Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 8/10/2025

Table of Contents

On 8th October 2025, the combined futures and options data reflected a cautious mood in the market, as Open Interest Volume Analysis showed a predominance of short covering with some fresh short additions, signaling a mixed and tactical positioning ahead of important expiry dates. Nifty’s combined futures open interest slipped 1.4%, driven by long covering in near-term October contracts, while November showed fresh short interest creeping in, hinting at a market bracing for near-term volatility.

Bank Nifty echoed this theme, seeing a 3.5% combined OI decline, consistent with bulls unwinding some positions, but November contracts gained fresh longs, revealing pockets of confidence in the banking sector’s medium-term outlook. In contrast, Finnifty and Midcap Nifty both saw combined futures open interest rise, dominated by short additions across series, reflecting traders’ cautious stance in broader market segments.

Sensex futures showed a 3.4% rise in open interest, primarily due to fresh short accumulation, underlining a defensive stance among institutions. Today’s Open Interest Volume Analysis points to a market in consolidation, with participants preparing for moves in either direction as expiry pressures mount.

NSE & BSE F&O Market Signals

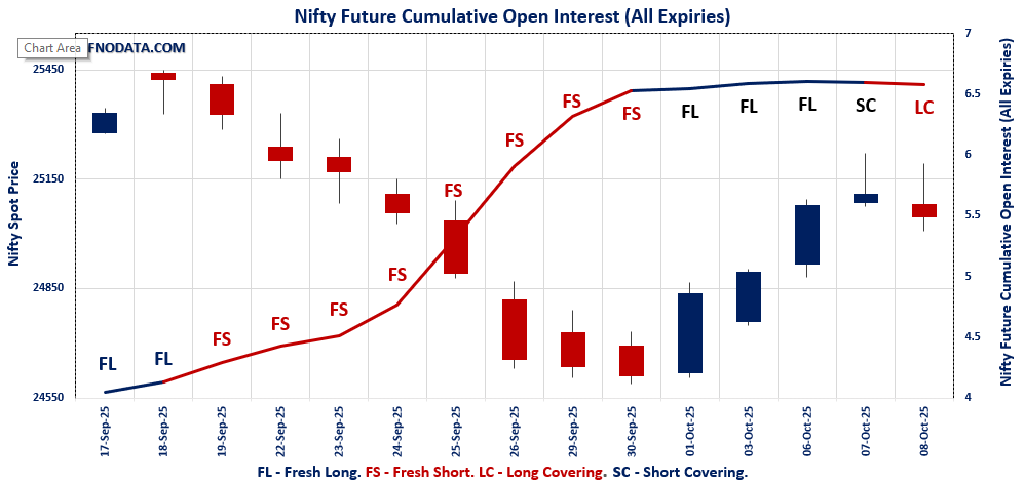

NIFTY Future analysis

NIFTY Spot closed at: 25046.15 (-0.2%)

Combined = October + November + December

Combined Fut Open Interest Change: -1.4%

Combined Fut Volume Change: 12.6%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 7% Previous 7%

NIFTY OCTOBER Future closed at: 25120.4 (-0.4%)

October Fut Premium 74.25 (Decreased by -42.75 points)

October Fut Open Interest Change: -1.8%

October Fut Volume Change: 14.3%

October Fut Open Interest Analysis: Long Covering

NIFTY NOVEMBER Future closed at: 25247.7 (-0.4%)

November Fut Premium 201.55 (Decreased by -46.25 points)

November Fut Open Interest Change: 2.7%

November Fut Volume Change: -1.5%

November Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (14/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.622 (Decreased from 0.914)

Put-Call Ratio (Volume): 0.996

Max Pain Level: 25100

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26000

Highest PUT Addition: 24900

NIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.021 (Increased from 0.996)

Put-Call Ratio (Volume): 0.870

Max Pain Level: 25000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25500

Highest PUT Addition: 24800

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 56018.25 (-0.4%)

Combined = October + November + December

Combined Fut Open Interest Change: -3.5%

Combined Fut Volume Change: 8.6%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 11% Previous 10%

BANKNIFTY OCTOBER Future closed at: 56218 (-0.4%)

October Fut Premium 199.75 (Decreased by -29.5 points)

October Fut Open Interest Change: -4.8%

October Fut Volume Change: 9.7%

October Fut Open Interest Analysis: Long Covering

BANKNIFTY NOVEMBER Future closed at: 56536.2 (-0.4%)

November Fut Premium 517.95 (Decreased by -12.3 points)

November Fut Open Interest Change: 3.7%

November Fut Volume Change: 2.7%

November Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.030 (Decreased from 1.092)

Put-Call Ratio (Volume): 1.032

Max Pain Level: 56000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 55000

Highest CALL Addition: 56000

Highest PUT Addition: 54500

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 26656.4 (-0.5%)

Combined = October + November + December

Combined Fut Open Interest Change: 1.5%

Combined Fut Volume Change: -24.8%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 4% Previous 4%

FINNIFTY OCTOBER Future closed at: 26750.9 (-0.5%)

October Fut Premium 94.5 (Decreased by -18.4 points)

October Fut Open Interest Change: 1.5%

October Fut Volume Change: -21.9%

October Fut Open Interest Analysis: Fresh Short

FINNIFTY NOVEMBER Future closed at: 26872.2 (-0.6%)

November Fut Premium 215.8 (Decreased by -29.2 points)

November Fut Open Interest Change: 0.0%

November Fut Volume Change: -57.7%

November Fut Open Interest Analysis: Long Covering

FINNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.548 (Decreased from 0.618)

Put-Call Ratio (Volume): 0.616

Max Pain Level: 26700

Maximum CALL Open Interest: 27200

Maximum PUT Open Interest: 25000

Highest CALL Addition: 27000

Highest PUT Addition: 25700

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 12910.65 (-0.8%)

Combined = October + November + December

Combined Fut Open Interest Change: 1.7%

Combined Fut Volume Change: 31.8%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 3% Previous 3%

MIDCPNIFTY OCTOBER Future closed at: 12951.35 (-1.0%)

October Fut Premium 40.7 (Decreased by -25.45 points)

October Fut Open Interest Change: 1.5%

October Fut Volume Change: 32.9%

October Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY NOVEMBER Future closed at: 13014 (-0.9%)

November Fut Premium 103.35 (Decreased by -19.8 points)

November Fut Open Interest Change: 8.1%

November Fut Volume Change: 10.2%

November Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.102 (Decreased from 1.309)

Put-Call Ratio (Volume): 0.953

Max Pain Level: 12900

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 12500

Highest CALL Addition: 13000

Highest PUT Addition: 12000

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 81,773.66 (-0.19%)

SENSEX Monthly Future closed at: 82,124.85 (-0.33%)

Premium: 351.19 (Decreased by -122.91 points)

Open Interest Change: 3.4%

Volume Change: 22.8%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (7/10/2025) Option Analysis

Put-Call Ratio (OI): 0.740 (Decreased from 1.004)

Put-Call Ratio (Volume): 1.079

Max Pain Level: 81800

Maximum CALL OI: 84000

Maximum PUT OI: 80000

Highest CALL Addition: 82300

Highest PUT Addition: 80800

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 81.28 Cr.

DIIs Net BUY: ₹ 329.96 Cr.

FII Derivatives Activity

| FII Trading Stats | 8.10.25 | 7.10.25 | 6.10.25 |

| FII Cash (Provisional Data) | 81.28 | 1,440.66 | -213.54 |

| Index Future Open Interest Long Ratio | 7.50% | 7.34% | 7.08% |

| Index Future Volume Long Ratio | 51.79% | 62.85% | 38.17% |

| Call Option Open Interest Long Ratio | 47.09% | 48.06% | 51.46% |

| Call Option Volume Long Ratio | 49.82% | 50.00% | 50.17% |

| Put Option Open Interest Long Ratio | 66.93% | 68.69% | 61.56% |

| Put Option Volume Long Ratio | 50.22% | 50.19% | 49.95% |

| Stock Future Open Interest Long Ratio | 60.95% | 61.25% | 61.43% |

| Stock Future Volume Long Ratio | 46.29% | 48.01% | 49.24% |

| Index Futures | Short Covering | Short Covering | Fresh Short |

| Index Options | Fresh Long | Short Covering | Fresh Long |

| Nifty Futures | Fresh Short | Short Covering | Fresh Short |

| Nifty Options | Fresh Long | Short Covering | Fresh Long |

| BankNifty Futures | Short Covering | Short Covering | Short Covering |

| BankNifty Options | Fresh Short | Fresh Short | Fresh Long |

| FinNifty Futures | Fresh Short | Fresh Short | Short Covering |

| FinNifty Options | Fresh Short | Fresh Short | Fresh Short |

| MidcpNifty Futures | Long Covering | Short Covering | Fresh Long |

| MidcpNifty Options | Fresh Long | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Fresh Short | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Long Covering | Long Covering | Fresh Short |

| Stock Options | Fresh Long | Fresh Short | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (9/10/2025)

The SENSEX index closed at 81773.66. The SENSEX weekly expiry for OCTOBER 9, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.740 against previous 1.004. The 84000CE option holds the maximum open interest, followed by the 83000CE and 83500CE options. Market participants have shown increased interest with significant open interest additions in the 82300CE option, with open interest additions also seen in the 83000CE and 82200CE options. On the other hand, open interest reductions were prominent in the 82200PE, 80400PE, and 84800CE options. Trading volume was highest in the 82000CE option, followed by the 81500PE and 81800PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 09-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 81773.66 | 0.740 | 1.004 | 1.079 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,06,47,120 | 2,20,61,380 | 1,85,85,740 |

| PUT: | 3,00,71,200 | 2,21,58,120 | 79,13,080 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 28,42,680 | 11,49,560 | 2,22,84,520 |

| 83000 | 26,35,020 | 13,07,520 | 5,42,06,380 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82300 | 23,17,120 | 14,70,880 | 11,62,64,420 |

| 83000 | 26,35,020 | 13,07,520 | 5,42,06,380 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84800 | 1,18,540 | -1,04,460 | 21,44,960 |

| 81000 | 2,62,980 | -83,480 | 10,89,320 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 21,38,440 | 11,21,380 | 16,78,77,540 |

| 82200 | 20,91,980 | 12,67,200 | 14,34,73,700 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 21,51,980 | 3,65,320 | 2,16,68,820 |

| 80500 | 19,99,380 | 4,38,660 | 2,64,65,500 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80800 | 14,75,160 | 8,99,860 | 2,59,94,660 |

| 81500 | 16,52,260 | 5,84,720 | 16,06,19,840 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82200 | 1,98,000 | -1,39,500 | 4,20,33,300 |

| 80400 | 3,27,440 | -1,14,280 | 79,04,280 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 16,52,260 | 5,84,720 | 16,06,19,840 |

| 81800 | 8,36,780 | 2,80,660 | 15,99,70,540 |

NIFTY Weekly Expiry (14/10/2025)

The NIFTY index closed at 25046.15. The NIFTY weekly expiry for OCTOBER 14, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.622 against previous 0.914. The 26000CE option holds the maximum open interest, followed by the 25200CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 26000CE option, with open interest additions also seen in the 25100CE and 25200CE options. On the other hand, open interest reductions were prominent in the 25200PE, 25500PE, and 24800CE options. Trading volume was highest in the 25100PE option, followed by the 25000PE and 25200CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 14-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,046.15 | 0.622 | 0.914 | 0.996 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 15,55,65,375 | 6,95,86,350 | 8,59,79,025 |

| PUT: | 9,67,73,775 | 6,35,74,275 | 3,31,99,500 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,31,27,250 | 77,50,125 | 12,52,153 |

| 25,200 | 1,17,96,450 | 63,43,650 | 46,42,507 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,31,27,250 | 77,50,125 | 12,52,153 |

| 25,100 | 91,08,000 | 65,55,825 | 42,93,795 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 4,64,700 | -46,725 | 76,785 |

| 24,500 | 2,97,825 | -18,075 | 8,967 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,17,96,450 | 63,43,650 | 46,42,507 |

| 25,100 | 91,08,000 | 65,55,825 | 42,93,795 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 78,33,075 | 10,91,550 | 50,09,632 |

| 24,000 | 76,28,325 | 26,14,875 | 6,55,632 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 64,33,650 | 32,29,575 | 23,47,114 |

| 24,000 | 76,28,325 | 26,14,875 | 6,55,632 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 30,03,075 | -70,050 | 25,21,040 |

| 25,500 | 3,93,450 | -69,375 | 51,065 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 45,08,775 | 12,63,150 | 53,07,212 |

| 25,000 | 78,33,075 | 10,91,550 | 50,09,632 |

NIFTY Monthly Expiry (28/10/2025)

The NIFTY index closed at 25046.15. The NIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.021 against previous 0.996. The 26000CE option holds the maximum open interest, followed by the 25500CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25500CE option, with open interest additions also seen in the 25100CE and 24800PE options. On the other hand, open interest reductions were prominent in the 25600CE, 25700CE, and 24900PE options. Trading volume was highest in the 25500CE option, followed by the 25000PE and 25200CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,046.15 | 1.021 | 0.996 | 0.870 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,44,03,000 | 4,41,67,875 | 2,35,125 |

| PUT: | 4,53,50,100 | 4,40,04,075 | 13,46,025 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 53,74,500 | 68,325 | 68,352 |

| 25,500 | 51,12,675 | 6,52,875 | 1,25,988 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 51,12,675 | 6,52,875 | 1,25,988 |

| 25,100 | 16,57,425 | 5,17,425 | 53,363 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 12,77,700 | -7,79,700 | 72,237 |

| 25,700 | 13,16,925 | -4,58,625 | 48,765 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 51,12,675 | 6,52,875 | 1,25,988 |

| 25,200 | 22,84,950 | 3,95,325 | 86,262 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 46,67,700 | 1,89,450 | 1,16,060 |

| 24,800 | 39,73,200 | 5,14,500 | 52,646 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 39,73,200 | 5,14,500 | 52,646 |

| 25,200 | 17,52,675 | 3,91,425 | 75,223 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 15,01,500 | -2,52,900 | 43,963 |

| 24,000 | 35,61,600 | -1,15,200 | 37,064 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 46,67,700 | 1,89,450 | 1,16,060 |

| 25,200 | 17,52,675 | 3,91,425 | 75,223 |

BANKNIFTY Monthly Expiry (28/10/2025)

The BANKNIFTY index closed at 56018.25. The BANKNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.030 against previous 1.092. The 57000CE option holds the maximum open interest, followed by the 55000PE and 54000PE options. Market participants have shown increased interest with significant open interest additions in the 56000CE option, with open interest additions also seen in the 56500CE and 54500PE options. On the other hand, open interest reductions were prominent in the 55500CE, 58500CE, and 54000PE options. Trading volume was highest in the 56000PE option, followed by the 56000CE and 57000CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 56,018.25 | 1.030 | 1.092 | 1.032 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,59,33,925 | 1,50,60,710 | 8,73,215 |

| PUT: | 1,64,09,120 | 1,64,41,215 | -32,095 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 21,29,855 | 73,640 | 1,44,175 |

| 58,000 | 11,88,565 | 1,24,985 | 76,753 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 11,44,710 | 1,55,260 | 1,54,265 |

| 56,500 | 8,07,240 | 1,48,470 | 1,39,597 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 55,500 | 4,74,460 | -96,635 | 18,218 |

| 58,500 | 5,28,920 | -90,370 | 45,563 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 11,44,710 | 1,55,260 | 1,54,265 |

| 57,000 | 21,29,855 | 73,640 | 1,44,175 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 16,94,105 | -29,400 | 1,05,207 |

| 54,000 | 12,32,280 | -74,480 | 58,269 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 9,81,120 | 1,27,400 | 52,772 |

| 53,000 | 8,73,005 | 1,14,240 | 39,987 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 54,000 | 12,32,280 | -74,480 | 58,269 |

| 56,500 | 3,66,590 | -64,225 | 72,061 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 11,65,010 | 45,920 | 2,22,477 |

| 56,200 | 1,88,650 | -105 | 1,17,851 |

FINNIFTY Monthly Expiry (28/10/2025)

The FINNIFTY index closed at 26656.4. The FINNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.548 against previous 0.618. The 27200CE option holds the maximum open interest, followed by the 27300CE and 27000CE options. Market participants have shown increased interest with significant open interest additions in the 27000CE option, with open interest additions also seen in the 27200CE and 26800CE options. On the other hand, open interest reductions were prominent in the 27300CE, 25000PE, and 26500PE options. Trading volume was highest in the 27200CE option, followed by the 27000CE and 26800CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,656.40 | 0.548 | 0.618 | 0.616 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 11,85,795 | 10,44,485 | 1,41,310 |

| PUT: | 6,49,415 | 6,44,995 | 4,420 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,200 | 2,49,535 | 31,525 | 7,219 |

| 27,300 | 1,61,655 | -18,590 | 1,085 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,08,355 | 51,545 | 4,633 |

| 27,200 | 2,49,535 | 31,525 | 7,219 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 1,61,655 | -18,590 | 1,085 |

| 26,500 | 33,865 | -4,745 | 207 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,200 | 2,49,535 | 31,525 | 7,219 |

| 27,000 | 1,08,355 | 51,545 | 4,633 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 66,625 | -12,155 | 1,180 |

| 27,200 | 60,710 | 130 | 64 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 44,525 | 18,980 | 532 |

| 26,800 | 26,130 | 4,290 | 2,482 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 66,625 | -12,155 | 1,180 |

| 26,500 | 39,130 | -6,825 | 1,263 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,700 | 30,615 | 2,340 | 2,532 |

| 26,800 | 26,130 | 4,290 | 2,482 |

MIDCPNIFTY Monthly Expiry (28/10/2025)

The MIDCPNIFTY index closed at 12910.65. The MIDCPNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.102 against previous 1.309. The 13000CE option holds the maximum open interest, followed by the 12500PE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 13000CE option, with open interest additions also seen in the 14000CE and 12000PE options. On the other hand, open interest reductions were prominent in the 67500CE, 68400CE, and 69000PE options. Trading volume was highest in the 13000CE option, followed by the 13000PE and 13500CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 12,910.65 | 1.102 | 1.309 | 0.953 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 59,38,240 | 48,29,020 | 11,09,220 |

| PUT: | 65,45,280 | 63,22,120 | 2,23,160 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 9,76,360 | 3,37,120 | 30,386 |

| 14,000 | 6,79,280 | 3,07,580 | 6,898 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 9,76,360 | 3,37,120 | 30,386 |

| 14,000 | 6,79,280 | 3,07,580 | 6,898 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 6,31,820 | -1,15,920 | 14,968 |

| 12,700 | 2,73,420 | -53,340 | 809 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 9,76,360 | 3,37,120 | 30,386 |

| 13,500 | 6,31,820 | -1,15,920 | 14,968 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 9,07,620 | -1,14,940 | 11,245 |

| 12,000 | 6,58,560 | 1,34,540 | 6,751 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,000 | 6,58,560 | 1,34,540 | 6,751 |

| 13,000 | 5,56,780 | 97,440 | 22,320 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 9,07,620 | -1,14,940 | 11,245 |

| 13,025 | 30,660 | -65,240 | 4,259 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 5,56,780 | 97,440 | 22,320 |

| 12,900 | 3,13,460 | 35,980 | 12,674 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The derivatives positioning on 8th October 2025 tells a nuanced story of balance and anticipation. The combined data shows that while short covering dominated near-term contracts in some indices, fresh short positioning in November and across broader futures signals that traders remain cautious about broader sustainability of gains.

The divergence between fresh longs in Bank Nifty’s November contracts and continued short buildup in Finnifty and Midcap Nifty underscores the selective nature of the market’s optimism. Options data with decreasing PCR reflects traders’ guarded risk appetite and willingness to hedge rallies at resistance zones. Overall, the Open Interest Volume Analysis suggests the market is at a crossroads—primed for a meaningful move but presently marked by consolidation and hedging as participants wait for decisive triggers in the week ahead.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Previous Day’s NSE & BSE Indices F&O […]