Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 1/09/2025

Table of Contents

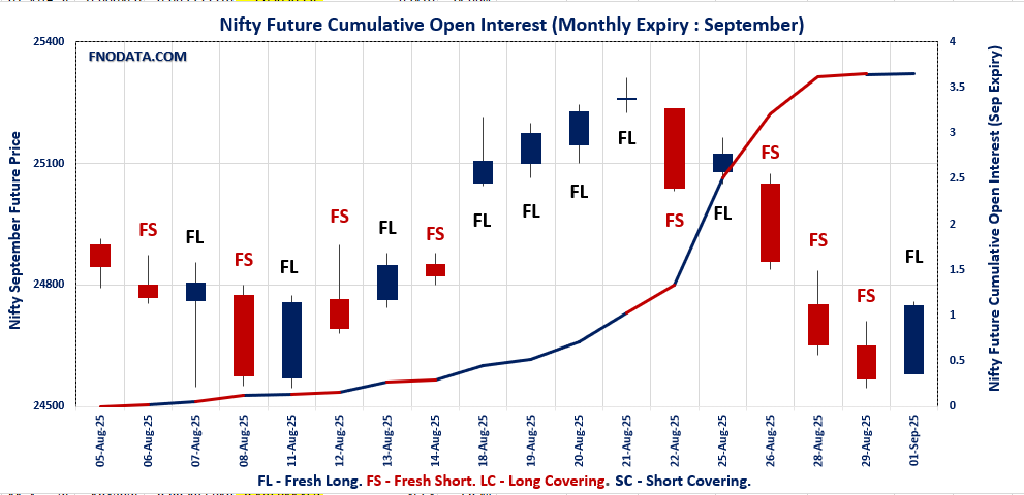

The Derivatives Open Interest Volume Analysis for 1st September 2025 reveals a market that is regrouping after a volatile start to the September series, with bulls finally stepping up. Nifty September futures closed at 24,748.00, up 0.73%, riding on a modest 0.1% increase in open interest as fresh long positions find foothold after recent profit-taking. The premium slipped by nearly 19 points, pointing to less aggressive hedging and more comfort among buyers. Notably, the Put-Call Ratio (OI) surged to 1.15 on the weekly chain—put writers came back strong at the 24,500–24,650 strikes, anchoring expiry near 24,600 for now. Monthly options show similar optimism, with a PCR above 1 and call resistance stacking at the 25,000–25,500 band, suggesting a strive for further upside if new buying persists.

BANKNIFTY, FINNIFTY, and MIDCPNIFTY also confirmed new do-or-die bullish interest: BankNifty added fresh longs as open interest ticked up and premium dropped, while the options chain shows support at 54,000 and resistance at 57,000. FINNIFTY’s bullishness was clearer—up 0.55% on a 2.5% open interest jump, with strong put writing at 25,700. MIDCPNIFTY did one better, adding 2% with long OI build and heavy put writing, signaling risk appetite is back in midcaps. SENSEX, though, showed mainly short covering, up 0.58% with open interest dropping as bears book profits and the focus shifts to expiry.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 24,625.05 (0.81%)

NIFTY SEPTEMBER Future closed at: 24,748.00 (0.73%)

Premium: 122.95 (Decreased by -18.7 points)

Open Interest Change: 0.1%

Volume Change: -24.1%

Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (2/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.150 (Increased from 0.541)

Put-Call Ratio (Volume): 0.872

Max Pain Level: 24600

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24500

Highest CALL Addition: 24650

Highest PUT Addition: 24500

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.151 (Decreased from 1.171)

Put-Call Ratio (Volume): 0.993

Max Pain Level: 24900

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25500

Highest PUT Addition: 23000

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 54,002.45 (0.65%)

BANKNIFTY SEPTEMBER Future closed at: 54,370.00 (0.57%)

Premium: 367.55 (Decreased by -37.2 points)

Open Interest Change: 0.4%

Volume Change: -14.0%

Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.885 (Increased from 0.859)

Put-Call Ratio (Volume): 0.816

Max Pain Level: 55000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 55000

Highest PUT Addition: 54000

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 25,743.50 (0.69%)

FINNIFTY SEPTEMBER Future closed at: 25,909.10 (0.55%)

Premium: 165.6 (Decreased by -35 points)

Open Interest Change: 2.5%

Volume Change: -3.3%

Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.985 (Decreased from 1.128)

Put-Call Ratio (Volume): 1.047

Max Pain Level: 25800

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25700

Highest CALL Addition: 26500

Highest PUT Addition: 25650

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 12,715.70 (2.13%)

MIDCPNIFTY SEPTEMBER Future closed at: 12,791.20 (2.20%)

Premium: 75.5 (Increased by 10 points)

Open Interest Change: 0.2%

Volume Change: -20.0%

Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.117 (Decreased from 1.191)

Put-Call Ratio (Volume): 0.850

Max Pain Level: 12700

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12000

Highest CALL Addition: 13400

Highest PUT Addition: 12700

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 80,364.49 (0.70%)

SENSEX Monthly Future closed at: 80,848.55 (0.58%)

Premium: 484.06 (Decreased by -90.94 points)

Open Interest Change: -5.7%

Volume Change: -19.9%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (4/09/2025) Option Analysis

Put-Call Ratio (OI): 0.841 (Increased from 0.539)

Put-Call Ratio (Volume): 0.926

Max Pain Level: 80400

Maximum CALL OI: 81000

Maximum PUT OI: 80000

Highest CALL Addition: 81000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,429.71 Cr

DIIs Net BUY: ₹ 4,344.93 Cr

FII Derivatives Activity

| FII Trading Stats | 1.09.25 | 29.08.25 | 28.08.25 |

| FII Cash (Provisional Data) | -1,429.71 | -8,312.66 | -3,856.51 |

| Index Future Open Interest Long Ratio | 9.27% | 8.60% | 8.24% |

| Index Future Volume Long Ratio | 57.01% | 41.33% | 45.11% |

| Call Option Open Interest Long Ratio | 46.88% | 45.86% | 45.81% |

| Call Option Volume Long Ratio | 50.19% | 49.75% | 49.94% |

| Put Option Open Interest Long Ratio | 60.05% | 67.80% | 75.15% |

| Put Option Volume Long Ratio | 49.40% | 49.92% | 50.01% |

| Stock Future Open Interest Long Ratio | 62.92% | 62.44% | 62.27% |

| Stock Future Volume Long Ratio | 55.04% | 52.36% | 49.21% |

| Index Futures | Fresh Long | Fresh Short | Long Covering |

| Index Options | Fresh Short | Fresh Short | Long Covering |

| Nifty Futures | Fresh Long | Fresh Short | Long Covering |

| Nifty Options | Fresh Short | Fresh Short | Short Covering |

| BankNifty Futures | Fresh Long | Long Covering | Long Covering |

| BankNifty Options | Fresh Long | Fresh Long | Long Covering |

| FinNifty Futures | Fresh Long | Long Covering | Fresh Short |

| FinNifty Options | Fresh Short | Fresh Short | Long Covering |

| MidcpNifty Futures | Fresh Long | Fresh Long | Long Covering |

| MidcpNifty Options | Fresh Long | Fresh Short | Short Covering |

| NiftyNxt50 Futures | Fresh Short | Short Covering | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Long Covering |

| Stock Futures | Fresh Long | Fresh Long | Long Covering |

| Stock Options | Fresh Short | Fresh Long | Long Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (2/09/2025)

The NIFTY index closed at 24625.05. The NIFTY weekly expiry for SEPTEMBER 2, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.150 against previous 0.541. The 24500PE option holds the maximum open interest, followed by the 25000CE and 24600PE options. Market participants have shown increased interest with significant open interest additions in the 24500PE option, with open interest additions also seen in the 24600PE and 24550PE options. On the other hand, open interest reductions were prominent in the 24500CE, 25500CE, and 24600CE options. Trading volume was highest in the 24600CE option, followed by the 24500PE and 24550CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 02-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,625.05 | 1.150 | 0.541 | 0.872 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,73,76,850 | 19,30,97,850 | -3,57,21,000 |

| PUT: | 18,10,36,500 | 10,43,94,525 | 7,66,41,975 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,76,68,500 | 11,06,700 | 20,55,462 |

| 24,800 | 1,18,11,225 | 19,09,350 | 33,58,135 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,650 | 91,61,625 | 33,41,925 | 58,07,928 |

| 24,800 | 1,18,11,225 | 19,09,350 | 33,58,135 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 43,88,775 | -80,06,175 | 58,91,800 |

| 25,500 | 69,96,600 | -51,39,300 | 8,11,138 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 80,95,950 | -43,86,225 | 93,32,794 |

| 24,550 | 40,29,750 | -28,82,025 | 67,12,326 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,95,79,875 | 1,40,85,075 | 82,76,109 |

| 24,600 | 1,45,34,775 | 1,23,27,300 | 61,98,214 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,95,79,875 | 1,40,85,075 | 82,76,109 |

| 24,600 | 1,45,34,775 | 1,23,27,300 | 61,98,214 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,500 | 71,60,925 | -31,69,725 | 8,82,243 |

| 23,400 | 21,47,325 | -4,49,775 | 2,57,431 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,95,79,875 | 1,40,85,075 | 82,76,109 |

| 24,550 | 1,21,22,925 | 1,02,38,925 | 66,24,284 |

SENSEX Weekly Expiry (4/09/2025)

The SENSEX index closed at 80364.49. The SENSEX weekly expiry for SEPTEMBER 4, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.841 against previous 0.539. The 81000CE option holds the maximum open interest, followed by the 80000PE and 82000CE options. Market participants have shown increased interest with significant open interest additions in the 80000PE option, with open interest additions also seen in the 78000PE and 80200PE options. On the other hand, open interest reductions were prominent in the 75500PE, 85000CE, and 80100CE options. Trading volume was highest in the 80000PE option, followed by the 80200PE and 80100PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 04-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80364.49 | 0.841 | 0.539 | 0.926 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,41,36,800 | 1,31,96,460 | 9,40,340 |

| PUT: | 1,18,84,840 | 71,12,040 | 47,72,800 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 12,10,680 | 2,51,120 | 1,73,33,900 |

| 82000 | 8,20,440 | 1,55,520 | 74,40,660 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 12,10,680 | 2,51,120 | 1,73,33,900 |

| 82000 | 8,20,440 | 1,55,520 | 74,40,660 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 3,91,120 | -1,21,180 | 11,89,320 |

| 80100 | 1,86,840 | -90,480 | 1,16,39,180 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 80200 | 2,68,180 | -80,320 | 1,81,28,580 |

| 81000 | 12,10,680 | 2,51,120 | 1,73,33,900 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 9,76,580 | 6,18,540 | 2,24,53,780 |

| 78000 | 7,66,860 | 4,33,100 | 47,91,940 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 9,76,580 | 6,18,540 | 2,24,53,780 |

| 78000 | 7,66,860 | 4,33,100 | 47,91,940 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 75500 | 97,240 | -1,81,000 | 8,82,280 |

| 72400 | 2,07,260 | -69,460 | 4,18,880 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 9,76,580 | 6,18,540 | 2,24,53,780 |

| 80200 | 5,33,740 | 3,94,140 | 1,96,57,360 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 24625.05. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.151 against previous 1.171. The 25000CE option holds the maximum open interest, followed by the 24000PE and 24500PE options. Market participants have shown increased interest with significant open interest additions in the 25500CE option, with open interest additions also seen in the 23000PE and 26000CE options. On the other hand, open interest reductions were prominent in the 24600CE, 24500CE, and 24500PE options. Trading volume was highest in the 24000PE option, followed by the 25000CE and 24500PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,625.05 | 1.151 | 1.171 | 0.993 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,32,85,500 | 4,11,68,925 | 21,16,575 |

| PUT: | 4,98,13,050 | 4,82,03,175 | 16,09,875 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 59,42,550 | 1,74,000 | 57,566 |

| 26,000 | 44,52,150 | 4,18,200 | 36,764 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 35,65,200 | 4,67,175 | 43,906 |

| 26,000 | 44,52,150 | 4,18,200 | 36,764 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 9,59,400 | -1,30,800 | 26,170 |

| 24,500 | 20,23,950 | -1,29,225 | 44,255 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 59,42,550 | 1,74,000 | 57,566 |

| 24,500 | 20,23,950 | -1,29,225 | 44,255 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 50,55,450 | 2,58,825 | 65,866 |

| 24,500 | 44,60,850 | -1,28,100 | 56,346 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 34,90,425 | 4,54,950 | 32,327 |

| 22,000 | 23,32,500 | 4,01,625 | 12,010 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 44,60,850 | -1,28,100 | 56,346 |

| 25,000 | 42,34,725 | -98,625 | 19,189 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 50,55,450 | 2,58,825 | 65,866 |

| 24,500 | 44,60,850 | -1,28,100 | 56,346 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 54002.45. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.885 against previous 0.859. The 57000CE option holds the maximum open interest, followed by the 54000PE and 56000CE options. Market participants have shown increased interest with significant open interest additions in the 54000PE option, with open interest additions also seen in the 51000PE and 55000CE options. On the other hand, open interest reductions were prominent in the 57000CE, 50000PE, and 56000PE options. Trading volume was highest in the 54000PE option, followed by the 54000CE and 53800PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,002.45 | 0.885 | 0.859 | 0.816 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,35,00,995 | 1,28,62,180 | 6,38,815 |

| PUT: | 1,19,46,630 | 1,10,46,185 | 9,00,445 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 17,86,840 | -52,340 | 39,310 |

| 56,000 | 12,33,085 | 9,870 | 55,661 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 11,37,710 | 81,235 | 71,166 |

| 57,500 | 7,12,355 | 66,465 | 21,635 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 17,86,840 | -52,340 | 39,310 |

| 50,000 | 1,11,685 | -20,440 | 759 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 9,01,510 | 6,195 | 1,17,158 |

| 55,000 | 11,37,710 | 81,235 | 71,166 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 12,48,275 | 1,70,420 | 1,17,941 |

| 57,000 | 10,39,845 | 10,500 | 711 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 12,48,275 | 1,70,420 | 1,17,941 |

| 51,000 | 5,48,725 | 90,665 | 23,968 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 4,35,015 | -30,555 | 20,371 |

| 56,000 | 4,18,530 | -23,100 | 2,343 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 12,48,275 | 1,70,420 | 1,17,941 |

| 53,800 | 1,85,290 | 71,715 | 79,155 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 25743.5. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.985 against previous 1.128. The 26000CE option holds the maximum open interest, followed by the 26500CE and 25700PE options. Market participants have shown increased interest with significant open interest additions in the 25650PE option, with open interest additions also seen in the 26500CE and 26000CE options. On the other hand, open interest reductions were prominent in the 25000PE, 24500PE, and 25450PE options. Trading volume was highest in the 25000PE option, followed by the 26500CE and 25700PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,743.50 | 0.985 | 1.128 | 1.047 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,98,060 | 2,72,805 | 1,25,255 |

| PUT: | 3,92,080 | 3,07,840 | 84,240 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 80,795 | 22,165 | 2,622 |

| 26,500 | 72,410 | 23,725 | 3,591 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 72,410 | 23,725 | 3,591 |

| 26,000 | 80,795 | 22,165 | 2,622 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,900 | 12,220 | -2,730 | 235 |

| 26,200 | 13,260 | -1,690 | 989 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 72,410 | 23,725 | 3,591 |

| 25,700 | 45,435 | 13,910 | 2,667 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 56,680 | 4,810 | 3,527 |

| 26,000 | 49,985 | 7,410 | 593 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,650 | 39,780 | 36,790 | 1,896 |

| 25,500 | 32,435 | 20,345 | 1,791 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 46,150 | -30,225 | 5,132 |

| 24,500 | 12,220 | -3,380 | 287 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 46,150 | -30,225 | 5,132 |

| 25,700 | 56,680 | 4,810 | 3,527 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 12715.7. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.117 against previous 1.191. The 12000PE option holds the maximum open interest, followed by the 13000CE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 13400CE option, with open interest additions also seen in the 12700PE and 13500CE options. On the other hand, open interest reductions were prominent in the 56500CE, 56500CE, and 56500CE options. Trading volume was highest in the 13000CE option, followed by the 12000PE and 12600CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,715.70 | 1.117 | 1.191 | 0.850 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 41,35,600 | 31,84,580 | 9,51,020 |

| PUT: | 46,17,620 | 37,93,020 | 8,24,600 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,74,840 | -1,21,520 | 16,163 |

| 13,500 | 4,66,900 | 1,68,700 | 8,550 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 3,07,720 | 3,05,200 | 4,351 |

| 13,500 | 4,66,900 | 1,68,700 | 8,550 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,74,840 | -1,21,520 | 16,163 |

| 12,600 | 1,88,300 | -1,02,620 | 12,583 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,74,840 | -1,21,520 | 16,163 |

| 12,600 | 1,88,300 | -1,02,620 | 12,583 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,90,720 | 1,680 | 15,160 |

| 12,500 | 4,39,040 | -40,880 | 9,479 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 2,59,280 | 2,16,440 | 11,025 |

| 12,200 | 2,71,320 | 84,700 | 4,263 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 4,39,040 | -40,880 | 9,479 |

| 13,000 | 1,46,020 | -17,640 | 853 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,90,720 | 1,680 | 15,160 |

| 12,600 | 2,99,740 | 40,320 | 12,539 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Today’s Derivatives Open Interest Volume Analysis tells us the tide may be turning in favor of buyers as new longs pile in, especially with the weekly and monthly PCRs above 1 showing fresh risk-on sentiment. For tactical traders, consider using bullish spreads or put credit spreads near expiry pivot zones (24,600 for Nifty, 54,000 for BankNifty) and be ready to ride upswings if spot holds above these levels. Use call spreads or staggered longs toward resistance bands for low-risk upside exposure. Avoid chasing moves above 25,000 until fresh open interest and volumes confirm the breakout.

For FINNIFTY and MIDCPNIFTY participants, stay nimble with index-based longs and defined-risk options strategies around current support levels. Keep an eye out for sudden spikes in OI and volume as confirmation of a sustainable move. The Derivatives Open Interest Volume Analysis empowers traders to act with conviction, prioritize disciplined entries, and make sense of the evolving market backdrop.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]