Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 11/08/2025

Table of Contents

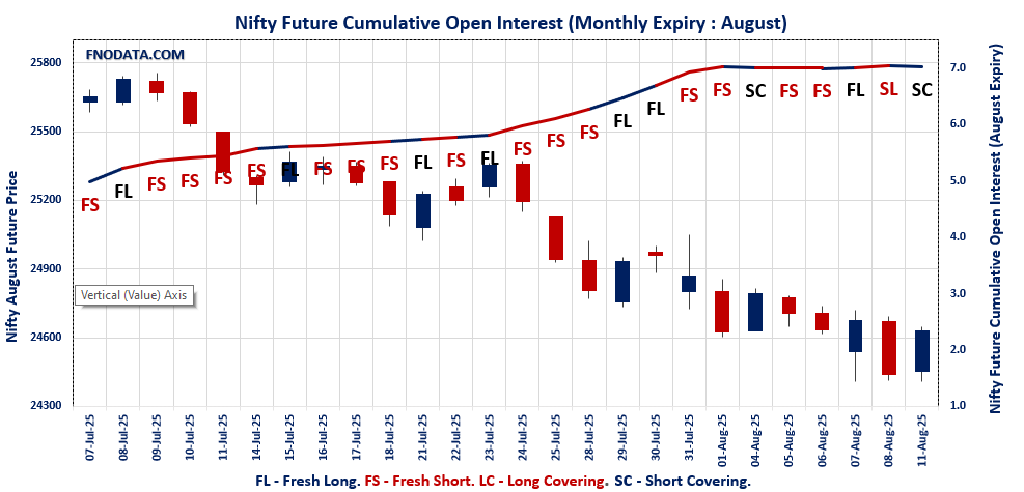

The Open Interest Volume Analysis for 11th August 2025 highlights a much-needed bounce in Indian markets, as indices finally found their footing after a stretch of downward pressure. Nifty August futures rose 0.76% to 24,627.90, but what stands out is the 1.9% drop in open interest and a sharp fall in futures premium by nearly 35 points—clear signs of aggressive short covering and profit booking from recent bears.

Weekly options data reinforce this shift: the Put-Call Ratio (OI) almost doubled to 0.998, marking a return of balance as put writers stepped back in around the 24,400–24,550 area, with max pain now centered at 24,550. Monthlies echoed this stabilization, with the PCR inching up to 0.988 and the 24,800–25,000 zone emerging as overhead resistance. Overall, the derivatives landscape paints a picture of a market moving out of “risk-off mode” and into a tactical, range-bound phase as traders unwind bearish bets and cautiously watch for a trend change.

BankNifty followed suit, gaining 0.68% with a 3.7% reduction in open interest and a dramatic drop in premium, again underscoring short covering rather than any large-scale bullish buildup. FINNIFTY and MIDCPNIFTY both gained nearly 1%, with FINNIFTY showing near-flat OI and midcaps seeing fresh long interest, as reflected in their higher PCRs. SENSEX futures also rebounded with a significant OI drop, and weekly options now indicate rising confidence—with PCR above 1.12 and call/put interest packed at key expiry pivots.

NSE & BSE F&O Market Signals

NIFTY AUGUST Future

NIFTY Spot closed at: 24,585.05 (0.91%)

NIFTY AUGUST Future closed at: 24,627.90 (0.76%)

Premium: 42.85 (Decreased by -34.95 points)

Open Interest Change: -1.9%

Volume Change: -20.2%

NIFTY Weekly Expiry (14/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.998 (Increased from 0.476)

Put-Call Ratio (Volume): 0.884

Max Pain Level: 24550

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 23500

Highest CALL Addition: 25050

Highest PUT Addition: 24400

NIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.988 (Increased from 0.936)

Put-Call Ratio (Volume): 0.894

Max Pain Level: 24900

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 24800

Highest PUT Addition: 24300

BANKNIFTY AUGUST Future

BANKNIFTY Spot closed at: 55,510.75 (0.92%)

BANKNIFTY AUGUST Future closed at: 55,540.00 (0.68%)

Premium: 29.25 (Decreased by -131.85 points)

Open Interest Change: -3.7%

Volume Change: -6.8%

BANKNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.757 (Increased from 0.708)

Put-Call Ratio (Volume): 0.711

Max Pain Level: 55800

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 63000

Highest PUT Addition: 52500

FINNIFTY AUGUST Future

FINNIFTY Spot closed at: 26,405.80 (0.91%)

FINNIFTY AUGUST Future closed at: 26,411.40 (0.64%)

Premium: 5.6 (Decreased by -69.55 points)

Open Interest Change: 0.5%

Volume Change: -49.1%

FINNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.746 (Increased from 0.603)

Put-Call Ratio (Volume): 0.643

Max Pain Level: 26500

Maximum CALL Open Interest: 27900

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 26000

MIDCPNIFTY AUGUST Future

MIDCPNIFTY Spot closed at: 12,610.50 (0.83%)

MIDCPNIFTY AUGUST Future closed at: 12,658.50 (0.82%)

Premium: 48 (Decreased by -1.85 points)

Open Interest Change: 4.5%

Volume Change: -12.0%

MIDCPNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.865 (Increased from 0.840)

Put-Call Ratio (Volume): 0.722

Max Pain Level: 12700

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12000

Highest CALL Addition: 14000

Highest PUT Addition: 12550

SENSEX Weekly Expiry (12/08/2025) Future

SENSEX Spot closed at: 80,604.08 (0.93%)

SENSEX Weekly Future closed at: 80,546.60 (0.70%)

Discount: -57.48 (Decreased by -185.29 points)

Open Interest Change: -32.8%

Volume Change: 79.0%

SENSEX Weekly Expiry (12/08/2025) Option Analysis

Put-Call Ratio (OI): 1.129 (Increased from 0.551)

Put-Call Ratio (Volume): 0.910

Max Pain Level: 80500

Maximum CALL OI: 82000

Maximum PUT OI: 79000

Highest CALL Addition: 82000

Highest PUT Addition: 79000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,202.65 Cr

DIIs Net BUY: ₹ 5,972.36 Cr

FII Derivatives Activity

| FII Trading Stats | 11.08.25 | 8.08.25 | 7.08.25 |

| FII Cash (Provisional Data) | -1,202.65 | 1,932.81 | -4,997.19 |

| Index Future Open Interest Long Ratio | 8.45% | 8.28% | 8.59% |

| Index Future Volume Long Ratio | 55.96% | 36.17% | 42.00% |

| Call Option Open Interest Long Ratio | 45.29% | 44.40% | 45.57% |

| Call Option Volume Long Ratio | 50.29% | 49.47% | 50.20% |

| Put Option Open Interest Long Ratio | 64.22% | 70.86% | 70.48% |

| Put Option Volume Long Ratio | 49.38% | 50.40% | 49.88% |

| Stock Future Open Interest Long Ratio | 61.80% | 61.54% | 61.97% |

| Stock Future Volume Long Ratio | 53.53% | 46.60% | 51.07% |

| Index Futures | Short Covering | Fresh Short | Fresh Short |

| Index Options | Fresh Short | Fresh Short | Short Covering |

| Nifty Futures | Short Covering | Fresh Short | Fresh Short |

| Nifty Options | Fresh Short | Fresh Long | Short Covering |

| BankNifty Futures | Short Covering | Fresh Short | Fresh Long |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Long |

| FinNifty Futures | Fresh Long | Long Covering | Long Covering |

| FinNifty Options | Fresh Long | Fresh Short | Fresh Short |

| MidcpNifty Futures | Fresh Short | Long Covering | Fresh Short |

| MidcpNifty Options | Fresh Short | Fresh Short | Short Covering |

| NiftyNxt50 Futures | Fresh Long | Fresh Short | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Fresh Long |

| Stock Futures | Fresh Long | Long Covering | Fresh Long |

| Stock Options | Fresh Long | Fresh Long | Fresh Short |

Fresh Long: increase in open interest and increase in price

Fresh Short: increase in open interest and decrease in price

Short Covering: decrease in open interest and increase in price

Long Covering: decrease in open interest and decrease in price

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (14/08/2025)

The NIFTY index closed at 24585.05. The NIFTY weekly expiry for AUGUST 14, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.998 against previous 0.476. The 25000CE option holds the maximum open interest, followed by the 23500PE and 24400PE options. Market participants have shown increased interest with significant open interest additions in the 24400PE option, with open interest additions also seen in the 23500PE and 24500PE options. On the other hand, open interest reductions were prominent in the 24500CE, 24600CE, and 24400CE options. Trading volume was highest in the 24500CE option, followed by the 24400PE and 24600CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 14-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,585.05 | 0.998 | 0.476 | 0.884 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 14,10,56,625 | 16,96,17,000 | -2,85,60,375 |

| PUT: | 14,07,24,975 | 8,07,42,750 | 5,99,82,225 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,09,43,850 | -14,76,225 | 13,90,652 |

| 25,500 | 93,40,200 | -4,31,775 | 5,67,769 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,050 | 26,22,450 | 5,57,925 | 4,09,848 |

| 27,100 | 25,36,800 | 1,79,700 | 78,082 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 53,10,000 | -57,46,050 | 40,62,247 |

| 24,600 | 82,31,775 | -22,17,075 | 30,89,063 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 53,10,000 | -57,46,050 | 40,62,247 |

| 24,600 | 82,31,775 | -22,17,075 | 30,89,063 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 99,94,500 | 47,31,225 | 6,23,476 |

| 24,400 | 96,03,600 | 57,13,575 | 37,23,837 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 96,03,600 | 57,13,575 | 37,23,837 |

| 23,500 | 99,94,500 | 47,31,225 | 6,23,476 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,200 | 19,20,450 | -12,54,525 | 2,57,588 |

| 24,900 | 4,10,625 | -66,225 | 11,437 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,400 | 96,03,600 | 57,13,575 | 37,23,837 |

| 24,500 | 91,35,975 | 43,49,850 | 26,27,733 |

SENSEX Weekly Expiry (12/08/2025)

The SENSEX index closed at 80604.08. The SENSEX weekly expiry for AUGUST 12, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.129 against previous 0.551. The 82000CE option holds the maximum open interest, followed by the 79000PE and 78000PE options. Market participants have shown increased interest with significant open interest additions in the 79000PE option, with open interest additions also seen in the 79500PE and 78000PE options. On the other hand, open interest reductions were prominent in the 80000CE, 82500CE, and 80100CE options. Trading volume was highest in the 80000PE option, followed by the 80500CE and 81000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 12-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80604.08 | 1.129 | 0.551 | 0.910 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,42,56,800 | 2,63,29,760 | -20,72,960 |

| PUT: | 2,73,95,440 | 1,45,06,140 | 1,28,89,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 21,06,900 | 6,47,760 | 2,48,17,840 |

| 81000 | 17,38,560 | 22,600 | 8,56,05,700 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 21,06,900 | 6,47,760 | 2,48,17,840 |

| 81400 | 8,69,820 | 5,27,600 | 1,86,53,220 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 3,54,700 | -8,87,440 | 5,57,36,240 |

| 82500 | 10,53,460 | -5,75,840 | 1,31,53,060 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 11,53,920 | -2,37,340 | 9,17,27,180 |

| 81000 | 17,38,560 | 22,600 | 8,56,05,700 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 20,82,940 | 14,02,820 | 5,12,76,020 |

| 78000 | 19,24,620 | 9,13,620 | 1,77,91,140 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 20,82,940 | 14,02,820 | 5,12,76,020 |

| 79500 | 16,04,140 | 9,64,840 | 5,99,39,080 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 76000 | 5,06,460 | -1,70,740 | 50,40,000 |

| 75000 | 3,03,840 | -93,220 | 18,44,140 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 17,61,380 | 9,12,760 | 9,41,86,780 |

| 79500 | 16,04,140 | 9,64,840 | 5,99,39,080 |

NIFTY Monthly Expiry (28/08/2025)

The NIFTY index closed at 24585.05. The NIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.988 against previous 0.936. The 25000CE option holds the maximum open interest, followed by the 26000CE and 24000PE options. Market participants have shown increased interest with significant open interest additions in the 24300PE option, with open interest additions also seen in the 24000PE and 23500PE options. On the other hand, open interest reductions were prominent in the 24500CE, 24400CE, and 24600CE options. Trading volume was highest in the 25000CE option, followed by the 24000PE and 24500PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,585.05 | 0.988 | 0.936 | 0.894 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,27,66,575 | 4,41,89,925 | -14,23,350 |

| PUT: | 4,22,37,450 | 4,13,48,400 | 8,89,050 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 65,78,475 | -25,425 | 88,695 |

| 26,000 | 44,33,325 | -1,20,525 | 31,448 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 19,84,725 | 63,450 | 34,433 |

| 25,350 | 1,54,350 | 43,500 | 2,769 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 22,53,750 | -3,02,550 | 80,256 |

| 24,400 | 5,86,500 | -2,48,475 | 43,311 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 65,78,475 | -25,425 | 88,695 |

| 24,500 | 22,53,750 | -3,02,550 | 80,256 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 42,85,350 | 1,86,975 | 85,984 |

| 24,500 | 37,89,825 | 60,000 | 84,387 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,300 | 15,42,375 | 2,33,550 | 32,529 |

| 24,000 | 42,85,350 | 1,86,975 | 85,984 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 12,01,575 | -1,21,950 | 31,868 |

| 24,800 | 10,67,025 | -85,425 | 10,134 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 42,85,350 | 1,86,975 | 85,984 |

| 24,500 | 37,89,825 | 60,000 | 84,387 |

BANKNIFTY Monthly Expiry (28/08/2025)

The BANKNIFTY index closed at 55510.75. The BANKNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.757 against previous 0.708. The 57000CE option holds the maximum open interest, followed by the 57000PE and 56000CE options. Market participants have shown increased interest with significant open interest additions in the 63000CE option, with open interest additions also seen in the 52500PE and 54900PE options. On the other hand, open interest reductions were prominent in the 59000CE, 55000CE, and 56000CE options. Trading volume was highest in the 55500CE option, followed by the 55000PE and 55200CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,510.75 | 0.757 | 0.708 | 0.711 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,69,60,090 | 1,75,02,984 | -5,42,894 |

| PUT: | 1,28,45,770 | 1,23,83,665 | 4,62,105 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 22,68,420 | -28,000 | 84,354 |

| 56,000 | 13,04,065 | -1,23,270 | 1,20,433 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 63,000 | 4,62,945 | 2,86,790 | 15,346 |

| 65,000 | 4,74,600 | 67,585 | 11,718 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 5,75,715 | -1,48,750 | 24,219 |

| 55,000 | 3,64,630 | -1,44,235 | 92,704 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 9,63,620 | -63,770 | 1,70,150 |

| 55,200 | 1,43,150 | -72,905 | 1,24,500 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 13,23,035 | -9,555 | 3,997 |

| 55,000 | 9,81,540 | 48,335 | 1,32,712 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 52,500 | 3,59,940 | 1,01,990 | 22,290 |

| 54,900 | 1,53,755 | 73,500 | 31,646 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 9,05,310 | -78,330 | 69,214 |

| 56,000 | 8,44,585 | -68,845 | 18,745 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 9,81,540 | 48,335 | 1,32,712 |

| 55,200 | 2,23,300 | 54,180 | 1,03,072 |

FINNIFTY Monthly Expiry (28/08/2025)

The FINNIFTY index closed at 26405.8. The FINNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.746 against previous 0.603. The 27900CE option holds the maximum open interest, followed by the 26500CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26000PE option, with open interest additions also seen in the 27000CE and 26200PE options. On the other hand, open interest reductions were prominent in the 26500CE, 26300CE, and 26600CE options. Trading volume was highest in the 26500CE option, followed by the 27000CE and 26000PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,405.80 | 0.746 | 0.603 | 0.643 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,17,120 | 10,20,110 | -2,990 |

| PUT: | 7,58,745 | 6,15,225 | 1,43,520 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,900 | 1,26,620 | -195 | 200 |

| 26,500 | 1,20,965 | -35,360 | 6,096 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,03,935 | 25,090 | 5,314 |

| 26,700 | 59,670 | 13,065 | 1,081 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,20,965 | -35,360 | 6,096 |

| 26,300 | 16,965 | -13,195 | 2,663 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,20,965 | -35,360 | 6,096 |

| 27,000 | 1,03,935 | 25,090 | 5,314 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,07,640 | 37,310 | 3,942 |

| 26,500 | 66,365 | -5,070 | 647 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,07,640 | 37,310 | 3,942 |

| 26,200 | 31,330 | 22,815 | 3,350 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 66,365 | -5,070 | 647 |

| 25,500 | 44,330 | -4,680 | 2,818 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,07,640 | 37,310 | 3,942 |

| 26,200 | 31,330 | 22,815 | 3,350 |

MIDCPNIFTY Monthly Expiry (28/08/2025)

The MIDCPNIFTY index closed at 12610.5. The MIDCPNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.865 against previous 0.840. The 12000PE option holds the maximum open interest, followed by the 13000CE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 14000CE option, with open interest additions also seen in the 12700CE and 13500CE options. On the other hand, open interest reductions were prominent in the 66000PE, 65900PE, and 57000PE options. Trading volume was highest in the 12600CE option, followed by the 12500PE and 13000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,610.50 | 0.865 | 0.840 | 0.722 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 62,80,540 | 62,51,980 | 28,560 |

| PUT: | 54,29,620 | 52,49,160 | 1,80,460 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,30,800 | -1,07,240 | 16,498 |

| 13,500 | 5,74,560 | 60,480 | 4,867 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 4,75,300 | 1,11,720 | 2,549 |

| 12,700 | 3,98,020 | 60,620 | 12,031 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,30,800 | -1,07,240 | 16,498 |

| 13,800 | 3,05,200 | -48,860 | 1,252 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 3,21,720 | -19,180 | 17,696 |

| 13,000 | 7,30,800 | -1,07,240 | 16,498 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,84,700 | -31,360 | 8,907 |

| 12,500 | 5,01,760 | -33,180 | 17,430 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,550 | 92,120 | 42,980 | 5,899 |

| 12,600 | 3,55,180 | 39,900 | 15,366 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 5,01,760 | -33,180 | 17,430 |

| 12,000 | 7,84,700 | -31,360 | 8,907 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 5,01,760 | -33,180 | 17,430 |

| 12,600 | 3,55,180 | 39,900 | 15,366 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis confirms that bears are covering in droves, allowing markets to breathe and potentially form a near-term base. With Nifty max pain still near 24,550 and the PCR crossing close to 1, a range-bound setup is likely as both buyers and sellers recalibrate risk. For short-term traders, this is an environment to focus on neutral-to-slightly bullish options strategies—straddles or strangles near max pain, vertical call spreads between 24,600 and 24,900, or simply trailing stops on profitable long trades as the market absorbs supply. Upside will face tough resistance near 25,000 due to heavy call OI; for downside, remaining hedged below 24,400 is prudent if renewed selling emerges.

In BankNifty and midcaps, follow the open interest and volume clues—momentum trades are best taken only as new OI confirms the direction, while FINNIFTY’s muted buildup warns against expecting a sustained sectoral rally just yet. Above all, let this Open Interest Volume Analysis frame your trading plan: stick to disciplined, data-driven decisions in this transition zone, and be ready to shift gears quickly as fresh open interest and option cues shape the next trend in August.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]