Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 14/08/2025

Table of Contents

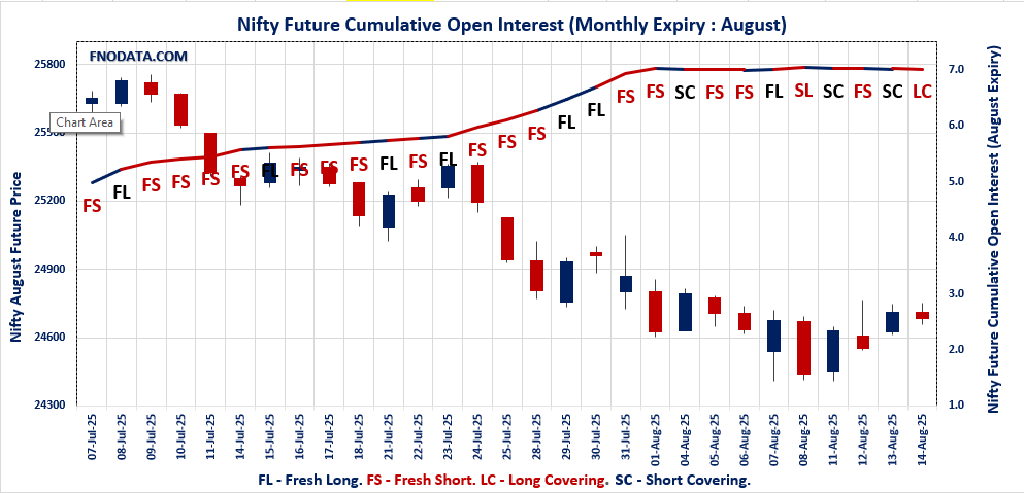

The Open Interest Volume Analysis for 14th August 2025 reveals a market treading water after recent swings, as traders brace for the next direction. Nifty August futures closed at 24,684.70, posting a negligible 0.11% drop despite the spot index eking out a tiny 0.05% gain. The big story is the sharp 39-point drop in futures premium, along with a modest 0.7% decline in open interest and lighter volumes, signaling that both bulls and bears are content to unwind positions and step back after expiry volatility. Weekly options data echoes this hesitation—the Put-Call Ratio (OI) slipped to 0.88, showing that call writers are taking charge near key resistance at 25,500 and 26,000 strangles, while put writers look for support around 22,600–23,500. Max pain for expiry is tightly clamped at 24,650, suggesting Nifty is likely to remain pinned near this zone barring any big external catalyst.

BANKNIFTY and FINNIFTY also reflected the same mood. BANKNIFTY futures saw a modest uptick, but a 2.4% OI drop and a sharp shrinkage in premium indicate lack of bullish conviction. Options open interest still crowds at 57,000, while near-term support pockets develop at 51,000–55,000. FINNIFTY’s mild gains were coupled with falling open interest and premium—classic consolidation after short covering, with max pain at 26,400 and key OI clusters hinting at a range-bound outlook. In MIDCPNIFTY, price drifted 0.6% lower with OI width narrowing, reflecting indecision and a tug-of-war between selective buying and persistent profit booking. SENSEX too was flat, as a big drop in open interest and premium suggests traders are staying on the sidelines ahead of the long weekend.

NSE & BSE F&O Market Signals

NIFTY AUGUST Future

NIFTY Spot closed at: 24,631.30 (0.05%)

NIFTY AUGUST Future closed at: 24,684.70 (-0.11%)

Premium: 53.4 (Decreased by -39.45 points)

Open Interest Change: -0.7%

Volume Change: -13.1%

NIFTY Weekly Expiry (21/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.879 (Decreased from 1.041)

Put-Call Ratio (Volume): 0.867

Max Pain Level: 24650

Maximum CALL Open Interest: 25500

Maximum PUT Open Interest: 22600

Highest CALL Addition: 26000

Highest PUT Addition: 23500

NIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.967 (Increased from 0.928)

Put-Call Ratio (Volume): 0.869

Max Pain Level: 24850

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24500

Highest CALL Addition: 24700

Highest PUT Addition: 24200

BANKNIFTY AUGUST Future

BANKNIFTY Spot closed at: 55,341.85 (0.29%)

BANKNIFTY AUGUST Future closed at: 55,503.80 (0.13%)

Premium: 161.95 (Decreased by -89.8 points)

Open Interest Change: -2.4%

Volume Change: 2.9%

BANKNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.716 (Increased from 0.696)

Put-Call Ratio (Volume): 0.740

Max Pain Level: 55700

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 59500

Highest PUT Addition: 51000

FINNIFTY AUGUST Future

FINNIFTY Spot closed at: 26,333.45 (0.36%)

FINNIFTY AUGUST Future closed at: 26,405.10 (0.19%)

Premium: 71.65 (Decreased by -44.75 points)

Open Interest Change: -1.7%

Volume Change: -19.3%

FINNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.870 (Increased from 0.667)

Put-Call Ratio (Volume): 0.680

Max Pain Level: 26400

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 28300

Highest PUT Addition: 26000

MIDCPNIFTY AUGUST Future

MIDCPNIFTY Spot closed at: 12,639.10 (-0.47%)

MIDCPNIFTY AUGUST Future closed at: 12,666.95 (-0.64%)

Premium: 27.85 (Decreased by -22 points)

Open Interest Change: 0.5%

Volume Change: -20.2%

MIDCPNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.865 (Decreased from 0.964)

Put-Call Ratio (Volume): 0.944

Max Pain Level: 12700

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12000

Highest CALL Addition: 13000

Highest PUT Addition: 12650

SENSEX Monthly Expiry (24/08/2025) Future

SENSEX Spot closed at: 80,597.66 (0.07%)

SENSEX Monthly Future closed at: 80,811.45 (-0.06%)

Premium: 213.79 (Decreased by -103.55 points)

Open Interest Change: -5.7%

Volume Change: -42.7%

SENSEX Weekly Expiry (19/08/2025) Option Analysis

Put-Call Ratio (OI): 0.886 (Decreased from 1.026)

Put-Call Ratio (Volume): 0.961

Max Pain Level: 80600

Maximum CALL OI: 83000

Maximum PUT OI: 78000

Highest CALL Addition: 81000

Highest PUT Addition: 78000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,926.76 Cr

DIIs Net BUY: ₹ 3,895.68 Cr

FII Derivatives Activity

| FII Trading Stats | 14.08.25 | 13.08.25 | 12.08.25 |

| FII Cash (Provisional Data) | -1,926.76 | -3,644.43 | -3,398.80 |

| Index Future Open Interest Long Ratio | 8.30% | 8.66% | 7.95% |

| Index Future Volume Long Ratio | 49.61% | 56.32% | 39.49% |

| Call Option Open Interest Long Ratio | 47.04% | 46.96% | 44.55% |

| Call Option Volume Long Ratio | 49.85% | 50.29% | 49.83% |

| Put Option Open Interest Long Ratio | 71.87% | 60.21% | 66.30% |

| Put Option Volume Long Ratio | 50.09% | 49.48% | 50.18% |

| Stock Future Open Interest Long Ratio | 61.72% | 61.98% | 61.79% |

| Stock Future Volume Long Ratio | 47.74% | 52.69% | 50.74% |

| Index Futures | Long Covering | Fresh Long | Fresh Short |

| Index Options | Long Covering | Fresh Short | Fresh Long |

| Nifty Futures | Short Covering | Fresh Long | Fresh Short |

| Nifty Options | Long Covering | Fresh Short | Fresh Long |

| BankNifty Futures | Short Covering | Fresh Short | Fresh Short |

| BankNifty Options | Fresh Short | Fresh Short | Long Covering |

| FinNifty Futures | Long Covering | Fresh Long | Long Covering |

| FinNifty Options | Fresh Long | Fresh Short | Fresh Short |

| MidcpNifty Futures | Long Covering | Fresh Short | Long Covering |

| MidcpNifty Options | Fresh Long | Short Covering | Fresh Long |

| NiftyNxt50 Futures | Long Covering | Fresh Long | Long Covering |

| NiftyNxt50 Options | Long Covering | Short Covering | Fresh Long |

| Stock Futures | Fresh Short | Fresh Long | Fresh Long |

| Stock Options | Fresh Long | Fresh Long | Fresh Short |

Fresh Long: increase in open interest and increase in price

Fresh Short: increase in open interest and decrease in price

Short Covering: decrease in open interest and increase in price

Long Covering: decrease in open interest and decrease in price

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (21/08/2025)

The NIFTY index closed at 24631.3. The NIFTY weekly expiry for AUGUST 21, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.879 against previous 1.041. The 25500CE option holds the maximum open interest, followed by the 22600PE and 25000CE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 25500CE and 25000CE options. On the other hand, open interest reductions were prominent in the 24450CE, 24550CE, and 24350CE options. Trading volume was highest in the 24600PE option, followed by the 24700CE and 24600CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 21-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,631.30 | 0.879 | 1.041 | 0.867 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,88,23,250 | 3,27,34,275 | 2,60,88,975 |

| PUT: | 5,17,21,725 | 3,40,72,125 | 1,76,49,600 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 53,60,475 | 28,25,850 | 1,68,553 |

| 25,000 | 48,85,950 | 23,43,825 | 2,97,872 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 44,31,300 | 28,70,025 | 1,27,299 |

| 25,500 | 53,60,475 | 28,25,850 | 1,68,553 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,450 | 1,52,700 | -31,425 | 9,331 |

| 24,550 | 2,61,975 | -29,325 | 36,478 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 35,39,100 | 15,41,475 | 3,63,915 |

| 24,600 | 28,03,125 | 10,01,550 | 3,34,701 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 22,600 | 49,06,575 | 12,08,775 | 73,940 |

| 23,500 | 38,29,425 | 20,26,275 | 1,01,983 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 38,29,425 | 20,26,275 | 1,01,983 |

| 24,000 | 37,22,850 | 14,58,825 | 1,52,302 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| – | – | – | – |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 34,06,350 | 10,91,700 | 4,32,331 |

| 24,500 | 26,43,900 | 8,72,475 | 2,58,742 |

SENSEX Weekly Expiry (19/08/2025)

The SENSEX index closed at 80597.66. The SENSEX weekly expiry for AUGUST 19, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.886 against previous 1.026. The 83000CE option holds the maximum open interest, followed by the 78000PE and 81000CE options. Market participants have shown increased interest with significant open interest additions in the 78000PE option, with open interest additions also seen in the 81000CE and 83000CE options. On the other hand, open interest reductions were prominent in the 80500CE, 77500PE, and 80400PE options. Trading volume was highest in the 80600PE option, followed by the 80500PE and 80700CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 19-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80597.66 | 0.886 | 1.026 | 0.961 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,17,50,580 | 74,63,360 | 42,87,220 |

| PUT: | 1,04,05,280 | 76,60,460 | 27,44,820 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 10,43,660 | 3,63,560 | 60,81,220 |

| 81000 | 8,62,800 | 4,51,140 | 1,14,94,760 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 8,62,800 | 4,51,140 | 1,14,94,760 |

| 83000 | 10,43,660 | 3,63,560 | 60,81,220 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 5,27,860 | -70,140 | 97,08,920 |

| 80400 | 83,780 | -34,880 | 22,57,060 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 80700 | 4,44,640 | 2,29,440 | 1,46,30,820 |

| 80600 | 4,54,480 | 1,91,760 | 1,35,25,420 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 9,37,140 | 4,95,540 | 46,41,840 |

| 80500 | 8,27,780 | 1,02,620 | 1,51,11,580 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 9,37,140 | 4,95,540 | 46,41,840 |

| 78500 | 5,60,720 | 3,21,120 | 33,23,660 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 77500 | 2,95,640 | -68,980 | 34,95,240 |

| 80400 | 2,51,420 | -34,960 | 70,29,840 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80600 | 3,72,920 | 1,31,740 | 1,54,57,360 |

| 80500 | 8,27,780 | 1,02,620 | 1,51,11,580 |

NIFTY Monthly Expiry (28/08/2025)

The NIFTY index closed at 24631.3. The NIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.967 against previous 0.928. The 25000CE option holds the maximum open interest, followed by the 25500CE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 24700CE option, with open interest additions also seen in the 24200PE and 24700PE options. On the other hand, open interest reductions were prominent in the 26000CE, 25400CE, and 24000PE options. Trading volume was highest in the 25000CE option, followed by the 24500PE and 24600PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,631.30 | 0.967 | 0.928 | 0.869 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,56,45,525 | 4,63,99,200 | -7,53,675 |

| PUT: | 4,41,39,675 | 4,30,63,200 | 10,76,475 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 68,28,000 | 8,925 | 88,323 |

| 25,500 | 47,84,100 | 1,59,075 | 40,283 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 22,29,075 | 5,90,700 | 56,163 |

| 24,500 | 21,15,225 | 1,95,150 | 36,116 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 41,10,225 | -10,43,925 | 48,950 |

| 25,400 | 11,07,900 | -9,15,525 | 35,816 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 68,28,000 | 8,925 | 88,323 |

| 24,700 | 22,29,075 | 5,90,700 | 56,163 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 40,63,950 | 1,23,750 | 75,410 |

| 24,000 | 38,29,950 | -2,79,225 | 60,903 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 19,23,000 | 5,34,900 | 39,340 |

| 24,700 | 18,16,650 | 4,59,900 | 47,474 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 38,29,950 | -2,79,225 | 60,903 |

| 22,800 | 12,03,225 | -2,11,800 | 6,994 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 40,63,950 | 1,23,750 | 75,410 |

| 24,600 | 16,94,550 | 85,350 | 68,191 |

BANKNIFTY Monthly Expiry (28/08/2025)

The BANKNIFTY index closed at 55341.85. The BANKNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.716 against previous 0.696. The 57000CE option holds the maximum open interest, followed by the 56000CE and 57000PE options. Market participants have shown increased interest with significant open interest additions in the 59500CE option, with open interest additions also seen in the 57500CE and 51000PE options. On the other hand, open interest reductions were prominent in the 58000CE, 57000CE, and 55200CE options. Trading volume was highest in the 55500CE option, followed by the 55400CE and 55300CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,341.85 | 0.716 | 0.696 | 0.740 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,88,00,915 | 1,94,06,975 | -6,06,060 |

| PUT: | 1,34,57,640 | 1,35,04,365 | -46,725 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 22,75,910 | -1,76,260 | 77,079 |

| 56,000 | 14,95,655 | -15,750 | 1,24,535 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 4,33,860 | 1,37,095 | 22,546 |

| 57,500 | 7,62,405 | 1,06,225 | 38,787 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 10,12,340 | -2,34,290 | 50,152 |

| 57,000 | 22,75,910 | -1,76,260 | 77,079 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 11,56,365 | -76,335 | 1,81,187 |

| 55,400 | 3,81,220 | 10,325 | 1,39,863 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 13,13,060 | -6,335 | 1,911 |

| 55,000 | 9,58,720 | -69,650 | 1,14,097 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 4,36,240 | 47,775 | 16,708 |

| 55,300 | 2,67,645 | 44,975 | 1,20,400 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 7,67,935 | -93,450 | 54,882 |

| 51,500 | 2,01,250 | -92,295 | 16,166 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 9,03,630 | 37,135 | 1,23,482 |

| 55,300 | 2,67,645 | 44,975 | 1,20,400 |

FINNIFTY Monthly Expiry (28/08/2025)

The FINNIFTY index closed at 26333.45. The FINNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.870 against previous 0.667. The 26500CE option holds the maximum open interest, followed by the 26000PE and 27000CE options. Market participants have shown increased interest with significant open interest additions in the 26000PE option, with open interest additions also seen in the 26400PE and 26350PE options. On the other hand, open interest reductions were prominent in the 26500CE, 27000CE, and 26250CE options. Trading volume was highest in the 27000CE option, followed by the 26300PE and 26300CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,333.45 | 0.870 | 0.667 | 0.680 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 11,62,200 | 12,69,450 | -1,07,250 |

| PUT: | 10,11,400 | 8,46,235 | 1,65,165 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,52,490 | -31,915 | 4,696 |

| 27,000 | 1,16,545 | -19,500 | 8,319 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 28,300 | 9,490 | 6,630 | 217 |

| 26,400 | 64,285 | 6,565 | 3,562 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,52,490 | -31,915 | 4,696 |

| 27,000 | 1,16,545 | -19,500 | 8,319 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,16,545 | -19,500 | 8,319 |

| 26,300 | 25,740 | -3,510 | 6,159 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,46,835 | 63,050 | 5,682 |

| 26,500 | 77,805 | 9,100 | 997 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,46,835 | 63,050 | 5,682 |

| 26,400 | 64,220 | 39,390 | 3,204 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,250 | 21,320 | -17,810 | 1,681 |

| 25,500 | 59,345 | -16,770 | 1,384 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 51,805 | 7,150 | 6,287 |

| 26,000 | 1,46,835 | 63,050 | 5,682 |

MIDCPNIFTY Monthly Expiry (28/08/2025)

The MIDCPNIFTY index closed at 12639.1. The MIDCPNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.865 against previous 0.964. The 13000CE option holds the maximum open interest, followed by the 12000PE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 13000CE option, with open interest additions also seen in the 13500CE and 12650PE options. On the other hand, open interest reductions were prominent in the 67000CE, 64400PE, and 64400PE options. Trading volume was highest in the 12700CE option, followed by the 12700PE and 12600PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,639.10 | 0.865 | 0.964 | 0.944 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 69,98,600 | 60,80,340 | 9,18,260 |

| PUT: | 60,55,280 | 58,60,540 | 1,94,740 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 8,64,780 | 2,26,100 | 16,524 |

| 13,500 | 6,52,260 | 1,08,080 | 4,052 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 8,64,780 | 2,26,100 | 16,524 |

| 13,500 | 6,52,260 | 1,08,080 | 4,052 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 15,000 | 48,300 | -13,720 | 293 |

| 14,000 | 4,79,360 | -11,060 | 1,490 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 4,79,920 | 61,460 | 20,352 |

| 13,000 | 8,64,780 | 2,26,100 | 16,524 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 8,18,440 | 44,380 | 7,322 |

| 11,500 | 5,33,960 | 53,060 | 2,119 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,650 | 1,90,260 | 99,400 | 12,353 |

| 12,450 | 1,11,580 | 87,080 | 1,586 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 2,70,340 | -1,91,800 | 17,808 |

| 12,800 | 1,41,260 | -62,020 | 3,583 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 2,70,340 | -1,91,800 | 17,808 |

| 12,600 | 2,89,660 | 26,180 | 17,682 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This session’s Open Interest Volume Analysis shows a market reluctant to commit strongly in either direction, with signs of short-term exhaustion replacing last week’s turbulence. For Nifty, 24,650 is the expiry magnet—look for sideways movement around this mark unless fresh global news tips the scale. Range-bound strategies like iron condors, calendar spreads, or hedged straddles centered between 24,600–24,900 strikes are likely to be optimal for now. A decisive break above 25,000 on a build in open interest and volume would be an early alert for momentum traders, while repeated failure to hold 24,600 could accelerate a test of old support at 24,300 or lower.

BankNifty and FINNIFTY traders should focus on nimble spreads near their max pain pivots with modest position sizing, as premium decay and light participation dominate. For broader indices and midcaps, wait-and-watch remains the best approach; there’s little evidence of large-scale risk taking or sector rotation. Let this Open Interest Volume Analysis be your guide through this consolidation—keep your strategies tactical, risk contained, and readiness high for when the next strong directional move takes shape.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]