Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 13/10/2025

Table of Contents

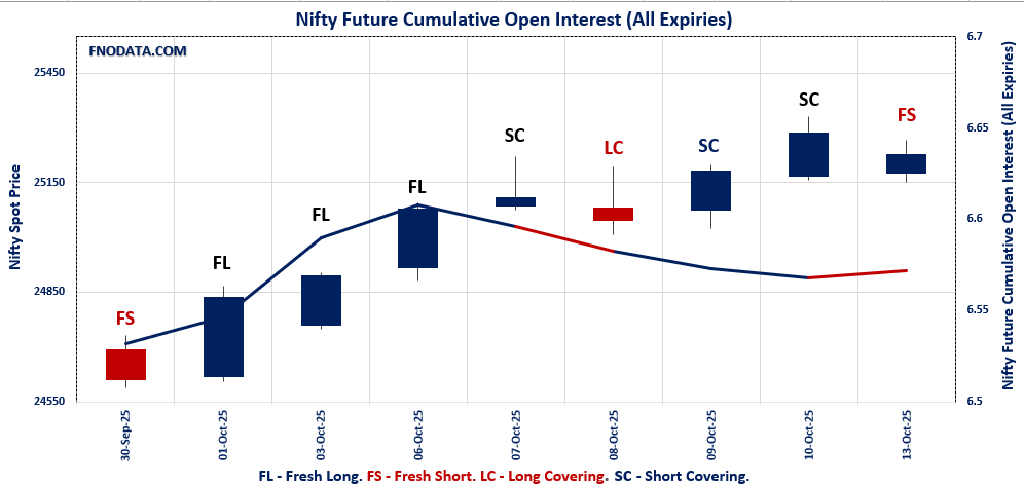

On 13th October 2025, the Open Interest Volume Analysis revealed a nuanced shift in index sentiment: traders balanced fresh shorts in Nifty and Sensex with selective long buildup across midcaps and financials. Nifty’s combined futures open interest edged up by 0.4%—a signal that bears are tentatively building fresh shorts, even as October contracts saw modest long covering while November contracts attracted new short interest.

The bright spot in the session came from Bank Nifty and Finnifty, where fresh long positions dominated combined futures activity despite mixed price action, hinting at sector rotation and optimism in banking and financials. Midcap Nifty mirrored this positivity with steady increases in both price and OI, indicating traders are accumulating for the next leg.

In the options space, the PCR cooled in Nifty, Bank Nifty, and Sensex, while Finnifty and midcaps saw more robust put writing—suggesting confidence but also healthy hedging at higher strikes. Altogether, today’s Open Interest Volume Analysis reflects a market where participants remain tactically cautious in large indices but are actively positioning for upturns in select sectors.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25227.35 (-0.2%)

Combined = October + November + December

Combined Fut Open Interest Change: 0.4%

Combined Fut Volume Change: 19.6%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 9% Previous 8%

NIFTY OCTOBER Future closed at: 25309.3 (-0.4%)

October Fut Premium 81.95 (Decreased by -43.7 points)

October Fut Open Interest Change: -0.2%

October Fut Volume Change: 22.2%

October Fut Open Interest Analysis: Long Covering

NIFTY NOVEMBER Future closed at: 25446 (-0.4%)

November Fut Premium 218.65 (Decreased by -36.1 points)

November Fut Open Interest Change: 6.7%

November Fut Volume Change: 0.7%

November Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (14/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.031 (Decreased from 1.399)

Put-Call Ratio (Volume): 1.005

Max Pain Level: 25200

Maximum CALL Open Interest: 25300

Maximum PUT Open Interest: 25200

Highest CALL Addition: 25200

Highest PUT Addition: 25200

NIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.007 (Decreased from 1.066)

Put-Call Ratio (Volume): 0.902

Max Pain Level: 25100

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25600

Highest PUT Addition: 25200

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 56625 (0.0%)

Combined = October + November + December

Combined Fut Open Interest Change: 1.0%

Combined Fut Volume Change: -28.4%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 12% Previous 12%

BANKNIFTY OCTOBER Future closed at: 56856.2 (0.0%)

October Fut Premium 231.2 (Decreased by -21.25 points)

October Fut Open Interest Change: 0.6%

October Fut Volume Change: -27.0%

October Fut Open Interest Analysis: Fresh Short

BANKNIFTY NOVEMBER Future closed at: 57151.6 (0.0%)

November Fut Premium 526.6 (Decreased by -15.65 points)

November Fut Open Interest Change: 0.3%

November Fut Volume Change: -34.9%

November Fut Open Interest Analysis: Fresh Short

BANKNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.098 (Decreased from 1.123)

Put-Call Ratio (Volume): 0.914

Max Pain Level: 56300

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 55000

Highest CALL Addition: 56700

Highest PUT Addition: 54500

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 26885.25 (0.2%)

Combined = October + November + December

Combined Fut Open Interest Change: 2.1%

Combined Fut Volume Change: -30.1%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 6% Previous 5%

FINNIFTY OCTOBER Future closed at: 26993.4 (0.1%)

October Fut Premium 108.15 (Decreased by -15.2 points)

October Fut Open Interest Change: 0.6%

October Fut Volume Change: -31.1%

October Fut Open Interest Analysis: Fresh Long

FINNIFTY NOVEMBER Future closed at: 27145.2 (0.1%)

November Fut Premium 259.95 (Decreased by -4.2 points)

November Fut Open Interest Change: 33.3%

November Fut Volume Change: -17.9%

November Fut Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.707 (Increased from 0.671)

Put-Call Ratio (Volume): 0.761

Max Pain Level: 26900

Maximum CALL Open Interest: 27300

Maximum PUT Open Interest: 25700

Highest CALL Addition: 27550

Highest PUT Addition: 25700

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13186.95 (0.3%)

Combined = October + November + December

Combined Fut Open Interest Change: 0.3%

Combined Fut Volume Change: 22.1%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 4% Previous 4%

MIDCPNIFTY OCTOBER Future closed at: 13238.8 (0.2%)

October Fut Premium 51.85 (Decreased by -15.15 points)

October Fut Open Interest Change: 0.3%

October Fut Volume Change: 27.5%

October Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY NOVEMBER Future closed at: 13290.75 (0.1%)

November Fut Premium 103.8 (Decreased by -18.85 points)

November Fut Open Interest Change: 0.8%

November Fut Volume Change: -37.5%

November Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.268 (Decreased from 1.285)

Put-Call Ratio (Volume): 0.991

Max Pain Level: 13000

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 12500

Highest CALL Addition: 13200

Highest PUT Addition: 13200

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 82,327.05 (-0.21%)

SENSEX Monthly Future closed at: 82,683.65 (-0.36%)

Premium: 356.6 (Decreased by -124.78 points)

Open Interest Change: 5.1%

Volume Change: -43.7%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (16/10/2025) Option Analysis

Put-Call Ratio (OI): 1.018 (Decreased from 1.405)

Put-Call Ratio (Volume): 1.071

Max Pain Level: 82300

Maximum CALL OI: 85000

Maximum PUT OI: 82000

Highest CALL Addition: 85000

Highest PUT Addition: 79500

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 240.10 Cr.

DIIs Net BUY: ₹ 2,333.42 Cr.

FII Derivatives Activity

| FII Trading Stats | 13.10.25 | 10.10.25 | 9.10.25 |

| FII Cash (Provisional Data) | -240.1 | 459.2 | 1,308.16 |

| Index Future Open Interest Long Ratio | 7.31% | 7.53% | 7.49% |

| Index Future Volume Long Ratio | 40.46% | 57.85% | 55.33% |

| Call Option Open Interest Long Ratio | 48.19% | 50.68% | 48.65% |

| Call Option Volume Long Ratio | 49.73% | 50.26% | 50.21% |

| Put Option Open Interest Long Ratio | 64.83% | 62.39% | 64.31% |

| Put Option Volume Long Ratio | 50.19% | 50.13% | 49.80% |

| Stock Future Open Interest Long Ratio | 60.90% | 61.37% | 61.17% |

| Stock Future Volume Long Ratio | 45.74% | 52.11% | 52.09% |

| Index Futures | Fresh Short | Short Covering | Short Covering |

| Index Options | Long Covering | Fresh Long | Fresh Short |

| Nifty Futures | Fresh Short | Short Covering | Short Covering |

| Nifty Options | Long Covering | Fresh Long | Fresh Short |

| BankNifty Futures | Fresh Short | Short Covering | Short Covering |

| BankNifty Options | Fresh Short | Fresh Long | Long Covering |

| FinNifty Futures | Fresh Short | Fresh Short | Fresh Short |

| FinNifty Options | Long Covering | Fresh Long | Short Covering |

| MidcpNifty Futures | Fresh Short | Short Covering | Fresh Long |

| MidcpNifty Options | Fresh Long | Fresh Short | Fresh Long |

| NiftyNxt50 Futures | Short Covering | Long Covering | Long Covering |

| NiftyNxt50 Options | Fresh Short | Fresh Short | Fresh Long |

| Stock Futures | Long Covering | Fresh Long | Fresh Long |

| Stock Options | Fresh Long | Fresh Long | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (16/10/2025)

The SENSEX index closed at 82327.05. The SENSEX weekly expiry for OCTOBER 16, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.018 against previous 1.405. The 85000CE option holds the maximum open interest, followed by the 82000PE and 84000CE options. Market participants have shown increased interest with significant open interest additions in the 85000CE option, with open interest additions also seen in the 86000CE and 84000CE options. On the other hand, open interest reductions were prominent in the 82500PE, 82600PE, and 82700PE options. Trading volume was highest in the 82200PE option, followed by the 82000PE and 82500CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 16-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 82327.05 | 1.018 | 1.405 | 1.071 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,22,62,020 | 79,65,200 | 42,96,820 |

| PUT: | 1,24,85,100 | 1,11,91,440 | 12,93,660 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 10,75,960 | 4,46,220 | 46,39,020 |

| 84000 | 8,02,520 | 3,18,300 | 73,28,880 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 10,75,960 | 4,46,220 | 46,39,020 |

| 86000 | 7,39,660 | 3,30,760 | 37,13,800 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84900 | 78,940 | -35,560 | 6,15,020 |

| 87200 | 4,620 | -15,100 | 51,060 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 5,53,660 | 88,900 | 2,44,80,560 |

| 83000 | 6,62,520 | 2,16,680 | 2,07,56,160 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 9,96,320 | 94,080 | 2,89,75,740 |

| 79000 | 7,20,100 | 1,55,840 | 44,55,680 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 79500 | 5,43,080 | 2,91,360 | 28,75,820 |

| 82200 | 5,20,240 | 1,85,240 | 3,03,58,500 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 82500 | 2,94,940 | -3,57,580 | 1,07,86,520 |

| 82600 | 1,03,000 | -1,96,140 | 31,52,120 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 82200 | 5,20,240 | 1,85,240 | 3,03,58,500 |

| 82000 | 9,96,320 | 94,080 | 2,89,75,740 |

NIFTY Weekly Expiry (14/10/2025)

The NIFTY index closed at 25227.35. The NIFTY weekly expiry for OCTOBER 14, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.031 against previous 1.399. The 25200PE option holds the maximum open interest, followed by the 25300CE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 25200CE option, with open interest additions also seen in the 25300CE and 25250CE options. On the other hand, open interest reductions were prominent in the 25300PE, 25250PE, and 26500CE options. Trading volume was highest in the 25200PE option, followed by the 25200CE and 25300CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 14-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,227.35 | 1.031 | 1.399 | 1.005 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 18,25,08,525 | 14,98,78,575 | 3,26,29,950 |

| PUT: | 18,81,40,275 | 20,97,06,975 | -2,15,66,700 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 1,53,48,900 | 67,28,325 | 87,78,390 |

| 25,500 | 1,48,46,850 | 36,55,725 | 31,07,800 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,06,10,100 | 73,56,450 | 1,06,01,452 |

| 25,300 | 1,53,48,900 | 67,28,325 | 87,78,390 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 54,01,350 | -30,60,075 | 4,90,316 |

| 27,000 | 30,28,650 | -14,98,425 | 4,30,590 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,06,10,100 | 73,56,450 | 1,06,01,452 |

| 25,300 | 1,53,48,900 | 67,28,325 | 87,78,390 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,59,83,775 | 21,91,125 | 1,21,75,534 |

| 25,000 | 1,33,46,550 | 1,12,425 | 46,93,187 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,59,83,775 | 21,91,125 | 1,21,75,534 |

| 25,150 | 1,00,30,650 | 16,63,125 | 78,12,407 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,300 | 40,74,675 | -60,77,775 | 32,99,461 |

| 25,250 | 54,02,925 | -32,42,625 | 52,37,980 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,59,83,775 | 21,91,125 | 1,21,75,534 |

| 25,150 | 1,00,30,650 | 16,63,125 | 78,12,407 |

NIFTY Monthly Expiry (28/10/2025)

The NIFTY index closed at 25227.35. The NIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.007 against previous 1.066. The 26000CE option holds the maximum open interest, followed by the 25000PE and 25500CE options. Market participants have shown increased interest with significant open interest additions in the 25600CE option, with open interest additions also seen in the 25200CE and 25300CE options. On the other hand, open interest reductions were prominent in the 25700CE, 25800CE, and 25100PE options. Trading volume was highest in the 25000PE option, followed by the 25200CE and 25200PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,227.35 | 1.007 | 1.066 | 0.902 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,84,40,100 | 4,46,95,725 | 37,44,375 |

| PUT: | 4,87,68,975 | 4,76,66,925 | 11,02,050 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 56,35,500 | 1,57,650 | 74,183 |

| 25,500 | 47,50,350 | 4,53,675 | 1,02,061 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 25,34,925 | 13,64,625 | 80,140 |

| 25,200 | 26,99,850 | 8,63,700 | 1,15,156 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 18,66,000 | -7,36,050 | 80,076 |

| 25,800 | 21,58,875 | -3,55,800 | 63,995 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 26,99,850 | 8,63,700 | 1,15,156 |

| 25,500 | 47,50,350 | 4,53,675 | 1,02,061 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 52,67,625 | -2,26,800 | 1,20,022 |

| 24,000 | 35,16,150 | 1,13,100 | 39,856 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 25,07,775 | 4,97,775 | 1,02,773 |

| 24,900 | 19,01,700 | 3,05,625 | 37,187 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,100 | 16,12,500 | -2,88,750 | 54,422 |

| 25,000 | 52,67,625 | -2,26,800 | 1,20,022 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 52,67,625 | -2,26,800 | 1,20,022 |

| 25,200 | 25,07,775 | 4,97,775 | 1,02,773 |

BANKNIFTY Monthly Expiry (28/10/2025)

The BANKNIFTY index closed at 56625. The BANKNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.098 against previous 1.123. The 57000CE option holds the maximum open interest, followed by the 55000PE and 57000PE options. Market participants have shown increased interest with significant open interest additions in the 56700CE option, with open interest additions also seen in the 54500PE and 58500CE options. On the other hand, open interest reductions were prominent in the 56200PE, 54900PE, and 52500PE options. Trading volume was highest in the 57000CE option, followed by the 56500PE and 56500CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 56,625.00 | 1.098 | 1.123 | 0.914 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,72,94,270 | 1,65,68,160 | 7,26,110 |

| PUT: | 1,89,82,845 | 1,86,04,320 | 3,78,525 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 22,64,675 | 89,985 | 1,96,018 |

| 58,000 | 11,81,985 | -6,300 | 1,10,640 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 56,700 | 4,00,785 | 1,12,105 | 1,11,333 |

| 58,500 | 8,09,970 | 1,03,250 | 53,582 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 8,51,445 | -38,815 | 23,649 |

| 56,200 | 1,20,960 | -26,320 | 13,131 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 22,64,675 | 89,985 | 1,96,018 |

| 56,500 | 7,94,850 | 16,695 | 1,60,649 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 55,000 | 15,92,920 | -33,250 | 65,765 |

| 57,000 | 15,05,210 | 6,020 | 65,954 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 54,500 | 12,33,995 | 1,09,130 | 43,152 |

| 56,500 | 7,43,505 | 66,815 | 1,88,352 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,200 | 2,30,790 | -1,04,405 | 50,470 |

| 54,900 | 1,52,495 | -83,440 | 9,359 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 56,500 | 7,43,505 | 66,815 | 1,88,352 |

| 56,600 | 2,67,855 | 47,285 | 1,20,871 |

FINNIFTY Monthly Expiry (28/10/2025)

The FINNIFTY index closed at 26885.25. The FINNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.707 against previous 0.671. The 27300CE option holds the maximum open interest, followed by the 27200CE and 27000CE options. Market participants have shown increased interest with significant open interest additions in the 25700PE option, with open interest additions also seen in the 27550CE and 27000PE options. On the other hand, open interest reductions were prominent in the 25000PE, 27300CE, and 29000CE options. Trading volume was highest in the 27000CE option, followed by the 26800PE and 26800CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 26,885.25 | 0.707 | 0.671 | 0.761 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 11,83,585 | 11,54,465 | 29,120 |

| PUT: | 8,36,225 | 7,74,475 | 61,750 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 1,68,090 | -8,840 | 1,414 |

| 27,200 | 1,51,775 | -3,120 | 3,520 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,550 | 11,635 | 11,635 | 221 |

| 27,500 | 1,02,505 | 10,595 | 1,538 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 1,68,090 | -8,840 | 1,414 |

| 29,000 | 29,640 | -5,720 | 350 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,11,345 | -4,290 | 5,879 |

| 26,800 | 62,205 | -650 | 3,844 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 80,080 | 18,135 | 439 |

| 26,900 | 79,690 | 3,250 | 2,184 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 80,080 | 18,135 | 439 |

| 27,000 | 51,545 | 11,570 | 1,646 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 36,140 | -8,905 | 2,252 |

| 26,300 | 41,080 | -3,965 | 338 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 38,350 | -2,470 | 4,202 |

| 25,000 | 36,140 | -8,905 | 2,252 |

MIDCPNIFTY Monthly Expiry (28/10/2025)

The MIDCPNIFTY index closed at 13186.95. The MIDCPNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.268 against previous 1.285. The 12500PE option holds the maximum open interest, followed by the 14000CE and 13000PE options. Market participants have shown increased interest with significant open interest additions in the 13200CE option, with open interest additions also seen in the 13200PE and 13100PE options. On the other hand, open interest reductions were prominent in the 67900CE, 68700PE, and 68700PE options. Trading volume was highest in the 13000PE option, followed by the 13200CE and 13100PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,186.95 | 1.268 | 1.285 | 0.991 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 61,49,220 | 59,59,240 | 1,89,980 |

| PUT: | 77,98,700 | 76,60,240 | 1,38,460 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 7,11,340 | -12,460 | 3,944 |

| 13,500 | 6,74,100 | 13,720 | 14,006 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 4,98,260 | 1,72,900 | 18,465 |

| 13,775 | 1,58,620 | 38,220 | 695 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 4,61,720 | -89,600 | 8,220 |

| 13,150 | 66,640 | -13,300 | 5,774 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 4,98,260 | 1,72,900 | 18,465 |

| 13,500 | 6,74,100 | 13,720 | 14,006 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 7,44,520 | -25,900 | 5,228 |

| 13,000 | 7,09,800 | -82,740 | 18,717 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 3,82,900 | 99,540 | 9,902 |

| 13,100 | 3,46,640 | 72,100 | 17,550 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,09,800 | -82,740 | 18,717 |

| 12,900 | 3,34,740 | -28,980 | 8,826 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,09,800 | -82,740 | 18,717 |

| 13,100 | 3,46,640 | 72,100 | 17,550 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

The derivatives structure for 13th October 2025 paints an intricate picture: Nifty and Sensex see emerging fresh shorts, confirming some nervousness near recent highs, but the underlying bid in Bank Nifty, Finnifty, and midcap contracts hints at selective bullish conviction. Mixed moves in option chains, with a drop in PCR for heavyweights but stable or rising ratios for midcaps and financial indices, suggest traders are hedging risk but not abandoning longs.

The overall Open Interest Volume Analysis indicates that while headline indices may struggle for immediate direction, underlying sector strength—especially in banking and midcaps—could drive the next move once expiry noise subsides. For investors, keeping an eye on changing OI patterns helps identify where real momentum is building beneath headline volatility.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]