Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 21/08/2025

Table of Contents

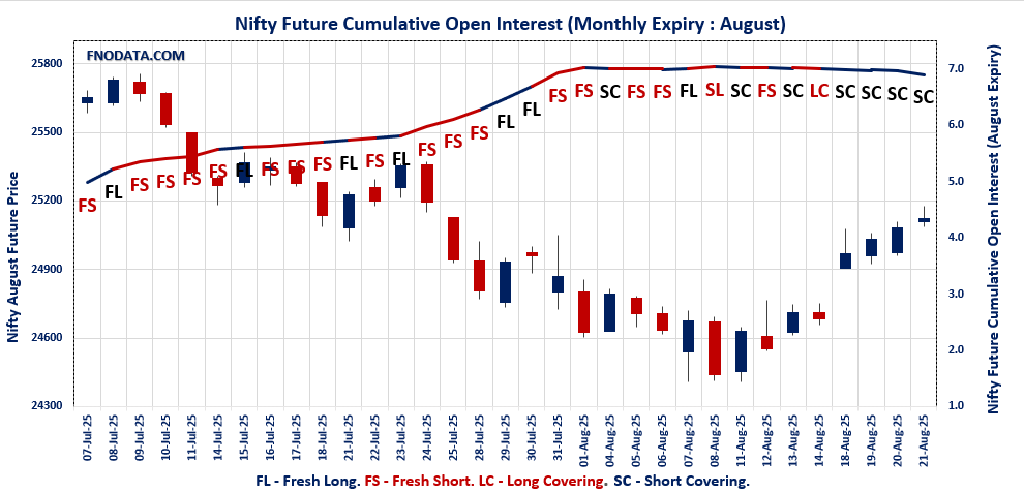

The Open Interest Volume Analysis for 21st August 2025 shows a market taking a well-earned breather after hitting fresh highs, with expiry week volatility beginning to cool. Nifty August futures finished at 25,122.50, up just 0.16%, even as open interest dropped sharply by 5.6%—a strong signal of profit-booking and position unwinding heading into the monthly expiry. The premium ticked slightly higher, hinting that traders are still gently hedging for potential swings but aren’t eager to take on fresh risk. Nifty’s options landscape echoes this mood: while the monthly Put-Call Ratio (OI) eased down to 1.004, max pain now sits at 25,050—a practical anchor given the stack of puts and calls at and just above this level. Heavy call writing at 26,000 and solid put building at 24,000 and 25,000 reinforces the idea that the market will likely drift sideways, with moves capped in both directions until rollover and expiry pressures pass.

Other key indices reflect a similar theme. BankNifty August futures gained 0.13% with a marginal dip in open interest, its option chain still crowded around the 57,000 resistance zone and support at the 56,000 mark. FINNIFTY posted stable action, with a 4.2% OI drop as old longs exit and new positions wait until expiry volatility shakes out. MIDCPNIFTY underperformed, sliding 0.57% as traders locked in profits after a strong run. SENSEX, meanwhile, saw renewed buying interest—both price and OI bounced up, suggesting some rotational flow is headed toward largecaps as funds prep for the next cycle.

NSE & BSE F&O Market Signals

NIFTY AUGUST Future

NIFTY Spot closed at: 25,083.75 (0.13%)

NIFTY AUGUST Future closed at: 25,122.50 (0.16%)

Premium: 38.75 (Increased by 6 points)

Open Interest Change: -5.6%

Volume Change: 1.3%

NIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.004 (Decreased from 1.114)

Put-Call Ratio (Volume): 0.916

Max Pain Level: 25050

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26000

Highest PUT Addition: 25100

BANKNIFTY AUGUST Future

BANKNIFTY Spot closed at: 55,755.45 (0.10%)

BANKNIFTY AUGUST Future closed at: 55,890.00 (0.13%)

Premium: 134.55 (Increased by 17.45 points)

Open Interest Change: -0.6%

Volume Change: 18.9%

BANKNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.703 (Decreased from 0.711)

Put-Call Ratio (Volume): 0.830

Max Pain Level: 56000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 56000

Highest PUT Addition: 55800

FINNIFTY AUGUST Future

FINNIFTY Spot closed at: 26,573.35 (0.32%)

FINNIFTY AUGUST Future closed at: 26,632.60 (0.31%)

Premium: 59.25 (Decreased by -2.45 points)

Open Interest Change: -4.2%

Volume Change: -22.6%

FINNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.831 (Increased from 0.762)

Put-Call Ratio (Volume): 0.600

Max Pain Level: 26550

Maximum CALL Open Interest: 26600

Maximum PUT Open Interest: 26500

Highest CALL Addition: 26800

Highest PUT Addition: 26600

MIDCPNIFTY AUGUST Future

MIDCPNIFTY Spot closed at: 12,921.35 (-0.60%)

MIDCPNIFTY AUGUST Future closed at: 12,949.40 (-0.57%)

Premium: 28.05 (Increased by 4 points)

Open Interest Change: -0.1%

Volume Change: 34.7%

MIDCPNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.034 (Decreased from 1.338)

Put-Call Ratio (Volume): 1.005

Max Pain Level: 12900

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12800

Highest CALL Addition: 13000

Highest PUT Addition: 12700

SENSEX Monthly Expiry (24/08/2025) Future

SENSEX Spot closed at: 82,000.71 (0.17%)

SENSEX Monthly Future closed at: 82,106.75 (0.21%)

Premium: 106.04 (Increased by 27.98 points)

Open Interest Change: 6.4%

Volume Change: 8.9%

SENSEX Weekly Expiry (26/08/2025) Option Analysis

Put-Call Ratio (OI): 1.145 (Decreased from 1.373)

Put-Call Ratio (Volume): 0.934

Max Pain Level: 82000

Maximum CALL OI: 85000

Maximum PUT OI: 79000

Highest CALL Addition: 85000

Highest PUT Addition: 79000

II & DII Cash Market Activity

FIIs Net BUY: ₹ 1,246.51 Cr

DIIs Net BUY: ₹ 2,546.27 Cr

FII Derivatives Activity

| FII Trading Stats | 21.08.25 | 20.08.25 | 19.08.25 |

| FII Cash (Provisional Data) | 1,246.51 | -1,100.09 | -634.26 |

| Index Future Open Interest Long Ratio | 10.46% | 9.90% | 9.71% |

| Index Future Volume Long Ratio | 56.67% | 46.50% | 49.35% |

| Call Option Open Interest Long Ratio | 48.69% | 47.65% | 49.14% |

| Call Option Volume Long Ratio | 49.88% | 49.78% | 50.20% |

| Put Option Open Interest Long Ratio | 70.94% | 61.57% | 66.65% |

| Put Option Volume Long Ratio | 50.17% | 49.46% | 50.11% |

| Stock Future Open Interest Long Ratio | 62.12% | 62.28% | 62.41% |

| Stock Future Volume Long Ratio | 48.73% | 49.20% | 53.18% |

| Index Futures | Short Covering | Fresh Short | Fresh Short |

| Index Options | Short Covering | Fresh Short | Fresh Long |

| Nifty Futures | Short Covering | Fresh Short | Fresh Short |

| Nifty Options | Short Covering | Fresh Short | Fresh Long |

| BankNifty Futures | Short Covering | Fresh Short | Short Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Short | Long Covering | Fresh Short |

| FinNifty Options | Fresh Long | Short Covering | Fresh Long |

| MidcpNifty Futures | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Options | Fresh Short | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Long Covering | Short Covering | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Fresh Long |

| Stock Futures | Fresh Short | Fresh Short | Fresh Long |

| Stock Options | Fresh Long | Fresh Long | Fresh Short |

Fresh Long: increase in open interest and increase in price

Fresh Short: increase in open interest and decrease in price

Short Covering: decrease in open interest and increase in price

Long Covering: decrease in open interest and decrease in price

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (26/08/2025)

The SENSEX index closed at 82000.71. The SENSEX weekly expiry for AUGUST 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.145 against previous 1.373. The 79000PE option holds the maximum open interest, followed by the 85000CE and 80000PE options. Market participants have shown increased interest with significant open interest additions in the 79000PE option, with open interest additions also seen in the 85000CE and 82000PE options. On the other hand, open interest reductions were prominent in the 79900PE, 81800CE, and 81500CE options. Trading volume was highest in the 82000PE option, followed by the 82000CE and 82200CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 26-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82000.71 | 1.145 | 1.373 | 0.934 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,25,31,560 | 62,08,460 | 63,23,100 |

| PUT: | 1,43,42,680 | 85,23,960 | 58,18,720 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 11,05,760 | 6,43,920 | 40,17,060 |

| 84000 | 9,27,340 | 5,00,720 | 56,22,440 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 11,05,760 | 6,43,920 | 40,17,060 |

| 83500 | 8,09,960 | 5,18,600 | 47,94,560 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81800 | 93,220 | -56,420 | 26,47,780 |

| 81500 | 2,84,480 | -53,720 | 11,48,620 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 6,91,200 | 2,80,320 | 1,51,90,660 |

| 82200 | 4,03,320 | 3,11,580 | 1,20,89,780 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 11,47,920 | 6,56,920 | 49,69,460 |

| 80000 | 10,14,300 | 5,09,900 | 49,81,880 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 11,47,920 | 6,56,920 | 49,69,460 |

| 82000 | 8,64,140 | 5,48,320 | 1,63,66,460 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 79900 | 1,00,220 | -71,000 | 9,61,820 |

| 79300 | 91,640 | -43,220 | 8,03,420 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 8,64,140 | 5,48,320 | 1,63,66,460 |

| 82100 | 3,59,540 | 3,22,660 | 1,07,86,800 |

NIFTY Monthly Expiry (28/08/2025)

The NIFTY index closed at 25083.75. The NIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.004 against previous 1.114. The 26000CE option holds the maximum open interest, followed by the 25000PE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 25600CE and 25100PE options. On the other hand, open interest reductions were prominent in the 25000CE, 23600PE, and 22800PE options. Trading volume was highest in the 25100CE option, followed by the 25300CE and 25100PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,083.75 | 1.004 | 1.114 | 0.916 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 9,47,60,100 | 6,44,48,925 | 3,03,11,175 |

| PUT: | 9,50,96,850 | 7,17,73,125 | 2,33,23,725 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,09,15,725 | 38,00,025 | 2,50,985 |

| 25,500 | 81,70,275 | 19,50,375 | 4,11,898 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,09,15,725 | 38,00,025 | 2,50,985 |

| 25,600 | 43,05,075 | 27,18,375 | 1,90,398 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 59,93,400 | -2,58,075 | 2,70,343 |

| 24,950 | 3,14,850 | -1,45,050 | 22,872 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 47,14,500 | 17,18,850 | 5,82,824 |

| 25,300 | 48,62,100 | 15,00,375 | 5,24,002 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 84,01,350 | 19,14,150 | 4,72,048 |

| 24,000 | 72,53,025 | 9,63,300 | 2,27,022 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 38,36,925 | 20,63,325 | 5,11,504 |

| 25,000 | 84,01,350 | 19,14,150 | 4,72,048 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,600 | 5,01,000 | -1,53,300 | 33,067 |

| 22,800 | 15,35,775 | -1,47,900 | 16,266 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 38,36,925 | 20,63,325 | 5,11,504 |

| 25,000 | 84,01,350 | 19,14,150 | 4,72,048 |

BANKNIFTY Monthly Expiry (28/08/2025)

The BANKNIFTY index closed at 55755.45. The BANKNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.703 against previous 0.711. The 57000CE option holds the maximum open interest, followed by the 56000CE and 57000PE options. Market participants have shown increased interest with significant open interest additions in the 55800PE option, with open interest additions also seen in the 56000CE and 55900CE options. On the other hand, open interest reductions were prominent in the 55700CE, 54500PE, and 53500PE options. Trading volume was highest in the 56000CE option, followed by the 55800CE and 56000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,755.45 | 0.703 | 0.711 | 0.830 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,19,42,655 | 2,05,91,865 | 13,50,790 |

| PUT: | 1,54,24,185 | 1,46,34,305 | 7,89,880 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 24,78,840 | 72,030 | 1,24,622 |

| 56,000 | 20,42,705 | 2,22,495 | 2,98,405 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 20,42,705 | 2,22,495 | 2,98,405 |

| 55,900 | 4,87,725 | 1,72,585 | 1,76,124 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,700 | 3,40,655 | -1,06,820 | 1,30,215 |

| 58,200 | 64,995 | -54,145 | 6,110 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 20,42,705 | 2,22,495 | 2,98,405 |

| 55,800 | 6,44,980 | 57,225 | 2,15,909 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 12,69,555 | -17,605 | 5,494 |

| 56,000 | 12,52,685 | 1,44,235 | 2,07,203 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,800 | 6,40,045 | 2,26,625 | 2,02,596 |

| 55,500 | 11,71,345 | 1,65,760 | 1,29,218 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 5,51,600 | -99,400 | 45,945 |

| 53,500 | 4,23,955 | -89,950 | 43,171 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 12,52,685 | 1,44,235 | 2,07,203 |

| 55,800 | 6,40,045 | 2,26,625 | 2,02,596 |

FINNIFTY Monthly Expiry (28/08/2025)

The FINNIFTY index closed at 26573.35. The FINNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.831 against previous 0.762. The 26600CE option holds the maximum open interest, followed by the 27000CE and 26500PE options. Market participants have shown increased interest with significant open interest additions in the 26800CE option, with open interest additions also seen in the 26600CE and 26600PE options. On the other hand, open interest reductions were prominent in the 26500CE, 26450PE, and 25000PE options. Trading volume was highest in the 26800CE option, followed by the 26600CE and 26600PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,573.35 | 0.831 | 0.762 | 0.600 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,09,430 | 14,09,980 | 99,450 |

| PUT: | 12,54,370 | 10,74,190 | 1,80,180 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 1,53,335 | 46,995 | 10,808 |

| 27,000 | 1,49,630 | -10,270 | 9,280 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 1,47,160 | 52,390 | 21,627 |

| 26,600 | 1,53,335 | 46,995 | 10,808 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,03,415 | -36,335 | 4,541 |

| 27,000 | 1,49,630 | -10,270 | 9,280 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 1,47,160 | 52,390 | 21,627 |

| 26,600 | 1,53,335 | 46,995 | 10,808 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,48,005 | 7,085 | 6,885 |

| 25,500 | 1,29,935 | 21,125 | 1,643 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 1,15,375 | 36,270 | 9,483 |

| 26,300 | 49,400 | 26,000 | 2,567 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,450 | 19,110 | -13,910 | 1,365 |

| 25,000 | 61,295 | -11,765 | 1,448 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 1,15,375 | 36,270 | 9,483 |

| 26,500 | 1,48,005 | 7,085 | 6,885 |

MIDCPNIFTY Monthly Expiry (28/08/2025)

The MIDCPNIFTY index closed at 12921.35. The MIDCPNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.034 against previous 1.338. The 13000CE option holds the maximum open interest, followed by the 13500CE and 12800PE options. Market participants have shown increased interest with significant open interest additions in the 13000CE option, with open interest additions also seen in the 12700PE and 13050CE options. On the other hand, open interest reductions were prominent in the 67000CE, 66500PE, and 66600PE options. Trading volume was highest in the 13000CE option, followed by the 13000PE and 13100CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,921.35 | 1.034 | 1.338 | 1.005 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 94,48,180 | 77,86,380 | 16,61,800 |

| PUT: | 97,70,740 | 1,04,15,860 | -6,45,120 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,29,800 | 3,89,200 | 76,009 |

| 13,500 | 9,08,740 | 55,020 | 20,421 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,29,800 | 3,89,200 | 76,009 |

| 13,050 | 3,02,260 | 2,30,440 | 25,419 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 58,940 | -97,160 | 1,090 |

| 12,800 | 2,57,180 | -77,000 | 4,497 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,29,800 | 3,89,200 | 76,009 |

| 13,100 | 5,49,780 | 1,24,320 | 45,243 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 8,47,420 | 1,62,120 | 27,730 |

| 13,000 | 7,73,500 | -1,55,400 | 56,476 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 6,96,080 | 3,36,700 | 21,454 |

| 12,800 | 8,47,420 | 1,62,120 | 27,730 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,55,580 | -1,77,240 | 10,714 |

| 12,500 | 7,28,140 | -1,69,680 | 24,014 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,73,500 | -1,55,400 | 56,476 |

| 12,900 | 5,09,460 | -59,220 | 38,890 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Today’s Open Interest Volume Analysis makes it clear that expiry jitters and profit-taking have taken center stage, helping the market set an important near-term top. For Nifty, the 25,000–25,100 band is set to remain the expiry magnet; traders are likely to keep things range-bound with iron condors, calendar spreads, or credit spreads around these strikes being the best bets through expiry. A strong move above 25,200 with rising open interest would be an early sign that fresh buyers are jumping in, but otherwise, expect time decay and premium erosion to reward conservative, range-based trading until rollover flow begins.

In BankNifty, keep a close watch on open interest and premium behavior at 56,000–57,000—any surge in OI alongside price would mark the next bout of momentum. In FINNIFTY and MIDCPNIFTY, wait for new OI trends after expiry clears, as these pockets are likely to lead the next cycle if fresh money comes back. Let this Open Interest Volume Analysis guide your risk and strategy—trade lighter through expiry, and stay ready to reposition quickly as the market shows its hand in the final week of August.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]