Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 18/09/2025

Table of Contents

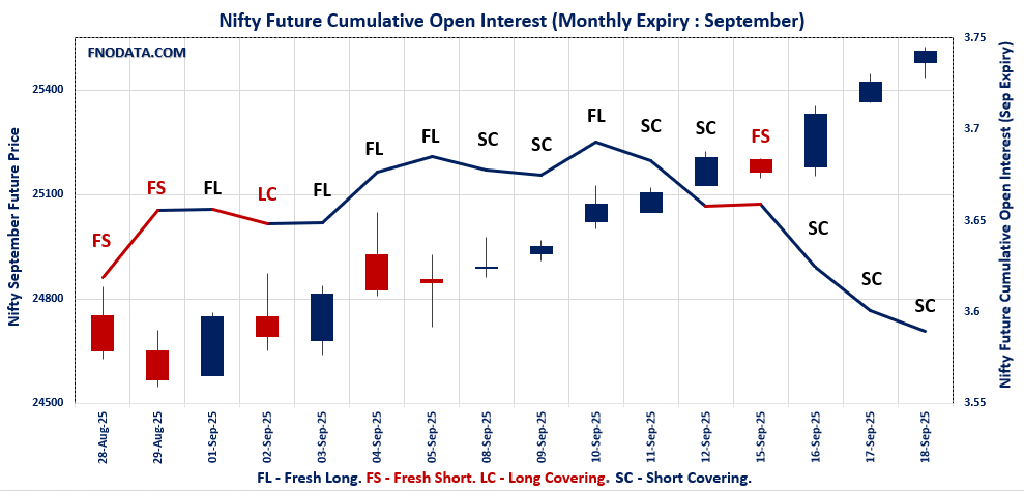

The session on 18th September 2025 confirmed that the upward drift in the indices is still being powered by short covering, as Nifty, Bank Nifty, and Sensex futures all closed higher with falling open interest. Nifty futures ended at 25,510 with OI down 1.1%, while Bank Nifty mirrored the move with nearly a 7.4% drop in OI – clear signs that bears are steadily retreating. In the weekly Nifty options setup, PCR (OI) eased to 1.094 as fresh call writing appeared at 25,800, yet strong put additions at 25,400 reaffirmed support.

Interestingly, FINNIFTY showed similar short unwindings coupled with record jump in volumes, pointing to aggressive covering by traders. MIDCPNIFTY stood out, building fresh longs with a 3.6% OI rise alongside a 93% volume surge, reflecting real conviction in midcap momentum. Sensex too aligned with the short covering theme, with futures gaining over 0.3% and OI down 9.5%. The broader Open Interest Volume Analysis suggests markets are climbing a wall of worry, where unwinding pressure fuels the rally, but fresh long participation is still selective.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 25,423.60 (0.37%)

NIFTY SEPTEMBER Future closed at: 25,510.90 (0.34%)

Premium: 87.3 (Decreased by -5.85 points)

Open Interest Change: -1.1%

Volume Change: 21.1%

Open Interest Analysis: Short Covering

NIFTY Weekly Expiry (23/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.094 (Decreased from 1.167)

Put-Call Ratio (Volume): 1.077

Max Pain Level: 25400

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25800

Highest PUT Addition: 25400

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.132 (Decreased from 1.144)

Put-Call Ratio (Volume): 1.191

Max Pain Level: 25200

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 27000

Highest PUT Addition: 25200

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 55,727.45 (0.42%)

BANKNIFTY SEPTEMBER Future closed at: 55,879.60 (0.32%)

Premium: 152.15 (Decreased by -54.35 points)

Open Interest Change: -7.4%

Volume Change: 8.2%

Open Interest Analysis: Short Covering

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.105 (Increased from 1.094)

Put-Call Ratio (Volume): 0.913

Max Pain Level: 55400

Maximum CALL Open Interest: 56000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 55800

Highest PUT Addition: 55700

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 26,698.65 (0.51%)

FINNIFTY SEPTEMBER Future closed at: 26,751.80 (0.31%)

Premium: 53.15 (Decreased by -52.3 points)

Open Interest Change: -6.6%

Volume Change: 122.6%

Open Interest Analysis: Short Covering

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.081 (Increased from 1.028)

Put-Call Ratio (Volume): 0.918

Max Pain Level: 26400

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26700

Highest PUT Addition: 26700

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 13,234.25 (0.63%)

MIDCPNIFTY SEPTEMBER Future closed at: 13,282.55 (0.66%)

Premium: 48.3 (Increased by 5.25 points)

Open Interest Change: 3.6%

Volume Change: 93.9%

Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.224 (Increased from 1.082)

Put-Call Ratio (Volume): 0.833

Max Pain Level: 13100

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12500

Highest CALL Addition: 13300

Highest PUT Addition: 13200

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 83,013.96 (0.39%)

SENSEX Monthly Future closed at: 83,185.60 (0.32%)

Premium: 171.64 (Decreased by -54.85 points)

Open Interest Change: -9.5%

Volume Change: 57.3%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (25/09/2025) Option Analysis

Put-Call Ratio (OI): 1.019 (Decreased from 1.054)

Put-Call Ratio (Volume): 0.984

Max Pain Level: 83000

Maximum CALL OI: 83000

Maximum PUT OI: 83000

Highest CALL Addition: 86000

Highest PUT Addition: 83000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 366.69 Cr.

DIIs Net BUY: ₹ 3,326.56 Cr.

FII Derivatives Activity

| FII Trading Stats | 18.09.25 | 17.09.25 | 16.09.25 |

| FII Cash (Provisional Data) | 366.69 | 308.32 | 308.32 |

| Index Future Open Interest Long Ratio | 13.96% | 13.22% | 12.44% |

| Index Future Volume Long Ratio | 59.59% | 69.77% | 67.04% |

| Call Option Open Interest Long Ratio | 50.72% | 49.29% | 49.16% |

| Call Option Volume Long Ratio | 50.27% | 49.99% | 50.77% |

| Put Option Open Interest Long Ratio | 64.44% | 64.23% | 68.13% |

| Put Option Volume Long Ratio | 50.30% | 49.76% | 50.20% |

| Stock Future Open Interest Long Ratio | 61.95% | 62.01% | 62.07% |

| Stock Future Volume Long Ratio | 50.05% | 49.67% | 51.14% |

| Index Futures | Short Covering | Short Covering | Short Covering |

| Index Options | Fresh Long | Fresh Short | Short Covering |

| Nifty Futures | Short Covering | Short Covering | Short Covering |

| Nifty Options | Fresh Long | Fresh Short | Short Covering |

| BankNifty Futures | Short Covering | Short Covering | Short Covering |

| BankNifty Options | Fresh Long | Fresh Short | Fresh Long |

| FinNifty Futures | Fresh Long | Fresh Short | Fresh Short |

| FinNifty Options | Long Covering | Fresh Long | Fresh Short |

| MidcpNifty Futures | Short Covering | Short Covering | Fresh Short |

| MidcpNifty Options | Fresh Short | Short Covering | Fresh Short |

| NiftyNxt50 Futures | Long Covering | Long Covering | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Short | Long Covering |

| Stock Futures | Fresh Long | Fresh Short | Fresh Long |

| Stock Options | Fresh Long | Fresh Short | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (23/09/2025)

The NIFTY index closed at 25423.6. The NIFTY weekly expiry for SEPTEMBER 23, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.094 against previous 1.167. The 26000CE option holds the maximum open interest, followed by the 25500CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25400PE option, with open interest additions also seen in the 25800CE and 25000PE options. On the other hand, open interest reductions were prominent in the 25300CE, 25350CE, and 24200PE options. Trading volume was highest in the 25400PE option, followed by the 25400CE and 25500CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 23-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,423.60 | 1.094 | 1.167 | 1.077 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 13,00,47,825 | 9,20,74,575 | 3,79,73,250 |

| PUT: | 14,22,92,850 | 10,74,35,475 | 3,48,57,375 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,14,59,475 | 28,57,125 | 8,97,349 |

| 25,500 | 1,11,12,300 | 38,88,675 | 30,05,470 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 86,08,125 | 48,06,225 | 9,91,686 |

| 25,500 | 1,11,12,300 | 38,88,675 | 30,05,470 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 30,33,600 | -17,50,425 | 9,03,650 |

| 25,350 | 19,51,875 | -11,34,825 | 10,73,893 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 72,86,025 | 20,92,650 | 33,46,918 |

| 25,500 | 1,11,12,300 | 38,88,675 | 30,05,470 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,04,79,825 | 42,60,450 | 8,99,355 |

| 25,400 | 90,16,125 | 58,72,050 | 38,25,627 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 90,16,125 | 58,72,050 | 38,25,627 |

| 25,000 | 1,04,79,825 | 42,60,450 | 8,99,355 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,200 | 34,94,925 | -8,18,625 | 3,00,769 |

| 25,250 | 40,34,550 | -7,65,150 | 10,89,446 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 90,16,125 | 58,72,050 | 38,25,627 |

| 25,300 | 90,02,925 | 20,81,400 | 22,54,692 |

SENSEX Weekly Expiry (25/09/2025)

The SENSEX index closed at 83013.96. The SENSEX weekly expiry for SEPTEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.019 against previous 1.054. The 83000CE option holds the maximum open interest, followed by the 83000PE and 85000CE options. Market participants have shown increased interest with significant open interest additions in the 83000PE option, with open interest additions also seen in the 86000CE and 83000CE options. On the other hand, open interest reductions were prominent in the 82600CE, 82700CE, and 82400CE options. Trading volume was highest in the 83000CE option, followed by the 83000PE and 84000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 25-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 83013.96 | 1.019 | 1.054 | 0.984 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 39,27,260 | 12,13,860 | 27,13,400 |

| PUT: | 40,00,820 | 12,79,280 | 27,21,540 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 4,54,420 | 3,38,700 | 32,78,540 |

| 85000 | 4,03,600 | 3,17,400 | 14,71,180 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 86000 | 3,88,260 | 3,52,340 | 10,63,320 |

| 83000 | 4,54,420 | 3,38,700 | 32,78,540 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82600 | 16,100 | -10,540 | 1,25,620 |

| 82700 | 58,620 | -7,280 | 3,02,460 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 4,54,420 | 3,38,700 | 32,78,540 |

| 84000 | 2,66,600 | 1,48,100 | 15,21,800 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 4,30,820 | 3,83,680 | 32,54,780 |

| 81000 | 2,87,980 | 2,07,660 | 8,75,260 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 4,30,820 | 3,83,680 | 32,54,780 |

| 81000 | 2,87,980 | 2,07,660 | 8,75,260 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80100 | 6,280 | -1,180 | 21,060 |

| 78300 | 220 | -260 | 1,480 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 4,30,820 | 3,83,680 | 32,54,780 |

| 82500 | 2,09,840 | 1,09,880 | 13,72,080 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 25423.6. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.132 against previous 1.144. The 26000CE option holds the maximum open interest, followed by the 25000PE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 25200PE option, with open interest additions also seen in the 25500PE and 27000CE options. On the other hand, open interest reductions were prominent in the 25100PE, 23500PE, and 25700CE options. Trading volume was highest in the 25500CE option, followed by the 25300PE and 25400PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,423.60 | 1.132 | 1.144 | 1.191 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 5,57,17,725 | 5,22,91,500 | 34,26,225 |

| PUT: | 6,30,86,700 | 5,98,43,775 | 32,42,925 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 57,47,775 | 1,89,225 | 1,19,865 |

| 25,500 | 50,47,500 | 6,19,425 | 1,86,151 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 39,62,175 | 11,15,025 | 33,751 |

| 25,800 | 28,94,850 | 8,97,000 | 1,04,409 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 23,48,550 | -3,19,050 | 99,727 |

| 25,000 | 35,44,275 | -2,22,525 | 21,025 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 50,47,500 | 6,19,425 | 1,86,151 |

| 26,000 | 57,47,775 | 1,89,225 | 1,19,865 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 57,47,325 | 75,750 | 1,18,260 |

| 24,000 | 45,58,875 | 5,27,775 | 51,956 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 33,82,275 | 13,36,425 | 1,10,313 |

| 25,500 | 30,44,250 | 11,23,950 | 1,30,182 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 24,62,550 | -10,92,675 | 1,00,069 |

| 23,500 | 16,14,750 | -4,72,500 | 25,359 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 25,61,400 | 4,64,175 | 1,44,235 |

| 25,400 | 21,57,750 | 7,81,050 | 1,40,687 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 55727.45. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.105 against previous 1.094. The 54000PE option holds the maximum open interest, followed by the 55000PE and 56000CE options. Market participants have shown increased interest with significant open interest additions in the 55800CE option, with open interest additions also seen in the 55700PE and 55700CE options. On the other hand, open interest reductions were prominent in the 55000CE, 53300PE, and 55500CE options. Trading volume was highest in the 56000CE option, followed by the 55800CE and 55700CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,727.45 | 1.105 | 1.094 | 0.913 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,63,17,270 | 1,56,02,075 | 7,15,195 |

| PUT: | 1,80,27,595 | 1,70,70,165 | 9,57,430 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 12,98,920 | -63,595 | 2,48,783 |

| 57,000 | 11,15,785 | -1,13,520 | 1,12,428 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,800 | 5,73,055 | 3,29,000 | 2,06,721 |

| 55,700 | 4,49,015 | 2,06,395 | 1,96,279 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 8,59,985 | -1,48,190 | 36,308 |

| 55,500 | 7,21,080 | -1,22,800 | 1,62,490 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 12,98,920 | -63,595 | 2,48,783 |

| 55,800 | 5,73,055 | 3,29,000 | 2,06,721 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 14,38,075 | -40,845 | 70,890 |

| 55,000 | 14,19,985 | 15,960 | 1,50,718 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,700 | 4,23,360 | 3,02,995 | 1,74,889 |

| 55,800 | 2,52,735 | 1,76,715 | 1,55,015 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 53,300 | 97,580 | -1,43,745 | 13,984 |

| 51,500 | 3,62,915 | -85,155 | 19,749 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,700 | 4,23,360 | 3,02,995 | 1,74,889 |

| 55,500 | 6,88,440 | 57,215 | 1,73,922 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 26698.65. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.081 against previous 1.028. The 26000PE option holds the maximum open interest, followed by the 27000CE and 27500CE options. Market participants have shown increased interest with significant open interest additions in the 26700PE option, with open interest additions also seen in the 26000PE and 26700CE options. On the other hand, open interest reductions were prominent in the 26500CE, 25500PE, and 25000PE options. Trading volume was highest in the 27000CE option, followed by the 26700CE and 26500PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,698.65 | 1.081 | 1.028 | 0.918 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 8,99,405 | 9,14,225 | -14,820 |

| PUT: | 9,72,010 | 9,39,640 | 32,370 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 95,095 | -5,460 | 10,186 |

| 27,500 | 87,945 | 4,810 | 2,483 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 37,180 | 22,555 | 6,999 |

| 26,750 | 14,560 | 7,280 | 1,623 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 80,665 | -30,810 | 1,497 |

| 26,600 | 31,720 | -16,185 | 3,125 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 95,095 | -5,460 | 10,186 |

| 26,700 | 37,180 | 22,555 | 6,999 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,24,345 | 27,365 | 3,419 |

| 26,500 | 81,250 | 3,380 | 6,554 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 40,300 | 29,445 | 6,309 |

| 26,000 | 1,24,345 | 27,365 | 3,419 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 78,390 | -18,005 | 1,808 |

| 25,000 | 55,965 | -17,420 | 536 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 81,250 | 3,380 | 6,554 |

| 26,700 | 40,300 | 29,445 | 6,309 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 13234.25. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.224 against previous 1.082. The 13500CE option holds the maximum open interest, followed by the 14000CE and 12500PE options. Market participants have shown increased interest with significant open interest additions in the 13200PE option, with open interest additions also seen in the 12500PE and 13300CE options. On the other hand, open interest reductions were prominent in the 68000CE, 68000CE, and 67000CE options. Trading volume was highest in the 13300CE option, followed by the 13200CE and 13200PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,234.25 | 1.224 | 1.082 | 0.833 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 72,70,200 | 72,42,200 | 28,000 |

| PUT: | 88,98,680 | 78,39,160 | 10,59,520 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 10,30,820 | 96,320 | 19,849 |

| 14,000 | 7,00,280 | -72,660 | 5,247 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 6,35,040 | 1,30,200 | 37,512 |

| 13,600 | 3,78,840 | 1,00,660 | 6,746 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,150 | 92,400 | -1,51,480 | 7,050 |

| 13,100 | 2,67,260 | -74,060 | 4,566 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 6,35,040 | 1,30,200 | 37,512 |

| 13,200 | 5,59,300 | -28,840 | 29,631 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 6,72,000 | 1,46,160 | 6,171 |

| 13,200 | 6,67,100 | 3,56,580 | 27,022 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 6,67,100 | 3,56,580 | 27,022 |

| 12,500 | 6,72,000 | 1,46,160 | 6,171 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,150 | 93,100 | -57,260 | 7,714 |

| 12,650 | 54,040 | -30,940 | 508 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 6,67,100 | 3,56,580 | 27,022 |

| 13,000 | 6,19,500 | -2,240 | 16,085 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Derivative positioning on 18th September 2025 shows a market steadily unwinding shorts and shifting towards stability ahead of the next weekly expiry. Nifty’s max pain has shifted upward to 25,400, in line with heavy put build-up, reinforcing that downside protection is strong. Bank Nifty’s option setup reflects a similar theme with 55,700–55,800 becoming the balancing zone, where bears appear reluctant to add fresh positions.

FINNIFTY’s dual put and call additions at 26,700 highlight a potential consolidation pocket, while MIDCPNIFTY’s fresh long OI buildup near 13,200 signals real accumulation in the midcap space. Sensex, with its 9.5% OI drop and puts clustering at 83,000, reinforces bullish undercurrents from institutional players. Overall, the Open Interest Volume Analysis makes it evident that while the ongoing rally is still leaning heavily on short covering, the emergence of selective fresh long positions—especially in midcaps—could lay the groundwork for a broader bullish phase if global sentiment remains supportive.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]