Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 20/10/2025

Table of Contents

The start of the trading week on October 20, 2025, brought a decisive tone to the index futures segment as the Open Interest Volume Analysis signaled a clear directional bias across major indices.

NIFTY and BANKNIFTY continued to display strength through fresh long additions at the combined futures level, confirming that institutional participants remained confident in the near-term momentum. A 5.4% rise in combined open interest for NIFTY alongside a steep 24.7% drop in volumes typically implies that the long positions are being built steadily rather than in panic.

Similarly, BANKNIFTY’s 6.8% surge in open interest shows aggressive positioning with healthy rollovers building up from 17% to 20%. The data underlines that while the market is moving gradually higher, traders are becoming selective and relying more on durable trends rather than short-term speculative spikes — a classic setup for structured long carry positions going into expiry week.

NSE & BSE F&O Market Signals

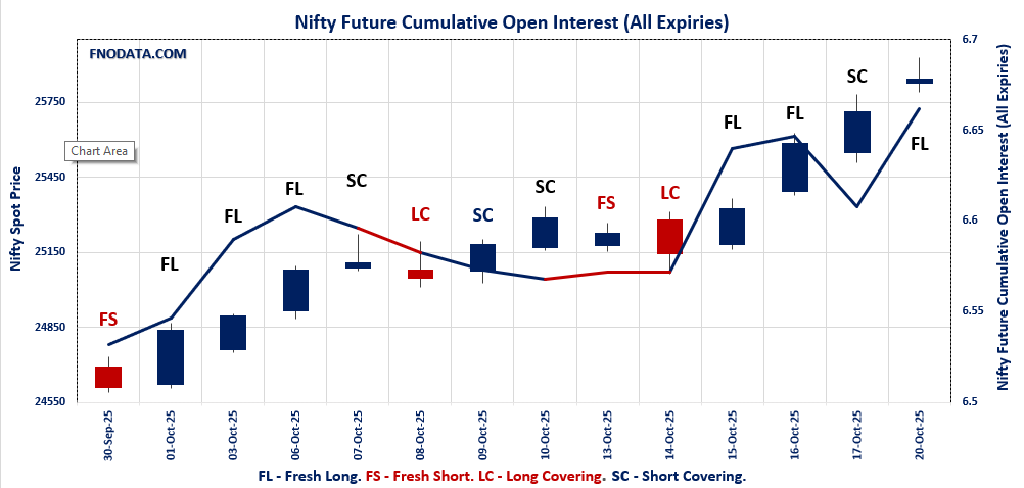

NIFTY Future analysis

NIFTY Spot closed at: 25843.15 (0.5%)

Combined = October + November + December

Combined Fut Open Interest Change: 5.4%

Combined Fut Volume Change: -24.7%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 16% Previous 15%

NIFTY OCTOBER Future closed at: 25915.1 (0.6%)

October Fut Premium 71.95 (Increased by 24 points)

October Fut Open Interest Change: 3.8%

October Fut Volume Change: -28.7%

October Fut Open Interest Analysis: Fresh Long

NIFTY NOVEMBER Future closed at: 26046.3 (0.6%)

November Fut Premium 203.15 (Increased by 20.6 points)

November Fut Open Interest Change: 16.0%

November Fut Volume Change: 9.4%

November Fut Open Interest Analysis: Fresh Long

NIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.036 (Decreased from 1.064)

Put-Call Ratio (Volume): 0.969

Max Pain Level: 25650

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26500

Highest PUT Addition: 25700

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 58033.2 (0.6%)

Combined = October + November + December

Combined Fut Open Interest Change: 6.8%

Combined Fut Volume Change: -20.1%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 20% Previous 17%

BANKNIFTY OCTOBER Future closed at: 58099.6 (0.6%)

October Fut Premium 66.4 (Increased by 22.55 points)

October Fut Open Interest Change: 2.9%

October Fut Volume Change: -24.0%

October Fut Open Interest Analysis: Fresh Long

BANKNIFTY NOVEMBER Future closed at: 58382 (0.6%)

November Fut Premium 348.8 (Increased by 4.55 points)

November Fut Open Interest Change: 26.9%

November Fut Volume Change: 4.7%

November Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.130 (Decreased from 1.168)

Put-Call Ratio (Volume): 0.999

Max Pain Level: 57000

Maximum CALL Open Interest: 57000

Maximum PUT Open Interest: 57000

Highest CALL Addition: 58200

Highest PUT Addition: 58000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27505.5 (-0.1%)

Combined = October + November + December

Combined Fut Open Interest Change: -1.4%

Combined Fut Volume Change: -38.9%

Combined Fut Open Interest Analysis: Long Covering

Rollover: 12% Previous 9%

FINNIFTY OCTOBER Future closed at: 27550.2 (0.0%)

October Fut Premium 44.7 (Increased by 24 points)

October Fut Open Interest Change: -3.8%

October Fut Volume Change: -42.4%

October Fut Open Interest Analysis: Long Covering

FINNIFTY NOVEMBER Future closed at: 27676.3 (0.0%)

November Fut Premium 170.8 (Increased by 32.8 points)

November Fut Open Interest Change: 23.0%

November Fut Volume Change: -14.1%

November Fut Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.256 (Increased from 1.233)

Put-Call Ratio (Volume): 0.974

Max Pain Level: 27300

Maximum CALL Open Interest: 27500

Maximum PUT Open Interest: 26500

Highest CALL Addition: 29000

Highest PUT Addition: 27000

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13232.9 (0.5%)

Combined = October + November + December

Combined Fut Open Interest Change: -6.7%

Combined Fut Volume Change: 0.6%

Combined Fut Open Interest Analysis: Short Covering

Rollover: 6% Previous 5%

MIDCPNIFTY OCTOBER Future closed at: 13258 (0.5%)

October Fut Premium 25.1 (Decreased by -3.95 points)

October Fut Open Interest Change: -7.7%

October Fut Volume Change: 0.9%

October Fut Open Interest Analysis: Short Covering

MIDCPNIFTY NOVEMBER Future closed at: 13314.15 (0.5%)

November Fut Premium 81.25 (Decreased by -6 points)

November Fut Open Interest Change: 11.4%

November Fut Volume Change: -1.1%

November Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.049 (Decreased from 1.061)

Put-Call Ratio (Volume): 0.715

Max Pain Level: 13200

Maximum CALL Open Interest: 13500

Maximum PUT Open Interest: 12500

Highest CALL Addition: 13300

Highest PUT Addition: 13300

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 84,363.37 (0.49%)

SENSEX Monthly Future closed at: 84,665.75 (0.65%)

Premium: 302.38 (Increased by 133.02 points)

Open Interest Change: -8.9%

Volume Change: -34.6%

Open Interest Analysis: Short Covering

SENSEX Weekly Expiry (23/10/2025) Option Analysis

Put-Call Ratio (OI): 0.856 (Decreased from 1.074)

Put-Call Ratio (Volume): 0.941

Max Pain Level: 84400

Maximum CALL OI: 85000

Maximum PUT OI: 82000

Highest CALL Addition: 85000

Highest PUT Addition: 82000

FII & DII Cash Market Activity

FIIs Net BUY: ₹ 790.45 Cr.

DIIs Net BUY: ₹ 2,485.46 Cr.

FII Derivatives Activity

| FII Trading Stats | 20.10.25 | 17.10.25 | 16.10.25 |

| FII Cash (Provisional Data) | 790.45 | 308.98 | 997.29 |

| Index Future Open Interest Long Ratio | 18.65% | 16.60% | 13.80% |

| Index Future Volume Long Ratio | 56.53% | 69.26% | 73.70% |

| Call Option Open Interest Long Ratio | 53.03% | 53.84% | 54.88% |

| Call Option Volume Long Ratio | 49.99% | 49.96% | 50.74% |

| Put Option Open Interest Long Ratio | 64.43% | 60.79% | 62.57% |

| Put Option Volume Long Ratio | 50.07% | 49.97% | 50.23% |

| Stock Future Open Interest Long Ratio | 60.58% | 60.33% | 60.50% |

| Stock Future Volume Long Ratio | 53.04% | 49.47% | 50.75% |

| Index Futures | Short Covering | Short Covering | Fresh Long |

| Index Options | Short Covering | Fresh Short | Fresh Long |

| Nifty Futures | Short Covering | Short Covering | Short Covering |

| Nifty Options | Short Covering | Fresh Short | Fresh Long |

| BankNifty Futures | Short Covering | Short Covering | Fresh Long |

| BankNifty Options | Long Covering | Fresh Short | Fresh Long |

| FinNifty Futures | Short Covering | Short Covering | Fresh Long |

| FinNifty Options | Short Covering | Fresh Long | Fresh Long |

| MidcpNifty Futures | Short Covering | Short Covering | Fresh Short |

| MidcpNifty Options | Long Covering | Fresh Long | Fresh Long |

| NiftyNxt50 Futures | Long Covering | Short Covering | Fresh Short |

| NiftyNxt50 Options | Short Covering | Fresh Short | Long Covering |

| Stock Futures | Short Covering | Fresh Short | Fresh Long |

| Stock Options | Long Covering | Fresh Long | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (23/10/2025)

The SENSEX index closed at 84363.37. The SENSEX weekly expiry for OCTOBER 23, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.856 against previous 1.074. The 82000PE option holds the maximum open interest, followed by the 85000CE and 87000CE options. Market participants have shown increased interest with significant open interest additions in the 82000PE option, with open interest additions also seen in the 85000CE and 87000CE options. On the other hand, open interest reductions were prominent in the 79500PE, 84000CE, and 84100CE options. Trading volume was highest in the 84500CE option, followed by the 84500PE and 85000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 23-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 84363.37 | 0.856 | 1.074 | 0.941 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,45,66,820 | 97,91,540 | 1,47,75,280 |

| PUT: | 2,10,36,020 | 1,05,19,240 | 1,05,16,780 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 17,46,580 | 11,95,460 | 2,56,44,400 |

| 87000 | 17,14,880 | 11,78,480 | 71,94,320 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 17,46,580 | 11,95,460 | 2,56,44,400 |

| 87000 | 17,14,880 | 11,78,480 | 71,94,320 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84000 | 3,52,720 | -1,61,540 | 52,81,440 |

| 84100 | 1,04,600 | -1,51,180 | 23,91,140 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 13,96,260 | 9,72,600 | 3,41,65,540 |

| 85000 | 17,46,580 | 11,95,460 | 2,56,44,400 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 20,92,960 | 16,54,040 | 96,37,540 |

| 84000 | 14,70,220 | 10,37,200 | 2,29,66,120 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 82000 | 20,92,960 | 16,54,040 | 96,37,540 |

| 84000 | 14,70,220 | 10,37,200 | 2,29,66,120 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 79500 | 1,81,340 | -1,67,220 | 25,51,060 |

| 78500 | 88,320 | -1,05,040 | 11,88,180 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 9,25,260 | 8,61,200 | 2,62,48,140 |

| 84000 | 14,70,220 | 10,37,200 | 2,29,66,120 |

NIFTY Monthly Expiry (28/10/2025)

The NIFTY index closed at 25843.15. The NIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.036 against previous 1.064. The 26000CE option holds the maximum open interest, followed by the 25000PE and 26500CE options. Market participants have shown increased interest with significant open interest additions in the 25700PE option, with open interest additions also seen in the 26500CE and 27000CE options. On the other hand, open interest reductions were prominent in the 25700CE, 24850PE, and 24800PE options. Trading volume was highest in the 26000CE option, followed by the 25900CE and 25800PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,843.15 | 1.036 | 1.064 | 0.969 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 10,76,02,725 | 7,33,48,275 | 3,42,54,450 |

| PUT: | 11,14,37,925 | 7,80,42,975 | 3,33,94,950 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 92,61,375 | 30,54,075 | 8,68,637 |

| 26,500 | 84,59,925 | 31,22,700 | 3,86,609 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 84,59,925 | 31,22,700 | 3,86,609 |

| 27,000 | 72,90,525 | 30,78,375 | 1,89,811 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 22,00,575 | -7,88,925 | 1,23,841 |

| 25,750 | 6,20,925 | -2,65,875 | 65,429 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 92,61,375 | 30,54,075 | 8,68,637 |

| 25,900 | 53,35,575 | 24,82,200 | 7,39,834 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 88,52,250 | 11,65,050 | 2,91,367 |

| 25,500 | 74,65,575 | 17,78,100 | 3,65,016 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,700 | 59,24,400 | 33,32,625 | 3,52,060 |

| 25,900 | 29,31,600 | 26,21,850 | 4,62,160 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,850 | 5,59,200 | -6,96,975 | 47,629 |

| 24,800 | 39,23,775 | -3,87,150 | 1,82,955 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 41,69,625 | 20,41,875 | 5,41,153 |

| 25,900 | 29,31,600 | 26,21,850 | 4,62,160 |

BANKNIFTY Monthly Expiry (28/10/2025)

The BANKNIFTY index closed at 58033.2. The BANKNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.130 against previous 1.168. The 57000PE option holds the maximum open interest, followed by the 57000CE and 55000PE options. Market participants have shown increased interest with significant open interest additions in the 58000PE option, with open interest additions also seen in the 58200CE and 60000CE options. On the other hand, open interest reductions were prominent in the 56400PE, 57000CE, and 56300PE options. Trading volume was highest in the 58000CE option, followed by the 58000PE and 58200CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 58,033.20 | 1.130 | 1.168 | 0.999 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,96,75,390 | 1,84,53,785 | 12,21,605 |

| PUT: | 2,22,23,670 | 2,15,57,375 | 6,66,295 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 17,65,645 | -1,97,260 | 21,616 |

| 58,000 | 15,02,585 | 1,68,000 | 3,41,891 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,200 | 5,58,355 | 2,95,365 | 2,18,975 |

| 60,000 | 12,58,425 | 2,85,005 | 1,17,682 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 17,65,645 | -1,97,260 | 21,616 |

| 57,700 | 1,65,655 | -1,85,080 | 37,510 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 15,02,585 | 1,68,000 | 3,41,891 |

| 58,200 | 5,58,355 | 2,95,365 | 2,18,975 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 22,14,380 | -87,395 | 1,65,700 |

| 55,000 | 17,21,510 | 1,04,405 | 1,04,015 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 9,19,520 | 5,79,215 | 2,61,279 |

| 57,400 | 4,32,460 | 2,60,400 | 53,013 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,400 | 1,61,420 | -2,62,850 | 31,425 |

| 56,300 | 1,86,025 | -1,86,200 | 24,467 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 9,19,520 | 5,79,215 | 2,61,279 |

| 57,000 | 22,14,380 | -87,395 | 1,65,700 |

FINNIFTY Monthly Expiry (28/10/2025)

The FINNIFTY index closed at 27505.5. The FINNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.256 against previous 1.233. The 26500PE option holds the maximum open interest, followed by the 27000PE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 27000PE option, with open interest additions also seen in the 26000PE and 29000CE options. On the other hand, open interest reductions were prominent in the 26400PE, 28200CE, and 26850PE options. Trading volume was highest in the 27600CE option, followed by the 27500PE and 27700CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,505.50 | 1.256 | 1.233 | 0.974 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 12,88,885 | 10,32,980 | 2,55,905 |

| PUT: | 16,18,955 | 12,74,130 | 3,44,825 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,20,705 | 27,560 | 6,145 |

| 28,000 | 85,930 | 5,785 | 4,548 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 29,000 | 79,430 | 36,075 | 2,717 |

| 27,700 | 50,570 | 30,940 | 6,290 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 28,200 | 22,425 | -6,500 | 1,035 |

| 27,300 | 43,030 | -5,525 | 291 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 72,215 | 24,830 | 10,039 |

| 27,700 | 50,570 | 30,940 | 6,290 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,44,235 | 12,545 | 2,938 |

| 27,000 | 1,38,125 | 67,210 | 5,883 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,38,125 | 67,210 | 5,883 |

| 26,000 | 1,31,560 | 46,345 | 3,105 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,400 | 37,635 | -7,020 | 386 |

| 26,850 | 19,110 | -6,045 | 331 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 80,080 | 26,975 | 8,082 |

| 27,000 | 1,38,125 | 67,210 | 5,883 |

MIDCPNIFTY Monthly Expiry (28/10/2025)

The MIDCPNIFTY index closed at 13232.9. The MIDCPNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.049 against previous 1.061. The 12500PE option holds the maximum open interest, followed by the 13500CE and 13300CE options. Market participants have shown increased interest with significant open interest additions in the 13300CE option, with open interest additions also seen in the 13300PE and 13500CE options. On the other hand, open interest reductions were prominent in the 68500CE, 68400CE, and 68400CE options. Trading volume was highest in the 13400CE option, followed by the 13500CE and 13300CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,232.90 | 1.049 | 1.061 | 0.715 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 99,16,900 | 83,26,500 | 15,90,400 |

| PUT: | 1,04,03,260 | 88,30,780 | 15,72,480 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 11,18,460 | 2,96,660 | 34,722 |

| 13,300 | 10,92,700 | 5,62,100 | 32,767 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 10,92,700 | 5,62,100 | 32,767 |

| 13,500 | 11,18,460 | 2,96,660 | 34,722 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,775 | 1,07,940 | -62,300 | 861 |

| 13,150 | 45,640 | -45,920 | 1,254 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 7,28,280 | 2,08,460 | 42,562 |

| 13,500 | 11,18,460 | 2,96,660 | 34,722 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 12,500 | 11,65,080 | 36,960 | 9,240 |

| 13,000 | 10,46,920 | 1,81,580 | 20,475 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 6,50,300 | 4,27,560 | 19,288 |

| 12,600 | 7,65,380 | 1,96,000 | 5,461 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 12,800 | 4,75,860 | -75,320 | 9,302 |

| 12,100 | 77,280 | -38,080 | 1,668 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,200 | 8,19,840 | 1,48,680 | 24,336 |

| 13,000 | 10,46,920 | 1,81,580 | 20,475 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

To sum up, today’s Open Interest Volume Analysis points toward an early-stage bullish consolidation across the large-cap indices, but with clear divergences in midcap and financial space. FINNIFTY’s long-covering and MIXED formation, combined with MIDCPNIFTY’s short-covering tone, reveal that breadth is yet to fully support the headline indices.

The overall derivative structure suggests a “buy on dips” approach remains valid for NIFTY and BANKNIFTY as long as rollovers continue to strengthen and OI expansion sustains above current levels.

However, traders should remain vigilant for any spike in unwinding as low volume confirmation warns against over-leveraged trades. Smart money is still building exposure selectively.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]