50,725 | 7,86,634 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 80,74,125 | -30,79,050 | 35,13,076 |

| 25,900 | 36,76,200 | -20,21,625 | 2,86,330 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 34,47,075 | -12,85,950 | 37,37,468 |

| 24,800 | 80,74,125 | -30,79,050 | 35,13,076 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,21,18,575 | 37,28,550 | 8,19,694 |

| 24,800 | 88,33,200 | 43,91,100 | 20,14,878 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 88,33,200 | 43,91,100 | 20,14,878 |

| 24,000 | 1,21,18,575 | 37,28,550 | 8,19,694 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 39,78,675 | -8,31,975 | 2,25,390 |

| 25,100 | 19,34,625 | -7,91,025 | 50,519 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 85,54,500 | 34,86,675 | 37,50,054 |

| 24,600 | 75,58,425 | 15,78,150 | 28,21,920 |

BANKNIFTY Monthly Expiry (31/07/2025)

The BANKNIFTY index closed at 56222. The BANKNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.590 against previous 0.596. The 57000CE option holds the maximum open interest, followed by the 57500CE and 60000CE options. Market participants have shown increased interest with significant open interest additions in the 57500CE option, with open interest additions also seen in the 56300CE and 56300PE options. On the other hand, open interest reductions were prominent in the 53000PE, 57000PE, and 57400CE options. Trading volume was highest in the 56000PE option, followed by the 56000CE and 56500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 56,222.00 | 0.590 | 0.596 | 0.748 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,69,05,935 | 2,66,01,155 | 3,04,780 |

| PUT: | 1,58,77,190 | 1,58,44,264 | 32,926 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 23,15,390 | -87,990 | 3,09,409 |

| 57,500 | 18,70,260 | 3,48,215 | 1,90,590 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 57,500 | 18,70,260 | 3,48,215 | 1,90,590 |

| 56,300 | 6,44,560 | 2,84,165 | 2,78,916 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,400 | 3,99,455 | -1,62,330 | 88,436 |

| 58,000 | 14,58,135 | -1,23,340 | 2,12,474 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 6,92,580 | 30,345 | 5,17,954 |

| 56,500 | 10,70,615 | -29,470 | 4,00,354 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 13,09,280 | 1,07,870 | 6,49,657 |

| 55,000 | 11,44,570 | 1,25,020 | 1,89,991 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,300 | 5,63,885 | 2,20,885 | 1,72,036 |

| 55,000 | 11,44,570 | 1,25,020 | 1,89,991 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,000 | 6,81,835 | -1,66,040 | 49,928 |

| 57,000 | 6,72,805 | -1,64,255 | 30,281 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 13,09,280 | 1,07,870 | 6,49,657 |

| 56,100 | 3,90,040 | 1,23,550 | 3,43,031 |

FINNIFTY Monthly Expiry (31/07/2025)

The FINNIFTY index closed at 26700.7. The FINNIFTY monthly expiry for JULY 31, 2025, has revealed key trends in open interest. The current Put/Call Ratio is at 0.617 against previous 0.694. The 27500CE option holds the maximum open interest, followed by the 27000CE and 27300CE options. Market participants have shown increased interest with significant open interest additions in the 27600CE option, with open interest additions also seen in the 26700CE and 25800PE options. On the other hand, open interest reductions were prominent in the 27900CE, 26000PE, and 26850CE options. Trading volume was highest in the 26800CE option, followed by the 26600PE and 26700CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,700.70 | 0.617 | 0.694 | 0.710 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 35,76,950 | 30,31,730 | 5,45,220 |

| PUT: | 22,05,320 | 21,03,140 | 1,02,180 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 3,27,210 | 33,020 | 17,643 |

| 27,000 | 2,79,890 | 31,655 | 19,624 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 1,96,950 | 1,36,305 | 12,195 |

| 26,700 | 1,89,215 | 89,375 | 24,714 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 25,870 | -61,295 | 3,984 |

| 26,850 | 61,880 | -43,940 | 9,199 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 1,73,810 | 22,555 | 36,060 |

| 26,700 | 1,89,215 | 89,375 | 24,714 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 1,82,195 | 78,845 | 6,620 |

| 26,700 | 1,38,710 | 11,310 | 17,103 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 1,82,195 | 78,845 | 6,620 |

| 26,650 | 78,585 | 48,945 | 14,210 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,14,595 | -57,915 | 10,163 |

| 26,500 | 1,05,820 | -32,305 | 23,890 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 1,12,385 | 26,065 | 33,840 |

| 26,500 | 1,05,820 | -32,305 | 23,890 |

MIDCPNIFTY Monthly Expiry (31/07/2025)

The MIDCPNIFTY index closed at 13033.7. The MIDCPNIFTY monthly expiry for JULY 31, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.764 against previous 0.571. The 13500CE option holds the maximum open interest, followed by the 13300CE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 13000PE option, with open interest additions also seen in the 13500CE and 13400CE options. On the other hand, open interest reductions were prominent in the 70000CE, 69000CE, and 67800CE options. Trading volume was highest in the 13000CE option, followed by the 12900PE and 13100CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 31-07-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,033.70 | 0.764 | 0.571 | 0.802 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,86,23,080 | 2,03,43,960 | -17,20,880 |

| PUT: | 1,42,31,700 | 1,16,10,340 | 26,21,360 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 24,94,660 | 3,86,960 | 51,210 |

| 13,300 | 14,52,500 | -1,37,060 | 47,124 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 24,94,660 | 3,86,960 | 51,210 |

| 13,400 | 11,42,260 | 3,15,140 | 34,149 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 10,67,360 | -6,48,620 | 1,55,732 |

| 13,100 | 7,92,400 | -3,19,480 | 1,03,027 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 10,67,360 | -6,48,620 | 1,55,732 |

| 13,100 | 7,92,400 | -3,19,480 | 1,03,027 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 13,55,760 | 6,16,980 | 93,938 |

| 12,500 | 11,93,360 | 98,140 | 31,141 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 13,55,760 | 6,16,980 | 93,938 |

| 12,850 | 5,44,880 | 2,73,140 | 39,337 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,300 | 3,98,440 | -31,780 | 9,174 |

| 13,300 | 2,35,200 | -29,540 | 667 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,900 | 10,78,560 | 2,66,840 | 1,15,721 |

| 13,000 | 13,55,760 | 6,16,980 | 93,938 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Today’s Open Interest Volume Analysis reveals a market carefully balancing between expiry-driven positioning and tentative short-term bullishness. Nifty’s max pain at 24,850 continues to attract settlements, reinforced by the convergence of call and put open interest right around this level. The sharp drop in open interest across indices hints at position squaring, but the underlying modest price gains and rising PCR (OI) in Nifty suggest traders are cautiously rebuilding protective floors.

BankNifty and FINNIFTY maintain similar max pain alignment while showing signs of hedging and short covering rather than fresh directional bets. For traders, this environment favors range-based strategies targeting the 24,800–25,000 zone for Nifty, with swift reaction plays around breakouts or breakdowns from these expiry pivots. Watch for volatility spikes near max pain strikes and consider options strategies like iron condors or calendar spreads to capitalize on the compressed ranges. As expiry day approaches, keeping an eye on evolving open interest and volume trends will be key to navigating the last leg of this options cycle effectively.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]