Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 7/08/2025

Table of Contents

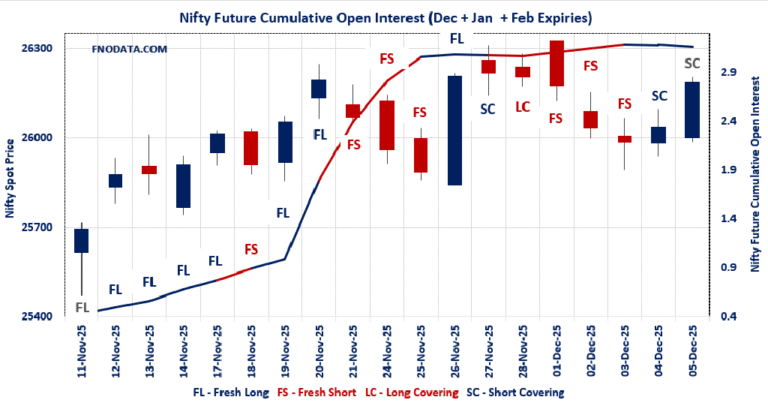

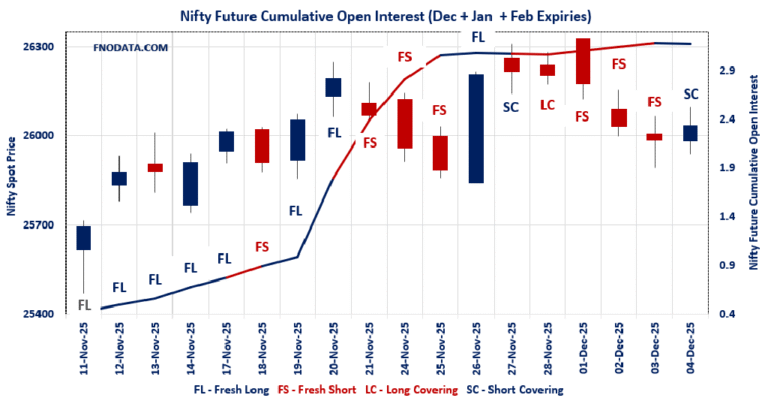

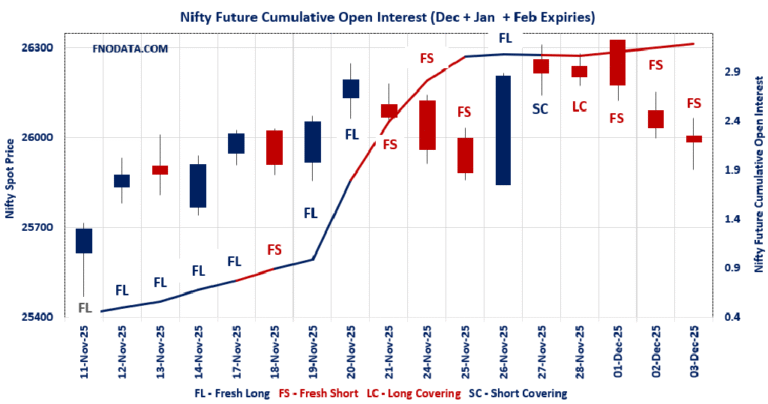

The Open Interest Volume Analysis for 14th August 2025 shows a market that is starting to regain its balance after a period of volatility. Nifty August futures finished at 24,673.40, up 0.16%, and open interest moved just 0.4% higher—a sign of measured, low-risk buildup as traders weigh the next move. The notable 16-point jump in premium reveals more hedging activity, suggesting that participants still want a buffer as spot prices hover above 24,600. In the weekly options, the Put-Call Ratio (OI) rose to 1.02, crossing above 1 for the first time in days, supported by strong put writing at the 23,500 and 24,550 strikes, while calls are clustered at 25,000. Max pain at 24,600 signals a comfortable expiry anchor, with heavy open interest on both sides around this level showing that neither bulls nor bears have a runaway edge. The monthly series tells a similar story: PCR is steady just under 1, and the 25,000 strike remains the ceiling. This pattern reveals a cautious but stabilizing market preparing for a fresh trigger.

Healthy signs are also seen in BANKNIFTY and MIDCPNIFTY futures. BANKNIFTY stronger by 0.32% with a firm premium surge and stable OI hints that buyers are tiptoeing back, even while the bulk of bets are still range-bound near the 57,000 mark. MIDCPNIFTY’s 0.7% gain with higher OI and higher premium suggests a mild risk-on shift in midcaps—supported by a rising put-call ratio above 1, which often leads near-term recoveries. FINNIFTY and SENSEX have also ended in the green, but with subdued OI changes and more signs of selective trading than broad conviction.

NSE & BSE F&O Market Signals

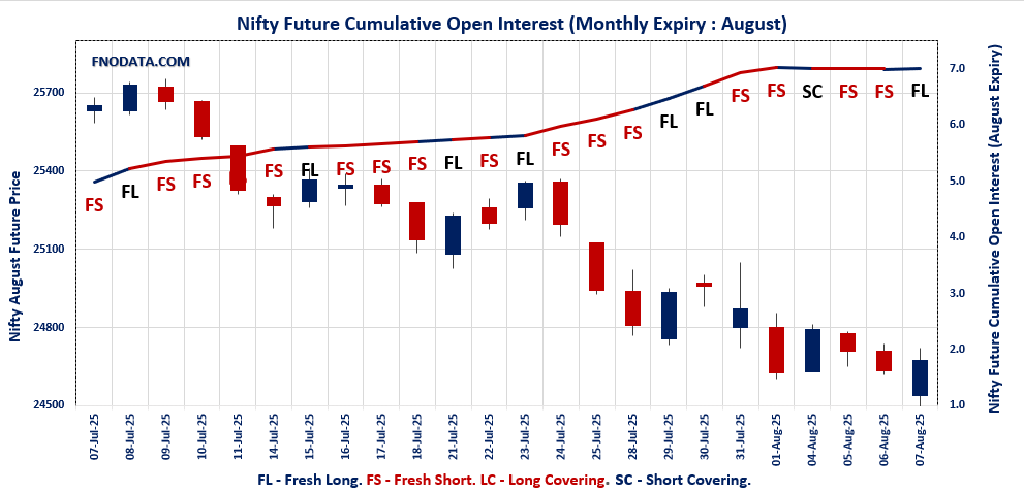

NIFTY AUGUST Future

NIFTY Spot closed at: 24,596.15 (0.09%)

NIFTY AUGUST Future closed at: 24,673.40 (0.16%)

Premium: 77.25 (Increased by 16.55 points)

Open Interest Change: 0.4%

Volume Change: 85.4%

NIFTY Weekly Expiry (14/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.020 (Increased from 0.810)

Put-Call Ratio (Volume): 0.840

Max Pain Level: 24600

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 23500

Highest CALL Addition: 25000

Highest PUT Addition: 23500

NIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.986 (Decreased from 0.987)

Put-Call Ratio (Volume): 0.879

Max Pain Level: 25000

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 24500

Highest PUT Addition: 23500

BANKNIFTY AUGUST Future

BANKNIFTY Spot closed at: 55,521.15 (0.20%)

BANKNIFTY AUGUST Future closed at: 55,757.60 (0.32%)

Premium: 236.45 (Increased by 66.8 points)

Open Interest Change: 0.0%

Volume Change: 29.1%

BANKNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.795 (Increased from 0.768)

Put-Call Ratio (Volume): 0.903

Max Pain Level: 56000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 65000

Highest PUT Addition: 55100

FINNIFTY AUGUST Future

FINNIFTY Spot closed at: 26,403.90 (0.12%)

FINNIFTY AUGUST Future closed at: 26,508.90 (0.21%)

Premium: 105 (Increased by 21.75 points)

Open Interest Change: 2.0%

Volume Change: 64.1%

FINNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.683 (Increased from 0.663)

Put-Call Ratio (Volume): 0.612

Max Pain Level: 26500

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27900

Highest PUT Addition: 23500

MIDCPNIFTY AUGUST Future

MIDCPNIFTY Spot closed at: 12,724.70 (0.70%)

MIDCPNIFTY AUGUST Future closed at: 12,789.45 (0.88%)

Premium: 64.75 (Increased by 23.15 points)

Open Interest Change: 3.6%

Volume Change: 53.3%

MIDCPNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.038 (Increased from 0.934)

Put-Call Ratio (Volume): 0.814

Max Pain Level: 12775

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12000

Highest CALL Addition: 13600

Highest PUT Addition: 12600

SENSEX Weekly Expiry (12/08/2025) Future

SENSEX Spot closed at: 80,623.26 (0.10%)

SENSEX Weekly Future closed at: 80,727.70 (0.15%)

Premium: 104.44 (Increased by 40.23 points)

Open Interest Change: -0.5%

Volume Change: 68.1%

SENSEX Weekly Expiry (12/08/2025) Option Analysis

Put-Call Ratio (OI): 1.106 (Increased from 0.624)

Put-Call Ratio (Volume): 0.958

Max Pain Level: 80500

Maximum CALL OI: 83000

Maximum PUT OI: 78000

Highest CALL Addition: 84000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 4,997.19 Cr

DIIs Net BUY: ₹ 10,864.04 Cr

FII Derivatives Activity

| FII Trading Stats | 7.08.25 | 6.08.25 | 5.08.25 |

| FII Cash (Provisional Data) | -4,997.19 | -4,999.10 | -22.48 |

| Index Future Open Interest Long Ratio | 8.59% | 8.58% | 8.42% |

| Index Future Volume Long Ratio | 42.00% | 53.88% | 28.82% |

| Call Option Open Interest Long Ratio | 45.57% | 46.88% | 47.20% |

| Call Option Volume Long Ratio | 50.20% | 49.88% | 50.10% |

| Put Option Open Interest Long Ratio | 70.48% | 66.33% | 63.75% |

| Put Option Volume Long Ratio | 49.88% | 50.53% | 50.36% |

| Stock Future Open Interest Long Ratio | 61.97% | 61.94% | 62.18% |

| Stock Future Volume Long Ratio | 51.07% | 47.92% | 46.07% |

| Index Futures | Fresh Short | Short Covering | Fresh Short |

| Index Options | Short Covering | Fresh Long | Fresh Long |

| Nifty Futures | Fresh Short | Long Covering | Fresh Short |

| Nifty Options | Short Covering | Fresh Long | Fresh Long |

| BankNifty Futures | Fresh Long | Short Covering | Fresh Short |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Long |

| FinNifty Futures | Long Covering | Fresh Long | Long Covering |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Futures | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Options | Short Covering | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Fresh Short | Short Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Long Covering | Long Covering |

| Stock Futures | Fresh Long | Long Covering | Long Covering |

| Stock Options | Fresh Short | Fresh Short | Fresh Long |

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (14/08/2025)

The NIFTY index closed at 24596.15. The NIFTY weekly expiry for AUGUST 14, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.020 against previous 0.810. The 23500PE option holds the maximum open interest, followed by the 25000CE and 22800PE options. Market participants have shown increased interest with significant open interest additions in the 23500PE option, with open interest additions also seen in the 22800PE and 24500PE options. On the other hand, open interest reductions were prominent in the 25650CE, 26850CE, and 24950PE options. Trading volume was highest in the 24500CE option, followed by the 24500PE and 24600CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 14-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,596.15 | 1.020 | 0.810 | 0.840 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,36,81,300 | 3,54,13,725 | 2,82,67,575 |

| PUT: | 6,49,62,225 | 2,86,85,250 | 3,62,76,975 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 53,40,000 | 28,82,100 | 4,72,833 |

| 26,000 | 44,46,750 | 21,30,975 | 1,80,603 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 53,40,000 | 28,82,100 | 4,72,833 |

| 26,000 | 44,46,750 | 21,30,975 | 1,80,603 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,650 | 4,17,600 | -85,125 | 19,657 |

| 26,850 | 7,500 | -3,375 | 451 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 25,61,700 | 18,71,400 | 6,57,973 |

| 24,600 | 30,75,975 | 11,51,400 | 5,72,887 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 54,88,950 | 34,22,325 | 2,11,351 |

| 22,800 | 51,37,200 | 33,29,850 | 1,12,661 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 54,88,950 | 34,22,325 | 2,11,351 |

| 22,800 | 51,37,200 | 33,29,850 | 1,12,661 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,950 | 38,475 | -1,050 | 1,241 |

| 25,250 | 24,750 | – | 172 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 46,26,675 | 30,01,950 | 5,94,365 |

| 24,400 | 35,88,750 | 24,32,100 | 5,55,729 |

SENSEX Weekly Expiry (12/08/2025)

The SENSEX index closed at 80623.26. The SENSEX weekly expiry for AUGUST 12, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.106 against previous 0.624. The 78000PE option holds the maximum open interest, followed by the 80000PE and 83000CE options. Market participants have shown increased interest with significant open interest additions in the 80000PE option, with open interest additions also seen in the 78000PE and 77000PE options. On the other hand, open interest reductions were prominent in the 85500CE, 80600CE, and 83100CE options. Trading volume was highest in the 80000PE option, followed by the 80500CE and 81000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 12-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80623.26 | 1.106 | 0.624 | 0.958 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,23,96,220 | 85,39,680 | 38,56,540 |

| PUT: | 1,37,09,720 | 53,31,369 | 83,78,351 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 9,50,600 | 3,55,360 | 69,04,820 |

| 83500 | 8,18,820 | 2,61,380 | 44,34,740 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 7,54,780 | 4,22,200 | 46,76,700 |

| 80000 | 4,27,720 | 3,68,860 | 1,08,24,820 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85500 | 93,440 | -1,15,280 | 11,85,960 |

| 80600 | 1,66,160 | -54,800 | 68,85,260 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 4,39,280 | 57,080 | 1,60,28,220 |

| 81000 | 5,66,700 | 49,440 | 1,31,72,620 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 10,74,760 | 6,59,280 | 70,85,340 |

| 80000 | 10,39,180 | 7,96,180 | 2,16,89,220 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 10,39,180 | 7,96,180 | 2,16,89,220 |

| 78000 | 10,74,760 | 6,59,280 | 70,85,340 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 76200 | 9,620 | -24,480 | 2,75,780 |

| 81000 | 2,03,420 | -14,760 | 12,95,620 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 10,39,180 | 7,96,180 | 2,16,89,220 |

| 80200 | 2,42,760 | 1,49,120 | 1,20,12,080 |

NIFTY Monthly Expiry (28/08/2025)

The NIFTY index closed at 24596.15. The NIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.986 against previous 0.987. The 25000CE option holds the maximum open interest, followed by the 26000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 24500CE option, with open interest additions also seen in the 23500PE and 23900PE options. On the other hand, open interest reductions were prominent in the 23000PE, 24800PE, and 25000PE options. Trading volume was highest in the 25000CE option, followed by the 24000PE and 24500PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,596.15 | 0.986 | 0.987 | 0.879 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,97,52,100 | 3,86,58,225 | 10,93,875 |

| PUT: | 3,91,85,700 | 3,81,42,750 | 10,42,950 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 60,86,700 | 1,46,625 | 1,37,136 |

| 26,000 | 45,58,950 | 18,825 | 40,302 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 15,91,125 | 6,28,875 | 1,06,604 |

| 24,600 | 11,50,725 | 3,75,375 | 57,628 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 15,90,300 | -1,42,350 | 58,938 |

| 25,400 | 7,65,975 | -1,24,800 | 21,086 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 60,86,700 | 1,46,625 | 1,37,136 |

| 24,500 | 15,91,125 | 6,28,875 | 1,06,604 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 39,00,300 | -81,975 | 1,32,472 |

| 24,500 | 34,31,775 | -75,075 | 1,22,601 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 18,09,600 | 5,20,350 | 49,679 |

| 23,900 | 11,04,000 | 4,28,925 | 28,882 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 24,11,100 | -2,49,225 | 40,741 |

| 24,800 | 11,58,900 | -2,16,600 | 17,919 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 39,00,300 | -81,975 | 1,32,472 |

| 24,500 | 34,31,775 | -75,075 | 1,22,601 |

BANKNIFTY Monthly Expiry (28/08/2025)

The BANKNIFTY index closed at 55521.15. The BANKNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.795 against previous 0.768. The 57000CE option holds the maximum open interest, followed by the 57000PE and 56000CE options. Market participants have shown increased interest with significant open interest additions in the 65000CE option, with open interest additions also seen in the 55100PE and 52000PE options. On the other hand, open interest reductions were prominent in the 58000CE, 61000CE, and 56000PE options. Trading volume was highest in the 55000PE option, followed by the 55500CE and 55200PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,521.15 | 0.795 | 0.768 | 0.903 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,52,08,165 | 1,53,73,365 | -1,65,200 |

| PUT: | 1,20,95,685 | 1,18,09,359 | 2,86,326 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 21,94,955 | -35,840 | 96,819 |

| 56,000 | 12,47,540 | 33,810 | 1,12,838 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 65,000 | 3,92,665 | 1,16,340 | 20,836 |

| 55,000 | 2,96,905 | 49,770 | 75,620 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 8,86,410 | -1,26,245 | 44,121 |

| 61,000 | 3,69,495 | -1,14,380 | 17,745 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 7,24,920 | -34,755 | 1,31,609 |

| 56,000 | 12,47,540 | 33,810 | 1,12,838 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 13,52,260 | -32,515 | 6,190 |

| 54,000 | 9,33,730 | 24,815 | 76,965 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,100 | 1,37,445 | 61,425 | 80,759 |

| 52,000 | 5,29,270 | 55,405 | 34,326 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 8,96,455 | -64,820 | 36,298 |

| 53,500 | 3,58,785 | -54,740 | 41,261 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 9,18,155 | -6,930 | 1,58,228 |

| 55,200 | 1,74,825 | 25,830 | 1,13,036 |

FINNIFTY Monthly Expiry (28/08/2025)

The FINNIFTY index closed at 26403.9. The FINNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.683 against previous 0.663. The 27000CE option holds the maximum open interest, followed by the 27900CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 27900CE option, with open interest additions also seen in the 27500CE and 26500CE options. On the other hand, open interest reductions were prominent in the 27000CE, 26800CE, and 26400CE options. Trading volume was highest in the 27000CE option, followed by the 26400CE and 26600CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,403.90 | 0.683 | 0.663 | 0.612 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 8,82,635 | 8,01,450 | 81,185 |

| PUT: | 6,02,940 | 5,31,375 | 71,565 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,09,850 | -29,575 | 5,624 |

| 27,900 | 1,09,135 | 84,500 | 2,708 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 1,09,135 | 84,500 | 2,708 |

| 27,500 | 71,955 | 20,150 | 2,699 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,09,850 | -29,575 | 5,624 |

| 26,800 | 99,450 | -21,450 | 2,894 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,09,850 | -29,575 | 5,624 |

| 26,400 | 31,850 | -20,150 | 4,537 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 86,970 | 13,585 | 3,441 |

| 26,500 | 70,720 | 14,755 | 945 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 56,745 | 16,705 | 994 |

| 26,500 | 70,720 | 14,755 | 945 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 40,755 | -9,880 | 1,964 |

| 26,800 | 16,835 | -9,620 | 347 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 22,230 | 11,765 | 3,445 |

| 26,000 | 86,970 | 13,585 | 3,441 |

MIDCPNIFTY Monthly Expiry (28/08/2025)

The MIDCPNIFTY index closed at 12724.7. The MIDCPNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.038 against previous 0.934. The 12000PE option holds the maximum open interest, followed by the 13000CE and 12500PE options. Market participants have shown increased interest with significant open interest additions in the 12600PE option, with open interest additions also seen in the 13600CE and 12600CE options. On the other hand, open interest reductions were prominent in the 56000CE, 56000CE, and 56000PE options. Trading volume was highest in the 13000CE option, followed by the 12600PE and 12700CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,724.70 | 1.038 | 0.934 | 0.814 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 46,41,840 | 50,19,420 | -3,77,580 |

| PUT: | 48,18,660 | 46,88,460 | 1,30,200 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,70,360 | -1,29,500 | 20,520 |

| 13,500 | 4,47,860 | -50,680 | 7,137 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 1,86,060 | 69,440 | 2,603 |

| 12,600 | 1,47,840 | 55,300 | 15,140 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,70,360 | -1,29,500 | 20,520 |

| 12,650 | 36,120 | -71,260 | 6,890 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,70,360 | -1,29,500 | 20,520 |

| 12,700 | 2,04,680 | -19,880 | 18,956 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,23,240 | -54,180 | 12,175 |

| 12,500 | 4,98,260 | -91,140 | 15,579 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 2,16,300 | 85,820 | 19,356 |

| 12,800 | 2,22,320 | 49,420 | 3,615 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 2,75,520 | -1,11,860 | 1,937 |

| 12,500 | 4,98,260 | -91,140 | 15,579 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 2,16,300 | 85,820 | 19,356 |

| 12,500 | 4,98,260 | -91,140 | 15,579 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Today’s Open Interest Volume Analysis suggests the market is pausing and cautiously rebuilding after recent pressure, with immediate expiry risk well-managed around the 24,600–24,700 zone for Nifty. The uptick in PCR and max pain stability give bulls a foothold, but strong call writing at 25,000 means any rally will face quick profit-taking unless backed by new catalysts. Bulls should favor neutral-to-slightly bullish options spreads near 24,600 or buy on dips as long as put support keeps increasing around 24,500. For bears, a sustained break below 24,550 could bring fast downside scalps, but lack of aggressive OI build on the short side calls for caution.

In the broader market, BankNifty, FINNIFTY, and MIDCPNIFTY show that interest is returning, especially in midcaps where OI patterns point to improving sentiment. Volatility spikes could come if key resistance is crossed, so stay alert for volume and OI surges as early signals. Let this Open Interest Volume Analysis guide your approach for the coming sessions: stick to tactical range trades, monitor emerging OI trends, and watch for a clear break from these expiry anchor zones before betting on the next trend.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]