Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 3/09/2025

Table of Contents

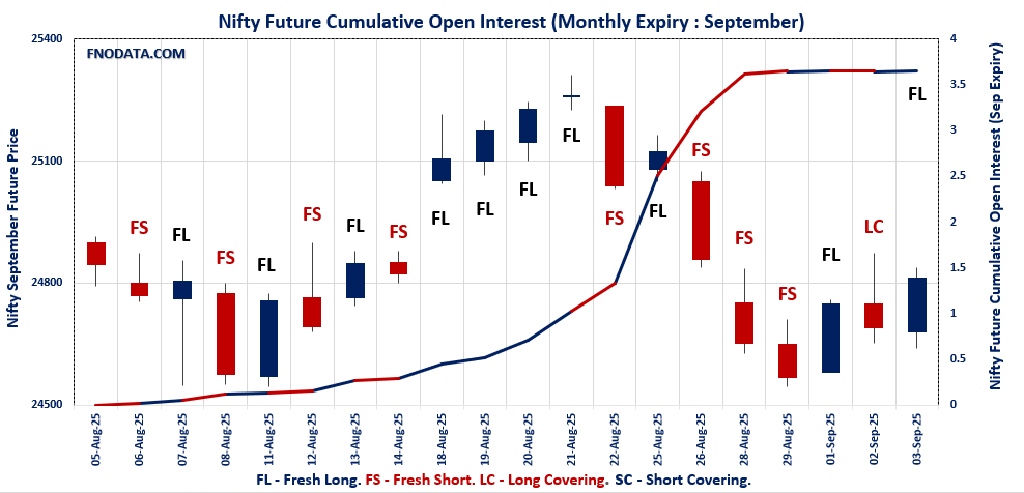

The Nifty Open Interest Volume Analysis for 3rd September 2025 highlights a notable shift in sentiment as bulls step up, following a cautious start to the week. Nifty September futures jumped by 0.49% to 24,813.10, while open interest stayed flat—a telltale sign of fresh long buildup with participants testing waters at lower levels. A 14-point premium drop reveals that hedging has softened and players are more comfortable taking exposure. Meanwhile, the weekly options chain points to rising confidence: the Put-Call Ratio (OI) jumped to 1.24, supported by strong put writing and sturdy support forming at 24,500–24,700. Heavy call additions at 25,000 hint resistance is close, keeping Nifty in a tight expiry range.

BankNifty shook off recent weakness, posting a short covering bounce as prices rose and open interest slipped nearly 3%. Option activity remains polarized between 54,000 support and stiff resistance around 57,000–57,500. FINNIFTY and MIDCPNIFTY also caught some bullish action, with both indices securing fresh longs and put writers defending major support levels. SENSEX tracked the same move—trend reversal was evident through short covering, as large investors rotate positions with the September series in sight.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 24,715.05 (0.55%)

NIFTY SEPTEMBER Future closed at: 24,813.10 (0.49%)

Premium: 98.05 (Decreased by -14.15 points)

Open Interest Change: 0.0%

Volume Change: -24.6%

Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (9/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.245 (Increased from 0.813)

Put-Call Ratio (Volume): 0.881

Max Pain Level: 24700

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24500

Highest CALL Addition: 25000

Highest PUT Addition: 24500

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.106 (Decreased from 1.124)

Put-Call Ratio (Volume): 0.871

Max Pain Level: 24900

Maximum CALL Open Interest: 25000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25500

Highest PUT Addition: 24600

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 54,067.55 (0.76%)

BANKNIFTY SEPTEMBER Future closed at: 54,373.60 (0.62%)

Premium: 306.05 (Decreased by -72.35 points)

Open Interest Change: -2.9%

Volume Change: 0.7%

Open Interest Analysis: Short Covering

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.901 (Increased from 0.834)

Put-Call Ratio (Volume): 0.795

Max Pain Level: 54600

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 65000

Highest PUT Addition: 42000

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 25,732.55 (0.62%)

FINNIFTY SEPTEMBER Future closed at: 25,869.10 (0.48%)

Premium: 136.55 (Decreased by -36.7 points)

Open Interest Change: 0.2%

Volume Change: -9.4%

Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.809 (Decreased from 0.867)

Put-Call Ratio (Volume): 0.407

Max Pain Level: 25750

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26200

Highest PUT Addition: 25600

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 12,773.60 (0.51%)

MIDCPNIFTY SEPTEMBER Future closed at: 12,825.10 (0.56%)

Premium: 51.5 (Increased by 6.85 points)

Open Interest Change: 1.3%

Volume Change: -15.8%

Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.107 (Decreased from 1.151)

Put-Call Ratio (Volume): 0.974

Max Pain Level: 12725

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12000

Highest CALL Addition: 13300

Highest PUT Addition: 12100

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 80,567.71 (0.51%)

SENSEX Monthly Future closed at: 80,922.25 (0.38%)

Premium: 354.54 (Decreased by -105.93 points)

Open Interest Change: -4.5%

Volume Change: 20.4%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (4/09/2025) Option Analysis

Put-Call Ratio (OI): 1.210 (Increased from 0.673)

Put-Call Ratio (Volume): 0.913

Max Pain Level: 80300

Maximum CALL OI: 81000

Maximum PUT OI: 80000

Highest CALL Addition: 81000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,666.46 Cr

DIIs Net BUY: ₹ 2,495.33 Cr

FII Derivatives Activity

| FII Trading Stats | 3.09.25 | 2.09.25 | 1.09.25 |

| FII Cash (Provisional Data) | -1,666.46 | -1,159.48 | -1,429.71 |

| Index Future Open Interest Long Ratio | 8.08% | 8.01% | 9.27% |

| Index Future Volume Long Ratio | 44.84% | 35.38% | 57.01% |

| Call Option Open Interest Long Ratio | 45.63% | 46.50% | 46.88% |

| Call Option Volume Long Ratio | 49.71% | 50.15% | 50.19% |

| Put Option Open Interest Long Ratio | 63.36% | 74.67% | 60.05% |

| Put Option Volume Long Ratio | 49.07% | 50.46% | 49.40% |

| Stock Future Open Interest Long Ratio | 62.71% | 62.93% | 62.92% |

| Stock Future Volume Long Ratio | 47.00% | 49.52% | 55.04% |

| Index Futures | Fresh Short | Fresh Short | Fresh Long |

| Index Options | Fresh Short | Short Covering | Fresh Short |

| Nifty Futures | Fresh Short | Fresh Short | Fresh Long |

| Nifty Options | Fresh Short | Short Covering | Fresh Short |

| BankNifty Futures | Fresh Long | Fresh Short | Fresh Long |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Long |

| FinNifty Futures | Long Covering | Long Covering | Fresh Long |

| FinNifty Options | Fresh Long | Long Covering | Fresh Short |

| MidcpNifty Futures | Fresh Short | Fresh Short | Fresh Long |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Fresh Long | Fresh Long | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Fresh Short | Long Covering | Fresh Long |

| Stock Options | Fresh Short | Fresh Long | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (4/09/2025)

The SENSEX index closed at 80567.71. The SENSEX weekly expiry for SEPTEMBER 4, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.210 against previous 0.673. The 80000PE option holds the maximum open interest, followed by the 78000PE and 81000CE options. Market participants have shown increased interest with significant open interest additions in the 80000PE option, with open interest additions also seen in the 78000PE and 80200PE options. On the other hand, open interest reductions were prominent in the 81700CE, 80800CE, and 80200CE options. Trading volume was highest in the 80000PE option, followed by the 80500CE and 81000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 04-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 80567.71 | 1.210 | 0.673 | 0.913 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,96,48,960 | 2,33,76,800 | 62,72,160 |

| PUT: | 3,58,76,520 | 1,57,24,440 | 2,01,52,080 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 27,17,840 | 9,58,960 | 11,57,11,180 |

| 82000 | 21,06,000 | 6,47,160 | 1,92,24,480 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 27,17,840 | 9,58,960 | 11,57,11,180 |

| 82500 | 19,97,660 | 9,26,600 | 1,59,94,340 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81700 | 6,53,380 | -3,35,000 | 96,28,860 |

| 80800 | 9,92,940 | -2,59,260 | 8,47,79,320 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 80500 | 10,37,220 | 36,660 | 14,17,93,860 |

| 81000 | 27,17,840 | 9,58,960 | 11,57,11,180 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 32,27,900 | 21,57,460 | 14,91,92,780 |

| 78000 | 29,10,140 | 19,47,980 | 1,74,27,220 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 32,27,900 | 21,57,460 | 14,91,92,780 |

| 78000 | 29,10,140 | 19,47,980 | 1,74,27,220 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 76400 | 19,320 | -8,480 | 2,15,560 |

| 73500 | 14,160 | -7,660 | 86,940 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 32,27,900 | 21,57,460 | 14,91,92,780 |

| 80200 | 21,40,660 | 15,72,460 | 11,36,17,200 |

NIFTY Weekly Expiry (9/09/2025)

The NIFTY index closed at 24715.05. The NIFTY weekly expiry for SEPTEMBER 9, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.245 against previous 0.813. The 24500PE option holds the maximum open interest, followed by the 24600PE and 25000CE options. Market participants have shown increased interest with significant open interest additions in the 24500PE option, with open interest additions also seen in the 24600PE and 24000PE options. On the other hand, open interest reductions were prominent in the 26250CE, 25400PE, and 25500PE options. Trading volume was highest in the 24600PE option, followed by the 24600CE and 24700CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 09-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,715.05 | 1.245 | 0.813 | 0.881 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,58,91,975 | 7,27,05,000 | 3,31,86,975 |

| PUT: | 13,18,33,125 | 5,91,05,550 | 7,27,27,575 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 89,14,350 | 30,88,125 | 17,81,195 |

| 25,500 | 74,83,350 | 25,68,825 | 5,54,714 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 89,14,350 | 30,88,125 | 17,81,195 |

| 26,000 | 71,49,675 | 27,10,650 | 3,88,563 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,250 | 1,11,675 | -75,825 | 16,632 |

| 26,400 | 1,76,025 | -2,325 | 12,127 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 42,19,275 | 11,88,300 | 42,12,507 |

| 24,700 | 54,77,400 | 12,12,000 | 36,47,090 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,17,39,900 | 67,44,900 | 30,32,913 |

| 24,600 | 94,91,625 | 60,81,300 | 42,70,717 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 1,17,39,900 | 67,44,900 | 30,32,913 |

| 24,600 | 94,91,625 | 60,81,300 | 42,70,717 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 96,750 | -17,475 | 486 |

| 25,500 | 2,03,850 | -12,150 | 1,135 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 94,91,625 | 60,81,300 | 42,70,717 |

| 24,500 | 1,17,39,900 | 67,44,900 | 30,32,913 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 24715.05. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.106 against previous 1.124. The 25000CE option holds the maximum open interest, followed by the 24000PE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 25500CE option, with open interest additions also seen in the 24600PE and 25000CE options. On the other hand, open interest reductions were prominent in the 24500PE, 25900CE, and 23100PE options. Trading volume was highest in the 25000CE option, followed by the 24500PE and 24000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,715.05 | 1.106 | 1.124 | 0.871 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,60,60,200 | 4,44,09,750 | 16,50,450 |

| PUT: | 5,09,30,850 | 4,99,24,800 | 10,06,050 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 59,85,450 | 1,78,275 | 77,690 |

| 26,000 | 44,63,775 | 1,09,575 | 30,613 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 39,82,875 | 2,00,925 | 45,678 |

| 25,000 | 59,85,450 | 1,78,275 | 77,690 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 4,32,975 | -69,600 | 6,273 |

| 25,700 | 8,01,600 | -32,250 | 13,881 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 59,85,450 | 1,78,275 | 77,690 |

| 25,500 | 39,82,875 | 2,00,925 | 45,678 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 50,94,150 | 1,21,425 | 56,906 |

| 24,500 | 43,05,225 | -1,65,300 | 62,273 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,600 | 15,24,300 | 1,95,300 | 39,396 |

| 23,500 | 23,22,375 | 1,50,000 | 25,248 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 43,05,225 | -1,65,300 | 62,273 |

| 23,100 | 2,09,475 | -44,400 | 2,313 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 43,05,225 | -1,65,300 | 62,273 |

| 24,000 | 50,94,150 | 1,21,425 | 56,906 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 54067.55. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.901 against previous 0.834. The 57000CE option holds the maximum open interest, followed by the 54000PE and 55000CE options. Market participants have shown increased interest with significant open interest additions in the 65000CE option, with open interest additions also seen in the 42000PE and 53500PE options. On the other hand, open interest reductions were prominent in the 54000CE, 56000CE, and 55000CE options. Trading volume was highest in the 54000CE option, followed by the 54000PE and 53700PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 54,067.55 | 0.901 | 0.834 | 0.795 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,49,47,585 | 1,51,38,290 | -1,90,705 |

| PUT: | 1,34,69,125 | 1,26,18,290 | 8,50,835 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 18,27,440 | -4,130 | 45,852 |

| 55,000 | 12,50,375 | -61,320 | 90,697 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 65,000 | 3,11,535 | 88,725 | 48,024 |

| 55,500 | 8,84,175 | 58,845 | 51,042 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 10,57,385 | -1,28,345 | 1,48,165 |

| 56,000 | 12,22,060 | -99,890 | 64,499 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 10,57,385 | -1,28,345 | 1,48,165 |

| 55,000 | 12,50,375 | -61,320 | 90,697 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 13,10,435 | 32,305 | 1,12,078 |

| 57,000 | 10,40,720 | 980 | 630 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 42,000 | 93,975 | 85,820 | 3,787 |

| 53,500 | 6,56,215 | 82,600 | 80,140 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 57,645 | -17,045 | 713 |

| 48,000 | 1,91,270 | -13,930 | 5,065 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 13,10,435 | 32,305 | 1,12,078 |

| 53,700 | 2,04,960 | 76,545 | 1,06,591 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 25732.55. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.809 against previous 0.867. The 26000CE option holds the maximum open interest, followed by the 26500CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26200CE option, with open interest additions also seen in the 25600PE and 25500CE options. On the other hand, open interest reductions were prominent in the 25750PE, 25550PE, and 25000PE options. Trading volume was highest in the 26000CE option, followed by the 25800CE and 25500PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,732.55 | 0.809 | 0.867 | 0.407 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,19,220 | 4,91,855 | 27,365 |

| PUT: | 4,19,965 | 4,26,595 | -6,630 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,13,750 | -2,535 | 21,444 |

| 26,500 | 71,695 | 6,565 | 5,623 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,200 | 29,250 | 13,130 | 2,117 |

| 25,500 | 13,910 | 7,345 | 2,196 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,750 | 11,050 | -5,395 | 781 |

| 25,800 | 37,700 | -4,355 | 9,377 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,13,750 | -2,535 | 21,444 |

| 25,800 | 37,700 | -4,355 | 9,377 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 60,320 | 7,020 | 678 |

| 25,700 | 51,090 | 780 | 1,459 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 30,420 | 11,635 | 1,926 |

| 26,000 | 60,320 | 7,020 | 678 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,750 | 7,670 | -19,175 | 747 |

| 25,550 | 17,355 | -10,010 | 1,972 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 43,940 | 3,250 | 5,710 |

| 25,000 | 36,855 | -8,775 | 3,499 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 12773.6. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.107 against previous 1.151. The 12000PE option holds the maximum open interest, followed by the 13500CE and 13000CE options. Market participants have shown increased interest with significant open interest additions in the 12100PE option, with open interest additions also seen in the 12800PE and 13300CE options. On the other hand, open interest reductions were prominent in the 67000CE, 69100CE, and 69100PE options. Trading volume was highest in the 12700PE option, followed by the 12700CE and 13000CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,773.60 | 1.107 | 1.151 | 0.974 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 46,16,780 | 42,54,880 | 3,61,900 |

| PUT: | 51,09,720 | 48,95,940 | 2,13,780 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 5,88,700 | 40,320 | 4,867 |

| 13,000 | 5,66,440 | 16,660 | 15,511 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 2,09,160 | 80,920 | 5,389 |

| 12,800 | 4,45,620 | 63,280 | 11,815 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 3,13,040 | -32,620 | 4,416 |

| 12,650 | 32,620 | -9,660 | 1,246 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 2,62,500 | 44,380 | 18,019 |

| 13,000 | 5,66,440 | 16,660 | 15,511 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 7,10,220 | -1,960 | 8,563 |

| 12,500 | 5,30,040 | 24,920 | 8,177 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,100 | 2,30,300 | 1,17,600 | 3,649 |

| 12,800 | 3,52,940 | 97,300 | 7,922 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 11,800 | 1,15,360 | -1,24,180 | 2,805 |

| 12,725 | 41,580 | -25,900 | 6,703 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 2,75,520 | -7,000 | 22,544 |

| 12,000 | 7,10,220 | -1,960 | 8,563 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Today’s Nifty Open Interest Volume Analysis signals the potential for a trending move if open interest begins to increase alongside a rally. Bulls should eye defined-risk call spreads above the 24,700 mark, while range-based traders may profit from iron condors and straddles at 24,700–25,000. Watch for a breakout above 25,000 with rising volumes for confirmation of sustained upside. BankNifty and midcaps are best traded using protective stops—ride long bias but adapt quickly if resistance stalls price momentum.

In FINNIFTY and MIDCPNIFTY, trail winners with moving stops and hold new longs only as long as put writing and open interest keep rising. Protect capital and remain tactical as expiry euphoria sets in. The Nifty Open Interest Volume Analysis remains the key insight for keeping your portfolio tuned for the next powerful market wave.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Previous Day’s NSE & BSE Indices F&O […]