Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 27/10/2025

Table of Contents

Combined open interest moved higher across all majors (NIFTY, BANKNIFTY, FINNIFTY, MIDCPNIFTY, SENSEX), indicating fresh long buildup in the market in today’s session—the tone is supportive for bulls with expiry week in play.

Rollover jumped sharply in every segment, showing confidence among traders to carry forward positions to November contracts; momentum has shifted from caution to aggressive positioning.

Elevated open interest and rising premiums in November futures (especially NIFTY, BANKNIFTY, FINNIFTY) reflect strong conviction in uptrend continuation and improves risk/reward for long bets into expiry.

October futures across indices are experiencing short covering, which further supports the bullish undertone as sellers unwind and buyers take charge.

“Open Interest Volume Analysis” now points to real money entering the market behind the up-move, with data signaling an inflection higher in overall sentiment.

NSE & BSE F&O Market Signals

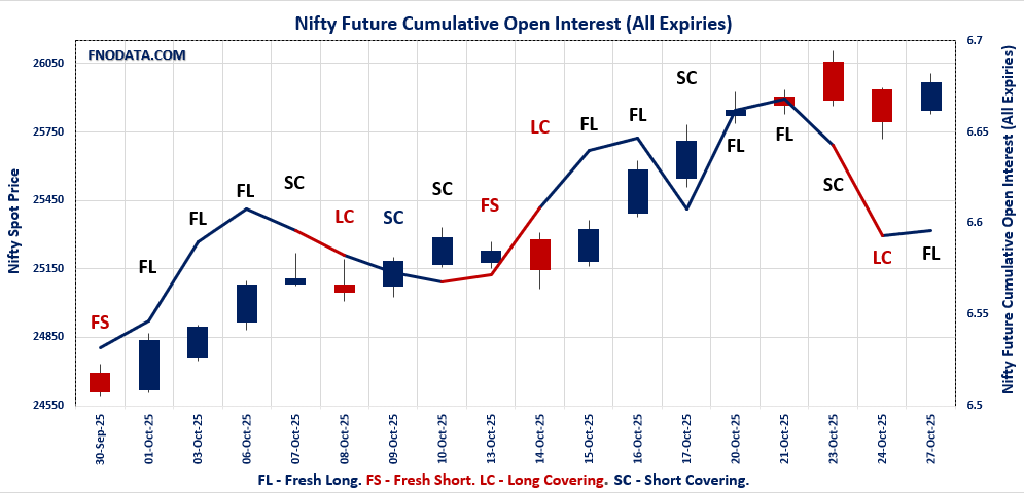

NIFTY Future analysis

NIFTY Spot closed at: 25966.05 (0.7%)

Combined = October + November + December

Combined Fut Open Interest Change: 0.3%

Combined Fut Volume Change: 41.3%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 57% Previous 33%

NIFTY OCTOBER Future closed at: 26013.5 (0.8%)

October Fut Premium 47.45 (Increased by 27.8 points)

October Fut Open Interest Change: -34.8%

October Fut Volume Change: 11.3%

October Fut Open Interest Analysis: Short Covering

NIFTY NOVEMBER Future closed at: 26168.4 (0.8%)

November Fut Premium 202.35 (Increased by 45.5 points)

November Fut Open Interest Change: 78.8%

November Fut Volume Change: 103.3%

November Fut Open Interest Analysis: Fresh Long

NIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.060 (Increased from 0.657)

Put-Call Ratio (Volume): 0.974

Max Pain Level: 25950

Maximum CALL Open Interest: 26500

Maximum PUT Open Interest: 25900

Highest CALL Addition: 26550

Highest PUT Addition: 25900

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 58114.25 (0.7%)

Combined = October + November + December

Combined Fut Open Interest Change: 7.1%

Combined Fut Volume Change: 9.1%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 62% Previous 43%

BANKNIFTY OCTOBER Future closed at: 58183.2 (0.8%)

October Fut Premium 68.95 (Increased by 65.35 points)

October Fut Open Interest Change: -28.3%

October Fut Volume Change: -1.3%

October Fut Open Interest Analysis: Short Covering

BANKNIFTY NOVEMBER Future closed at: 58501.6 (0.9%)

November Fut Premium 387.35 (Increased by 86.15 points)

November Fut Open Interest Change: 60.9%

November Fut Volume Change: 27.4%

November Fut Open Interest Analysis: Fresh Long

BANKNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.056 (Increased from 0.836)

Put-Call Ratio (Volume): 0.911

Max Pain Level: 57800

Maximum CALL Open Interest: 59000

Maximum PUT Open Interest: 58000

Highest CALL Addition: 58200

Highest PUT Addition: 58000

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27519 (0.5%)

Combined = October + November + December

Combined Fut Open Interest Change: 0.7%

Combined Fut Volume Change: 55.5%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 41% Previous 19%

FINNIFTY OCTOBER Future closed at: 27568.6 (0.6%)

October Fut Premium 49.6 (Increased by 44.3 points)

October Fut Open Interest Change: -25.9%

October Fut Volume Change: 18.9%

October Fut Open Interest Analysis: Short Covering

FINNIFTY NOVEMBER Future closed at: 27678 (0.5%)

November Fut Premium 159 (Increased by 25.9 points)

November Fut Open Interest Change: 112.9%

November Fut Volume Change: 124.1%

November Fut Open Interest Analysis: Fresh Long

FINNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.077 (Increased from 1.029)

Put-Call Ratio (Volume): 1.045

Max Pain Level: 27500

Maximum CALL Open Interest: 27700

Maximum PUT Open Interest: 27500

Highest CALL Addition: 27950

Highest PUT Addition: 27500

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13345.3 (1.4%)

Combined = October + November + December

Combined Fut Open Interest Change: 6.3%

Combined Fut Volume Change: -26.5%

Combined Fut Open Interest Analysis: Fresh Long

Rollover: 67% Previous 46%

MIDCPNIFTY OCTOBER Future closed at: 13367.75 (1.5%)

October Fut Premium 22.45 (Increased by 18.95 points)

October Fut Open Interest Change: -34.4%

October Fut Volume Change: -36.7%

October Fut Open Interest Analysis: Short Covering

MIDCPNIFTY NOVEMBER Future closed at: 13415.75 (1.5%)

November Fut Premium 70.45 (Increased by 11.85 points)

November Fut Open Interest Change: 54.3%

November Fut Volume Change: -11.0%

November Fut Open Interest Analysis: Fresh Long

MIDCPNIFTY Monthly Expiry (28/10/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.203 (Increased from 0.874)

Put-Call Ratio (Volume): 0.844

Max Pain Level: 13300

Maximum CALL Open Interest: 13400

Maximum PUT Open Interest: 13300

Highest CALL Addition: 13400

Highest PUT Addition: 13300

SENSEX Monthly Expiry (30/10/2025) Future

SENSEX Spot closed at: 84,778.84 (0.67%)

SENSEX Monthly Future closed at: 84,980.50 (0.83%)

Premium: 201.66 (Increased by 129.79 points)

Open Interest Change: 0.5%

Volume Change: -38.0%

Open Interest Analysis: Fresh Long

SENSEX Weekly Expiry (30/10/2025) Option Analysis

Put-Call Ratio (OI): 1.088 (Increased from 0.548)

Put-Call Ratio (Volume): 0.852

Max Pain Level: 84700

Maximum CALL OI: 85000

Maximum PUT OI: 80000

Highest CALL Addition: 87000

Highest PUT Addition: 81000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 55.58 Cr.

DIIs Net BUY: ₹ 2,492.12 Cr.

FII Derivatives Activity

| FII Trading Stats | 27.10.25 | 24.10.25 | 23.10.25 |

| FII Cash (Provisional Data) | -55.58 | 621.51 | -1,165.94 |

| Index Future Open Interest Long Ratio | 25.69% | 24.84% | 23.87% |

| Index Future Volume Long Ratio | 49.53% | 53.54% | 63.57% |

| Call Option Open Interest Long Ratio | 52.03% | 51.91% | 53.24% |

| Call Option Volume Long Ratio | 49.98% | 49.91% | 50.23% |

| Put Option Open Interest Long Ratio | 58.78% | 60.69% | 61.32% |

| Put Option Volume Long Ratio | 49.86% | 50.03% | 50.06% |

| Stock Future Open Interest Long Ratio | 61.98% | 61.48% | 61.63% |

| Stock Future Volume Long Ratio | 50.93% | 49.81% | 51.54% |

| Index Futures | Fresh Short | Short Covering | Short Covering |

| Index Options | Long Covering | Fresh Short | Fresh Long |

| Nifty Futures | Fresh Short | Short Covering | Short Covering |

| Nifty Options | Long Covering | Fresh Short | Fresh Long |

| BankNifty Futures | Fresh Short | Fresh Long | Fresh Long |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Long Covering | Fresh Short | Fresh Long |

| FinNifty Options | Short Covering | Fresh Short | Short Covering |

| MidcpNifty Futures | Fresh Short | Short Covering | Fresh Long |

| MidcpNifty Options | Fresh Short | Fresh Short | Fresh Short |

| NiftyNxt50 Futures | Short Covering | Short Covering | Short Covering |

| NiftyNxt50 Options | Fresh Long | Fresh Long | Fresh Long |

| Stock Futures | Fresh Long | Long Covering | Fresh Long |

| Stock Options | Long Covering | Short Covering | Fresh Long |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (30/10/2025)

The SENSEX index closed at 84778.84. The SENSEX weekly expiry for OCTOBER 30, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.088 against previous 0.548. The 85000CE option holds the maximum open interest, followed by the 80000PE and 81000PE options. Market participants have shown increased interest with significant open interest additions in the 81000PE option, with open interest additions also seen in the 82000PE and 84500PE options. On the other hand, open interest reductions were prominent in the 88000CE, 84500CE, and 84300CE options. Trading volume was highest in the 85000CE option, followed by the 84500PE and 84800PE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 30-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 84778.84 | 1.088 | 0.548 | 0.852 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,02,84,780 | 1,12,67,900 | -9,83,120 |

| PUT: | 1,11,94,320 | 61,72,220 | 50,22,100 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 7,23,240 | 19,780 | 2,04,44,780 |

| 88000 | 6,22,020 | -2,99,400 | 53,43,360 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 5,61,380 | 1,19,780 | 65,73,020 |

| 84900 | 2,40,280 | 97,460 | 1,12,00,180 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 88000 | 6,22,020 | -2,99,400 | 53,43,360 |

| 84500 | 2,88,380 | -2,82,340 | 88,20,760 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 85000 | 7,23,240 | 19,780 | 2,04,44,780 |

| 84800 | 2,74,000 | 94,440 | 1,38,11,260 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 7,06,160 | 1,57,620 | 30,39,420 |

| 81000 | 6,79,860 | 4,31,800 | 37,18,820 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 81000 | 6,79,860 | 4,31,800 | 37,18,820 |

| 82000 | 6,59,840 | 4,10,400 | 41,05,940 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 83900 | 1,35,360 | -18,720 | 32,74,680 |

| 79900 | 23,100 | -10,740 | 1,05,900 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 84500 | 6,24,060 | 3,78,340 | 1,70,70,140 |

| 84800 | 3,21,040 | 2,58,000 | 1,57,64,940 |

NIFTY Monthly Expiry (28/10/2025)

The NIFTY index closed at 25966.05. The NIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.060 against previous 0.657. The 26500CE option holds the maximum open interest, followed by the 25900PE and 25500PE options. Market participants have shown increased interest with significant open interest additions in the 25900PE option, with open interest additions also seen in the 26000PE and 25950PE options. On the other hand, open interest reductions were prominent in the 27000CE, 25900CE, and 26000CE options. Trading volume was highest in the 26000CE option, followed by the 25900PE and 26000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,966.05 | 1.060 | 0.657 | 0.974 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 19,86,60,675 | 25,63,39,650 | -5,76,78,975 |

| PUT: | 21,05,65,500 | 16,84,02,300 | 4,21,63,200 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 1,72,54,650 | -30,17,325 | 18,83,299 |

| 26,100 | 1,28,73,075 | -6,92,625 | 70,09,497 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,550 | 37,57,350 | 8,74,950 | 5,92,965 |

| 26,350 | 49,54,125 | 3,73,050 | 15,63,370 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,000 | 1,09,56,375 | -76,98,750 | 10,47,986 |

| 25,900 | 43,09,950 | -67,68,075 | 44,03,595 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,20,48,375 | -57,96,225 | 1,03,19,690 |

| 26,100 | 1,28,73,075 | -6,92,625 | 70,09,497 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 1,36,62,375 | 98,98,050 | 84,40,636 |

| 25,500 | 1,32,58,425 | 4,57,200 | 14,33,817 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 1,36,62,375 | 98,98,050 | 84,40,636 |

| 26,000 | 1,22,18,175 | 82,16,175 | 81,69,356 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 24,800 | 49,85,475 | -14,83,275 | 6,87,604 |

| 24,000 | 46,72,575 | -11,34,450 | 3,84,162 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,900 | 1,36,62,375 | 98,98,050 | 84,40,636 |

| 26,000 | 1,22,18,175 | 82,16,175 | 81,69,356 |

BANKNIFTY Monthly Expiry (28/10/2025)

The BANKNIFTY index closed at 58114.25. The BANKNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.056 against previous 0.836. The 58000PE option holds the maximum open interest, followed by the 59000CE and 57000PE options. Market participants have shown increased interest with significant open interest additions in the 58000PE option, with open interest additions also seen in the 58100PE and 58200PE options. On the other hand, open interest reductions were prominent in the 59500CE, 58000CE, and 56000PE options. Trading volume was highest in the 58000PE option, followed by the 58000CE and 58200CE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 58,114.25 | 1.056 | 0.836 | 0.911 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 2,12,88,295 | 2,52,12,390 | -39,24,095 |

| PUT: | 2,24,84,700 | 2,10,87,815 | 13,96,885 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 59,000 | 14,79,065 | -1,33,420 | 5,12,801 |

| 58,500 | 13,99,230 | -2,46,365 | 8,82,604 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,200 | 8,31,775 | 1,26,735 | 10,05,231 |

| 58,900 | 3,28,545 | 1,08,570 | 1,83,809 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 59,500 | 9,85,250 | -5,29,480 | 2,32,281 |

| 58,000 | 12,88,490 | -3,92,595 | 11,71,728 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 12,88,490 | -3,92,595 | 11,71,728 |

| 58,200 | 8,31,775 | 1,26,735 | 10,05,231 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 19,01,760 | 11,53,565 | 14,62,695 |

| 57,000 | 14,48,160 | -1,22,185 | 3,59,956 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 19,01,760 | 11,53,565 | 14,62,695 |

| 58,100 | 6,77,005 | 5,49,185 | 8,02,255 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 56,000 | 13,30,315 | -3,32,430 | 2,12,827 |

| 53,000 | 3,75,655 | -2,95,260 | 54,723 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 19,01,760 | 11,53,565 | 14,62,695 |

| 58,100 | 6,77,005 | 5,49,185 | 8,02,255 |

FINNIFTY Monthly Expiry (28/10/2025)

The FINNIFTY index closed at 27519. The FINNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.077 against previous 1.029. The 27500PE option holds the maximum open interest, followed by the 27700CE and 27600CE options. Market participants have shown increased interest with significant open interest additions in the 27500PE option, with open interest additions also seen in the 27400PE and 27450PE options. On the other hand, open interest reductions were prominent in the 26500PE, 26700PE, and 26400PE options. Trading volume was highest in the 27500PE option, followed by the 27600CE and 27700CE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,519.00 | 1.077 | 1.029 | 1.045 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 17,62,540 | 18,67,320 | -1,04,780 |

| PUT: | 18,98,715 | 19,21,205 | -22,490 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,700 | 1,54,960 | -3,510 | 43,261 |

| 27,600 | 1,49,890 | -8,775 | 64,523 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,950 | 56,485 | 43,420 | 6,336 |

| 27,500 | 1,34,290 | 27,885 | 42,480 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 32,825 | -28,990 | 1,158 |

| 27,300 | 32,825 | -28,990 | 1,158 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,600 | 1,49,890 | -8,775 | 64,523 |

| 27,700 | 1,54,960 | -3,510 | 43,261 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,70,560 | 88,660 | 82,798 |

| 27,300 | 1,19,925 | 41,535 | 18,590 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,70,560 | 88,660 | 82,798 |

| 27,400 | 1,10,045 | 77,935 | 40,556 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,500 | 80,860 | -1,15,635 | 8,867 |

| 26,700 | 33,995 | -62,920 | 7,894 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,70,560 | 88,660 | 82,798 |

| 27,400 | 1,10,045 | 77,935 | 40,556 |

MIDCPNIFTY Monthly Expiry (28/10/2025)

The MIDCPNIFTY index closed at 13345.3. The MIDCPNIFTY monthly expiry for OCTOBER 28, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.203 against previous 0.874. The 13300PE option holds the maximum open interest, followed by the 13400CE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 13300PE option, with open interest additions also seen in the 13400CE and 13350PE options. On the other hand, open interest reductions were prominent in the 69200CE, 67000PE, and 69300PE options. Trading volume was highest in the 13300CE option, followed by the 13400CE and 13300PE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 28-10-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,345.30 | 1.203 | 0.874 | 0.844 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,19,99,680 | 1,31,05,120 | -11,05,440 |

| PUT: | 1,44,30,920 | 1,14,47,940 | 29,82,980 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 16,54,660 | 6,17,680 | 1,77,428 |

| 13,500 | 13,66,260 | 1,68,140 | 1,12,176 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,400 | 16,54,660 | 6,17,680 | 1,77,428 |

| 13,450 | 8,03,460 | 5,40,400 | 60,826 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 9,21,200 | -13,49,320 | 1,85,085 |

| 13,200 | 4,84,260 | -10,02,400 | 32,111 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 9,21,200 | -13,49,320 | 1,85,085 |

| 13,400 | 16,54,660 | 6,17,680 | 1,77,428 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 23,15,740 | 16,81,120 | 1,76,440 |

| 13,200 | 12,67,420 | 5,71,620 | 1,13,462 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 23,15,740 | 16,81,120 | 1,76,440 |

| 13,350 | 6,94,400 | 5,84,220 | 61,417 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 8,99,360 | -7,71,540 | 53,100 |

| 12,900 | 4,31,480 | -2,74,120 | 28,036 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,300 | 23,15,740 | 16,81,120 | 1,76,440 |

| 13,200 | 12,67,420 | 5,71,620 | 1,13,462 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Today’s Open Interest Volume Analysis highlights the beginning of a fresh leg higher in major indices, reset by aggressive long positions being rolled into November.

Option data (put-call ratios climbing above 1 and rising max pain levels) further confirm a favorable environment for buyers, suggesting the path of least resistance is up.

Actionable advice: Focus on dips for accumulation while tracking OI spikes in November contracts; avoid chasing, look for confirmatory volume and open interest trends.

Momentum traders should stay nimble, but there’s room for swing longs as rollover data and OI analytics align bullishly in today’s Open Interest Volume Analysis.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]