Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 9/10/2025

Table of Contents

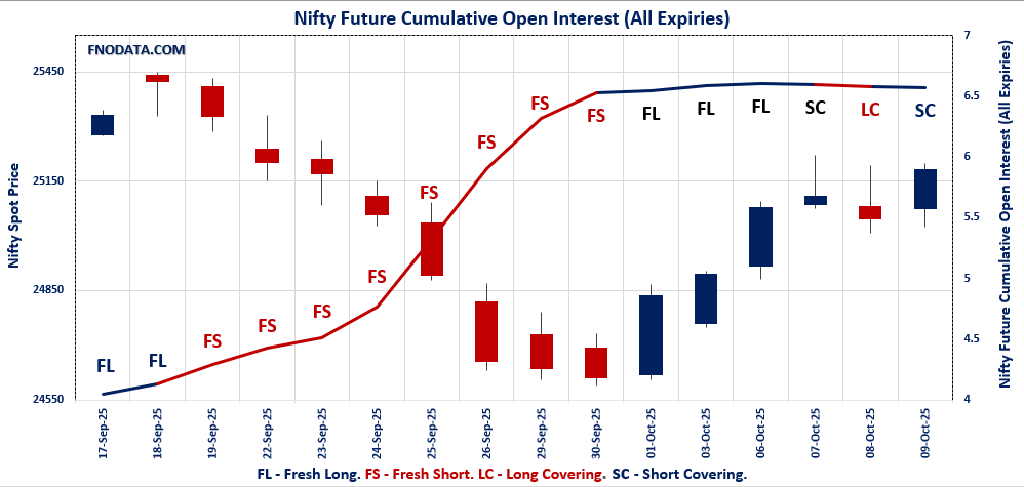

On 9th October 2025, the combined futures and options setup told a nuanced story of selective optimism and sector rotation, as highlighted by Open Interest Volume Analysis. Nifty’s combined futures open interest dipped by 1%, reflecting broad short covering in the face of mild price gains, suggesting that traders are booking out of Friday positions rather than chasing a breakout.

However, the November futures contract showed fresh long interest—signaling that market participants remain confident about the next leg up but are shifting their bets further out on the calendar. Bank Nifty, on the other hand, reversed trend with combined futures OI climbing 1.3%, driven by fresh long accumulation in both October and November series, which hints at a strong undercurrent of demand in financials. Finnifty was the standout, with a sharp 13% surge in OI across all contracts and aggressive long builds in both October and November, confirming that financial sector appetite remains robust.

In contrast, Midcap Nifty displayed sectoral divergence: short covering in October but fresh long additions in November, a sign of participants cherry-picking midcap exposure for the next week. Sensex futures showed aggressive short covering—down nearly 11% OI—even as spot prices rose, paralleling the bullish bias. Today’s Open Interest Volume Analysis reveals a market warming up to new positions in select pockets while keeping risk balanced in others.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25181.8 (0.5%)

Combined = October + November + December

Combined Fut Open Interest Change: -1.0%

Combined Fut Volume Change: -9.6%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 7% Previous 7%

NIFTY OCTOBER Future closed at: 25273.8 (0.6%)

October Fut Premium 92 (Increased by 17.75 points)

October Fut Open Interest Change: -1.1%

October Fut Volume Change: -8.7%

October Fut Open Interest Analysis: Short Covering

NIFTY NOVEMBER Future closed at: 25403 (0.6%)

November Fut Premium 221.2 (Increased by 19.65 points)

November Fut Open Interest Change: 1.0%

November Fut Volume Change: -23.4%

November Fut Open Interest Analysis: Fresh Long

NIFTY Weekly Expiry (14/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.005 (Increased from 0.622)

Put-Call Ratio (Volume): 0.895

Max Pain Level: 25150

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25400

Highest PUT Addition: 25100

NIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.014 (Decreased from 1.021)

Put-Call Ratio (Volume): 0.978

Max Pain Level: 25000

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25600

Highest PUT Addition: 24900

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 56192.05 (0.3%)

Combined = October + November + December

Combined Fut Open Interest Change: 1.3%

Combined Fut Volume Change: -29.3%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 11% Previous 11%

BANKNIFTY OCTOBER Future closed at: 56413.2 (0.3%)

October Fut Premium 221.15 (Increased by 21.4 points)

October Fut Open Interest Change: 1.3%

October Fut Volume Change: -28.8%

October Fut Open Interest Analysis: Fresh Long

BANKNIFTY NOVEMBER Future closed at: 56714.8 (0.3%)

November Fut Premium 522.75 (Increased by 4.8 points)

November Fut Open Interest Change: 0.4%

November Fut Volume Change: -32.9%

November Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.055 (Increased from 1.030)

Put-Call Ratio (Volume): 0.890

Max Pain Level: 56000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 55000

Highest CALL Addition: 60500

Highest PUT Addition: 56200

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 26724.3 (0.3%)

Combined = October + November + December

Combined Fut Open Interest Change: 13.0%

Combined Fut Volume Change: 42.7%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 4% Previous 4%

FINNIFTY OCTOBER Future closed at: 26833.5 (0.3%)

October Fut Premium 109.2 (Increased by 14.7 points)

October Fut Open Interest Change: 12.9%

October Fut Volume Change: 45.6%

October Fut Open Interest Analysis: Fresh Long

FINNIFTY NOVEMBER Future closed at: 26973.3 (0.4%)

November Fut Premium 249 (Increased by 33.2 points)

November Fut Open Interest Change: 15.8%

November Fut Volume Change: -18.2%

November Fut Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.597 (Increased from 0.548)

Put-Call Ratio (Volume): 0.626

Max Pain Level: 26700

Maximum CALL Open Interest: 27200

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27100

Highest PUT Addition: 26000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13034.55 (1.0%)

Combined = October + November + December

Combined Fut Open Interest Change: -1.4%

Combined Fut Volume Change: -21.9%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 3% Previous 3%

MIDCPNIFTY OCTOBER Future closed at: 13100.75 (1.2%)

October Fut Premium 66.2 (Increased by 25.5 points)

October Fut Open Interest Change: -1.5%

October Fut Volume Change: -21.5%

October Fut Open Interest Analysis: Short Covering

MIDCPNIFTY NOVEMBER Future closed at: 13157.1 (1.1%)

November Fut Premium 122.55 (Increased by 19.2 points)

November Fut Open Interest Change: 2.7%

November Fut Volume Change: -23.1%

November Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.253 (Increased from 1.102)

Put-Call Ratio (Volume): 1.098

Max Pain Level: 13000

Maximum CALL Open Interest: 13000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 13100

Highest PUT Addition: 12700

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 82,172.10 (0.49%)

SENSEX Monthly Future closed at: 82,516.60 (0.48%)

Premium: 344.5 (Decreased by -6.69 points)

Open Interest Change: -10.9%

Volume Change: -5.0%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (16/10/2025) Option Analysis

Put-Call Ratio (OI): 1.136 (Increased from 0.778)

Put-Call Ratio (Volume): 1.034

Max Pain Level: 82000

Maximum CALL OI: 82000

Maximum PUT OI: 82000

Highest CALL Addition: 85000

Highest PUT Addition: 82000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 1,308.16 Cr.

DIIs Net BUY: ₹ 864.36 Cr.

FII Derivatives Activity

| FII Trading Stats | 9.10.25 | 8.10.25 | 7.10.25 |

| FII Cash (Provisional Data) | 1,308.16 | 81.28 | 1,440.66 |

| Index Future Open Interest Long Ratio | 7.49% | 7.50% | 7.34% |

| Index Future Volume Long Ratio | 55.33% | 51.79% | 62.85% |

| Call Option Open Interest Long Ratio | 48.65% | 47.09% | 48.06% |

| Call Option Volume Long Ratio | 50.21% | 49.82% | 50.00% |

| Put Option Open Interest Long Ratio | 64.31% | 66.93% | 68.69% |

| Put Option Volume Long Ratio | 49.80% | 50.22% | 50.19% |

| Stock Future Open Interest Long Ratio | 61.17% | 60.95% | 61.25% |

| Stock Future Volume Long Ratio | 52.09% | 46.29% | 48.01% |

| Index Futures | Short Covering | Short Covering | Short Covering |

| Index Options | Fresh Short | Fresh Long | Short Covering |

| Nifty Futures | Short Covering | Fresh Short | Short Covering |

| Nifty Options | Fresh Short | Fresh Long | Short Covering |

| BankNifty Futures | Short Covering | Short Covering | Short Covering |

| BankNifty Options | Long Covering | Fresh Short | Fresh Short |

| FinNifty Futures | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Options | Short Covering | Fresh Short | Fresh Short |

| MidcpNifty Futures | Fresh Long | Long Covering | Short Covering |

| MidcpNifty Options | Fresh Long | Fresh Long | Fresh Short |

| NiftyNxt50 Futures | Long Covering | Short Covering | Fresh Short |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Fresh Long | Long Covering | Long Covering |

| Stock Options | Fresh Long | Fresh Long | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (16/10/2025)

The SENSEX index closed at 82172.1. The SENSEX weekly expiry for OCTOBER 16, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.136 against previous 0.778. The 82000PE option holds the maximum open interest, followed by the 82000CE and 78000PE options. Market participants have shown increased interest with significant open interest additions in the 82000PE option, with open interest additions also seen in the 78000PE and 85000CE options. On the other hand, open interest reductions were prominent in the 81500CE, 81700CE, and 81600CE options. Trading volume was highest in the 82000CE option, followed by the 82000PE and 83000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 16-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82172.1 | 1.136 | 0.778 | 1.034 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 39,47,620 | 16,97,800 | 22,49,820 |

| PUT: | 44,85,620 | 13,21,700 | 31,63,920 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,23,780 | 2,49,380 | 34,44,160 |

| 85000 | 4,10,800 | 3,07,360 | 9,27,500 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 4,10,800 | 3,07,360 | 9,27,500 |

| 82000 | 5,23,780 | 2,49,380 | 34,44,160 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 81500 | 34,520 | -6,740 | 1,98,260 |

| 81700 | 24,180 | -3,940 | 2,45,860 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,23,780 | 2,49,380 | 34,44,160 |

| 83000 | 2,45,860 | 84,320 | 18,92,480 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,95,500 | 3,96,120 | 32,28,840 |

| 78000 | 4,95,100 | 3,84,320 | 9,12,140 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,95,500 | 3,96,120 | 32,28,840 |

| 78000 | 4,95,100 | 3,84,320 | 9,12,140 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83400 | 120 | -40 | 80 |

| – | – | – | – |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 5,95,500 | 3,96,120 | 32,28,840 |

| 81000 | 2,42,460 | 1,09,820 | 17,68,640 |

NIFTY Weekly Expiry (14/10/2025)

The NIFTY index closed at 25181.8. The NIFTY weekly expiry for OCTOBER 14, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.005 against previous 0.622. The 25000PE option holds the maximum open interest, followed by the 26000CE and 25100PE options. Market participants have shown increased interest with significant open interest additions in the 25100PE option, with open interest additions also seen in the 25000PE and 25050PE options. On the other hand, open interest reductions were prominent in the 25100CE, 25150CE, and 25200CE options. Trading volume was highest in the 25200CE option, followed by the 25100PE and 25100CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 14-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,181.80 | 1.005 | 0.622 | 0.895 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 14,97,50,700 | 15,55,65,375 | -58,14,675 |

| PUT: | 15,05,32,875 | 9,67,73,775 | 5,37,59,100 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,34,49,375 | 3,22,125 | 8,69,704 |

| 25,500 | 1,03,10,175 | 10,72,125 | 16,72,704 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 87,73,725 | 16,62,450 | 19,33,085 |

| 25,600 | 73,12,050 | 12,34,275 | 8,42,065 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 44,43,375 | -46,64,625 | 39,40,831 |

| 25,150 | 34,94,625 | -29,35,800 | 32,21,911 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 98,31,975 | -19,64,475 | 46,41,516 |

| 25,100 | 44,43,375 | -46,64,625 | 39,40,831 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 1,37,26,650 | 58,93,575 | 35,43,693 |

| 25,100 | 1,07,77,575 | 62,68,800 | 44,01,376 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 1,07,77,575 | 62,68,800 | 44,01,376 |

| 25,000 | 1,37,26,650 | 58,93,575 | 35,43,693 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 23,700 | 13,02,600 | -88,200 | 1,11,186 |

| 24,850 | 23,97,075 | -81,900 | 7,67,626 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 1,07,77,575 | 62,68,800 | 44,01,376 |

| 25,000 | 1,37,26,650 | 58,93,575 | 35,43,693 |

NIFTY Monthly Expiry (28/10/2025)

The NIFTY index closed at 25181.8. The NIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.014 against previous 1.021. The 26000CE option holds the maximum open interest, followed by the 25500CE and 25000PE options. Market participants have shown increased interest with significant open interest additions in the 25600CE option, with open interest additions also seen in the 25700CE and 24900PE options. On the other hand, open interest reductions were prominent in the 24800PE, 25000CE, and 25100CE options. Trading volume was highest in the 25500CE option, followed by the 25000PE and 25200CE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,181.80 | 1.014 | 1.021 | 0.978 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,48,65,900 | 4,44,03,000 | 4,62,900 |

| PUT: | 4,55,08,875 | 4,53,50,100 | 1,58,775 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 54,15,300 | 40,800 | 56,656 |

| 25,500 | 50,63,025 | -49,650 | 1,07,263 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 20,20,650 | 7,42,950 | 46,698 |

| 25,700 | 19,39,575 | 6,22,650 | 48,933 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 33,88,950 | -4,68,825 | 53,418 |

| 25,100 | 14,31,900 | -2,25,525 | 51,574 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 50,63,025 | -49,650 | 1,07,263 |

| 25,200 | 21,73,425 | -1,11,525 | 80,099 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 46,27,125 | -40,575 | 1,02,837 |

| 24,000 | 35,25,000 | -36,600 | 35,832 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 24,900 | 19,59,300 | 4,57,800 | 39,461 |

| 25,100 | 14,77,800 | 2,28,900 | 58,839 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 33,51,900 | -6,21,300 | 62,319 |

| 24,500 | 32,91,825 | -1,49,625 | 53,434 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 46,27,125 | -40,575 | 1,02,837 |

| 25,200 | 17,16,225 | -36,450 | 65,946 |

BANKNIFTY Monthly Expiry (28/10/2025)

The BANKNIFTY index closed at 56192.05. The BANKNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.055 against previous 1.030. The 57000CE option holds the maximum open interest, followed by the 55000PE and 54000PE options. Market participants have shown increased interest with significant open interest additions in the 60500CE option, with open interest additions also seen in the 56200PE and 56500PE options. On the other hand, open interest reductions were prominent in the 56000CE, 55500CE, and 56300CE options. Trading volume was highest in the 56000PE option, followed by the 56000CE and 56500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 56,192.05 | 1.055 | 1.030 | 0.890 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,63,45,385 | 1,59,33,925 | 4,11,460 |

| PUT: | 1,72,45,270 | 1,64,09,120 | 8,36,150 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 21,30,065 | 210 | 99,797 |

| 58,000 | 12,15,585 | 27,020 | 54,396 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 60,500 | 2,28,165 | 1,08,850 | 11,833 |

| 63,500 | 3,09,470 | 75,075 | 8,842 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 10,76,250 | -68,460 | 1,41,426 |

| 55,500 | 4,26,335 | -48,125 | 12,506 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 10,76,250 | -68,460 | 1,41,426 |

| 56,500 | 8,41,820 | 34,580 | 1,06,332 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 17,31,520 | 37,415 | 67,271 |

| 54,000 | 12,44,285 | 12,005 | 39,657 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,200 | 2,84,900 | 96,250 | 87,763 |

| 56,500 | 4,45,305 | 78,715 | 43,345 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 52,800 | 31,745 | -21,945 | 3,240 |

| 50,000 | 2,71,775 | -17,780 | 10,985 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 12,19,610 | 54,600 | 1,73,717 |

| 56,200 | 2,84,900 | 96,250 | 87,763 |

FINNIFTY Monthly Expiry (28/10/2025)

The FINNIFTY index closed at 26724.3. The FINNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.597 against previous 0.548. The 27200CE option holds the maximum open interest, followed by the 27300CE and 27000CE options. Market participants have shown increased interest with significant open interest additions in the 27100CE option, with open interest additions also seen in the 26000PE and 26500PE options. On the other hand, open interest reductions were prominent in the 27200CE, 27300CE, and 27000CE options. Trading volume was highest in the 27000CE option, followed by the 27200CE and 26600PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,724.30 | 0.597 | 0.548 | 0.626 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 11,31,975 | 11,85,795 | -53,820 |

| PUT: | 6,75,740 | 6,49,415 | 26,325 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,200 | 2,17,295 | -32,240 | 3,884 |

| 27,300 | 1,38,580 | -23,075 | 1,142 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,100 | 28,535 | 28,535 | 635 |

| 26,700 | 32,110 | 6,240 | 2,690 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,200 | 2,17,295 | -32,240 | 3,884 |

| 27,300 | 1,38,580 | -23,075 | 1,142 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 89,505 | -18,850 | 3,952 |

| 27,200 | 2,17,295 | -32,240 | 3,884 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 66,235 | 13,195 | 997 |

| 27,200 | 61,230 | 520 | 10 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 66,235 | 13,195 | 997 |

| 26,500 | 48,425 | 9,295 | 1,940 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 57,655 | -8,970 | 927 |

| 26,400 | 47,710 | -2,665 | 1,389 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,600 | 36,855 | -1,755 | 3,381 |

| 26,700 | 34,905 | 4,290 | 2,297 |

MIDCPNIFTY Monthly Expiry (28/10/2025)

The MIDCPNIFTY index closed at 13034.55. The MIDCPNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.253 against previous 1.102. The 13000CE option holds the maximum open interest, followed by the 13000PE and 14000CE options. Market participants have shown increased interest with significant open interest additions in the 12700PE option, with open interest additions also seen in the 13000PE and 13100PE options. On the other hand, open interest reductions were prominent in the 68400PE, 76000CE, and 76000PE options. Trading volume was highest in the 13000CE option, followed by the 13000PE and 12900PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,034.55 | 1.253 | 1.102 | 1.098 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 58,45,980 | 59,38,240 | -92,260 |

| PUT: | 73,22,140 | 65,45,280 | 7,76,860 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,75,040 | -2,01,320 | 22,700 |

| 14,000 | 7,13,160 | 33,880 | 3,894 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,100 | 3,09,260 | 90,300 | 8,024 |

| 13,600 | 2,34,360 | 50,680 | 3,889 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,75,040 | -2,01,320 | 22,700 |

| 12,900 | 1,06,540 | -50,120 | 3,587 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,75,040 | -2,01,320 | 22,700 |

| 13,500 | 6,00,740 | -31,080 | 9,090 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,18,900 | 1,62,120 | 18,151 |

| 12,500 | 6,67,520 | -2,40,100 | 8,545 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 6,54,220 | 3,08,700 | 8,434 |

| 13,000 | 7,18,900 | 1,62,120 | 18,151 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 6,67,520 | -2,40,100 | 8,545 |

| 12,000 | 5,95,420 | -63,140 | 4,370 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,18,900 | 1,62,120 | 18,151 |

| 12,900 | 3,83,740 | 70,280 | 14,847 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The derivatives snapshot for 9th October 2025 paints an interesting pre-weekend setup. Nifty and Sensex are dominated by short covering, highlighting that profit booking and rollover unwinding are still in play for index heavyweights. Yet the distinct fresh long buildup in Bank Nifty, Finnifty, and Midcap Nifty (especially in November contracts) shows the market’s confidence is re-emerging within financials and select midcaps.

Options data backs this up: rising PCR in both weekly and monthly series for Bank Nifty, Finnifty, and midcap contracts points to strengthening support, even as call writers continue to cap upside close to resistance. Overall, the Open Interest Volume Analysis signals that while broad index moves remain cautious, sector-led bullishness is quietly gathering force and may drive the next directional move if global cues stay friendly and domestic triggers align post-expiry.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]