Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 3/10/2025

Table of Contents

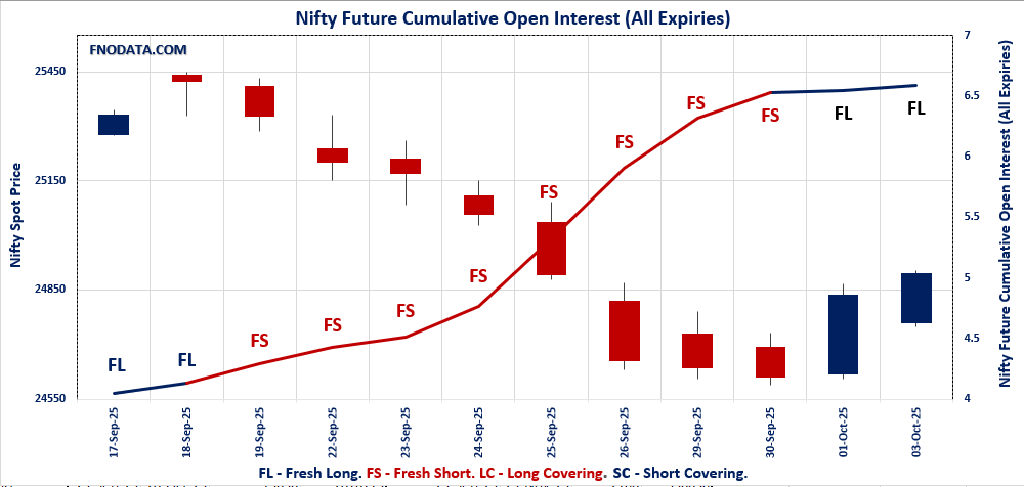

On 3rd October 2025, the Open Interest Volume Analysis for combined futures contracts (across October, November, and December) signaled renewed market confidence after expiry. Nifty saw a healthy 4.3% rise in combined open interest, driven entirely by fresh long build-up despite slipping volumes—a sign that participants are positioning for higher levels rather than unwinding.

This bullish sentiment echoed throughout Bank Nifty as well, with combined OI up by 1.9% and solid long accumulation in October even as November contracts saw short covering. Finnifty took the spotlight with a robust 20.5% spike in combined OI, fueled by aggressive long additions in both the near and far series, reflecting surging optimism in financials. Even Midcap Nifty maintained a subtle uptrend with ongoing fresh long build-up, rounding out a day characterized by selective accumulation and new risk-taking, rather than caution.

In the options space, a small cooling in PCR across Nifty, Bank Nifty, and Finnifty suggests that while bulls hold the advantage, call writers are staying alert at higher strikes. Overall, today’s Open Interest Volume Analysis spotlights a zone where the long side is regaining dominance, but not without competition.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 24894.25 (0.2%)

Combined = October + November + December

Combined Fut Open Interest Change: 4.3%

Combined Fut Volume Change: -22.3%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 6% Previous 6%

NIFTY OCTOBER Future closed at: 25006.6 (0.2%)

October Fut Premium112.35 (Decreased by -18.55 points)

October Fut Open Interest Change: 4.4%

October Fut Volume Change: -20.4%

October Fut Open Interest Analysis: Fresh Long

NIFTY NOVEMBER Future closed at: 25137.4 (0.2%)

November Fut Premium243.15 (Decreased by -14.15 points)

November Fut Open Interest Change: 1.2%

November Fut Volume Change: -37.4%

November Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (7/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.207 (Decreased from 1.242)

Put-Call Ratio (Volume): 0.921

Max Pain Level: 24900

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 24000

Highest CALL Addition: 25500

Highest PUT Addition: 24900

NIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.035 (Decreased from 1.051)

Put-Call Ratio (Volume): 0.916

Max Pain Level: 25000

Maximum CALL Open Interest: 25500

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26000

Highest PUT Addition: 24500

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 55589.25 (0.4%)

Combined = October + November + December

Combined Fut Open Interest Change: 1.9%

Combined Fut Volume Change: -56.8%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 9% Previous 9%

BANKNIFTY OCTOBER Future closed at: 55854.2 (0.3%)

October Fut Premium264.95 (Decreased by -50.3 points)

October Fut Open Interest Change: 1.8%

October Fut Volume Change: -58.2%

October Fut Open Interest Analysis: Fresh Long

BANKNIFTY NOVEMBER Future closed at: 56152.2 (0.3%)

November Fut Premium562.95 (Decreased by -57.5 points)

November Fut Open Interest Change: -2.5%

November Fut Volume Change: -45.0%

November Fut Open Interest Analysis: Short Covering

BANKNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.127 (Increased from 1.100)

Put-Call Ratio (Volume): 0.904

Max Pain Level: 55500

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 55000

Highest CALL Addition: 58000

Highest PUT Addition: 53500

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 26426.75 (0.2%)

Combined = October + November + December

Combined Fut Open Interest Change: 20.5%

Combined Fut Volume Change: -38.3%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 3% Previous 3%

FINNIFTY OCTOBER Future closed at: 26549.7 (0.1%)

October Fut Premium122.95 (Decreased by -13.95 points)

October Fut Open Interest Change: 20.0%

October Fut Volume Change: -39.6%

October Fut Open Interest Analysis: Fresh Long

FINNIFTY NOVEMBER Future closed at: 26700.4 (0.2%)

November Fut Premium273.65 (Decreased by -3.25 points)

November Fut Open Interest Change: 38.5%

November Fut Volume Change: 14.3%

November Fut Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.583 (Decreased from 0.641)

Put-Call Ratio (Volume): 0.660

Max Pain Level: 26400

Maximum CALL Open Interest: 26800

Maximum PUT Open Interest: 26000

Highest CALL Addition: 26800

Highest PUT Addition: 26500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 12793.6 (0.8%)

Combined = October + November + December

Combined Fut Open Interest Change: 0.3%

Combined Fut Volume Change: -50.1%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 3% Previous 3%

MIDCPNIFTY OCTOBER Future closed at: 12865.15 (0.7%)

October Fut Premium71.55 (Decreased by -7 points)

October Fut Open Interest Change: 0.3%

October Fut Volume Change: -50.5%

October Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY NOVEMBER Future closed at: 12915.55 (0.6%)

November Fut Premium121.95 (Decreased by -14.9 points)

November Fut Open Interest Change: 2.4%

November Fut Volume Change: -39.7%

November Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.357 (Increased from 1.241)

Put-Call Ratio (Volume): 1.001

Max Pain Level: 12750

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12000

Highest CALL Addition: 13500

Highest PUT Addition: 12200

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 81,207.17 (0.28%)

SENSEX Monthly Future closed at: 81,696.00 (0.18%)

Premium: 488.83 (Decreased by -74.21 points)

Open Interest Change: 7.1%

Volume Change: -53.3%

Open Interest Analysis: Fresh Long

SENSEX Weekly Expiry (1/10/2025) Option Analysis

Put-Call Ratio (OI): 0.950 (Decreased from 1.224)

Put-Call Ratio (Volume): 0.873

Max Pain Level: 81000

Maximum CALL OI: 83500

Maximum PUT OI: 78000

Highest CALL Addition: 83500

Highest PUT Addition: 78000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 1,503.12 Cr.

DIIs Net BUY: ₹ 528.48 Cr.

FII Derivatives Activity

| FII Trading Stats | 3.10.25 | 1.10.25 | 30.09.25 |

| FII Cash (Provisional Data) | -1,503.12 | -1,605.20 | -2,061.72 |

| Index Future Open Interest Long Ratio | 6.73% | 6.80% | 5.98% |

| Index Future Volume Long Ratio | 29.81% | 48.91% | 42.36% |

| Call Option Open Interest Long Ratio | 49.73% | 48.99% | 44.24% |

| Call Option Volume Long Ratio | 50.08% | 50.44% | 50.09% |

| Put Option Open Interest Long Ratio | 62.77% | 66.17% | 72.24% |

| Put Option Volume Long Ratio | 50.07% | 50.08% | 50.08% |

| Stock Future Open Interest Long Ratio | 61.52% | 61.74% | 61.86% |

| Stock Future Volume Long Ratio | 47.53% | 49.42% | 50.39% |

| Index Futures | Fresh Short | Fresh Short | Long Covering |

| Index Options | Fresh Long | Fresh Long | Short Covering |

| Nifty Futures | Fresh Short | Fresh Short | Long Covering |

| Nifty Options | Fresh Long | Fresh Long | Short Covering |

| BankNifty Futures | Fresh Long | Short Covering | Long Covering |

| BankNifty Options | Short Covering | Fresh Long | Long Covering |

| FinNifty Futures | Fresh Short | Fresh Short | Long Covering |

| FinNifty Options | Fresh Short | Fresh Short | Long Covering |

| MidcpNifty Futures | Fresh Long | Fresh Long | Long Covering |

| MidcpNifty Options | Fresh Long | Fresh Long | Short Covering |

| NiftyNxt50 Futures | Fresh Short | Fresh Short | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Long Covering |

| Stock Futures | Fresh Short | Fresh Short | Short Covering |

| Stock Options | Fresh Short | Fresh Long | Long Covering |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (9/10/2025)

The SENSEX index closed at 81207.17. The SENSEX weekly expiry for OCTOBER 9, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.950 against previous 1.224. The 83500CE option holds the maximum open interest, followed by the 78000PE and 82500CE options. Market participants have shown increased interest with significant open interest additions in the 83500CE option, with open interest additions also seen in the 78000PE and 82500CE options. On the other hand, open interest reductions were prominent in the 76500PE, 80800CE, and 80600CE options. Trading volume was highest in the 81000CE option, followed by the 81000PE and 80900PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 09-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81207.17 | 0.950 | 1.224 | 0.873 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 97,54,140 | 32,55,680 | 64,98,460 |

| PUT: | 92,63,920 | 39,84,440 | 52,79,480 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 10,36,540 | 8,56,100 | 46,10,700 |

| 82500 | 7,81,580 | 5,76,600 | 65,75,800 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 10,36,540 | 8,56,100 | 46,10,700 |

| 82500 | 7,81,580 | 5,76,600 | 65,75,800 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 80800 | 67,380 | -20,000 | 92,59,960 |

| 80600 | 25,160 | -11,980 | 12,40,760 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 6,15,120 | 1,79,220 | 2,49,00,560 |

| 81500 | 2,91,200 | 1,06,080 | 1,46,75,240 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 8,44,740 | 5,78,380 | 37,30,060 |

| 81000 | 7,17,940 | 4,00,000 | 2,47,18,200 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 78000 | 8,44,740 | 5,78,380 | 37,30,060 |

| 81000 | 7,17,940 | 4,00,000 | 2,47,18,200 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 76500 | 1,67,220 | -52,780 | 16,96,180 |

| 78700 | 57,180 | -8,020 | 9,19,560 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 7,17,940 | 4,00,000 | 2,47,18,200 |

| 80900 | 3,12,220 | 2,35,960 | 1,93,29,420 |

NIFTY Weekly Expiry (7/10/2025)

The NIFTY index closed at 24894.25. The NIFTY weekly expiry for OCTOBER 7, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.207 against previous 1.242. The 24000PE option holds the maximum open interest, followed by the 24800PE and 26000CE options. Market participants have shown increased interest with significant open interest additions in the 24900PE option, with open interest additions also seen in the 24000PE and 24800PE options. On the other hand, open interest reductions were prominent in the 24700CE, 24650CE, and 24600CE options. Trading volume was highest in the 24800PE option, followed by the 24800CE and 24900CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 07-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,894.25 | 1.207 | 1.242 | 0.921 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 16,69,75,125 | 11,10,67,725 | 5,59,07,400 |

| PUT: | 20,16,07,350 | 13,79,30,625 | 6,36,76,725 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,29,78,150 | 47,42,250 | 6,99,877 |

| 25,000 | 1,27,41,900 | 28,75,200 | 53,70,257 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 1,25,69,850 | 54,85,950 | 9,60,806 |

| 24,900 | 98,46,525 | 51,53,850 | 71,56,298 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,700 | 27,13,125 | -6,78,750 | 14,54,004 |

| 24,650 | 8,03,025 | -3,43,800 | 2,56,914 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 51,44,325 | 8,91,150 | 72,73,414 |

| 24,900 | 98,46,525 | 51,53,850 | 71,56,298 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 1,56,44,775 | 63,86,775 | 12,31,398 |

| 24,800 | 1,40,50,200 | 59,04,000 | 87,60,760 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 1,04,46,750 | 69,92,625 | 33,23,033 |

| 24,000 | 1,56,44,775 | 63,86,775 | 12,31,398 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,850 | 10,52,550 | -2,30,925 | 2,98,018 |

| 23,250 | 3,54,525 | -57,150 | 70,395 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 1,40,50,200 | 59,04,000 | 87,60,760 |

| 24,850 | 74,44,950 | 43,27,650 | 46,37,324 |

NIFTY Monthly Expiry (28/10/2025)

The NIFTY index closed at 24894.25. The NIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.035 against previous 1.051. The 25500CE option holds the maximum open interest, followed by the 26000CE and 25000CE options. Market participants have shown increased interest with significant open interest additions in the 24500PE option, with open interest additions also seen in the 26000CE and 25500CE options. On the other hand, open interest reductions were prominent in the 23000PE, 24300PE, and 25400CE options. Trading volume was highest in the 25000CE option, followed by the 25500CE and 24000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 24,894.25 | 1.035 | 1.051 | 0.916 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,37,84,325 | 4,12,52,175 | 25,32,150 |

| PUT: | 4,53,22,800 | 4,33,37,100 | 19,85,700 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 50,57,100 | 4,47,900 | 63,433 |

| 26,000 | 49,33,650 | 4,70,925 | 46,400 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 49,33,650 | 4,70,925 | 46,400 |

| 25,500 | 50,57,100 | 4,47,900 | 63,433 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 16,81,500 | -78,000 | 25,216 |

| 25,200 | 14,67,150 | -52,800 | 21,617 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 46,65,750 | 2,21,475 | 70,007 |

| 25,500 | 50,57,100 | 4,47,900 | 63,433 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 41,44,725 | 1,63,875 | 36,810 |

| 24,500 | 39,72,375 | 6,34,200 | 47,980 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,500 | 39,72,375 | 6,34,200 | 47,980 |

| 24,800 | 33,87,675 | 2,89,125 | 48,590 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,000 | 22,75,350 | -1,18,125 | 16,131 |

| 24,300 | 14,60,475 | -89,475 | 19,050 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 24,000 | 37,99,050 | -2,775 | 56,989 |

| 24,800 | 33,87,675 | 2,89,125 | 48,590 |

BANKNIFTY Monthly Expiry (28/10/2025)

The BANKNIFTY index closed at 55589.25. The BANKNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.127 against previous 1.100. The 57000CE option holds the maximum open interest, followed by the 55000PE and 54000PE options. Market participants have shown increased interest with significant open interest additions in the 58000CE option, with open interest additions also seen in the 53500PE and 55500PE options. On the other hand, open interest reductions were prominent in the 55000CE, 55200CE, and 51000PE options. Trading volume was highest in the 55500PE option, followed by the 55500CE and 56000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 55,589.25 | 1.127 | 1.100 | 0.904 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,30,84,295 | 1,20,67,825 | 10,16,470 |

| PUT: | 1,47,47,215 | 1,32,74,905 | 14,72,310 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 21,09,730 | 42,735 | 82,363 |

| 56,000 | 10,91,755 | 87,850 | 1,30,037 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 10,84,475 | 1,84,030 | 54,336 |

| 57,500 | 5,27,030 | 91,105 | 43,795 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 8,59,425 | -49,700 | 28,540 |

| 55,200 | 88,200 | -33,670 | 21,583 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 7,61,600 | 14,630 | 1,35,532 |

| 56,000 | 10,91,755 | 87,850 | 1,30,037 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 14,43,470 | 76,300 | 94,903 |

| 54,000 | 11,97,140 | 74,130 | 52,684 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 53,500 | 7,62,335 | 1,43,465 | 36,390 |

| 55,500 | 7,74,095 | 1,38,565 | 1,39,925 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 51,000 | 4,25,425 | -28,770 | 17,803 |

| 47,500 | 26,355 | -16,975 | 2,679 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 7,74,095 | 1,38,565 | 1,39,925 |

| 55,000 | 14,43,470 | 76,300 | 94,903 |

FINNIFTY Monthly Expiry (28/10/2025)

The FINNIFTY index closed at 26426.75. The FINNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.583 against previous 0.641. The 26800CE option holds the maximum open interest, followed by the 27000CE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26800CE option, with open interest additions also seen in the 26500PE and 27000CE options. On the other hand, open interest reductions were prominent in the 25850PE, 26100CE, and 26050PE options. Trading volume was highest in the 26800CE option, followed by the 26500CE and 26500PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,426.75 | 0.583 | 0.641 | 0.660 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 3,91,820 | 1,90,840 | 2,00,980 |

| PUT: | 2,28,540 | 1,22,265 | 1,06,275 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 88,140 | 67,080 | 4,920 |

| 27,000 | 54,275 | 20,670 | 1,943 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 88,140 | 67,080 | 4,920 |

| 27,000 | 54,275 | 20,670 | 1,943 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 1,755 | -325 | 21 |

| – | – | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 88,140 | 67,080 | 4,920 |

| 26,500 | 32,630 | 16,510 | 4,043 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 42,380 | 11,440 | 1,369 |

| 26,500 | 37,440 | 27,105 | 3,307 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 37,440 | 27,105 | 3,307 |

| 26,300 | 25,415 | 14,495 | 2,819 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,850 | 1,950 | -975 | 51 |

| 26,050 | 975 | -260 | 32 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 37,440 | 27,105 | 3,307 |

| 26,300 | 25,415 | 14,495 | 2,819 |

MIDCPNIFTY Monthly Expiry (28/10/2025)

The MIDCPNIFTY index closed at 12793.6. The MIDCPNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.357 against previous 1.241. The 12000PE option holds the maximum open interest, followed by the 12500PE and 13000CE options. Market participants have shown increased interest with significant open interest additions in the 12200PE option, with open interest additions also seen in the 13500CE and 12800PE options. On the other hand, open interest reductions were prominent in the 68000CE, 57000PE, and 57000CE options. Trading volume was highest in the 13000CE option, followed by the 12800CE and 12700PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,793.60 | 1.357 | 1.241 | 1.001 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 40,06,240 | 36,18,300 | 3,87,940 |

| PUT: | 54,34,520 | 44,91,760 | 9,42,760 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,14,220 | 31,780 | 16,390 |

| 13,500 | 4,83,980 | 1,53,300 | 4,896 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 4,83,980 | 1,53,300 | 4,896 |

| 13,200 | 3,42,860 | 90,580 | 4,620 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 3,77,020 | -65,800 | 6,367 |

| 12,650 | 50,260 | -16,800 | 778 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,14,220 | 31,780 | 16,390 |

| 12,800 | 3,31,520 | 30,800 | 11,031 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 8,47,000 | 12,600 | 8,613 |

| 12,500 | 7,81,900 | 76,860 | 7,037 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,200 | 2,41,080 | 1,77,660 | 5,961 |

| 12,800 | 2,29,460 | 99,120 | 5,890 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 3,69,740 | -19,180 | 9,182 |

| 12,675 | 29,820 | -13,300 | 979 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 3,69,740 | -19,180 | 9,182 |

| 12,000 | 8,47,000 | 12,600 | 8,613 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The F&O data for 3rd October 2025 paints a cautiously optimistic view, with rising combined futures OI and fresh longs showing traders are willing to back further gains as the new series unfolds. Nifty’s strong long additions amid contained volumes suggest conviction is present, even if momentum isn’t runaway. Bank Nifty’s fresh long interest and Finnifty’s outstanding OI increase highlight that financials remain the backbone of the market’s bullish bias.

Midcap Nifty, though less explosive, supports the case that risk appetite hasn’t vanished, with selective adding continuing at every dip. Still, slightly lower PCRs in options for indices like Nifty and Sensex remind us that sharp resistance is likely near overhead calls, and that traders’ optimism is being met with caution at every bounce. In summary, this Open Interest Volume Analysis tells us that the post-expiry market is loaded with bullish intent, but remains balanced by vigilant risk management—and the next leg up will need a decisive breakout above crowded resistance levels.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]