Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 19/09/2025

Table of Contents

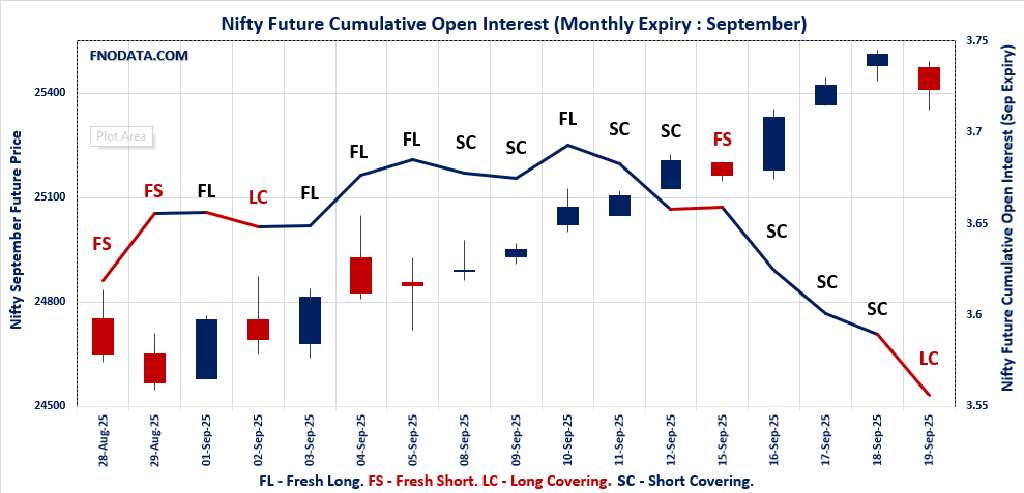

On 19th September 2025, the F&O market witnessed a pullback that was largely driven by long covering, marking a pause in the bullish streak of previous sessions. Nifty futures slipped to 25,411 with OI down by 3.3%, signaling that traders booked out of their longs instead of adding fresh directional bets. The weekly option chain painted a cautious tone as PCR (OI) fell sharply to 0.817 from 1.094, with puts concentrating at 25,300 while new call writing emerged at 25,400.

Bank Nifty also mirrored the same setup, closing lower as long positions were liquidated, reinforced by falling OI of 2.2%, though options data at 55,500 showed fresh activity on both sides, hinting at indecision. On the other hand, FINNIFTY diverged with fresh short build-up, suggesting selling pressure in financial heavyweights. MIDCPNIFTY and Sensex both displayed long covering, highlighting that the unwinding wasn’t index‑specific but a broad‑based cautionary move. The day’s Open Interest Volume Analysis clearly captured how the week’s bullish momentum eased into a defensive stance ahead of expiry.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 25,327.05 (-0.38%)

NIFTY SEPTEMBER Future closed at: 25,411.20 (-0.39%)

Premium: 84.15 (Decreased by -3.15 points)

Open Interest Change: -3.3%

Volume Change: 16.6%

Open Interest Analysis: Long Covering

NIFTY Weekly Expiry (23/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.817 (Decreased from 1.094)

Put-Call Ratio (Volume): 1.125

Max Pain Level: 25350

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25300

Highest CALL Addition: 25400

Highest PUT Addition: 25300

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.042 (Decreased from 1.132)

Put-Call Ratio (Volume): 0.970

Max Pain Level: 25200

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26500

Highest PUT Addition: 24900

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 55,458.85 (-0.48%)

BANKNIFTY SEPTEMBER Future closed at: 55,654.40 (-0.40%)

Premium: 195.55 (Increased by 43.4 points)

Open Interest Change: -2.2%

Volume Change: -26.3%

Open Interest Analysis: Long Covering

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.025 (Decreased from 1.105)

Put-Call Ratio (Volume): 1.244

Max Pain Level: 55300

Maximum CALL Open Interest: 56000

Maximum PUT Open Interest: 54000

Highest CALL Addition: 55500

Highest PUT Addition: 51000

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 26,527.60 (-0.64%)

FINNIFTY SEPTEMBER Future closed at: 26,623.40 (-0.48%)

Premium: 95.8 (Increased by 42.65 points)

Open Interest Change: 0.5%

Volume Change: -18.6%

Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.985 (Decreased from 1.081)

Put-Call Ratio (Volume): 1.066

Max Pain Level: 26400

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26600

Highest PUT Addition: 26600

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 13,240.50 (0.05%)

MIDCPNIFTY SEPTEMBER Future closed at: 13,282.00 (0.00%)

Premium: 41.5 (Decreased by -6.8 points)

Open Interest Change: -2.5%

Volume Change: -58.1%

Open Interest Analysis: Long Covering

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.163 (Decreased from 1.224)

Put-Call Ratio (Volume): 1.102

Max Pain Level: 13150

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12500

Highest CALL Addition: 13300

Highest PUT Addition: 13250

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 82,626.23 (-0.47%)

SENSEX Monthly Future closed at: 82,811.95 (-0.45%)

Premium: 185.72 (Increased by 14.08 points)

Open Interest Change: -2.0%

Volume Change: -39.8%

Open Interest Analysis: Long Covering

SENSEX Weekly Expiry (25/09/2025) Option Analysis

Put-Call Ratio (OI): 0.708 (Decreased from 1.019)

Put-Call Ratio (Volume): 1.177

Max Pain Level: 82700

Maximum CALL OI: 85000

Maximum PUT OI: 80000

Highest CALL Addition: 85000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 390.74 Cr.

DIIs Net BUY: ₹ 2,105.22 Cr.

FII Derivatives Activity

| FII Trading Stats | 19.09.25 | 18.09.25 | 17.09.25 |

| FII Cash (Provisional Data) | 390.74 | 366.69 | 308.32 |

| Index Future Open Interest Long Ratio | 12.89% | 13.96% | 13.22% |

| Index Future Volume Long Ratio | 45.66% | 59.59% | 69.77% |

| Call Option Open Interest Long Ratio | 51.67% | 50.72% | 49.29% |

| Call Option Volume Long Ratio | 50.17% | 50.27% | 49.99% |

| Put Option Open Interest Long Ratio | 63.38% | 64.44% | 64.23% |

| Put Option Volume Long Ratio | 49.95% | 50.30% | 49.76% |

| Stock Future Open Interest Long Ratio | 61.79% | 61.95% | 62.01% |

| Stock Future Volume Long Ratio | 49.63% | 50.05% | 49.67% |

| Index Futures | Long Covering | Short Covering | Short Covering |

| Index Options | Fresh Long | Fresh Long | Fresh Short |

| Nifty Futures | Long Covering | Short Covering | Short Covering |

| Nifty Options | Fresh Long | Fresh Long | Fresh Short |

| BankNifty Futures | Fresh Short | Short Covering | Short Covering |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Long | Fresh Long | Fresh Short |

| FinNifty Options | Fresh Long | Long Covering | Fresh Long |

| MidcpNifty Futures | Short Covering | Short Covering | Short Covering |

| MidcpNifty Options | Fresh Long | Fresh Short | Short Covering |

| NiftyNxt50 Futures | Short Covering | Long Covering | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Short |

| Stock Futures | Fresh Short | Fresh Long | Fresh Short |

| Stock Options | Fresh Short | Fresh Long | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (23/09/2025)

The NIFTY index closed at 25327.05. The NIFTY weekly expiry for SEPTEMBER 23, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.817 against previous 1.094. The 26000CE option holds the maximum open interest, followed by the 25400CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 25400CE option, with open interest additions also seen in the 25350CE and 26000CE options. On the other hand, open interest reductions were prominent in the 25400PE, 25450PE, and 24700PE options. Trading volume was highest in the 25300PE option, followed by the 25400CE and 25350PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 23-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,327.05 | 0.817 | 1.094 | 1.125 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 17,72,46,000 | 13,00,47,825 | 4,71,98,175 |

| PUT: | 14,47,68,600 | 14,22,92,850 | 24,75,750 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,58,43,150 | 43,83,675 | 11,12,358 |

| 25,400 | 1,53,95,100 | 81,09,075 | 58,88,951 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 1,53,95,100 | 81,09,075 | 58,88,951 |

| 25,350 | 64,45,350 | 44,93,475 | 47,32,249 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 28,78,275 | -12,33,300 | 4,73,669 |

| 26,100 | 39,87,225 | -6,96,150 | 6,43,980 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 1,53,95,100 | 81,09,075 | 58,88,951 |

| 25,350 | 64,45,350 | 44,93,475 | 47,32,249 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 1,26,93,225 | 36,90,300 | 78,56,235 |

| 25,000 | 94,21,725 | -10,58,100 | 19,95,307 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 1,26,93,225 | 36,90,300 | 78,56,235 |

| 25,250 | 59,87,400 | 19,52,850 | 38,69,406 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 54,05,550 | -36,10,575 | 47,60,679 |

| 25,450 | 12,36,525 | -27,92,475 | 14,50,946 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 1,26,93,225 | 36,90,300 | 78,56,235 |

| 25,350 | 54,82,425 | 12,48,600 | 54,24,130 |

SENSEX Weekly Expiry (25/09/2025)

The SENSEX index closed at 82626.23. The SENSEX weekly expiry for SEPTEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.708 against previous 1.019. The 85000CE option holds the maximum open interest, followed by the 83000CE and 84000CE options. Market participants have shown increased interest with significant open interest additions in the 85000CE option, with open interest additions also seen in the 84000CE and 80000PE options. On the other hand, open interest reductions were prominent in the 83000PE, 83100PE, and 83200PE options. Trading volume was highest in the 82600PE option, followed by the 82700PE and 82500PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 25-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82626.23 | 0.708 | 1.019 | 1.177 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 95,34,540 | 39,27,260 | 56,07,280 |

| PUT: | 67,45,760 | 40,00,820 | 27,44,940 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 8,72,020 | 4,68,420 | 42,58,500 |

| 83000 | 7,17,860 | 2,63,440 | 1,68,28,640 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 8,72,020 | 4,68,420 | 42,58,500 |

| 84000 | 5,62,840 | 2,96,240 | 64,39,160 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81800 | 10,640 | -5,720 | 24,220 |

| 81000 | 20,120 | -5,460 | 13,960 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 7,17,860 | 2,63,440 | 1,68,28,640 |

| 82700 | 3,13,040 | 2,54,420 | 1,38,25,600 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 5,30,320 | 2,93,200 | 28,04,580 |

| 82500 | 4,09,800 | 1,99,960 | 1,84,16,320 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 5,30,320 | 2,93,200 | 28,04,580 |

| 82600 | 3,43,820 | 2,84,020 | 2,03,71,800 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 2,85,580 | -1,45,240 | 91,77,500 |

| 83100 | 67,260 | -88,340 | 22,96,760 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82600 | 3,43,820 | 2,84,020 | 2,03,71,800 |

| 82700 | 3,03,020 | 1,95,020 | 1,88,76,140 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 25327.05. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.042 against previous 1.132. The 26000CE option holds the maximum open interest, followed by the 25000PE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 26500CE option, with open interest additions also seen in the 25400CE and 25500CE options. On the other hand, open interest reductions were prominent in the 25200PE, 25800CE, and 25150PE options. Trading volume was highest in the 25500CE option, followed by the 25300PE and 25400CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,327.05 | 1.042 | 1.132 | 0.970 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 6,17,32,800 | 5,57,17,725 | 60,15,075 |

| PUT: | 6,43,32,075 | 6,30,86,700 | 12,45,375 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 63,24,600 | 5,76,825 | 1,15,385 |

| 25,500 | 56,26,500 | 5,79,000 | 2,42,928 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 29,57,025 | 7,55,775 | 58,689 |

| 25,400 | 24,97,650 | 6,34,875 | 1,88,858 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 24,70,725 | -4,24,125 | 1,12,622 |

| 25,000 | 33,48,450 | -1,95,825 | 33,621 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 56,26,500 | 5,79,000 | 2,42,928 |

| 25,400 | 24,97,650 | 6,34,875 | 1,88,858 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 57,75,975 | 28,650 | 1,73,128 |

| 24,500 | 44,89,425 | 2,35,125 | 62,230 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 26,91,450 | 3,94,800 | 66,774 |

| 25,100 | 28,32,750 | 3,70,200 | 1,42,096 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 25,99,350 | -7,82,925 | 1,39,521 |

| 25,150 | 7,20,075 | -2,93,325 | 67,229 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 28,38,375 | 2,76,975 | 2,09,032 |

| 25,400 | 22,66,575 | 1,08,825 | 1,74,345 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 55458.85. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.025 against previous 1.105. The 56000CE option holds the maximum open interest, followed by the 54000PE and 55000PE options. Market participants have shown increased interest with significant open interest additions in the 55500CE option, with open interest additions also seen in the 55600CE and 51000PE options. On the other hand, open interest reductions were prominent in the 54500PE, 53600PE, and 55700PE options. Trading volume was highest in the 55500PE option, followed by the 55500CE and 55600PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,458.85 | 1.025 | 1.105 | 1.244 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,76,10,955 | 1,63,17,270 | 12,93,685 |

| PUT: | 1,80,44,745 | 1,80,27,595 | 17,150 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 14,78,225 | 1,79,305 | 1,82,005 |

| 58,000 | 12,14,360 | 1,00,625 | 44,667 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 10,34,415 | 3,13,335 | 2,40,540 |

| 55,600 | 4,78,450 | 2,26,975 | 1,48,275 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 2,39,295 | -62,650 | 12,979 |

| 54,900 | 1,06,365 | -52,325 | 5,007 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 10,34,415 | 3,13,335 | 2,40,540 |

| 56,000 | 14,78,225 | 1,79,305 | 1,82,005 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 14,62,050 | 23,975 | 65,647 |

| 55,000 | 14,50,435 | 30,450 | 1,65,018 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 6,73,845 | 2,06,075 | 26,345 |

| 52,500 | 7,56,360 | 1,21,730 | 31,850 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 8,66,775 | -1,06,890 | 71,730 |

| 53,600 | 1,81,685 | -89,250 | 12,360 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 7,51,015 | 62,575 | 3,21,412 |

| 55,600 | 2,36,530 | 8,855 | 1,91,340 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 26527.6. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.985 against previous 1.081. The 26000PE option holds the maximum open interest, followed by the 27000CE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 26600CE option, with open interest additions also seen in the 26600PE and 26550CE options. On the other hand, open interest reductions were prominent in the 26000PE, 26650PE, and 26700PE options. Trading volume was highest in the 26500PE option, followed by the 27000CE and 26600PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,527.60 | 0.985 | 1.081 | 1.066 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,11,595 | 8,99,405 | 1,12,190 |

| PUT: | 9,96,840 | 9,72,010 | 24,830 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,05,560 | 10,465 | 9,470 |

| 26,500 | 92,820 | 12,155 | 3,823 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 87,425 | 55,705 | 5,298 |

| 26,550 | 18,330 | 13,520 | 1,628 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 17,030 | -4,875 | 545 |

| 26,000 | 45,955 | -3,965 | 83 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,05,560 | 10,465 | 9,470 |

| 26,600 | 87,425 | 55,705 | 5,298 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,06,860 | -17,485 | 3,737 |

| 26,500 | 88,595 | 7,345 | 10,004 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 65,000 | 19,630 | 6,016 |

| 26,550 | 21,515 | 9,620 | 3,228 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,06,860 | -17,485 | 3,737 |

| 26,650 | 7,345 | -9,360 | 1,184 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 88,595 | 7,345 | 10,004 |

| 26,600 | 65,000 | 19,630 | 6,016 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 13240.5. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.163 against previous 1.224. The 13500CE option holds the maximum open interest, followed by the 13300CE and 12500PE options. Market participants have shown increased interest with significant open interest additions in the 13300CE option, with open interest additions also seen in the 13250PE and 13000PE options. On the other hand, open interest reductions were prominent in the 69300CE, 67700CE, and 69700PE options. Trading volume was highest in the 13300CE option, followed by the 13200PE and 13500CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,240.50 | 1.163 | 1.224 | 1.102 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 79,27,780 | 72,70,200 | 6,57,580 |

| PUT: | 92,19,980 | 88,98,680 | 3,21,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 10,16,680 | -14,140 | 20,734 |

| 13,300 | 9,68,940 | 3,33,900 | 43,476 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 9,68,940 | 3,33,900 | 43,476 |

| 13,250 | 1,83,680 | 84,420 | 13,302 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,600 | 3,45,800 | -33,040 | 10,362 |

| 13,225 | 57,120 | -23,520 | 6,693 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 9,68,940 | 3,33,900 | 43,476 |

| 13,500 | 10,16,680 | -14,140 | 20,734 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 7,63,420 | 91,420 | 7,346 |

| 13,000 | 7,56,700 | 1,37,200 | 18,166 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,250 | 2,45,140 | 1,40,140 | 17,760 |

| 13,000 | 7,56,700 | 1,37,200 | 18,166 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 5,25,980 | -79,520 | 8,023 |

| 12,900 | 5,01,620 | -77,000 | 8,660 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 6,73,820 | 6,720 | 26,522 |

| 13,000 | 7,56,700 | 1,37,200 | 18,166 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The derivative setup on 19th September 2025 underscores a market entering a consolidation band after a week of steady gains. Nifty’s max pain shifted slightly higher to 25,350, but the falling PCR and fresh call build-up suggest upside resistance just ahead. Bank Nifty’s options at 55,500 showed a tug-of-war but with overall OI unwinding pointing to hesitation among participants. FINNIFTY’s fresh shorts serve as a tactical warning that financials may drag if the caution extends, while MIDCPNIFTY’s steady unwinding contrasts with earlier long accumulation, showing traders turning defensive in the broader market.

Even the Sensex saw consistent long covering, with max pain parked near 82,700, reinforcing the near‑term equilibrium. All in all, today’s Open Interest Volume Analysis reflects a market that hasn’t turned bearish but is entering a cooling phase where profit‑taking and lighter positioning dominate. The next decisive shift is likely tied to global cues and expiry‑week adjustments.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]