Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 16/09/2025

Table of Contents

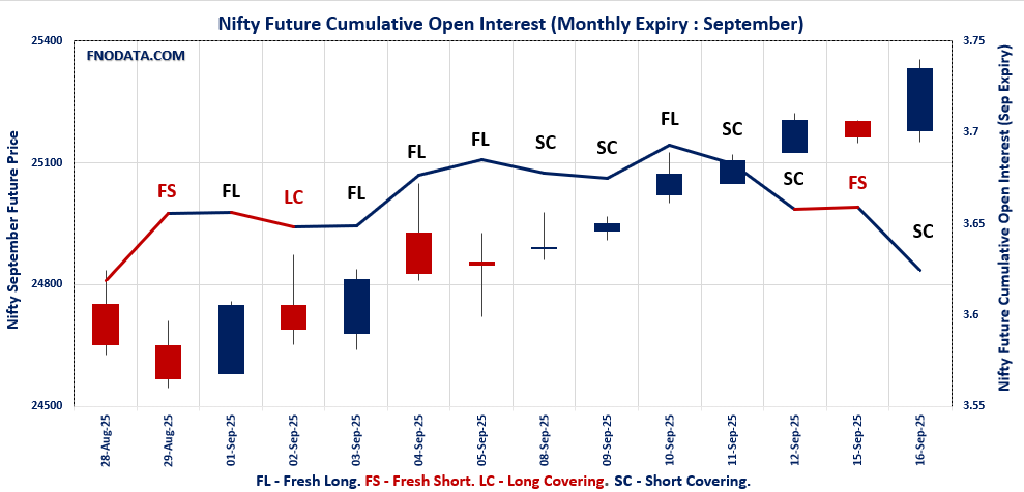

On 16th September 2025, the Indian derivatives market witnessed a sharp comeback driven by short covering, as both Nifty and Bank Nifty futures rallied with volumes surging over 70%. Nifty futures closed higher at 25,331 with OI dropping by 3.4%, a clear indication of shorts being unwound, while the weekly option chain showed strong put additions at 25,200, shifting the max pain level higher.

Bank Nifty mirrored the same trend with aggressive short covering and fresh put build-up near 55,000, confirming trader confidence in defenses holding up. Interestingly, FINNIFTY too saw heavy unwinding in OI with price gains, but the real outlier was MIDCPNIFTY, where fresh long build-up pointed to sustained strength in midcaps. Meanwhile, SENSEX futures surged with an 8.3% OI build-up, signaling fresh long positions at higher levels, reinforcing bullish bets. This Open Interest Volume Analysis paints a picture of bears on the back foot and buyers regaining control ahead of expiry week.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 25,239.10 (0.68%)

NIFTY SEPTEMBER Future closed at: 25,331.40 (0.66%)

Premium: 92.3 (Decreased by -3.2 points)

Open Interest Change: -3.4%

Volume Change: 75.2%

Open Interest Analysis: Short Covering

NIFTY Weekly Expiry (23/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.310 (Increased from 0.949)

Put-Call Ratio (Volume): 0.982

Max Pain Level: 25200

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25200

Highest CALL Addition: 26000

Highest PUT Addition: 25200

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.157 (Increased from 1.109)

Put-Call Ratio (Volume): 1.137

Max Pain Level: 25000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25600

Highest PUT Addition: 25000

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 55,147.60 (0.47%)

BANKNIFTY SEPTEMBER Future closed at: 55,339.60 (0.41%)

Premium: 192 (Decreased by -33.75 points)

Open Interest Change: -3.7%

Volume Change: 52.2%

Open Interest Analysis: Short Covering

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.082 (Increased from 1.005)

Put-Call Ratio (Volume): 0.881

Max Pain Level: 55000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 55200

Highest PUT Addition: 55000

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 26,495.30 (0.39%)

FINNIFTY SEPTEMBER Future closed at: 26,594.40 (0.35%)

Premium: 99.1 (Decreased by -9.35 points)

Open Interest Change: -5.2%

Volume Change: 74.5%

Open Interest Analysis: Short Covering

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.073 (Increased from 1.063)

Put-Call Ratio (Volume): 0.890

Max Pain Level: 26200

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26900

Highest PUT Addition: 26500

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 13,146.55 (0.34%)

MIDCPNIFTY SEPTEMBER Future closed at: 13,192.85 (0.37%)

Premium: 46.3 (Increased by 3.65 points)

Open Interest Change: 1.3%

Volume Change: 21.5%

Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.181 (Decreased from 1.271)

Put-Call Ratio (Volume): 0.818

Max Pain Level: 13000

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12000

Highest CALL Addition: 13500

Highest PUT Addition: 13200

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 82,380.69 (0.73%)

SENSEX Monthly Future closed at: 82,599.35 (0.68%)

Premium: 218.66 (Decreased by -36.6 points)

Open Interest Change: 8.3%

Volume Change: 73.9%

Open Interest Analysis: Fresh Long

SENSEX Weekly Expiry (18/09/2025) Option Analysis

Put-Call Ratio (OI): 1.451 (Increased from 0.912)

Put-Call Ratio (Volume): 0.862

Max Pain Level: 82300

Maximum CALL OI: 84000

Maximum PUT OI: 80000

Highest CALL Addition: 84000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 308.32 Cr.

DIIs Net BUY: ₹ 1,518.73 Cr.

FII Derivatives Activity

| FII Trading Stats | 16.09.25 | 15.09.25 | 12.09.25 |

| FII Cash (Provisional Data) | 308.32 | -1,268.59 | 129.58 |

| Index Future Open Interest Long Ratio | 12.44% | 11.85% | 11.81% |

| Index Future Volume Long Ratio | 67.04% | 55.20% | 77.28% |

| Call Option Open Interest Long Ratio | 49.16% | 48.24% | 49.96% |

| Call Option Volume Long Ratio | 50.77% | 49.57% | 50.35% |

| Put Option Open Interest Long Ratio | 68.13% | 62.51% | 62.77% |

| Put Option Volume Long Ratio | 50.20% | 50.13% | 50.19% |

| Stock Future Open Interest Long Ratio | 62.07% | 62.06% | 62.28% |

| Stock Future Volume Long Ratio | 51.14% | 46.73% | 51.09% |

| Index Futures | Short Covering | Short Covering | Short Covering |

| Index Options | Short Covering | Fresh Short | Fresh Long |

| Nifty Futures | Short Covering | Short Covering | Short Covering |

| Nifty Options | Short Covering | Fresh Short | Fresh Long |

| BankNifty Futures | Short Covering | Short Covering | Short Covering |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Short | Short Covering | Fresh Short |

| FinNifty Options | Fresh Short | Short Covering | Fresh Long |

| MidcpNifty Futures | Fresh Short | Fresh Long | Long Covering |

| MidcpNifty Options | Fresh Short | Fresh Long | Short Covering |

| NiftyNxt50 Futures | Short Covering | Fresh Long | Long Covering |

| NiftyNxt50 Options | Long Covering | Fresh Long | Short Covering |

| Stock Futures | Fresh Long | Fresh Short | Fresh Long |

| Stock Options | Fresh Short | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (23/09/2025)

The NIFTY index closed at 25239.1. The NIFTY weekly expiry for SEPTEMBER 23, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.310 against previous 0.949. The 26000CE option holds the maximum open interest, followed by the 25200PE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25200PE option, with open interest additions also seen in the 26000CE and 25100PE options. On the other hand, open interest reductions were prominent in the 25100CE, 25050CE, and 25150CE options. Trading volume was highest in the 25200CE option, followed by the 25200PE and 25100PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 23-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,239.10 | 1.310 | 0.949 | 0.982 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,40,11,100 | 3,29,77,350 | 2,10,33,750 |

| PUT: | 7,07,75,400 | 3,13,01,625 | 3,94,73,775 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,70,550 | 32,52,825 | 2,34,884 |

| 25,200 | 38,02,350 | 15,41,625 | 5,43,013 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 70,70,550 | 32,52,825 | 2,34,884 |

| 25,200 | 38,02,350 | 15,41,625 | 5,43,013 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 14,65,575 | -6,10,650 | 2,67,731 |

| 25,050 | 2,07,375 | -1,39,575 | 38,797 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 38,02,350 | 15,41,625 | 5,43,013 |

| 25,300 | 27,97,950 | 14,13,300 | 3,87,169 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 56,43,225 | 48,26,700 | 4,74,655 |

| 25,000 | 50,74,875 | 23,74,500 | 3,30,178 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 56,43,225 | 48,26,700 | 4,74,655 |

| 25,100 | 42,73,950 | 26,58,000 | 3,91,914 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,550 | 49,575 | -3,300 | 2,232 |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 56,43,225 | 48,26,700 | 4,74,655 |

| 25,100 | 42,73,950 | 26,58,000 | 3,91,914 |

SENSEX Weekly Expiry (18/09/2025)

The SENSEX index closed at 82380.69. The SENSEX weekly expiry for SEPTEMBER 18, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.451 against previous 0.912. The 84000CE option holds the maximum open interest, followed by the 80000PE and 82000PE options. Market participants have shown increased interest with significant open interest additions in the 80000PE option, with open interest additions also seen in the 84000CE and 82000PE options. On the other hand, open interest reductions were prominent in the 82000CE, 81900CE, and 81800CE options. Trading volume was highest in the 82000PE option, followed by the 82200CE and 82500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 18-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82380.69 | 1.451 | 0.912 | 0.862 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,59,34,780 | 1,10,39,560 | 48,95,220 |

| PUT: | 2,31,22,160 | 1,00,72,820 | 1,30,49,340 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 17,01,020 | 9,88,620 | 86,33,580 |

| 83500 | 11,48,580 | 5,90,140 | 80,60,360 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 17,01,020 | 9,88,620 | 86,33,580 |

| 83500 | 11,48,580 | 5,90,140 | 80,60,360 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 4,21,360 | -5,10,220 | 1,81,89,260 |

| 81900 | 1,95,240 | -3,16,100 | 84,18,820 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82200 | 2,96,520 | -50,540 | 1,90,46,780 |

| 82500 | 7,76,300 | 2,69,020 | 1,90,06,040 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 17,00,080 | 11,66,740 | 66,47,320 |

| 82000 | 14,80,800 | 8,75,280 | 2,32,16,500 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 17,00,080 | 11,66,740 | 66,47,320 |

| 82000 | 14,80,800 | 8,75,280 | 2,32,16,500 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 79900 | 1,45,200 | -21,280 | 8,40,480 |

| 80100 | 86,480 | -20,740 | 8,93,580 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 14,80,800 | 8,75,280 | 2,32,16,500 |

| 82200 | 6,75,740 | 6,30,720 | 1,57,62,160 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 25239.1. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.157 against previous 1.109. The 25000PE option holds the maximum open interest, followed by the 26000CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 25000PE option, with open interest additions also seen in the 25200PE and 24900PE options. On the other hand, open interest reductions were prominent in the 24700PE, 24800PE, and 24900CE options. Trading volume was highest in the 25000PE option, followed by the 25500CE and 25200CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,239.10 | 1.157 | 1.109 | 1.137 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,91,62,275 | 4,83,37,425 | 8,24,850 |

| PUT: | 5,69,04,450 | 5,36,12,175 | 32,92,275 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 52,22,175 | 1,15,500 | 69,968 |

| 25,500 | 45,79,800 | -2,16,525 | 1,03,039 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 24,78,900 | 4,42,425 | 52,862 |

| 26,500 | 18,73,650 | 3,29,550 | 18,026 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 12,53,550 | -2,34,075 | 12,614 |

| 25,500 | 45,79,800 | -2,16,525 | 1,03,039 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 45,79,800 | -2,16,525 | 1,03,039 |

| 25,200 | 24,42,225 | -1,73,025 | 97,413 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 60,43,425 | 14,16,000 | 1,18,198 |

| 24,500 | 45,50,100 | 61,650 | 60,102 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 60,43,425 | 14,16,000 | 1,18,198 |

| 25,200 | 18,25,350 | 6,16,125 | 91,375 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 23,65,425 | -4,33,725 | 45,517 |

| 24,800 | 23,87,625 | -3,93,900 | 61,459 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 60,43,425 | 14,16,000 | 1,18,198 |

| 25,200 | 18,25,350 | 6,16,125 | 91,375 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 55147.6. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.082 against previous 1.005. The 54000PE option holds the maximum open interest, followed by the 57000CE and 56000CE options. Market participants have shown increased interest with significant open interest additions in the 55000PE option, with open interest additions also seen in the 54000PE and 55100PE options. On the other hand, open interest reductions were prominent in the 57000PE, 57000CE, and 55000CE options. Trading volume was highest in the 55000CE option, followed by the 55000PE and 56000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,147.60 | 1.082 | 1.005 | 0.881 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,56,08,635 | 1,61,22,170 | -5,13,535 |

| PUT: | 1,68,86,255 | 1,62,04,900 | 6,81,355 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 14,52,765 | -3,18,590 | 61,002 |

| 56,000 | 13,88,415 | -44,870 | 1,17,070 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,200 | 3,23,190 | 1,06,155 | 93,896 |

| 55,300 | 2,56,935 | 75,250 | 57,365 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 14,52,765 | -3,18,590 | 61,002 |

| 55,000 | 12,17,930 | -1,66,425 | 1,89,331 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 12,17,930 | -1,66,425 | 1,89,331 |

| 56,000 | 13,88,415 | -44,870 | 1,17,070 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 15,19,620 | 1,77,555 | 67,158 |

| 55,000 | 13,63,740 | 3,12,830 | 1,69,581 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 13,63,740 | 3,12,830 | 1,69,581 |

| 54,000 | 15,19,620 | 1,77,555 | 67,158 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 6,16,920 | -3,52,085 | 11,749 |

| 52,600 | 64,435 | -42,665 | 6,885 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 13,63,740 | 3,12,830 | 1,69,581 |

| 55,100 | 2,52,945 | 1,21,135 | 90,192 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 26495.3. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.073 against previous 1.063. The 26500CE option holds the maximum open interest, followed by the 27000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26500PE option, with open interest additions also seen in the 26900CE and 26400PE options. On the other hand, open interest reductions were prominent in the 24500PE, 24000PE, and 23000PE options. Trading volume was highest in the 26500CE option, followed by the 27000CE and 26500PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,495.30 | 1.073 | 1.063 | 0.890 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 8,58,130 | 8,66,710 | -8,580 |

| PUT: | 9,20,595 | 9,21,635 | -1,040 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,19,405 | -6,305 | 5,454 |

| 27,000 | 95,810 | -1,495 | 4,578 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,900 | 53,560 | 19,305 | 1,297 |

| 26,600 | 40,885 | 5,005 | 3,101 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 23,660 | -11,440 | 2,383 |

| 26,500 | 1,19,405 | -6,305 | 5,454 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,19,405 | -6,305 | 5,454 |

| 27,000 | 95,810 | -1,495 | 4,578 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 88,270 | 1,885 | 3,151 |

| 25,000 | 77,805 | 2,795 | 1,312 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 66,365 | 24,440 | 4,000 |

| 26,400 | 40,365 | 13,325 | 1,696 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 22,945 | -29,900 | 1,681 |

| 24,000 | 34,970 | -20,150 | 1,136 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 66,365 | 24,440 | 4,000 |

| 26,000 | 88,270 | 1,885 | 3,151 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 13146.55. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.181 against previous 1.271. The 13500CE option holds the maximum open interest, followed by the 14000CE and 12000PE options. Market participants have shown increased interest with significant open interest additions in the 13500CE option, with open interest additions also seen in the 13200CE and 13200PE options. On the other hand, open interest reductions were prominent in the 68000CE, 67500CE, and 66000PE options. Trading volume was highest in the 13300CE option, followed by the 13100CE and 13100PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,146.55 | 1.181 | 1.271 | 0.818 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 67,64,940 | 64,65,200 | 2,99,740 |

| PUT: | 79,91,760 | 82,16,740 | -2,24,980 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 9,68,800 | 1,85,080 | 9,379 |

| 14,000 | 7,37,660 | 3,920 | 1,818 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 9,68,800 | 1,85,080 | 9,379 |

| 13,200 | 5,39,280 | 1,44,340 | 12,169 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 3,82,620 | -1,08,360 | 19,744 |

| 13,050 | 57,120 | -35,980 | 1,141 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 4,33,160 | 13,440 | 21,616 |

| 13,100 | 3,82,620 | -1,08,360 | 19,744 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 6,72,000 | -59,220 | 2,789 |

| 13,000 | 6,71,580 | 24,920 | 9,477 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 2,40,240 | 1,26,140 | 4,360 |

| 12,800 | 6,32,660 | 86,660 | 6,126 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 4,24,480 | -1,25,720 | 18,064 |

| 13,400 | 26,600 | -74,340 | 915 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 4,24,480 | -1,25,720 | 18,064 |

| 13,000 | 6,71,580 | 24,920 | 9,477 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The derivatives positioning on 16th September 2025 highlights a market tilting in favor of the bulls. Nifty’s PCR (OI) rising sharply to 1.310 clearly shows put writers are regaining dominance, with strong support emerging at 25,200. Bank Nifty’s max pain level holding steady at 55,000 alongside rising call writing at 55,200 points to a consolidation zone before the next directional move.

FINNIFTY’s shifting buildup suggests cautious optimism, but MIDCPNIFTY stands out with fresh longs—an encouraging sign for broader market participation. The strongest signal comes from SENSEX futures, where steady fresh longs with volumes up nearly 74% suggest institutional flow supporting the uptrend. Overall, the Open Interest Volume Analysis underlines that short covering is fueling the present rally, but with simultaneous fresh longs appearing in midcaps and Sensex, this move could well extend into a more convincing bullish leg if global sentiment remains supportive.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]