Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 25/08/2025

Table of Contents

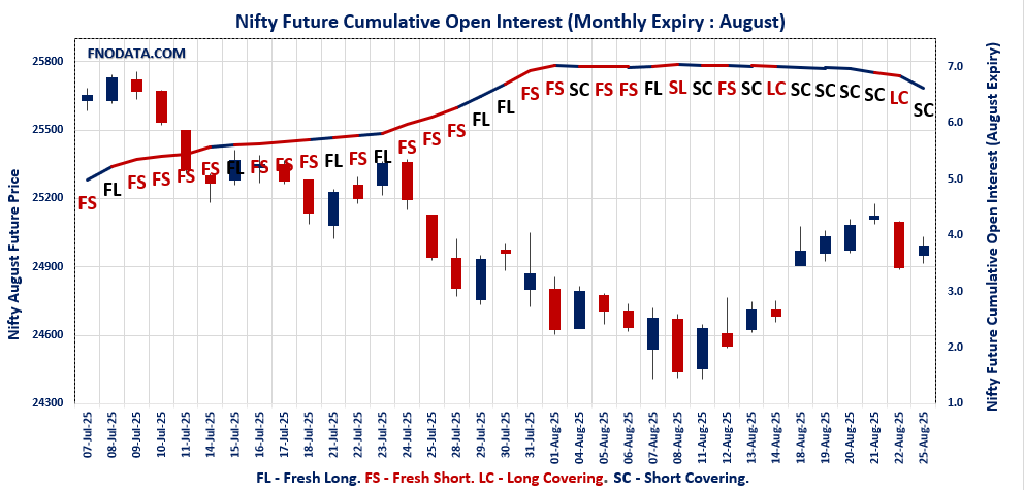

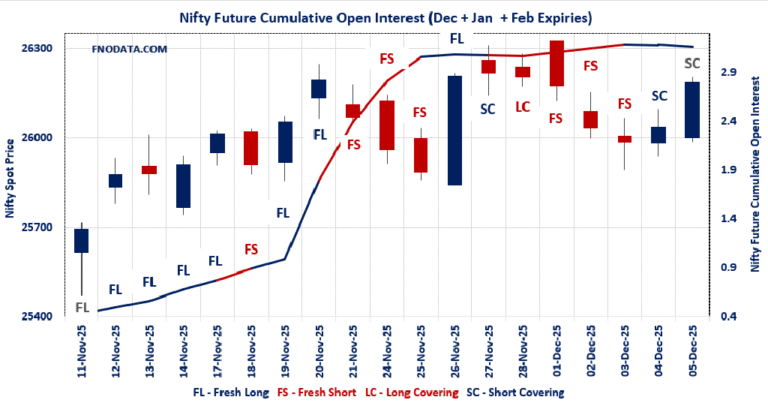

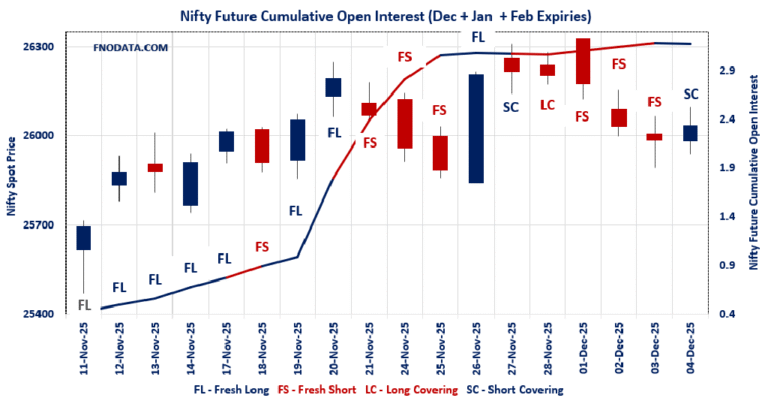

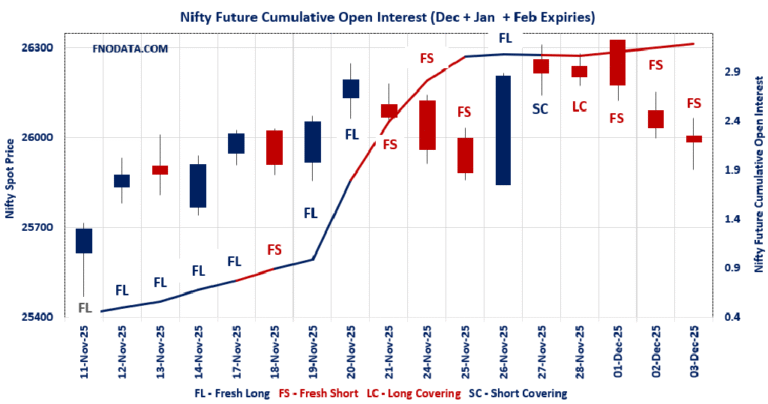

The Open Interest Volume Analysis for 25th August 2025 indicates a market moving cautiously into the final days before expiry, with signs of short and long covering helping to stabilize prices after recent volatility. Nifty August futures rose 0.37% to 24,989.70 on a 22% decline in open interest and a 10-point drop in premium, signaling that bears are covering their shorts while bulls remain guarded. The weekly Put-Call Ratio (OI) climbed from 0.61 to 0.77, reflecting renewed put writing near 25,000—the established max pain level which continues to anchor price action. Call open interest remains concentrated at 25,000 and 25,550 strikes, creating a resistance band just above spot, while put interest around 25,000 suggests balanced hedging on both sides.

BankNifty showed almost no price change but saw a 10.9% drop in open interest and small premium shrinkage—clear signs of long covering rather than fresh longs, as heavy call and put open interest clusters center near 57,000 and 55,000 respectively, providing a range before expiry. FINNIFTY and MIDCPNIFTY futures mirrored the cautious tone: modest price changes with falling open interest, indicating traders are locking profits and squaring positions. The Put-Call Ratios for these indices also correspond with a more defensive posture. SENSEX, while up 0.4%, experienced a 36% drop in open interest and premium, signaling significant unwinding ahead of the monthly expiry, with max pain steady near 81,700.

NSE & BSE F&O Market Signals

NIFTY AUGUST Future

NIFTY Spot closed at: 24,967.75 (0.39%)

NIFTY AUGUST Future closed at: 24,989.70 (0.37%)

Premium: 21.95 (Decreased by -6.15 points)

Open Interest Change: -22.0%

Volume Change: 35.0%

Open Interest Analysis: Short Covering

NIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.773 (Increased from 0.610)

Put-Call Ratio (Volume): 0.870

Max Pain Level: 25000

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25550

Highest PUT Addition: 25000

BANKNIFTY AUGUST Future

BANKNIFTY Spot closed at: 55,139.30 (-0.02%)

BANKNIFTY AUGUST Future closed at: 55,258.80 (-0.02%)

Premium: 119.5 (Decreased by -1.7 points)

Open Interest Change: -10.9%

Volume Change: -37.5%

Open Interest Analysis: Long Covering

BANKNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.494 (Decreased from 0.522)

Put-Call Ratio (Volume): 0.833

Max Pain Level: 55500

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 55000

Highest CALL Addition: 55500

Highest PUT Addition: 55000

FINNIFTY AUGUST Future

FINNIFTY Spot closed at: 26,306.90 (-0.04%)

FINNIFTY AUGUST Future closed at: 26,364.80 (-0.05%)

Premium: 57.9 (Decreased by -2.55 points)

Open Interest Change: -5.2%

Volume Change: -24.7%

Open Interest Analysis: Long Covering

FINNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.756 (Increased from 0.674)

Put-Call Ratio (Volume): 0.981

Max Pain Level: 26400

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26500

Highest CALL Addition: 26700

Highest PUT Addition: 26250

MIDCPNIFTY AUGUST Future

MIDCPNIFTY Spot closed at: 12,953.35 (0.14%)

MIDCPNIFTY AUGUST Future closed at: 12,969.20 (0.18%)

Premium: 15.85 (Increased by 5.75 points)

Open Interest Change: -34.8%

Volume Change: 55.1%

Open Interest Analysis: Short Covering

MIDCPNIFTY Monthly Expiry (28/08/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.005 (Decreased from 1.030)

Put-Call Ratio (Volume): 1.000

Max Pain Level: 12950

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12800

Highest CALL Addition: 13050

Highest PUT Addition: 12650

SENSEX Monthly Expiry (24/08/2025) Future

SENSEX Spot closed at: 81,635.91 (0.40%)

SENSEX Monthly Future closed at: 81,685.05 (0.34%)

Premium: 49.14 (Decreased by -53.26 points)

Open Interest Change: -36.2%

Volume Change: -7.1%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (26/08/2025) Option Analysis

Put-Call Ratio (OI): 0.935 (Increased from 0.637)

Put-Call Ratio (Volume): 0.988

Max Pain Level: 81700

Maximum CALL OI: 82500

Maximum PUT OI: 81500

Highest CALL Addition: 82500

Highest PUT Addition: 81500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 2,466.24 Cr

DIIs Net BUY: ₹ 3,176.69 Cr

FII Derivatives Activity

| FII Trading Stats | 25.08.25 | 22.08.25 | 21.08.25 |

| FII Cash (Provisional Data) | -2,466.24 | -1,622.52 | 1,246.51 |

| Index Future Open Interest Long Ratio | 13.42% | 10.70% | 10.46% |

| Index Future Volume Long Ratio | 50.47% | 46.25% | 56.67% |

| Call Option Open Interest Long Ratio | 47.21% | 46.38% | 48.69% |

| Call Option Volume Long Ratio | 50.14% | 49.35% | 49.88% |

| Put Option Open Interest Long Ratio | 65.62% | 69.35% | 70.94% |

| Put Option Volume Long Ratio | 49.61% | 50.48% | 50.17% |

| Stock Future Open Interest Long Ratio | 61.93% | 61.85% | 62.12% |

| Stock Future Volume Long Ratio | 50.17% | 49.63% | 48.73% |

| Index Futures | Fresh Long | Fresh Short | Short Covering |

| Index Options | Fresh Short | Fresh Short | Short Covering |

| Nifty Futures | Fresh Short | Fresh Short | Short Covering |

| Nifty Options | Fresh Short | Fresh Long | Short Covering |

| BankNifty Futures | Short Covering | Fresh Short | Short Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Short | Long Covering | Fresh Short |

| FinNifty Options | Fresh Long | Fresh Short | Fresh Long |

| MidcpNifty Futures | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Options | Long Covering | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Long Covering | Short Covering | Long Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Short | Fresh Long |

| Stock Futures | Fresh Long | Long Covering | Fresh Short |

| Stock Options | Short Covering | Short Covering | Fresh Long |

Fresh Long: increase in open interest and increase in price

Fresh Short: increase in open interest and decrease in price

Short Covering: decrease in open interest and increase in price

Long Covering: decrease in open interest and decrease in price

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (26/08/2025)

The SENSEX index closed at 81635.91. The SENSEX weekly expiry for AUGUST 26, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.935 against previous 0.637. The 82500CE option holds the maximum open interest, followed by the 82000CE and 83000CE options. Market participants have shown increased interest with significant open interest additions in the 81500PE option, with open interest additions also seen in the 81600PE and 81000PE options. On the other hand, open interest reductions were prominent in the 85000CE, 79000PE, and 81500CE options. Trading volume was highest in the 81500PE option, followed by the 82000CE and 81600PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 26-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81635.91 | 0.935 | 0.637 | 0.988 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,40,38,880 | 2,08,64,880 | 31,74,000 |

| PUT: | 2,24,75,420 | 1,32,80,780 | 91,94,640 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 16,95,460 | 6,57,380 | 4,32,24,740 |

| 82000 | 16,21,680 | 3,25,540 | 9,10,12,120 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 16,95,460 | 6,57,380 | 4,32,24,740 |

| 82600 | 8,25,380 | 4,00,220 | 1,66,91,060 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 5,37,860 | -3,66,060 | 63,62,940 |

| 81500 | 7,34,600 | -2,13,520 | 5,81,28,820 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 16,21,680 | 3,25,540 | 9,10,12,120 |

| 81700 | 7,67,800 | 1,45,240 | 6,58,26,640 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 15,39,320 | 8,44,880 | 10,64,17,340 |

| 81000 | 14,13,080 | 7,39,520 | 6,19,09,260 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 15,39,320 | 8,44,880 | 10,64,17,340 |

| 81600 | 10,03,280 | 7,63,880 | 7,40,78,600 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 8,43,400 | -2,93,420 | 90,13,820 |

| 79800 | 2,39,800 | -47,740 | 35,80,240 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 15,39,320 | 8,44,880 | 10,64,17,340 |

| 81600 | 10,03,280 | 7,63,880 | 7,40,78,600 |

NIFTY Monthly Expiry (28/08/2025)

The NIFTY index closed at 24967.75. The NIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.773 against previous 0.610. The 25000CE option holds the maximum open interest, followed by the 26000CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25000PE option, with open interest additions also seen in the 24950PE and 24900PE options. On the other hand, open interest reductions were prominent in the 24900CE, 25000CE, and 25800CE options. Trading volume was highest in the 25000CE option, followed by the 25000PE and 24900PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,967.75 | 0.773 | 0.610 | 0.870 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 17,34,43,950 | 19,01,66,475 | -1,67,22,525 |

| PUT: | 13,40,57,400 | 11,60,44,125 | 1,80,13,275 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,47,15,900 | -26,60,925 | 50,81,630 |

| 26,000 | 1,43,13,975 | -9,69,375 | 6,16,643 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,550 | 36,44,925 | 18,00,000 | 4,23,967 |

| 25,400 | 82,38,675 | 10,15,800 | 6,83,049 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 42,82,725 | -32,92,500 | 26,32,464 |

| 25,000 | 1,47,15,900 | -26,60,925 | 50,81,630 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,47,15,900 | -26,60,925 | 50,81,630 |

| 24,950 | 34,06,950 | -7,83,150 | 31,82,921 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,09,59,825 | 36,25,050 | 37,51,491 |

| 24,000 | 1,01,33,475 | 20,35,200 | 6,07,399 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,09,59,825 | 36,25,050 | 37,51,491 |

| 24,950 | 53,41,500 | 33,89,550 | 32,66,731 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,800 | 33,71,250 | -18,49,125 | 3,61,474 |

| 23,600 | 7,02,150 | -5,59,800 | 1,42,141 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,09,59,825 | 36,25,050 | 37,51,491 |

| 24,900 | 90,21,300 | 25,72,200 | 37,26,825 |

BANKNIFTY Monthly Expiry (28/08/2025)

The BANKNIFTY index closed at 55139.3. The BANKNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.494 against previous 0.522. The 57000CE option holds the maximum open interest, followed by the 56000CE and 55500CE options. Market participants have shown increased interest with significant open interest additions in the 55500CE option, with open interest additions also seen in the 55200CE and 55300CE options. On the other hand, open interest reductions were prominent in the 57000PE, 65000CE, and 59500CE options. Trading volume was highest in the 55000PE option, followed by the 55200PE and 55200CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,139.30 | 0.494 | 0.522 | 0.833 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,12,42,960 | 2,86,08,790 | 26,34,170 |

| PUT: | 1,54,21,980 | 1,49,34,115 | 4,87,865 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 27,25,135 | 1,21,835 | 1,76,650 |

| 56,000 | 26,22,060 | 26,530 | 3,12,719 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 21,96,320 | 5,48,835 | 4,08,014 |

| 55,200 | 7,84,560 | 3,76,880 | 4,45,570 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 65,000 | 9,94,945 | -1,71,115 | 29,985 |

| 59,500 | 3,45,170 | -94,290 | 20,902 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,200 | 7,84,560 | 3,76,880 | 4,45,570 |

| 55,500 | 21,96,320 | 5,48,835 | 4,08,014 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 12,90,205 | 2,05,415 | 5,31,009 |

| 54,000 | 10,34,075 | 32,235 | 1,33,289 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 12,90,205 | 2,05,415 | 5,31,009 |

| 55,100 | 3,95,500 | 2,04,400 | 3,33,255 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 9,48,710 | -2,52,210 | 9,661 |

| 56,000 | 8,80,040 | -90,510 | 23,359 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 12,90,205 | 2,05,415 | 5,31,009 |

| 55,200 | 4,89,405 | 1,65,235 | 4,67,690 |

FINNIFTY Monthly Expiry (28/08/2025)

The FINNIFTY index closed at 26306.9. The FINNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.756 against previous 0.674. The 26500CE option holds the maximum open interest, followed by the 26700CE and 27000CE options. Market participants have shown increased interest with significant open interest additions in the 26250PE option, with open interest additions also seen in the 26700CE and 26500CE options. On the other hand, open interest reductions were prominent in the 27500CE, 27900CE, and 25300PE options. Trading volume was highest in the 26300PE option, followed by the 26500CE and 26400CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,306.90 | 0.756 | 0.674 | 0.981 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 24,05,975 | 20,92,220 | 3,13,755 |

| PUT: | 18,18,505 | 14,10,370 | 4,08,135 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 2,88,405 | 50,375 | 19,705 |

| 26,700 | 2,45,830 | 68,250 | 16,401 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 2,45,830 | 68,250 | 16,401 |

| 26,500 | 2,88,405 | 50,375 | 19,705 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 80,210 | -42,380 | 4,270 |

| 27,900 | 34,905 | -31,265 | 1,534 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 2,88,405 | 50,375 | 19,705 |

| 26,400 | 1,50,865 | 46,345 | 18,620 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,48,980 | -4,355 | 4,093 |

| 26,400 | 1,34,745 | 33,085 | 14,819 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,250 | 97,045 | 78,195 | 15,221 |

| 25,600 | 59,540 | 50,115 | 3,418 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 20,345 | -25,025 | 2,310 |

| 25,000 | 54,665 | -12,155 | 4,119 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,300 | 1,09,330 | 37,765 | 32,456 |

| 26,200 | 95,745 | 25,740 | 16,136 |

MIDCPNIFTY Monthly Expiry (28/08/2025)

The MIDCPNIFTY index closed at 12953.35. The MIDCPNIFTY monthly expiry for AUGUST 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.005 against previous 1.030. The 13000CE option holds the maximum open interest, followed by the 13500CE and 13100CE options. Market participants have shown increased interest with significant open interest additions in the 12650PE option, with open interest additions also seen in the 13050CE and 12600PE options. On the other hand, open interest reductions were prominent in the 68000CE, 67000CE, and 66500CE options. Trading volume was highest in the 13000CE option, followed by the 13000PE and 12900PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-08-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,953.35 | 1.005 | 1.030 | 1.000 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,01,22,840 | 1,02,17,620 | -94,780 |

| PUT: | 1,01,69,600 | 1,05,20,160 | -3,50,560 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,35,260 | -1,64,360 | 1,15,415 |

| 13,500 | 8,85,220 | 53,760 | 16,251 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,050 | 3,96,620 | 1,15,080 | 47,646 |

| 13,150 | 2,82,800 | 1,10,320 | 14,425 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,35,260 | -1,64,360 | 1,15,415 |

| 13,100 | 8,73,040 | -1,08,500 | 41,700 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 11,35,260 | -1,64,360 | 1,15,415 |

| 13,050 | 3,96,620 | 1,15,080 | 47,646 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 8,60,020 | -2,16,580 | 46,125 |

| 12,900 | 8,57,080 | 34,440 | 49,222 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,650 | 3,78,840 | 1,40,560 | 11,832 |

| 12,600 | 5,98,080 | 1,13,400 | 21,671 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 8,60,020 | -2,16,580 | 46,125 |

| 12,700 | 4,16,220 | -2,08,320 | 23,896 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,92,120 | -50,960 | 95,504 |

| 12,900 | 8,57,080 | 34,440 | 49,222 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

This day’s Open Interest Volume Analysis underscores a market that is digesting recent gains and falls into a well-defined range with key max pain levels holding firm. For Nifty traders, 25,000 remains the key expiry anchor, with the strike band around 25,000–25,550 providing strong resistance and support. Expect range-bound movement and favor options strategies like iron condors or calendar spreads for limited risk through expiry. BankNifty and other indices echo this consolidation, with bearish and bullish positions unwinding, meaning new direction cues may only emerge post-expiry.

Traders should focus on defensive positioning now—use premium decay and focused hedging to protect capital rather than chasing directional trades. Keep a close eye on sudden changes in open interest and volume as expiry nears, as these will be the first signs of the market’s next meaningful move. Let this Open Interest Volume Analysis inform tactical decisions, enhance risk management, and help navigate the delicate final days of August expiry.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]