Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 22/09/2025

Table of Contents

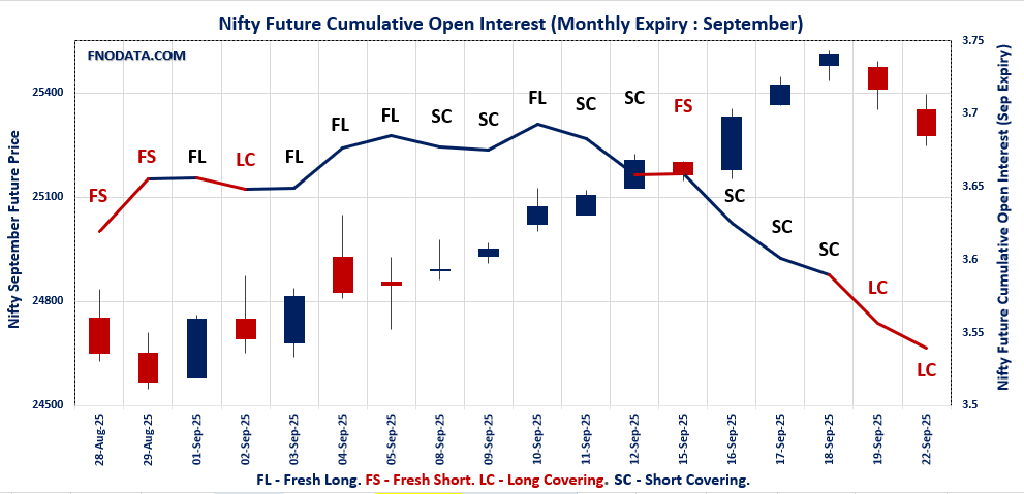

On 22nd September 2025, the derivatives market reflected a clear sign of fatigue, with all major indices witnessing long covering. Nifty futures slipped to 25,277 with OI down 1.7% and premium narrowing, a classic indicator that longs were squared off rather than fresh shorts being added. The weekly option data underlined this nervousness – PCR (OI) plunged to 0.572, showcasing dominance of call writers, even as puts held firm at 25,200.

Similarly, Bank Nifty futures saw a 5.8% drop in OI with prices slipping, pointing to long liquidation. The option chain for Bank Nifty painted resistance at 56,000 and firm support at 55,000, but fresh call activity at 55,600 added a bearish undertone. FINNIFTY, MIDCPNIFTY, and Sensex also followed the same theme, with positions unwinding across the board. The day’s Open Interest Volume Analysis shows defensive repositioning by traders, indicating that the bulls have temporarily stepped aside before expiry week.

NSE & BSE F&O Market Signals

NIFTY SEPTEMBER Future

NIFTY Spot closed at: 25,202.35 (-0.49%)

NIFTY SEPTEMBER Future closed at: 25,277.70 (-0.53%)

Premium: 75.35 (Decreased by -8.8 points)

Open Interest Change: -1.7%

Volume Change: -18.6%

Open Interest Analysis: Long Covering

NIFTY Weekly Expiry (23/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.572 (Decreased from 0.817)

Put-Call Ratio (Volume): 1.038

Max Pain Level: 25250

Maximum CALL Open Interest: 25500

Maximum PUT Open Interest: 25200

Highest CALL Addition: 25300

Highest PUT Addition: 25200

NIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.870 (Decreased from 1.042)

Put-Call Ratio (Volume): 0.831

Max Pain Level: 25200

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26000

Highest PUT Addition: 24500

BANKNIFTY SEPTEMBER Future

BANKNIFTY Spot closed at: 55,284.75 (-0.31%)

BANKNIFTY SEPTEMBER Future closed at: 55,471.80 (-0.33%)

Premium: 187.05 (Decreased by -8.5 points)

Open Interest Change: -5.8%

Volume Change: 0.7%

Open Interest Analysis: Long Covering

BANKNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.948 (Decreased from 1.025)

Put-Call Ratio (Volume): 0.919

Max Pain Level: 55300

Maximum CALL Open Interest: 56000

Maximum PUT Open Interest: 55000

Highest CALL Addition: 55600

Highest PUT Addition: 50000

FINNIFTY SEPTEMBER Future

FINNIFTY Spot closed at: 26,528.40 (0.00%)

FINNIFTY SEPTEMBER Future closed at: 26,610.50 (-0.05%)

Premium: 82.1 (Decreased by -13.7 points)

Open Interest Change: -2.0%

Volume Change: -47.2%

Open Interest Analysis: Long Covering

FINNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.015 (Increased from 0.985)

Put-Call Ratio (Volume): 0.964

Max Pain Level: 26500

Maximum CALL Open Interest: 27000

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27000

Highest PUT Addition: 26000

MIDCPNIFTY SEPTEMBER Future

MIDCPNIFTY Spot closed at: 13,094.90 (-1.10%)

MIDCPNIFTY SEPTEMBER Future closed at: 13,127.50 (-1.16%)

Premium: 32.6 (Decreased by -8.9 points)

Open Interest Change: -2.5%

Volume Change: 124.1%

Open Interest Analysis: Long Covering

MIDCPNIFTY Monthly Expiry (30/09/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.965 (Decreased from 1.163)

Put-Call Ratio (Volume): 0.897

Max Pain Level: 13100

Maximum CALL Open Interest: 13300

Maximum PUT Open Interest: 12500

Highest CALL Addition: 13200

Highest PUT Addition: 12600

SENSEX Monthly Expiry (25/09/2025) Future

SENSEX Spot closed at: 82,159.97 (-0.56%)

SENSEX Monthly Future closed at: 82,343.90 (-0.57%)

Premium: 183.93 (Decreased by -1.79 points)

Open Interest Change: -12.4%

Volume Change: 0.1%

Open Interest Analysis: Long Covering

SENSEX Weekly Expiry (25/09/2025) Option Analysis

Put-Call Ratio (OI): 0.590 (Decreased from 0.708)

Put-Call Ratio (Volume): 1.099

Max Pain Level: 82400

Maximum CALL OI: 83000

Maximum PUT OI: 82000

Highest CALL Addition: 82500

Highest PUT Addition: 79000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 2,910.09 Cr.

DIIs Net BUY: ₹ 2,582.63 Cr.

FII Derivatives Activity

| FII Trading Stats | 22.09.25 | 19.09.25 | 18.09.25 |

| FII Cash (Provisional Data) | -2,910.09 | 390.74 | 366.69 |

| Index Future Open Interest Long Ratio | 13.27% | 12.89% | 13.96% |

| Index Future Volume Long Ratio | 54.81% | 45.66% | 59.59% |

| Call Option Open Interest Long Ratio | 48.57% | 51.67% | 50.72% |

| Call Option Volume Long Ratio | 49.58% | 50.17% | 50.27% |

| Put Option Open Interest Long Ratio | 63.62% | 63.38% | 64.44% |

| Put Option Volume Long Ratio | 50.10% | 49.95% | 50.30% |

| Stock Future Open Interest Long Ratio | 61.60% | 61.79% | 61.95% |

| Stock Future Volume Long Ratio | 48.96% | 49.63% | 50.05% |

| Index Futures | Short Covering | Long Covering | Short Covering |

| Index Options | Fresh Short | Fresh Long | Fresh Long |

| Nifty Futures | Short Covering | Long Covering | Short Covering |

| Nifty Options | Fresh Short | Fresh Long | Fresh Long |

| BankNifty Futures | Short Covering | Fresh Short | Short Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Long |

| FinNifty Futures | Fresh Long | Fresh Long | Fresh Long |

| FinNifty Options | Fresh Long | Fresh Long | Long Covering |

| MidcpNifty Futures | Short Covering | Short Covering | Short Covering |

| MidcpNifty Options | Fresh Short | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Short Covering | Long Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Long Covering | Fresh Short | Fresh Long |

| Stock Options | Short Covering | Fresh Short | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

NIFTY Weekly Expiry (23/09/2025)

The NIFTY index closed at 25202.35. The NIFTY weekly expiry for SEPTEMBER 23, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.572 against previous 0.817. The 25500CE option holds the maximum open interest, followed by the 25300CE and 25400CE options. Market participants have shown increased interest with significant open interest additions in the 25300CE option, with open interest additions also seen in the 25200CE and 25500CE options. On the other hand, open interest reductions were prominent in the 25300PE, 25350PE, and 25400PE options. Trading volume was highest in the 25300PE option, followed by the 25300CE and 25200PE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 23-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,202.35 | 0.572 | 0.817 | 1.038 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 23,06,00,850 | 17,72,46,000 | 5,33,54,850 |

| PUT: | 13,19,06,175 | 14,47,68,600 | -1,28,62,425 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 2,28,57,450 | 83,47,425 | 44,11,769 |

| 25,300 | 1,97,04,450 | 1,33,16,775 | 94,41,369 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 1,97,04,450 | 1,33,16,775 | 94,41,369 |

| 25,200 | 1,09,95,900 | 84,38,250 | 34,13,171 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 14,61,825 | -15,50,175 | 1,54,676 |

| 26,500 | 60,66,300 | -15,27,300 | 5,61,739 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 1,97,04,450 | 1,33,16,775 | 94,41,369 |

| 25,350 | 1,35,13,725 | 70,68,375 | 66,85,511 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,35,40,650 | 47,47,575 | 87,36,041 |

| 25,000 | 1,02,22,425 | 8,00,700 | 24,75,736 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,35,40,650 | 47,47,575 | 87,36,041 |

| 25,150 | 66,70,200 | 31,70,850 | 44,30,747 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 46,80,975 | -80,12,250 | 1,05,63,409 |

| 25,350 | 15,40,275 | -39,42,150 | 40,70,324 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 46,80,975 | -80,12,250 | 1,05,63,409 |

| 25,200 | 1,35,40,650 | 47,47,575 | 87,36,041 |

SENSEX Weekly Expiry (25/09/2025)

The SENSEX index closed at 82159.97. The SENSEX weekly expiry for SEPTEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.590 against previous 0.708. The 83000CE option holds the maximum open interest, followed by the 85000CE and 82500CE options. Market participants have shown increased interest with significant open interest additions in the 82500CE option, with open interest additions also seen in the 83000CE and 84200CE options. On the other hand, open interest reductions were prominent in the 85300CE, 82600PE, and 82700PE options. Trading volume was highest in the 82500PE option, followed by the 82000PE and 82500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 25-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82159.97 | 0.590 | 0.708 | 1.099 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,50,04,680 | 95,34,540 | 54,70,140 |

| PUT: | 88,55,620 | 67,45,760 | 21,09,860 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83000 | 10,72,440 | 3,54,580 | 1,77,92,380 |

| 85000 | 9,95,480 | 1,23,460 | 49,81,900 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 8,81,960 | 6,54,040 | 2,34,73,480 |

| 83000 | 10,72,440 | 3,54,580 | 1,77,92,380 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 85300 | 73,420 | -2,18,480 | 9,21,860 |

| 84800 | 59,440 | -27,840 | 8,21,820 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 8,81,960 | 6,54,040 | 2,34,73,480 |

| 83000 | 10,72,440 | 3,54,580 | 1,77,92,380 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,84,920 | 1,79,940 | 2,40,60,300 |

| 79000 | 5,23,860 | 2,88,640 | 28,51,860 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 79000 | 5,23,860 | 2,88,640 | 28,51,860 |

| 82200 | 4,08,620 | 2,62,820 | 1,78,22,640 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82600 | 1,57,820 | -1,86,000 | 1,43,71,160 |

| 82700 | 1,64,080 | -1,38,940 | 77,59,500 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 3,91,680 | -18,120 | 2,72,37,580 |

| 82000 | 5,84,920 | 1,79,940 | 2,40,60,300 |

NIFTY Monthly Expiry (30/09/2025)

The NIFTY index closed at 25202.35. The NIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.870 against previous 1.042. The 26000CE option holds the maximum open interest, followed by the 25000PE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 26500CE and 26300CE options. On the other hand, open interest reductions were prominent in the 25400PE, 25500PE, and 25450PE options. Trading volume was highest in the 25300PE option, followed by the 25500CE and 25300CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,202.35 | 0.870 | 1.042 | 0.831 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 8,18,74,200 | 6,17,32,800 | 2,01,41,400 |

| PUT: | 7,12,13,100 | 6,43,32,075 | 68,81,025 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 83,79,150 | 20,54,550 | 1,96,102 |

| 25,500 | 66,50,325 | 10,23,825 | 3,26,417 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 83,79,150 | 20,54,550 | 1,96,102 |

| 26,500 | 46,07,700 | 16,50,675 | 1,16,132 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 7,59,225 | -69,825 | 2,303 |

| 26,950 | 30,150 | -62,100 | 3,617 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 66,50,325 | 10,23,825 | 3,26,417 |

| 25,300 | 36,50,775 | 15,01,125 | 2,75,814 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 66,73,650 | 8,97,675 | 2,33,906 |

| 24,500 | 59,97,525 | 15,08,100 | 1,17,970 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 59,97,525 | 15,08,100 | 1,17,970 |

| 25,000 | 66,73,650 | 8,97,675 | 2,33,906 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 17,35,800 | -5,30,775 | 1,40,666 |

| 25,500 | 25,28,700 | -3,04,275 | 83,594 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 30,03,450 | 1,65,075 | 3,34,905 |

| 25,200 | 26,64,375 | 65,025 | 2,59,391 |

BANKNIFTY Monthly Expiry (30/09/2025)

The BANKNIFTY index closed at 55284.75. The BANKNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.948 against previous 1.025. The 56000CE option holds the maximum open interest, followed by the 55000PE and 54000PE options. Market participants have shown increased interest with significant open interest additions in the 55600CE option, with open interest additions also seen in the 60000CE and 50000PE options. On the other hand, open interest reductions were prominent in the 51500PE, 59500CE, and 55500PE options. Trading volume was highest in the 55500CE option, followed by the 55500PE and 55600CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,284.75 | 0.948 | 1.025 | 0.919 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,86,54,865 | 1,76,10,955 | 10,43,910 |

| PUT: | 1,76,84,385 | 1,80,44,745 | -3,60,360 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 15,42,485 | 64,260 | 2,05,381 |

| 57,000 | 12,40,630 | 84,525 | 71,457 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 55,600 | 6,84,670 | 2,06,220 | 2,23,347 |

| 60,000 | 6,83,025 | 1,66,600 | 19,452 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 1,75,175 | -64,120 | 10,319 |

| 57,800 | 59,780 | -51,765 | 9,680 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 11,10,595 | 76,180 | 3,01,050 |

| 55,600 | 6,84,670 | 2,06,220 | 2,23,347 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 14,63,070 | 12,635 | 1,52,917 |

| 54,000 | 14,52,320 | -9,730 | 66,735 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 50,000 | 5,13,555 | 1,22,465 | 19,385 |

| 47,000 | 1,78,780 | 47,215 | 3,439 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 51,500 | 3,81,955 | -66,920 | 14,915 |

| 55,500 | 6,93,505 | -57,510 | 3,00,157 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 6,93,505 | -57,510 | 3,00,157 |

| 55,600 | 2,50,530 | 14,000 | 1,72,182 |

FINNIFTY Monthly Expiry (30/09/2025)

The FINNIFTY index closed at 26528.4. The FINNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.015 against previous 0.985. The 27000CE option holds the maximum open interest, followed by the 26000PE and 26600PE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 26000PE and 26600PE options. On the other hand, open interest reductions were prominent in the 26600CE, 26500CE, and 25000PE options. Trading volume was highest in the 27000CE option, followed by the 26500PE and 26600PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,528.40 | 1.015 | 0.985 | 0.964 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,87,450 | 10,11,595 | 75,855 |

| PUT: | 11,03,505 | 9,96,840 | 1,06,665 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,98,185 | 92,625 | 14,424 |

| 27,500 | 81,445 | -10,270 | 2,304 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,98,185 | 92,625 | 14,424 |

| 26,800 | 21,190 | 21,190 | 1,787 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 57,590 | -29,835 | 7,758 |

| 26,500 | 67,340 | -25,480 | 3,579 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,98,185 | 92,625 | 14,424 |

| 26,600 | 57,590 | -29,835 | 7,758 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,54,570 | 47,710 | 3,193 |

| 26,600 | 90,935 | 25,935 | 8,592 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,54,570 | 47,710 | 3,193 |

| 26,600 | 90,935 | 25,935 | 8,592 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 29,640 | -24,310 | 1,020 |

| 25,500 | 72,865 | -13,910 | 1,579 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 79,755 | -8,840 | 11,820 |

| 26,600 | 90,935 | 25,935 | 8,592 |

MIDCPNIFTY Monthly Expiry (30/09/2025)

The MIDCPNIFTY index closed at 13094.9. The MIDCPNIFTY monthly expiry for SEPTEMBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.965 against previous 1.163. The 13300CE option holds the maximum open interest, followed by the 13500CE and 13200CE options. Market participants have shown increased interest with significant open interest additions in the 13200CE option, with open interest additions also seen in the 12600PE and 13600CE options. On the other hand, open interest reductions were prominent in the 67000PE, 56000PE, and 56000PE options. Trading volume was highest in the 13200CE option, followed by the 13200PE and 13300CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 30-09-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,094.90 | 0.965 | 1.163 | 0.897 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 90,44,140 | 79,27,780 | 11,16,360 |

| PUT: | 87,27,880 | 92,19,980 | -4,92,100 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 10,17,240 | 48,300 | 31,628 |

| 13,500 | 9,23,580 | -93,100 | 22,669 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 8,91,940 | 3,52,520 | 37,141 |

| 13,600 | 5,38,160 | 1,92,360 | 12,779 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 6,48,060 | -1,12,420 | 10,312 |

| 13,500 | 9,23,580 | -93,100 | 22,669 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 8,91,940 | 3,52,520 | 37,141 |

| 13,300 | 10,17,240 | 48,300 | 31,628 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 8,33,280 | 69,860 | 11,478 |

| 13,200 | 7,13,160 | 39,340 | 33,093 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,600 | 5,69,800 | 2,29,180 | 6,981 |

| 12,425 | 1,03,320 | 81,760 | 833 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,250 | 87,500 | -1,57,640 | 6,488 |

| 12,700 | 4,29,240 | -1,07,800 | 8,399 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 7,13,160 | 39,340 | 33,093 |

| 13,000 | 6,81,940 | -74,760 | 24,141 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The overall F&O data for 22nd September 2025 projects a market under consolidation pressure. Nifty’s max pain at 25,250 reflects expiry‑driven balancing, but the steep fall in PCR suggests downside risk if 25,200 breaks. Bank Nifty’s unwinding near 55,300 with OI falling confirms that traders are less willing to carry longs into expiry, while fresh call additions cap upside momentum.

FINNIFTY’s relatively balanced PCR above 1 indicates sectoral resilience, but broad-based long covering in MIDCPNIFTY and Sensex shows caution has spread across the market. In essence, today’s Open Interest Volume Analysis captures a tactical retreat—traders locking in gains and cutting exposures before expiry volatility sets in. Whether this is mere profit‑booking or a precursor to deeper weakness will depend on how global cues and domestic rollovers play out in the next two sessions.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]