Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 1/08/2025

Table of Contents

The Open Interest Volume Analysis for 1st August 2025 signals a decisive breakdown in market sentiment as the post-expiry hangover transitions into aggressive risk re-pricing. Nifty July futures slid sharply by 0.98% to 24,627.20, even as open interest spiked 8.3% and volumes tumbled by 35%—a clear indication of fresh short builds on rising pessimism amid lower liquidity. The collapse in the futures premium by over 41 points adds to the bearish tone, showing traders have no appetite for long risk and are aggressively hedging on further declines. On the options front, the alarm bells are ringing: the weekly Put-Call Ratio (OI) plummeted to 0.570 as call writers swamped strikes up to 25,000, and new put writing retreated further to 24,200, making 24,700 the max pain magnet for the coming week. The monthly series remains marginally constructive with a PCR above 1, but heavy OI and additions at the 25,000 strike telegraph that any upward move will face repeated resistance.

BankNifty mirrored the carnage, dropping 0.71% amid a massive 16% surge in open interest and premium collapse—classic signs of fresh shorts piling on while bullish hands sit out. Option PCR also slid, and heavy OI at strikes from 56,000 down to 54,000 points to further downside hedging, with max pain shifting lower. Broader indices such as FINNIFTY and MIDCPNIFTY also closed in the red, with heavy futures unwinding in the latter and a short-covering dip in FINNIFTY, while their PCRs show divergent but overall heavy risk aversion. SENSEX continues its defensive stance, with a nearly 9% OI jump on the weekly future as market-makers price in more turbulence around the 80,900 max pain level.

NSE & BSE F&O Market Signals

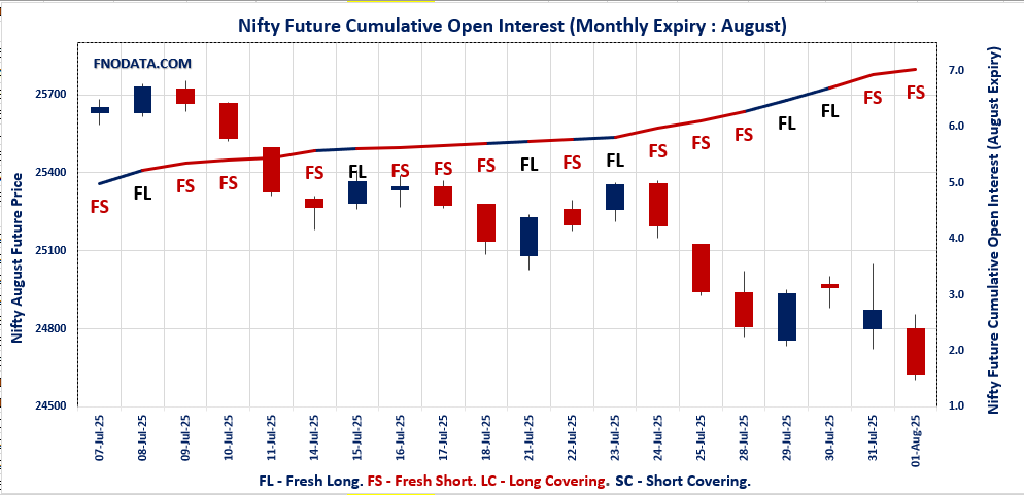

NIFTY AUGUST Future

NIFTY Spot closed at: 24,565.35 (-0.82%)

NIFTY AUGUST Future closed at: 24,627.20 (-0.98%)

Premium: 61.85 (Decreased by -41.4 points)

Open Interest Change: 8.3%

Volume Change: -34.9%

NIFTY Weekly Expiry (7/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.570 (Decreased from 0.909)

Put-Call Ratio (Volume): 0.977

Max Pain Level: 24700

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24200

Highest CALL Addition: 24800

Highest PUT Addition: 24200

NIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.023 (Decreased from 1.075)

Put-Call Ratio (Volume): 0.888

Max Pain Level: 25000

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25000

Highest PUT Addition: 24700

BANKNIFTY AUGUST Future

BANKNIFTY Spot closed at: 55,617.60 (-0.62%)

BANKNIFTY AUGUST Future closed at: 55,794.20 (-0.71%)

Premium: 176.6 (Decreased by -55.45 points)

Open Interest Change: 16.0%

Volume Change: -42.1%

BANKNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.865 (Decreased from 0.904)

Put-Call Ratio (Volume): 1.021

Max Pain Level: 56200

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 56000

Highest PUT Addition: 54000

FINNIFTY AUGUST Future

FINNIFTY Spot closed at: 26,492.50 (-0.59%)

FINNIFTY AUGUST Future closed at: 26,569.60 (-0.60%)

Premium: 77.1 (Decreased by -3.95 points)

Open Interest Change: -2.6%

Volume Change: -63.6%

FINNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.271 (Increased from 1.035)

Put-Call Ratio (Volume): 1.014

Max Pain Level: 26650

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 26000

MIDCPNIFTY AUGUST Future

MIDCPNIFTY Spot closed at: 12,668.25 (-1.55%)

MIDCPNIFTY AUGUST Future closed at: 12,687.80 (-1.80%)

Premium: 19.55 (Decreased by -34 points)

Open Interest Change: 3.7%

Volume Change: -49.3%

MIDCPNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.010 (Decreased from 1.199)

Put-Call Ratio (Volume): 0.868

Max Pain Level: 12800

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12000

Highest CALL Addition: 12800

Highest PUT Addition: 12000

SENSEX Weekly Expiry (5/08/2025) Future

SENSEX Spot closed at: 80,599.91 (-0.72%)

SENSEX Weekly Future closed at: 80,596.20 (-0.83%)

Discount: -3.71 (Decreased by -88.43 points)

Open Interest Change: 8.7%

Volume Change: -5.7%

SENSEX Weekly Expiry (5/08/2025) Option Analysis

Put-Call Ratio (OI): 0.591 (Decreased from 1.062)

Put-Call Ratio (Volume): 1.028

Max Pain Level: 80900

Maximum CALL OI: 81000

Maximum PUT OI: 78000

Highest CALL Addition: 81000

Highest PUT Addition: 78000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 3,366.40 Cr

DIIs Net BUY: ₹ 3,186.86 Cr

FII Derivatives Activity

| FII Trading Stats | 1.08.25 | 31.07.25 | 30.07.25 |

| FII Cash (Provisional Data) | -3,366.40 | -5,588.91 | -850.04 |

| Index Future Open Interest Long Ratio | 8.60% | 9.59% | 14.06% |

| Index Future Volume Long Ratio | 26.03% | 47.41% | 48.72% |

| Call Option Open Interest Long Ratio | 43.99% | 45.45% | 47.38% |

| Call Option Volume Long Ratio | 49.56% | 50.05% | 49.81% |

| Put Option Open Interest Long Ratio | 66.13% | 69.51% | 57.59% |

| Put Option Volume Long Ratio | 50.18% | 50.03% | 49.57% |

| Stock Future Open Interest Long Ratio | 62.15% | 62.50% | 62.16% |

| Stock Future Volume Long Ratio | 47.13% | 49.09% | 49.95% |

| Index Futures | Fresh Short | Long Covering | Fresh Short |

| Index Options | Fresh Short | Short Covering | Fresh Short |

| Nifty Futures | Fresh Short | Long Covering | Fresh Short |

| Nifty Options | Fresh Short | Short Covering | Fresh Short |

| BankNifty Futures | Fresh Short | Short Covering | Fresh Short |

| BankNifty Options | Fresh Long | Short Covering | Fresh Short |

| FinNifty Futures | Long Covering | Fresh Long | Long Covering |

| FinNifty Options | Fresh Short | Long Covering | Long Covering |

| MidcpNifty Futures | Fresh Short | Long Covering | Long Covering |

| MidcpNifty Options | Fresh Long | Long Covering | Long Covering |

| NiftyNxt50 Futures | Fresh Short | Long Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Short | Long Covering | Fresh Short |

| Stock Futures | Long Covering | Long Covering | Fresh Short |

| Stock Options | Fresh Long | Long Covering | Long Covering |

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (7/08/2025)

The NIFTY index closed at 24565.35. The NIFTY weekly expiry for AUGUST 7, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.570 against previous 0.909. The 25000CE option holds the maximum open interest, followed by the 26000CE and 24800CE options. Market participants have shown increased interest with significant open interest additions in the 24800CE option, with open interest additions also seen in the 24700CE and 25000CE options. On the other hand, open interest reductions were prominent in the 24800PE, 24850PE, and 24900PE options. Trading volume was highest in the 24700PE option, followed by the 24700CE and 24600PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 07-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,565.35 | 0.570 | 0.909 | 0.977 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 14,38,00,950 | 6,20,24,700 | 8,17,76,250 |

| PUT: | 8,19,69,450 | 5,64,07,500 | 2,55,61,950 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,09,20,300 | 59,40,825 | 24,25,575 |

| 26,000 | 95,65,350 | 42,36,975 | 6,77,378 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 94,56,675 | 65,22,750 | 28,48,811 |

| 24,700 | 74,89,350 | 61,75,275 | 32,93,906 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 12,525 | -900 | 85 |

| 23,700 | 6,525 | -300 | 130 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 74,89,350 | 61,75,275 | 32,93,906 |

| 24,800 | 94,56,675 | 65,22,750 | 28,48,811 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 62,55,375 | 36,62,175 | 10,35,551 |

| 23,500 | 61,46,475 | 21,30,300 | 4,54,626 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 62,55,375 | 36,62,175 | 10,35,551 |

| 23,500 | 61,46,475 | 21,30,300 | 4,54,626 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 26,15,700 | -6,32,475 | 12,77,480 |

| 24,850 | 5,18,250 | -4,80,300 | 2,28,340 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 34,90,875 | 3,12,825 | 36,23,841 |

| 24,600 | 39,52,125 | 8,82,075 | 31,36,571 |

SENSEX Weekly Expiry (5/08/2025)

The SENSEX index closed at 80599.91. The SENSEX weekly expiry for AUGUST 5, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.591 against previous 1.062. The 81000CE option holds the maximum open interest, followed by the 83000CE and 82000CE options. Market participants have shown increased interest with significant open interest additions in the 81000CE option, with open interest additions also seen in the 83000CE and 82000CE options. On the other hand, open interest reductions were prominent in the 76000PE, 81500PE, and 81200PE options. Trading volume was highest in the 81000PE option, followed by the 81000CE and 80000PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 05-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80599.91 | 0.591 | 1.062 | 1.028 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,13,29,920 | 89,84,720 | 1,23,45,200 |

| PUT: | 1,26,09,200 | 95,38,569 | 30,70,631 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 16,30,300 | 13,53,660 | 4,99,92,620 |

| 83000 | 15,91,060 | 9,85,940 | 1,94,04,060 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 16,30,300 | 13,53,660 | 4,99,92,620 |

| 83000 | 15,91,060 | 9,85,940 | 1,94,04,060 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 1,47,180 | -75,220 | 19,58,460 |

| 90000 | 46,680 | -30,920 | 3,74,900 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 16,30,300 | 13,53,660 | 4,99,92,620 |

| 82000 | 14,25,280 | 9,30,020 | 3,69,02,380 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 10,35,900 | 4,15,340 | 91,86,520 |

| 79000 | 8,31,280 | 3,89,540 | 1,76,94,820 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 10,35,900 | 4,15,340 | 91,86,520 |

| 77000 | 7,84,500 | 4,13,780 | 48,26,940 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 76000 | 2,19,820 | -2,53,980 | 24,90,580 |

| 81500 | 1,54,440 | -1,63,760 | 40,73,080 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 5,88,960 | -37,460 | 5,24,23,740 |

| 80000 | 5,68,600 | 89,380 | 4,52,21,420 |

NIFTY Monthly Expiry (28/08/2025)

The NIFTY index closed at 24565.35. The NIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.023 against previous 1.075. The 25000CE option holds the maximum open interest, followed by the 26000CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25000CE option, with open interest additions also seen in the 24700CE and 24700PE options. On the other hand, open interest reductions were prominent in the 25000PE, 25100PE, and 25300PE options. Trading volume was highest in the 25000CE option, followed by the 25500CE and 24000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,565.35 | 1.023 | 1.075 | 0.888 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,62,45,550 | 3,03,54,150 | 58,91,400 |

| PUT: | 3,70,84,800 | 3,26,23,575 | 44,61,225 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 55,63,575 | 9,24,825 | 97,002 |

| 26,000 | 41,50,200 | 3,48,375 | 52,789 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 55,63,575 | 9,24,825 | 97,002 |

| 24,700 | 10,34,550 | 7,36,500 | 46,310 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,750 | 53,025 | -10,350 | 2,243 |

| 27,050 | 18,225 | -4,425 | 163 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 55,63,575 | 9,24,825 | 97,002 |

| 25,500 | 38,32,725 | 1,06,575 | 82,730 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 39,03,600 | -1,31,475 | 38,428 |

| 24,000 | 38,90,475 | 3,88,575 | 75,249 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 13,20,000 | 6,00,825 | 56,969 |

| 24,000 | 38,90,475 | 3,88,575 | 75,249 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 39,03,600 | -1,31,475 | 38,428 |

| 25,100 | 6,45,075 | -28,725 | 3,559 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 38,90,475 | 3,88,575 | 75,249 |

| 24,500 | 26,43,525 | 3,15,825 | 74,929 |

BANKNIFTY Monthly Expiry (28/08/2025)

The BANKNIFTY index closed at 55617.6. The BANKNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.865 against previous 0.904. The 57000CE option holds the maximum open interest, followed by the 57000PE and 56000PE options. Market participants have shown increased interest with significant open interest additions in the 56000CE option, with open interest additions also seen in the 57000CE and 54000PE options. On the other hand, open interest reductions were prominent in the 56500PE, 64500CE, and 63000CE options. Trading volume was highest in the 56000PE option, followed by the 56000CE and 55800PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,617.60 | 0.865 | 0.904 | 1.021 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,14,29,425 | 88,89,274 | 25,40,151 |

| PUT: | 98,92,015 | 80,33,235 | 18,58,780 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 20,87,260 | 2,27,290 | 93,841 |

| 56,000 | 9,05,940 | 3,68,830 | 1,59,761 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 9,05,940 | 3,68,830 | 1,59,761 |

| 57,000 | 20,87,260 | 2,27,290 | 93,841 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 64,500 | 21,665 | -17,920 | 3,955 |

| 63,000 | 1,70,205 | -12,565 | 9,870 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 9,05,940 | 3,68,830 | 1,59,761 |

| 57,000 | 20,87,260 | 2,27,290 | 93,841 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 14,18,585 | -11,585 | 19,261 |

| 56,000 | 9,39,575 | 1,98,100 | 1,63,459 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 7,46,270 | 2,14,655 | 58,554 |

| 56,000 | 9,39,575 | 1,98,100 | 1,63,459 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,500 | 3,26,900 | -30,800 | 23,413 |

| 57,000 | 14,18,585 | -11,585 | 19,261 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 9,39,575 | 1,98,100 | 1,63,459 |

| 55,800 | 1,95,895 | 1,08,780 | 1,43,115 |

FINNIFTY Monthly Expiry (28/08/2025)

The FINNIFTY index closed at 26492.5. The FINNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.271 against previous 1.035. The 26000PE option holds the maximum open interest, followed by the 27000CE and 26600PE options. Market participants have shown increased interest with significant open interest additions in the 26000PE option, with open interest additions also seen in the 27000CE and 26600PE options. On the other hand, open interest reductions were prominent in the 27750CE, 27750CE, and 27750CE options. Trading volume was highest in the 27000CE option, followed by the 26600PE and 26000PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,492.50 | 1.271 | 1.035 | 1.014 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,72,740 | 58,955 | 2,13,785 |

| PUT: | 3,46,775 | 61,035 | 2,85,740 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 62,985 | 50,635 | 8,567 |

| 26,600 | 27,170 | 24,765 | 3,209 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 62,985 | 50,635 | 8,567 |

| 26,600 | 27,170 | 24,765 | 3,209 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 62,985 | 50,635 | 8,567 |

| 26,700 | 25,090 | 22,035 | 3,989 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 80,665 | 69,680 | 4,348 |

| 26,600 | 39,455 | 36,140 | 4,690 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 80,665 | 69,680 | 4,348 |

| 26,600 | 39,455 | 36,140 | 4,690 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 39,455 | 36,140 | 4,690 |

| 26,000 | 80,665 | 69,680 | 4,348 |

MIDCPNIFTY Monthly Expiry (28/08/2025)

The MIDCPNIFTY index closed at 12668.25. The MIDCPNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.010 against previous 1.199. The 12000PE option holds the maximum open interest, followed by the 13000CE and 12500PE options. Market participants have shown increased interest with significant open interest additions in the 12000PE option, with open interest additions also seen in the 12800CE and 13000CE options. On the other hand, open interest reductions were prominent in the 76000PE, 76000PE, and 76000PE options. Trading volume was highest in the 12800PE option, followed by the 13000CE and 12800CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,668.25 | 1.010 | 1.199 | 0.868 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 32,38,480 | 14,86,380 | 17,52,100 |

| PUT: | 32,71,660 | 17,82,480 | 14,89,180 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,33,020 | 1,95,440 | 16,389 |

| 13,500 | 3,63,440 | 1,87,460 | 13,581 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 2,35,200 | 2,00,200 | 16,381 |

| 13,000 | 4,33,020 | 1,95,440 | 16,389 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 76,440 | -58,940 | 920 |

| 11,500 | 11,620 | -140 | 1 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,33,020 | 1,95,440 | 16,389 |

| 12,800 | 2,35,200 | 2,00,200 | 16,381 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,45,920 | 2,03,980 | 10,270 |

| 12,500 | 4,12,020 | 1,45,460 | 10,853 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,45,920 | 2,03,980 | 10,270 |

| 12,400 | 2,22,600 | 1,75,700 | 4,797 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 2,38,980 | -35,420 | 3,161 |

| 12,900 | 1,12,420 | -10,360 | 4,729 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 1,31,880 | 89,740 | 17,647 |

| 12,500 | 4,12,020 | 1,45,460 | 10,853 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Today’s Open Interest Volume Analysis confirms the bears are firmly in control, with nearly every indicator—from steep open interest and premium drops in Nifty and BankNifty futures, to aggressive call writing and risk-off put positioning—pointing to continued volatility and downside pressure. For Nifty, the region between 24,700 (max pain) and 25,000 (major call OI) sets the likely expiry band, and only a convincing close above 25,000 would hint at a reversal. Until then, the odds favor drift or even sharper sell-offs toward the next big support at 24,200.

For actionable trades, bearish and range-bound setups like credit call spreads at 25,000, or iron condors centered around 24,700, will yield the best risk-adjusted returns. BankNifty’s eruption in OI and premium collapse makes it a prime candidate for short-side setups, but keep position sizes disciplined given ongoing volatility spikes. Traders should remain hedge-focused, quickly locking profits and not overstaying risk as institutional selling and lack of retail participation drive the tape. Let this Open Interest Volume Analysis guide your trading compass: stay cautious, react swiftly to sharp moves, and wait for clear signals before betting on a sustained reversal.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]