Turning Complex Derivative Data into Clear Market Insights

NSE & BSE Indices Futures and Options Open Interest Volume Analysis for 6/11/2025

Table of Contents

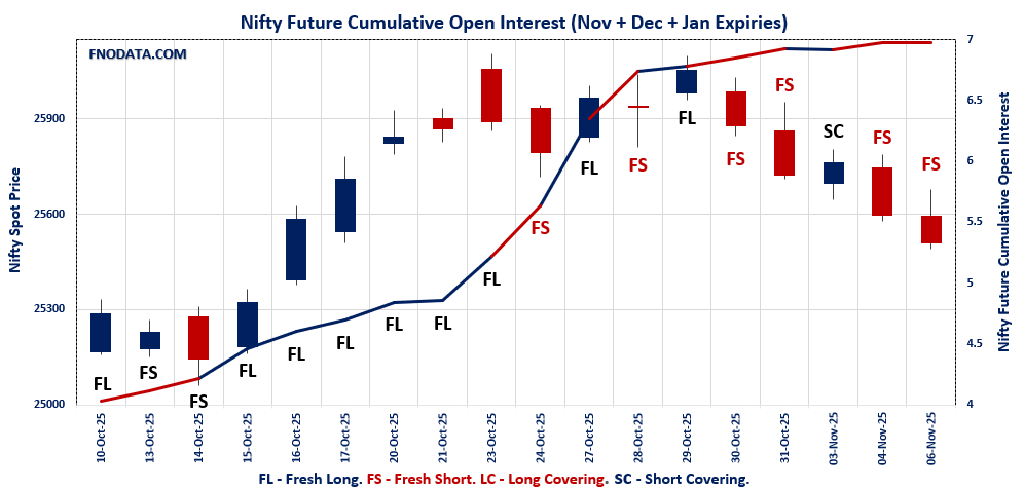

NIFTY’s Open Interest Volume Analysis signals renewed bearish momentum: Combined open interest ticks up 0.2% on further price decline, confirming persistent fresh short building across November, December, and January series.

Fresh shorts visible in near-month and far-month contracts: December OI up +2%, spot and futures down -0.3% to -0.4%—consistent short-side bias as new sellers dominate over the end-of-week.

Options PCR deteriorates: Weekly put-call ratio drops sharply to 0.627, monthly at 1.045, reinforcing the bearish tilt as call writers ramp up activity with each dip.

Key option levels anchor at 25600: Max pain aligns exactly at heavy addition levels, suggesting the market expects limited bounce and consolidation below resistance zones.

Premiums expand while prices fall: Growing futures premium points to increased volatility, with sellers pricing in deeper downside or risk hedging at current levels.

NSE & BSE F&O Market Signals

NIFTY Future analysis

NIFTY Spot closed at: 25509.7 (-0.3%)

Combined = November + December + January

Combined Fut Open Interest Change: 0.2%

Combined Fut Volume Change: -19.0%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 8% Previous 7%

NIFTY NOVEMBER Future closed at: 25627.2 (-0.3%)

November Fut Premium 117.5 (Increased by 6.85 points)

November Fut Open Interest Change: -0.1%

November Fut Volume Change: -20.9%

November Fut Open Interest Analysis: Long Covering

NIFTY DECEMBER Future closed at: 25807.1 (-0.4%)

December Fut Premium 297.4 (Decreased by -2.85 points)

December Fut Open Interest Change: 2.0%

December Fut Volume Change: 12.6%

December Fut Open Interest Analysis: Fresh Short

NIFTY Weekly Expiry (11/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.627 (Decreased from 0.733)

Put-Call Ratio (Volume): 0.947

Max Pain Level: 25600

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 25600

Highest PUT Addition: 25500

NIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 1.045 (Decreased from 1.108)

Put-Call Ratio (Volume): 0.826

Max Pain Level: 25900

Maximum CALL Open Interest: 26000

Maximum PUT Open Interest: 25000

Highest CALL Addition: 26100

Highest PUT Addition: 25600

BANKNIFTY Future Analysis

BANKNIFTY Spot closed at: 57554.25 (-0.5%)

Combined = November + December + January

Combined Fut Open Interest Change: 5.7%

Combined Fut Volume Change: -1.1%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 9% Previous 10%

BANKNIFTY NOVEMBER Future closed at: 57886.8 (-0.4%)

November Fut Premium332.55 (Increased by 41.8 points)

November Fut Open Interest Change: 6.4%

November Fut Volume Change: -3.0%

November Fut Open Interest Analysis: Fresh Short

BANKNIFTY DECEMBER Future closed at: 58254 (-0.4%)

December Fut Premium699.75 (Increased by 45.8 points)

December Fut Open Interest Change: -2.5%

December Fut Volume Change: 25.0%

December Fut Open Interest Analysis: Long Covering

BANKNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.781 (Decreased from 0.830)

Put-Call Ratio (Volume): 1.079

Max Pain Level: 58000

Maximum CALL Open Interest: 58000

Maximum PUT Open Interest: 58000

Highest CALL Addition: 58000

Highest PUT Addition: 57600

FINNIFTY Future Analysis

FINNIFTY Spot closed at: 27033.1 (-0.6%)

Combined = November + December + January

Combined Fut Open Interest Change: 15.1%

Combined Fut Volume Change: 78.1%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 2% Previous 2%

FINNIFTY NOVEMBER Future closed at: 27183.1 (-0.5%)

November Fut Premium 150 (Increased by 18.6 points)

November Fut Open Interest Change: 14.5%

November Fut Volume Change: 76.9%

November Fut Open Interest Analysis: Fresh Short

FINNIFTY DECEMBER Future closed at: 27348.5 (-0.3%)

December Fut Premium 315.4 (Increased by 74.4 points)

December Fut Open Interest Change: 45.5%

December Fut Volume Change: 200.0%

December Fut Open Interest Analysis: Fresh Short

FINNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.847 (Decreased from 0.919)

Put-Call Ratio (Volume): 0.524

Max Pain Level: 27300

Maximum CALL Open Interest: 27500

Maximum PUT Open Interest: 26000

Highest CALL Addition: 27300

Highest PUT Addition: 27200

MIDCPNIFTY Future Analysis

MIDCPNIFTY Spot closed at: 13375.25 (-1.0%)

Combined = November + December + January

Combined Fut Open Interest Change: 3.3%

Combined Fut Volume Change: 29.6%

Combined Fut Open Interest Analysis: Fresh Short

Rollover: 3% Previous 3%

MIDCPNIFTY NOVEMBER Future closed at: 13412.3 (-0.8%)

November Fut Premium 37.05 (Increased by 24.15 points)

November Fut Open Interest Change: 3.1%

November Fut Volume Change: 28.1%

November Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY DECEMBER Future closed at: 13473.95 (-0.8%)

December Fut Premium 98.7 (Increased by 20.65 points)

December Fut Open Interest Change: 12.8%

December Fut Volume Change: 70.1%

December Fut Open Interest Analysis: Fresh Short

MIDCPNIFTY Monthly Expiry (25/11/2025) Option Analysis

Put-Call Ratio (Open Interest): 0.932 (Decreased from 0.962)

Put-Call Ratio (Volume): 0.958

Max Pain Level: 13450

Maximum CALL Open Interest: 14000

Maximum PUT Open Interest: 13000

Highest CALL Addition: 14000

Highest PUT Addition: 12700

SENSEX Monthly Expiry (27/11/2025) Future

SENSEX Spot closed at: 83,311.01 (-0.18%)

SENSEX Monthly Future closed at: 83,790.10 (-0.21%)

Premium: 479.09 (Decreased by -28.06 points)

Open Interest Change: 15.7%

Volume Change: 124.9%

Open Interest Analysis: Fresh Short

SENSEX Weekly Expiry (13/11/2025) Option Analysis

Put-Call Ratio (OI): 0.706 (Increased from 0.626)

Put-Call Ratio (Volume): 0.910

Max Pain Level: 83500

Maximum CALL OI: 87000

Maximum PUT OI: 80000

Highest CALL Addition: 87000

Highest PUT Addition: 80000

FII & DII Cash Market Activity

FIIs Net SELL: ₹ 3,263.21 Cr.

DIIs Net BUY: ₹ 5,283.91 Cr.

FII Derivatives Activity

| FII Trading Stats | 6.11.25 | 4.11.25 | 3.11.25 |

| FII Cash (Provisional Data) | -3,263.21 | -1,067.01 | -1,883.78 |

| Index Future Open Interest Long Ratio | 14.29% | 15.22% | 15.61% |

| Index Future Volume Long Ratio | 44.57% | 38.66% | 37.90% |

| Call Option Open Interest Long Ratio | 48.94% | 50.80% | 50.39% |

| Call Option Volume Long Ratio | 49.71% | 50.33% | 49.99% |

| Put Option Open Interest Long Ratio | 63.55% | 66.55% | 60.50% |

| Put Option Volume Long Ratio | 50.01% | 50.76% | 49.87% |

| Stock Future Open Interest Long Ratio | 60.76% | 60.91% | 61.57% |

| Stock Future Volume Long Ratio | 49.22% | 44.10% | 48.43% |

| Index Futures | Long Covering | Fresh Short | Fresh Short |

| Index Options | Fresh Short | Short Covering | Long Covering |

| Nifty Futures | Long Covering | Fresh Short | Fresh Short |

| Nifty Options | Fresh Short | Short Covering | Long Covering |

| BankNifty Futures | Long Covering | Long Covering | Fresh Long |

| BankNifty Options | Fresh Short | Fresh Long | Fresh Short |

| FinNifty Futures | Fresh Short | Long Covering | Long Covering |

| FinNifty Options | Fresh Short | Fresh Long | Fresh Short |

| MidcpNifty Futures | Fresh Long | Long Covering | Fresh Long |

| MidcpNifty Options | Fresh Short | Short Covering | Fresh Long |

| NiftyNxt50 Futures | Long Covering | Long Covering | Fresh Long |

| NiftyNxt50 Options | Fresh Short | Fresh Long | Fresh Short |

| Stock Futures | Long Covering | Long Covering | Fresh Short |

| Stock Options | Fresh Long | Fresh Long | Fresh Short |

Fresh Long: Net Buy with Increase in Open Interest

Fresh Short: Net Sell with Increase in Open Interest

Short Covering: Net Buy with Decrease in Open Interest

Long Covering: Net Sell with Decrease in Open Interest

NSE & BSE Option market Trends : Options Insights

SENSEX Weekly Expiry (13/11/2025)

The SENSEX index closed at 83311.01. The SENSEX weekly expiry for NOVEMBER 13, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.706 against previous 0.626. The 87000CE option holds the maximum open interest, followed by the 83500CE and 80000PE options. Market participants have shown increased interest with significant open interest additions in the 87000CE option, with open interest additions also seen in the 83500CE and 80000PE options. On the other hand, open interest reductions were prominent in the 84600PE, 84900PE, and 92200CE options. Trading volume was highest in the 83500PE option, followed by the 83500CE and 84000CE options, indicating active trading in these strikes.

| SENSEX | Weekly | Expiry: | 13-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 83311.01 | 0.706 | 0.626 | 0.910 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 44,64,540 | 12,75,680 | 31,88,860 |

| PUT: | 31,51,020 | 7,98,720 | 23,52,300 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 4,72,500 | 4,22,080 | 10,99,760 |

| 83500 | 3,92,980 | 3,26,260 | 25,22,120 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 87000 | 4,72,500 | 4,22,080 | 10,99,760 |

| 83500 | 3,92,980 | 3,26,260 | 25,22,120 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 92200 | 320 | -20 | 440 |

| 92300 | 200 | – | – |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 3,92,980 | 3,26,260 | 25,22,120 |

| 84000 | 2,67,060 | 1,61,260 | 18,85,460 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 3,53,720 | 3,13,400 | 9,60,300 |

| 83500 | 3,48,940 | 2,58,960 | 31,09,560 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 80000 | 3,53,720 | 3,13,400 | 9,60,300 |

| 83500 | 3,48,940 | 2,58,960 | 31,09,560 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 84600 | 5,880 | -600 | 8,700 |

| 84900 | 1,840 | -140 | 2,340 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 83500 | 3,48,940 | 2,58,960 | 31,09,560 |

| 83000 | 1,84,120 | 1,30,180 | 16,99,580 |

NIFTY Weekly Expiry (4/11/2025)

The NIFTY index closed at 25509.7. The NIFTY weekly expiry for NOVEMBER 11, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.627 against previous 0.733. The 26000CE option holds the maximum open interest, followed by the 26500CE and 25700CE options. Market participants have shown increased interest with significant open interest additions in the 25600CE option, with open interest additions also seen in the 25700CE and 26500CE options. On the other hand, open interest reductions were prominent in the 25800PE, 26000PE, and 26100PE options. Trading volume was highest in the 25600PE option, followed by the 25500PE and 25600CE options, indicating active trading in these strikes.

| NIFTY | Weekly | Expiry: | 11-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,509.70 | 0.627 | 0.733 | 0.947 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 18,37,62,075 | 9,68,66,925 | 8,68,95,150 |

| PUT: | 11,51,90,925 | 7,09,72,500 | 4,42,18,425 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 1,26,62,925 | 49,15,425 | 13,51,005 |

| 26,500 | 1,08,09,150 | 59,21,025 | 9,83,685 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 94,61,550 | 67,32,075 | 30,25,226 |

| 25,700 | 1,07,53,800 | 62,24,325 | 23,80,602 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,200 | 1,18,050 | -8,475 | 21,025 |

| 24,800 | 36,225 | -8,100 | 841 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 94,61,550 | 67,32,075 | 30,25,226 |

| 25,700 | 1,07,53,800 | 62,24,325 | 23,80,602 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 86,15,775 | 25,62,450 | 7,37,275 |

| 25,200 | 75,73,875 | 23,74,575 | 8,70,162 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 64,73,700 | 34,80,825 | 32,56,435 |

| 25,400 | 57,26,775 | 34,18,800 | 15,43,106 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,800 | 15,25,275 | -4,48,350 | 4,63,779 |

| 26,000 | 17,48,100 | -2,07,450 | 73,810 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 51,66,000 | 18,45,975 | 37,37,367 |

| 25,500 | 64,73,700 | 34,80,825 | 32,56,435 |

NIFTY Monthly Expiry (25/11/2025)

The NIFTY index closed at 25509.7. The NIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 1.045 against previous 1.108. The 26000CE option holds the maximum open interest, followed by the 25000PE and 26000PE options. Market participants have shown increased interest with significant open interest additions in the 26100CE option, with open interest additions also seen in the 25700CE and 25800CE options. On the other hand, open interest reductions were prominent in the 25400PE, 26000PE, and 25300PE options. Trading volume was highest in the 26000CE option, followed by the 25500PE and 25000PE options, indicating active trading in these strikes.

| NIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 25,509.70 | 1.045 | 1.108 | 0.826 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 4,36,65,975 | 4,15,57,050 | 21,08,925 |

| PUT: | 4,56,50,100 | 4,60,50,075 | -3,99,975 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 64,17,975 | 2,17,575 | 1,01,031 |

| 27,000 | 38,87,025 | 65,775 | 35,099 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 26,100 | 22,55,925 | 5,78,850 | 40,581 |

| 25,700 | 14,51,625 | 2,88,375 | 48,346 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 26,800 | 11,55,225 | -1,53,375 | 15,548 |

| 26,700 | 8,63,625 | -1,26,975 | 17,961 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 64,17,975 | 2,17,575 | 1,01,031 |

| 26,500 | 33,94,650 | -84,675 | 64,624 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 25,000 | 47,82,525 | 1,07,550 | 68,325 |

| 26,000 | 43,41,300 | -2,69,550 | 29,373 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 25,600 | 11,63,400 | 1,65,600 | 53,290 |

| 25,000 | 47,82,525 | 1,07,550 | 68,325 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,400 | 11,29,650 | -3,02,100 | 31,900 |

| 26,000 | 43,41,300 | -2,69,550 | 29,373 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 35,57,475 | -1,71,825 | 86,861 |

| 25,000 | 47,82,525 | 1,07,550 | 68,325 |

BANKNIFTY Monthly Expiry (25/11/2025)

The BANKNIFTY index closed at 57554.25. The BANKNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.781 against previous 0.830. The 58000PE option holds the maximum open interest, followed by the 58000CE and 60000CE options. Market participants have shown increased interest with significant open interest additions in the 58000CE option, with open interest additions also seen in the 57600PE and 57700CE options. On the other hand, open interest reductions were prominent in the 57000PE, 57000CE, and 54000PE options. Trading volume was highest in the 57700PE option, followed by the 58000CE and 58000PE options, indicating active trading in these strikes.

| BANKNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 57,554.25 | 0.781 | 0.830 | 1.079 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 1,46,53,730 | 1,35,97,395 | 10,56,335 |

| PUT: | 1,14,48,010 | 1,12,84,385 | 1,63,625 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 15,88,090 | 3,05,795 | 1,06,548 |

| 60,000 | 11,32,320 | 27,195 | 49,325 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 15,88,090 | 3,05,795 | 1,06,548 |

| 57,700 | 1,77,905 | 1,12,700 | 53,739 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 8,48,890 | -1,29,430 | 14,291 |

| 59,000 | 8,84,555 | -31,990 | 54,108 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 15,88,090 | 3,05,795 | 1,06,548 |

| 58,500 | 10,65,085 | 85,540 | 57,762 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 58,000 | 17,20,145 | 3,885 | 1,01,621 |

| 57,000 | 10,99,210 | -1,60,930 | 72,523 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 57,600 | 2,13,325 | 1,15,920 | 82,372 |

| 57,700 | 1,91,380 | 63,035 | 1,09,978 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 57,000 | 10,99,210 | -1,60,930 | 72,523 |

| 54,000 | 3,81,815 | -43,855 | 16,240 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 57,700 | 1,91,380 | 63,035 | 1,09,978 |

| 58,000 | 17,20,145 | 3,885 | 1,01,621 |

FINNIFTY Monthly Expiry (25/11/2025)

The FINNIFTY index closed at 27033.1. The FINNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.847 against previous 0.919. The 27500CE option holds the maximum open interest, followed by the 29000CE and 27300CE options. Market participants have shown increased interest with significant open interest additions in the 27300CE option, with open interest additions also seen in the 27500CE and 27200CE options. On the other hand, open interest reductions were prominent in the 30000CE, 29000CE, and 25500PE options. Trading volume was highest in the 27300CE option, followed by the 27500CE and 27100PE options, indicating active trading in these strikes.

| FINNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 27,033.10 | 0.847 | 0.919 | 0.524 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 7,27,870 | 5,61,860 | 1,66,010 |

| PUT: | 6,16,200 | 5,16,490 | 99,710 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 27,500 | 1,02,635 | 34,840 | 7,125 |

| 29,000 | 1,00,555 | -5,720 | 366 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 89,180 | 66,365 | 9,241 |

| 27,500 | 1,02,635 | 34,840 | 7,125 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 30,000 | 8,710 | -7,215 | 221 |

| 29,000 | 1,00,555 | -5,720 | 366 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,300 | 89,180 | 66,365 | 9,241 |

| 27,500 | 1,02,635 | 34,840 | 7,125 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 26,000 | 71,955 | 17,875 | 1,761 |

| 26,500 | 63,375 | 6,370 | 1,250 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 27,200 | 33,475 | 18,460 | 1,458 |

| 26,000 | 71,955 | 17,875 | 1,761 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 25,500 | 59,475 | -4,550 | 487 |

| 27,400 | 10,855 | -1,820 | 345 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 27,100 | 20,735 | 3,705 | 2,139 |

| 27,000 | 37,895 | 8,580 | 1,809 |

MIDCPNIFTY Monthly Expiry (25/11/2025)

MIDCPNIFTY Monthly Expiry (25/11/2025)

MIDCPNIFTY Monthly Expiry (25/11/2025)

MIDCPNIFTY Monthly Expiry (25/11/2025)

The MIDCPNIFTY index closed at 13375.25. The MIDCPNIFTY monthly expiry for NOVEMBER 25, 2025 has revealed key trends in open interest. The current Put/Call Ratio is at 0.932 against previous 0.962. The 14000CE option holds the maximum open interest, followed by the 13000PE and 13500CE options. Market participants have shown increased interest with significant open interest additions in the 14000CE option, with open interest additions also seen in the 13900CE and 12700PE options. On the other hand, open interest reductions were prominent in the 72000CE, 70500PE, and 69000PE options. Trading volume was highest in the 13500PE option, followed by the 13400PE and 13500CE options, indicating active trading in these strikes.

| MIDCPNIFTY | Monthly | Expiry: | 25-11-2025 |

| Index Spot | PCR OI | Prev PCR OI | PCR VOL |

| 13,375.25 | 0.932 | 0.962 | 0.958 |

| Total Open Interest Change in all CALLs & PUTs: | |||

| Current | Prior | Net Ch | |

| CALL: | 65,73,280 | 61,41,100 | 4,32,180 |

| PUT: | 61,27,100 | 59,05,900 | 2,21,200 |

| Top CALL Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 10,74,500 | 1,12,280 | 12,678 |

| 13,500 | 7,31,360 | 80,220 | 14,181 |

| Top CALL Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 14,000 | 10,74,500 | 1,12,280 | 12,678 |

| 13,900 | 2,40,800 | 88,200 | 6,547 |

| Top CALL Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,550 | 1,48,680 | -1,37,900 | 3,603 |

| 14,800 | 90,720 | -37,660 | 909 |

| Top CALL Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 7,31,360 | 80,220 | 14,181 |

| 14,000 | 10,74,500 | 1,12,280 | 12,678 |

| Top PUT Open Interest: | |||

| Strike | OI | OI Change | Volume |

| 13,000 | 7,71,400 | -2,100 | 8,195 |

| 13,500 | 6,81,800 | 11,480 | 16,848 |

| Top PUT Open Interest addition: | |||

| Strike | OI | OI Change | Volume |

| 12,700 | 2,82,100 | 84,280 | 3,646 |

| 12,600 | 2,41,360 | 66,220 | 3,694 |

| Top PUT Open Interest reduction: | |||

| Strike | OI | OI Change | Volume |

| 13,550 | 66,220 | -37,380 | 1,468 |

| 12,000 | 1,81,160 | -18,620 | 725 |

| Top PUT Volume: | |||

| Strike | OI | OI Change | Volume |

| 13,500 | 6,81,800 | 11,480 | 16,848 |

| 13,400 | 6,31,960 | 26,320 | 14,231 |

Conclusion: What the NSE & BSE Indices Futures and Options Open Interest Volume Analysis Tells Us

Bearish trend remains front and center: Today’s Open Interest Volume Analysis confirms systematic short additions and option chain alignment against any meaningful upside attempts.

Actionable feedback: Continue to prefer short trades on rallies near max pain or heavy call OI zones (25600–26000 spot levels); abstain from aggressive bottom-fishing until sustained short covering emerges in OI and PCR readings.

Sectoral consensus on weakness: BankNIFTY, FINNIFTY, MIDCPNIFTY all display similar short build-up, suggesting a broad-based caution—rotate only into sectors where fresh long OI appears.

Manage risk using option boundaries: Center position stops around 25600–25800 and use real-time OI spikes to avoid being trapped in sudden reversals.

Stay nimble: Open Interest Volume Analysis continues to advocate tactical, defensive strategies with readiness to flip if shorts begin to unwind or momentum shifts decisively.

Check Previous Day’s NSE & BSE Indices F&O Analysis

FII / FPI trading activity in Capital Market Segment

NSE Derivatives Raw Data

BSE Derivatives Raw Data

Disclaimer

fnodata.com is a financial blog providing research-based data and analysis. The content creator of the fnodata.com is not a SEBI registered Investment Advisor. The content on this blog is for informational purposes only and should not be considered as investment advice. You are responsible for your own investment decisions. You should consult with a financial advisor or conduct your own research before making any investment decisions.

[…] Check Previous Day’s NSE & BSE Indices F&O Analysis […]